Utilization in the Securities Lending Market

Utilization Metrics

Utilization is defined as loaned shares divided by available shares in the securities lending market, expressed as a percentage. The Utilization metric on TWS is not specific to IB. It is based on industrywide data provided by a securities finance data vendor. The metric is not conclusive however, as not every lender reports their Utilization to the vendor. In addition, although the source is believed to be reliable, IBKR does not warrant its accuracy.

Generally, Utilization is the ratio of demand to supply. For example, Apple Inc. (AAPL) may have utilization of less than 1% because the stock has vast availability relative to the demand to borrow shares for shorting. Roku Inc. (ROKU) may have utilization above 90% because of higher demand to short shares as compared to the number of available shares.

For accounts enrolled in the Stock Yield Enhancement Program, a high stock-specific Utilization percentage may increase the likelihood that IB may be able to lend your shares. Conversely, stocks with a low Utilization percentage are generally in lesser demand in the securities finance market, generally reducing IB’s ability to lend your shares.

Utilization can be added as a column in TWS.

Using Mosaic Market Scanner to Determine an Indication of Stock Utilization

TWS users can find stock utilization indications by using Mosaic Market Scanner filters. After opening the scanner, Select Custom Scanner and input parameters. Some useful filters include Price, Market Cap, Fee Rate and Utilization.

Please also see Important Considerations and Risks of Participating in Interactive Brokers Fully-Paid Securities Lending Programs here.

添加/消耗流动性

本文旨在对交易所费用、添加/消耗流动性费用以及非组合佣金提供正确的理解。

添加或消耗流动性的概念既适用于股票,也适用于股票/指数期权。一个定单是消耗流动性还是添加流动性,取决于定单是适销还是非适销。

适销定单会消耗流动性。

适销定单要么是市价定单,要么是限价等于或高于/低于当前市价的买入/卖出限价定单。

1. 对于适销的买入限价定单,限价等于或高于卖价。

2. 对于适销的卖出限价定单,限价等于或低于买价。

举例:

XYZ股票当前卖价尺寸/价格为400股/46.00。您输入一个买入限价定单,即以46.01的价格买入100股XYZ股票。由于定单马上就能执行,其将被视为适销定单。如果交易所会对消耗流动性收费,则客户将需缴纳该费用。

非适销定单是限价低于/高于当前市价的买入/卖出限价定单。

1. 对于非适销的买入限价定单,限价低于卖价。

2. 对于非适销的卖出限价定单,限价高于买价。

举例:

XYZ股票当前卖价尺寸/价格为400股/46.00。您输入一个买入限价定单,即以45.99的价格买入100股XYZ股票。由于定单将被作为最佳买价发布至市场,而不会立即执行,其将被视为非适销定单。

若有人发送了一个适销的卖出定单,从而使您的买入限价定单得以执行,则如果有添加流动性返点,您会收到一定折扣(返点)。

请注意:

1. 所有交易期权的账户均需就消耗/添加流动性缴纳/享受期权交易所费用或返点。

2. 根据IB网站,消耗/添加流动性费用表下只有负数才是折扣(返点)。

https://www.ibkr.com.cn/cn/index.php?f=2356

T+2结算概述

简介

- 降低金融系统的风险 – 由于证券价格变动的可能性会随时间上升,缩短结算周期能降低由于未付款或未交付证券导致的信用风险敞口。 通过降低待结算义务的名义价值,能够提高金融系统抵御严重市场冲击带来的潜在系统性后果。

- 提高现金调用效率 – 对于持“现金”账户的客户,若资金结算未完成,则无法交易(即不得空买空卖——在不支付的情况下买卖证券)。 实施T+2制度后,销售证券所得的资金将比之前早一个工作日到账,因此客户将能更快地将资金用于后续交易。

- 提高全球结算一致性 - 当前欧洲和亚洲等市场实行T+2制度,向T+2结算周期的转变将使美国和加拿大市场更好地与其它主要国际市场接轨。

买卖期权、期货或期货期权合约的结算规则是否会变化?

不要。此类产品当前在T+1日结算,结算周期不变。

U.S. Microcap Stock Restrictions

Introduction

To comply with regulations regarding the sale of unregistered securities and to minimize the manual processing associated with trading shares that are not publicly quoted, IBKR imposes certain restrictions on U.S. Microcap Stocks. A list of those restrictions, along with other FAQs relating to this topic are provided below.

Microcap Restrictions

- IBKR will only accept transfers of blocks of U.S. Microcap stocks from Eligible Clients. Eligible Clients include accounts that: (1) maintain equity (pre or post-transfer) of at least $5 million or, clients of financial advisors with aggregate assets under management of at least $20 million; and (2) have less than half of their equity in U.S. Microcap Stocks.

- IBKR will only accept transfers1 of blocks of U.S. Microcap Stocks where the Eligible Client can confirm the shares were purchased on the open market or registered with the SEC;

- IBKR will not accept transfers1 of or opening orders for U.S. Microcap Stocks designated by OTC as Caveat Emptor or Grey Market from any client. Clients with existing positions in these stocks may close the positions;

- IBKR will not accept transfers of U.S. Microcap Stocks to cover a short position established at IBKR;

- Execution-only clients (i.e., execute trades through IBKR, but clear those trades elsewhere) may not trade U.S. Microcap Stocks within their IBKR account. (IBKR may make exceptions for U.S.-registered brokers);

Microcap FAQs

What is a U.S. Microcap Stock?

