How to Deposit CZK to Interactive Brokers

What transfer method can I use to fund my account in CZK?

IBKR is currently not offering a local bank account held with a bank in Czech Republic that would allow you to use domestic transfer method to fund your account in CZK.

Depending on which Interactive Brokers entity your brokerage account is held with, you may be directed to deposit CZK into an Interactive Brokers bank account held at a bank in Germany. However, please note that even though the bank account is located outside of the Czech Republic, it is denominated in CZK and can receive CZK transfers without issues. IBKR is currently not offering a local bank account in Czech Republic that would allow you to use domestic transfer method to fund your account.

IMPORTANT: You must instruct your bank to transfer CZK.

If your bank is located in the Czech Republic, your bank application may ask if you would prefer to send funds in the currency of the destination country (which is EUR for Germany). Do not select to transfer EUR, and do not select SEPA as the transfer method as it is only valid for EUR transfers.

Ensure that the currency sent by your bank is CZK.

Certain banks in the Czech Republic may send funds in EUR by default when the destination bank is in Germany if you use their mobile application. We advise you to avoid using the mobile application and switch to their desktop application instead.

A list of banks affected can be found below. Please note that we cannot confirm the accuracy of the information provided, as they are based on client feedback and user experience. We recommend contacting your bank for further assistance on how to use their platforms and how to transfer funds in CZK:

- mBank

- ČSOB

- Komerční Banka

- Equa bank

- Česká spořitelna

IMPORTANT: If you send EUR to Interactive Brokers' bank account denominated in CZK, the funds will not arrive at Interactive Brokers and will be returned to the remitter bank account automatically. Interactive Brokers will not be informed nor involved in the return process at the bank. The return process can be lengthy and fees may apply.

SWIFT payment

The Society for Worldwide Interbank Financial Telecommunication - SWIFT - is a network that allows banks to communicate financial information securely.

SWIFT payments are offered by most banks, for international money transfers, and involve a series of banks which work together to make sure your money arrives at your account.

If you transfer CZK from or to a financial institution outside of Czech Republic, they may require to use a so called intermediary or correspondent bank to route the payment through, before reaching your account and they are called cross-border payments.

Bank transfers can take time to complete, particularly when it comes to cross-border payments. Clients are increasingly accustomed to a payments experience that feels instant. But making a payment to another country can be much more complex and time-consuming.

Processing bank transfers involves a number of steps – particularly for cross-border payments. These are sent via the correspondent banking network and typically pass between several different banks along the way. After being initiated, a wire transfer is sent by the debtor agent to an intermediary bank before moving on to the creditor agent. Once these steps are complete, the recipient will receive their funds.

There are a number of reasons why cross-border payments may be delayed or held up. Firstly, not all account balances can be updated outside the operating hours of local settlement systems. Delays can also arise if compliance checks need to be carried out, especially when a payment passes through different countries and jurisdictions.

Difference between domestic and international bank transfer

Banks make a domestic transfer to send funds to financial institutions residing in the same country or financial zone. When sending funds to financial institutions in a foreign country or financial zone, banks have to make an international bank transfer. The differences between these two bank transfers affect the number of fees banks charge and the duration it takes to complete the transfer.

How long does it usually take for my funds to arrive?

|

Payment Type |

Timing |

Approximate Cost* |

|

Domestic/Local Transfer method |

same day up to 1 business day |

free of cost or very low cost |

|

International bank transfer (SWIFT) |

from 1 to 4 business days |

vary by bank |

*Please consult with the sending institution about the costs to process your payment as this may vary by financial institution. IBKR does not charge fees for the deposit of funds.

IBKR credit funds real time upon receipt . Please note that we do not have influence on the speed of transfer. You may consult with your bank regarding their processing times .

Payments that are subject to additional review may take longer to credit.

How long does it usually take for my funds to arrive?

|

Payment Type |

Timing |

Approximate Cost* |

|

Domestic/Local Transfer method |

same day up to 1 business day |

free of cost or very low cost |

|

International bank transfer (SWIFT) |

from 1 to 4 business days |

vary by bank |

*Please consult with the sending institution about the costs to process your payment as this may vary by financial institution. IBKR does not charge fees for the deposit of funds.

