FAQS: IBIE Account Transfer

This is an important document regarding the proposed transfer of your account from IBUK and IBLLC to IBIE that requires your attention. Please read the entirety of this document ahead of taking any action referred to in the Covering Letter sent to you via email.

Please take time to read these FAQs, which summarise some of the key changes to the regulatory framework which will be brought about by the Proposed Transfer (as described below) and provide answers to some of the more general questions that you may have. The FAQs should be read in conjunction with the Covering Letter. If you require any further information, please get in touch with us using the contact details provided in the Covering Letter.

Discussion:

The FAQs are split into three parts.

- Part A sets out key information in relation to the Proposed Transfer (as described below).

- Part B covers key legal and regulatory topics that arise as a result of the Proposed Transfer (as described below).

- Part C aims to answer any other questions that you may have and provides some further and more practical information in relation to what will and will not be changing following the Proposed Transfer (as described below).

PART A – THE PROPOSED TRANSFER

1. What is the situation currently?

As you will be aware, at present, your relationship with Interactive Brokers is led by our entity based in the United Kingdom, specifically Interactive Brokers (U.K.) Limited (“IBUK”) and the services provided to you are provided by IBUK and, depending on the products you do business in, our US affiliate Interactive Brokers LLC (“IBLLC”).

2. What is Interactive Brokers requesting?

We are inviting all clients domiciled in the European Economic Area (“EEA”) to transfer their accounts to one of our brokers based in Europe.

We propose to transfer the relationship that you currently have with IBUK and IBLLC to Interactive Brokers Ireland Limited (“IBIE”), an Interactive Brokers investment firm located in Ireland. It is our intention that all of your accounts, investments and services currently provided to you by IBUK and IBLLC will instead be singularly provided by IBIE (for convenience we will refer to this as the “Proposed Transfer”).

3. Who is IBIE? What sort of a firm is it?

IBIE is an investment firm regulated by the Central Bank of Ireland and authorised pursuant to the second Markets in Financial Instruments Directive (Directive 2014/65/EU). IBIE is an affiliate of IBUK and IBLLC.

4. What are IBIE’s legal details?

Interactive Brokers Ireland Limited is registered as a private company limited by shares (registration number 657406) and is listed in the Register of Companies maintained by the Irish Companies Registration Office. Its registered address is 10 Earlsfort Terrace, Dublin 2, D02 T380, Ireland. IBIE can be contracted by telephone at 00800-42-276537 or electronically through the IBIE website at www.interactivebrokers.ie.

5. Who regulates IBIE and what are their contact details?

As set out above the Central Bank of Ireland is the competent regulator for IBIE (in the same way that the Financial Conduct Authority is the competent regulator for IBUK). IBIE is included in the Central Bank of Ireland’s register of authorised firms under number 423427. The Central Bank of Ireland’s contact details are set out below:

Location

The Central Bank of Ireland

New Wapping Street

North Wall Quay

Dublin 1

D01 F7X3

Contact Numbers

Phone: +353 (0)1 224 6000

Fax: +353 (0)1 224 5550

Postal Address

Central Bank of Ireland

P.O. Box 559

Dublin 1

Public Helpline

E-mail: enquiries@centralbank.ie

Lo-Call: 1890 777 777

Phone: +353 (0)1 224 5800

6. Where does IBIE fit with respect to the broader Interactive Brokers group?

IBIE is a wholly-owned subsidiary that sits within the broader Interactive Brokers Group.

7. What does the Proposed Transfer mean for me? Will there be any material impacts?

We do not anticipate any material impacts for you as a result of the Proposed Transfer. Nonetheless, it is very important that you read these FAQs carefully and in full and make sure that you understand what the changes are for you.

8. What do I have to do if I want to continue doing business with Interactive Brokers?

If you would like to continue to do business with Interactive Brokers, we require your cooperation and action.

Specifically, we need you to consent and agree to the Customer Agreement and other Documents available under the Important Information section of the Proposed Transfer process and to the regulatory matters outlined in the Covering Letter, the Important Information and Consent sections of the Proposed Transfer process. You can do this by following the instructions in the Covering Letter.

To be clear, you do not have to consent to the Proposed Transfer if you feel that you may be adversely affected by it. You have the option of transferring your positions to another broker or closing your positions and transferring any cash balance to another account.

If you do not take action by December 7, 2022, your account will be restricted from opening new transactions or transferring in new assets. You always have the ability to transfer your account to another broker. If you wish to decline, please follow the instructions in the Covering Letter.

In either case, we ask that you read the entirety of this FAQs and the Covering Letter before deciding to consent to or decline the Proposed Transfer.

9. What happens next?

If you consent to the transfer, please complete all actions detailed in the Covering Letter and we will prepare your account to be transferred to IBIE. Once your account is transferred, IBIE will write to you with further information about your new relationship with them.

PART B – LEGAL AND REGULATORY CHANGES THAT YOU SHOULD BE AWARE OF

1. What terms and conditions will govern my relationship with IBIE following the Proposed Transfer? Are these different to the ones that currently apply?

Trades that you conduct after the Proposed Transfer will be governed by the new Customer Agreement between you and IBIE. A copy of the IBIE Customer Agreement is available in the Important Information section of the Proposed Transfer process.

2. What conduct of business rules (including best execution) will apply to my relationship with IBIE? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK?

There are some changes to be aware of, which we explain below.

If you do business with IBUK on a “carried” basis (in other words, you trade index options, futures and futures options and IBUK carries your account and custodies your assets) then the Financial Conduct Authority’s conduct of business rules currently apply to you. These rules are based heavily on the recast Markets in Financial Instruments Directive, the Markets in Financial Regulation and various delegated directives and regulations (collectively, “MiFID”). In relation to best execution, where it applies, IBUK must take all sufficient steps to achieve the best possible result for you when we execute your order.

If you currently do business with IBUK on an “introduced” basis (in other words, you trade products outside of those mentioned in the previous paragraph and you have a relationship with both IBUK and its US affiliate, IBLLC) a mix of conduct of business rules will currently apply to you. For instance, with respect to the introduction of your business to IBLLC, the Financial Conduct Authority’s conduct of business rules will apply (see above in relation to these). Once introduced to IBLLC, the relevant U.S. Securities and Exchange Commission and U.S. Commodity Futures Trading Commission rules and regulations (among others) will apply to IBLLC’s role (including its obligations in relation to best execution and custody).

Please note that it is of course possible that your business is split across these two scenarios (in other words some of your business is conducted on a “carried” basis while some of it is conducted on an “introduced” basis).

Going forward, the distinction between “carried” and “introduced” business will no longer apply and in each case set out above, Irish conduct of business rules will exclusively apply to your relationship with IBIE. Similar to the UK Financial Conduct Authority’s rules, the Irish conduct of business rules are based on MiFID and IBIE’s obligations in relation to best execution will largely mirror those that currently apply to IBUK.

In our view, while the rules that apply to our relationship will change, we do not consider such changes to be material or to result in a lesser degree of protection being afforded to you.

3. How will my investments that I custody with IBIE be held from a legal/regulatory perspective? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK?

The rules that currently apply depends on the sort of business that you presently have with IBUK (please see the response to Question B2 above). Where you conduct “carried” business with IBUK, the Financial Conduct Authority’s client asset (or “CASS”) rules will apply. These rules are based heavily on MiFID. Where you conduct “introduced” business with IBUK and IBLLC, the US custody rules will apply to your custody assets.

