Discount Certificates Tutorial

Introduction

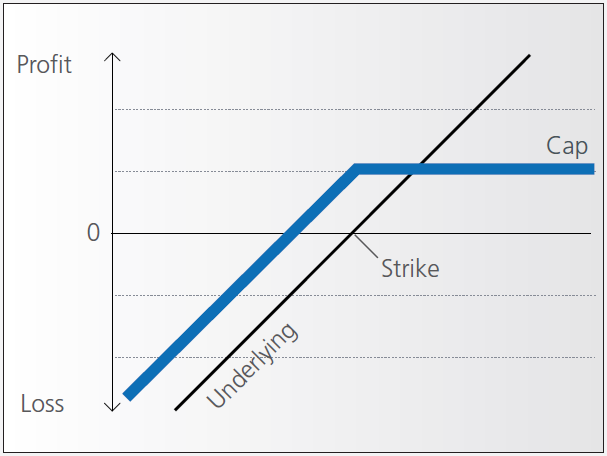

Discount certificates are designed to provide an enhanced return in sideways markets, compared to a direct investment in the underlying.

Discount certificates make it possible for you to buy an underlying instrument for less than its current market price. However, the maximum payback on a discount certificate is limited to a predetermined amount (cap).

Discount certificates normally have a term to maturity of one to three years. At maturity, a determination is made of where the price of the underlying instrument stands.

If it is at or above the cap, you’ll earn the maximum return and receive payment of the amount reflected by the cap.

If the price of the underlying instrument is below the cap on the maturity date, you’ll receive either the corresponding number of shares or a cash settlement reflecting the value of the underlying instrument on the maturity date.

Pay-out Profile

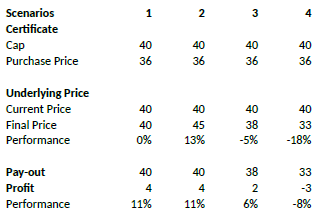

Example

Assume a discount certificate on ABC share. The certificate has a cap of EUR 40.00, and a purchase price of EUR 36.00. The table below shows scenarios depending on the final price of the underlying.

Factor Certificates Tutorial

Introduction

Factor certificates employ a daily leverage factor that multiplies the daily performance of the underlying instrument. Unlike knock-out warrants and mini-futures, factor certificates do not have a knock-out barrier. To avoid a loss greater than the investment, the calculation resets intraday if the performance of the underlying threatens to render the certificate worthless.

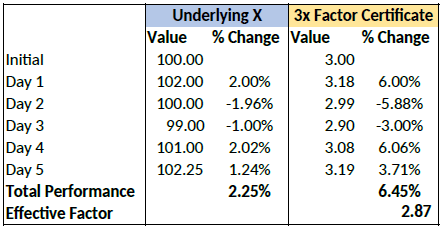

Daily Leverage

The performance of the certificate is calculated daily, without reference to previous days’ values. If the underlying returns 1% on the day, the value of 3x certificate increases by 3%, a 5x by 5%. The next day the process is repeated, referencing the prior day’s underlying close.

As such, factor certificates are particularly suitable for day-traders.

However, for a period of more than one day, the cumulative performance of the underlying cannot be simply multiplied by a factor of 3 as the previous day’s price always forms the new basis of calculating each day’s performance for the certificate. To illustrate with an example:

Cumulatively, the factor certificate has returned less than 3x the performance of the underlying.

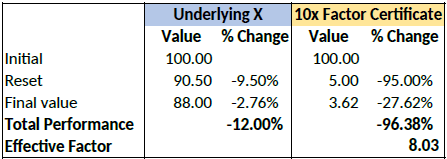

Intraday Reset

If an underlying for a factor certificate loses more than a certain percentage of its value intraday, the calculation is reset by simulating a new day. The reset threshold varies depending on the leverage factor.

Let’s assume a long factor certificate with a 10x leverage factor. According to the terms of the certificate, a reset will be triggered if the underlying loses more than 9.5% during the calculation day.

Let’s now assume that the underlying loses 12% of its value during a particular day. The reset

and final performance will be as follows:

Overview of Central Bank of Ireland CFD Rules Implementation for Retail Clients at IBIE

|

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with IBKR. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. |

The Central Bank of Ireland (CBI) enacted new rules applicable to retail clients trading CFDs, effective 1st August 2019. Professional clients are unaffected.

The rules consist of: 1) leverage limits; 2) a margin close out rule on a per account basis; 3) negative balance protection on a per account basis; 4) a restriction on the incentives offered to trade CFDs; and 5) a standardized risk warning.

Most clients (excepting regulated entities) are initially categorised as Retail Clients. IBKR may in certain circumstances agree to reclassify a Retail Client as a Professional Client, or a Professional Client as a Retail Client. Please see MiFID Categorisation for further detail.

The following sections detail how IBKR has implemented the CBI Decision.

1 Leverage Limits

1.1 Margins

Leverage limits were set by CBI at different levels depending on the underlying:

- 3.33% for major currency pairs; Major currency pairs are any combination of USD; CAD; EUR; GBP; CHF; JPY

- 5% for:

- Non-major currency pairs are any combination that includes a currency not listed above, e.g., USD.CNH

- Major indices are IBUS500; IBUS30; IBUST100; IBGB100; IBDE40; IBEU50; IBFR40; IBJP225; IBAU200

- Gold

- 10% for non-major equity indices; IBES35; IBCH20; IBNL25; IBHK50

- 20% for individual equities

1.2 Applied Margins - Standard Requirement

In addition to the CBI Margins, IBKR establishes its own margin requirements (IB Margins) based on the historical volatility of the underlying, and other factors. We will apply the IB Margins if they are higher than those prescribed by CBI .

Details of applicable IB and CBI margins can be found here.

1.2.1 Applied Margins - Concentration Minimum

A concentration charge is applied if your portfolio consists of a small number of CFD and/or Stock positions, or if the three largest positions have a dominant weight. We stress the portfolio by applying a 30% adverse move on the three largest positions and a 5% adverse move on the remaining positions. The total loss is applied as the maintenance margin requirement if it is greater than the standard requirement for the combined Stock and CFD positions. Note that the concentration charge is the only instance where CFD and Stock positions are margined together.

1.3 Funding of Initial Margin Requirements

You can only use cash to post initial margin to open a CFD position.

Initially all cash used to fund the account is available for CFD trading. Any initial margin requirements for other instruments and cash used to purchase cash stock reduce the available cash. If your cash stock purchases have created a margin loan, no funds are available for CFD trades even if your account has significant equity. We cannot increase a margin loan to fund CFD margin under the CBI rules.

