IBKR Metals CFDs – Facts and Q&A

The following article is intended to provide a general introduction to London Gold and Silver Contracts for Differences (CFDs) issued by IBKR.

Please follow these links for information on IBKR Share CFDs, Index CFDs and Forex CFDs.

Risk Warning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

61% of retail investor accounts lose money when trading CFDs with IBKR.

You should consider whether you understand how CFDs work and whether you can afford to take the

high risk of losing your money.

ESMA Rules for CFDs (Retail Clients only)

The European Securities and Markets Authority (ESMA) has enacted new CFD rules effective 1st August

2018.

The rules include: 1) leverage limits on the opening of a CFD position; 2) a margin close out rule on a per

account basis; and 3) negative balance protection on a per account basis.

The ESMA Decision is only applicable to retail clients. Professional clients are unaffected.

Please refer to the following articles for more detail:

ESMA CFD Rules Implementation at IBKR (UK) and IBKR LLC

ESMA CFD Rules Implementation at IBIE and IBCE

Introduction

A London Gold CFD enables you to have exposure to price movements of physical Gold without actually owning it. A London Gold CFD is an agreement between you and IBKR to exchange the difference in price of the underlying over a period of time. The difference to be exchanged is determined by the change in the reference price of the underlying. Thus, if the price of physical Gold traded on the London bullion market rises and you are long the CFD, you receive cash from IBKR and vice versa. A London Gold CFD can be bought long or sold short to suit your view of market direction in the future.

Contract Specifications

| Contract | IBKR Symbol | Per Trade Fee | Minimum per Order | Multiplier |

| London Gold | XAUUSD | 0.015% | USD 2.00 | 1 |

| London Silver | XAGUSD | 0.03% | USD 2.00 | 1 |

Price Determination

The IBKR London Gold and Silver CFDs reference physical Gold and Silver traded on the London bullion market. The London bullion market is a wholesale over-the-counter market for the trading of precious metals. Trading is conducted among members of the London Bullion Market Association (LBMA). Most of the members are major international banks.

IBKR receives quote streams from approximately 10 such major banks, in much the same way it does for cash forex. IBKR Smart routes between the banks, and the best available price at any given time becomes the reference price for the CFDs. IBKR does not add a spread to the banks’ quotes.

Low Commissions and Financing Rates: Unlike other CFD providers IBKR charges a transparent

commission, rather than widening the spread. Commission rates are only 0.015% for London Gold and 0.03% for London Silver. Overnight financing rates are just benchmark +/- 1.5% (an additional 1% surcharge is added for retail accounts).

Transparent Quotes: Because IBKR does not widen the spread, the Metals CFD quotes accurately

represent the spreads and price movements of the related cash metal, as described above.

Margin Efficiency: IBKR establishes house-margin requirements based on historic volatility of the

underlying and other factors. Retail clients are subject to regulatory minimum initial margins of 5% for

London Gold or 10% for London Silver.

Trading Permissions: Same as for Share and Index CFDs.

Market Data Permissions: Metals CFD market data is free, but a permission is required for system

reasons.

Worked Trade Example (Professional Clients):

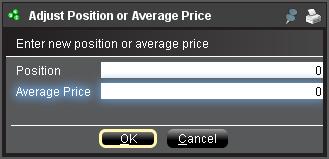

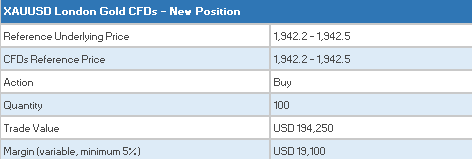

You purchase 100 XAUUSD CFDs at $1,942.5 for USD 194,250 which you then hold for 5 days.

![]()

Closing the Position

CFD Resources

Below are some useful links with more detailed information on IB’s CFD offering:

Frequently asked Questions

Are short Metals CFDs subject to forced buy-in?

No.

Can I take delivery of the underlying metal?

No, IBKR does not support physical delivery for Metals CFDs.

Are there any market data requirements?

The market data for Metal CFDs is free, and is included the market data for Index CFDs. However, you need to subscribe to the permission for system reasons. To do this, log into Account Management, and click through the following tabs: Settings/User Settings/Trading Platform/Market Data Subscriptions. Alternatively you can set up an Index or Metals CFD in your TWS quote monitor and click the “Market Data Subscription Manager” button that appears on the quote line.

How are my CFD trades and positions reflected in my statements?

If you are a client of IBKR (U.K.) or IBKR LLC, your CFD positions are held in a separate account segment identified by your primary account number with the suffix “F”. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. You can make the choice in the statement window in Account Management.

If you are a client of other IBKR entities, there is no separate segment. You can view your positions normally alongside your non-CFD positions.

In what type of IB accounts can I trade CFDs e.g., Individual, Friends and Family,

Institutional, etc.?

All margin and cash accounts are eligible for CFD trading.

Can I trade CFDs over the phone?

No. In exceptional cases we may agree to process closing orders over the phone, but never opening

orders.

Can anyone trade IB CFDs?

All clients can trade IB CFDs, except residents of the USA, Canada, Hong Kong, New Zealand and

Israel. There are no exemptions based on investor type to the residency-based exclusions.

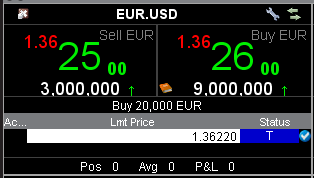

¿Cómo introducir una orden con FX Trader?

Trader Workstation (TWS) les permite a los operadores crear órdenes de fórex (FX) desde una página denominada la página de FX Trader.

Aunque la apariencia de la pantalla de FX Trader es distinta de la pantalla Gestión de orden, la funcionalidad de negociación es la misma.

La pantalla de FX Trader muestra los pares de divisas en un diseño del tipo "celda", al cual se puede acceder desde el icono FX Trader en la parte superior de la pantalla principal de TWS.

![]()

De modo similar a la línea de datos de mercado en la pantalla Gestión de orden, la oferta se encuentra a la izquierda y la demanda a la derecha. Las órdenes de compra se crean haciendo clic en demanda y ventas al hacer clic en la oferta.

Las órdenes y negociaciones activas se mostrarán en las pestañas correspondientes en la segunda sección de la ventana de FX Trader.

Nota: las órdenes creadas en FX Trader se visualizan en las pantallas Gestión de orden en TWS. Sin embargo, las órdenes creadas en la pantalla Gestión de orden no estarán visibles en la ventana de FX Trader.

Haga clic aquí para ver un seminario web grabado previamente acerca de cómo usar FX Trader.