Going forward, as set out above, the distinction between “carried” and “introduced” business will no longer apply and in each case set out above, Irish custody rules will exclusively apply to your relationship with IBIE. Like the UK Financial Conduct Authority’s rules, the Irish conduct of business rules are based on MiFID. Please consult the Client Assets Key Information Document provided in the Important Information section in relation to the Irish custody regime.

4. How am I protected against loss? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK?

Currently, your eligible assets are protected from loss either under the US Securities Investor Protection Corporation at an amount of up to USD 500,000 (subject to a cash sublimit of USD 250,000) or the UK Financial Services Compensation Scheme at an amount up to GBP 50,000 (which regime applies depends on the relevant segment of your IBUK account, as explained in the response to Question B2 above). After the Proposed Transfer, the Irish Investor Compensation Scheme, which is administered by The Investor Compensation Company DAC, may protect your assets from loss should IBIE default and be unable to meet its obligations to you.

Ireland’s compensation scheme is similar to the compensation scheme you have access to in the UK, albeit with a lower limit. The purpose of the Irish Investor Compensation Scheme is to pay compensation to you (subject to certain limits) if you have invested money or investment instruments in either of the following cases:

- A firm goes out of business and cannot return your investments or money; and

- A Central Bank of Ireland determination or a court ruling has been made under the Investor Compensation Act 1998.

The Investor Compensation Company DAC (ICCL) administers the scheme. IBIE will be a member of the scheme.

The scheme covers investment products including:

- Public and private company shares

- Units in collective investment schemes

- Life insurance policies (including unit-linked funds)

- Non-life insurance policies

- Tracker bonds

- Futures and options

Usually, you can only make a claim after a firm goes out of business and its assets have been liquidated and distributed to those who are owed money. Please check the details of the schemes for any limits that apply – not all losses will be covered as there are maximum levels of compensation. The ICCL will pay you compensation for 90% of the amount you have lost, up to a maximum of €20,000.

5. How do I make a complaint to IBIE? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK? What if my complaint relates to something that happened while I was a customer of IBUK?

The new Customer Agreement sets out how to lodge a complaint with IBIE. The complaints handling procedures are materially similar to those that apply to your existing relationship with IBUK. If the substance of your complaint relates to something that happened prior to the Proposed Transfer, then you should address your complaint to IBUK. Its current contact information will stay the same and can be found at interactivebrokers.co.uk should you need to contact IBUK.

6. After the Proposed Transfer, will I still have access to the Financial Ombudsman Service?

In case of complaint, investors should follow the complaints procedure as referred to in the Customer Agreement. Once your account is transferred to IBIE, the UK Financial Ombudsman Service will cease to have jurisdiction over any complaints that you may have in respect of IBUK. However, please be aware that Ireland has a dispute resolution scheme in the form of the Financial Services and Pensions Ombudsman (“FSPO”). The FSPO is a free and independent statutory dispute resolution scheme for financial services. You may be eligible to make a complaint to the FSPO if you are an “eligible complainant”. Details of who are “eligible complainants” can be found on www.fspo.ie. The FSPO can be contacted at:

Postal Address

Financial Services and Pensions Ombudsman

Lincoln House,

Lincoln Place

Dublin 2

D02 VH29

Telephone

+353 (0)1 567 7000

Email

Info@fspo.ie

7. How will my personal data be processed and protected? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK in this context?

Your data will be processed and protected in accordance with the Interactive Brokers Group Privacy Policy which can be found at: https://www.interactivebrokers.com/en/index.php?f=305. There will be no material change.

PART C – OTHER PRACTICAL QUESTIONS AND NEXT STEPS

1. Who should I contact before the Proposed Transfer takes place and after the Proposed Transfer if I have any questions in the ordinary course?

Generally speaking, you should contact IBUK with any questions that you may have prior to the Proposed Transfer, and you should contact IBIE with any questions that you may have following the Proposed Transfer taking place. Regardless of who you contact at Interactive Brokers, we will ensure your query is promptly dealt with and we will help you to connect with the right person or department.

2. Will the range of products offered be the same?

Our current expectation is that the same range of products will be offered by IBIE as are offered by IBUK.

There might be a restriction on Foreign Exchange transactions that would create a negative balance or would increase a preexisting negative balance in either component currency. However, the same currency pairs can be traded as Forex CFD. Contracts For Difference are complex instruments, and we invite you to carefully review the CFD risk warnings before trading these instruments following the transfer of your account.

Please note that IBIE offers financing for securities and commodities trades but cannot support withdrawals of borrowed funds. You will be free to withdraw any free cash not needed to support your open positions. If you would like to withdraw additional funds, you can sell positions and withdraw the proceeds.

In limited instances where clients hold restricted products, clients may transfer and maintain or close such positions but won’t be allowed to increase the position.

3. I currently trade OTC derivatives with IBUK – what will happen to my open positions?

Your open positions will be transferred to IBIE and you will face IBIE rather than IBUK. You will no longer have any legal relationship with IBUK in relation to those positions. We will separately provide you with an updated Key Investor Information Document (please follow the link to the PRIIPs KID landing page in the Covering Letter).

4. What happens to any security I have granted to IBUK/IBLLC as part of a margin loan?

If you have granted security or collateral to IBUK/IBLLC this will transfer to IBIE upon the Proposed Transfer taking place.

We do not anticipate you needing to take any steps to reflect the change in beneficiary, although we may need to take some administrative steps of our own to update security registers with the change in details. This should, however, not affect our priority or otherwise affect the date from which the security is valid.

5. Will I have access to the same trading platform or be subject to any software changes following the transfer of my account?

The transfer of your account will have no impact upon the software you use to trade or administer your account. The technology will remain the same as it is today.

6. Will all account balances be transferred at the same time?

All balances, with the exception of accruals (e.g., interest, dividends) will be transferred at the same time. Once accruals have been posted to cash, they will automatically be swept to the transferred account.

7. What will happen to my current account following the transfer of my account?

Once all accruals have been swept, your current account will be closed and inaccessible for trading purposes. You will still be able to access this closed account via the Client Portal for purposes of viewing and printing archived activity and tax statements.

8. Will IBKR’s commissions and fees change when my account is transferred?

No. IBKR commissions and fees do not vary by the broker your account is maintained with.

9. Will my trading permissions change when my account is transferred?

No. Your trading permissions will not change when your account is transferred.

10. Will open orders (e.g., Good-til-Canceled) be carried over when my account is transferred?

Open orders will not be carried over to the new account, and we recommend that clients review their orders immediately following the transfer of their account to ensure that the open orders are consistent with their trading intentions.

11. Will I be subject to the U.S. Pattern Day Trading Rule if my account is transferred?

Accounts maintained with IBUK are subject to the U.S. Pattern Day Trading (PDT) rule as the accounts are introduced to and carried by IBLLC, a U.S. broker. The PDT rules restricts accounts with equity below USD 25,000 to no more than 3 Day Trades within any 5-business day period.

As accounts transferred to IBIE will not be introduced to IBLLC, they will not be subject to the PDT rule.

12. Will I receive a single, combined annual activity statement at year end?

No. You will receive an annual statement of your existing account which will cover the period starting 1 January 2022 through the date your account was transferred and a second annual statement for your new account which will cover the period starting from the transfer date through the end of the year.

