Connecticut Sales and Use Tax

The state of Connecticut imposes a sales and use tax which is applicable to online access to information including all data and access fees.

The tax rate as of 2017 is 1% and is applicable to clients with the state of legal residency of Connecticut or a Connecticut permanent/resident address.

The sales and use tax will be applied to all research and market data subscriptions as well as special connections such as VPN, IB Gateway, Extranet and Dedicated Leased Lines.

The sales and use tax will be passed through to client accounts at the time of the subscription billing. The tax is only applicable if a monthly fee is charged, therefore should an account receive a waiver the sales and use tax will similarly be waived.

Chicago Personal Property Tax

Chicago has a personal property tax which applies to a non-possessory computer lease by a Chicago resident. The Chicago tax authorities have ruled that tax is to be applied in cases where a customer pays for electronic research/use of an interactive site. The passive receipt or streaming of information is not subject to the tax.

Clients whose permanent residential address or principal business address is Chicago will have this tax passed through to their accounts.

The tax rate, as of October 2017, is 9%. The tax will be charged on the research and news feeds a client is subscribed to. Should a research and news feed be eligible to a waiver based upon commissions generated, the tax will not be applied.

As of October 2017, research and news subscriptions which would be subject to the tax would include

Base IBIS Research Platform and the IBIS Research Essentials Subscription Bundle

Cusip

Dow Jones News Service

Dow Jones Real Time News

US Press Release Feed

Reuters Global Newswire

Reuters StreetEvents Calendars

Reuters Fundamentals

Reuters Basic Newfeed

Morningstar Equity, ETF and Credit Reports

Wall Street Horizons

Zacks Equity Research Reports

The above list is provided on a best efforts basis and is subject to change. Clients will be responsible for any pass through tax regardless of any discrepancy from the list provided above.

Retención fiscal sobre pagos equivalentes a dividendos - preguntas frecuentes

Antecedentes

NOTA IMPORTANTE: No proporcionamos asesoría fiscal, legal o financiera. Cada cliente debe hablar con sus propios asesores para determinar el impacto que las normas de la sección 871(m) puedan tener en la actividad de negociación del cliente.

How to update the US Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) on your account

If you have been informed or believe that your account profile contains an incorrect US SSN/ITIN, you may simply log into your Account Management to update this information. Depending on your taxpayer status, you can update your US SSN/ITIN by modifying one of the following documents:

1) IRS Form W9 (if you are a US tax resident and/or US citizen holding a US SSN/ITIN)

2) IRS Form W-8BEN (if you are a Non-US tax resident holding a US SSN/ITIN)

Please note, if your SSN/ITIN has already been verified with the IRS you will be unable to update the information. If however the IRS has not yet verified the ID, you will have the ability to update through Account Management.

How to Modify Your W9/W8

1) To submit this information change request, first login to Account Management

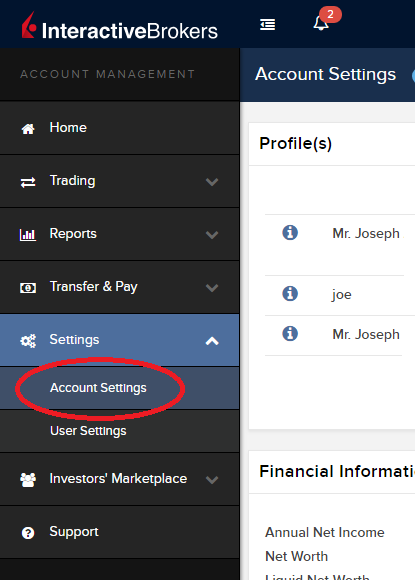

2) Click on the Settings section followed by Account Settings

3) Find the Profile(s) section. Locate the User you wish to update and click on the Info button (the "i" icon) to the left of the User's name

.png)

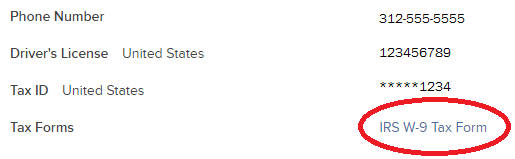

4) Scroll down to the bottom where you will see the words Tax Forms. Next to it will be a link with the current tax form we have for the account. Click on this tax form to open it