Realized CFD profits are included in cash and are available immediately; the cash does not have to settle first. Unrealized profits however cannot be used to meet initial margin requirements.

2 Margin Close Out Rule

2.1 Maintenance Margin Calculations & Liquidations

The CBI requires IBKR to liquidate CFD positions latest when qualifying equity falls below 50% of the initial margin posted to open the positions. IBKR may close out positions sooner if our risk view is more conservative. Qualifying equity for this purpose includes CFD cash and unrealized CFD P&L (positive and negative). Note that CFD cash excludes cash supporting margin requirements for other instruments.

The basis for the calculation is the initial margin posted at the time of opening a CFD position. In other words, and unlike margin calculations applicable to non-CFD positions, the initial margin amount does not change when the value of the open position changes.

2.1.1 Example

You have EUR 2000 cash in your account and no open positions. You want to buy 100 CFDs of XYZ at a limit price of EUR 100. You are first filled 50 CFDs and then the remaining 50. Your available cash reduces as your trades are filled:

|

|

Cash |

Equity* |

Position |

Price |

Value |

Unrealized P&L |

IM |

MM |

Available Cash |

MM Violation |

|

Pre Trade |

2000 |

2000 |

|

|

|

|

|

|

2000 |

|

|

Post Trade 1 |

2000 |

2000 |

50 |

100 |

5000 |

0 |

1000 |

500 |

1000 |

No |

|

Post Trade 2 |

2000 |

2000 |

100 |

100 |

10000 |

0 |

2000 |

1000 |

0 |

No |

*Equity equals Cash plus Unrealized P&L

The price increases to 110. Your equity is now 3000, but you cannot open additional positions because your available cash is still 0, and under the CBI rules IM and MM remain unchanged:

|

|

Cash |

Equity |

Position |

Price |

Value |

Unrealized P&L |

IM |

MM |

Available Cash |

MM Violation |

|

Change |

2000 |

3000 |

100 |

110 |

11000 |

1000 |

2000 |

1000 |

0 |

No |

The price then drops to 95. Your equity declines to 1500 but there is no margin violation since it is still greater than the 1000 requirement:

|

|

Cash |

Equity |

Position |

Price |

Value |

Unrealized P&L |

IM |

MM |

Available Cash |

MM Violation |

|

Change |

2000 |

1500 |

100 |

95 |

9500 |

(500) |

2000 |

1000 |

0 |

No |

The price falls further to 85, causing a margin violation and triggering a liquidation:

|

|

Cash |

Equity |

Position |

Price |

Value |

Unrealized P&L |

IM |

MM |

Available Cash |

MM Violation |

|

Change |

2000 |

500 |

100 |

85 |

8500 |

(1500) |

2000 |

1000 |

0 |

Yes |

3 Negative Equity Protection

The CBI Decision limits your CFD-related liability to the funds dedicated to CFD-trading. Other financial instruments (e.g., shares or futures) cannot be liquidated to satisfy a CFD margin-deficit.*

Therefore, non-CFD assets are not part of your capital at risk for CFD trading.

Should you lose more than the cash dedicated to CFD trading, IB must write off the loss.

As Negative Equity Protection represents additional risk to IBKR, we will charge retail investors an additional financing spread of 1% for CFD positions held overnight. You can find detailed CFD financing rates here.

*Although we cannot liquidate non-CFD positions to cover a CFD deficit, we can liquidate CFD positions to cover a non-CFD deficit.

CFDマーケットモデルの概要

店頭取引の差金決済取引(CFD)は通常、次の3つあるモデルのどれかを使用しています: ダイレクト・マーケットアクセス(DMA)モデル、エージェンシーブローカーモデル、マーケットメーカーモデル。

IBでは3つの中でも一番透明性の高いものとされるDMAモデルを使用しています。このモデルを使用する場合、プロバイダーは原資産の実際の取引所でCFD注文をすぐにヘッジし、ヘッジ価格でCFDが約定されます。これは価格の透明性を強化することを目的とし、プロバイダーへの報酬はマークアップやマークダウンではなく、通常、手数料のみに基づくものとなります。

DMAモデルを使用する場合、プロ志向のお客様は株式取引同様に、取引所ブックにクオートを追加することができます。弊社ではすべてのCFD注文をヘッジ注文と合わせるため、約定のつかないCFD注文は取引所の原資産株式と一致するやはり約定のつかない注文を作成します。注文はレベル2のブック上で確認することができます。

またすぐに約定するしないに関わらず、注文はすべて弊社のSmartRoutingテクノロジーを利用して、複数ある原資産マーケット(LSE、CHI-X、Turquois、BATS、または内部の別のお客様の注文)のひとつにルーティングされます。

エージェンシーブローカーモデルはDMAモデルに似ており、 注文は原資産の実際の取引所で直接ヘッジされますが、 注文はプロバイダーによって管理され、約定可能になった場合のみに発注されるため、注文の発注者は自身の指値注文を取引所で見ることができません。

これとは対照的に通常のマーケットメーカーモデルを使用する場合、CFDプロバイダーはすべての注文を管理し、オプションやワラント、先物および原資産マーケットを直接利用して取引をいかにヘッジまたは相殺するかを判断します。プロバイダーは手数料を取らずに注文を市場に出すことがよくあり、ビッド・アスクのスプレッドに利益を出すプロバイダー自身の価格モデルに基づいて価格が動かされます。このモデルは市場に大きな変動がある際にはスプレッドを広げ、また再クオートができるものとみられています。

Overview of ESMA CFD Rules Implementation at IBKR (UK) - Retail Investors Only

|

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

61% of retail investor accounts lose money when trading CFDs with IBKR.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. |

The European Securities and Markets Authority (ESMA) enacted new rules applicable to retail clients trading CFDs, effective 1st August 2018. Professional clients are unaffected.

The rules consist of: 1) leverage limits; 2) a margin close out rule on a per account basis; 3) negative balance protection on a per account basis; 4) a restriction on the incentives offered to trade CFDs; and 5) a standardized risk warning.

Most clients (excepting regulated entities) are initially categorised as Retail Clients. IBKR may in certain circumstances agree to reclassify a Retail Client as a Professional Client, or a Professional Client as a Retail Client. Please see MiFID Categorisation for further detail.

The following sections detail how IBKR (UK) has implemented the ESMA Decision.