13. Will the current cost basis of positions be carried over when my account is transferred?

Yes, the transfer of your account will have no impact upon the cost basis of your positions.

14. Will the transferred account retain the same configuration as the current account?

The configuration of the account following transfer will match that of the current account to the extent permissible by regulation. This includes attributes such as margin capability, market data, additional users, and alerts.

15. Will my login credentials change?

No. Your username, password, and any 2-factor authentication process in place for your existing account will remain active following transfer. You will, however, be assigned a new account ID for your transferred account.

EDD Requests for Information (RFI)

These FAQs are meant to serve as guidelines for answering customer questions with regard to recent communications that have been sent to a large number of IBKR account holders, requesting specific information. If there are further questions not addressed in this guide, please contact the EDD department.

Shareholders Rights Directive II

On 3 September 2020, a new European Directive, the Shareholders Rights Directive II ("SRD II"), will enter into force introducing important regulatory changes for intermediaries. SRD II aims to encourage long-term shareholder engagement in European shares by introducing new requirements, including:

- Obligations for all intermediaries in the chain of custody to provide shareholders information to issuers on demand and no later than the business day immediately following the date of receipt of the request;

- Requirements for intermediaries to make available meeting announcements or any other information which an issuer is required to provide to shareholders to enable a shareholder to exercise its rights

- Requirements for intermediaries to facilitate the ability of shareholders to participate in meetings by passing on a shareholder's participation instructions (for example a vote or request to attend the meeting), without delay.

Note that the Directive applies to any intermediary, whether based in the EEA or not. Accordingly, IBKR may in the future forward any request to provide shareholders information that IBKR may receive from issuers (or other appointed entities) whose share is owned through the IBKR accounts of an intermediary or their clients.

Upon receipt of these requests, intermediaries will be required to provide shareholders information directly to the issuers no later than the business day immediately following the date of receipt of the request.

Information to Disclose

- Full name;

- Contact details (address, email address);

- Unique identifiers;

- Number of shares held;

- Category/classes of shares held (Only if explicitly requested);

- Dates from which the shares are held (Only if explicitly requested);

- Depository location;

- Vote-eligible shares.

Requests Thresholds

Member states can establish that the right of the issuer to obtain the shareholders information is only effective with regard to holding of a minimum percentage of voting rights, which where set cannot exceed 0.5%.

Requests Handling

IBKR will send these requests in a standardised electronic format. Shareholders information shall be provided directly to the issuer (or other third party entity appointed) in the format prescribed by SRD II. We recommend that intermediaries review the Commission Implementing Regulation (EU) 2018 1212, which details the regulatory formats.

IBKR has appointed a third party provider, Mediant, to facilitate the requests handling. To use their services, they can be contacted directly at SRDTabulations@mediantonline.com.

Alternatively, intermediaries should ensure that they have alternative ways to reply to these requests for information after 3 September 2020.

SFTR: Reporting to Trade Repository Obligations and Interactive Brokers Delegated Service to help meet your obligations

Background: Securities Financing Transactions Regulation (“SFTR”) is a European regulation aimed at mitigating the risk of shadow banking. SFT's have been identified as being one of the central causes of the financial crisis and during and post crisis, regulators have struggled with anticipating the risks associated with securities financing. This led to the introduction of a reporting requirement for these SFTs.

Transactions that are reportable under SFTR: Repurchase agreements (repos), stock loans, margin loans, sell/buy-back transactions and collateral management transactions.

Whom do SFTR reporting obligations apply to: Reporting obligations normally apply to all clients established in the EU with the exception of natural persons. They apply to:

- Financial counterparties ("FC"): include investment firms, credit institutions, insurance and reinsurance undertakings, UCITS and UCITS management companies, Alternative Investment Fund managed by an AIFM authorised under the Alternative Investment Fund Managers Directive ("AIFMD"), institutions for occupational retirement provision, central counterparties and central securities depositories.

- Non-Financial Counterparty ("NFC"): Undertakings established in the Union or in a third country that do not fall under the definition of financial counterparty.

- Small Non- Financial Counterparty ("NFC-"): A small non-financial counterparty is one which does not exceed the limits of at least two of three criteria: a balance sheet total of EUR 20m, net turnover of EUR 40m, and average number of 250 employees during the financial year. Under SFTR, small NFC's reporting obligations are automatically delegated to the financial counterparty with which they execute an SFT.

What must be reported?

The types of SFTs in scope of the requirements include:

Transaction level reporting:

- Securities and commodities lending / borrowing transactions

- Buy-sell backs / sell-buy backs

- Repo transactions

Position Level reporting:

- Margin lending

In-scope entities will be required to report details of an SFT which is in scope if that SFT:

- is concluded after the date on which the Regulatory Technical Standards apply to the entity

- has a remaining maturity of over 180 days on the date on which the RTS apply to the entity

- is an open / rolling transaction that has been outstanding for more than 180 days on the date on which the RTS apply to the entity

When must it be reported?

SFTR is a two-sided reporting requirement, with both collateral provider (borrower) and collateral receiver (lender) required to report their side of the SFT to an approved Trade Repository on trade date +1 (T+1).

All new SFTs, modifications of open SFT’s and terminations of existing SFTs must be reported daily. Collateral is reported on T+1 or value date +1 (S+1) dependent on the method of collateralisation used.

What do reports include?

Reporting will be done using a combination of 153 fields, depending on product and report type.

- 18 counterparty data fields - which includes information about the counterparty such as LEI and country of legal residence.

- 99 Transaction fields – which includes the loan and collateral data information on the type of SFT which has been involved in the transaction

- 20 Margin fields – which includes information on margin such as the portfolio code and currency.

- 18 Reuse fields – which includes cash reinvestment and funding source data

What must match between reports?

The SFTR reporting format includes 153 reportable fields, some of which must match between reports of the two counterparties. There will be two phases of the trade repositories’ reconciliation process, with the first phase consisting of 62 matching fields which are required for the initial SFTR implementation. A second phase, starting 2 years after the start of the reporting obligation, will contain another 34 fields which are required to match, bringing the total number of matching fields to 96.

In this context, it is particularly important that the globally unique transaction identifier - a UTI, be used and shared between the parties to the trade. The parties should agree who is to generate the UTI. If no such agreement is in place, the regulation describes a waterfall model for who would be the generating party. The generating party is obligated to share the UTI with the counterpart in an electronic format in a timely manner for both parties to be able to fulfil their T+1 reporting obligation.

INTERACTIVE BROKERS DELEGATED REPORTING SERVICE TO HELP MEET YOUR REPORTING OBLIGATIONS

FCs, NFCs and NFC-s must report details of their transactions to authorised Trade Repositories. This obligation can be discharged directly through a Trade Repository, or by delegating the operational aspects of reporting to the counterparty or a third party (who submits reports on their behalf).

As mentioned above, when executing an SFT with an FC, an NFC- does not have to submit relevant reports, as these are submitted by the FC on the NFC-‘s behalf.

However, NFC-s who do not execute SFTs with an FC are required to submit reports.

Depending on the different setups available, Interactive Brokers clients’ may not be executing an SFT with an FC, and therefore Interactive Brokers offers a delegated reporting service, to ensure its clients can report all SFTs they execute.

As mentioned above, SFTR reports submitted by the two counterparties of an SFT must contain the same UTI. To ensure this requirement is satisfied, Interactive Brokers suggests that all of its clients in scope delegate reporting to Interactive Brokers.

