Tarifas de subrogación de ADR

Los titulares de cuenta que mantengan posiciones en recibos de depósito estadounidenses (American Depository Receipts - ADRs) deberían tener en cuenta que dichos valores están sujetos a tarifas periódicas para compensar al banco agente que proporciona los servicios de custodia en nombre del ADR. Estos servicios incluyen, típicamente, hacer inventario de las acciones extranjeras subyacentes al ADR y gestionar todos los servicios de registro, cumplimiento normativo y mantenimiento de registros.

Históricamente, los bancos agentes solo podían recaudar las tarifas de custodia al restarlas del dividendo del ADR; sin embargo, como muchos ADR no pagan dividendos de forma regular, estos bancos no han podido recaudar sus tarifas. Como resultado, en 2009, la empresa Depository Trust Company (DTC) recibió la aprobación de SEC para comenzar la recaudación de estas tarifas en nombre de los bancos para ADR que no paguen dividendos periódicos. La DTC recauda estas tarifas de los brókeres participantes (tales como IB) que mantienen los ADR para sus clientes. Estas tarifas se consideran como tarifas de subrogación ya que están diseñadas para ser recaudadas por el bróker de sus clientes.

Si mantiene posiciones en un ADR que paga dividendos, estas tarifas se deducirán del dividendo, del mismo modo que se hacía en el pasado. Si mantiene una posición en un ADR que no paga un dividendo, esta tarifa de subrogación se reflejará en el extracto mensual de la fecha de registro en la que se evalúe. De forma similar a cómo trata los dividendos en efectivo, IB intentará reflejar las próximas asignaciones de tarifas de ADR en la sección Devengos de los extractos de cuentas. Una vez cargada, la tarifa se reflejará en la sección Depósitos y Retiradas del extracto con la descripción 'Ajustes - otros' junto con el símbolo del ADR concreto con el que se asocia.

Aunque esta tarifa se encontrará, normalmente, entre $0.01 - $0.03 por acción, las cantidades pueden diferir según ADR y se recomienda que consulte su folleto de ADR para consultar la información específica. Una búsqueda en línea del folleto puede realizarse a través de la herramienta EDGAR Company Search de SEC.

¿Cuales son las fechas claves en relación con los dividendos de acciones?

Las fechas claves en relación con los dividendos de acciones son las siguientes:

1. Fecha de declaración: fecha en la que la junta de directores de la empresa aprueba el pago de dividendos y designa la fecha de pago y la fecha de cierre de registro.

2. Fecha de cierre de registro: la fecha que determina los accionistas con derecho a recibir el pago del dividendo. Debe ser titular de acciones al final del día de la fecha del cierre de registro para recibir el dividendo.

3. Fecha exdividendo: la fecha en la que las acciones se negociarán sin el derecho a recibir el dividendo. Debido a que la mayoría de las operaciones en acciones en Estados Unidos se liquidan de forma regular, es decir tres días hábiles tras la operación, una persona física debe comprar las acciones tres días hábiles antes de la fecha de cierre de registro para cualificarse para el dividendo. La fecha exdividendo es, por lo tanto, dos días hábiles anterior a la fecha de cierre de registro.

4. Fecha de pago: fecha en la que el dividendo declarado se paga a todos los accionistas que tengan acciones en la fecha de cierre de registro.

Inversiones cualificadas para cuentas RSP y TFSA

La normativa de la Canadian Revenue Agency (“CRA”) impone restricciones sobre los tipos de posiciones que pueden mantenerse en cuentas RSP y TFSA con elegibilidad limitada para aquellas que cumplan la definición de “Inversión Cualificada”. Las posiciones mantenidas en dichas cuentas que no cumplan con esta definición se referirán como "inversiones no cualificadas" y estarán sujetas a un impuesto CRA igual al 50% del valor justo de mercado de la propiedad en el momento en que se adquirió o se convirtió en no cualificada.