Introducción a los fórex (FX)

IB ofrece centros y plataformas de negociación dirigidos a operadores que negocian princialmente con fórex, así como aquellos cuya actividad ocasional con fórex se origina a partir de acciones en múltiples divisas y/o transacciones de derivados. El siguiente artículo describe las cuestiones básicas para ingresar órdenes de fórex en la plataforma TWS, así como consideraciones relacionadas con convenciones para cotizaciones e informes de posiciones (posnegociación).

Una negociación con fórex (FX) comprende la compra simultánea de una divisa y la venta de otra, a cuya combinación se refiere comúnmente como par cruzado. En los ejemplos a continuación, el par cruzado EUR.USD se considerará aquel en donde la primera divisa en el par (EUR) se conoce como la divisa de la transacción que uno desea comprar o vender, y la segunda divisa (USD) es la divisa de liquidación.

Ir a un tema específico en este artículo:

- Cotizaciones de precios para fórex

- Crear una línea de cotización

- Crear una orden

- Valor PIP

- Informe de posiciones (posnegociación)

Cotizaciones de precios para fórex

Un par de divisas es la cotización del valor relativo de una unidad de divisa contra la unidad de otra en un mercado de divisas. La divisa que se utiliza como referencia se denomina la divisa de cotización, mientras que la divisa cotizada con relación a esta se denomina divisa base. En la plataforma TWS ofrecemos un símbolo de ticker por cada par de divisas. Podría utilizar FXTrader para revertir la cotización. Los operadores compran o venden la divisa base, y compran o venden la divisa de cotización. Por ej. el símbolo de ticker del par de divisas EUR/USD es:

EUR.USD

en donde:

- EUR es la divisa base

- USD es la divisa de cotización

El precio del par de divisas anterior representa la cantidad de unidades de USD (divisa de cotización) que se necesitan para negociar una unidad de EUR (divisa base). En otras palabras, el precio de 1 EUR expresado en USD.

Una orden de compra en EUR.USD comprará EUR y venderá una cantidad equivalente en USD, según el precio de negociación.

Crear una línea de cotización

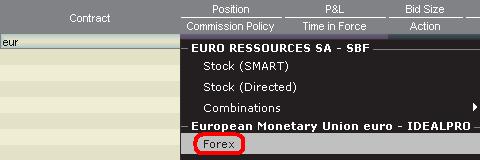

Los pasos para añadir una línea de cotización de divisas en TWS son los siguientes:

1. Ingrese la divisa de la transacción (ejemplo: EUR) y presione enter.

2. Elija el tipo de producto fórex

3. Seleccione la divisa de liquidación (ejemplo: USD) y elija el centro de negociación de fórex.

.jpg)

Notas:

IDEALFX proporciona acceso directo a cotizaciones de fórex interbancarias para órdenes que exceden el requisito de cantidad mínima de IDEALFX (normalmente 25,000 USD). Las órdenes dirigidas a IDEALFX que no cumplan con el requisito de tamaño mínimo se redirigirán automáticamente a un centro para órdenes pequeñas, principalmente para conversiones de fórex. Haga clic aquí para obtener información sobre las cantidades mínima y máxima para IDEALFX.

Los dílers de divisas cotizan los pares FX en un sentido específico. Como resultado, es posible que los operadores deban ajustar el símbolo de la divisa que se ingresó para encontrar el par de divisas deseado. Por ejemplo, si se utilizó el símbolo de divisa CAD, los operadores verán que la divisa de liquidación USD no puede encontrarse en la ventana de selección del contrato. Esto se debe a que este par se cotiza como USD.CAD y solo puede accederse a él ingresando el símbolo subyacente como USD y luego seleccionando fórex.

Crear una orden

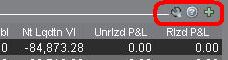

Dependiendo de los encabezados que se muestren, el par de divisas se visualizará del siguiente modo:

Las columnas Contrato y Descripción mostrarán el par en el formato divisa de transacción.divisa de liquidación (ejemplo: EUR.USD). La columna Subyacente solo mostrará la divisa de transacción.

Haga clic aquí para saber más acerca de cómo cambiar los encabezados de las columnas que se muestran.

1. Para ingresar una orden, haga clic izquierdo sobre demanda (para vender) o sobre oferta (para comprar).

2. Especifique la cantidad de la divisa de negociación que desea comprar o vender. La cantidad de la orden se expresa en la divisa base, que es la primera divisa del par en TWS.

Interactive Brokers no sabe cuál es el concepto de los contratos que representan una cantidad fija de divisa base en un mercado de divisas. En cambio, el tamaño de la negociación es la cantidad necesaria en la divisa base.

Por ejemplo, una orden de compra por 100,000 EUR.USD servirá para comprar 100,000 EUR y vender la cantidad equivalente en USD según el tipo de cambio mostrado.

3. Especifique el tipo de orden deseado, el tipo de cambio (precio) y transmita la orden.

Nota: las órdenes podrán presentarse en términos de unidades de divisas completas y no existen contratos o tamaños de lote mínimos a tener en cuentaademás de los mínimos de mercado de los centros de negociación como se especifica arriba.

Pregunta habitual: ¿cómo se ingresa una orden en el FX Trader?

Valor PIP

El PIP es una medida de cambio en un par de divisas, la cual para la mayoría de los pares representa el cambio más pequeño, aunque para otros se permiten cambios en PIP fraccionados.

Por ej. en EUR.USD 1 PIP equivale a 0.0001, mientras que en USD.JPY 1 PIP equivale a 0.01.

Para calcular el valor de 1 PIP en unidades de divisa de cotización, se puede aplicar la siguiente fórmula:

(cantidad teórica) x (1 PIP)

Ejemplos:

- Símbolo del ticker = EUR.USD

- Cantidad = 100,000 EUR

- 1 PIP = 0.0001

Valor de 1 PIP = 100’000 x 0.0001= 10 USD

- Símbolo del ticker = USD.JPY

- Cantidad = 100’000 USD

- 1 PIP = 0.01

Valor de 1 PIP = 100’000 x (0.01)= JPY 1000

Para calcular el valor de 1 PIP en unidades de la divisa base se puede aplicar la siguiente fórmula:

(cantidad teórica) x (1 PIP/tipo de cambio)

Ejemplos:

- Símbolo del ticker = EUR.USD

- Cantidad = 100’000 EUR

- 1 PIP = 0.0001

- Tipo de cambio = 1.3884

Valor de 1 PIP = 100’000 x (0.0001/1.3884)= 7.20 EUR

- Símbolo del ticker = USD.JPY

- Cantidad = 100’000 USD

- 1 PIP = 0.01

- Tipo de cambio = 101.63

Valor de 1 PIP = 100’000 x (0.01/101.63)= 9.84 USD

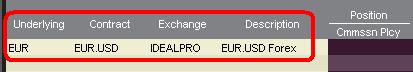

Informe de posiciones (posnegociación)

La información sobre la posición FX es un aspecto importante de la negociación con IB que debería entenderse antes de ejecutar transacciones en una cuenta activa. El software de negociación de IB refleja las posiciones FX en dos sitios distintos, los cuales pueden verse en la ventana de la cuenta.