IBKR credit funds real time upon receipt . Please note that we do not have influence on the speed of transfer. You may consult with your bank regarding their processing times .

Payments that are subject to additional review may take longer to credit.

如果我交易的产品是以我账户中没有的币种计价的会怎么样?

买卖给定的产品所需的特定币种是交易所决定的,不是IBKR决定的。例如,当您下单买入某种以您的账户中没有的币种计价的证券,假设您使用的是保证金账户且在满足了保证金要求后有多余的资产,则IBKR会借入该币种的资金。请注意,IBKR有义务以指定的计价币种和清算所结算该交易。如您不希望我们借入资金进而产生利息成本,则您需先向您的账户存入所需的币种及金额的资金,或通过IdealPro或各种零数(odd lot)交易场所将账户中的资金兑换为所需的币种及金额——对于超过25,000美元或等值的金额,通过IdealPro兑换;对于小于25,000美元或等值的金额,通过零数交易场所兑换,这两种渠道都可在TWS中找到。

需注意的还有,当您平仓了以特定币种计价的证券,所获资金将始终以该币种保留在您的账户中,不论该币种是否是您为账户选择的基础货币。相应地,这部分资金相对于您的基础货币将存在汇率风险,直至您完成换汇或用这些资金交易其它以该币种计价的产品。

为什么活动报表的现金报告部分反映的是证券和商品之间的内部转账?

根据监管要求,IBKR须将您账户中的证券资产和商品资产分隔开来。 这些商品资产可能包含期货期权仓位的市场价值加上用作商品期货和期货期权仓位保证金的现金。 您商品仓位的保证金要求会定期重新计算,如果保证金降低,则多出来的现金便会从账户的商品分区转到证券分区。 同样,如果商品保证金要求提高,IBKR也会将资金从证券分区转到商品分区。 由于美国证券投资者保护公司(SIPC)的保险覆盖的是您账户证券分区(而非商品分区)的资产,这种定期转账也是为了确保您的现金能得到最大程度的保护。 请注意,这种现金移动表示的是您账户中的日记账分录,是用来互相抵消的,因此对账户的总现金余额并没有影响(参考活动报表现金报告的总计栏)。

我向账户存入资金的同时IBKR会延迟平仓清算吗?

IBKR的保证金政策规定,如果一个账户违反保证金要求/保证金不足,则该账户将不能进行转账或其它存款。 如果违反保证金要求/保证金不足,账户将立即面临平仓清算。自动平仓清算会以市价委托单的方式完成,账户中的任何/所有仓位都可能会被清算。某些情况下,由于特定市场行情,保证金不足最好是通过手动平仓清算解决。

从风险角度而言,存入或汇入账户的资金在完成相应的资金与银行结算并正式记入账户之前是不纳入考虑的。平仓清算系统是完全自动的,其程序在账户违反保证金/保证不足时会立即执行。

主经纪客户请注意:外部执行并不能解决实时保证金不足问题,因为外部交易在交易发生当天美东时间晚上9点或交易报入账户并经外部确认完成匹配(取较晚发生者)之前是不纳入考虑的。我们也不建议在到期日当天在外部交易期权,因为有可能会出现晚报或误报,从而导致保证金计算出错或行权和被行权活动出错。想要在到期日在IB外部的机构交易到期期权的客户必须在美东时间下午2:50之前上传其FTP文件,并且应自担风险。

美国微型市值股票限制

简介

为遵守非注册证券卖出相关法规、最小化非公开报价证券交易过程中的人工处理,IBKR对美国微型市值股票实施了一定限制。下方列出了该等限制以及与此话题相关的其它常见问题。

微型市值股票限制

- IBKR将只接受来自符合条件之客户的美国微型市值股票转账。符合条件的客户包括:(1) 资产(转账前或转账后)不低于500万美元的账户,或资产规模不低于2000万美元的财务顾问的客户;并且(2) 美国微型市值股票投资占比不到其账户资产的一半。

