关于盈透证券价格限制通知的披露

监管部门期望经纪公司能采取控制措施防止将具有扰乱市场风险(如突然的价格波动)的委托单提交到市场中心。

为此,盈透证券对客户委托单设置了多项价格筛选条件。该等价格筛选条件某些情况下会对客户委托单施以价格限制以避免对市场造成干扰,而该等价格限制通常是IB计算得出的参考价格基础上的一个%浮动范围(价格限制的范围取决于金融产品的类型及其当前价格)。

尽管价格限制是为了在追求交易确定性和最小化价格风险之间寻求平衡,但其可能会导致交易延迟或无法成交。更多信息请参见盈透证券的委托单传递和定单流收入披露。

如果客户的委托单被IB的系统施加了价格限制,则客户会 (i) 在TWS中或通过API或FIX标签58(对于FIX用户)收到价格限制的实时通知;并/或 (ii) 收到每日FYI消息,其中会列出前一日被施加了价格限制的前10笔委托单,包括该等委托单的初步价格限制(如有)和进一步价格限制的限制范围。

客户可以点击FYI消息中的退订链接选择不再接受此类FYI消息。选择退订此类FYI消息即表示客户:

- 同意不再接收盈透证券发出的任何关于对客户委托单应用了价格限制的通知;并且

- 确认客户已经了解,客户的委托单未来可能会被施加价格限制,但客户不想再就其委托单被施加了价格限制收到任何通知。

OTC市场(微型市值股票)——美国证监会(SEC)规则15c2-11变更

- 仍然处于OTCQX、OTCQB和Pink Current市场层次的证券不会发生改变。

- 许多股票被移到Pink Limited和Expert层次,并被OTC市场指定为“仅限主动提供报价”。客户可以在线下单平仓该等仓位。无论是在线方式还是电话联系都不再接受该等仓位的开仓委托单。

- 灰色市场层次的证券不允许非公开报价。

美国微型市值股票限制

简介

为遵守非注册证券卖出相关法规、最小化非公开报价证券交易过程中的人工处理,IBKR对美国微型市值股票实施了一定限制。下方列出了该等限制以及与此话题相关的其它常见问题。

微型市值股票限制

- IBKR将只接受来自符合条件之客户的美国微型市值股票转账。符合条件的客户包括:(1) 资产(转账前或转账后)不低于500万美元的账户,或资产规模不低于2000万美元的财务顾问的客户;并且(2) 美国微型市值股票投资占比不到其账户资产的一半。

- IBKR将只接受符合条件的客户能够确认股票系从公开市场买入或已在美国证监会(SEC)进行过注册的美国微型市值股票的大宗转账1;

- IBKR不接受客户被OTC标记为“买者自负”或“灰色市场”的美国微型市值股票转账1或开仓委托单。持有该等股票仓位的客户可以进行平仓;

- IBKR不接受为了回补在IBKR的空头仓位而进行的美国微型市值股票转账;

- 仅执行客户(即只通过IBKR执行交易,但在别处清算)不能在其IBKR账户中交易美国微型市值股票。(IBKR可对在美国注册的经纪商例外对待);

微型市值股票常见问题

什么是美国微型市值股票?

“微型市值股票”是指市值介于5000万美元到3亿美元之间并且价格低于5美元一股的(1) 场外交易股票或(2) Nasdaq和NYSE American挂牌股票。就该政策而言,微型市值股票包括市值等于或低于5000万美元的美国上市公司股票,这种股票有时也被称为纳级股或者是在与微型市值股票相关的市场上交易。

为避免股价短期小幅波动导致股票被反复重新分类,所有被分类为美国微型市值股的股票只有在其市值和股价连续30天均分别超过5亿美元和5美元的情况下才会重新分类。

微型市值股票通常股价很低,常常被称为仙股。IBKR也可设置例外,包括对股价低但近期市值上涨的股票。此外,IBKR不会将非美国公司的ADR视作微型市值股票。

微型市值股票在哪里交易?

微型市值股票通常在OTC市场而非全国性证券交易所交易。其通常由做市商在OTC系统(如OTCBB)和OTC Markets Group管理的市场(如OTCQX、OTCQB和Pink)以电子方式报价。该类别下还包含非公开报价的股票和被指定为“买者自负”、其它OTC或“灰色市场”的股票。

此外,美国监管部门也将在Nasdaq和NYSE American挂牌、价格等于或低于5美元一股且市值等于或低于3亿美元的股票视为微型市值股票。

如果IBKR收到来自符合条件之客户的转仓,其中一个或多个仓位是微型市值股票,会怎么样?

如果IBKR收到包含微型市值股票的转仓,IBKR有权限制其中任何微型市值股票仓位的卖出,除非符合条件的客户能够提供适当的文件证明该等股票系在公开市场买入(即通过其它经纪商在交易所买入)或者该等股票已经根据S-1或类似股票注册声明表在美国证监会进行过注册。

符合条件的客户可以通过提供经纪商给出的能够反映股票买入交易的经纪报表或交易确认来证明股票确实是在公开市场上买入。符合条件的客户也可以通过提供其股票在美国证监会(Edgar系统)进行注册的备案号(以及任何可证明股票就是注册声明上所列股票的文件)来证明股票已经过注册。

注意:所有客户随时都可转出我们对其实施了限制的股票。

IBKR对主经纪账户有什么限制?