Interactive Brokers will take care of generating matching UTIs when submitting its own reports and those of its clients on whose behalf it submits reports.

Validating Explicit Permissions - The European Securities and Markets Authority (ESMA) have introduced a mandate whereby trade repositories need to confirm a delegated reporting agreement is in place between the two parties before accepting and sending on any reports to the regulator. Due to this, the Trade Repository that Interactive Brokers works with - Depository Trust and Clearing Corporation ("DTCC"), has introduced a process to collect this information. As a client of Interactive Brokers, if you opt for delegated reporting, this mandate will apply.

DTCC will collect this information by sending clients an email asking for confirmation from the client that they have delegated their SFTR reporting to Interactive Brokers. – This will be a one-time process for each client. Once confirmed, DTCC will accept the reports and send them onto the regulator.

Securities Financing Transactions: Currently, Interactive Brokers clients can execute two types of SFTs: margin lending and stock loans. SFTR also requires reporting information on funding sources and collateral reuse.

Trade repository Interactive Brokers use: Interactive Brokers (U.K.) Limited will use the services of Depository Trust and Clearing Corporation ("DTCC") Trade Repository.

Timetable to report to Trade repositories: The reporting start date is 13 July 2020:

July 2020: Report Phase 1 – July 13 2020 reporting go-live for banks, investment firms & Credit Institutions and CCPs & CSDs

Oct 2020: Report Phase 2 - Insurance, UCITS, AIF & Pensions

Jan 2021: Report phase 3 - Reporting go-live for Non-Financial Companies

THIS INFORMATION IS GUIDANCE FOR INTERACTIVE BROKERS CLEARED CUSTOMERS ONLY.

NOTE: THE INFORMATION ABOVE IS NOT INTENDED TO BE A COMPREHENSIVE OR EXHAUSTIVE NOR A DEFINITIVE INTERPRETATION OF THE REGULATION, BUT A SUMMARY OF ESMA'S SFTR REGULATION AND RESULTING TRADE REPOSITORY REPORTING OBLIGATIONS

Interactive Brokers (U.K.) Limited – Classificazione dei clienti ai sensi del MiFID

Introduzione

Ai sensi dell'atto legislativo dell'Unione Europea noto come MiFID ("Markets in Financial Instruments Directive"), così come modificato dalla direttiva MiFID II, Interactive Brokers (U.K.) Limited (IBUK) è tenuta a classificare i propri clienti in base al loro grado di conoscenza, esperienza e competenza, assegnando a ciascuno di essi una delle seguenti categorie: "al dettaglio" (retail), "professionale" (professional) e "controparte qualificata" (eligible counterparty).

Sotto il profilo dei diversi gradi di tutela legale di cui godono, le differenze tra clienti professionali e al dettaglio sono le seguenti:

1. Descrizione dei prodotti preassemblati e dei rischi a essi connessi: quando un’impresa offre un servizio di investimento insieme a un altro servizio o prodotto come parte di un pacchetto o come condizione per l’ottenimento dello stesso accordo o pacchetto, essa è tenuta (i) a comunicare ai clienti al dettaglio se i rischi derivanti da tale accordo o pacchetto sono verosimilmente diversi dai rischi associati ai componenti dell’accordo o pacchetto presi separatamente, e (ii) a fornire loro una descrizione adeguata dei diversi elementi dell'accordo o pacchetto e del modo in cui la composizione di quest’ultimo modifica i rischi. Questo requisito non riguarda in alcun modo i clienti professionali. Ciononostante, questi ultimi ricevono da IBUK la stessa tutela prevista per i clienti al dettaglio, salvo nel caso illustrato al punto 3.

2. Tutela degli investitori in relazione alla fornitura di "contratti per differenza" (contracts for difference, "CFD"): l'ESMA (European Securities and Markets Authority) ha adottato una serie di misure relative alla fornitura di CFD agli investitori al dettaglio, tra cui: (i) nuovi limiti all'entità della leva finanziaria utilizzabile per aprire una nuova posizione, che variano in base alla volatilità del sottostante; (ii) una regola che determina la chiusura automatica di posizioni in caso di mancato raggiungimento dei margini; tale regola riguarda il conto del cliente nel suo complesso ed è volta ad armonizzare la percentuale relativa ai margini al di sotto della quale gli operatori sono obbligati a chiudere una o più posizioni aperte in CFD; (iii) una regola che stabilisce una protezione rispetto all'eventualità di un saldo negativo nel conto del cliente;

(iv) Una limitazione degli incentivi offerti per negoziare CFD; e (v) un avviso sui rischi standardizzato, comprendente la percentuale dei conti in perdita tra quelli aperti da investitori al dettaglio presso il fornitore di CFD. Questo requisito non riguarda in alcun modo i clienti professionali.

3. Comunicazioni con i clienti: in generale le imprese devono assicurarsi che le comunicazioni rivolte ai propri clienti siano eque, chiare e non fuorvianti. Le modalità tramite le quali esse forniscono informazioni su sé stesse, sui propri servizi e prodotti e sui relativi costi possono tuttavia variare in base alla categoria di appartenenza del cliente (al dettaglio o professionale), con particolare riferimento alla precisione delle informazioni, ai mezzi di comunicazione impiegati e alle tempistiche in base alle quali queste vengono fornite. L'obbligo di trasmettere al cliente determinati documenti relativi ai diversi prodotti, come i Key Information Documents (KID) per i cosiddetti PRIIPs (Packaged Retail and Insurance-based Investment Products), non si applica infine ai clienti professionali.

4. Comunicazione dell'eventuale deprezzamento di determinati prodotti: qualora un cliente al dettaglio detenga posizioni in strumenti finanziari caratterizzati dall'effetto leva o in operazioni aventi ad oggetto passività potenziali, le imprese di investimento sono tenute comunicare al cliente gli eventuali deprezzamenti del 10% (e successivamente di multipli del 10%) subiti da tali prodotti. Questo requisito non riguarda in alcun modo i clienti professionali.

5. Adeguatezza: nell'ambito delle operazioni di valutazione dell'adeguatezza di prodotti o servizi forniti senza consulenza, talvolta le imprese sono tenute a verificare che il cliente possieda l'esperienza e la conoscenza necessarie a comprendere i rischi associati al prodotto o servizio offerto o richiesto. Laddove la valutazione dell'adeguatezza risulti obbligatoria, le imprese possono legittimamente presumere che i clienti professionali abbiano il livello di esperienza e conoscenza necessario per comprendere i rischi associati al servizio o all'operazione offerti o richiesti, o ai tipi di operazioni o prodotti in relazione ai quali il cliente è classificato come cliente professionale. Nel caso dei clienti al dettaglio il livello di esperienza e conoscenza non può essere presunto e dunque deve essere di volta in volta verificato.

IBUK fornisce servizi senza consulenza e nel valutare l’adeguatezza dei servizi o prodotti offerti o richiesti rispetto ai clienti professionali non è in alcun modo tenuta a seguire le procedure o richiedere le informazioni previste per i clienti al dettaglio; qualora non sia in grado di determinare l’adeguatezza di un certo prodotto o servizio rispetto a un cliente professionale, inoltre, IBUK non è in alcun modo tenuta ad informare tale cliente.

6. Esclusione della responsabilità: in base alle norme stabilite dalla FCA le imprese possono escludere o restringere l'entità dei propri obblighi e delle proprie responsabilità verso i clienti al dettaglio in misura minore rispetto a quelli professionali.