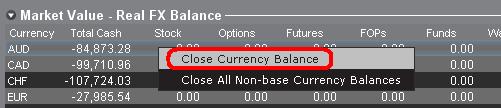

1. Valor de mercado

La sección Valor de mercado en la ventana Cuenta refleja las posiciones de las divisas en tiempo real expresadas en términos de cada divisa individual (no como par de divisas).

La sección Valor de mercado en la ventana Cuenta es el único sitio en el que los operadores pueden ver la información sobre la posición FX reflejada en tiempo real. Los operadores de múltiples posiciones de divisas no tienen la obligación de cerrarlas utilizando el mismo par usado para abrir la posición. Por ejemplo, un operador que ha comprado el par EUR.USD (comprando EUR y vendiendo USD) y que también ha comprado el par USD.JPY (comprando USD y vendiendo JPY) puede cerrar la posición resultante negociando el par EUR.JPY (vendiendo EUR y comprando JPY).

Notas:

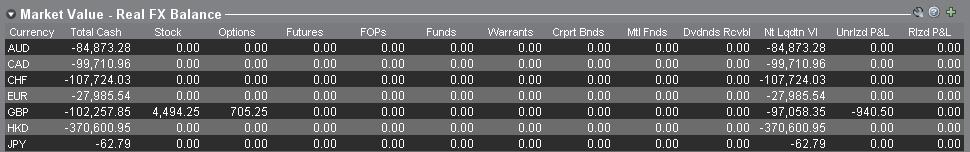

La sección Valor de mercado puede expandirse o minimizarse. Los negociadores deberían verificar el símbolo que aparece por encima de la columna Valor neto de liquidación para asegurarse de que se muestre el signo menos en verde. Si aparece un símbolo más en verde, algunas posiciones activas pueden estar ocultas.

Los operadores pueden iniciar transacciones de cierre desde la sección Valor de mercado haciendo clic derecho sobre la divisa que desean cerrar y eligiendo las opciones "cerrar saldo de divisa" o "cerrar todos los saldos de divisa no base".

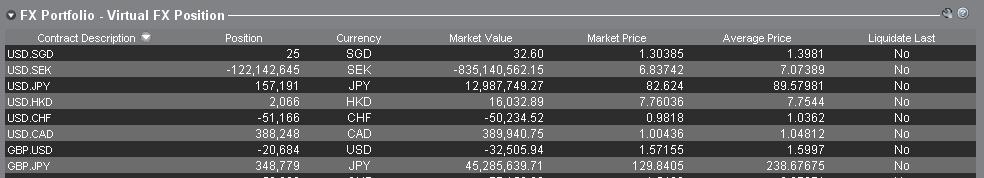

2. Cartera FX

La sección Cartera FX de la ventana de cuenta proporciona una indicación de las Posiciones virtuales y muestra información sobre la posición en términos de pares de divisas en lugar de divisas individuales como aparece en la sección Valor de mercado. Este formato de visualización especial tiene por objetivo ajustarse a una convención que es común entre los operadores de fórex institucionales, y normalmente los operadores minoristas u ocasionales de fórex pueden desestimarlo. Las cantidades de la posición de la Cartera FX no refleja toda la actividad de FX; sin emabrgo, los operadores pueden modificar las cantidades de la posición y los costes promedio que aparecen en esta sección. La capacidad de manipular la información sobre la posición y el coste promedio sin ejecutar una transacción puede ser útil para los operadores que negocien con divisas además de productos de divisa no base. Esto les permitirá a los operadores separar conversiones automáticas de forma manual (lo cual se produce automáticamente cuando se negocian productos sin divisa base) de una actividad de negociación de FX directa.

La sección de cartera FX hace accesible la posición de FX y la información sobre pérdidas y ganancias que se visualiza en todas las demás ventanas de negociación. Esto tiene la tendencia de causar cierta confusión respecto de la determinación de la información real sobre posiciones en tiempo real. Para limitar o eliminar esta confusión, los operadores pueden optar por una de las siguientes alternativas:

a. Minimizar la sección Cartera FX

Al hacer clic en la flecha hacia la izquierda de la expresión Cartera FX, los operadores pueden minimizar la sección Cartera FX. Minimizar esta sección evitará que se muestre la información sobre la Posición virtual en todas las páginas de negociación. (Nota: esto no hará que la información de Valor de mercado se visualice; solo evitará que se muestre la información de Cartera FX.)

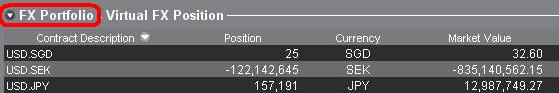

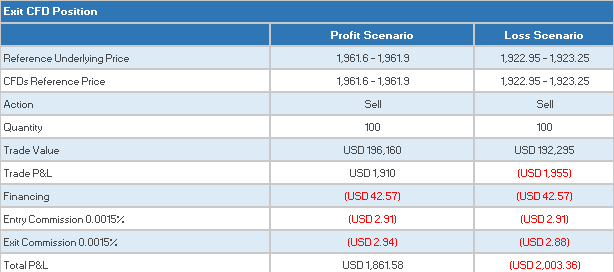

b. Ajustar posición o precio promedio

Al hacer clic derecho en la sección de cartera FX de la venta de cuenta, los operadores tienen la opción de ajustar la posición o el precio promedio. Una vez que los operadores han cerrado todas las posiciones sin divisa base, y han confirmado que la sección de valor de mercado refleja todas las posiciones sin divisa base, los operadores pueden restablecer en 0 los campos de posición y precio promedio. Esta pantalla restablecerá a cantidad de la posición reflejada en la sección de cartera FX, y debería permitirles a los operadores visualizar con mayor precisión la posición y la información sobre pérdidas y ganancias en las pantallas de negociación. (Nota: este es un proceso manual y debería realizarse cada vez que se cierren las posiciones de divisas). Los operadores siempre deberían confirmar la información sobre la posición en la sección Valor de mercado para asegurarse de que las órdenes transmitidas alcancen el resultado deseado de apertura o cierre de una posición.