1 Leverage Limits

1.1 ESMA Margins

Leverage limits were set by ESMA at different levels depending on the underlying:

- 3.33% for major currency pairs; Major currency pairs are any combination of USD; CAD; EUR; GBP; CHF; JPY

- 5% for non-major currency pairs and major indices;

- Non-major currency pairs are any combination that includes a currency not listed above, e.g. USD.CNH

- Major indices are IBUS500; IBUS30; IBUST100; IBGB100; IBDE40; IBEU50; IBFR40; IBJP225; IBAU200

- 10% for non-major equity indices; IBES35; IBCH20; IBNL25; IBHK50

- 20% for individual equities

1.2 Applied Margins - Standard Requirement

In addition to the ESMA Margins, IBKR (UK) establishes its own margin requirements (IB Margins) based on the historical volatility of the underlying, and other factors. We will apply the IB Margins if they are higher than those prescribed by ESMA.

Details of applicable IB and ESMA margins can be found here.

1.2.1 Applied Margins - Concentration Minimum

A concentration charge is applied if your portfolio consists of a small number of CFD positions, or if the three largest positions have a dominant weight. We stress the portfolio by applying a 30% adverse move on the three largest positions and a 5% adverse move on the remaining positions. The total loss is applied as the maintenance margin requirement if it is greater than the standard requirement.

1.3 Funds Available for Initial Margin

You can only use cash to post initial margin to open a CFD position. Realized CFD profits are included in cash and are available immediately; the cash does not have to settle first. Unrealized profits however cannot be used to meet initial margin requirements.

1.4 Automatic Funding of Initial Margin Requirements (F-segments)

IBKR (UK) automatically transfers funds from your main account to the F-segment of your account to fund initial margin requirements for CFDs.

Note however that no transfers are made to satisfy CFD maintenance margin requirements. Therefore if qualifying equity (defined below) becomes insufficient to meet margin requirements, a liquidation will occur even if you have ample funds in your main account. If you wish to avoid a liquidation you must transfer additional funds to the F-segment in Account Management.

2 Margin Close Out Rule

2.1 Maintenance Margin Calculations & Liquidations

ESMA requires IBKR to liquidate CFD positions latest when qualifying equity falls below 50% of the initial margin posted to open the positions. IBKR may close out positions sooner if our risk view is more conservative. Qualifying equity for this purpose includes cash in the F-segment (excluding cash in any other account segment) and unrealized CFD P&L (positive and negative).

The basis for the calculation is the initial margin posted at the time of opening a CFD position. In other words, and unlike margin calculations applicable to non-CFD positions, the initial margin amount does not change when the value of the open position changes.

2.1.1 Example

You have EUR 2000 cash in your CFD account. You want to buy 100 CFDs of XYZ at a limit price of EUR 100. You are first filled 50 CFDs and then the remaining 50. Your available cash reduces as your trades are filled:

| Cash | Equity* | Position | Price | Value | Unrealized P&L | IM | MM | Available Cash | MM Violation | |

| Pre Trade | 2000 | 2000 | 2000 | |||||||

| Post Trade 1 | 2000 | 2000 | 50 | 100 | 5000 | 0 | 1000 | 500 | 1000 | No |

| Post Trade 2 | 2000 | 2000 | 100 | 100 | 10000 | 0 | 2000 | 1000 | 0 | No |

*Equity equals Cash plus Unrealized P&L

The price increases to 110. Your equity is now 3000, but you cannot open additional positions because your available cash is still 0, and under the ESMA rules IM and MM remain unchanged:

| Cash | Equity | Position | Price | Value | Unrealized P&L | IM | MM | Available Cash | MM Violation | |

| Change | 2000 | 3000 | 100 | 110 | 11000 | 1000 | 2000 | 1000 | 0 | No |

The price then drops to 95. Your equity declines to 1500 but there is no margin violation since it is still greater than the 1000 requirement:

| Cash | Equity | Position | Price | Value | Unrealized P&L | IM | MM | Available Cash | MM Violation | |

| Change | 2000 | 1500 | 100 | 95 | 9500 | (500) | 2000 | 1000 | 0 | No |

The price falls further to 85, causing a margin violation and triggering a liquidation:

| Cash | Equity | Position | Price | Value | Unrealized P&L | IM | MM | Available Cash | MM Violation | |

| Change | 2000 | 500 | 100 | 85 | 8500 | (1500) | 2000 | 1000 | 0 | Yes |

3 Negative Equity Protection

The ESMA Decision limits your CFD-related liability to the funds dedicated to CFD-trading. Other financial instruments (e.g. shares or futures) cannot be liquidated to satisfy a CFD margin-deficit.*

Therefore assets in the security and commodity segments of your main account, and non-CFD assets held in the F-segment, are not part of your capital at risk for CFD trading. However, all cash in the F-segment can be used to cover losses arising from CFD trading.

As Negative Equity Protection represents additional risk to IBKR, we will charge retail investors an additional financing spread of 1% for CFD positions held overnight. You can find detailed CFD financing rates here.

*Although we cannot liquidate non-CFD positions to cover a CFD deficit, we can liquidate CFD positions to cover a non-CFD deficit.

4 Incentives Offered to trade CFDs

The ESMA Decision imposes a ban on monetary and certain types of non-monetary benefits related to CFD trading. IBKR does not offer any bonus or other incentives to trade CFDs.

IBKR OTC Futures on LME Metals – Facts and Q&A

Introduction

IBKR LME OTC Futures provide clients synthetic access to the London Metal Exchange, a peer to peer exchange not generally available to non-member investors.

The LME OTC Futures are OTC derivative contracts with IBUK as the counterparty. The LME OTC Futures reference the corresponding LME future in terms of price, lot size, type and specification but are themselves not registered contracts. Physical delivery is not permitted.

IBKR LME OTC Futures are traded through your margin account, and you can therefore enter long as well as short leveraged positions. Margin rates equal those established by the LME. Like other futures they are risk-based (SPAN), and therefore variable. Current margins range between 6 and 9% depending on the contract.

Contracts

IBKR offers OTC Futures on the 3rd Wednesday expirations for the following metals:

| Metal | IBKR Symbol | Price USD/ | Multiplier |

| High Grade Primary Aluminium | AH | Metric Ton | 25 |

| Copper Grade A | CA | Metric Ton | 25 |

| Primary Nickel | NI | Metric Ton | 6 |

| Standard Lead | PB | Metric Ton | 25 |

| Tin | SNLME | Metric Ton | 5 |

| Special High Grade Zinc | ZSLME | Metric Ton | 25 |

3rd Wednesday Expirations

The LME features a range of contracts adapted to the needs of physical traders and hedgers. The principal among them are daily 3-month forwards used by physical traders to precisely match their hedges to their needs.

The 3rd Wednesday contracts are monthly contracts, like futures, and as such better adapted to the needs of financial traders. As the name suggests, they expire on the 3rd Wednesday of each month and, although physically settled on the LME, are strictly cash-settled at IBKR. The 3rd Wednesday contracts have become increasingly popular and account for 65% of open interest on the LME.