活动包含主经纪服务的客户只在IBKR同意接受的来自其执行经纪商的交易方面被视为符合条件的客户。然而,尽管主经纪账户可以在IBKR清算美国微型市值股票,但在IBKR确认股票根据上述程序可以卖出之前,相关股票将受到限制。

要为在公开市场上买入的股票移除限制,请让执行经纪商提供有公司抬头的签字函件或正式账户报表,证明股票系从公开市场买入。提供的函件或报表必须包含以下信息。如果股票是通过发行取得,则函件必须提供相关注册声明文件或链接并说明该等股票是发行股票的一部分。

经纪商函件必须包含的信息:

1) IBKR账户号码

2) IBKR账户名称

3) 交易日期

4) 结算日期

5) 代码

6) 买卖方向

7) 价格

8) 数量

9) 执行时间

10) 交易所

11) 必须有签字

12) 必须有公司正式抬头

简而言之:如果多头仓位不再受到限制则可以接受卖出多头交易。卖出空头交易可以接受。买入多头交易可以接受,但仓位将被限制,直到向合规部门提供足够资料将限制移除。不接受买入补仓交易和日内轧平交易。

如果您买入的股票被重新分类为“灰色市场”或“买者自负”股票怎么办?

如果您在IBKR账户中买入的股票之后被分类为“买者自负”或“灰色市场”股票,您将可以继续持有仓位、平仓或转仓,但无法增加持仓。

我账户中微型市值股票交易受到限制的原因是什么?

您被限制交易微型市值股票的主要原因有两个:

- 与发行方存在潜在关联:美国证监会规则144对发行人的关联方交易股票(包括微型市值股票)有一定限制。如果IBKR发现微型市值股票交易活动或持仓接近规则144规定的交易量阈值(“规则144阈值”),则IBKR会限制客户交易该微型市值股票,直到完成合规审查。

- 微型市值股票转仓:如果客户近期将微型市值股票转入其IBKR账户,IBKR会限制客户交易该证券,直到完成合规审查。

如果符合其中一种情况,相关证券交易会受到限制,客户会在账户管理的消息中心下收到相应通知。该通知将说明限制的原因以及客户为了解除限制必须采取的措施。

为什么IBKR将我视为微型市值股票发行方的潜在关联方?

“关联方”是与发行方存在控制关系的人士,如执行官、董事或大股东。

规则144适用于包括微型市值股票在内的所有证券。但是,鉴于交易微型市值股票涉及高风险,如果客户的微型市值股交易和/或持仓接近规则144阈值,IBKR将限制客户交易该微型市值股票。 该等限制在合规对客户的潜在关联方身份进行审核并作出决定之前将保持生效。

对于潜在关联方审核,为什么我需要要求每两周进行一次新的审核?

客户的关联方身份可能会在IBKR完成上述潜在关联方审核后很快发生变化。因此,IBKR认为如果客户的的微型市值股交易和/或持仓仍然接近规则144阈值,每两周刷新一下潜在关联方审核较为合适。

哪里可以查看IBKR指定为美国微型市值股的股票列表?

请打开以下链接:www.ibkr.com/download/us_microcaps.csv

请注意,此列表每日更新。

哪里可以了解更多有关微型市值股票的信息?

有关微型市值股票的更多信息,包括其相关风险,请参见美国证监会网站:https://www.sec.gov/reportspubs/investor-publications/investorpubsmicrocapstockhtm.html

-----------------------------------------------------------

1包括任何方式的转账(如ACATS、DWAC、FOP)、通过“南向(Southbound)”转账将加拿大挂牌股票转成美国股票的转换、为回补空头仓位进行的转账、在其它经纪商执行但在IBKR清算的IB主经纪服务客户等。

小数股交易

小数股交易可供您投资那些您可能没有足够资金购买一整股股票的公司。从前没有小数股交易时您可能只能买入一两家公司的股票,现在却能将资金分散到更多公司,从而更加轻松地实现投资组合多元化。

如果您的账户启用了小数股交易功能,我们会根据您指定的现金金额买入或卖出不足整股的股票。例如,如果您想投资500美元,而您想买入的股票当前是1000美元一股,那么您最后会买到0.5股。

谁可以申请小数股交易许可?

所有个人、独立账户(但居住在以色列的人士、加拿大RRSP/TFSA账户和盈透证券日本有限公司实体账户除外)均可以申请小数股交易许可。

财务顾问、资金经理和介绍经纪商可以选择给所有客户启用,或者所有客户均不启用。

如何启用小数股交易?

如果符合条件,则您可以在客户端中启用小数股交易。依次点击“使用者”菜单(右上角的小人图标)和“设置”。在“账户设置”下找到“交易”部分,点击“交易许可”。下拉到“股票”,点击“+添加”然后勾选“全球(小股数交易)”旁的复选框,点击“保存”。然后点击“继续”,按屏幕提示操作。 之后您便可以就您已有相关交易许可的符合条件的股票进行小数股交易了。要就符合条件的美国股票进行小数股交易,您需要有美国股票交易许可;要就符合条件的欧洲股票进行小数股交易,您需要有欧洲股票交易许可。

请注意,交易小数股需要TWS 979或以上版本。该功能目前支持大多数委托单类型。

什么产品可支持小数股交易?

我们现在针对符合条件的美国和欧洲股票与ETF支持小数股交易。*

您可点击下方链接查看支持小数股交易的股票列表。请注意,该列表可能会在无事先通知的情况下发生调整:

http://www.ibkr.com/download/fracshare_stk.csv

*根据欧盟法规,欧盟零售客户一般不能就美国ETF进行小数股交易。

可以卖空小数股吗?

只要您有保证金并且有美国或欧洲挂牌股票的小数股交易许可,IBKR便可支持您对符合条件的股票进行小数股卖空。

小数股交易有什么费用?

使用小数股交易没有额外费用。只收取标准佣金(IBKR Lite版和IBKR Pro版)。

小数股交易可以使用哪些委托单类型?