Les aconsejamos a los operadores familiarizarse con FX Trading utilizando una cuenta de negociación simulada o Demo antes de ejecutar transacciones en una cuenta activa. Usted puede Contactar con IB para obtener aclaraciones sobre la información proporcionada arriba.

Otras preguntas habituales:

Leveraged FX Currency Restrictions for Israeli Retail Clients

Due to a June 2018 ruling by the Israeli financial court, Interactive Brokers is no longer permitted to offer spot forex trading to Israeli retail clients. While IBKR's forex offering is a deliverable "spot" transaction, the ruling interpreted a 2014 amendment to Israeli Securities Law 5728-1968 to cover spot/cash transactions in addition to derivative/contract style transactions.

- Forex transactions that would create a negative balance or would increase a pre-existing negative balance in either component currency will not be allowed to Israeli retail clients.

- The negative cash balance test applies only to the component currencies and for the cash movements created directly by the forex trade. There is no restriction regarding the creation of negative balances by other means such as cashiering activity or trading activities in securities (stocks, bonds, options, etc).

| Currency | Cash | Cash |

| ILS | 10,000 | 10,000 |

| USD | 1,000 | -2,510 |

| EUR | 0 | 3,000 |

USD -2,000.

| Currency | Cash | Stock | Cash | Stock |

| USD | 1,000 | 0 | -2,000 | 3,000 |

Example: Having USD 1,000 and converting to ILD, value of ILS 3,600 (1 USD = 3.6 ILS)

|

Currency

|

Cash

|

Cash

|

|

ILS

|

0

|

3,600

|

|

USD

|

1,000

|

0

|

|

Currency

|

Cash

|

Cash

|

|

EUR

|

0

|

-600

|

|

USD

|

1,000

|

1,000

|

Procedure

In order to be consider a "Qualified Investor" IB requires client to meet the following criteria and procedural requirements.

Qualified Investor qualification need to be recertified every 3 years.

For Individuals

Individuals, which comply with at least one of the following alternatives:

- Total value of Liquid Assets greater than NIS 8 million; or

- Annual income in each preceding two years is greater than NIS 1.2 million or the income of the Household to which he belongs is greater than NIS 1.8 million.; or

- Total value of Liquid Assets greater than NIS 5 million and the annual income in each proceeding two years is greater than NIS 600,000 or such annual income of the Household to which he belongs is greater than NIS 900,000.

"Liquid Assets" means cash, deposits, securities, equities and funds.

"Household" means an individual and the persons living with him or who are dependent on him for their living.

The client must:

- compete the Qualified Investor Representation form and

- provide a written signed confirmation from a registered attorney or accountant certifying their qualification. This certification should be no older than 3 months.

For Corporates

The following entities can be exempted:

- Authorized mutual funds or fund managers

- Provident funds or fund managers

- Insurers

- Banking corporations

- Portfolio managers

- Investment advisors, who acquire for themselves

- Stock Exchange members

- Underwrites, who buy for themselves

- Venture capital funds

- Corporations (including funds, partnerships) other than corporations which were incorporated for the purpose of purchasing securities in a specific offer, with equity exceeding 50 million NIS

- Corporations, wholly owned by one of the aforementioned investors

Entities qualifying under exemptions 1-9 must provide confirmation of their status from a governmental register.

Entities that wish to be considered under exemptions 10 and 11 must:

- complete the Qualified Investor Representation form and

- provide a written signed confirmation from a registered attorney or accountant certifying their qualification. This certification should be no older than 3 months.

Forex Execution Statistics

IBKR clients can now analyze the quality of their forex executions in comparison to forex trades by other IBKR customers through the FX Browser tool in Client Portal. The tool provides transaction data for the 15 forex transactions that occur immediately before and after in the same currency pair of the client's transaction.

Note:

The number of transactions may be limited to fewer than the stated 15 as the NFA also has placed a 15 minute window on the query. Meaning, if within a 15 minute window before and after the customer's execution there are fewer than 15 executions the customer's query will return only those executions which occurred within the time window.

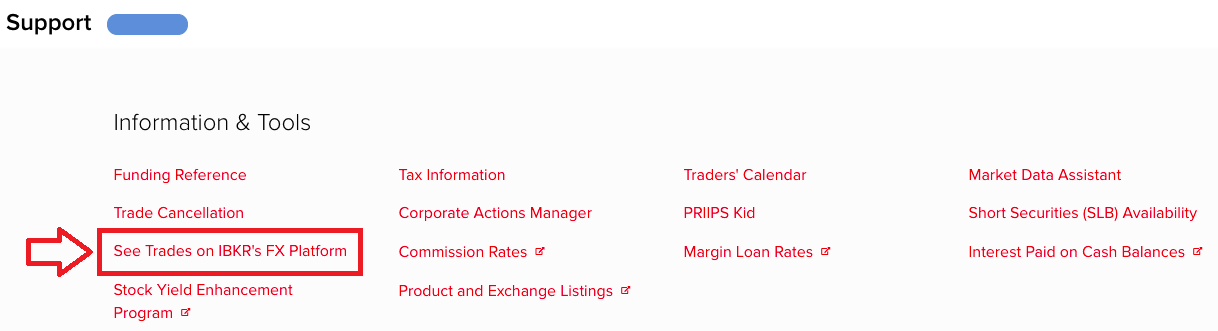

Accessing the FX Browser Tool

To Access the FX Browser tool, login to Client Portal using the Login button on our website. Click the Help menu (question mark icon in the top right corner) followed by Support Center. Please note, at this time only data for the live account will be provided.

.png)

From there, select "See Trades on IBKR's FX Platform" from the list of Information & Tools:

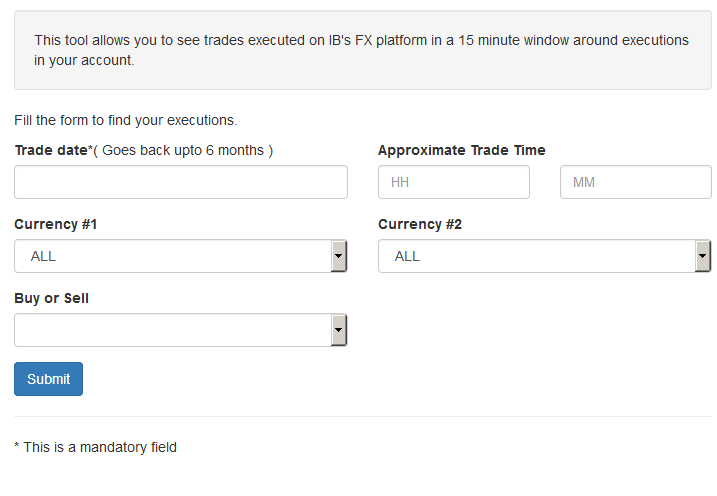

Submitting a Query

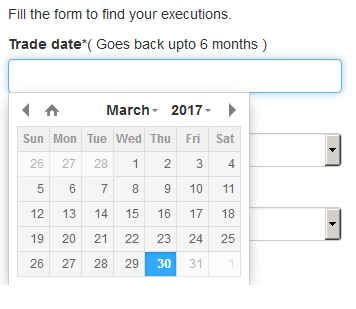

When the FX Browser is launched, you will be presented with the following screen:

Please note that only Trade Date is a mandatory field in the query. When clicking on the Trade Date field, a calendar widget will populate and allow you to select your trade date. Only transactions from the last 6 months will be available to search.