Las inversiones no cualificas incluyen los siguientes instrumentos: inversiones en propiedades, incluidos capital, certificados de inversión garantizada (GIC), bonos gubernamentales y corporativos, fondos mutuos y valores cotizados en un mercado designado. Tenga en cuenta que ciertas inversiones, aunque sean cualificadas, pueden no ser ofrecidas por IB debido al propio tipo de producto o no se admite el mercado designado.1

Las inversiones no cualificadas incluyen cualquier propiedad que no esté clasificada como Inversión Cualificada. Ejemplos de esto incluyen la negociación en acciones en NEX en Canadá, así como acciones en PINK y OTCBB en los Estados Unidos.

Si desea información adicional, consulte los siguientes enlaces de la página web de CRA:

http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/rrsp-reer/glssry-eng.html

http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ntvdnc/nnqlfdnvst-eng.html

Qualified Investments in RSP & TFSA Accounts

Canadian Revenue Agency (“CRA”) regulations place restrictions upon the types of positions that may be held in RSP and TFSA accounts with eligibility limited to those meeting the definition of a “Qualified Investment”. Positions held in such accounts that do not meet this definition are referred to as “Non-Qualified Investments” and are subject to a CRA tax equal to 50% of the fair market value of the property at the time it was acquired or it became Non-Qualified.

Qualified Investments include the following instruments: an investment in properties, including money, guaranteed investment certificates (GICs), government and corporate bonds, mutual funds, and securities listed on a designated stock exchange. Note that certain investments, while Qualified, may not be offered by IB due to the product type itself or its designated exchange not being supported.1

Non-Qualified investments include any property that is not is not classified as a Qualified Investment. Examples include stocks trading on NEX in Canada, as well as on PINK and OTCBB shares in the US.

For additional information, please refer to the CRA website links below:

http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/rrsp-reer/glssry-eng.html

http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ntvdnc/nnqlfdnvst-eng.html

Determining Buying Power

Buying power serves as a measurement of the dollar value of securities that one may purchase in a securities account without depositing additional funds. In the case of a cash account where, by definition, securities may not be purchased using funds borrowed from the broker and must be paid for in full, buying power is equal to the amount of settled cash on hand. Here, for example, an account holding $10,000 in cash may purchase up to $10,000 in stock.

In a margin account, buying power is increased through the use of leverage provided by the broker using cash as well as the value of stocks already held in the account as collateral. The amount of leverage depends upon whether the account is approved for Reg. T margin or Portfolio Margin. Here, a Reg. T account holding $10,000 in cash may purchase and hold overnight $20,000 in securities as Reg. T imposes an initial margin requirement of 50%, which translates to buying power of 2:1 (i.e., 1/.50). Similarly, a Reg. T account holding $10,000 in cash may purchase and hold on an intra-day basis $40,000 in securities given IB’s default intra-day maintenance margin requirement of 25%, which translates to buying power of 4:1 (i.e., 1/.25).

In the case of a Portfolio Margin account, greater leverage is available although, as the name suggests, the amount is highly dependent upon the make-up of the portfolio. Here, the requirement on individual stocks (initial = maintenance) generally ranges from 15% - 30%, translating to buying power of between 6.67 – 3.33:1. As the margin rate under this methodology can change daily as it considers risk factors such as the observed volatility of each stock and concentration, portfolios comprised of low-volatility stocks and which are diversified in nature tend to receive the most favorable margin treatment (e.g., higher buying power).

In addition to the cash examples above, buying power may be provided to securities held in the margin account, with the leverage dependent upon the loan value of the securities and the amount of funds, if any, borrowed to purchase them. Take, for example, an account which holds $10,000 in securities which are fully paid (i.e., no margin loan). Using the Reg. T initial margin requirement of 50%, these securities would have a loan value of $5,000 (= $10,000 * (1 - 0.50)) which, using that same initial requirement providing buying power of 2:1, could be applied to purchase and hold overnight an additional $10,000 of securities. Similarly, an account holding $10,000 in securities and a $1,000 margin loan (i.e., net liquidating equity of $9,000), has a remaining equity loan value of $4,000 which could be applied to purchase and hold overnight an additional $8,000 of securities. The same principles would hold true in a Portfolio Margin account, albeit with a potentially different level of buying power.