对于小数股交易,IBKR只接受部分委托单类型(如市价单、限价单、止损单、止损限价单等)。如果您选择下达一个含小数股的非适销(当前无法成交)限价单,小数股部分只有在整个委托单都适销(可以成交)的情况下才会执行(因此可能完全不会执行),尽管如果股数是整数,委托单可能会更早执行。

IBKR如何处理欧洲股票的小数股委托单?

取决于委托单的交易数量和属性,IBKR会将含小数股的欧洲股票委托单传递至由多个执行目的地组成的池子,这与其它委托单类型使用的有所不同。您应查看适用的委托单执行政策了解更多详细信息。

我可以向IBKR转账小数股吗?

IBKR不接受通过转仓转入小数股。

小数股可以参加股息再投资项目(DRIP)吗?

目前通过DRIP再投资的股息无法接收小数股。希望未来可以实现。

请注意,上方表述不适用于共同基金股息,共同基金的股息再投资之后可能会产生小数份额。

我会从公司行动中收到小数股仓位吗?

如果您的账户获批可以进行小数股交易并且美国或欧洲公司行动发行了小数股,则小数股会留在您的账户中。但是,如果您的账户没有小数股交易许可或者公司行动发行的是不符合小数股条件的股票,则小数股会被平掉。

我账户中持有的小数股有投票权吗?

您账户中持有的小数股没有投票权,您也无法就该等小数股的任何公司行动(包括但不限于要约收购或认股权配售)进行自主选择,并且我们也无法就小于一股的持仓为您提供任何其它股东文件。

小数股有股息吗?

您的小数股仓位与整股仓位一样有股息。

通过API可以进行小数股交易吗?

目前FIX/CTCI支持小数股交易,但API尚不支持。

IBKR股票收益提升计划

计划概览

股票收益提升计划(Stock Yield Enhancement Program)让客户有机会用账户中全额支付的股票赚取额外收益。该计划允许IBKR通过抵押(美国国债或现金)从您那里借入股票,然后将股票借给希望做空股票并愿意支付借券利息的交易者。有关股票收益提升计划的更多信息,请参见此处或查看常见问题页面。