Active customers may wish to limit the results by further selecting the currency pair, side or time of the execution.

Once the desired query has been entered, click on the Submit button.

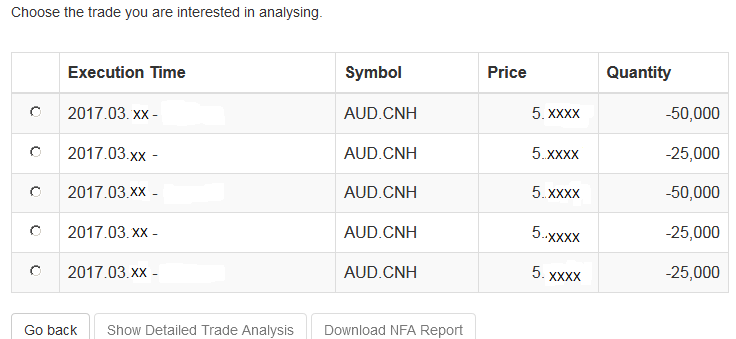

The next screen will display the list of executions for the given account on the specified day. From there, you may select the execution you wish to receive the execution statistics on.

Once the execution you wish to view has been selected, click the "Download NFA Report" button.

Reading the Report

The results will be returned in a new tab and will contain the 15 executions before and 15 executions after the trade you selected on the previous screen. Per the note above, if fewer than 15 executions occurred in the 15 minute time frame only those executions will be displayed.

The query results will include the following information:

- Execution date and time, as expressed in Eastern time

- Side (buy or sell)

- Quantity (of Transaction Currency)

- Currency pair

- Execution price

- Commissions and other charges assessed by the FDM

- Currency denomination of commissions

Your trade will be marked as Trade Number "0" and the trades before and after your trade will be numbered from 1 to 15.

Error Messages

If the search criteria you enter does not bring up any trade information, you will be presented with the following error message:

Automatic Forex Swap

OVERVIEW

In general, interest on account balances are credited/debited at benchmark rates plus/minus a spread as shown on our web pages. For qualified clients with substantial forex positions, however, IB has created a mechanism to carry large gross FX positions with higher efficiency with respect to carrying costs. We refer to it as the “auto swap program”. The design allows clients to benefit from IB’s participation in the interbank forex swaps market where implied interest rate spreads are usually much narrower than the spreads available in the retail deposit market.

a. Concept

Interest is charged on settled balances, so the intent of a Forex swap as used here is to defer the settlement of a currency position from one day to the next business day. This is done by a simultaneous sell and buy of the same amount of base (first) currency but for two different value dates e.g. on T you go long 10 mio. EUR.USD for value date T+2. By example, on T+1 the position is swapped T+2 to T+3, here a sell of 10 mio EUR.USD for T+2 and a purchase of 10 mio. EUR.USD for T+3. As a result you have deferred settlement from T+2 to T+3, with the difference in prices of the two trades representing the financing cost from T+2 to T+3.

b. Cost

This service is provided as a free service and no commission or markup is charged by Interactive Brokers. The interbank market bid/ask spread inherent in the swap prices may be regarded as a cost but is not determined by Interactive Brokers. Interactive Brokers provides the service on a best efforts basis to our large Forex clients.

c. Position Criteria

Swap activity is only applied to accounts with gross FX positions larger than 10 mio. USD or approximate equivalent of other currencies. Positions are swapped (rolled) in increments or multiples of USD 1 mio. (or equivalent). The residual settled balances are traded under IB‘s standard interest model1. Positions that are swapped (rolled) are real positions, i.e. the projected T+1 settled cash balances.

The so-called “Virtual Positions” are not considered; the virtual position is only a representation of the original trades expressed as currency pairs, for example EUR.CHF.

Settled cash balances are a single currency concept, e.g. EUR or CNH. IB executes all swaps against USD as it is the most efficient funding currency. Should you have a position in a cross, e.g. EUR against CHF, two swaps, one in EUR.USD and one in USD.CHF will be done. The threshold(s) and increment(s) may change at any time without notice.

d. Client Eligibility

As we offer this service for free, only clients with substantial currency positions are eligible for inclusion in the service. US legal residents need to be an Eligible Contract Participant (ECP) and be in the possession of an LEI number (legal entity identifier). Interactive Brokers cannot guarantee a client’s inclusion in the program and all inquiries require compliance approval prior to become active.2

e. Swap Price Recognition

Interactive Brokers may conduct a series of swaps in a currency during a day. Interactive Brokers will use average bid and ask prices at which it executed, respectively average bid and asks as quoted in the interbank market. Swap prices are not published but can be seen (or calculated) in the statement after execution. The swaps are applied in the account at the end of the day.

f. Recognition in the Statement

You will find the swap transaction(s) in the Trades section of the statement. The swap are represented as simultaneous purchase/sale or vice versa, do not have a time stamp and shows an M (manual entry) in the code column. The actual swap prices are the difference in between the two prices.

Here an example for cob 20150203 that shows a swap from 20150203 to 20150204.