Quotes and Market Data

IBKR streams quotes from the LME (L2 market data) and does not widen the quote. Every client order is first hedged on exchange and the LME OTC order filled at the price of the hedge.

Cash Flows

Daily variation margin and realized P&L for the IBKR LME OTC Futures are cash-settled daily, like a standard future. By contrast, cash flows for the underlying LME contract are only settled after the contract has expired.

Margins

The margin requirements for the IBKR LME OTC Futures equal the requirement for the underlying contract on the LME. LME uses Standard Portfolio Analysis of Risk (SPAN) to calculate Initial Margin.

Like for other futures, the margin rates are established as an absolute value per contract and usually updated monthly.

Trading Permissions

You will need to set up permissions for United Kingdom Metals in Client Portal.

Market Data

You will need a subscription for Level II London Metal Exchange, currently GBP 1.00.

LME OTC Resources

Product Listings & Links to Contract Details

Commissions

Margin Requirements

Frequently asked Questions

What do I need to do to start trading LME OTC Futures?

You need to set up trading permission for United Kingdom Metals in Client Portal. If you have an IB LLC or an IB UK account carried by IB LLC we will set up a new account segment (identified with your existing account number plus the suffix “F”). Once the set-up is confirmed you can begin to trade. You do not need to fund the F segment separately; funds will be automatically transferred from your main account to meet margin requirements.

How are my LME OTC Futures trades and positions reflected in my statements?

Your positions are held in a separate account segment identified by your primary account number with the suffix “F”. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. You can make the choice in the statement window in Client Portal.

What account protections apply when trading LME OTC Futures?

LME OTC Futures are contracts with IB UK as your counterparty, and are not traded on a regulated exchange and are not cleared on a central clearinghouse. Since IB UK is the counterparty to your trades, you are exposed to the financial and business risks, including credit risk, associated with dealing with IB UK. Please note however that all client funds are always fully segregated, including for institutional clients. IB UK is a participant in the UK Financial Services Compensation Scheme ("FSCS"). IB UK is not a member of the U.S. Securities Investor Protection Corporation (“SIPC”).

Can I trade LME OTC Futures over the phone?

No. In exceptional cases we may agree to process closing orders over the phone, but never opening orders.

Overview of Forex CFDs issued by IB Australia - Facts and Q&A

The following article is intended to provide a general introduction to forex-based Contracts for Differences (CFDs) issued by IB Australia (IBA).

Transparent DMA Quotes: IBA ensures tight spreads and substantial liquidity as a result of combining quotation streams from 14 of the world's largest foreign exchange dealers which constitute more than 70% of market share in the global interbank market*. This results in displayed quotes as small as 0.1 PIP. IBA does not mark up the quotes, rather passes through the prices that it receives and charges a separate low commission.

*Source: Euromoney FX survey FX Poll 2016.

Carry Interest: Forex CFDs are rolled over reflecting the benchmark interest rate differential of the relevant currency pair. This is in principle similar to the TOM Next rolls used by other brokers, but offers greater stability as benchmark rates generally are less volatile than swap rates. In addition IBA applies a low financing spread that for major pairs starts at just 1.0% and can be as low as 0.5% for large balances. More volatile pairs have higher financing spreads.

The carry interest for IBA Forex CFDs is based on a currency-pair specific benchmark and a spread. The benchmark is the difference between the IBA benchmark rates for the two currencies. It is calculated as + BM Base currency – BM Quote currency.

For example, April 21, 2016 the GBP benchmark rate was 0.483%, the USD rate was 0.37%. The applicable benchmark rate is:

GBP.USD BM +0.48% - 0.37% = +0.113%

The applicable customer rate is Pair BM – IBA spread for long positions, BM + spread for short positions:

GBP.USD Long Rate +0.113% - 1.00% = -0.887%

GBP.USD Short Rate +0.113% + 1.00% = +1.113%

It is important to note that the long rate is applied as a credit, the short rate as a debit. Consequently for a long position a positive rate means a credit, a negative rate a charge. However for short positions a positive rate means a charge, a negative rate a credit.

Interest is calculated on the contract value expressed in the quote currency, and credited or debited in that currency if it is either AUD or USD. Interest in other currencies is converted into the base currency of your account and then credited or debited.

For example:

| Daily Interest | |||||

|---|---|---|---|---|---|

| Position | GBP.USD Close | USD Value | Rate | USD | |

| GBP.USD | -20,000 | 1.43232 | -28,646.40 | 1.113% | -0.89 |

Interest on Forex CFD balances is calculated on a stand-alone contract basis, and not combined or netted with other currency exposures, including Spot FX. Although IBA does not directly reference swap rates, IBA reserves the right to apply higher spreads in exceptional market conditions, such as during spikes in swap rates that can occur around fiscal year-ends.

Detailed interest schedules can be viewed here.

Trading: IBA Forex CFDs can be traded either in classical TWS or in the IBA FX Trader, with over 20 available order types and algos. To find the contract you want to trade in classical TWS or FX Trader, enter the currency pair (i.e. EUR.USD) and choose Sec Type CFD in the Contract Selection pop-up.

Margin: IBA Forex CFD margins are determined for each currency pair on a per contract basis without regard to other Forex balances held in the account. Margins start as low as 2.5% of contract value for major currency pairs. Details for all currency pairs can be found here.

Commissions: IBA passes through the prices that it receives and charges a separate low commission. We do this in the interest of providing a transparent pricing structure instead of marking up our quotes and charging nothing in commissions as is the practice with many forex brokers. Commissions are tiered based on monthly traded value, and range from 0.20 basis points to 0.08 basis points.

Details are found here.

Trading Permissions: In order to trade Forex CFDs, you must set up the trading permission for Forex CFDs in Account Management. The suitability criteria are the same as those for Leverage FX. Share and Index CFDs are a separate trading permission.

