出金リクエストの横に表示される「保留中アドバイザー」のステータス

Normal 0 0 2 false false false EN-US JA X-NONE MicrosoftInternetExplorer4

出金リクエストをしたクライアント口座のお客様はアカウントマネジメントの取引履歴項目で「保留中アドバイザー」とういうステータスが表示されることがあります。

-->概要:

クライアント・ポータルの取引履歴項目の中には、出金リクエストをしたクライアント口座のステータスが、「保留中アドバイザー」と表示されることがあります。

インフォメーション:

アドバイザー体系におけるクライアント口座は、個人口座と同様に、クライアント・ポータルにログインして出金リクエストを行うことができます。クライアント口座より出金リクエストが行われるとアドバイザーは出金を許可する必要がありますが、これが行われない場合、出金手続きは継続するものの最大で3営業日の延滞が発生します。

アドバイザー承認ステップ:

クライアント口座より出金リクエストが提出されると、アドバイザーは出金リクエストがある旨のEメール通知を受け取ります。アドバイザーはアドバイザー・ポータルにログインし、クライアント管理、ダッシュボート、保留中アイテムと進んで許可をします。アドバイザーは「許可」ボタンをクリックして、保留中の出金手続きを進めます。

保留期間についての注意点:

出金可能額の80%を超える金額の出金リクエストは、アドバイザーの許可が下りる、または3日間が経過するまで保留となります。出金可能額の80%以下の金額の出金リクエストは、アドバイザーの許可が下りる、または翌営業日まで保留となります。

この保留期間はお客様のアドバイザーに対して出金通知を行うため、および必要に応じては出金可能資金の準備期間として設けられています。

Welcome to Interactive Brokers

Now that your account is funded and approved you can start trading. The information below will help you getting

started as a new customer of Interactive Brokers.

- Your Money

- Configure your account to trade

- How to trade

- Trade all over the World

- Five points to enrich your IB experience

1. Your Money

Deposits & Withdrawals General Info. All transactions are administered through your secure Account Management

Deposits

First, you create a deposit notification through your Account Management > Funding > Fund Transfers > Transaction Type: “Deposit” How to create a deposit notification. The second step is to instruct your Bank to do the wire transfer with the bank details provided in your Deposit Notification.

Withdrawals

Create a withdrawal instruction via your secure Account Management > Funding > Fund Transfers > Transaction Type: "Withdrawals" How to create a withdrawal instruction

If you instruct a withdrawal over the Withdrawal limits, it will be considered an exceptional withdrawal and we will therefore need to match bank account holder and IB account. If destination bank account has been used for a deposit, withdrawal will be processed; otherwise, you must contact customer service and provide the documents needed.

Troubleshooting

Deposits: My bank sent the money but I do not see it credited into my IB account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) A Deposit Notification is missing. You have to create it via your Account Management and send a ticket to Customer Service

c) Amending details are missing. Your name or IB account number is missing in the transfer details. You have to contact your bank and ask for the full amending details.

d) ACH initiated by IB is limited to 100k USD in a 7 business period. If you opened a Portfolio Margin account where the initial requirement is 110k, a wire deposit might be the better deposit option to reduce wait time for your first trade. If selecting ACH a wait time of almost 2 weeks or a temporary downgrade to RegT can be possible solutions.

Withdrawals: I have requested a withdrawal but I do not see the money credited to my bank account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) Rejected. Over the max it can be withdrawn. Please check your account cash balance. Note that for regulatory requirements, when the funds are deposited, there is a 3 day holding period before they can be withdrawn.

c) Your bank returned the funds. Probably because receiving bank account and remitting bank account names do not match.

2. Configure your account to trade

Difference between Cash and Margin accounts: If you have chosen the FastTrack application, by default your account type is a cash account with US stock permission. If you would like to get leverage and trade on margin, here how to upgrade to a RegT Margin account

Trading Permissions

In order to be able to trade a particular asset class in a particular country, you need to get the trading permission for it via your Account Management. Please note that trading permissions are free. You might however be asked to sign risk

disclosures required by local regulatory authorities. How to Request Trading Permissions

Market Data

If you want to have market data in real-time for a particular product/exchange, you need to subscribe to a market data package charged by the exchange. How to subscribe to Market data

The Market data assistant will help you choose the right package. Please watch this Video explaining how it works.

Customers have the option to receive delayed market data for free by clicking the Free Delayed Data button from a non-subscribed ticker row.