Finally, while the concept of buying power applies to the purchase of assets such as stocks, bonds, funds and forex, it does not translate in the same manner to derivatives. Most securities derivatives (e.g., short options and single stock futures) are not assets but rather contingent liabilities and long options, while an asset, are short-term in nature, considered a wasting asset and therefore generally have no loan value. The margin requirement on short options, therefore, is not based upon a percentage of the option premium value, but rather determined on the underlying stock as if the option were assigned (under Reg. T) or by estimating the cost to repurchase the option given adverse market changes (under Portfolio Margining).

Determining Tick Value

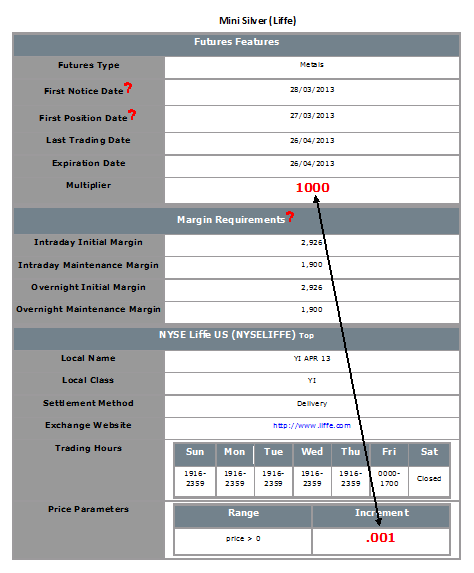

Financial instruments are subject to minimum price changes or increments which are commonly referred to as ticks. Tick values vary by instrument and are determined by the listing exchange. IB provides this information directly from the Contract Search tool on the website or via the Trader Workstation (TWS). To access from TWS, enter a symbol on the quote line, right click and from the drop-down window select the Contract Info and then Details menu options. The contract specifications window for the instrument will then be displayed (Exhibit 1).

To determine the notional value of a tick, multiple the tick increment by the contract trade unit or multiplier. As illustrated in the example below, the LIFFE Mini Silver futures contact has a tick value or minimum increment of .001 which, when multiplied by the contract multiplier of 1,000 ounces, results in a minimum tick value of $1.00 per contract. Accordingly, every tick change up or down results in a profit or loss of $1.00 per LIFFE Mini Silver futures contract.

Exhibit 1

SPY - Dividend Recognition

Unlike the case of a stock, in which a dividend is taxable in the year in which it is paid, the SPDR S&P 500 ETF Trust (Symbol: SPY) represents itself as a Regulated Investment Company and its dividend is deemed taxable in the year in which the record date is determined. As such, SPY dividends declared in either October, November or December and payable to shareholders of record on a specified date in one of those months will be considered taxable income income in that year despite the fact that such dividend will generally be paid in January of the following year.

Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

Margin Treatment for Foreign Stocks Carried by a U.S. Broker

As a U.S. broker-dealer registered with the Securities & Exchange Commission (SEC) for the purpose of facilitating customer securities transactions, IB LLC is subject to various regulations relating to the extension of credit and margining of those transactions. In the case of foreign equity securities (i.e., non-U.S. issuer), Reg T. allows a U.S. broker to extend margin credit to those which either appear on the Federal Reserve Board's periodically published List of Foreign Margin Stocks, or are deemed to have a have a "ready market" under SEC Rule 15c3-1 or SEC no-action letter.