- IBKR将只接受符合条件的客户能够确认股票系从公开市场买入或已在美国证监会(SEC)进行过注册的美国微型市值股票的大宗转账1;

- IBKR不接受客户被OTC标记为“买者自负”或“灰色市场”的美国微型市值股票转账1或开仓委托单。持有该等股票仓位的客户可以进行平仓;

- IBKR不接受为了回补在IBKR的空头仓位而进行的美国微型市值股票转账;

- 仅执行客户(即只通过IBKR执行交易,但在别处清算)不能在其IBKR账户中交易美国微型市值股票。(IBKR可对在美国注册的经纪商例外对待);

微型市值股票常见问题

什么是美国微型市值股票?

“微型市值股票”是指市值介于5000万美元到3亿美元之间并且价格低于5美元一股的(1) 场外交易股票或(2) Nasdaq和NYSE American挂牌股票。就该政策而言,微型市值股票包括市值等于或低于5000万美元的美国上市公司股票,这种股票有时也被称为纳级股或者是在与微型市值股票相关的市场上交易。

为避免股价短期小幅波动导致股票被反复重新分类,所有被分类为美国微型市值股的股票只有在其市值和股价连续30天均分别超过5亿美元和5美元的情况下才会重新分类。

微型市值股票通常股价很低,常常被称为仙股。IBKR也可设置例外,包括对股价低但近期市值上涨的股票。此外,IBKR不会将非美国公司的ADR视作微型市值股票。

微型市值股票在哪里交易?

微型市值股票通常在OTC市场而非全国性证券交易所交易。其通常由做市商在OTC系统(如OTCBB)和OTC Markets Group管理的市场(如OTCQX、OTCQB和Pink)以电子方式报价。该类别下还包含非公开报价的股票和被指定为“买者自负”、其它OTC或“灰色市场”的股票。

此外,美国监管部门也将在Nasdaq和NYSE American挂牌、价格等于或低于5美元一股且市值等于或低于3亿美元的股票视为微型市值股票。

如果IBKR收到来自符合条件之客户的转仓,其中一个或多个仓位是微型市值股票,会怎么样?

如果IBKR收到包含微型市值股票的转仓,IBKR有权限制其中任何微型市值股票仓位的卖出,除非符合条件的客户能够提供适当的文件证明该等股票系在公开市场买入(即通过其它经纪商在交易所买入)或者该等股票已经根据S-1或类似股票注册声明表在美国证监会进行过注册。

符合条件的客户可以通过提供经纪商给出的能够反映股票买入交易的经纪报表或交易确认来证明股票确实是在公开市场上买入。符合条件的客户也可以通过提供其股票在美国证监会(Edgar系统)进行注册的备案号(以及任何可证明股票就是注册声明上所列股票的文件)来证明股票已经过注册。

注意:所有客户随时都可转出我们对其实施了限制的股票。

IBKR对主经纪账户有什么限制?

活动包含主经纪服务的客户只在IBKR同意接受的来自其执行经纪商的交易方面被视为符合条件的客户。然而,尽管主经纪账户可以在IBKR清算美国微型市值股票,但在IBKR确认股票根据上述程序可以卖出之前,相关股票将受到限制。

要为在公开市场上买入的股票移除限制,请让执行经纪商提供有公司抬头的签字函件或正式账户报表,证明股票系从公开市场买入。提供的函件或报表必须包含以下信息。如果股票是通过发行取得,则函件必须提供相关注册声明文件或链接并说明该等股票是发行股票的一部分。

经纪商函件必须包含的信息:

1) IBKR账户号码

2) IBKR账户名称

3) 交易日期

4) 结算日期

5) 代码

6) 买卖方向

7) 价格

8) 数量

9) 执行时间

10) 交易所

11) 必须有签字

12) 必须有公司正式抬头

简而言之:如果多头仓位不再受到限制则可以接受卖出多头交易。卖出空头交易可以接受。买入多头交易可以接受,但仓位将被限制,直到向合规部门提供足够资料将限制移除。不接受买入补仓交易和日内轧平交易。

如果您买入的股票被重新分类为“灰色市场”或“买者自负”股票怎么办?