The term “Microcap Stock” refers to shares (1) traded over the counter or (2) that are listed on Nasdaq and NYSE American that have a market capitalization of between $50 million to $300 million and are trading at or below $5. For purposes of this policy, the term Microcap Stock will include the shares of U.S. public companies which have a market capitalization at or below $50 million, which are sometimes referred to as nanocap stocks or trade on a market generally associated with Microcap Stocks.

To avoid situations where minor, short-term fluctuations in a stock price cause repeated reclassification, any stock classified as U.S. Microcap will remain in that classification until both its market capitalization and share price exceed $300 million and $5, respectively, for a 30 consecutive calendar day period.

As Microcap Stocks are often low-priced, they are commonly referred to as penny stocks. IBKR may make exceptions, including for stocks traded at low prices that recently had a greater market cap. In addition, IBKR will not consider ADRs on non-US companies to be Micro-Cap stocks.

Where do Microcap Stocks trade?

Microcap Stocks typically trade in the OTC market, rather than on a national securities exchange. They are often electronically quoted by market makers on OTC systems such as the OTC Bulletin Board (OTCBB) and the markets administered by the OTC Markets Group (e.g., OTCQX, OTCQB & Pink). Also included in this category are stocks which may not be publicly quoted and which are designated as Caveat Emptor, Other OTC or Grey Market.

In addition, U.S. regulators also consider stocks listed on Nasdaq or NYSE American trading at or below $5 with a market capitalization at or less than $300 million to be Microcap Stocks.

What happens if IBKR receives a transfer from an Eligible Client where one or more of the positions transferred is a Microcap Stock?

If IBKR receives a transfer containing a block of a Microcap stock, IBKR reserves the right to restrict the sale of any Microcap position(s) included in the transfer unless the Eligible Client provides appropriate documentation establishing that the shares were either purchased on the open market (i.e., on a public exchange through another broker) or were registered with the SEC pursuant to an S-1 or similar registration statement.

Eligible Clients can prove that shares were purchased on the open market by providing a brokerage statement or trade confirm from a reputable broker reflecting the purchase of the shares on a public exchange. Eligible Clients can establish that the shares are registered by providing the SEC (Edgar system) File number under which their shares were registered by the company (and any documents necessary to confirm the shares are the ones listed in the registration statement).

NOTE: All customers are free to transfer out any shares we have restricted at any time.

What restrictions will IBKR apply to Prime accounts?

Clients whose activities include Prime services are considered Eligible Clients solely for the purposes of those trades which IBKR has agreed to accept from its executing brokers. However, while Prime accounts may clear U.S. Microcap Stocks at IBKR, those shares will be restricted until such time IBKR confirms that the shares are eligible for re-sale under the procedures discussed above.

To remove the restriction for shares purchased on the open market, please have the executing broker provide a signed letter on company letterhead or an official Account Statement stating that the shares were purchased in the open market. The letter or statement must also include the below required criteria. Alternatively, if the shares were acquired through an offering the letter or statement must provide documents or links to the relevant registration statement and state that the shares were part of it.

Required Broker Letter Criteria:

1) IBKR Account Number

2) IBKR Account Title

3) Trade Date

4) Settlement Date

5) Symbol

6) Side

7) Price

8) Quantity

9) Time of Execution

10) Exchange

11) Must be signed

12) Must be on Firm's official letterhead

To summarize: Sell Long trades will be accepted if the long position is no longer restricted. Sell Short trades will be accepted. Buy Long trades will be accepted and the position will be restricted until Compliance is provided with sufficient information to remove the restriction. Buy Cover trades and intraday round trip trades will not be accepted.

What happens if a stock you purchase gets reclassified as Grey Market or Caveat Emptor?

If you purchase a stock in your IBKR account that at a later date becomes classified as a Caveat Emptor or Grey Market stock, you will be allowed to maintain, close or transfer the position but will not be able to increase your position.

What are some of the reasons why Microcap Stock trading may be restricted in my account?

There are two primary reasons why you might be restricted from trading in a Microcap Stock:

- Potential Affiliation to Issuer: U.S. Securities and Exchange Commission (“SEC”) Rule 144 places certain limitations on trading of stocks (including Microcap Stocks) by an “affiliate” of the issuer. If IBKR observes trading activity or holdings in a Microcap Stock that are close to the trading volume thresholds under Rule 144 (“Rule 144 Thresholds”), IBKR may restrict the customer from trading the Microcap Stock until a compliance review is completed.

- Transfer of Microcap Stock: If the customer has recently transferred a Microcap Stock into their IBKR account, IBKR may restrict the customer from trading in that security until a compliance review is completed.

If one of the above reasons apply, trading will be restricted in the security and a notification will be sent to the customer’s message center in Account Management. This notification will describe the reason for the restriction and the steps the customer must take before IBKR will consider lifting the restriction.

Why does IBKR consider me to be a potential affiliate of a Microcap Stock issuer?

An “affiliate” is a person, such as an executive officer, a director or large shareholder, in a relationship of control with the issuer.

Rule 144 applies to all securities, including Microcap Stocks. However, given the heightened risks associated with trading Microcap Stocks, if a customer’s trading and/or holdings in a Microcap Stock are close to the Rule 144 Thresholds, IBKR will restrict the customer’s trading in the Microcap Stock. This restriction will remain in effect pending a compliance review into the customer’s potential affiliate status.

For the Potential Affiliate review, why do I need to ask for a new review every two weeks?

A customer’s affiliate status may change soon after IBKR completes the above-referenced Potential Affiliate review. As such, IBKR believes it is appropriate to refresh a Potential Affiliate review every two weeks if a customer’s trading activity and/or holdings in the Microcap Stock remain close to the Rule 144 Thresholds.