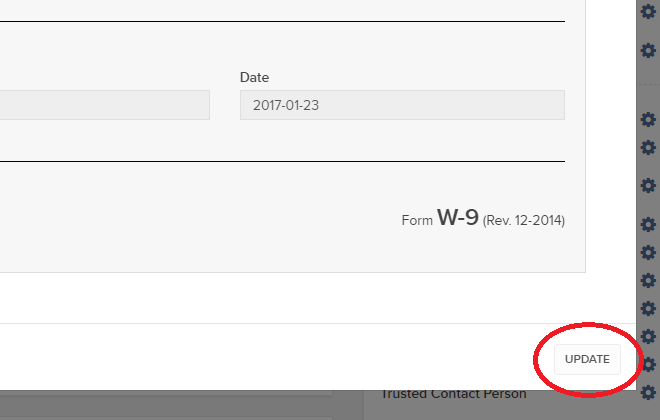

5) Review the form. If your US SSN/ITIN is incorrect, click on the UPDATE button at the bottom of the page

6) Make the requisite changes and click the CONTINUE button to submit your request.

7) If supporting documentation is required to approve your information change request, you will receive a message. Otherwise, your information change request should be approved within 24-48 hours.

Withholding Tax on Dividend Equivalent Payments - FAQs

Background

IMPORTANT NOTE: We do not provide tax, legal or financial advice. Each customer must speak with the customer’s own advisors to determine the impact that the Section 871(m) rules may have on the customer’s trading activity.

Common Reporting Standard (CRS)

The Common Reporting Standard (CRS), referred to as the Standard for Automatic Exchange of Financial Account Information (AEOI), calls on countries to obtain information from their financial institutions and exchange that information with other countries automatically on an annual basis. The CRS sets out the financial account information to be exchanged, the financial institutions required to report, the different types of accounts and taxpayers covered, as well as common due diligence procedures to be followed by financial institutions. For more information about CRS, please visit the OECD website.

Interactive Brokers entities comply with the requirements of CRS as implemented in the jurisdictions where they are located, and report account information to the applicable government authorities. Clients reported by Interactive Brokers under CRS will receive a CRS Client Report in the Client Portal shortly after the reporting deadlines specified below. The CRS Client Report provides an overview of the information that was reported by Interactive Brokers.

- What information is reported under CRS:

- Account number

- Name

- Address

- Tax ID Number

- Tax residency country

- Date of birth

- Year-end account balance

- Gross proceeds (all sales)

- Interest income

- Dividend income

- Other income

- When and where is the information reported:

- Interactive Brokers Australia Pty. Ltd. reports to the Australian Taxation Office (ATO) by July 31.

- Interactive Brokers Canada Inc. reports to the Canada Revenue Agency (CRA) by May 1.

- Interactive Brokers Central Europe Zrt. reports to the National Tax and Customs Administration of Hungary (NAV) by June 30.

- Interactive Brokers Hong Kong Limited reports to the Inland Revenue Department of Hong Kong SAR (IRD) by May 31.

- Interactive Brokers India Pvt. Ltd. reports to the Reserve Bank of India/Central Board of Direct Taxes (RBI/CBDT) by May 31.

- Interactive Brokers Ireland Limited reports to the Office of the Revenue Commissioners of Ireland by June 30.

- Interactive Brokers Securities Japan Inc. reports to the National Tax Agency of Japan (NTA) by April 30.

- Interactive Brokers Singapore Pte. Ltd. reports to the Inland Revenue Authority of Singapore (IRAS) by May 31.

- Interactive Brokers U.K. Limited reports to Her Majesty's Revenue and Customs of the United Kingdom (HMRC) by May 31.

- Additional Notes:

- Information relating to clients of Introducing Brokers is not reported by Interactive Brokers. Introducing Brokers are responsible for their own reporting under CRS.

- Accounts held by Interactive Brokers LLC are not reported under CRS as the United States has not signed the CRS.