如果您在IBKR账户中买入的股票之后被分类为“买者自负”或“灰色市场”股票,您将可以继续持有仓位、平仓或转仓,但无法增加持仓。

我账户中微型市值股票交易受到限制的原因是什么?

您被限制交易微型市值股票的主要原因有两个:

- 与发行方存在潜在关联:美国证监会规则144对发行人的关联方交易股票(包括微型市值股票)有一定限制。如果IBKR发现微型市值股票交易活动或持仓接近规则144规定的交易量阈值(“规则144阈值”),则IBKR会限制客户交易该微型市值股票,直到完成合规审查。

- 微型市值股票转仓:如果客户近期将微型市值股票转入其IBKR账户,IBKR会限制客户交易该证券,直到完成合规审查。

如果符合其中一种情况,相关证券交易会受到限制,客户会在账户管理的消息中心下收到相应通知。该通知将说明限制的原因以及客户为了解除限制必须采取的措施。

为什么IBKR将我视为微型市值股票发行方的潜在关联方?

“关联方”是与发行方存在控制关系的人士,如执行官、董事或大股东。

规则144适用于包括微型市值股票在内的所有证券。但是,鉴于交易微型市值股票涉及高风险,如果客户的微型市值股交易和/或持仓接近规则144阈值,IBKR将限制客户交易该微型市值股票。 该等限制在合规对客户的潜在关联方身份进行审核并作出决定之前将保持生效。

对于潜在关联方审核,为什么我需要要求每两周进行一次新的审核?

客户的关联方身份可能会在IBKR完成上述潜在关联方审核后很快发生变化。因此,IBKR认为如果客户的的微型市值股交易和/或持仓仍然接近规则144阈值,每两周刷新一下潜在关联方审核较为合适。

哪里可以查看IBKR指定为美国微型市值股的股票列表?

请打开以下链接:www.ibkr.com/download/us_microcaps.csv

请注意,此列表每日更新。

哪里可以了解更多有关微型市值股票的信息?

有关微型市值股票的更多信息,包括其相关风险,请参见美国证监会网站:https://www.sec.gov/reportspubs/investor-publications/investorpubsmicrocapstockhtm.html

-----------------------------------------------------------

1包括任何方式的转账(如ACATS、DWAC、FOP)、通过“南向(Southbound)”转账将加拿大挂牌股票转成美国股票的转换、为回补空头仓位进行的转账、在其它经纪商执行但在IBKR清算的IB主经纪服务客户等。

如何用手机向IBKR发送文件

即使您一时无法扫描文件,盈透证券也支持您给我们发送文件副本。您可以用手机将所需文件拍下来。

下方介绍了在不同手机操作系统下如何拍照并将照片通过电子邮件发送给盈透证券的详细步骤:

如果您已经知道如何拍照并通过电子邮件发送图片,请点击此处——电子邮件应该发送到哪里以及邮件主题应该写什么。

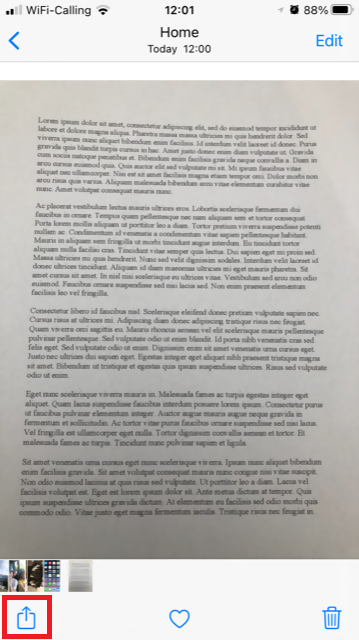

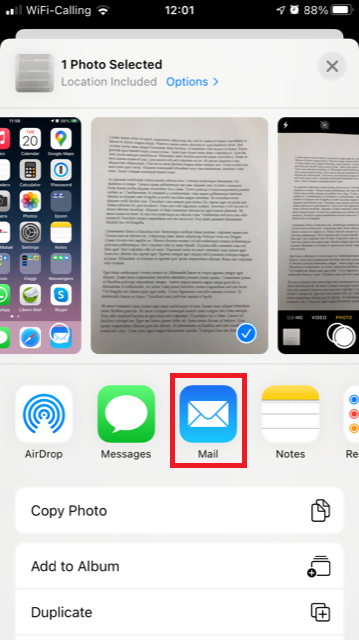

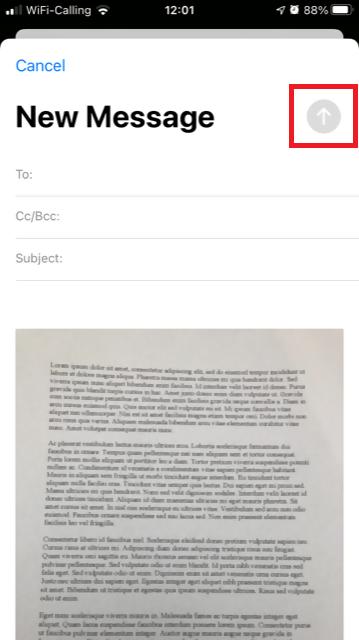

iOS

1. 从手机屏幕的底部向上滑,然后点击相机图标。

如果没找到相机图标,您可以从iPhone主屏幕点击相机应用程序图标。

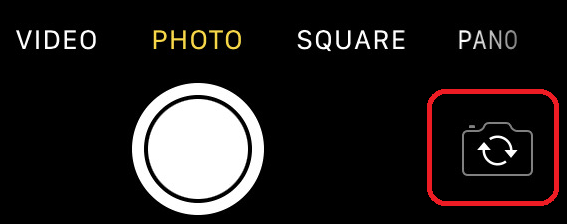

通常情况下打开的应该是后置摄像头。如果打开的是前置摄像头,请点击摄像头切换按钮。

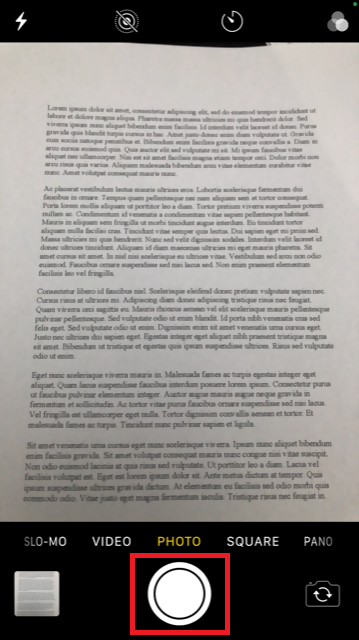

2. 将手机移到文件上方,镜头对准需要的位置或页面。

3. 确保光线均匀、充足,避免因为拿手机的姿势在文件上投下任何阴影。手机拿稳,防止抖动。点击拍照按钮拍照。

4. 点击左下角的缩略图查看您刚刚拍的照片。

5. 确保照片清晰,文件字迹清楚。您可以用两个手指在图片上划开来放大图片查看细节。

如果图片质量或亮度不好,请重复上述步骤重新拍照。

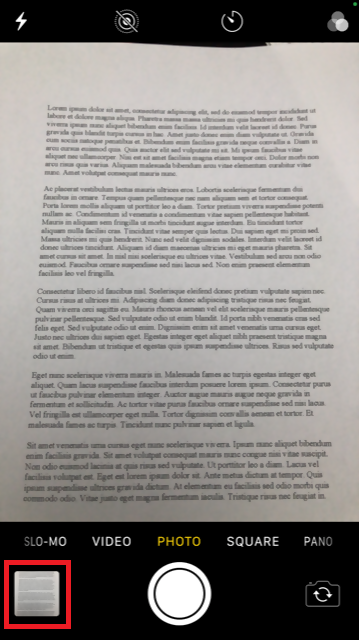

6. 点击屏幕左下角的分享图标。

7. 点击电子邮件图标。

注意:要发送电子邮件,您的手机必须有相应配置。如果不知道如何配置,请联系您的电子邮件供应商。

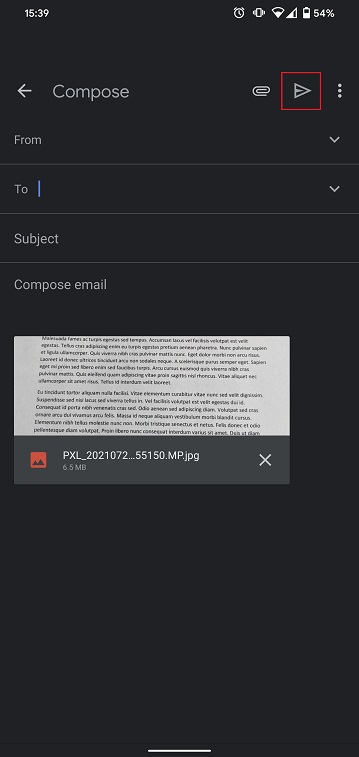

8. 请参见此处了解如何填写电子邮件收件人(To:)和主题(Subject:)。填写完毕后,点击右上方的向上箭头发送邮件。