7. Possibilità di ricorrere al "Financial Ombudsman Service": per i clienti professionali (salvo eccezioni, come ad esempio consumatori, piccole imprese o persone fisiche che operino al di fuori della propria attività commerciale, industriale, artigianale o professionale) è in genere preclusa la possibilità di rivolgersi al Financial Ombudsman Service, un servizio di risoluzione delle controversie nel settore finanziario disponibile nel Regno Unito.

8. Sistemi di indennizzo: IBUK è membro del Financial Services Compensation Scheme (FSCS), un sistema di indennizzo vigente nel Regno Unito. In caso di mancato adempimento degli obblighi di IBUK nei confronti dei propri clienti, questi possono rivolgersi a FSCS per chiedere un indennizzo. L'erogazione dell'indennizzo dipende da una serie di fattori, quali la natura della controversia, l'idoneità del soggetto che lo richiede e il tipo di impresa nei confronti della quale viene sollevata la controversia. I criteri di idoneità per poter ottenere l'indennizzo previsto da FSC sono stabiliti da apposite norme.

Modificare la propria categoria da "al dettaglio" a "professionale"

I clienti al dettaglio di IBUK possono chiedere di essere riclassificati come "clienti professionali". È possibile verificare in qualsiasi momento la propria categoria di appartenenza e richiederne la modifica accedendo a Gestione conto e navigando fino a Impostazioni > Impostazioni conto > Categoria cliente ai sensi del MiFID.

Le richieste di modifica della propria categoria da "al dettaglio" a "professionale" saranno prese in considerazione solamente nei seguenti due casi:

(i) il cliente è autorizzato a operare nei mercati regolamentati o regolamentato a tale fine;

(ii) il cliente è un'impresa di grandi dimensioni che soddisfa, a livello di singola società, almeno uno dei seguenti criteri dimensionali:

(a) totale di bilancio pari ad almeno 20,000,000 EUR;

(b) fatturato netto pari ad almeno 40,000,000 EUR;

(c) fondi propri per almeno EUR 2,000,000;

(iii) il cliente è un investitore istituzionale la cui attività principale consiste nell'investire in strumenti finanziari; quest'ultima categoria comprende gli enti dediti alla cartolarizzazione di attivi o ad altre operazioni finanziarie.

2. Ciascun cliente di IBUK può chiedere di essere considerato "cliente professionale su richiesta" (elective professional client); IBUK soddisferà tale richiesta se, previa valutazione della sua competenza, esperienza e conoscenza, e tenendo conto della natura delle operazioni o dei servizi previsti, riterrà che il cliente è in grado di adottare decisioni di investimento in modo autonomo e comprendere i rischi associati a tali operazioni o servizi. I clienti che non possiedono i requisiti per essere considerati "clienti professionali di diritto" possono dunque chiedere di essere considerati "clienti professionali su richiesta".

Per potersi vedere soddisfatta una tale richiesta, il cliente dovrà dimostrare di soddisfare almeno due (2) dei seguenti criteri:

1. Nel corso dei quattro (4) tremestri precedenti, il cliente ha effettuato operazioni di dimensioni significative con una frequenza media di dieci (10) operazioni al trimestre.

Le operazioni dei clienti saranno considerate "di dimensioni significative" qualora rispettino tutte le seguenti condizioni:

a. Nel corso dei quattro (4) trimestri precedenti sono stati eseguiti almeno quaranta (40) ordini;

b. È stato eseguito almeno un (1) ordine nel corso di ciascuno dei quattro (4) trimestri precedenti;

c. Il valore nozionale complessivo associato ai primi quaranta (40) ordini per valore nozionale eseguiti negli ultimi quattro (4) trimestri è superiore a 200,000 EUR;

d. Il valore patrimoniale netto del conto è superiore a 50,000 EUR.

Ai fini di questi calcoli gli ordini eseguiti aventi ad oggetto valute a pronti e metalli OTC non allocati non saranno presi in considerazione.

2. Il cliente detiene un portafoglio di strumenti finanziari (inclusi i contanti) per un valore superiore ai 500,000 EUR (o importo equivalente in altra valuta);

3. Il cliente negozia tramite il proprio conto o tramite il conto di un'impresa e lavora o ha lavorato nel settore finanziario per almeno un anno ricoprendo una posizione professionale che presupponga la conoscenza dei prodotti negoziati.

Prima di trasmettere la propria richiesta di essere considerati clienti professionali, i clienti al dettaglio dovranno leggere e accettare le avvertenze fornite da IBUK.

Modificare la propria categoria da "professionale" a "al dettaglio" I clienti professionali possono chiedere a IBUK di essere considerati clienti al dettaglio accedendo a Gestione conto e seguendo lo stesso percorso descritto in alto (Impostazioni > Impostazioni conto > Categoria cliente ai sensi del MiFID).

Con l'unica eccezione dei "soggetti regolamentati" (regulated entities) e dei fondi gestiti da soggetti regolamentati, considerati "clienti professionali di diritto" (per se professional client), tali richieste saranno sempre soddisfatte.

LE INDICAZIONI QUI FORNITE SONO RIVOLTE ESCLUSIVAMENTE AI CLIENTI CHE SI AVVALGONO DEI SERVIZI DI COMPENSAZIONE DI INTERACTIVE BROKERS E CHE DETENGONO UN CONTO "FULLY DISCLOSED".

LE INFORMAZIONI COMUNICATE TRAMITE IL PRESENTE ARTICOLO NON SONO DA INTENDERSI IN ALCUN MODO COME UN'INTERPRETAZIONE DEFINITIVA, ESAUSTIVA O COMPLETA DELLE NORME VIGENTI, BENSÌ COME UNA SINTESI DELLE POLITICHE RELATIVE ALLA CATEGORIZZAZIONE DEI CLIENTI ADOTTATE DA IBUK.

IBKR Australia Short Position Reporting

Introduction

You can request IBKR Australia perform your Australian short position reporting obligations on your behalf.

What is a short position?

A short position arises where the quantity of an eligible product that you hold is less than the quantity of the eligible product that you have an obligation to deliver, such as when you engaged in short selling an ASX-listed security and borrowed securities from IBKR to cover your delivery obligation.

When do I have a reporting obligation?

Short sellers have an obligation to report certain short positions to the Australian Securities & Investments Commission (ASIC). Reporting on short positions that are below the thresholds set by ASIC is optional. A short position does not need to be reported to ASIC when:

- The value of the position is AUD 100,000 or less; and

- The position is 0.01% or less of the total quantity of securities or products on issue for that security or product.

Otherwise, the short position must be reported.

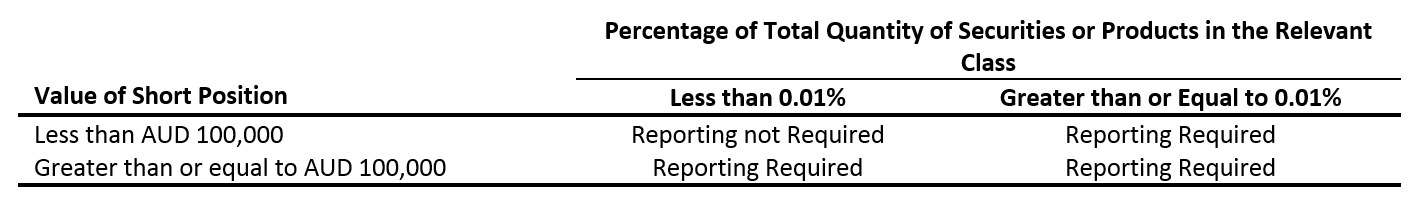

The following table provides a convenient summary of when a short position must be reported (“Reportable Short Position”):

What you need to know about short position reporting:

It is important that any clients trading or wishing to trade eligible products understand that they may have an obligation to report their Reportable Short Positions to ASIC daily.

