Delivery Settings for Shareholder Materials

IBKR’s default setting for distributing shareholder communications (e.g., proxy materials and annual reports) from U.S. and Canadian issuers is electronic delivery. Under this method the account holder will receive an email notice when information becomes available for a security they hold from our processing agent, Mediant Communications. This notification will provide the necessary links for accessing the information and voting through the Internet in lieu of receiving these documents via postal service. The technology which you will need to secure the information includes access to the Internet and a web browser supporting secure connections. In addition, you will need to be able to read the documents online and print a copy provided your system supports documents in a PDF format.

Other items of note:

- The information above applies solely to shareholder communications associated with U.S. and Canadian issuers. The delivery of communications for securities issued outside of these two countries is typically electronic, but managed directly by the issuer or its agent (i.e., not Mediant).

See also: Non-Objecting Beneficial Owner (NOBO)

并购套利:交易涉及待定兼并/收购之公司股票

交易涉及已宣布但尚未完成之并购的公司之股票的行为被称为“并购套利”。

当一家公司决定接管一家上市公司时,收购公司必须同意支付给目标公司每股价格通常会高于公开交易所的现行价格。这种价格差被称为“收购溢价”。

收购条款公布后,目标公司的股价会上扬,但通常会继续徘徊在收购条款中指定的价格下方。

举例:A公司同意收购B公司。在宣布收购前,B公司在纽交所的股价为每股$20.00美元。交易条款明确指出A公司将以现金形式向B公司每股支付$25.00美元。交易公布不久,一般会看到B公司股价达到$24.90美元——高于其之前的交易价格,但仍然对比约定交易价格仍然有40个基点折扣。

这种折扣存在有两个主要原因:

- 出于比如监管、业务或融资困难等原因,尽管宣布收购,但可能永远无法完成;以及

- 持有目标公司股票的利息成本。

如果收购公司是一家上市公司,收购交易还可能以“固定比率”的方式进行,即收购公司以其股票的固定比率支付给目标公司。一旦固定比率收购交易宣布,目标公司的股价将成为收购公司股价的一个应变量。

举例:C公司(股价为$10.00美元)同意收购D公司(股价为$15.00美元)。交易条款明确指出C公司两股换D公司一股。交易公布不久,一般会看到D公司在交易所的股价达到$19.90美元,尽管C公司两股的价格当前价值$20.00美元现金。

与现金交易一样,由于可能存在交易障碍和利息成本,目标公司的交易价格通常会在交易比率隐含的水平上打折扣。这种价差还可能会受所收到股息与交易预期生命周期内应付股息之间差额的影响以及收购方股票借用困难的影响。(有时收购会以股票的浮动比率或浮动换股比率进行。有些并购还采用股票和现金结合的方式,这需要目标公司的股东进行选举。相对于标准、简单的“现金”和“固定比率收购交易,这种交易会使得收购公司股价和股票公司股价之间的关系更加复杂),从而需要非常详细、特殊的交易策略。

对于现金和固定比率收购交易,目标公司公开市场价格上的折扣会随着交易结束日期的临近和交易经历不同的里程碑(如成功收到融资以及获得股东和监管批准)而缩小。通常折扣会在收购完成时基本消失。

标准并购套利交易策略试图捕捉被收购公司当前交易价格和最终交易价格之间的价差。在现金收购中,标准的并购套利交易是在目标公司的公开市场价格低于并购交易价格时买入目标公司的股票,期望并购交易将顺利完成且目标公司的股价会上升至交易价格。在固定比率收购中,标准的并购套利交易是在目标公司股票还以收购条款中所确定价格的折扣价(以公司的当前股价和收购交易的约定比率进行计算)进行交易时买入目标公司股票并同时卖空收购公司股票。在两种情况中,交易者都希望收购交易能顺利完成,收购交易价格折扣慢慢消失,从而盈利。

当然,如果交易者认为市场对某项交易的前景太多乐观,他也可以执行跟以上描述相反的操作——卖空目标公司股票并买入收购公司股票。

与所有交易策略一样,并购套利策略包含内在风险。

如果收购成功完成,上述多头并购套利策略则可能盈利;但是,如果收购被延迟或取消——或者甚至传言将被延迟或取消——这些策略则有亏损的风险,某些情况下亏损会超过初始投资。空头并购套利策略在交易成功完成的情况下会有亏损的风险,并且如果目标公司获得诱人要约,损失可能会十分巨大。