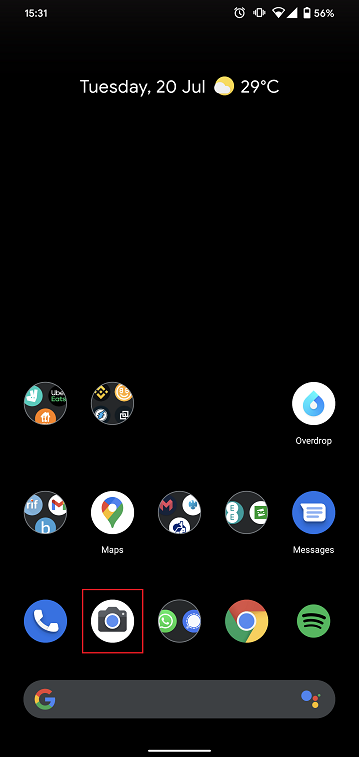

安卓

1. 打开应用程序列表,启动相机应用程序。或者直接从手机主屏幕启动相机。取决于您的手机型号、制造商或设置,相机应用程序的叫法可能有所不同。

通常情况下打开的应该是后置摄像头。如果打开的是前置摄像头,请点击摄像头切换按钮。

2. 将手机移到文件上方,镜头对准需要的位置或页面。

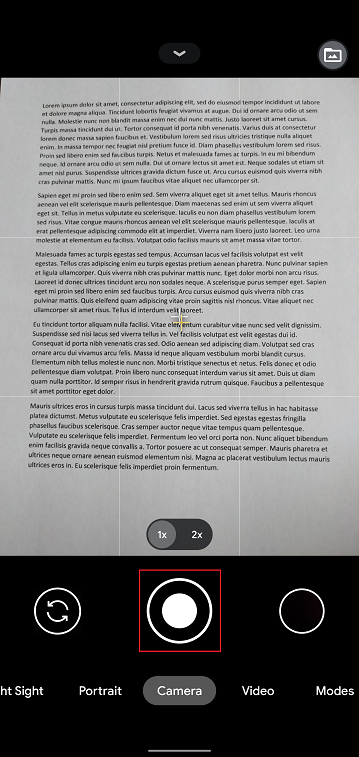

3. 确保光线均匀、充足,避免因为拿手机的姿势在文件上投下任何阴影。手机拿稳,防止抖动。点击拍照按钮拍照。

4. 确保照片清晰,文件字迹清楚。您可以用两个手指在图片上划开来放大图片查看细节。

如果图片质量或亮度不好,请重复上述步骤重新拍照。

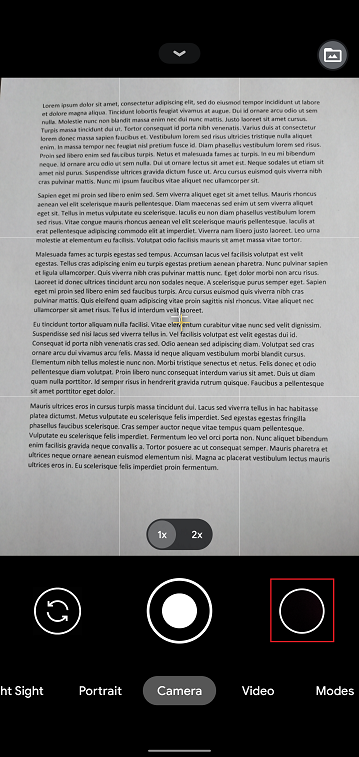

5. 点击屏幕右下角的空白圈圈图标。

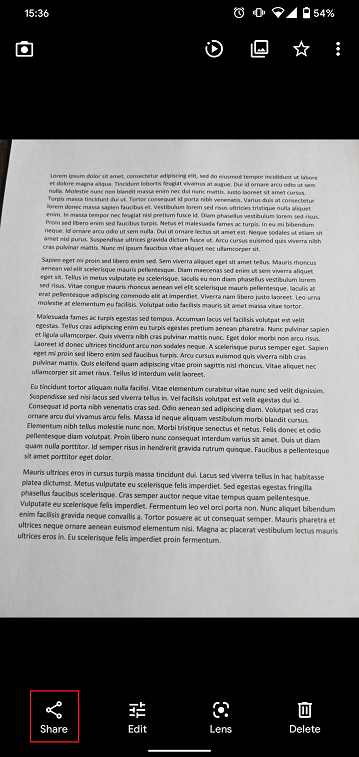

6. 点击屏幕左下角的分享图标。

7. 在显示的分享菜单中点击手机上安装好的电子邮件客户端的图标。下图显示的是Gmail,但手机设置不同,电子邮件程序也会不同。

.png)

注意:要发送电子邮件,您的手机必须有相应配置。如果不知道如何配置,请联系您的电子邮件供应商。

8. 请参见此处了解如何填写电子邮件收件人(To:)和主题(Subject:)。填写完毕后,点击右上方的飞机图标发送邮件。

电子邮件应该发送到哪里以及邮件主题应该写什么

应按照以下说明发送邮件:

1. 在收件人(To:)字段,输入:

- newaccounts@interactivebrokers.com(如果您是非欧洲国家居民)