Advisor Accounts

Have a look at the user guide getting started as advisors. Here you see how to create additional users to your advisor account and grant them access and much more.

3. How to trade

The Trader's University is the place to go when you want to learn how to use our Platforms. Here you will find our webinars, live and recorded in 10 languages and tours and documentation about our various Trading Platforms.

Trader Workstation (TWS)

Traders who require more sophisticated trading tools can use our market maker-designed Trader Workstation (TWS), which optimizes your trading speed and efficiency with an easy-to-use spreadsheet interface, support for more than 60 order types, task-specific trading tools for all trading styles, and real-time account balance and activity monitoring. Try the two models

TWS Mosaic: for intuitive usability, easy trading access, order management, watchlist, charts all in one window or

TWS Classic: the Advanced Order Management for traders who need more advanced tools and algos.

General Description and Information / Quick start guide / Usersguide

Interactive Tours: TWS Basics / TWS configuration / TWS Mosaic

How to place a trade: Video Classic TWS / Video Mosaic

Trading tools: General Description and Information / Users guide

Requirements: How to install Java for Windows / How to install Java for MAC / Port 4000 and 4001 needs to be open

Login TWS / Download TWS

WebTrader

Traders who prefer a clean and simple interface can use our HTML-based WebTrader, which makes it easy to view market data, submit orders, and monitor your account and executions. Use the latest WebTrader from every browser

Quick Start Guide / WebTrader User's Guide

Introduction: Video WebTrader

How to place a Trade: Video WebTrader

Login WebTrader

MobileTrader

Our mobile solutions allow you to trade your IB account on the go. The mobileTWS for iOS and the mobileTWS for BlackBerry are custom-designed for these popular models, while the generic MobileTrader supports most other Smart phones.

General Description and Information

Order Types Order Types available and Description / Videos / Tour / Users guide

Paper Trading General Description and Information / How to get a Paper Trading Account

Once your paper account is created, you can share the market data of your real account with your paper trading account: Account Management > Manage Account > Settings > Paper trading

4. Trade all over the World

IB accounts are multi-currency accounts. Your account can hold different currencies at the same time, this allows you to trade multiple products around the world from a single account.

Base Currency

Your base currency determines the currency of translation for your statements and the currency used for determining margin requirements. Base currency is determined when you open an account. Customers may change their base currency at any time through Account Management.

We do not automatically convert currencies into your Base currency

Currency conversions must be done manually by the customer. In this video you can learn how to do a currency conversion.

In order to open a position denominated in a currency that you do not have in your account, you have two possibilities:

A) Currency conversion.

B) IB Margin Loan. (Not available for Cash Accounts)

Please see this course explaining the mechanics of a foreign transaction.

5. Five points to enrich your IB experience

1. Contract Search

Here you will find all our products, symbols and specifications.

2. IB Knowledge Base

The Knowledge Base is a repository of glossary terms, how-to articles, troubleshooting tips and guidelines designed to assist IB customers with the management of their IB accounts. Just enter in the search button what you are looking for and you will get the answer.

3. Account Management

As our trading platforms give you access to the markets, the Account Management grants you access to your IB account. Use Account Management to manage account-related tasks such as depositing or withdrawing funds, viewing your statements, modifying market data and news subscriptions, changing your trading permissions, and verifying or changing your personal information.

Log In Account Management / AM Quick Start Guide / AM Users Guide

4. Secure Login System

To provide you with the highest level of online security, Interactive Brokers has implemented a Secure Login System (SLS) through which access to your account is subject to two-factor authentication. Two-factor authentication serves to confirm your identity at the point of login using two security factors: 1) Something you know (your username and password combination); and 2) Something you have (an IB issued security device which generates a random, single-use security code). As both knowledge of your username/password and physical possession of the security device are required to login to your account, participation in the Secure Login System virtually eliminates the possibility of anyone other than you accessing your account.

How to Activate your Security Device / How to Obtain a Security Code Card / How to return Security device

In case you forgot your password or lost your security code card, please call us for immediate assistance.

5. Statements and Reports

Easy to view and customize, our statements and reports cover all aspects of your Interactive Brokers account. How to view an Activity Statement

Overview of Dodd-Frank

Background

The Dodd-Frank Wall Street Reform and Consumer Protection Act, commonly referred to as Dodd-Frank, is a U.S. law enacted in July of 2010, the purpose of which is to prevent the recurrence of events which lead to the 2008 financial crisis. Its principal goals are to:

- Promote U.S. financial stability by improving accountability and transparency within the financial system;

- Protect taxpayers from future bailouts of institutions deemed “too big to fail”; and

- Protect consumers from financial services practices considered abusive.