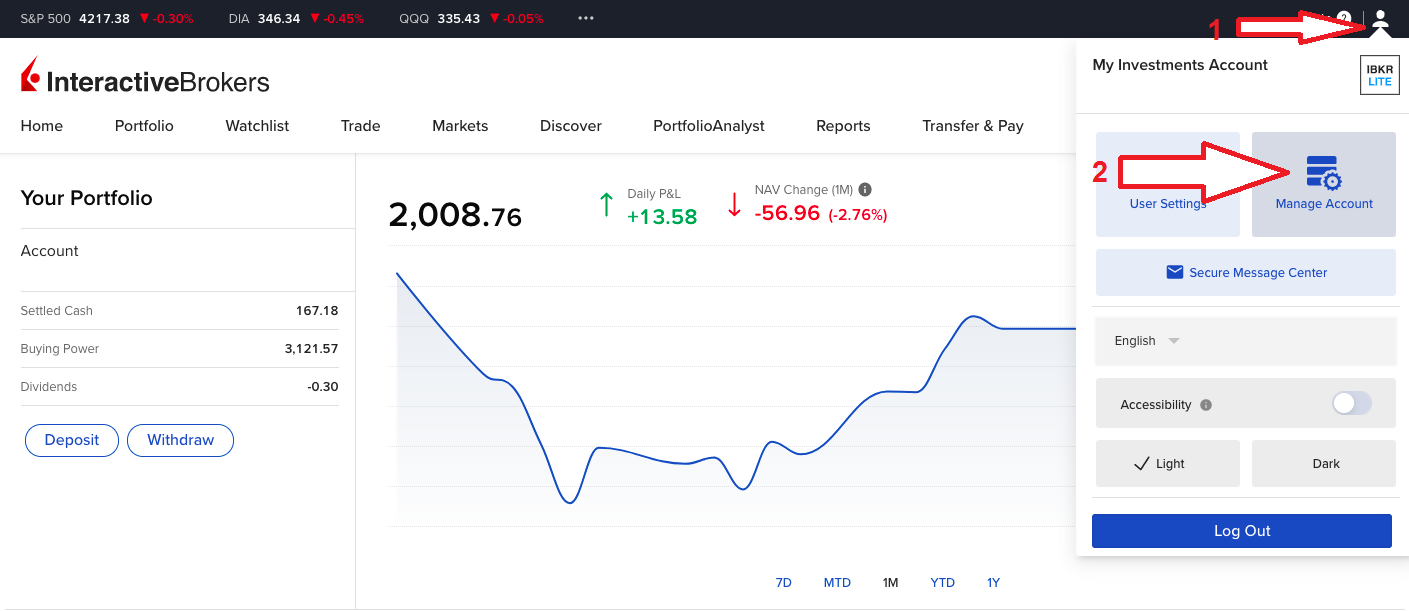

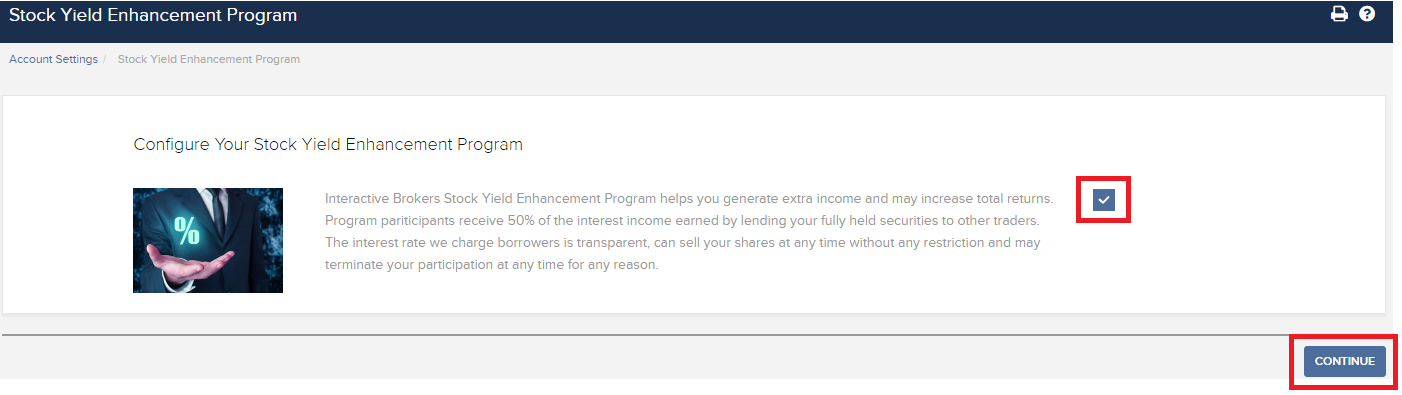

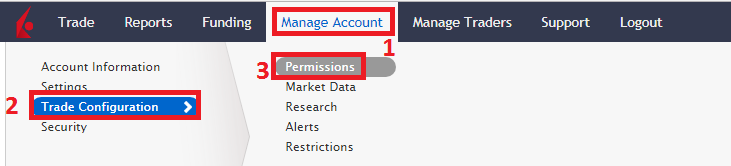

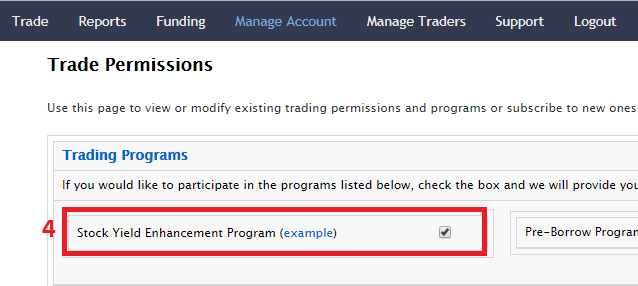

要参加计划,请登录客户端。登录后,点击使用者菜单(右上角的头像图标),然后点击管理账户。在配置部分,点击股票收益提升计划旁边的配置(齿轮)图标。在下一个界面勾选复选框然后点击继续。您将会看到参加计划必需的表格和披露。查看并签署表格后,您的申请便会提交处理。需要24到48小时才会激活生效。

.png)

For enrollment via Classic Account Management, please click on the below buttons in the order specified.

OTC Market (Microcap Stock) – Changes to SEC Rule 15c2-11

- No change is anticipated for securities that remain classified in the OTCQX, OTCQB, or Pink Current market tiers.

- Many stocks are being moved to the Pink Limited and Expert Tier and designated by OTC Markets as “unsolicited quotes only.” Clients can close these positions by placing orders online. Opening orders in these positions cannot be accepted online or by phone.

- No public quotations are permitted for securities classified in the Grey market tier.

什么是特殊备忘录账(SMA)?如何使用?

特殊备忘录账(SMA)表示的不是账户资金或现金,而是在Reg. T保证金账户内证券市场价值上升时产生的信用额度。其目的是为了维护未实现盈利对于后续交易所能提供的购买力,如果没有这种处理,购买力只有通过取出多余资金然后在要进行后续买入时再存入账户才能确定。从这个角度来说,SMA有助于维持账户价值稳定、尽可能减少非必要的资金转账。

SMA会随着证券价值上升而增加,但如果证券价值下跌,SMA并不会减少。SMA只有在买入证券和取款时才会减少,使用SMA唯一的限制是证券买入和取款不能让账户资产低于维持保证金要求。可增加SMA的项目包括现金存款、收到利息或股息(等额方式)和证券卖出(净收入的50%)。请注意,SMA余额表示的是开户以来每条会造成SMA水平变化的历史账目的总和。考虑到时间跨度和其中包含的账目数量,从每日活动报表中总结出当前的SMA水平虽然可行,但却不太现实。

要说明SMA是如何运作的,我们先假设账户持有人存入了$5,000美元,然后买了$10,000美元的证券,贷款50%(保证金要求等于1 – 贷款比例,也就是50%)。前后的账户相关数值如下:

|

项目

|

描述

|

事件1 - 首次存款

|

事件2 - 买入股票

|

|

A.

|

现金

|

$5,000

|

($5,000)

|

|

B.

|

多头股票市场价值

|

$0

|

$10,000

|

|

C.

|

净清算价值/含贷款价值* (A + B)

|

$5,000

|

$5,000

|

|

D.

|

初始保证金要求 (B * 50%)

|

$0

|

$5,000

|

|

E

|

可用资金 (C - D)

|

$5,000

|

$0

|

|

F.

|

SMA

|

$5,000

|

$0

|

|

G.

|

购买力

|

$10,000

|

$0

|

接下来,假设多头股票市场价值上涨至$12,000美元。$2,000美元的涨幅可产生$1,000美元的SMA,可供账户持有人:1) 在无需额外存入资金的情况下再买价值$2,000美元的证券,保证金贷款比率50%;或 2) 取出$1,000美元现金,如果账户没有现金,这$1,000美元将记入账户的贷款余额。见下表:

|

项目

|

描述

|

事件2 – 买入股票

|

事件3 - 股票升值

|

|

A.

|

现金

|

($5,000)

|

($5,000)

|

|

B.

|

多头股票市场价值

|

$10,000

|

$12,000

|

|

C.