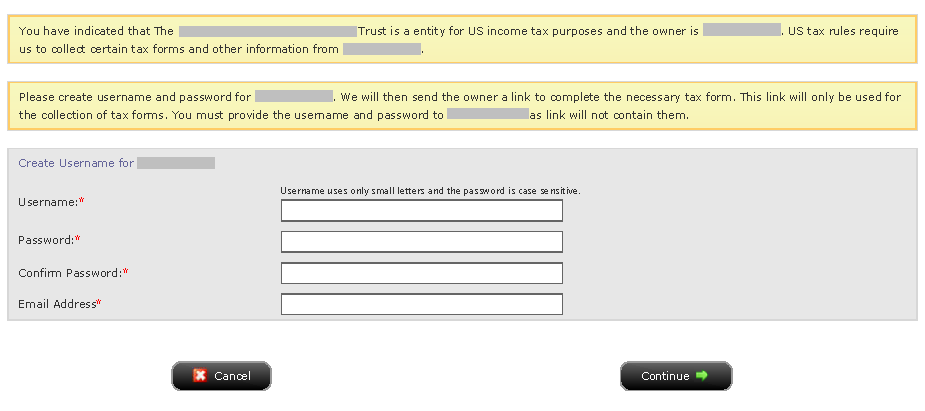

FATCA Procedures - Grantor Trust Tax Information Submission

Interactive Brokers is required to collect certain documentation from clients to comply with U.S. Foreign Account Tax Compliance Act (“FATCA”) and other international exchange of information agreements.

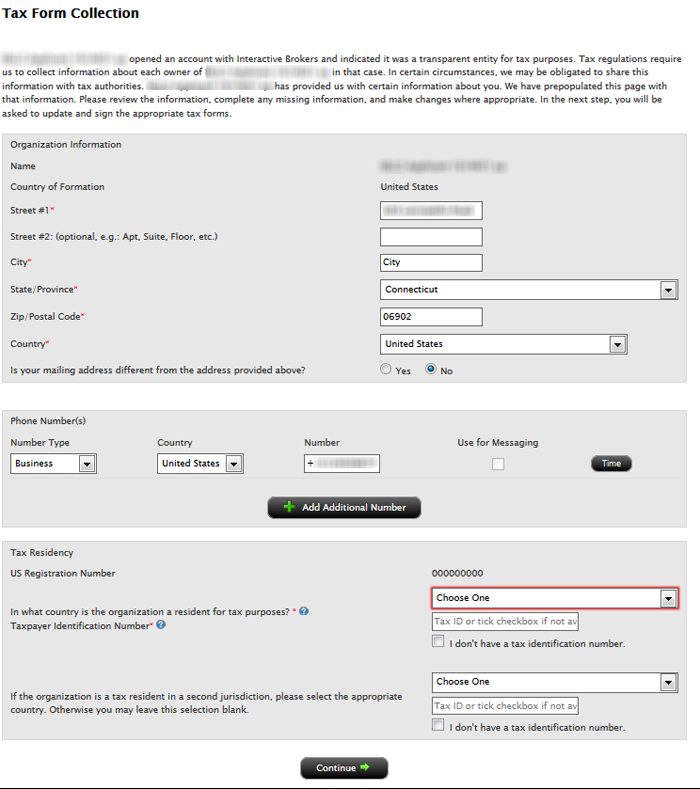

This guide contains instructions for a Trust to complete the online tax information and to electronically submit a W-9 or W-8BEN.

U.S. Tax Classification

Your U.S. income tax classification determines the tax form(s) required to document the account.

You must login to Account Management with the trust's primary username to access the Tax Form Collection page.

1. Tax Form Collection

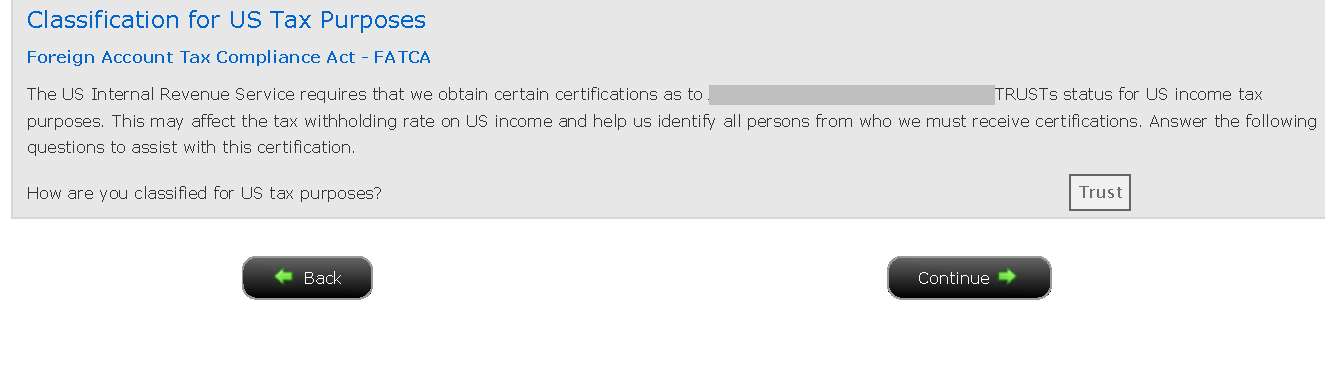

2. Classification for US Tax Purposes

3. Identify Grantors

a. Click Manage Account > Account Information > Tax Information > Tax Forms.