![]()

.jpg)

g. Examples of Swap Prices

Here a couple of examples that use swap prices from a major interbank provider. Often bid/ask spreads are even tighter.

|

Currency Pair |

Spot Bid |

Spot Ask |

Tenor |

Days in Period (TN) |

Swap Points Bid |

Swap Points Ask |

Implied Currency |

Implied Rate Bid |

Implied Rate Ask |

|

EUR.USD |

1.04481 |

1.04483 |

TomNext(TN) |

1 |

0.00004220 |

0.00004280 |

EUR |

-0.77% |

-0.75% |

|

USD.HKD |

7.76810 |

7.76810 |

TomNext(TN) |

1 |

-0.00011500 |

-0.00011000 |

HKD |

0.17% |

0.19% |

|

USD.JPY |

117.050 |

117.052 |

TomNext(TN) |

1 |

-0.0038 |

-0.0032 |

JPY |

-0.47% |

-0.47% |

|

USD.CNH |

6.93101 |

6.93105 |

TomNext(TN) |

1 |

0.0021 |

0.0028 |

CNH |

11.77% |

15.46% |

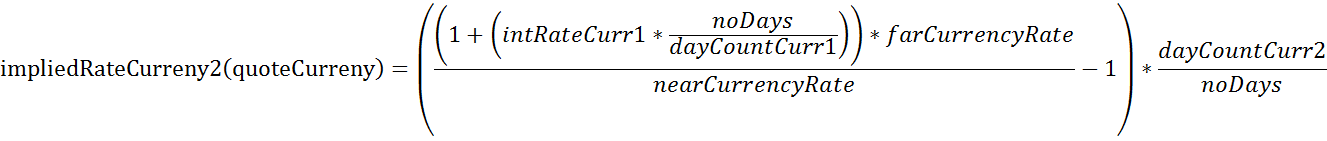

In more detail, let’s assume you want to calculate the implied CNH rate resulting from a USD.CNH swap. We are looking for the implied rate of the quote currency CNH (Currency 2). Therefore the following formula is used:

| Description | Variable | Value |

| Currency Pair (Currency1.Currency2) | USD.CNH | |

| day count convention Currency 1 (base Currency), i.e. USD | dayCountCurr1 | 360 |

| day count convention Currency 2 (quote Currency), i.e. CNH | dayCountCurr2 | 365 |

| Tenor | TomNext | |

| number of days in the Tenor | noDays | 1 |

| interest rate of Currency 1 (in decimals, i.e. 1% = 0.01) | inRateCurr1 | 0.0070 |

| Currency rate (Spot) | currencyRate | 6.939500 |

| swap Points expressed in decimals | swapPoints | 0.0012 |

| near Currency Rate (Spot - swap points) | nearCurrencyRate | 6.938300 |

| far Currency Rate (in a Tomnext swap this is the spot rate) | farCurrencyRate | 6.939500 |

| implied interes rate of Currency2, i.e. CNH | impliedRateCurrncy2(quoteCurrency) | 0.0702 |

So using above figures, this results in a 7.02% implied interest rate for CNH.

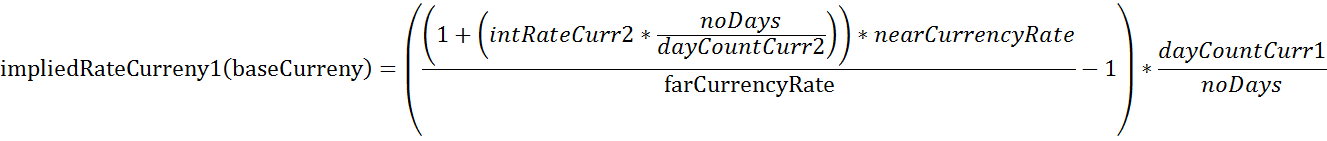

Now if you wanted to calculate the implied rate for the base currency (Currency 1) the formula would change slightly. Here an example using EUR.USD:

| Description | Variable | Value |

| Currency Pair (Currency1.Currency2) | EUR.USD | |

| day count convention Currency 1 (base Currency), i.e. EUR | dayCountCurr1 | 360 |

| day count convention Currency 2 (quote Currency), i.e. USD | dayCountCurr2 | 360 |

| Tenor | TomNext | |

| number of days in the Tenor | noDays | 1 |

| interest rate of Currency 2 (in decimals, i.e. 1% = 0.01) | inRateCurr2 | 0.0070 |

| Currency rate (Spot) | currencyRate | 1.039900 |

| swap Points expressed in decimals | swapPoints | 0.000042 |

| near Currency Rate (Spot - swap points) | nearCurrencyRate | 1.039858 |

| far Currency Rate (in a Tomnext swap this is the spot rate) | farCurrencyRate | 1.039900 |

| implied interes rate of Currency1, i.e. EUR | impliedRateCurrncy1(baseCurrency) | -0.0075 |

Using above example, this results in a -0.75 % implied interest rate for EUR.

1. For example, in the case of a USD 20.3 mio. position only 20 mio. will be swapped. USD 0.3 remains in the account and interest using benchmark and spreads will be applied. A USD 300k position will not be considered for swapping at all. The position by currency is taken as the reference, regardless of the overall position.

2 US, Australian and Israeli domiciled residents are currently not eligible for inclusion in the Automated Forex Swap Program.

Summary of Risks relating to Forex CFDs issued by Interactive Brokers Securities Japan, Inc.

This summary highlights the principal risks associated with trading Forex CFDs issued by IBSJ (“IB FXCFDs"). It is not a risk disclosure for regulatory purposes.

- Trading of IB FXCFDs is not suitable for all investors, and you should not trade them unless you are an experienced investor with a high risk tolerance and the capability to sustain losses if they occur

- The volatility of foreign exchange rates and interest rates may quickly cause significant losses. Forex CFDs employ leverage that further amplifies the volatility relative to your investment and you may lose more than you have invested. In addition, IB FXCFD roll over interest may turn from a credit to a debit due to changes in interest rates

- You are required to maintain sufficient equity in your account at all times to cover IBSJs maintenance margin requirement. There are no grace-periods and IBSJ does not issue margin calls. Your equity is calculated in real time and should it become insufficient, IBSJ will immediately and automatically liquidate positions to bring your account into margin compliance. Real time liquidations aim to minimize the risk that your account equity becomes negative, but they cannot eliminate that risk. Should your equity become negative you are required to deposit additional funds to cover the deficit

- The price IBSJ displays to you for IB FXCFDs is based on the prevailing foreign exchange market. However there is no guarantee for executions at that price. Slippage may occur for large trades or in fast moving markets and during heavily traded hours

- Moreover, your ability to establish or close positions on a timely basis is not guaranteed. It may become difficult to display quotes during major holidays or during hours when foreign exchange trading is not active. IBSJ may display prices that deviate from a fair market due to system-malfunctions or failures, or erroneous quotes that IBSJ may receive from market participants or for other reasons (off-market prices). IBSJ will adjust or cancel trades executed with off-market prices

- IB FXCFDs are over-the-counter trades between you and IBSJ. They are not traded on any exchange or cleared by any central counterparty. You are therefore exposed to counterparty risk and should IBSJ become insolvent you may not be able to fully recoup your investment, or at all

Please contact IBSJs Client Service Department should you have questions about the content of this summary and read the full risk disclosure carefully before commencing trading. The risk disclosure is available in Account Management when you request IB FXCFD trading permissions, and on IBSJs web site.