This obligation applies to any short sellers with a Reportable Short Position under the rules whether inside or outside of Australia. By default, IBKR Australia does not report Reportable Short Positions on your behalf, so you must arrange for the reporting of your short positions (if required).

IBKR Australia, along with many third-party firms, can provide this service to you subject to applicable terms and conditions.

If you would like IBKR Australia to perform your short position reporting for eligible products held in your IBKR account, please enrol in the service via Client Portal. Currently, this service is offered at no additional cost to IBKR Australia clients.

Please note:

- If your account does not allow shorting of securities, there is no need to sign up for this service.

- IBKR Australia will only offer the option to report all short positions and not only your Reportable Short Positions.

If you enroll in the IBKR short position reporting service:

- You must not hold any other eligible products with any other bank, broker or custodian because our systems use the positions in your IBKR account to determine whether you have a reportable short position. We cannot accurately calculate your short position if you hold eligible positions elsewhere.

- You must ensure that the information you provide us is complete and accurate in all respects, as we are required to provide ASIC with certain personal information about you.

- The obligation to report your short positions is always yours and is not transferred to IBKR under any circumstance (i.e. IBKR does not become responsible for your short position reporting obligations);

- If, for any reason, we are unable to report your short positions to ASIC before the deadline or at all, we will endeavour to inform you as early as possible so that you can make alternative arrangements. However, we make no warranties that you will receive the notification prior to the reporting deadline.

How do I apply?

To apply, all you need to do is log in to your account via the Client Portal, navigate to the Settings > Account Settings menu, click on the “ASIC Short Position Reporting” icon and follow the prompts.

As part of this process, you will need a unique identifier. For Australian applicants, this can be your ACN or ARBN. For overseas clients this can be your SWIFT BIC. Alternatively, you may register with ASIC to obtain a unique identity code.

Upon electing IBKR Australia to perform this short position reporting obligation on your behalf, you must warrant that the reportable short positions held with IBKR Australia represent your entire portfolio in applicable Reportable Short Positions and acknowledge that IBKR Australia will rely on this representation and warranty in good faith on each occasion that it makes a short position report to ASIC on your behalf.

Where can I get more information?

Clients seeking more information on their short position reporting obligations should refer to the following resources:

- ASIC Regulatory Guide 196, which contains an overview of the applicable short selling rules and disclosure requirements.

- ASIC Info Sheet 98, which provides an overview of how to submit short position reports to ASIC via FIX and a list of vendors who may be able to assist you with your short position reporting obligations if you don’t elect to enrol in the IBKR short position reporting service.

PRIIPs Overview

BACKGROUND

In 2018, an EU regulation, intended to protect “Retail” clients by ensuring that they are provided with adequate disclosure when purchasing certain products took effect. This disclosure document is referred to as a Key Information Document, or KID, and it contains information such as product description, cost, risk-reward profile and possible performance scenarios.

This regulation is known as the Packaged Retail and Insurance-based Investment Product Regulation (MiFID II, Directive 2014/65/EU), or PRIIPs, and it covers any investment where the amount payable to the client fluctuates because of exposure to reference values or to the performance of one or more assets not directly purchased by such retail investor. Common examples of such products include options, futures, CFDs, ETFs, ETNs and other structured products.

The UK Financial Conduct Authority (FCA) has equivalent requirements for UK residents.

It’s important to note that a broker cannot allow a Retail client to purchase a product covered by PRIIPs unless the issuer of that product has prepared the required disclosure document for the broker to provide to the client. U.S. clients are not impacted by PRIIPs, so the issuers of U.S. listed ETFs do not as a rule create KIDs. This means that EEA and UK Retail clients may not purchase the product. Clients nevertheless have several options:

- Many US ETF issuers have equivalent ETFs issued by their European entities. European-issued ETFs have KIDs and are therefore freely tradable.

- Clients can trade most large US ETFs as CFDs. The CFDs are issued by IBKRs European entities and as such meet all KID requirements.

- Clients may be eligible for re-classification as a professional client, for whom KIDs are not required.

CLIENT CATEGORISATION

We categorize all individual clients as “Retail” by default as this affords clients the broadest level of protection afforded by MiFID. Client who are categorised as “Professional” do not receive the same level of protection as “Retail” but are not subject to the KIDs requirement. As defined under MiFID II rules, “Professional” clients include regulated entities, large clients and individuals who have asked to be re-categorised as “elective professional clients” and meet the MiFID II requirements based on their knowledge, experience and financial capability.

We provide an online step-by-step process that allows “Retail” to request that their categorisation be changed to “Professional". The qualifications for re-categorisation along with the steps for requesting that one’s categorisation be considered are outlined in KB3298 or, to directly apply for a change in categorisation, the questionnaire is available in the Client Portal/Account Management.

Interactive Brokers (U.K.) Limited – MiFID Categorisation

Introduction

The European Union legislative act known as the Markets in Financial Instruments Directive, or MiFID, as amended by MiFID II, requires Interactive Brokers (U.K.) Limited (IBUK) to classify each Client according to their knowledge, experience and expertise: "Retail", "Professional" or "Eligible Counterparty".

In accordance with the Financial Conduct Authority rules, IBUK categorises most clients as Retail clients, providing them with a higher degree of protection.

Only those clients that are either regulated entities or funds managed by regulated fund managers, are categorised as Per Se Professional Clients.

Professional Clients are entitled to a lower degree of protection under the UK regulatory regimes than Retail Clients. This notice contains, for information purposes only, a summary of the protections that a Retail Client might lose if they are to be treated as a Professional Client.

1. Description of the nature and risks of packaged investments: A firm that offers an investment service with another service or product or as a condition of the same agreement with a Retail Client must: (i) inform Retail Clients if the risks resulting from the agreement are likely to be different from the risks associated with the components when taken separately; and (ii) provide Retail Clients with an adequate description of the different components of the agreement and the way in which its interaction modifies the risks. The above requirements do not apply in respect of Professional Clients. However, IBUK will not make such differentiation apart from the case specified under point 3 below.

2. Retail investor protection measures on the provision of Contracts for Differences (“CFDs”): The regulatory measures include: (i) Leverage limits on the opening of a position, which vary according to the volatility of the underlying; (ii) A margin close out rule on a per account basis that standardises the percentage of margin (at 50%of the minimum required margin) at which providers are required to close out one or more open CFDs; (iii) Negative balance protection on a per account basis;(iv) A restriction on the incentives offered to trade CFDs; and (v) A standardised risk warning, including the percentage of losses on a CFD provider’s Retail investor accounts. These measures do not apply in respect of Professional Clients.