.png)

Índice de preguntas frecuentes sobre FATCA

A continuación se indican varias preguntas frecuentes sobre FATCA, organizadas por tema. Para una vista general de FATCA, por favor, consulte el artículo KB1986.

1. General (consulte KB2602)

2. Temas relacionados con el lugar de nacimiento en EE. UU. (consulte KB2603)

3. Temas relacionados con titulares de la tarjeta verde (consulte KB2604)

4. Temas relacionados con un pasaporte estadounidense y otra prueba de ciudadanía estadounidense (consulte KB2605)

5. Temas relacionados con números de teléfono o direcciones estadounidenses (consulte KB2606)

6. Temas relacionados con discrepancias entre dirección y país de tratado fiscal (consulte KB2607)

No proporcionamos asesoría fiscal. Por favor, consulte con su asesor fiscal si desea asistencia con los formularios fiscales o para determinar su estado de contribuyente.

Entity and FATCA Classification for Non-Financial Entities

Introduction

Interactive Brokers (“IB”, “we” or “us”) is required to collect certain documentation from clients (“you”) to comply with U.S. Foreign Account Tax Compliance Act (“FATCA”) and other international exchange of information agreements.

This guide contains a series of flowcharts and accompanying notes that summarize IRS rules relating to:

1. The tax classification for purposes of determining which W-8 or W-9 tax form an entity is required to complete; and

2. The FATCA classification required of entities completing the W-8 tax form (Part I, Section 5).

![]() Note: The flowcharts and notes contained herein do not cover every possible scenario and other scenarios not presented here exist and may more closely align with your situation. You should consult a tax professional regarding your particular circumstances if you are still unsure of your U.S. entity and/or FATCA classification after reading this guide.

Note: The flowcharts and notes contained herein do not cover every possible scenario and other scenarios not presented here exist and may more closely align with your situation. You should consult a tax professional regarding your particular circumstances if you are still unsure of your U.S. entity and/or FATCA classification after reading this guide.

What is NOT Covered in this Guide

The guide is directed to non-U.S. entities that (i) are the beneficial owners of the payments made to the account and (ii) are not financial institutions. This guide does not apply to:

• Individuals (use W-9 or W-8BEN)

• U.S. entities (use W-9)

• Entities acting as an intermediary (such as a nominee, broker, custodian, investment advisor) on behalf of another person (use W-8IMY).

• Non-U.S. Tax-Exempt Organizations and Private Foundations

• Financial Institutions

![]() Note: The U.S. entered into bilateral agreements called Intergovernmental Agreements (IGAs) with many countries regarding the implementation of FATCA. In some cases, the provisions of an applicable IGA could modify the results described in this guide. Entities are covered by an IGA should refer to the IGA and/or consult a tax professional for their filing requirements.

Note: The U.S. entered into bilateral agreements called Intergovernmental Agreements (IGAs) with many countries regarding the implementation of FATCA. In some cases, the provisions of an applicable IGA could modify the results described in this guide. Entities are covered by an IGA should refer to the IGA and/or consult a tax professional for their filing requirements.