Trading Example

Opening the position

You purchase 10 lots (200000) EUR.CHF CFDs at $1.16195 for CHF 232,390, which you then hold for 5 days.

| EUR.CHF Forex CFDs – New Position | |

|---|---|

| Reference Underlying Price | 1.16188 - 1.16195 |

| CFDs Reference Price | 1.16188 - 1.16195 |

| Action | Buy |

| Quantity | 200,000 |

| Trade Value | CHF 232,390.00 |

| Margin (3% x 232,390) | AUD 9,100 |

| Interest Charged (on CHF 232,390 over 5 days) | |||

|---|---|---|---|

| Tier I (Pair BM 0.42% - IB Spread 1%) | CHF 232,390.00 | -0.58% | (CHF 18.72) |

Closing the position

| Exit CFD Position | ||

|---|---|---|

| Profit Scenario | Loss Scenario | |

| Reference Underlying Price | 1.16840 - 1.16848 | 1.15539 - 1.15546 |

| CFDs Reference Price | 1.16840 - 1.16848 | 1.15539 - 1.15546 |

| Action | Sell | Sell |

| Quantity | 200,000 | 200,000 |

| Trade Value | CHF 233,680.00 | CHF 231,078.00 |

| Trade P&L | CHF 1,290.00 | (CHF 1,312.00) |

| Financing | (CHF 18.72) | (CHF 18.72) |

| Entry Commission 0.002% | (CHF 4.65) | (CHF 4.65) |

| Entry Commission 0.002% | (CHF 4.67) | (CHF 4.62) |

| Total P&L | CHF 1,261.96 | (CHF 1,339.99) |

| Total P&L @ AUD.CHF 0.770855 | AUD 1,637.09 | (AUD 1,738.32) |

CFD Resources

Below are some useful links with more detailed information on IBA’s CFD offering:

Frequently Asked Questions

What is the difference between IBA Forex CFDs and other forms of forex trading?

IBA Forex CFDs are differentiated mainly by their their exceptionally tight spreads resulting from that IBA a) combines quotation streams from 14 of the world's largest foreign exchange dealers which constitute more than 70% of market share in the global interbank market*. This results in displayed quotes as small as 0.1 PIP, and b) IBA does not mark up the quotes, rather passes through the prices that it receives and charges a separate low commission.

*Source: Euromoney FX survey FX Poll 2016.

IBA Forex CFDs also offer a unique financing model for positions held overnight. IBA uses a pair benchmark rate which is the difference between the benchmark rates for the two underlying currencies. This is in principle similar to the TOM Next rolls used by other brokers, but offers greater stability as benchmark rates generally are less volatile than swap rates.

Please see the Carry Interest section above for a detailed example.

Are there any market data requirements?

The market data for IBA Forex CFDs is the same as for Leverage FX. It is a global permission and free of charge.

Related Articles

Overview of Share CFDs issued by IB Australia

Share CFD Definition

IBA CFDs are OTC contracts which deliver the return of the underlying stock, including dividends and corporate actions (read more about CFD corporate actions). You can enter long as well as short leveraged positions.

Said differently, it is an agreement between the buyer (you) and IBA to exchange the difference in the current value of a share, and its value at a future time. If you hold a long position and the difference is positive, IBA pays you. If it is negative, you pay IBA.

IBA’s CFDs work on an Open Trade Equity model. With IBA’s CFDs, the Open Trade Equity (OTE) represents the cumulative unrealised profit/loss on the CFD position relative to movements in the current price of the Reference Underlying. The profit/loss is realised when the position is closed. If the profit/loss is in a currency other than AUD or USD it is converted to the base currency of your account and credited/debited to cash.

The price of the CFD is the exchange-quoted price of the underlying share. In fact, IBA CFD quotes are identical to the Smart-routed quotes for shares that you can observe in the Trader Work Station and IBA offers Direct Market Access (DMA). Similar to shares, your nonmarketable (i.e., limit) orders have the underlying hedge directly represented on the deep book of those exchanges at which it trades. This also means that you can place orders to buy the CFD at the underlying bid and sell at the offer.

To compare IBA’s transparent CFD model to others available in the market please see our Overview of CFD Market Models.

IBA currently offers approximately 6200 Share CFDs covering the principal markets in the US, Europe and Asia. The constituents of the major indexes listed below are currently available as IBA Share CFDs. In many countries IBA also offers trading in liquid small cap shares. These are shares with free float adjusted market capitalization of at least USD 500

million and median daily trading value of at least USD 600 thousand. Please see CFD Product Listings for more detail. More countries will be added in the near future.

| United States | S&P 500, DJA, Nasdaq 100, S&P 400 (Mid Cap), Liquid Small Cap |

| United Kingdom | FTSE 350 + Liquid Small Cap (incl. IOB) |

| Germany | Dax, MDax, TecDax + Liquid Small Cap |

| Switzerland | Swiss portion of STOXX Europe 600 (48 shares) + Liquid Small Cap |

| France | CAC Large Cap, CAC Mid Cap + Liquid Small Cap |

| Netherlands | AEX, AMS Mid Cap + Liquid Small Cap |

| Belgium | BEL 20, BEL Mid Cap + Liquid Small Cap |

| Spain | IBEX 35 + Liquid Small Cap |

| Portugal | PSI 20 |

| Sweden | OMX Stockholm 30 + Liquid Small Cap |

| Finland | OMX Helsinki 25 + Liquid Small Cap |

| Denmark | OMX Copenhagen 30 + Liquid Small Cap |

| Norway | OBX |

| Czech | PX |

| Japan | Nikkei 225 + Liquid Small Cap |

| Hong Kong | HSI + Liquid Small Cap |

| Australia | ASX 200 + Liquid Small Cap |

| Singapore* | STI + Liquid Small Cap |

*not available to Singapore residents

Comparison Between CFDs and Underlying Shares

Depending on your trading objectives and trading style, CFDs offer a number of advantages compared to stocks, but also some disadvantages:

| Benefits of IB CFDs | Drawbacks of IB CFDs |

|---|---|

| No stamp duty or financial transaction tax (UK, France, Belgium) | No ownership rights |

| Generally lower commission and margin rates than shares | Complex corporate actions may not always be exactly replicable |

| Tax treaty rates for dividends without need for reclaim | Taxation of gains may differ from shares (please consult your tax advisor) |

| Exemption from day trading rules |

Worked Example

Opening the position:

You purchase 30,000 CFDs at $10.00 for $300,000, which you then hold for 30 days.

| AUD Share CFDs- New Position | |

|---|---|

| Reference Underlying Price | $9.98 - $10.00 |

| CFDs Reference Price | $9.98 - $10.00 |

| Action | Buy |

| Quantity | 30000 |

| Trade Value | $300,000 |

| Margin (20% x 300,000)1 | $60,000 |

| Interest tier Charged (on $300,000 over 30 days) | |||

|---|---|---|---|

| Tier I | $140,000 | 2.942% | $338.53 |

| Tier II 2 | $160,000 | 2.942% | $386.89 |

| Total Interest Charged | $725.42 | ||

Closing the position:

| Exit CFD Position | ||

|---|---|---|

| Profit Scenario | Loss Scenario | |

| Reference Underlying Price | $10.48 - $10.50 | $9.48 – $9.50 |

| CFDs Reference Price | $10.48 - 10.50 | $9.48 – 9.50 |

| Action | Sell | Sell |

| Quantity | 30,000 | 30,000 |

| Trade Value | $314,400 | $284,400 |

| Trade P&L | $14,400.00 | ($15,600.00) |

| Financing | ($725.42) | ($725.42) |

| Entry Commission 0.05% | ($150.00) | ($150.00) |

| Exit Commission 0.05% | ($157.20) | ($142.20) |

| Total P&L | $13,367.38 | ($16,617.62) |

1) Assuming minimum margin of 20%

2) IBA spread is 1.5% for all AUD tiers. Other currencies have additional tiers of 1%

and 0.5%

CFD Resources

Below are some useful links with more detailed information on IBA’s CFD offering:

CFD Contract Specifications

CFD Product Listings

CFD Commissions

CFD Financing Rates

CFD Margin Requirements

CFD Corporate Actions

The following video tutorial is also available:

How to Place a CFD Trade on the Trader Workstation

Frequently Asked Questions

What Stocks are available as CFDs?