3. Communication with clients, including financial promotions: A firm must ensure that its communications with all clients are, and remain, fair, clear and not misleading. However, the simplicity and frequency in which a firm may communicate with Professional Clients (about itself, its services and products, and its remuneration) may be different to the way in which the firm communicates with Retail Clients. Regulations relating to restrictions on, and the required contents of, direct offer financial promotions do not apply to promotions to Professional Clients and such promotions need not contain sufficient information for Professional Clients to make an informed assessment of the investment to which they relate. A firm’s obligations in respect of the level of details, medium and timing of the provision of information are different depending on whether the client is a Retailor Professional Client. The requirements to deliver certain product-specific documents, such as Key Information Documents (“KIDs”) for Packaged Retail and Insurance-based Investment Products (“PRIIPs”), are not applied to Professional Clients.

4. Depreciation in value reporting to clients: A firm that holds a Retail Client account that includes positions in leveraged financial instruments or contingent liability transactions must inform the Retail Client, where the initial value of each instrument depreciates by 10 per cent and thereafter at multiples of 10 per cent. The above reporting requirements do not apply in respect of Professional Clients (i.e., these reports do not have to be produced for Professional Clients).

5. Appropriateness: For transactions where a firm does not provide the client with investment advice or discretionary management services (such as an execution-only trade), it may be required to assess whether the transaction is appropriate. When assessing appropriateness for non-advised services, a firm may be required to determine whether the client has the necessary experience and knowledge in order to understand the risks involved in relation to the product or service offered or demanded. Where such an appropriateness assessment requirement applies in respect of a Retail Client, there is a specified test for ascertaining whether the client has the requisite investment knowledge and experience to understand the risks associated with the relevant transaction. However, in respect of a Professional Client the firm is entitled to assume that a Professional Client has the necessary level of experience, knowledge and expertise in order to understand the risks involved in relation to those particular investment services or transactions, or types of transaction or product, for which the client is classified as a Professional Client. IBUK provides non-advised services and is not required to request information or adhere to the assessment procedures for a Professional Client when assessing the appropriateness of a given service or product as with a Retail Client, and IBUK may not be required to give warnings to the Professional Client if it cannot determine appropriateness with respect to a given service or product.

6. Information about costs and associated charges: A firm must provide clients with information on costs and associated charges for its services and/or products. The information provided may not be as comprehensive for Professional Clients as it must be for Retail Clients.

7. Dealing: When undertaking transactions for Retail Clients, the total consideration, representing the price of the financial instrument and the costs relating to execution, should be the overriding factor in any execution. For Professional Clients a range of factors may be considered in order to achieve best execution –price is an important factor, but the relative importance of other different factors, such as speed, costs and fees may vary. However, IBUK will not make such differentiation.

8. Difficulty in carrying out orders: In relation to order execution, firms must inform Retail Clients about any material difficulty relevant to the proper carrying out of orders promptly on becoming aware of the difficulty. This is not required in respect of Professional Clients. The timeframe for providing confirmation that an order has been carried out is more rigorous for Retail Clients’ orders than Professional Clients’ orders.

9. Share trading obligation: In respect of shares admitted to trading on a regulated market or traded on a trading venue, the firm may, in relation to the investments of Retail Clients, only arrange for such trades to be carried out on a regulated market, a multilateral trading facility, a systematic internaliser or a third-country trading venue. This is a restriction which may not apply in respect of trading carried out for Professional Clients (i.e., this restriction can be disapplied where trades in such shares are carried out for Professional Clients in certain circumstances).

10. Exclusion of liability: Firms’ ability to exclude or restrict any duty or liability owed to clients is narrower under the FCA rules in the case of Retail Clients than in respect of Professional Clients.

11. The Financial Services Ombudsman: The services of the Financial Ombudsman Service in the UK may not be avail-able to Professional Clients, unless they are, for example, consumers, small businesses or individuals acting outside of their trade, business, craft or profession.

12. Compensation: IBUK is a member of the UK Financial Services Compensation Scheme. You may be entitled to claim compensation from that scheme if IBUK cannot meet its obligations to you. This will depend on the type of business and the circumstances of the claim; compensation is only available for certain types of claimants and claims in respect of certain types of business. Eligibility for compensation from the Financial Services Compensation Scheme is not contingent on your categorisation but on how the firm is constituted. Eligibility for compensation from the scheme is determined under the rules applicable to the scheme (more information is available at https://www.fscs.org.uk/).

13. Transfer of financial collateral arrangements: As a Professional Client, the firm may conclude title transfer financial collateral arrangements with you for the purpose of securing or covering your present or future, actual or contingent or prospective obligations, which would not be possible for Retail Clients.

14. Client money: The requirements under the client money rules in the FCA Handbook (CASS) are more prescriptive and provide more protection in respect of Retail Clients than in respect of Professional Clients.

Re-categorisation as Professional Client

IBUK allows its Retail Clients to request to be re-categorised as Professional Clients. Clients are notified of their Client Category and can check it at any time from Account Management, under Settings> Account Settings> MiFID Client Category. From this same screen, Clients can also request to change their MiFID Category.

IBUK will consider re-categorising Retail Clients to Professional Clients in two instances:

1. Per Se Professional Clients can notify IBUK that they consider that they should have been categorised as Per Se Professionals under the FCA rules, because at least one of the following conditions applies:

(i) authorised or regulated to operate in the financial markets; or

(ii) a large undertaking meeting two of the following size requirements on a company basis:

(a) balance sheet total of EUR 20,000,000;

(b) net turnover of EUR 40,000,000;

(c) own funds of EUR 2,000,000;

(iii) an institutional investor whose main activity is to invest in financial instruments. This includes entities dedicated to the securitisation of assets or other financing transactions.

2. IBUK may treat Clients as Elective Professional Clients if, based on an assessment of the Client’s expertise, experience, and knowledge, IBUK is reasonably assured that, in light of the nature of the transactions or services envisaged, the Client is capable of making its own investment decisions and understand the risks involved. Clients who do not meet the requirements to be categorised as Per Se Professional Clients can still request to be categorised as Elective Professional Clients.

To obtain such re-categorisation, Retail Clients must provide evidence that they satisfy at least two (2) of the following criteria:

1. Over the last four (4) quarters, the Client conducted trades in financial instruments in significant size at an average frequency of ten (10) per quarter.

To determine the significant size IBUK considers the following:

a. During the last four quarters, there were at least forty (40) trades; and

b. During each of the last four (4) quarters, there was at least one (1) trade; and

c. The total notional value of the top forty (40) trades of the last four (4) quarters is greater than EUR 200,000; and

d. The account has a net asset value greater than EUR 50,000.

Trades in Spot FX and Unallocated OTC Metals are not considered for the purpose of this calculation.

2. The Client holds a portfolio of financial instruments (including cash) that exceeds EUR 500,000 (or equivalent);

3. The Client is an individual account holder or a trader of an organisation account who works or has worked in the financial sector for at least one year in a professional position which requires knowledge of products it trades in.

Upon review and verification of the information and supporting evidence provided, IBUK will re-categorise clients if all relevant conditions are met to satisfaction.

Retail Clients requesting to be re-categorised as Professional Accounts must read and understand the warning provided by IBUK before the relevant request is submitted.

Re-categorisation as Retail Client

Professional Clients can request IBUK to be re-categorised as Retail Clients, from the same Account Management page described above (under Settings> Account Settings> MiFID Client Category).

With the sole exception of regulated entities or funds managed by regulated fund managers, which are categorised as Per Se Professional Clients, IBUK accepts all such requests.

THIS INFORMATION IS GUIDANCE FOR INTERACTIVE BROKERS FULLY DISCLOSED CLEARED CUSTOMERS ONLY.