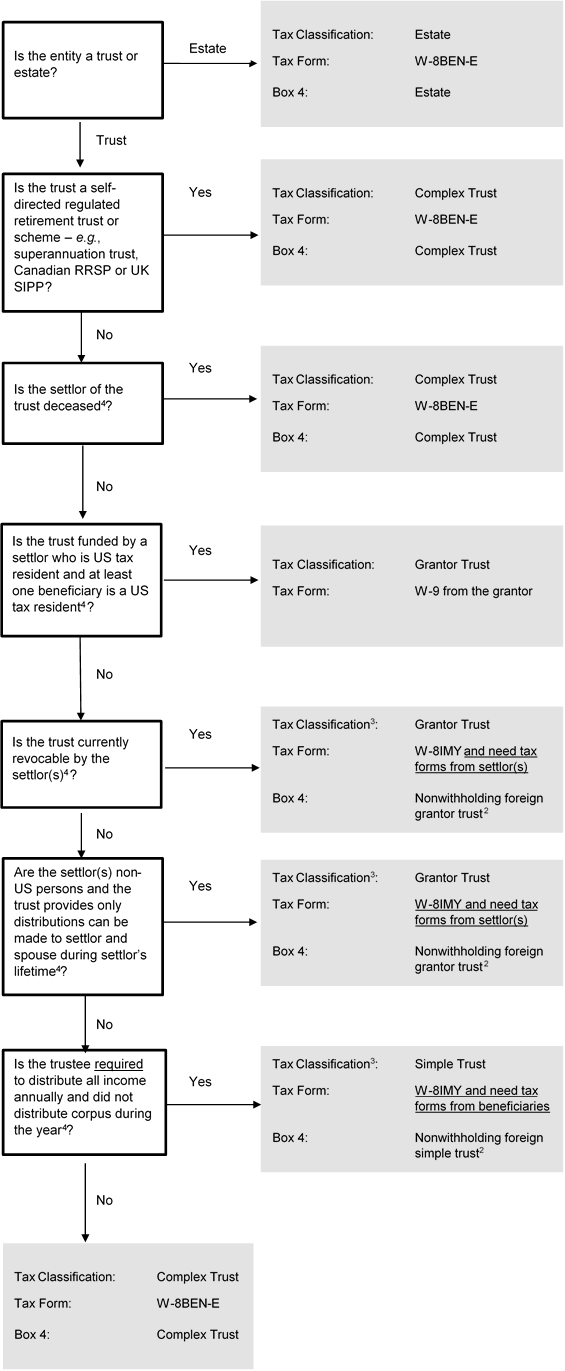

1. U.S. Tax Classification

Your U.S. income tax classification determines the tax form(s) required to document the account. The flow chart below may help you determine your tax classification and the tax form to be completed.

Important: The U.S. imposes income tax on its residents’ worldwide income. On the other hand, nonresidents are only subject to withholding tax on certain limited types of US source investment income (dividends from U.S. companies, etc.). Completion of a W-8 series tax form certifies you are NOT taxable as a U.S. resident. A W-8 form may also be used to claim a reduced rate of withholding tax under a U.S. income tax treaty.

Flowchart for Determining Tax Classification and Required Tax Form (Non-Trust Entities)

.png)

Flowchart for Determining Tax Classification and Required Tax Form (Trusts)