Large and Mid-Cap stocks in the US, Western Europe, Nordic and Japan. Liquid Small Cap stocks are also available in many markets. Please see CFD Product Listings for more detail. More countries will be added in the near future.

Do you have CFDs on Other Underlying Types?

Yes. Please see IBA Index CFDs - Facts and Q&A and Forex CFDs - Facts and Q&A.

How do you determine your Share CFD quotes?

IBA CFD quotes are identical to the Smart routed quotes for the underlying share. IBA does not widen the spread or hold positions against you. To learn more please go to Overview of CFD Market Models.

Can I see my limit orders reflected on the exchange?

Yes. IBA offers Direct market Access (DMA) whereby your non-marketable (i.e., limit) orders have the underlying hedge directly represented on the deep book of those exchanges at which it trades. This also means that you can place orders to buy the CFD at the underlying bid and sell at the offer. In addition, you may also receive price improvement if another

client’s order crosses at a better price than is available on public venues.

How do you determine margins for Share CFDs?

IBA establishes risk-based margin requirements based on the historical volatility of each underlying share. The minimum margin is 20% for long positions, 25% for short positions. In addition IB applies a concemtration charge margining the two largest positions at 30%, standard margin applied to additional positions. There are no portfolio off-sets between individual CFD positions or between CFDs and exposures to the underlying share. A large position charge applies if the CFD position exceeds 0.5% of the market capitalisation of the underlying share. Please refer to CFD Margin Requirements for more detail.

Are short Share CFDs subject to forced buy-in?

Yes. In the event the underlying stock becomes difficult or impossible to borrow, the holder of the short CFD position will become subject to buy-in.

How do you handle dividends and corporate actions?

IBA will generally reflect the economic effect of the corporate action for CFD holders as if they had been holding the underlying security. Dividends are reflected as cash adjustments, while other actions may be reflected through either cash or position adjustments, or both. For example, where the corporate action results in a change of the number of shares (e.g. stocksplit, reverse stock split), the number of CFDs will be adjusted accordingly. Where the action results in a new entity with listed shares, and IBA decides to offer these as CFDs, then new long or short positions will be created in the appropriate amount. For an overview please CFD Corporate Actions.

Please note that in some cases it may not be possible to accurately adjust the CFD for a complex corporate action such as some mergers. In these cases IBA may terminate the CFD prior to the ex-date.

What do I need to do to start trading CFDs with IBA?

You need to set up trading permission for CFDs in Account Management, and agree to the relevant trading disclosures.

Are there any market data requirements?

The market data for IBA Share CFDs is the market data for the underlying shares. It is therefore necessary to have market data permissions for the relevant exchanges. If you already have set up market data permissions for an exchange for trading the shares, you do not need to do anything. If you want to trade CFDs on an exchange for which you do not

currently have market data permissions, you can set up the permissions in the same way as you would if you planned to trade the underlying shares.

Can I transfer in CFD positions from another broker?

IBA will be glad to facilitate the transfer of CFD positions, subject to the agreement of the other broker. As the transfer of CFD positions is more complex than is the case for share positions, we generally require the position to be at least the equivalent of USD 100,000.

Are charts available for Share CFDs?

Yes.

What account protections apply when trading CFDs with IBA?

CFDs are contracts with IBA as your counterparty, and are not traded on a regulated exchange and are not cleared on a central clearinghouse. Since IBA is the counterparty to your CFD trades, you are exposed to the financial and business risks, including credit risk, associated with dealing with IBA. IBA will handle the client money it receives in accordance

with the rules set out in Part 7.8 of the Corporations Act 2001 (Cth) (Client Money Rules) and to the extent applicable the ASIC Market Integrity Rules (ASX market) 2010. Where required, IBA will pay such client money into a trust account. Please refer to the IBA CFD Product Disclosure Statement for further detail on risks associated with trading CFDs.

What are the maximum a positions I can have in a specific CFD?

There is no pre-set limit. Bear in mind however that very large positions may be subject to increased margin requirements. Please refer to CFD Margin Requirements for more detail.

Can I trade CFDs over the phone?

No. In exceptional cases we may agree to process closing orders over the phone, but never opening orders.

Related Articles

Overview of Index CFDs issued by IB Australia

IB Index CFDs are contracts which deliver the return of a market index. Said differently, the CFD is an agreement between the buyer (you) and IB to exchange the difference between the current value of an index, and its value at a future time. If you hold a long position and the difference is positive, IB pays you. If it is negative, you pay IB.

IBA’s CFDs work on an Open Trade Equity model. With IBA’s CFDs, the Open Trade Equity (OTE) represents the cumulative unrealised profit/loss on the CFD position relative to movements in the current price of the Reference Underlying. The profit/loss is realised when the position is closed. If the profit/loss is in a currency other than AUD or USD it is converted to the base currency of your account and credited/debited to cash.

IBA Index CFDs are available on the following major indices:

| IB Index CFDs | Commissions | ||||

|---|---|---|---|---|---|

| Contract | IB Symbol | Per Trade | Min. Per Order | Currency | Multiplier* |

| US 500 | IBUS500 | 0.005% | 1.00 | USD | 1 |

| US 30 | IBUS30 | 0.005% | 1.00 | USD | 1 |

| US Tech 100 | IBUST100 | 0.010% | 1.00 | USD | 1 |

| UK 100 | IBGB100 | 0.005% | 1.00 | GBP | 1 |

| EURO 50 | IBEU50 | 0.010% | 1.00 | EUR | 1 |

| GERMANY 40 | IBDE40 | 0.005% | 1.00 | EUR | 1 |

| FRANCE 40 | IBFR40 | 0.010% | 1.00 | EUR | 1 |

| SPAIN 35 | IBES35 | 0.010% | 1.00 | EUR | 1 |

| NETHERLANDS 25 | IBNL25 | 0.010% | 1.00 | EUR | 1 |

| SWITZERLAND 20 | IBCH20 | 0.010% | 1.00 | CHF | 1 |

| JAPAN 225 | IBJP225 | 0.010% | 40.00 | JPY | 1 |

| HONG KONG 50 | IBHK50 | 0.010% | 10.00 | HKD | 1 |

| AUSTRALIA 200 | IBAU200 | 0.010% | 1.00 | AUD | 1 |

| *times index level | |||||

The price of the Index CFD is directly related to the price of the exchange-quoted related future. The price-movement of the Index CFD tracks the movement of the related future, although the price levels differ by an adjustment for interest and dividends (fair-value adjustment).