|

净清算价值/含贷款价值* (A + B)

|

$5,000

|

$7,000

|

|

D.

|

初始保证金要求 (B * 50%)

|

$5,000

|

$6,000

|

|

E

|

可用资金 (C - D)

|

$0

|

$1,000

|

|

F.

|

SMA

|

$0

|

$1,000

|

|

G.

|

购买力

|

$0

|

$2,000

|

*含贷款价值英文缩写为EWL,在此例中,等于净清算价值。

最后,请注意,SMA只是一个用以衡量IB LLC下证券账户是否符合隔夜初始保证金要求的Reg. T概念,我们并不会用SMA来决定账户是否符合日内或隔夜维持保证金要求,也不会用它来决定商品账户是否符合保证金要求。同样,如果账户在隔夜或Reg.T初始保证金要求开始实施生效时(美国东部时间15:50)SMA为负值,则会面临强制平仓清算以满足保证金要求。

股票收益提升计划(SYEP)常见问题

股票收益提升计划推出的目的是什么?

股票收益提升计划可供客户通过允许IBKR将其账户内原本闲置的证券头寸(即全额支付和超额保证金证券)出借给第三方来赚取额外收益。参与此计划的客户会收到用以确保股票在借贷终止时顺利归还的抵押(美国国债或现金)。

什么是全额支付和超额保证金证券?

全额支付证券是客户账户中全款付清的证券。超额保证金证券是虽然没有全款付清但本身市场价值已超过保证金贷款余额的140%的证券。

客户股票收益提升计划的借出交易收益如何计算?

客户借出股票的收益取决于场外证券借贷市场的借贷利率。借出的股票不同,出借的日期不同,都会对借贷利率造成很大差异。通常,IBKR会按自己借出股票所得金额的大约50%向参与计划的客户支付利息。

借贷交易的抵押金额如何确定?

证券借贷的抵押(美国国债或现金)金额采用行业惯例确定,即用股票的收盘价乘以特定百分比(通常为102-105%),然后向上取整到最近的美元/分。每个币种的行业惯例不同。例如,借出100股收盘价为$59.24美元的美元计价股票,现金抵押应为$6,100 ($59.24 * 1.02 = $60.4248;取整到$61,再乘以100)。下表为各个币种的行业惯例:

| 美元 | 102%;向上取整到最近的元 |

| 加元 | 102%;向上取整到最近的元 |

| 欧元 | 105%;向上取整到最近的分 |

| 瑞士法郎 | 105%;向上取整到最近的生丁 |

| 英镑 | 105%;向上取整到最近的便士 |

| 港币 | 105%;向上取整到最近的分 |

更多信息,请参见KB1146。

股票收益提升计划下的抵押如何保管以及保管在何处?

对于IBLLC的客户,抵押将采用现金或美国国债的形式,并将转入IBLLC的联营公司IBKR Securities Services LLC (“IBKRSS”)进行保管。您在该计划下借出股票的抵押会由IBKRSS以您为受益人保管在一个账户中,您将享有第一优先级担保权益。如果IBLLC违约,您将可以直接从IBKRSS取得抵押,无需经过IBLLC。请参见 此处的《证券账户控制协议》了解更多信息。对于非IBLLC的客户,抵押将由账户所在实体保管。例如,IBIE的账户其抵押将由IBIE保管。例如,IBIE的账户其抵押将由IBIE保管。

退出IBKR股票收益提升计划或卖出/转账通过此计划借出的股票会对利息造成什么影响?

交易日的下一个工作日(T+1)停止计息。对于转账或退出计划,利息也会在发起转账或退出计划的下一个工作日停止计算。

参加IBKR股票收益提升计划有什么资格要求?

| 可参加股票收益提升计划的实体* |

| 盈透证券有限公司(IB LLC) |

| 盈透证券英国有限公司(IB UK)(SIPP账户除外) |

| 盈透证券爱尔兰有限公司(IB IE) |

| 盈透证券中欧有限公司(IB CE) |

| 盈透证券香港有限公司(IB HK) |

| 盈透证券加拿大有限公司(IB Canada)(RRSP/TFSA账户除外) |

| 盈透证券新加坡有限公司(IB Singapore) |

| 可参加股票收益提升计划的账户类型 |

| 现金账户(申请参加时账户资产超过$50,000美元) |

| 保证金账户 |

| 财务顾问客户账户* |

| 介绍经纪商客户账户:全披露和非披露* |

| 介绍经纪商综合账户 |

| 独立交易限制账户(STL) |

*参加的账户必须是保证金账户或满足上述现金账户最低资产要求的现金账户。

盈透证券日本、盈透证券卢森堡、盈透证券澳大利亚和盈透证券印度公司的客户不能参加此计划。账户开在IB LLC下的日本和印度客户可以参加。

此外,满足上方条件的财务顾问客户账户、全披露介绍经纪商客户和综合经纪商可以参加此计划。如果是财务顾问和全披露介绍经纪商,必须由客户自己签署协议。综合经纪商由经纪商签署协议。

IRA账户可以参加股票收益提升计划吗?

可以。

IRA账户由盈透证券资产管理公司(Interactive Brokers Asset Management)管理的账户分区可以参加股票收益提升计划吗?

不能。

英国SIPP账户可以参加股票收益提升计划吗?

不能。

如果参加计划的现金账户资产跌破最低资产要求$50,000美元会怎么样?

现金账户只有在申请参加计划当时必须满足这一最低资产要求。之后资产跌破此要求并不会对现有借贷造成任何影响,也不影响您继续借出股票。

如何申请参加IBKR股票收益提升计划?