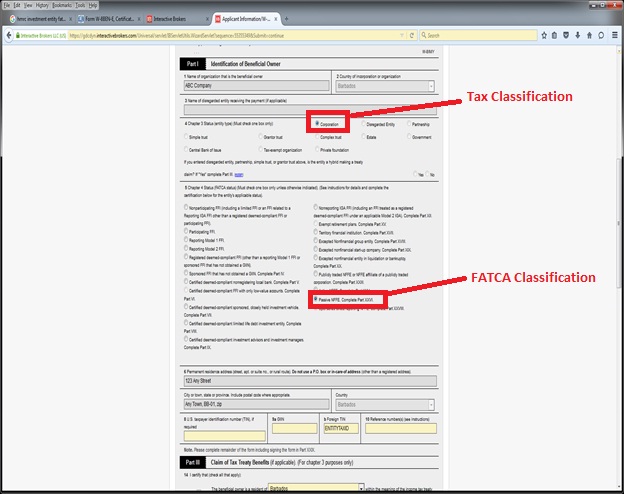

2. FATCA Classification

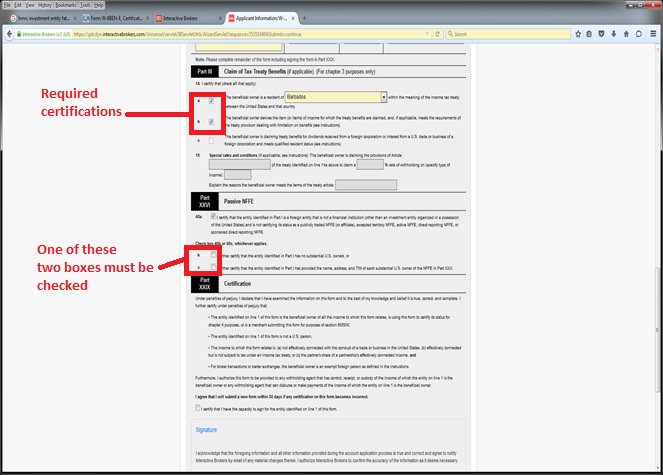

The W8 tax forms are also used to collect FATCA classifications. Many countries have executed “Intergovernmental Agreements (IGA)” with the U.S. requiring its local financial institutions to classify its customers for FATCA purposes. The classification rules under an IGA may not exactly match the classification rules established by the IRS. Other institutions have agreed with the IRS to become FATCA compliant and determine their customers’ FATCA classifications under the IRS rules. We are required to collect this information. The flowchart below applies the IRS default FATCA classification rules and is general in nature. The flowchart is accompanied by sample W-8BEN-E screenshots for a common account structure: a non-U.S. corporation classified for FATCA purposes as a Passive Non-Financial Foreign Entity (NFFE), which qualifies for treaty witholding rates.

![]() Note: It is important to recognize many organizations meet the qualifications for multiple FATCA types and you must select the most appropriate classification. Your specific situation may not fall within the general guidance. We recommend you seek your own independent advice as we are not in a position to make this determination for you and the rules are complex.

Note: It is important to recognize many organizations meet the qualifications for multiple FATCA types and you must select the most appropriate classification. Your specific situation may not fall within the general guidance. We recommend you seek your own independent advice as we are not in a position to make this determination for you and the rules are complex.

Flowchart for Determining FATCA Classification

.png)

Example: A corporation is a common form of entity ownership, involving two or more owners with none having any personal liability for the debts of entity. As outlined in the Tax Classification flowchart above, an entity of this type would be required to complete the W-8BEN-E. Assuming the corporation is not classified as a Foreign Financial Entity (e.g. bank, broker, investment manager, hedge fund, mutual fund, insurance company) as discussed in footnote 5 below, then its FATCA classification would be Passive NFFE. Screenshots of the W-8BEN-E for this sample entity are provided below.

Sample Screenshots - W-8BEN-E (Passive NFFE)

Footnotes

1 The US Internal Revenue Service (IRS) established rules for determining the tax classification of entities formed outside the United States. These rules apply regardless of how the entity is classified in its country of organization or residency.

Generally corporate entities are treated as the beneficial owners of an account and should complete a W-8BEN-E and select “corporation” unless they elect otherwise (discussed below).

IRS regulations assign a default classification to each entity type. This default classification may be overridden by making a filing with the IRS and obtaining an US employer identification number. Certain entities cannot change their classification and are treated as corporations in all events (e.g., Sociedad Anonima, Public Limited Company and Aktiengesellschaft). A complete list may be found at US Treasury Regulation Section 301.7701-2(b)(8).

The IRS default classification usually depends on (i) the number of owners and (ii) whether any owner is personally liable for the debts of the entity based on the organizing statute (i.e., bank guarantees or other contractual agreements by owners are ignored). The following table summarizes the default rules:

|

|

Number of Owners

|

Owners have Limited Liability?

|

|

|||

|

|

Yes?

|

No?

|

|

|||

|

|

1 Owner

|

Corporation

|

Disregarded Entity

|

|

||

|

|

2+ Owners

|

Corporation

|

Partnership

|

|

||

|

|

|

|

||||

Note: Since the entity tax classification of a disregarded entity is determined by its owner, a US disregarded entity may find the flowchart helpful if the owner is a non-US entity.

A fiscally transparent entity (such as a partnership, simple trust or grantor trust) using IRS Form W-8IMY must provide IRS tax forms for all of its beneficial owners (partners in a partnership, beneficiaries for a simple trust and settlors for a grantor trust) for the account to be documented for US tax purposes.

Certain unit investment trusts (generally where there is an ability to vary the investments) are not considered trusts for US tax purposes. These investment trusts are treated in the same manner as a traditional business entity under the rules discussed above (i.e., corporation, partnership or disregarded entity).

Finally, a trust (other than a unit investment trust treated as a business entity) is considered a non-US trust for US tax purposes if (1) a court outside the United States is able to exercise primary supervision over the administration of the trust, and (2) any non-US person has the ability to control (or veto) any “substantial decision” of the trust.

The flowchart assumes that the default entity classification rules apply and the entity is not a per se corporation.

2 A partnership or simple or grantor trust may enter into a withholding agreement with the IRS pursuant to which the partnership or simple or grantor trust agrees to withhold US taxes on the account. The flowchart assumes no withholding agreement was executed.