Where can I find a list of stocks that IBKR has designated as U.S. Microcaps?

A list of stocks designated as U.S. Microcaps by IBKR is available via the following link: www.ibkr.com/download/us_microcaps.csv

Note that this list is updated daily.

Where can I find additional information on Microcap Stocks?

Additional information on Microcap Stocks, including risks associated with such stocks may be found on the SEC website: https://www.sec.gov/reportspubs/investor-publications/investorpubsmicrocapstockhtm.html

-----------------------------------------------------------

1This includes transfers by any method (e.g., ACATS, DWAC, FOP), conversion of Canadian listings to their U.S. equivalent via “Southbound” transfer, transfers to cover existing short positions, IB Prime customers executing with other brokers and clearing to IBKR, etc.

IEX Discretionary Peg Order

IEX offers a Discretionary Peg™ (D-Peg™) order type which is a non-displayed order that is priced at either the National Best Bid (NBB for buys) or National Best Offer (NBO for sells). D-Peg™ orders passively rest on the book while seeking to access liquidity at a more aggressive price up to Midpoint of the NBBO, except when IEX determines that the quote is transitioning to less aggressive price

How to Place a D-Peg Order

Please note, the IEX D-Peg order type is only available via the TWS version 961 and above. Instructions for entering this order type are outlined below:

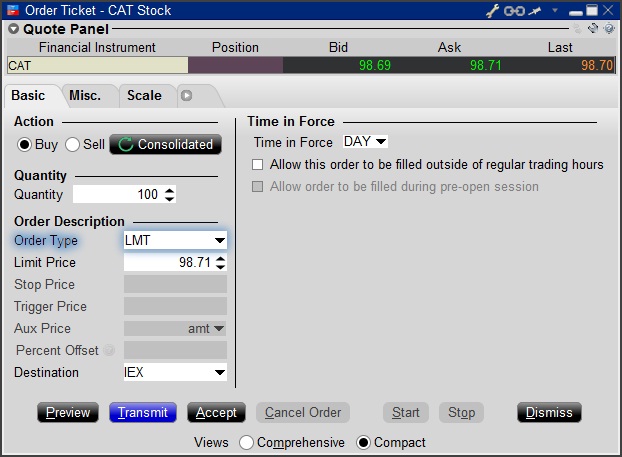

Step 1

Enter a symbol and choose a directed quote, selecting IEX as the destination. Right click on the data line and select Trade followed by Order Ticket to open the Order Ticket window.

Step 2

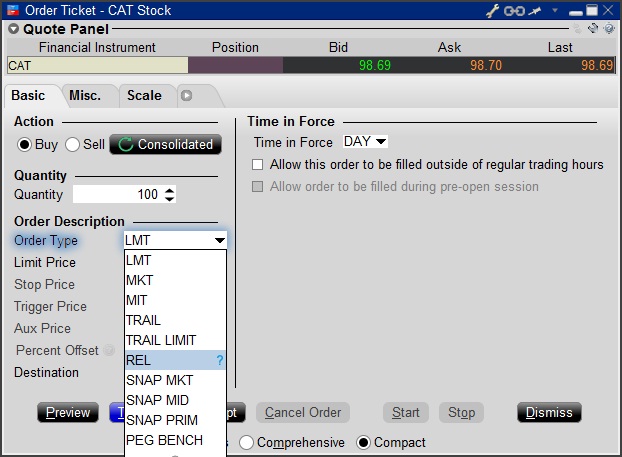

Select the REL order type from the Order Type drop down menu.

Step 3

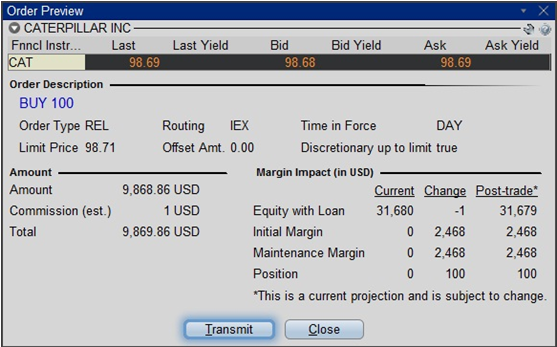

Click on the Miscellaneous tab (Misc.) and at the bottom there will be a checkbox for "Discretionary up to limit". Check this box. The price that you set in the Limit Price field will be used at the discretionary price on the order.

.jpg)

Step 4

Hit Preview to view the Order Preview window.

For additional information concerning this order type, please review the following exchange website link: https://www.iextrading.com/trading/dpeg/

IBKR股票差价合约概述

下方文章对IBKR发行的股票差价合约(CFD)进行了总体介绍。

有关IBKR指数差价合约的信息,请点击此处。有关外汇差价合约的信息,请点击此处。

涵盖主题如下:

I. 差价合约定义

II. 差价合约与底层股票之比较

III. 成本与保证金

IV. 范例

V. 差价合约的相关资源

VI. 常见问题

风险警告

差价合约属于复杂金融产品,其交易存在高风险,由于杠杆的作用,可能会出现迅速亏损。

在通过IBKR(UK)交易差价合约时,有67%的零售投资者账户出现了亏损。

您应考虑自己是否理解差价合约的运作机制以及自己是否能够承受亏损风险。

ESMA差价合约规定(仅限零售客户)