For example (actual quotes):

| 29-Jan-15 | IBDE 30 | DAX Mar'15 | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Time | Bid | Ask | Spread | Change | Bid | Ask | Spread | Change | |

| 10:10:04 | 10706.69 | 10707.19 | 0.5 | 10710.00 | 10710.50 | 0.5 | |||

| 10:10:11 | 10704.19 | 10705.19 | 1 | -2.5 | 10707.50 | 10708.50 | 1 | -2.5 | |

| 10:10:19 | 10709.19 | 10709.69 | 0.5 | 5.0 | 10712.50 | 10713.00 | 0.5 | 5.0 | |

| 10:10:27 | 10710.19 | 10710.69 | 0.5 | 1 | 10713.50 | 10714.00 | 0.5 | 1 | |

| 10:10:33 | 10709.69 | 10710.69 | 1 | -0.5 | 10713 | 10714 | 1 | -0.5 | |

IBA Index CFD Price Determination: As discussed the IBA Index CFDs track the related future, adjusted for fair value. The resulting synthetic index level is very close to the cash index, but may differ somewhat as explained below.

In the futures market fair value is the equilibrium price for a futures contract. It is the price at which an investor effectively pays the appropriate rate of interest, and is compensated for the dividends he forgoes by holding the future rather than the underlying shares.

The fair value is determined by adjusting the cash index as follows, taking into account the time remaining to expiry:

Cash Index Value + Interest - Dividends = Future at Fair Value

To determine the value of the IB Index CFD, we reverse the process:

Actual Futures Price - Interest + Dividends = IB Index CFD Value

The result is not necessarily the same value as the cash index. This is because the starting point is the actual price of the future, and the future may trade above or below its fair value.

Having established the level for the synthetic index, the actual CFD quotes show spreads and ticks that reflect those of the underlying future.

Low Commissions and Financing Rates: Unlike other Index CFD providers IB charges a transparent commission, rather than widening the spread of the related future. Depending on the index, commission rates are only 0.005% - 0.01%. Overnight financing rates are just benchmark +/- 1.5%.

Flexible Exposure to Major Markets: IB Index CFDs are available for the main US, European and Asia Pacific indices. They can be traded in lots as small as 1X the index level, a fraction of the size of the related futures. And unlike the related futures, they do not need to be rolled over. You can trade all European and US IB Index CFDs from 09:00 - 22:00 CET.

Margin Efficiency: IB Index CFDs are margined at the same low rates as the related future, adjusted for contract size (subject to a minimum of 5%). IB also offers intraday margin rates on Index CFDs at a level consistent with that of the related futures contract. Intraday rates are generally set at 50% of the overnight rate and are offered during a time frame which begins at the start of liquid trading hours and ends 15 minutes before the liquid trading close. A list of the Index CFDs subject to this change and their liquid trading hours is provided in the table below.

| IB Symbol | Liquid Hours | Total Hours | Time Zone |

|---|---|---|---|

| IBUS500 | 09:30 - 16:00 | 03:00 - 16:00 | EST |

| IBUS30 | 09:30 - 16:00 | 03:00 - 16:00 | EST |

| IBUST100 | 09:30 - 16:00 | 03:00 - 16:00 | EST |

| IBGB100 | 08:00 - 16:30 | 08:00 - 21:00 | GMT |

| IBEU50 | 09:00 - 22:00 | 09:00 - 22:00 | CET |

| IBDE40 | 09:00 - 22:00 | 09:00 - 22:00 | CET |

| IBFR40 | 09:00 - 18:15 | 09:00 - 22:00 | CET |

| IBES35 | 09:00 - 17:35 | 09:00 - 20:00 | CET |

| IBNL25 | 09:00 - 17:30 | 09:00 - 22:00 | CET |

| IBCH20 | 09:00 - 17:27 | 09:00 - 22:00 | CET |

| IBJP225 | 09:00 - 15:00 | 09:00 - 15:00 | JST |

| IBHK50 | 09:30 - 16:00 | 09:30 - 16:00 | HKT |

| IBAU200 | 10:00 - 16:00 | 10:00 - 16:00 | EDT |

Trading requiring margin involves a high degree of risk and may result in a loss of funds greater than the amount you have deposited.

Dividend Adjustment: Based on ordinary dividends for the constituents of each index. Dividends are accrued on the ex-date and settled T + 2.

Corporate Action Adjustments: None for the CFD. Corporate actions are reflected in the index level

Worked Trade Example:

Opening the Position

You purchase 10 IBUS30 CFDs at $23,534.48 for USD 235,344.80, which you then hold for 5 days.

| IBUS30 Index CFDs – New Position | |

|---|---|

| Reference Underlying Price | 23,465 - 23,466 |

| CFDs Reference Price | 23,533.48 - 23,534.48 |

| Action | Buy |

| Quantity | 10 |

| Trade Value | USD 235,344.80 |

| Margin (5%) | AUD 15,393.00 |

| Interest tier Charged (on AUD 235,344.80 over 5 days) | |||

|---|---|---|---|

| Flat Interest (USD Libor + 1.5%) | USD 235,344.80 | 2.684% | (USD 87.73) |

Closing the Position

| Exit CFD Position | ||

|---|---|---|

| Profit Scenario | Loss Scenario | |

| Reference Underlying Price | 23,627 - 23,628 | 23,303 - 23,304 |

| CFDs Reference Price | 23,693.34 - 23,694.34 | 23,369.34 - 23,370.34 |

| Action | Sell | Sell |

| Quantity | 10 | 10 |

| Trade Value | USD 236,933.40 | USD 233,693.40 |

| Trade P&L | USD 1,588.60 | (USD 1,651.40) |

| Financing | (USD 87.73) | (USD 87.73) |

| Entry Commission 0.005% | (USD 11.77) | (USD 11.77) |

| Exit Commission 0.005% | (USD 11.85) | (USD 11.68) |

| Total P&L | USD 1,477.25 | (USD 1,762.58) |

| Total P&L @ AUD.USD 0.76520 | AUD 1,930.55 | (AUD 2,303.43) |

CFD Resources

Below are some useful links with more detailed information on IB’s CFD offering:

Frequently asked Questions

What Indices are available as CFDs?