3 In general, US tax treaty benefits are granted to the beneficial owner of the income determined under US tax principles. For fiscally transparent entities (such as partnerships, simple or grantor trusts or disregarded entities), this means the owners of the entity, NOT THE ENTITY ITSELF, claim US tax treaty benefits. These benefits are claimed on the beneficial owners’ W8 tax forms. However in certain limited cases, an entity may be considered fiscally transparent for US tax purposes but not fiscally transparent by the country with which the US has an income tax treaty. This type of an entity is called a “hybrid entity.” In certain cases, a hybrid entity, not the owners, may claim US tax treaty benefits if the hybrid entity meets the so-called qualified resident test under the applicable tax treaty. A qualifying “hybrid entity” claims the benefits of a US tax treaty by providing a Form W-8BEN-E, in addition to the form required by the flowchart. Importantly, electing hybrid status does not eliminate the need to document all beneficial owners. We note it is unusual for a hybrid entity to claim treaty benefits. The more common scenario is the beneficial owners claim treaty benefits on their tax forms.

4 The rules for classifying trusts are difficult and complex. The flowchart applies generalized rules only. There are many nuances to be considered when classifying a trust which are not addressed in the flowchart. For example, simple trusts cannot have charitable beneficiaries.

5 What is a foreign financial institution for FATCA purpose?

The various FATCA classifications can be broken down into two major categories: foreign financial institutions (FFI) and non-financial foreign (NFFE). Very generally, a financial institution is an entity that is a:

• Depository Institution

• Custodial Institution

• Investment Entity

• Insurance Company that issues certain cash value insurance or annuity contracts.

An FFI typically is required to register with the IRS, obtain a Global Intermediary Identification Number and report on its customers / owners to the appropriate tax authorities. If the entity does not meet the definition of a Financial Institution, it is considered an NFFE and covered by this guide book.

Subject to variations under IRS regulations and intergovernmental agreements:

• a Depository Institution is an institution that accepts deposits in the ordinary course of a banking or similar business. This includes banks and credit unions.

• a Custodial Institution is an institution which holds financial assets for the account of others as a substantial portion of its business. This includes brokers, custodial banks, trust companies, clearing organizations, etc.

• an Investment Entity is any entity if either

(i) the entity generates 50%+ of its gross income from (i) trading in money market instruments, foreign currency, transferrable securities, interest rates, futures, etc.; (ii) portfolio management or (iii) otherwise investing, administering or managing funds or financial assets on behalf of other persons (generally, broker-dealers and investment managers);

or

(ii) 50%+ of the entity gross income is attributable to investing, reinvesting, or trading in financial assets AND it is managed by a Financial Institution (mutual funds, hedge funds, and collective investment vehicles are examples);

or

(iii) the entity holds itself out as an entity created to invest, reinvest, or trade invest in financial assets (mutual funds, hedge funds, and collective investment vehicles are examples).

An individual cannot be an FFI. Thus, an organization managed by a professional individual investment advisor (as opposed to an employee of an organization) would not be considered an Investment Entity under (ii) above because it is not managed by a financial institution.

Trusts, family investment companies and funds may fall within the definition of an Investment Entity when they are professionally managed by a financial institution – i.e. where a financial institution handles the day-to-day functions of the entity or has discretionary authority over the fund.

Example: Individual created a non-US Trust A and appoints X, a non-US bank or other financial institution, as the trustee. X, as trustee, is responsible for the management and administration of Trust A. Trust A is an Investment Entity and a Foreign Financial Institution because it is managed by a Foreign Financial Institution.

Example: Individual created a non-US Trust A and appoints Y, an individual professional manager, as the trustee. Y, as trustee, is responsible for the management and administration of Trust A. Trust A is not an Investment Entity or a Foreign Financial Institution because it is not managed by a Foreign Financial Institution. Individuals cannot be financial institutions.

6 The IRS has a list of countries with which it has executed intergovernmental agreements (IGAs) to authorize the implementation of FATCA in that jurisdiction. The list of IGAs can be found at https://www.treasury.gov/resource-center/tax-policy/treaties/Pages/FATCA....

7 See #4 for the definition of Financial Institution. An organization that is not considered a financial institution is considered a non-financial foreign entity (NFFE). There are 3 types of NFFEs; Excepted, Active and Passive. An Active NFFE is an operating business where less than 50% of (i) its gross income is considered passive income and (ii) its average assets are held for the production of passive income. Any NFFE that is not Excepted or Active is a Passive NFFE and must provide us with a certification of its substantial US owners (if any) – generally 10%+ direct or indirect ownership. Some IGAs modify the means of substantial US owners and refer to them as Controlling Persons.