Prior to November 2012, "ready market" was deemed to include equity securities of a foreign issuer that are listed on what is now known as the FTSE World Index. This definition was based upon a 1993 SEC no-action letter and was premised upon the fact that, while there may not have been a ready market for such securities within the U.S., the securities could be readily resold in the applicable foreign market. In November of 2012, the SEC issued a follow-up no-action letter (www.sec.gov/divisions/marketreg/mr-noaction/2012/finra-112812.pdf) which expanded the population of foreign equity securities deemed to have a ready market to also include those not listed on the FTSE World Index provided that the following four conditions are met:

1. The security is listed on a foreign exchange located within a FTSE World Index recognized country, where the security has been trading on the exchange for at least 90 days;

2. Daily bid, ask and last quotations for the security as provided by the foreign listing exchange are made continuously available to the U.S. broker through an electronic quote system;

3. The median daily trading volume calculated over the preceding 20 business day period of the security on its listing exchange is either at least 100,000 shares or $500,000 (excluding shares purchased by the computing broker);

4. The aggregate unrestricted market capitalization in shares of the security exceed $500 million over each of the preceding 10 business days.

Note: if a security previously meeting the above conditions no longer does so, the broker is provided with a 5 business day window after which time the security will no longer be deemed readily marketable and must be treated as non-marginable.

Foreign equity securities which do not meet the above conditions, will be treated as non-marginable and will therefore have no loan value. Note that for purposes of this no-action letter foreign equity securities do not include options.

Excess Margin Securities

The term "excess margin securities" refers to margin securities carried for the account of a customer having a market value in excess of 140 percent of the total debit balance in the customer's account. These securities are in excess of the securities held in a customer's margin account that are pledged by the customer as collateral for the margin loan and can be used to support the purchase of additional securities on margin

Example:

A customer whose account equity consists solely of a cash balance of USD 10,000 on Day 1 purchases 400 shares of stock ABC at USD 50 per share on Day 2.

| Account Balance | Day 1 | Day 2 |

| Cash | $10,000 | ($10,000) |

| Stock | $0 | $20,000 |

| Total | $10,000 | $10,000 |

On Day 2, the customer's excess margin securities total USD 6,000. This is calculated by subtracting 140% of the margin debit or loan balance from the market value of the stock position ($6,000 = $20,000 - {1.4 * $10,000}).

The term is relevant from a regulatory perspective as the SEC requires that U.S. broker dealers segregate and maintain in a good control location (e.g., DTC or bank) all customer securities which are deemed excess margin securities. Such securities cannot be pledged or loaned to finance the activities of the firm or other customers without specific written permission from the customer. The portion of the securities classified as margin securities ($20,000 - $6,000 or $14,000 in this example) are subject to a lien and may be pledged or loaned by the broker to others to assist in financing the loan made to the customer.

Note that securities which were excess margin at the date of acquisition may later be reclassified as margin securities based upon the customer's subsequent trade and/or margin borrowing activity. For example, if the loan value of excess margin securities is subsequently used to acquire additional securities on margin, a portion of securities will then be reclassified as margin securities and subject to a lien. If the customer subsequently deposits cash or sells securities to reduce or eliminate the margin loan, the securities will be reclassified as excess margin or fully paid and are required to be segregated.

See also "fully paid securities".

Fully Paid Securities

The term "fully paid securities" refers to securities held in a customer's margin or cash account that have been completely paid for and are not being pledged as collateral to support the purchase of other securities on margin. The term is relevant from a regulatory perspective as the SEC requires that U.S. broker dealers segregate and maintain in a good control location (e.g., DTC or bank) all customer securities which are fully paid. Such securities cannot be pledged or loaned to finance the activities of the firm or other customers.

Note that securities which were fully paid at the date of acquisition may later be reclassified as margin or excess margin securities based upon the customer's subsequent trade and/or borrowing activity. For example, if the loan value of fully paid securities is subsequently used to acquire additional securities on credit, a portion of securities will then be classified as margin securities and subject to a lien and potential pledge or hypothecation by the broker.

See also "excess margin securities".