该文章仅作信息提供之目的,不构成任何推荐或买卖证券请求。交易涉及已经宣布并购之公司的股票存在内在风险。在做任何交易决定之前,您都需要知晓交易的条款和风险。客户对其自己的交易决定负全部责任。

ADR代收费用

在美国存托凭证(ADR)持有头寸的账户持有人应注意,此类证券需定期缴纳费用用于补偿代表ADR提供托管服务的代理银行。服务通常包括盘存外国股票ADR及管理所有注册、合规与记录服务。

以前,代理银行只能通过扣除ADR股息收集代理费用,但是因越来越多的ADR不再定期支付股息,这些银行便无法收集费用。因此在2009年,美国存管信托公司(DTC)获得美国证监会批准代表银行向那些不定期支付股息的ADR收取托管费用。DTC从代客户持有ADR的经纪商(如IB)收取这些费用。这些费用被称为代收费用,因为它是由指定经纪商从客户处收取。

如果您持有支付股息的ADR其头寸,这些费用将像过去一样从股息中扣除。如果您在不支付股息的ADR中持有头寸,这笔代收费用将反映在登记日的月度报表中。与现金股息的处理方法相同,IB将尝试在账户报表中的应计部分显示即将进行的ADR费用分配。一旦被收取,该费用将在报表的存款与取款部分显示,费用描述为“调整 - 其他”且会显示关联的ADR图标。

该费用的金额范围通常为每股$0.01至$0.03美元,但可能因ADR的不同而不同,我们推荐您参考ADR招股说明获取具体信息。您可通过美国证监会的EDGAR公司搜索工具进行在线搜索。

Qualified Investments in RSP & TFSA Accounts

Canadian Revenue Agency (“CRA”) regulations place restrictions upon the types of positions that may be held in RSP and TFSA accounts with eligibility limited to those meeting the definition of a “Qualified Investment”. Positions held in such accounts that do not meet this definition are referred to as “Non-Qualified Investments” and are subject to a CRA tax equal to 50% of the fair market value of the property at the time it was acquired or it became Non-Qualified.

Qualified Investments include the following instruments: an investment in properties, including money, guaranteed investment certificates (GICs), government and corporate bonds, mutual funds, and securities listed on a designated stock exchange. Note that certain investments, while Qualified, may not be offered by IB due to the product type itself or its designated exchange not being supported.1

Non-Qualified investments include any property that is not is not classified as a Qualified Investment. Examples include stocks trading on NEX in Canada, as well as on PINK and OTCBB shares in the US.

For additional information, please refer to the CRA website links below:

http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/rrsp-reer/glssry-eng.html

http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ntvdnc/nnqlfdnvst-eng.html

Determining Buying Power

Buying power serves as a measurement of the dollar value of securities that one may purchase in a securities account without depositing additional funds. In the case of a cash account where, by definition, securities may not be purchased using funds borrowed from the broker and must be paid for in full, buying power is equal to the amount of settled cash on hand. Here, for example, an account holding $10,000 in cash may purchase up to $10,000 in stock.

In a margin account, buying power is increased through the use of leverage provided by the broker using cash as well as the value of stocks already held in the account as collateral. The amount of leverage depends upon whether the account is approved for Reg. T margin or Portfolio Margin. Here, a Reg. T account holding $10,000 in cash may purchase and hold overnight $20,000 in securities as Reg. T imposes an initial margin requirement of 50%, which translates to buying power of 2:1 (i.e., 1/.50). Similarly, a Reg. T account holding $10,000 in cash may purchase and hold on an intra-day basis $40,000 in securities given IB’s default intra-day maintenance margin requirement of 25%, which translates to buying power of 4:1 (i.e., 1/.25).

In the case of a Portfolio Margin account, greater leverage is available although, as the name suggests, the amount is highly dependent upon the make-up of the portfolio. Here, the requirement on individual stocks (initial = maintenance) generally ranges from 15% - 30%, translating to buying power of between 6.67 – 3.33:1. As the margin rate under this methodology can change daily as it considers risk factors such as the observed volatility of each stock and concentration, portfolios comprised of low-volatility stocks and which are diversified in nature tend to receive the most favorable margin treatment (e.g., higher buying power).