The principal indices in the United States, Europe and Asia Pacific. Please see CFD Product Listings for more detail.

Do you have CFDs on commodities?

IB does not currently offer Commodity CFDs.

How do you determine your Index CFD quotes?

IB Index CFDs track the related future, adjusted for fair value. It is in effect a synthetic index level that is very close to the cash index, but may differ somewhat as explained below.

In the futures market fair value is the equilibrium price for a futures contract. It is the price at which an investor effectively pays the appropriate rate of interest, and is compensated for the dividends he forgoes by holding the future rather than the underlying shares.

The fair value is determined by adjusting the cash index as follows, taking into account the time remaining to expiry:

Cash Index Value + Interest - Dividends = Future at Fair Value

To determine the value of the IB Index CFD, we reverse the process:

Actual Futures Price - Interest + Dividends = IB Index CFD Value

The result is not necessarily the same value as the cash index. This is because the starting point is the actual price of the future, and the future may trade above or below its fair value.

Having established the level for the synthetic index, the actual CFD quotes show spreads and ticks that reflect those of the underlying future. IB charges a commission rather than widening the spread, enabling a transparent comparison between the returns of the Index CFD and the related future.

How do you determine margins for Index CFDs?

The margins are the same as for the related future, adjusted for size, including lower rates intraday. Please refer to CFD Margin Requirements for more detail.

Are short Index CFDs subject to forced buy-in?

No. As the reference instrument is a future, the index CFD is not affected by stock loan availability.

How do you handle dividends and corporate actions?

The index level itself is adjusted for corporate actions, and no direct adjustments to the CFD are necessary. Index CFDs are however adjusted for dividends as the underlying future is typically based on a price index. The only exception among the currently available IB Index CFDs is Germany 40 (IBDE40), which is based on a total return index.

For an overview please see CFD Corporate Actions.

What do I need to do to start trading CFDs with IB?

You need to set up trading permission for CFDs in Account Management, and agree to the relevant trading disclosures. The trading permission covers both Index and Share CFDs.

Are there any market data requirements?

The market data for IB Index CFDs is free, but you need to subscribe to it for system reasons. It is a global permission (like FX), so you only need to subscribe once. To do this, log into account management, and click through the following tabs: Trade/Configuration/Market Data Subscriptions. Alternatively you can set up an Index CFD in your TWS quote monitor and click the “Market Data Subscription Manager” button that appears on the quote line.

Can I transfer in CFD positions from another broker?

IB does not currently have a facility for transferring Index CFD positions. IB will be glad to facilitate the transfer of Share CFD positions. As the transfer of CFD positions is more complex than is the case for share positions, we generally require the position to be at least the equivalent of USD 100,000.

What account protections apply when trading CFDs with IBA?

CFDs are contracts with IBA as your counterparty, and are not traded on a regulated exchange and are not cleared on a central clearinghouse. Since IBA is the counterparty to your CFD trades, you are exposed to the financial and business risks, including credit risk, associated with dealing with IBA. IBA will handle the client money it receives in accordance

with the rules set out in Part 7.8 of the Corporations Act 2001 (Cth) (Client Money Rules) and to the extent applicable the ASIC Market Integrity Rules (ASX market) 2010. Where required, IBA will pay such client money into a trust account. Please refer to the IBA CFD Product Disclosure Statement for further detail on risks associated with trading CFDs.

What are the maximum positions I can have in a specific Index CFD?

There is no pre-set limit for position size, but please be aware that trade-size restrictions apply to Index CFDs. Please see the table at the beginning of this document for more detail.

Can I trade CFDs over the phone?

No. In exceptional cases we may agree to process closing orders over the phone, but never opening orders.

Related Articles

インタラクティブ・ブローカーズ証券株式会社発行のFXCFDに関するリスク概要

このサマリーは店頭外国為替証拠金取引(“IB FXCFD"取引)に係わる重要なリスクを明確にするものです。規制を目的とするリスク開示書ではありません。

- IB FXCFD取引はすべての投資家のお客様に適したものではなく、お客様の知識や取引経験などをご考慮のうえ、ご自身が高いリスクを許容しうる投資経験や損失に耐えうる財産状況にない場合には、取引を取りやめるなど、ご自身の判断と責任において投資判断をされるようお願いいたします。

- 外国為替レートおよび金利レートのボラティリティーにより短時間で多額な損失が生じる可能性があります。FXCFDにはお客様の投資に係わるボラティリティーをさらに拡大させるレバレッジがかかっているため、投資額以上の損失が生じる可能性があります。IB FXCFDのロールオーバー金利はまた、金利レートの変動により受け取りから支払いに転じることがあります。

- 必要なIB維持証拠金を十分に補う資産が、いつでも口座に入っている必要があります。猶予期間はなく、当社はマージンコールの請求を行いません。資産はリアルタイムで計算され、これが不足した場合、当社では速やか、かつ自動的にポジションの強制決済を行って口座の証拠金不足を解消します。リアルタイムの強制決済は口座内の資産がマイナスになるリスクの最小化を目的としていますが、このリスクを取り除くことはできません。資産がマイナスになった場合には、不足分を補うために資金の追加が必要になります。

- 当社が提示するIB FXCFD取引の取引価格は現行の通貨市場に基づくものですが、この価格によって取引が約定されることを保証するものではありません。大きな数量の取引の場合、為替レートが素早く変動する市場において、また取引量が多い時間帯においてはスリッページが発生する可能性があります。

- またはお取引がタイミング良く行われるとの保障もありません。主要国の休日や取引が活発でない時間帯においては、取引レートの提示が困難になる場合があります。当社が表示する取引価格は、システムの不具合や故障など、あるいは当社が他の市場参加者などより受け取る価格情報の誤りなどの様々な理由により、市場価格から乖離する可能性があります(オフマーケット・プライス)。当社はオフマーケット・プライスにてお客様の取引が約定された場合、その内容を訂正する、あるいは取り消すことがあります。

- IB FXCFDは、お客様と当社との相対取引です。金融商品取引所で取引されるものではなく、また決済機関による決済もありません。従ってお客様は、当社の財務状況の変化などにより損失を被る可能性があります。

この概要の記載事項に関しご質問などございましたら、当社クライアント・サービスまでご連絡ください。またお取引にあたってはリスク開示書を良くお読みください。リスク開示書は当社のウェブサイト上、およびIB FXCFDの取引許可をリクエストしていただきますと、アカウント・マネジメントからもご確認いただけるようになります。