- newaccounts.uk@interactivebrokers.co.uk(如果您是欧洲国家居民)

2. 主题(Subject:)字段必须注明所有以下信息:

- 您的账户号码(通常格式为Uxxxxxxx,其中x是数字)或您的用户名

- 发送文件的目的。请采用以下惯例:

- 居住地证明请写PoRes

- 身份证明请写PID

资金转账限制

简介

作为反洗钱工作的一部分,IBKR会对某些客户存款和取款实施限制。该等限制针对的是具有较高反洗钱风险之国家相关的转账,同时会考虑客户的居住地、取款目的地和转账资金的计价币种等因素。1下方对该等限制进行了简要介绍。

限制概述

- 在被认定为具有较高反洗钱风险之国家居住或拥有联系地址的客户不得将资金取到位于另一具有较高反洗钱风险之国家的账户,除非其在该国也有联系地址。

- 在被认定为具有较高反洗钱风险之国家居住或拥有联系地址的客户不得从位于另一具有较高反洗钱风险之国家的账户发起存款,除非其在该国也有联系地址。

- 在被认定为具有较高反洗钱风险之国家居住或拥有联系地址的客户只能将资金取到其曾从中收到过存款的自己名下的账户。

- 客户只能以基础货币、其本国货币或通用货币(如USD、EUR、HKD、AUD、GBP、CHF、CAD、JPY和SGD)取款。

- IBSG的客户只能以SGD、USD、CNH、HKD和GBP取款。

- IBKR会对客户取款的目标银行数目进行限制,不论客户或银行的所在国家或地区。

请注意,客户如果要创建被限制的在线银行指令或发起被限制的存款或取款,系统会阻止其操作并报错。

1在决定一个国家是否存在较高反洗钱风险时,我们会参考金融行动特别工作组(FATF)提供的信息,金融行动特别工作组是为打击洗钱、恐怖主义融资和其它威胁国际金融体系及其它反洗钱指数完整的行为而成立的政府间组织。