In addition to the cash examples above, buying power may be provided to securities held in the margin account, with the leverage dependent upon the loan value of the securities and the amount of funds, if any, borrowed to purchase them. Take, for example, an account which holds $10,000 in securities which are fully paid (i.e., no margin loan). Using the Reg. T initial margin requirement of 50%, these securities would have a loan value of $5,000 (= $10,000 * (1 - 0.50)) which, using that same initial requirement providing buying power of 2:1, could be applied to purchase and hold overnight an additional $10,000 of securities. Similarly, an account holding $10,000 in securities and a $1,000 margin loan (i.e., net liquidating equity of $9,000), has a remaining equity loan value of $4,000 which could be applied to purchase and hold overnight an additional $8,000 of securities. The same principles would hold true in a Portfolio Margin account, albeit with a potentially different level of buying power.

Finally, while the concept of buying power applies to the purchase of assets such as stocks, bonds, funds and forex, it does not translate in the same manner to derivatives. Most securities derivatives (e.g., short options and single stock futures) are not assets but rather contingent liabilities and long options, while an asset, are short-term in nature, considered a wasting asset and therefore generally have no loan value. The margin requirement on short options, therefore, is not based upon a percentage of the option premium value, but rather determined on the underlying stock as if the option were assigned (under Reg. T) or by estimating the cost to repurchase the option given adverse market changes (under Portfolio Margining).

Determining Tick Value

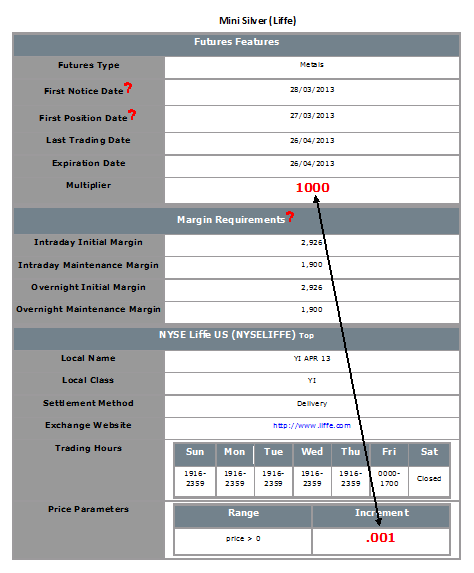

Financial instruments are subject to minimum price changes or increments which are commonly referred to as ticks. Tick values vary by instrument and are determined by the listing exchange. IB provides this information directly from the Contract Search tool on the website or via the Trader Workstation (TWS). To access from TWS, enter a symbol on the quote line, right click and from the drop-down window select the Contract Info and then Details menu options. The contract specifications window for the instrument will then be displayed (Exhibit 1).

To determine the notional value of a tick, multiple the tick increment by the contract trade unit or multiplier. As illustrated in the example below, the LIFFE Mini Silver futures contact has a tick value or minimum increment of .001 which, when multiplied by the contract multiplier of 1,000 ounces, results in a minimum tick value of $1.00 per contract. Accordingly, every tick change up or down results in a profit or loss of $1.00 per LIFFE Mini Silver futures contract.

Exhibit 1

SPY - Dividend Recognition

Unlike the case of a stock, in which a dividend is taxable in the year in which it is paid, the SPDR S&P 500 ETF Trust (Symbol: SPY) represents itself as a Regulated Investment Company and its dividend is deemed taxable in the year in which the record date is determined. As such, SPY dividends declared in either October, November or December and payable to shareholders of record on a specified date in one of those months will be considered taxable income income in that year despite the fact that such dividend will generally be paid in January of the following year.

Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

Margin Treatment for Foreign Stocks Carried by a U.S. Broker

As a U.S. broker-dealer registered with the Securities & Exchange Commission (SEC) for the purpose of facilitating customer securities transactions, IB LLC is subject to various regulations relating to the extension of credit and margining of those transactions. In the case of foreign equity securities (i.e., non-U.S. issuer), Reg T. allows a U.S. broker to extend margin credit to those which either appear on the Federal Reserve Board's periodically published List of Foreign Margin Stocks, or are deemed to have a have a "ready market" under SEC Rule 15c3-1 or SEC no-action letter.