For additional information, please review the following sections:

- Dodd-Frank reforms

- Dodd-Frank and your IB Account

Dodd-Frank Reforms

To accomplish its goals, Dodd-Frank proposed the following reforms:

- Enhanced oversight and supervision of financial institutions through the creation of Financial Stability Oversight Council

- Creation of a new agency responsible for implementing and enforcing compliance with consumer financial laws (Bureau of Consumer Financial Protection)

- Implementation of more stringent regulatory capital requirements

- Changes in the regulation of over the counter derivatives including restrictions upon access to Federal credit by swaps entities, establishment of regulatory oversight and mandatory trading and clearing requirements

- Enhanced regulation of credit rating agencies intended to eliminate exemptions from liability, enhance rating agency disclosure, establish prohibited activities and impose standards for independent Board governance

- Changes to corporate governance and executive compensation practices

- Incorporation of the Volcker Rule which imposes restrictions upon the speculative proprietary trading activities of banking entities

- Mandating studies intended to reform investor protection rules

- Changes to the securitization market including requirements that mortgage bankers retain a % of risky loans.

Dodd-Frank and Your IB Account

Perhaps most visible to IB account holders of all the Dodd-Frank regulations are those relating to money transfers. Here, Section 1073 of the Act introduces consumer protections designed to increase transparency with respect to the costs, timing and the right to repudiate cross-border transactions.

For purpose of Section 1073, a cross-border transaction is defined as an electronic transfer of money from a consumer in the United States to a person or business in a foreign country. As IB LLC is a U.S. based broker, all its account holders regardless of whether they are domiciled in the U.S. or not, benefit from this protection and it covers withdrawals denominated in a currency other than the U.S. dollar as well as USD denominated withdrawals sent to a non-U.S. bank. Account holders submitting a withdrawal which is covered by this regulation will be provided with a disclosure after confirming the request within Account Management. This disclosure will include the following information:

- The name and address of the sender and recipient

- The amount to be deducted from the sender’s IB account

- The amount projected to be credited to the recipient’s bank account including an estimate of fees which the receiving bank's correspondent bank(s) may charge. Note that these correspondent bank fees are not set by nor is any part of them earned by IB.

- A disclaimer that additional fees and foreign taxes may apply.

- Notice of the sender’s right to cancel the transfer request for a full refund within 30 minutes of it being authorized.

- Regulatory contact information in the event of questions or complaints.

When estimating correspondent bank transfer fees, IB takes into consideration information collected from past customer transactions in addition to data made available by our agent banks. We encourage our customers to review and consider this information when making decisions regarding cross-border transactions.

IRA: Required Minimum Distributions

IRA owners may be required to to withdraw funds beginning at age 73, and every year thereafter. Determining your Required Minimum Distribution (RMD) is significant while retaining an IRA, considering both your life expectancy and the IRA's fair market value.

The required amount for each eligible person is based on the December 31 IRA account value of the previous year and the IRA owners date of birth. Your spouse's date of birth may also be a factor if your spouse is at least 10 years younger than you. Interactive Brokers LLC provides several information resources to understand and calculate your RMD, including access to the online FINRA RMD Calculator.

Requesting Your RMD Withdrawal

The Internal Revenue Service (IRS) requires the IRA plan custodian to notify IRA owners about the RMD requirements by January 31 each year. If you turn 73 this year, you are required to begin taking RMDs before April 1 of the following year.

Eligible IRA owners must begin receiving withdrawals by December 31 of the year they reach age 73. The first RMD withdrawal, however, may be delayed until April 1 of the following year.

If you elect to delay the withdrawal, then please observe the following considerations:

(1) Two RMD withdrawals will be required the following year, the undistributed initial RMD and the new RMD.

(2) The new RMD will be slightly larger due to the December 31 market value's inclusion of the undistributed initial RMD.

Subsequent RMD withdrawals from your IRA must be distributed by December 31 to avoid a penalty tax.

Note: Roth IRAs are exempt from the RMD rules during the IRA owner's lifetime.

Requesting Your RMD Withdrawal

You may request a withdrawal of funds through the Transfer & Pay and then Transfer Funds menu options within Client Portal. The IRS deadline for taking RMDs is December 31 each year. Keep in mind that the year end withdrawal cut off for processing withdrawals from your Interactive Brokers account may occur before December 31.