欧洲证券与市场管理局(ESMA)颁布了新的差价合约规定,自2018年8月1日起生效。

新规包括:1) 开仓差价合约头寸的杠杆限制;2) 以单个账户为单位的保证金平仓规则;以及3) 以单个账户为单位的负余额保护规则;

ESMA新规仅适用于零售客户。专业客户不受影响。

请参见ESMA差价合约新规推行了解更多详细信息。

I. 股票差价合约定义

IBKR差价合约是场外交易合约,提供底层股票的收益,包括股息与公司行动(了解更多有关差价合约公司行动的信息)。

换句话说,这是买家(您)与IBKR就交易一只股票当前价值与未来价值之差额而达成的协定。如果您持有多头头寸,且差额为正,则IBKR会付钱给您。而如果差额为负,则您应向IBKR付钱。

IBKR股票差价合约通过您的保证金账户进行交易,因此您可建立多头以及空头杠杆头寸。差价合约的价格即是底层股票的交易所报价。实际上,IBKR差价合约报价与股票的智能传递报价(可在TWS中查看)相同,且IBKR提供直接市场接入(DMA)。与股票类似,您的非适销(即限价)定单会使底层对冲直接呈现在其进行交易之交易所的深度定单册中。 这也意味着您可以下单以底层买价买入差价合约或以底层卖价卖出差价合约。

要将IBKR透明的差价合约模型与市场上其他差价合约进行比较,请参见我们的差价合约市场模型概述。

IBKR目前提供约7100只股票差价合约,覆盖美国、欧洲和亚洲的主要市场。下表所列的主要指数其成分股目前都可做IBKR股票差价合约。在许多国家,IBKR还可供交易高流动性小盘股。这些股票自由流通量调整市值至少为5亿美元,每日交易量中间值至少为60万美元。 详情请见差价合约产品列表。不久将会增加更多国家。

| 美国 | 标普500、道琼斯股价平均指数、纳斯达克100、标普400中盘股、高流动性小盘股 |

| 英国 | 富时350 + 高流动性小盘股(包括IOB) |

| 德国 | Dax、MDax、TecDax + 高流动性小盘股 |

| 瑞士 | 斯托克欧洲600指数(48只股票)+ 高流动性小盘股 |

| 法国 | CAC大盘股、CAC中盘股 + 高流动性小盘股 |

| 荷兰 | AEX、AMS中盘股 + 高流动性小盘 |

| 比利时 | BEL 20、BEL中盘股 + 高流动性小盘 |

| 西班牙 | IBEX 35 + 高流动性小盘股 |

| 葡萄牙 | PSI 20 |

| 瑞典 | OMX斯德哥尔摩30指数 + 高流动性小盘股 |

| 芬兰 | OMX赫尔辛基25指数 + 高流动性小盘股 |

| 丹麦 | OMX哥本哈根30指数 + 高流动性小盘股 |

| 挪威 | OBX |

| 捷克 | PX |

| 日本 | 日经225指数 + 高流动性小盘股 |

| 香港 | 恒生指数 + 高流动性小盘股 |

| 澳大利亚 | ASX 200指数 + 高流动性小盘股 |

| 新加坡* | 海峡时报指数 + 高流动性小盘股 |

| 南非 | Top 40 + 高流动性小盘股 |

*对新加坡居民不可用

II. 差价合约与底层股票之比较

| IBKR差价合约的优势 | IBKR差价合约的缺点 |

|---|---|

| 无印花税和金融交易税(英国、法国、比利时) | 无股权 |

| 佣金和保证金利率通常比股票低 | 复杂公司行动并不总能完全复制 |

| 股息享受税务协定税率,无需重新申请 | 收益的征税可能与股票有所不同(请咨询您的税务顾问) |

| 不受即日交易规则限制 |

III. 成本与保证金

在欧洲股票市场,IBKR差价合约可以比IB极具竞争力的股票产品更加高效。

首先,IBKR差价合约佣金比股票低,且有着与股票一样低的融资点差:

| 欧洲 | 差价合约 | 股票 | |

|---|---|---|---|

| 佣金 | GBP | 0.05% | 英镑6.00 + 0.05%* |

| EUR | 0.05% | 0.10% | |

| 融资** | 基准+/- | 1.50% | 1.50% |

*每单 + 超出5万英镑部分的0.05%

**对于差价合约是总头寸价值的融资;对于股票是借用金额的融资

交易量更大时,差价合约佣金会变得更低,最低至0.02%。头寸更大时,融资利率也会降低,最低至0.5%。 详情请参见差价合约佣金和差价合约融资利率。

其次,差价合约的保证金要求比股票低。零售客户须满足欧洲监管机构ESMA规定的额外保证金要求。请参见ESMA差价合约新规推行了解详细信息。

| 差价合约 | 股票 | ||

|---|---|---|---|

| 所有 | 标准 | 投资组合保证金 | |

| 维持保证金要求* |

10% |

25% - 50% | 15% |

*蓝筹股特有保证金。零售客户最低初始保证金要求为20%。股票标准的25%日内维持保证金,50%隔夜保证金。 显示的投资组合保证金为维持保证金(包括隔夜)。波动较大的股票保证金要求更高

请参见CFD保证金要求了解更多详细信息。

IV. 范例(专业客户)

让我们来看一下例子。联合利华在阿姆斯特丹的挂牌股票在过去一个月(2012年5月14日前20个交易日)回报率为3.2%,您认为其会继续有良好表现。您想建立20万欧元的仓位,并持仓5天。您以10笔交易建仓并以10笔交易平仓。您的直接成本如下:

股票

| 差价合约 | 股票 | ||

|---|---|---|---|

| 200,000欧元头寸 | 标准 | 投资组合保证金 | |

| 保证金要求 | 20,000 | 100,000 | 30,000 |

| 佣金(双向) | 200.00 | 400.00 | 400.00 |

| 利率(简化) | 1.50% | 1.50% | 1.50% |

| 融资金额 | 200,000 | 100,000 | 170,000 |

| 融资天数 | 5 | 5 | 5 |

| 利息支出(1.5%的简化利率) | 41.67 | 20.83 | 35.42 |

| 总计直接成本(佣金+利息) | 241.67 | 420.83 | 435.42 |

| 成本差额 | 高74% | 高80% | |

注意:差价合约的利息支出根据总的合约头寸进行计算,而股票的利息支出则是根据借用金额进行计算。股票和差价合约的适用利率相同。

但是,假设您只有2万欧元可用来做保证金。如果联合利华继续上月的表现,您的潜在盈利比较如下:

| 杠杆回报 | 差价合约 | 股票 | |

|---|---|---|---|

| 可用保证金 | 20,000 | 20,000 | 20,000 |

| 总投入 | 200,000 | 40,000 | 133,333 |

| 总收益(5天) | 1,600 | 320 | 1,066.66 |

| 佣金 | 200.00 | 80.00 | 266.67 |

| 利息支出(1.5%的简化利率) | 41.67 | 4.17 | 23.61 |

| 总计直接成本(佣金+利息) | 241.67 | 84.17 | 290.28 |

| 净收益(总收益减去直接成本) | 1,358.33 | 235.83 | 776.39 |

| 保证金投资金额回报 | 0.07 | 0.01 | 0.04 |

| 差额 | 收益少83% | 收益少43% | |

| 杠杆风险 | 差价合约 | 股票 | |

|---|---|---|---|

| 可用保证金 | 20,000 | 20,000 | 20,000 |

| 总投入 | 200,000 | 40,000 | 133,333 |

| 总收益(5天) | -1,600 | -320 | -1,066.66 |

| 佣金 | 200.00 | 80.00 | 266.67 |

| 利息支出(1.5%的简化利率) | 41.67 | 4.17 | 23.61 |

| 总计直接成本(佣金+利息) | 241.67 | 84.17 | 290.28 |

| 净收益(总收益减去直接成本) | -1,841.67 | -404.17 | -1,356.94 |

| 差额 | 损失少78% | 损失少26% | |

V. 差价合约相关资源

下方链接可帮助您了解更多有关IBKR差价合约产品的详细信息:

还可参看以下视频教程:

VI. 常见问题

什么股票可进行差价合约交易?

美国、西欧、北欧与日本的大盘和中盘股股票。许多市场上的高流动性小盘股也可以。请参见差价合约产品列表了解更多详细信息。不久将会增加更多国家。

IB提供股票指数和外汇的差价合约吗?

是的。请参见IBKR指数差价合约 - 事实与常见问题以及外汇差价合约 - 事实与常见问题。

IB如何确定股票差价合约报价?

IBKR差价合约报价与底层股票的智能传递报价相同。IBKR不会扩大价差或与您对赌。要了解更多信息,请参见差价合约市场模型概述。

我能看到自己的限价定单反映在交易所中吗?

是的。IBKR提供直接市场接入(DMA),这样您的非适销(即限价)定单会使底层对冲直接呈现在其进行交易之交易所的深度定单册中。这也意味着您可以下单以底层买价买入差价合约或以底层卖价卖出差价合约。此外,如果其他客户的定单以优于公开市场的价格与您的定单交叉,您还可能会获得价格改善。

IB如何确定股票差价合约的保证金?

IBKR根据每只底层股票的历史波动率建立了基于风险的保证金要求机制。最低保证金为10%。 大多数IBKR差价合约都应用该保证金率,这使差价合约在大多数情况下都比底层股票交易更具效率。 零售客户须满足欧洲监管机构ESMA规定的额外保证金

要求。 请参见ESMA差价合约新规推行了解详细信息。单个差价合约头寸之间或差价合约与底层股票头寸之间没有投资组合抵消。集中头寸和超大头寸可能需要准备额外的保证金。请参见差价合约保证金要求了解更多详细信息。

空头股票差价合约会要强制补仓吗?

是的。如果底层股票很难或者根本不可能借到,则空头差价合约头寸的持有者将需要进行补仓。

IB如何处理股息和公司行动?

IBKR通常会为差价合约持有者反映公司行动的经济效应,就好像他们一直持有着底层证券一样。股息会表现为现金调整,而其他行动则会通过现金或头寸调整表现。例如,如果公司行动导致股票数量发生变化(如股票分隔和逆向股票分隔),差价合约的数量也会相应地进行调整。如果行动导致产生新的上市实体,且IBKR决定将其股票作为差价合约交易,则需要创建适当数量之新的多头或空头头寸。要了解概述信息,请参见差价合约公司行动。

*请注意,某些情况下对于合并等复杂公司行动可能无法对差价合约进行准确调整。这时候,IBKR可能会在除息日前终止差价合约。

任何人都能交易IBKR差价合约吗?

除美国、加拿大和香港的居民,其他所有客户都能交易IBKR差价合约。新加坡居民可交易除新加坡上市之股票差价合约以外的其它IBKR差价合约。任何投资者类型都不能免于这一基于居住地的限制。

我需要做什么才可以开始在IBKR交易差价合约?