CFD sobre fórex de IB: Presentación general

Advertencia de riesgo

Los CFD son instrumentos complejos y están asociados a un riesgo elevado de perder dinero rápidamente debido al apalancamiento.

El 67 % de las cuentas de inversores minoristas pierden dinero en la comercialización con CFD con IBKR (UK).

Debe considerar si entiende el funcionamiento de los CFD y si puede permitirse asumir un riesgo elevado de perder su dinero.

Normativa de la AEMV sobre CFD (solo para clientes minoristas)

La Asociación Europea de Valores y Mercados (AEVM) ha implementado una nueva normativa sobre los CFD, la cual entrará en vigor el 1 de agosto de 2018.

Las normas incluyen: 1) límites de apalancamiento en la apertura de una posición CFD; 2) una norma de cierre de margen sobre una base por cuenta; y 3) protección de saldo negativo sobre una base por cuenta. La decisión AEMV solo es aplicable a clientes minoristas.

Los clientes profesionales no se ven afectados.

Consulte la normativa sobre CFD de la AEVM en IBKR para obtener más información.

Funciones CFD sobre fórex de IBKR

Cotizaciones DMA transparentes: IB asegura ajustados diferenciales y una sustancial liquidez, resultado de combinar líneas de cotización de 14 de las sociedades de bolsa de mercados internacionales más importantes, lo cual constituye más del 70% de la participación en el mercado interbancario internacional*. Esto tiene como resultado cotizaciones tan pequeñas como 0.1 PIP. IB no amplía las cotizaciones, sino que subroga los precios que recibe y cobra una comisión baja por separado.

*Fuente: Euromoney FX survey FX Poll 2016.

Por ejemplo, el 21 de abril de 2016 la tasa de referente GBP era de 0.483%, la tasa USD era de 0.37%. La tasa de referente aplicable es:

GBP.USD BM +0.48% - 0.37% = +0.113%

La tasa de cliente aplicable es par BM – diferencial IB para posiciones largas; BM + diferencial para posiciones cortas:

GBP.USD Tasa en largo +0.113% - 1.00% = -0.887%

GBP.USD Tasa en corto +0.113% + 1.00% = +1.113%

Es importante saber que la tasa mayor se aplica como crédito y la tasa menor como débito. Por consiguiente, para una posición larga, una tasa positiva significa un crédito y una tasa negativa significa un cargo. Sin embargo, para posiciones cortas una tasa positiva significa un cargo, mientras que una tasa negativa significa un crédito.

El interés se calcula sobre el valor del contrato expresado en la divisa de cotización y se acredita o se debita en esa divisa. Por ejemplo:

Por ejemplo:

| Interés diario | |||||

|---|---|---|---|---|---|

| Posición | GBP.USD cierre | Valor USD | Tasa | USD | |

| GBP.USD | -20,000 | 1.43232 | -28,646.40 | 1.113% | -0.89 |

El interés sobre saldos CFD sobre fórex se calcula sobre la base de un contrato independiente, y no se combina o agrupa con otras exposiciones de divisas, incluido Fórex al contado. Aunque IB no referencia directamente las tasas de permuta, se reserva el derecho de aplicar diferenciales más elevados en condiciones de mercado excepcionales, como durante subidas en las tasas de permutas que puedan darse durante el fin de año fiscal.

Ejemplo de negociación (clientes profesionales)

Abrir la posición

Usted compra 10 lotes (200000) EUR.CHF en CFD a $1.16195 para CHF 232,390, que mantiene durante 5 días.

| EUR.CHF en CFD sobre fórex – nueva posición | |

|---|---|

| Precio de referencia de subyacente | 1.16188 - 1.16195 |

| Precio de referencia del CFD | 1.16188 - 1.16195 |

| Acción | Comprar |

| Cantidad | 200,000 |

| Valor de negociación | 232,390.00 CHF |

| Margen (3% x 232,390) | 9,100 AUD |

| Interés cargado (sobre 232,390 CHF durante 5 días) | |||

|---|---|---|---|

| Nivel I (Par BM 0.42% - Diferencial IB 1%) | 232,390.00 CHF | -0.58% | (18.72 CHF) |

Cerrar la posición

| Salir de la posición CFD | ||

|---|---|---|

| Escenario de ganancias | Escenario de pérdidas | |

| Precio de referencia de subyacente | 1.16840 - 1.16848 | 1.15539 - 1.15546 |

| Precio de referencia del CFD | 1.16840 - 1.16848 | 1.15539 - 1.15546 |

| Acción | Venta | Venta |

| Cantidad | 200,000 | 200,000 |

| Valor de negociación | 233,680.00 CHF | 231,078.00 CHF |

| Operar PyG | 1,290.00 CHF | (1,312.00 CHF) |

| Financiación | (18.72 CHF) | (18.72 CHF) |

| Comisión de entrada 0.002% | (4.65 CHF) | (4.65 CHF) |

| Comisión de entrada 0.002% | (4.67 CHF) | (4.62 CHF) |

| PyG totales | 1,261.96 CHF | (1,339.99 CHF) |

Recursos CFD

A continuación encontrará varios enlaces con más información sobre la oferta de CFD de IB:

Preguntas frecuentes

¿Quién puede operar en CFD sobre fórex de IB?

Todos los clientes pueden operar en CFD de IB, excepto los residentes de los Estados Unidos, Canadá y Hong Kong. No hay excepciones basadas en el tipo de inversor para las exclusiones según residencia.

¿Cuál es la diferencia entre CFD sobre fórex de IB y Fórex en efectivo de IB?

El fórex en efectivo de IB es una negociación en efectivo apalancada en la que usted toma la entrega de dos divisas que crean el par. Sus saldos relacionados con la negociación en fórex se combinan con los otros balances que surjan de sus otras actividades de negociación y usted paga o recibe interés en estos saldos consolidados según la tasa de referencia para cada divisa.

Por el contrario, los CFD sobre fórex de IB son un contrato que proporciona exposición, pero no entrega las divisas subyacentes y usted paga o recibe interés sobre el valor nocional del contrato. La tasa de referente para el contrato es la diferencia entre las tasas de referente parta las dos divisas subyacentes. En principio, esto es similar a las renovaciones TOM Next utilizadas por otros brókeres, pero ofrece mayor estabilidad ya que las tasas de referente son, en general, menos volátiles que las tasas de permutas.

Consulte la sección de interés de mantenimiento anterior para ver un ejemplo detallado.

¿Hay algún requisito para datos de mercado?

Los datos de mercado para CFD sobre Fórex de IB son los mismos que para FX apalancado. Es un permiso global y gratuito.