Please note that you can elect to transfer your funds to your bank account or to an Interactive Brokers non-IRA account. To transfer funds to an Interactive Brokers non-IRA account, log into Client Portal, select Transfer & Pay, Transfer Funds then select Transfer Funds Between Accounts.

Your RMD is determined by dividing the account balance on December 31 of last year by your life expectancy factor. Your life expectancy factor is taken from the Life Expectancy Tables contained in IRS Publication 590. Your IRA beneficiary election may play an important role in determining your RMD, as well.

You must calculate your RMD separately for each qualifying IRA custodied at Interactive Brokers and any other financial institution. The RMD, however, may be satisfied from any single one or combination of your IRAs. The IRA Required Minimum Distribution Worksheets may provide additional assistance with the calculation of your RMD.

Click here to return to the Retirement Account Resource page.

Disclaimer: IB does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax adviser or refer to the U.S. Internal Revenue Service.

IRA: Retirement Account Resource Center

IMPORTANT NOTE: This article has been customized for use by self-directed Individual Retirement Account (IRA) owners for information purposes only. Persons are encouraged to consult a qualified tax professional with the investments and elections within the IRA. IB does not provide tax advice. For detailed information regarding IRAs, you may consult the IRS Publication 590-A about IRA contributions and the IRS Publication 590-B about IRA distributions.

This resource center provides a central reference point for information concerning the various IRA account types offered by IB.

Important Notice - Select IRA Tax Reporting for key information with transaction and tax reporting in your IRA.

Account Management IRA Reference

Beneficiary Options

Recharacterizations from a Roth IRA

Required Minimum Distributions

IRS Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

Security Device Replacement Charge

Account holders logging into their account via IBKR's Secure Login System are issued a security device, which provides an additional layer of protection to that afforded by the user name and password, and which is intended to prevent online hackers and other unauthorized individuals from accessing their account. While IBKR does not charge any fee for the use of the device, certain versions require that the account holder return the device upon account closing or incur a replacement fee. Existing account holders are also subject to this replacement fee in the event their device is lost, stolen or damaged (note that there is no fee to replace a device returned as a result of battery failure).

In addition, while IBKR does not assess a replacement fee unless a determination has been made that the device has been lost, stolen, damaged or not returned, a reserve equal to the fee will placed upon the account upon issuance of the device to secure its return. This reserve will have no effect upon the equity of the account available for trading, but will act as limit to full withdrawals or transfers until such time the device is returned (i.e., cannot withdraw the reserve balance).

Outlined below are the replacement fee associated with each device.

| SECURITY DEVICE | REPLACEMENT FEE |

| Security Code Card1 | $0.001 |

| Digital Security Card + | $20.00 |

For instructions regarding the return of security devices, please see KB975

1 The Security Code Card is not required to be returned upon account closing and may be destroyed and discarded once remaining funds have been returned and the account has been fully closed. Access to Client Portal after closure for purposes of viewing and retrieving activity statements and tax documents is maintained using solely the existing user name and password combination. This type of two-factor security is no longer being issued.

Cash Sweeps

These regulations further require that all securities transactions be effected and margined in the securities segment of the Universal account and commodities transactions in the commodities segment.1 While the regulations allow for the custody of fully-paid securities positions in the commodities segment as margin collateral, IB does not do so, thereby limiting their hypothecation to the more restrictive rules of the SEC. Given the regulations and policies which direct the decision to hold positions in one segment vs. the other, cash remains the only asset eligible to be transferred between the two and for which customer discretion is provided.

Outlined below is a discussion as to the cash sweep options offered, the process for selecting an option as well as selection considerations.

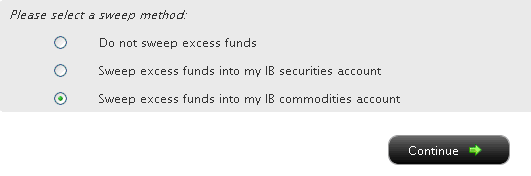

You may then select the radio button alongside the option of your choice and select the Continue button. Your choice will take effect as of the next business day and will remain in effect until a different option has been selected. Note that subject to the trading permission settings noted above, there is no restriction upon when or how often you may change your sweep method.