您需要在账户管理中设置差价合约交易许可,并同意相关交易披露。如果您的账户是在IB LLC开立,则IBKR将设置一个新的账户板块(即您当前的账户号码加上后缀“F”)。设置确认后您便可以开始交易了。您无需单独为F账户注资,资金会从您的主账户自动转入以满足差价合约保证金要求。

有什么市场数据要求吗?

IBKR股票差价合约的市场数据便是底层股票的市场数据。因此需要具备相关交易所的市场数据许可。如果您已经为股票交易设置了交易所的市场数据许可,那么就无需再进行任何操作。如果您想在当前并无市场数据许可的交易所交易差价合约,您可以设置许可,操作与底层股票的市场数据许可设置相同。

差价合约交易与头寸在报表中如何反映?

如果您是在IB LLC持有账户,且您的差价合约头寸持有在单独的账户板块(主账户号码加后缀“F”)中。您可以选择单独查看F板块的活动报表,也可以选择与主账户合并查看。您可在账户管理的报表窗口进行选择。对于其他账户,差价合约通常会与其他交易产品一起在您的账户报表中显示。

我可以从其他经纪商处转入差价合约头寸吗?

IBKR当前不支持差价合约头寸转账。

股票差价合约可以使用图表功能吗?

是的。

在IBKR交易差价合约有什么账户保护?

差价合约以IB英国作为您的交易对方,不是在受监管的交易所进行交易,也不是在中央结算所进行结算。因IB英国是您差价合约交易的对方,您会面临与IB英国交易相关的财务和商业风险,包括信用风险。但请注意,所有客户资金永远都是完全隔离的,包括对机构客户。IB英国是英国金融服务补偿计划(“FSCS”)参与者。IB英国不是美国证券投资者保护公司(“SIPC”)成员。请参见IB英国差价合约风险披露文件了解有关差价合约交易风险的详细信息。

在哪种类型(如个人、朋友和家庭、机构等)的IBKR账户中可交易差价合约?

所有保证金账户均可进行差价合约交易。现金账户和SIPP账户不能。

在某一特定差价合约中我最多可持有多少头寸?

没有预设限制。但请注意,超大头寸可能会有更高保证金要求。请参见CFD保证金要求了解更多详细信息。

我能否通过电话交易差价合约?

不要。在极端情况下我们可能同意通过电话处理平仓定单,但绝不会通过电话处理开仓定单。

差价合约属于复杂金融产品,其交易存在高风险,由于杠杆的作用,可能会出现迅速亏损。

在通过IBKR(UK)交易差价合约时,有67%的零售投资者账户出现了亏损。

您应考虑自己是否理解差价合约的运作机制以及自己是否能够承受亏损风险。

ESMA规定

欧洲证券与市场管理局(ESMA)发布临时产品干涉措施,自2018年8月1日起生效。

ESMA决议实施的限制包括:1) 开仓差价合约头寸的杠杆限制;2) 以单个账户为单位的保证金平仓规则;3) 以单个账户为单位的负余额保护规则;4) 对交易差价合约激励措施的限制;以及5) 标准的风险警告。

ESMA新规仅适用于零售客户。 专业客户不受影响。

SEC Tick Size Pilot Program

Background

Effective October 3, 2016, securities exchanges registered with the SEC will operate a Tick Size Pilot Program ("Pilot") intended to determine what impact, if any, widening of the minimum price change (i.e., tick size) will have on the trading, liquidity, and market quality of small cap stocks. The Pilot will last for 2 years and it will include approximately 1,200 securities having a market capitalization of $3 billion or less, average daily trading volume of 1 million shares or less, and a volume weighted average price of at least $2.00.

For purposes of the Pilot, these securities will be organized into groups that will determine a minimum tick size for both quote display and trading purposes. For example, Test Group 1 will consist of securities to be quoted in $0.05 increments and traded in $0.01 increments and Test Group 2 will include securities both quoted and traded in $0.05 increments. Test Group 3 will include also include securities both quoted and traded in $0.05 increments, but subject to Trade-at rules (more fully explained in the Rule). In addition, there will be a Control Group of securities that will continue to be quoted and traded in increments of $0.01. Details as to the Pilot and securities groupings are available on the FINRA website.

Impact to IB Account Holders

In order to comply with the SEC Rules associated with this Pilot, IB will change the way that it accepts orders in stocks included in the Pilot. Specifically, starting October 3, 2016 and in accordance with the phase-in schedule, IB will reject the following orders associated with Pilot Securities assigned to Test Groups:

- Limit orders having an explicit limit that is not entered in an increment of $0.05;

- Stop or Stop Limit orders having an explicit limit that is not entered in an increment of $0.05; and

- Orders having a price offset that is not entered in an increment of $0.05. Note that this does not apply to offsets which are percentage based and which therefore allow IB to calculate the permissible nickel increment

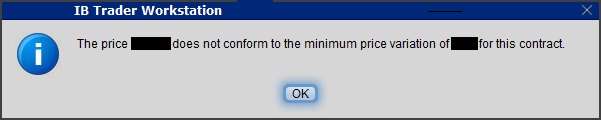

Clients submitting orders via the trading platform that are subject to rejection will receive the following pop-up message:

The following order types will continue to be accepted for Pilot Program Securities:

- Market orders;

- Benchmark orders having no impermissible offsets (e.g., VWAP, TVWAP);

- Pegged orders having no impermissible offsets ;

- Retail Price Improvement Orders routed to the NASDAQ-BX and NYSE as follows:

- Test Group 1 in .001

- Test Group 2 and 3 in .005

Other Items of Note

- GTC limit and stop orders entered prior to the start of the Pilot will be adjusted as allowed (e.g., a buy limit order at $5.01 will be adjusted to $5.00 and a sell limit at $5.01 adjusted to $5.05).