¿Cómo se reflejan en mis extractos las operaciones en CFD y mis posiciones?

Si mantiene una cuenta con IB LLC, sus posiciones en CFD se mantienen en un segmento de cuenta separado, identificado con su número de cuenta primaria con el sufijo “F”. Puede elegir ver los extractos de actividad para el segmento F o bien por separado o bien de forma consolidada con su cuenta principal. Puede realizar la selección en la ventana de extractos de Gestión de cuenta.

¿Puedo operar con CFD sobre fórex con los mismos tipos de órdenes y algoritmos que para fórex al contado (FX spot) y puedo operar con ellos en la FX Trader?

Sí, la experiencia de negociación es idéntica.

Allocation of Partial Fills

How are executions allocated when an order receives a partial fill because an insufficient quantity is available to complete the allocation of shares/contracts to sub-accounts?

Overview:

From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed (i.e. market closes, contract expires, halts due to news, prices move in an unfavorable direction, etc.). In such cases, IB determines which customers (who were originally included in the order group and/or profile) will receive the executed shares/contracts. The methodology used by IB to impartially determine who receives the shares/contacts in the event of a partial fill is described in this article.

Background:

Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. They can do so by first creating a group (i.e. ratio/percentage) or profile (i.e. specific amount) wherein a distinct number of shares/contracts are specified per client account (i.e. pre-trade allocation). These amounts can be prearranged based on certain account values including the clients’ Net Liquidation Total, Available Equity, etc., or indicated prior to the order execution using Ratios, Percentages, etc. Each group and/or profile is generally created with the assumption that the order will be executed in full. However, as we will see, this is not always the case. Therefore, we are providing examples that describe and demonstrate the process used to allocate partial executions with pre-defined groups and/or profiles and how the allocations are determined.

Here is the list of allocation methods with brief descriptions about how they work.

· AvailableEquity

Use sub account’ available equality value as ratio.

· NetLiq

Use subaccount’ net liquidation value as ratio

· EqualQuantity

Same ratio for each account

· PctChange1:Portion of the allocation logic is in Trader Workstation (the initial calculation of the desired quantities per account).

· Profile

The ratio is prescribed by the user

· Inline Profile

The ratio is prescribed by the user.

· Model1:

Roughly speaking, we use each account NLV in the model as the desired ratio. It is possible to dynamically add (invest) or remove (divest) accounts to/from a model, which can change allocation of the existing orders.

Basic Examples:

Details:

CTA/FA has 3-clients with a predefined profile titled “XYZ commodities” for orders of 50 contracts which (upon execution) are allocated as follows:

Account (A) = 25 contracts

Account (B) = 15 contracts

Account (C) = 10 contracts

Example #1:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 10 am (ET) the order begins to execute2but in very small portions and over a very long period of time. At 2 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 7 of the 50 contracts are filled or 14%). For each account the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 14% of 25 = 3.5 rounded down to 3

Account (B) = 14% of 15 = 2.1 rounded down to 2

Account (C) = 14% of 10 = 1.4 rounded down to 1

To Summarize:

A: initially receives 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: initially receives 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. Account C which currently has a ratio of 0.10).

A: final allocation of 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 2 contract, which is 2/10 of desired (fill ratio = 0.20)

The execution(s) received have now been allocated in full.

Example #2:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be filled3 but in very small portions and over a very long period of time. At 1 pm (ET) the order is canceled prior being executed in full. As a result, only a portion of the order is executed (i.e., 5 of the 50 contracts are filled or 10%).For each account, the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 10% of 25 = 2.5 rounded down to 2

Account (B) = 10% of 15 = 1.5 rounded down to 1

Account (C) = 10% of 10 = 1 (no rounding necessary)

To Summarize:

A: initially receives 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: initially receives 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. to Account B which currently has a ratio of 0.067).

A: final allocation of 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Example #3:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be executed2 but in very small portions and over a very long period of time. At 12 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 3 of the 50 contracts are filled or 6%). Normally the system initially allocates by rounding fractional amounts down to whole numbers, however for a fill size of less than 4 shares/contracts, IB first allocates based on the following random allocation methodology.

In this case, since the fill size is 3, we skip the rounding fractional amounts down.

For the first share/contract, all A, B and C have the same initial fill ratio and fill quantity, so we randomly pick an account and allocate this share/contract. The system randomly chose account A for allocation of the first share/contract.

To Summarize3:

A: initially receives 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: initially receives 0 contracts, which is 0/15 of desired (fill ratio = 0.00)

C: initially receives 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

Next, the system will perform a random allocation amongst the remaining accounts (in this case accounts B & C, each with an equal probability) to determine who will receive the next share/contract.

The system randomly chose account B for allocation of the second share/contract.

A: 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

The system then allocates the final [3] share/contract to an account(s) with the smallest ratio (i.e. Account C which currently has a ratio of 0.00).

A: final allocation of 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: final allocation of 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Available allocation Flags

Besides the allocation methods above, user can choose the following flags, which also influence the allocation:

· Strict per-account allocation.

For the initially submitted order if one or more subaccounts are rejected by the credit checking, we reject the whole order.

· “Close positions first”1.This is the default handling mode for all orders which close a position (whether or not they are also opening position on the other side or not). The calculation are slightly different and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases.

Other factor affects allocations:

1) Mutual Fund: the allocation has two steps. The first execution report is received before market open. We allocate based onMonetaryValue for buy order and MonetaryValueShares for sell order. Later, when second execution report which has the NetAssetValue comes, we do the final allocation based on first allocation report.

2) Allocate in Lot Size: if a user chooses (thru account config) to prefer whole-lot allocations for stocks, the calculations are more complex and will be described in the next version of this document.

3) Combo allocation1: we allocate combo trades as a unit, resulting in slightly different calculations.

4) Long/short split1: applied to orders for stocks, warrants or structured products. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex.

5) For non-guaranteed smart combo: we do allocation by each leg instead of combo.

6) In case of trade bust or correction1: the allocations are adjusted using more complex logic.

7) Account exclusion1: Some subaccounts could be excluded from allocation for the following reasons, no trading permission, employee restriction, broker restriction, RejectIfOpening, prop account restrictions, dynamic size violation, MoneyMarketRules restriction for mutual fund. We do not allocate to excluded accountsand we cancel the order after other accounts are filled. In case of partial restriction (e.g. account is permitted to close but not to open, or account has enough excess liquidity only for a portion of the desired position).

Footnotes:

Additional Information Regarding the Use of Stop Orders

U.S. equity markets occasionally experience periods of extraordinary volatility and price dislocation. Sometimes these occurrences are prolonged and at other times they are of very short duration. Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price.