要参加股票收益提升计划,请登录客户端。登录后,点击使用者菜单(右上角的小人图标),然后点击设置。然后,在账户设置内,寻找交易板块并点击股票收益提升计划以申请参加。 您将会看到参加该计划所需填写的表格和披露。阅读并签署表格后,您的申请便会提交处理。可能需要24到48小时才能完成激活。

如何终止股票收益提升计划?

要退出股票收益提升计划,请登录客户端。登录后,点击使用者菜单(右上角的小人图标),然后点击设置。在账户 设置板块内会找到交易,然后点击股票 收益 提升 计划,然后参照所需步骤。您的申请便会提交处理。 中止参加的请求通常会在当日结束时进行处理。

如果一个账户参加了计划然后又退出,那么该账户多久可以重新参加计划?

退出计划后,账户需要等待90天才能重新参加。

哪些证券头寸可以出借?

| 美国市场 | 欧洲市场 | 香港市场 | 加拿大市场 |

| 普通股(交易所挂牌、粉单和OTCBB) | 普通股(交易所挂牌) | 普通股(交易所挂牌) | 普通股(交易所挂牌) |

| ETF | ETF | ETF | ETF |

| 优先股 | 优先股 | 优先股 | 优先股 |

| 公司债券* |

*市政债券不适用。

借出IPO后在二级市场交易的股票有什么限制吗?

没有,只要账户本身没有就相应的证券受到限制就可以。

IBKR如何确定可以借出的股票数量?

第一步是确定IBKR有保证金扣押权从而可以在没有客户参与的情况下通过股票收益提升计划借出的证券的价值(如有)。根据规定,通过保证金贷款借钱给客户购买证券的经纪商可以将该客户的证券借出或用作抵押,金额最高不超过贷款金额的140%。例如,如果客户现金余额为$50,000美元,买入市场价值为$100,000美元的证券,则贷款金额为$50,000美元,那么经纪商对$70,000美元($50,000的140%)的证券享有扣押权。客户持有的证券超出这一金额的部分被称为超额保证金证券(此例子中为$30,000),需要记在隔离账户,除非客户授权IBKR通过股票收益提升计划将其借出。

计算贷款金额首先要将所有非美元计价的现金余额转换成美元,然后减去股票卖空所得(转换成美元)。如果结果为负数,则我们最高可抵押此数目的140%。此外,商品账户段中持有的现金余额和现货金属和差价合约相关现金不纳入考虑范围。 详细说明请参见此处。

例1: 客户在基础货币为美元的账户内持有100,000欧元,欧元兑美元汇率为1.40。客户买入价值$112,000美元(相当于80,000欧元)的美元计价股票。由于转换成美元后现金余额为正数,所有证券被视为全额支付。

| 项目 | 欧元 | 美元 | 基础货币(美元) |

| 现金 | 100,000 | (112,000) | $28,000 |

| 多头股票 | $112,000 | $112,000 | |

| 净清算价值 | $140,000 |

例2: 客户持有80,000美元、多头持有价值$100,000美元的美元计价股票并且做空了价值$100,000美元的美元计价股票。总计$28,000美元的多头证券被视为保证金证券,剩余的$72,000美元为超额保证金证券。计算方法是用现金余额减去卖空所得($80,000 - $100,000),所得贷款金额再乘以140% ($20,000 * 1.4 = $28,000)

| 项目 | 基础货币(美元) |

| 现金 | $80,000 |

| 多头股票 | $100,000 |

| 空头股票 | ($100,000) |

| 净清算价值 | $80,000 |

IBKR会把所有符合条件的股票都借出去吗?

不保证账户内所有符合条件的股票都能通过股票收益提升计划借出去,因为某些证券可能没有利率有利的市场,或者IBKR无法接入有意愿的借用方所在的市场,也有可能IBKR不想借出您的股票。

通过股票收益提升计划借出股票是否都要以100为单位?

不能。只要是整股都可以,但是借给第三方的时候我们只以100为倍数借出。这样,如果有第三方需要借用100股,就可能发生我们从一个客户那里借出75股、从另一个客户那里借出25股的情况。

如果可供借出的股票超过借用需求,如何在多个客户之间分配借出份额?

如果我们股票收益提升计划的参与者可用以借出的股票数量大于借用需求,则借出份额将按比例分配。例如,可供借出XYZ数量为20,000股,而对于XYZ的需求只有10,000股的情况下,每个客户可以借出其所持股数的一半。

股票是只借给其它IBKR客户还是也会借给其它第三方?

股票可以借给IBKR客户和第三方。

股票收益提升计划的参与者可以自行决定哪些股票IBKR可以借出吗?

不能。此计划完全由IBKR管理,IBKR在确定了自己因保证金贷款扣押权可以借出的证券后,可自行决定哪些全额支付或超额保证金证券可以借出,并发起借贷。

通过股票收益提升计划借出去的证券其卖出是否会受到限制?

借出去的股票可随时卖出,没有任何限制。卖出交易的结算并不需要股票及时归还,卖出收益会按正常结算日记入客户的账户。此外,借贷会于证券卖出的下一个工作日开盘终止。

客户就通过股票收益提升计划借出去的股票沽出持保看张期权还能享受持保看涨期权保证金待遇吗?

可以。由于借出去的股票其盈亏风险仍然在借出方身上,借出股票不会对相关保证金要求造成任何影响。

借出去的股票由于看涨期权被行权或看跌期权行权被交付会怎么样?

借贷将于平仓或减仓操作(交易、被行权、行权)的T+1日终止。

借出去的股票被暂停交易会怎么样?

暂停交易对股票借出没有直接影响,只要IBKR能继续借出该等股票,则无论股票是否被暂停交易,借贷都可以继续进行。

借贷股票的抵押可以划至商品账户段冲抵保证金和/或应付行情变化吗?