A Comparison of U.S. Segregation Models

銀行送金による出金方法

ご出金いただく場合は、アカウントマネジメントより出金指示をご入力ください。

<アカウントマネジメントのメニューが左側に表示されている場合>

アカウントマネジメントへログインし、Funds Management(資金管理)、Fund Transfers(入金・出金)を選択してください。

※画面上部に表示されております国旗を選択することでメニューの言語切替が可能です。

<アカウントマネジメントのメニューが上部に表示されている場合>

アカウントマネジメントへログインし、Funding(入金・出金)、Fund Transfers(入金・出金)を選択してください。

※画面右上に表示されております世界地図をクリックすることでメニューの言語切替が可能です。

1. 表示される画面上でTransaction(入金・出金)より「Withdraw Funds(出金)」、Method(方法)より「Zengin Wire(国内送金)」、Instruction(指示)より「Add New Instruction(出金先の新規登録)」を選択します。

※ IBSJ口座(国内商品取引口座)をお持ちのお客様は、上部にございます日本の国旗をクリックすることでメニューを日本語に変換できます。

※ IBLLC口座(海外商品取引口座)をお持ちのお客様は、Transactionより「Withdrawal Funds(出金)」、Methodより「Wire(電子送金)」、Instructionより「Add New Instruction(出金先の新規登録)」を選択してください。

2. 次にCurrency(通貨)、Bank Location(銀行所在地)、Bank Account Number(銀行口座番号)、Account Type(口座種別)、Bank/Branch code(銀行および支店コードをスペースなしで続けて入力)等の情報を入力する画面が表示されます。これらの情報をご入力後、「Continue(次に進む)」をクリックしてAmount(金額)をご入力ください。出金確認ページを完了しますと、お客様の出金リクエストは担当部署にてレビュー後、処理されます。

※ IBLLC口座(海外商品取引口座)をお持ちのお客様には、Currency(通貨)、Bank Location(銀行所在地)、Bank Account Number(銀行口座番号)、SWIFT code(SWIFTコード)等の情報を入力する画面が表示されます。

※ マネーロンダリング防止の取り組みとして、弊社からの出金は全てお客様のIB口座名義にて出金処理されますのでご了承ください。

この他ご不明な点がございましたら、カスタマーサービスまでお問い合わせください。

www.interactivebrokers.com/en/p.php?f=customerService&ib_entity=llc

How to withdraw funds via bank wire transfer

To make a wire withdrawal to your bank account you will first need to register a new withdrawal instruction through Account Management.

<If your Account Management has menus on left side>

Once logged into Account Management, select the Funds Management and then Funds Transfers menu options. ※ You may change languages by clicking a flag shown on the top.

<If your Account Management has menus on top>

Once logged into Account Management, select the Funding and then Funds Transfers menu options.

※ You may change languages by clicking a gray global map on the right top of the screen.

1. From there you will select the Transaction Type of "Withdrawal", the Method of " Zengin Wire ", the Instruction of "Add New Instruction".

※ If you are IBLLC customers, you will select the Transaction Type of "Withdraw Funds", the Method of "Wire", and Instruction of "Add New Instruction".

2. You will then be prompted to input Currency of denomination, Bank Location, Bank Account Number, Account Type, and Bank/Branch code (no space between bank and branch codes). Once that information has been input, click "Continue" button to enter withdrawal amount. After confirmation page, your withdrawal request will be reviewed and processed.

※ IBLLC customers will be prompted to input your receiving bank details including Currency of denomination, Bank Location, Bank Account Number and SWIFT code of your bank.

※ Please note that all withdrawals will be sent in the name of IB account holder in accordance with anti-money laundering regulations.

Should you have further questions, please contact one of our Customer Service Centers.

www.interactivebrokers.com/en/p.php?f=customerService&ib_entity=llc

IRA: Charitable Donations from IRAs

Charitable Distributions

What is a Qualified Charitable Distribution (QCD)?

How to determine if a charity can receive the QCD

Where can an IRA owner find additional information on QCDs?

Withdrawal Processing

When can I submit my withdrawal?

Can IBKR customers submit a QCD withdrawal online?

What amount may be withdrawn? Why?

Where are the funds disbursed?

Does the distribution count towards the Required Minimum Distribution (RMD) amount?

Eligible IRA Accounts

Is the Charitable Distribution allowed from all IRAs held at IBKR?

Are the QCDs allowed from other IRA and retirement plans not held at IBKR?

QCD Tax Reporting

How is the QCD reported to the IRS?

Can any taxes be withheld from the distribution?

Do federal taxes have to be paid on the distribution?

Does a state or municipal tax have to be paid on the distribution?

Charitable Distributions

What is a Qualified Charitable Distribution (QCD)?

An otherwise taxable distribution from an eligible IRA owned by an individual 72 or older paid to an IRS qualified charity.