8 Other possible choices include nonfinancial group entity, excepted nonfinancial start-up company, excepted non-financial entity in liquidation or bankruptcy, publicly traded NFFE or sponsored NFFE. See the instructions to the W-8 for further information.

Disclaimer

This guide does not constitute tax or legal advice and Interactive Brokers cannot advise you on how to complete IRS Forms W-8. Examples included in this guide are for illustration only and do not address all possible scenarios. Please consult your tax professional if you are unsure how to complete IRS Forms W-8.

FATCA FAQs - Issues Involving Mismatch Between Tax Treaty Country and Address

FATCA related FAQs involving mismatches between tax treaty country and address. See KB2601 for other FATCA related FAQ topics.

Q1: I claimed treaty benefits in one country but have an address outside that treaty country. Why did I receive an email asking for additional documentation?

A1: We are required to verify your connection with the treaty country since you also have an address outside that country. We can process your claim for treaty benefits if you provide one document from Category (A) AND one document from Category (B) below.

|

Category (A)

|

AND

|

Category (B)

|

|

ANY OF the following unexpired documents issued by the treaty country:

|

ANY OF the following documents that match your address in the treaty country:

|

|

|

· Driver’s license

|

· Driver’s license

|

|

|

· Passport

|

· Bank or brokerage statement*

|

|

|

· National identity card

|

· Utility bill*

|

*Bank or brokerage statements and utility bills must be less than 12 months old. Alternatively, if you cannot provide documents from both categories, please provide a written explanation as to why you are entitled to treaty benefits together with any supporting documentation. Note: we may request further information or documentation from you depending on the explanation provided.

Q2: I submitted a proof of address and I received an email that the document submission did not resolve the issue. Why?

A2: Please confirm that the proof of identity you submitted was issued by the treaty country and that the proof of address relates to your address in the treaty country. A proof of address document alone is not sufficient to resolve the matter. Sometimes, customers inadvertently submit documentation for the other address. Please check the date of the proof of address document. We can only accept documents dated less than 12 months old. Also confirm you submitted a proof of identity document from the treaty country.

Q3: I live in Hong Kong and chose China as my tax treaty country on my Form W-8BEN. I received a notification saying the proof of address and proof of identity I submitted was not sufficient to claim benefits under the U.S.-China tax treaty. Hong Kong is a Special Administrative Region of the People’s Republic of China, so the U.S.-China tax treaty applies to it, correct?

A3: No. According to the US Internal Revenue Service, the U.S.-People’s Republic of China tax treaty does NOT apply to Hong Kong. Unless you can provide a proof of address and identity in the People’s Republic of China or provide other evidence that you are a tax resident of People’s Republic of China, you may not claim Chinese tax treaty benefits.

Q4: I live in Macau and chose China as my tax treaty country on my Form W-8BEN. I received an e-mail saying that the proof of address I submitted for my Macau address was not sufficient to claim benefits under the U.S.-China tax treaty. Macau is a Special Administrative Region of the People’s Republic of China, so the U.S.-China tax treaty applies to it, correct?

A4: No. According to the U.S. Internal Revenue Service, the U.S.- People’s Republic of China tax treaty does NOT apply to Macau. Unless you can provide a proof of address and identity in the People’s Republic of China or provide other evidence that you are a tax resident of People’s Republic of China, you may not claim Chinese tax treaty benefits.

Q5: I live in Taiwan, ROC and chose China as my tax treaty country on my Form W-8BEN. I received an e-mail saying that the proof of address I submitted for my address in Taiwan, ROC was not sufficient to claim benefits under the U.S.-China tax treaty. Taiwan, ROC is formally known as the Republic of China, so the U.S.-China tax treaty applies to it, correct?

A5: No. According to the US Internal Revenue Service, the U.S.- People’s Republic of China tax treaty does NOT apply to Taiwan, ROC. Unless you can provide a proof of address in People’s Republic of China or provide other evidence that you are a tax resident of People’s Republic of China, you may not claim Chinese tax treaty benefits.

Q6: The information you have in your master file is out-of-date. I moved so that the address you identified as outside the treaty country is incorrect. What should I do?

A6: The fastest and most effective way to remedy the situation is to provide the requested information (see FAQ#1 above) so that our records are complete. You should also log into Account Management and make any required changes to your personal information.

We do not provide tax advice. Please consult your tax advisor for advice in completing tax forms and determining your taxpayer status.