不能。股票借贷的抵押不会对保证金或融资造成任何影响。

计划参与者发起保证金贷款或提高现有贷款金额会怎么样?

如果客户有全额支付的证券通过股票收益提升计划借出,之后又发起保证金贷款,则不属于超额保证金证券的部分将被终止借贷。同样,如果客户有超额保证金证券通过此计划借出,之后又要增加现有保证金贷款,则不属于超额保证金证券的部分也将被终止借贷。

什么情况下股票借贷会被终止?

发生以下情况(但不限于以下情况),股票借贷将被自动终止:

- 客户选择退出计划

- 转账股票

- 以股票作抵押借款

- 卖出股票

- 看涨期权被行权/看跌期权行权

- 账户关闭

股票收益提升计划的参与者是否会收到被借出股票的股息?

通过股票收益提升计划借出的股票通常会在除息日前召回以获取股息、避免股息替代支付。但是仍然有可能获得股息替代支付。

股票收益提升计划的参与者是否对被借出的股票保有投票权?

不能。如果登记日或投票、给予同意或采取其它行动的截止日期在贷款期内,则证券的借用者有权就证券相关事项进行投票或决断。

股票收益提升计划的参与者是否能就被借出的股票获得权利、权证和分拆股份?

可以。被借出股票分配的任何权利、权证和分拆股份都将属于证券的借出方。

股票借贷在活动报表中如何呈现?

借贷抵押、借出在外的股数、活动和收益在以下6个报表区域中反映:

1. 现金详情 – 详细列出了期初抵押(美国国债或现金)余额、借贷活动导致的净变化(如果发起新的借贷则为正;如果股票归还则为负)和期末现金抵押余额。

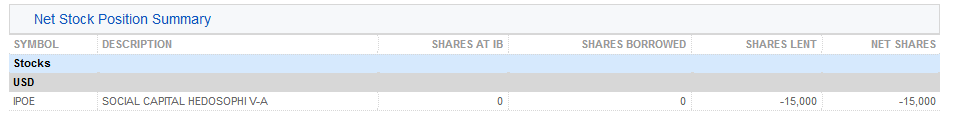

2. 净股票头寸总结 – 按股票详细列出了在IBKR持有的总股数、借入的股数、借出的股数和净股数(=在IBKR持有的总股数 + 借入的股数 - 借出的股数)。

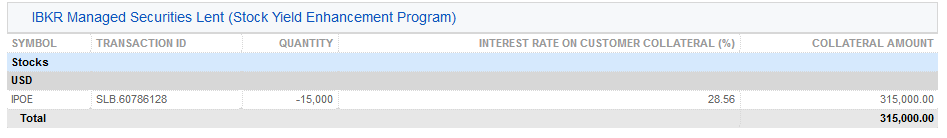

3. 借出的IBKR管理证券(股票收益提升计划) – 对通过股票收益提升计划借出的股票按股票列出了借出的股数以及利率(%)。

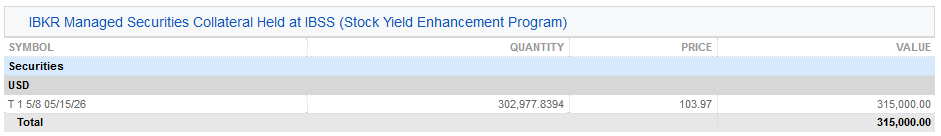

3a. 在IBSS保管的IBKR管理证券的抵押(股票收益提升计划)– IBLLC的客户会看到其报表中多出来一栏,显示作为抵押的美国国债以及抵押的数量、价格和总价值。

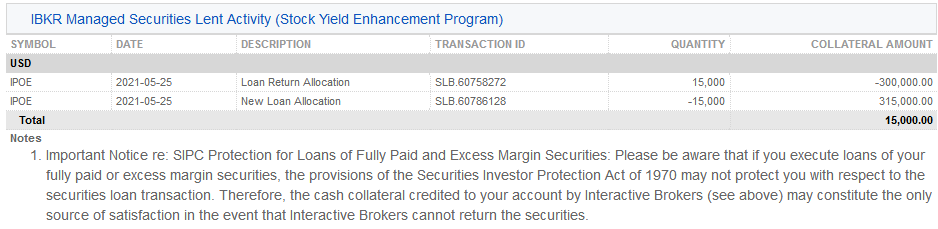

4. IBKR管理证券借出活动 (股票收益提升计划)– 详细列出了各证券的借贷活动,包括归还份额分配(即终止的借贷);新借出份额分配(即新发起的借贷);股数;净利率(%);客户抵押金额及其利率(%)。

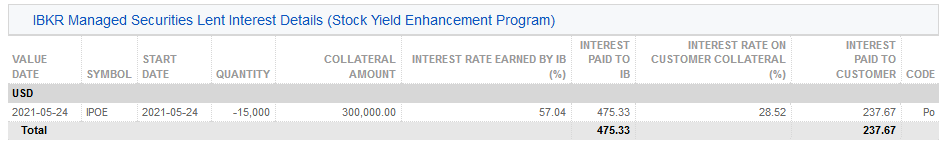

5. IBKR管理的证券借出活动利息详情 (股票收益提升计划)– 按每笔借出活动详细列出了IBKR赚取的利率(%);IBKR赚取的收益(为IBKR从该笔借出活动赚取的总收益,等于{抵押金额 * 利率}/360);客户抵押的利率(为IBKR从该笔借出活动赚取的收益的一半)以及支付给客户的利息(为客户的现金抵押赚取的利息收入)