How to determine if a charity can receive the QCD?

The IRS Exempt Organizations Select Check allows users to "Search for Charities" among a list of organizations eligible to receive tax-deductible charitable contributions.

Where can an IRA owner find additional information on QCDs?

Visit Charitable Donations for IRAs for additional information on qualified charitable distributions. See also IRS Publication 590-b.

Withdrawal Processing

Can IBKR customers submit a QCD withdrawal online?

What amount may be withdrawn? Why?

IBKR will process the withdrawal for any amount, as long as the account has sufficient available funds. Why? Although the QCD donations to the charity must not exceed $100,000 per year to retain QCD status, charitable gifts may exceed this limit.

Where are the funds disbursed?

Funds are made payable to the IRS qualified charity and mailed direct to the charity. Only funds disbursed to the charity can be designated from your IRA as a QCD.

Does the distribution count towards the Required Minimum Distribution (RMD) amount?

Yes

Eligible IRA Accounts

Is the Charitable Distribution allowed from all IRAs held at IBKR?

No, see the list below. IRA owners should contact a qualified tax advisor about how to preserve QCD tax benefits. Not all distributions are created equal. A tax advisor will be able to assess an IRA owner’s best choice.

Traditional IRA > YES

Rollover IRA > YES

Roth IRA > YES

Inherited IRA > YES, if the beneficiary is at least age 70 1/2

SEP IRA > NO

Education IRA > NO

Are the Charitable Distributions allowed from other IRA and retirement plans not held at IBKR?

No, not directly. Retirement plans, employer sponsored SEP IRAs, and Simple IRAs (account classifications not held at IBKR) are not eligible for a QCD election. IRA owners may be eligible to rollover assets from these plans into a traditional, rollover, or Roth IRA to request a charitable distribution. IRA owners should contact a qualified tax advisor or their retirement plan administrator.

QCD Tax Reporting

How is the QCD reported to the IRS?

IBKR will report the charitable distributions on Form 1099-R when issued. See Reports and Dates for 1099 availability dates.

Can any taxes be withheld from the distribution?

No.

Do federal taxes have to be paid on the distribution?

Generally, federal taxes are not paid with QCDs. But distributions in excess of the IRS limit may be subject to income tax. IBKR recommends that customers contact a qualified tax advisor.

Does a state or municipal tax have to be paid on the distribution?

Contact your tax advisor or local tax authority on state and municipal requirements for the distributed amount.

Disclaimer: IBKR does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax advisor or refer to the U.S. Internal Revenue Service.

Overview of Fees

Clients and as well as prospective clients are encouraged to review our website where fees are outlined in detail.

An overview of the most common fees is provided below:

1. Commissions - vary by product type and listing exchange and whether you elect a bundled (all in) or unbundled plan. In the case of US stocks, for example, we charge $0.005 per share with a minimum per trade of $1.00.

2. Interest - interest is charged on margin debit balances and IBKR uses internationally recognized benchmarks on overnight deposits as a basis for determining interest rates. We then apply a spread around the benchmark interest rate (“BM”) in tiers, such that larger cash balances receive increasingly better rates, to determine an effective rate. For example, in the case of USD denominated loans, the benchmark rate is the Fed Funds effective rate and a spread of 1.5% is added to the benchmark for balances up to $100,000. In addition, individuals who short stock should be aware of special fees expressed in terms of daily interest where the stock borrowed to cover the short stock sale is considered 'hard-to-borrow'.

3. Exchange Fees - again vary by product type and exchange. For example, in the case of US securities options, certain exchanges charge a fee for removing liquidity (market order or marketable limit order) and provide payments for orders which add liquidity (limit order). In addition, many exchanges charge fees for orders which are canceled or modified.

4. Market Data - you are not required to subscribe to market data, but if you do you may incur a monthly fee which is dependent upon the vendor exchange and their subscription offering. We provide a Market Data Assistant tool which assists in selecting the appropriate market data subscription service available based upon the product you wish to trade. To access, log in to Portal click on the Support section and then the Market Data Assistant link.

5. Minimum Monthly Activity Fee - there is no monthly minimum activity requirement or inactivity fee in your IBKR account.

6. Miscellaneous - IBKR allows for one free withdrawal per month and charges a fee for each subsequent withdrawal. In addition, there are certain pass-through fees for trade bust requests, options and futures exercise & assignments and ADR custodian fees.

For additional information, we recommend visiting our website and selecting any of the options from the Pricing menu option.