- Clients generating orders via third-party software (e.g., signal provider), order management system, computer to computer interfaces (CTCI) or through the API, should contact their vendor or review their systems to ensure that all systems recognize the Pilot restrictions.

- Incoming orders to IB that are marked with TSP exception codes from other Broker Dealers will not be acted upon by IB. For example, IB will not accept incoming orders marked with the Retail Investor Order or Trade-At ISO exception codes.

- The SEC order associated with this Pilot is available via the following link: https://www.sec.gov/rules/sro/nms/2015/34-74892-exa.pdf

- For a list of Pilot Program related FAQs, please see KB2750

Please note that the contents of this article are subject to revision as further regulatory guidance or changes to the Pilot Program are issued.

Allocation of Partial Fills

How are executions allocated when an order receives a partial fill because an insufficient quantity is available to complete the allocation of shares/contracts to sub-accounts?

Overview:

From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed (i.e. market closes, contract expires, halts due to news, prices move in an unfavorable direction, etc.). In such cases, IB determines which customers (who were originally included in the order group and/or profile) will receive the executed shares/contracts. The methodology used by IB to impartially determine who receives the shares/contacts in the event of a partial fill is described in this article.

Background:

Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. They can do so by first creating a group (i.e. ratio/percentage) or profile (i.e. specific amount) wherein a distinct number of shares/contracts are specified per client account (i.e. pre-trade allocation). These amounts can be prearranged based on certain account values including the clients’ Net Liquidation Total, Available Equity, etc., or indicated prior to the order execution using Ratios, Percentages, etc. Each group and/or profile is generally created with the assumption that the order will be executed in full. However, as we will see, this is not always the case. Therefore, we are providing examples that describe and demonstrate the process used to allocate partial executions with pre-defined groups and/or profiles and how the allocations are determined.

Here is the list of allocation methods with brief descriptions about how they work.

· AvailableEquity

Use sub account’ available equality value as ratio.

· NetLiq

Use subaccount’ net liquidation value as ratio

· EqualQuantity

Same ratio for each account

· PctChange1:Portion of the allocation logic is in Trader Workstation (the initial calculation of the desired quantities per account).

· Profile

The ratio is prescribed by the user

· Inline Profile

The ratio is prescribed by the user.

· Model1:

Roughly speaking, we use each account NLV in the model as the desired ratio. It is possible to dynamically add (invest) or remove (divest) accounts to/from a model, which can change allocation of the existing orders.

Basic Examples:

Details:

CTA/FA has 3-clients with a predefined profile titled “XYZ commodities” for orders of 50 contracts which (upon execution) are allocated as follows:

Account (A) = 25 contracts

Account (B) = 15 contracts

Account (C) = 10 contracts

Example #1:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 10 am (ET) the order begins to execute2but in very small portions and over a very long period of time. At 2 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 7 of the 50 contracts are filled or 14%). For each account the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 14% of 25 = 3.5 rounded down to 3

Account (B) = 14% of 15 = 2.1 rounded down to 2

Account (C) = 14% of 10 = 1.4 rounded down to 1

To Summarize:

A: initially receives 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: initially receives 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. Account C which currently has a ratio of 0.10).

A: final allocation of 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 2 contract, which is 2/10 of desired (fill ratio = 0.20)

The execution(s) received have now been allocated in full.

Example #2:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be filled3 but in very small portions and over a very long period of time. At 1 pm (ET) the order is canceled prior being executed in full. As a result, only a portion of the order is executed (i.e., 5 of the 50 contracts are filled or 10%).For each account, the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 10% of 25 = 2.5 rounded down to 2

Account (B) = 10% of 15 = 1.5 rounded down to 1

Account (C) = 10% of 10 = 1 (no rounding necessary)

To Summarize:

A: initially receives 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: initially receives 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. to Account B which currently has a ratio of 0.067).

A: final allocation of 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Example #3:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be executed2 but in very small portions and over a very long period of time. At 12 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 3 of the 50 contracts are filled or 6%). Normally the system initially allocates by rounding fractional amounts down to whole numbers, however for a fill size of less than 4 shares/contracts, IB first allocates based on the following random allocation methodology.

In this case, since the fill size is 3, we skip the rounding fractional amounts down.

For the first share/contract, all A, B and C have the same initial fill ratio and fill quantity, so we randomly pick an account and allocate this share/contract. The system randomly chose account A for allocation of the first share/contract.

To Summarize3:

A: initially receives 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: initially receives 0 contracts, which is 0/15 of desired (fill ratio = 0.00)

C: initially receives 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

Next, the system will perform a random allocation amongst the remaining accounts (in this case accounts B & C, each with an equal probability) to determine who will receive the next share/contract.

The system randomly chose account B for allocation of the second share/contract.

A: 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

The system then allocates the final [3] share/contract to an account(s) with the smallest ratio (i.e. Account C which currently has a ratio of 0.00).

A: final allocation of 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: final allocation of 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Available allocation Flags

Besides the allocation methods above, user can choose the following flags, which also influence the allocation:

· Strict per-account allocation.

For the initially submitted order if one or more subaccounts are rejected by the credit checking, we reject the whole order.

· “Close positions first”1.This is the default handling mode for all orders which close a position (whether or not they are also opening position on the other side or not). The calculation are slightly different and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases.