注:此部分只有在报表期内客户赚取的应计利息超过1美元的情况下才会显示。

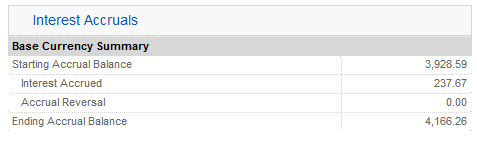

6. 应计利息 – 此处利息收入列为应计利息,与任何其它应计利息一样处理(累积计算,但只有超过$1美元才会显示并按月过账到现金)。年末申报时,该笔利息收入将上报表格1099(美国纳税人)。

常见问题解答:有特殊要求的证券

近期,GME、AMC、BB、EXPR、KOSS和一小部分美国证券表现出了极端波动,使我们不得不降低了向该等证券提供的杠杆,有时甚至只允许可降低风险的交易。以下是关于近期措施的常见问题解答。

问:目前交易GME及其它近期波动率上升的美国证券是否有限制?

答: IBKR目前不限制客户交易AMC、GME、BB、EXPR、KOSS或其它表现出极端市场波动的股票。这包括开仓或平仓。

和许多经纪商一样,IBKR有段时间曾对上述部分证券的开仓交易设有限制。这些限制现已解除。

IBKR没有限制客户平仓现有仓位,也不打算这么做。

问:我能否在IBKR使用保证金交易这些产品的股票、期权或其它衍生品?

答: IBKR已提高了交易GME及其它近期波动率巨大的美国证券的保证金要求,多头仓位保证金要求高达100%,空头仓位保证金要求高达300%。您在交易平台中提交委托单前可以查看相应保证金要求。

问:为什么对于某些证券IBKR要限制我开仓?

答: IBKR采取这些措施是出于风险管理的考虑,目的是为了保护公司和客户在极端波动的市场环境下不因价格的大幅变动而蒙受巨额损失。

IBKR对此次非自然波动给清算所、经纪商和市场参与者带来的影响保持谨慎担忧。

问:IBKR或其关联公司在此次被限制交易的产品中有持仓吗?

答:否。IBKR在这些证券中均没有自营交易持仓。

问:IBKR实施这些交易限制的依据是什么?

答: 根据客户协议,IBKR有权自行决定拒绝接受任何客户委托单。

IBKR还有权自行决定修改任何已开仓仓位或新仓位的保证金要求。毕竟,IBKR是保证金交易的资金贷出方。

问:这些限制是针对所有IBKR客户的,还是仅针对部分客户?

答: 所有限制,包括限制开仓及提高保证金,都是针对所有IBKR客户的。限制是基于证券而非客户实施的。

问:我在IBKR的资金有风险吗?IBKR有无蒙受实质性损失?

答: IBKR未蒙受任何实质性的损失。得益于其审慎的风控措施,IBKR很好地应对了本次市场波动。实际上,盈透集团的合并总股本逾90亿美元,超过监管要求60亿美元以上。

问:未来IBKR会怎么做?我怎么才能知道?

答: IBKR会继续监控市场动态,且会根据市场情况采取行动。如需了解最新的信息,请持续访问我们的网站。

FAQs: Securities subject to Special Requirements

We are seeing unprecedented volatility in GME, AMC, BB, EXPR, KOSS and a small number of other U.S. securities that has forced us reduce the leverage previously offered to these securities and, at times, limit trading to risk reducing transactions. Outlined below are a series of FAQs relating to these actions.

Q: Are there any current restrictions on my ability to trade GME and the other US securities that have been subject to the recent heightened volatility?

A: IBKR is currently not restricting customers from trading shares of AMC, GME, BB, EXPR, KOSS or the other stocks that have been the subject of extreme market volatility. That includes orders to open new positions or close existing ones.

Like many brokers, IBKR placed limits on opening new positions in certain of these securities for a period of time. Those restrictions have since been lifted.

IBKR has not restricted customers’ ability to close existing positions and does not plan to do so.

Q: Can I use margin in trading stocks, options or other derivatives on these products through IBKR?

A: IBKR has increased its margin requirements for securities in GME and the other US securities subject to the recent volatility, including up to 100% margin required for long positions and 300% margin on the short side. You can see these margin requirements in your trading platform prior to submitting an order.

Q: Why did IBKR place these restrictions on my ability to open new positions in certain securities?

A: IBKR took these actions for risk management purposes, to protect the firm and its customers from incurring outsized losses due to wild swings in prices in a volatile and unstable marketplace.

IBKR remains concerned about the effect of this unnatural volatility on the clearinghouses, brokers and market participants.

Q: Does IBKR or its affiliates have positions in these products that it was protecting by placing these restrictions?

A: No. IBKR itself has no proprietary positions in any of the securities.

Q: What allowed IBKR to place those restrictions?

A: Pursuant to its customer agreement, IBKR may decline to accept any customer’s order at IBKR’s discretion.

IBKR also has the right to modify margin requirements for any open or new positions at any time, in its sole discretion. After all, IBKR is the one whose money is being loaned in a margin trade.

Q: Did those restrictions apply to all or just some of IBKR’s customers?

A: All restrictions – all limits on opening new positions and margin increases – applied to all IBKR customers. They were placed based on the security, not based on the customer.

Q: Is my money at IBKR at risk? Has IBKR suffered material losses?

A: IBKR did not incur substantial losses. Through its prudent risk management, IBKR has navigated this market volatility well. In any event, on a consolidated basis, IBG LLC exceeds $9 billion in equity capital, over $6 billion in excess of regulatory requirements.

Q: What will IBKR do going forward? How will I know?

A: IBKR will continue to monitor developments in the market, and will make decisions based on market conditions. For current information, please continue to visit our website.