NOTE: THE INFORMATION ABOVE IS NOT INTENDED TO BE A COMPREHENSIVE, EXHAUSTIVE NOR A DEFINITIVE INTERPRETATION OF THE REGULATION, BUT A SUMMARY OF IBUK’S APPROACH TO CLIENT CATEGORISATION AND RE-CATEGORISATION POLICY.

Information Regarding Australian Regulatory Status Under IBKR Australia

Introduction

Australian resident customers maintaining an account with Interactive Brokers Australia Pty Ltd (IBKR

Australia), which holds an Australian Financial Services License, number 453554, are initially

classified as a retail investor, unless they satisfy one or more of the requirements to be classified as a

wholesale or professional investor according to the relevant provisions of the Corporations Act 2001.

This article outlines how this process is handled by IBKR Australia.

Australian Regulatory Status

All new customers of IBKR Australia default to being classified as a retail investor unless they produce to

IBKR Australia the required documentary evidence to allow IBKR Australia to treat them as a wholesale or

professional investor. Investors of IBKR Australia will only have their regulatory status change from

retail investor to either wholesale or professional investor subsequent to the required

documentation being received and approved by IBKR Australia.

What is a Wholesale Investor?

The most common way to be classified as a wholesale investor is to obtain a qualified accountant’s

certificate stating that you have net assets or net worth of at least $2.5 million AUD OR have a gross

annual income of at least $250,000 AUD in each of the last two financial years. The qualified

accountant’s certificate is only valid for two years before it needs to be renewed. We have prepared a

wholesale investor booklet, including a pro forma certificate for your accountant to complete, that

can be downloaded [here].

What is a Professional Investor?

In order to qualify as a professional investor, you must have an AFSL, be a body regulated by APRA, be a superannuation fund (but not a SMSF) and/or have net worth or liquid net worth of at least $10 million AUD. If you meet ONLY the financial criteria (i.e. net worth or liquid net worth of at least $10 million AUD), you will need to complete and submit to IBKR Australia the professional investor declaration contained within the professional investor booklet that we have prepared, which can be downloaded [here]. However, if you meet the criteria by virtue of having an AFSL, being a body regulated by APRA, or as a listed company (but not a SMSF), no booklet needs to be submitted.

What about Self-Managed Super Funds (SMSF’s)?

IBKR Australia have decided to treat all SMSF’s as retail investors, notwithstanding that they may meet the requirements to otherwise be classified as a wholesale or professional investor.

What about trusts?

For a trust to be considered as a wholesale investor, all trustees must be considered a wholesale

investor based on the tests described above.

Similarly, for a trust to be considered as a professional investor, all trustees must be considered a

professional investor based on the tests described above.

As a result, if at least one trustee is considered retail, the trust is considered a retail trust, regardless

of the status of any other trustees (if applicable).

Other

- For a full list of the disclosure documents and legal terms which govern the services IBKR Australia will make available please refer to the IBKR website.

- For further information on IBKR Australia, click on our Financial Services Guide.

- For more information or assistance, please contact IBKR Investor Services.

Restrizioni delle stanze di compensazione sui titoli legati alla cannabis

La Boerse Stuttgart e la Clearstream Banking hanno annunciato che non erogheranno più servizi per le emissioni la cui attività principale è legata direttamente o indirettamente alla cannabis e ad altri prodotti narcotici. Di conseguenza, tali titoli non saranno più negoziati sulle Borse di Stoccarda (SWB) e Francoforte (FWB). A partire dalla fine della giornata del 19 settembre 2018 IBKR adotterà i seguenti provvedimenti:

- Chiusura forzata di tutte le posizioni implicate i cui clienti non abbiano preso provvedimenti per la relativa chiusura e non idonee al trasferimento a quotazioni statunitensi; e

- Trasferimento forzato a quotazioni statunitensi delle eventuali posizioni implicate i cui clienti non abbiano preso provvedimenti per la relativa chiusura e idonee a tale trasferimento.

La tabella sottostante illustra le emissioni coinvolte così come annunciato dalla Boerse Stuttgart e dalla Clearstream Banking il 7 agosto 2018. La tabella comprende un'annotazione indicante se l'emissione coinvolta soddisfa i criteri per il trasferimento a quotazioni statunitensi. Si prega di notare che le stanze di compensazione hanno indicato che questo elenco potrebbe non essere completo, e i clienti sono esortati a verificare i rispettivi siti web per informazioni più aggiornate.

| ISIN | NOME | BORSA VALORI | IDONEA AL TRASFERIMENTO USA? | SIMBOLO USA |

| CA00258G1037 |

ABATTIS BIOCEUTICALS CORP |

FWB2 | SÌ |

ATTBF |

| CA05156X1087 |

AURORA CANNABIS INC |

FWB2, SWB2 | SÌ |

ACBFF |

| CA37956B1013 |

GLOBAL CANNABIS APPLICATIONS |

FWB2 | SÌ |

FUAPF |

| US3988451072 |

GROOVE BOTANICALS INC |

FWB | SÌ |

GRVE |

| US45408X3089 |

INDIA GLOBALIZATION CAPITAL |

FWB2, SWB2 | SÌ |

ICG |

| CA4576371062 |

INMED PHARMACEUTICALS INC |

FWB2 | SÌ |

IMLFF |

| CA53224Y1043 |

LIFESTYLE DELIVERY SYSTEMS I |

FWB2, SWB2 | SÌ |

LDSYF |

| CA56575M1086 |

MARAPHARM VENTURES INC |

FWB2, SWB2 | SÌ |

MRPHF |

| CA5768081096 |

MATICA ENTERPRISES INC |

FWB2, SWB2 | SÌ |

MQPXF |

| CA62987D1087 |

NAMASTE TECHNOLOGIES INC |

FWB2, SWB2 | SÌ |

NXTTF |

| CA63902L1004 |

NATURALLY SPLENDID ENT LTD |

FWB2, SWB2 | SÌ |

NSPDF |

| CA88166Y1007 |

TETRA BIO-PHARMA INC |

FWB2 | SÌ |

TBPMF |

| CA92347A1066 |

VERITAS PHARMA INC |

FWB2 | SÌ |

VRTHF |

| CA1377991023 |

CANNTAB THERAPEUTICS LTD |

FWB2 | NO | |

| CA74737N1042 |

QUADRON CANNATECH CORP |

FWB2 | NO | |

| CA84730M1023 |

SPEAKEASY CANNABIS CLUB LTD |

FWB2, SWB2 | NO | |

| CA86860J1066 |

SUPREME CANNABIS CO INC/THE |

FWB2 | NO | |

| CA92858L2021 |

VODIS PHARMACEUTICALS INC |

FWB2 | NO |

NOTE IMPORTANTI:

- Si prega di notare che le quotazioni statunitensi, in genere, sono negoziate over-the-counter (PINK) e denominate in USD, e non in EUR, implicando, quindi, un'esposizione al rischio di cambio oltre che al rischio di mercato.

- I titolari di conto che mantengano titoli PINK Sheet necessitano dei permessi di trading per gli Stati Uniti (Penny Stock) per poter immettere ordini di apertura.

- Tutti gli utenti di conti che mantengano permessi per il trading negli Stati Uniti (Penny Stock) sono tenuti all'uso del sistema di autenticazione a due livelli per effettuare l'accesso al conto.