Other factor affects allocations:

1) Mutual Fund: the allocation has two steps. The first execution report is received before market open. We allocate based onMonetaryValue for buy order and MonetaryValueShares for sell order. Later, when second execution report which has the NetAssetValue comes, we do the final allocation based on first allocation report.

2) Allocate in Lot Size: if a user chooses (thru account config) to prefer whole-lot allocations for stocks, the calculations are more complex and will be described in the next version of this document.

3) Combo allocation1: we allocate combo trades as a unit, resulting in slightly different calculations.

4) Long/short split1: applied to orders for stocks, warrants or structured products. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex.

5) For non-guaranteed smart combo: we do allocation by each leg instead of combo.

6) In case of trade bust or correction1: the allocations are adjusted using more complex logic.

7) Account exclusion1: Some subaccounts could be excluded from allocation for the following reasons, no trading permission, employee restriction, broker restriction, RejectIfOpening, prop account restrictions, dynamic size violation, MoneyMarketRules restriction for mutual fund. We do not allocate to excluded accountsand we cancel the order after other accounts are filled. In case of partial restriction (e.g. account is permitted to close but not to open, or account has enough excess liquidity only for a portion of the desired position).

Footnotes:

SEC Tick Size Pilot Program FAQs

Tick Size Pilot ("TSP" or "Pilot") Program:

Under the TSP Program, if IBKR receives any order in a Pilot Security that does not conform to the designated pricing increment (e.g., a limit price in a $0.01 increment for a security designated as trading $0.05 increments), IBKR will REJECT that order, subject to limited exceptions. IBKR strongly encourages a thorough review of your software or your vendor’s software to understand the criteria for what causes an order in a Pilot Security to be rejected to permit you or your vendor to make changes to correctly handle orders in Test Group Pilot Securities.

FREQUENTLY ASKED QUESTIONS:

Q: What is the Tick Size Pilot?

A: On May 6, 2015, the SEC approved an amended TSP NMS Plan. The Pilot will be two years in length. Data collection for the Pilot began on April 4, 2016, 6 months prior to the implementation of the trading and quoting rules for the Pilot. Implementation of the trading and quoting rules for the Pilot will begin on October 3, 2016.

The Pilot will be conducted using a Control Group and three Test Groups where variations in quoting and trading rules exist between each group. Please see the TSP NMS Plan for additional information.

Q: Will the Pilot quoting and trading rules apply during regular market hours, pre-market hours and post market hours?

A: The Pilot rules apply during all operational hours (pre-market, regular hours, and post market hours trading).

Q: Will the Pilot quoting and trading rules apply to odd-lot and mixed-lot sizes?

A: Yes, the Pilot rules to all order sizes.

Q: Will orders in Control Group Securities be accepted in price increments of less than $0.05?

A: Yes, orders submitted in price increments of less than $0.05 will continue to be accepted in Control Group securities.

Q: Will orders in a Test Group 1, 2 or 3 Pilot Securities be accepted in price increments of less than $0.05?

A: No, unless covered by an exception, orders submitted in price increments of less than $0.05 will be rejected.

Q: Which Pilot Security Orders in Test Groups will Interactive Brokers accept at other than $0.05 increments?

![]() Midpoint orders with no explicitly stated limit price or impermissible offsets will be accepted

Midpoint orders with no explicitly stated limit price or impermissible offsets will be accepted

![]() VWAP orders that do not have an explicitly stated limit price or impermissible offsets will be accepted.

VWAP orders that do not have an explicitly stated limit price or impermissible offsets will be accepted.

![]() Interactive Brokers will accept Exchange operated Retail Price Improvement orders as follows:

Interactive Brokers will accept Exchange operated Retail Price Improvement orders as follows:

![]() Test Group 1 in $0.001 price increments

Test Group 1 in $0.001 price increments

![]() Test Groups 2 and 3 in $0.005 price increments.

Test Groups 2 and 3 in $0.005 price increments.

Q: Will there be any changes to the Opening / Closing processes on Exchanges?

A: Please refer to each of the exchange rules for details but in general, there will be no changes to the Opening / Closing process. All orders entered and eligible to participate in Exchange Opening / Closing Cross will be accepted in increments of $0.05. The Exchanges will begin publishing all quotes in increments of $0.05; however, Net Order Imbalance Indicator prices may be published in increments of $0.025.

Q: What will happen to my GTC order that was placed prior to October 3rd in a Pilot Stock that was priced in impermissible tick increments?

A: Interactive Brokers will adjust outstanding limit and stop GTC orders in Pilot stocks in Test Groups that are not in permissible tick increments (e.g., a buy limit order at $5.01 will be adjusted to $5.00 and a sell limit at $5.01 adjusted to $5.05).

Q: What will happen to my GTC order placed after October 3rd that was placed and accepted in a nickel tick increment but the Pilot Stock moves from a Test Group to the Control Group that permits non-nickel increments?

A: The GTC order will automatically be able to be revised by the user in non-nickel increments on the date the Pilot stock moves from the Test Group to the Control Group. Similarly, if a stock is added to Test Group due to a corporate action, IBKR will cancel the GTC order if it is priced in impermissible increments.

Q: Where can I find out more information?

A: See KB2752 or the FINRA website for additional details regarding the Pilot Program: http://www.finra.org/industry/tick-size-pilot-program

Additional Information Regarding the Use of Stop Orders

U.S. equity markets occasionally experience periods of extraordinary volatility and price dislocation. Sometimes these occurrences are prolonged and at other times they are of very short duration. Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price.