Prior to November 2012, "ready market" was deemed to include equity securities of a foreign issuer that are listed on what is now known as the FTSE World Index. This definition was based upon a 1993 SEC no-action letter and was premised upon the fact that, while there may not have been a ready market for such securities within the U.S., the securities could be readily resold in the applicable foreign market. In November of 2012, the SEC issued a follow-up no-action letter (www.sec.gov/divisions/marketreg/mr-noaction/2012/finra-112812.pdf) which expanded the population of foreign equity securities deemed to have a ready market to also include those not listed on the FTSE World Index provided that the following four conditions are met:

1. The security is listed on a foreign exchange located within a FTSE World Index recognized country, where the security has been trading on the exchange for at least 90 days;

2. Daily bid, ask and last quotations for the security as provided by the foreign listing exchange are made continuously available to the U.S. broker through an electronic quote system;

3. The median daily trading volume calculated over the preceding 20 business day period of the security on its listing exchange is either at least 100,000 shares or $500,000 (excluding shares purchased by the computing broker);

4. The aggregate unrestricted market capitalization in shares of the security exceed $500 million over each of the preceding 10 business days.

Note: if a security previously meeting the above conditions no longer does so, the broker is provided with a 5 business day window after which time the security will no longer be deemed readily marketable and must be treated as non-marginable.

Foreign equity securities which do not meet the above conditions, will be treated as non-marginable and will therefore have no loan value. Note that for purposes of this no-action letter foreign equity securities do not include options.

Excess Margin Securities

The term "excess margin securities" refers to margin securities carried for the account of a customer having a market value in excess of 140 percent of the total debit balance in the customer's account. These securities are in excess of the securities held in a customer's margin account that are pledged by the customer as collateral for the margin loan and can be used to support the purchase of additional securities on margin

Example:

A customer whose account equity consists solely of a cash balance of USD 10,000 on Day 1 purchases 400 shares of stock ABC at USD 50 per share on Day 2.

| Account Balance | Day 1 | Day 2 |

| Cash | $10,000 | ($10,000) |

| Stock | $0 | $20,000 |

| Total | $10,000 | $10,000 |

On Day 2, the customer's excess margin securities total USD 6,000. This is calculated by subtracting 140% of the margin debit or loan balance from the market value of the stock position ($6,000 = $20,000 - {1.4 * $10,000}).

The term is relevant from a regulatory perspective as the SEC requires that U.S. broker dealers segregate and maintain in a good control location (e.g., DTC or bank) all customer securities which are deemed excess margin securities. Such securities cannot be pledged or loaned to finance the activities of the firm or other customers without specific written permission from the customer. The portion of the securities classified as margin securities ($20,000 - $6,000 or $14,000 in this example) are subject to a lien and may be pledged or loaned by the broker to others to assist in financing the loan made to the customer.

Note that securities which were excess margin at the date of acquisition may later be reclassified as margin securities based upon the customer's subsequent trade and/or margin borrowing activity. For example, if the loan value of excess margin securities is subsequently used to acquire additional securities on margin, a portion of securities will then be reclassified as margin securities and subject to a lien. If the customer subsequently deposits cash or sells securities to reduce or eliminate the margin loan, the securities will be reclassified as excess margin or fully paid and are required to be segregated.

See also "fully paid securities".

Fully Paid Securities

The term "fully paid securities" refers to securities held in a customer's margin or cash account that have been completely paid for and are not being pledged as collateral to support the purchase of other securities on margin. The term is relevant from a regulatory perspective as the SEC requires that U.S. broker dealers segregate and maintain in a good control location (e.g., DTC or bank) all customer securities which are fully paid. Such securities cannot be pledged or loaned to finance the activities of the firm or other customers.

Note that securities which were fully paid at the date of acquisition may later be reclassified as margin or excess margin securities based upon the customer's subsequent trade and/or borrowing activity. For example, if the loan value of fully paid securities is subsequently used to acquire additional securities on credit, a portion of securities will then be classified as margin securities and subject to a lien and potential pledge or hypothecation by the broker.

See also "excess margin securities".