Funds Transfer Restrictions

INTRODUCTION

As part of its anti-money laundering efforts, IBKR implements restrictions on certain client deposits and withdrawals. These restrictions apply to transfers associated with countries considered to have elevated AML risk and consider factors such as the client’s residency, the withdrawal destination and the denomination of the currency being transferred.1 An outline of these restrictions is provided below.

OVERVIEW OF RESTRICTIONS

- Clients residing or maintaining an address in a country designated as having elevated AML risk may not withdraw funds to an account located in another country that has elevated AML risk unless they also maintain an address in that country.

- Clients residing or maintaining an address in a country designated as having elevated AML risk may not deposit funds from an account located in another country having elevated AML risk unless they also maintain an address in that country.

- Clients residing or maintaining an address in a country designated as having elevated AML risk may only withdraw funds to an account from which that client received a first-party deposit.

- Clients may only withdraw funds in their base currency, their home country’s currency or common currencies (e.g. USD, EUR, HKD, AUD, GBP, CHF, CAD, JPY and SGD).

- IBSG clients may only withdraw in SGD, USD, CNH, EUR, GBP and HKD.

- IBKR may restrict the number of banks that a client may send money to, regardless of the domicile of the client or the bank.

- A change to your base currency requires a minimum of 5 days before withdrawal instructions can be entered and a withdrawal request can be processed.

Note that clients who attempt to create an online banking instruction or initiate a deposit or withdrawal which is restricted will be blocked from creating that instruction or initiating that transaction and will be presented with an online error message.

1In determining whether a country is associated with elevated AML risk, consideration is given to information provided by the Financial Action Task Force (FATF), an intergovernmental organization which promotes measures for combating money laundering, terrorist financing and other related threats to the integrity of the international financial system and other public AML indices.

Deposit Funds with IBKR Mobile Check Deposit

US clients using IBKR Mobile with IB Key two-factor authentication can deposit endorsed checks drawn on a US bank into their account from anywhere using Mobile Check Deposit.

Mobile Check Deposit is NOT supported for: IRAs, MMCs, partitioned accounts or Advisor Masters (Advisors cannot deposit into client accounts).

To use Mobile Check Deposit:

- You must be a US client.

- The check must be drawn on a US bank.

- The check must be properly endorsed.

- You must have IBKR Mobile installed on your phone.

- You must have activated IB Key two-factor authentication on the IBKR Mobile app.

- It must not be your first deposit.

To find out more about how to install IBKR Mobile, visit the IBKR Mobile web page.

- Log into IBKR Mobile, and tap the More menu followed by Transfer & Pay.

- From the Transfer & Pay menu tap Deposit Check.

- If prompted, read and accept the disclosure.

- Set up your deposit:

- a. If you hold multiple accounts with IBKR, select the account for the deposit in the Deposit to field.

- b. Enter the amount of the deposit in the Amount field.

- c. Scan the front and back of your check using the camera function on your phone. You may be asked to allow IBKR Mobile to access your camera. Please be sure that you have properly endorsed your check.

- When you are satisfied with your scanned images, tap Deposit Check at the bottom of the screen.

- Validate with IB Key as required.

- Once the deposit has been approved and processed, the funds are deposited into your IBKR account. Funds are generally available to use within six (6) business days after the deposit has been approved.

- Currently available for US clients and for checks drawn on US banks.

- Requires active IB Key protocol for two-factor authentication.

- To find out the daily limit and 30 day limit on check deposits, tap “What is my daily limit?” on the Deposit Check screen.