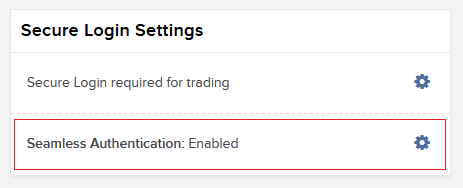

Secure Login with IBKR Mobile - FAQ

Securely log in to any IBKR application, including TWS, Client Portal or WebTrader using IBKR Mobile

Select the scenario below that best describes your issue:

I received the push notification on my smartphone. What is the next step?

I did not receive the push notification on my phone. How can I login?

I have a new smartphone. How do I activate the IBKR Mobile Authentication (IB Key) on this new phone?

- Please click here

My IBKR Mobile Authentication (IB Key) is activated on a different smartphone. How can I login?

- Please click here

I have reinstalled the IBKR Mobile app on the same smartphone. How can I activate IBKR Mobile Authentication (IB Key) again?

- Please click here

I'm unable to receive push notifications on my phone. How do I enable these notifications?

- Please click here

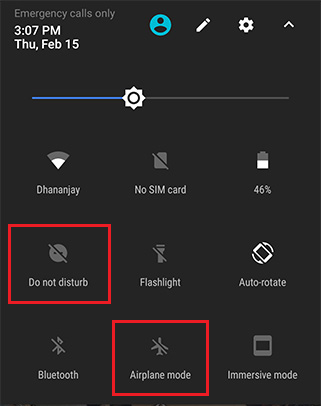

Android

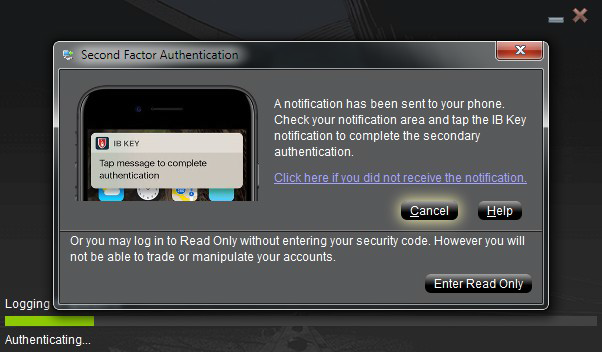

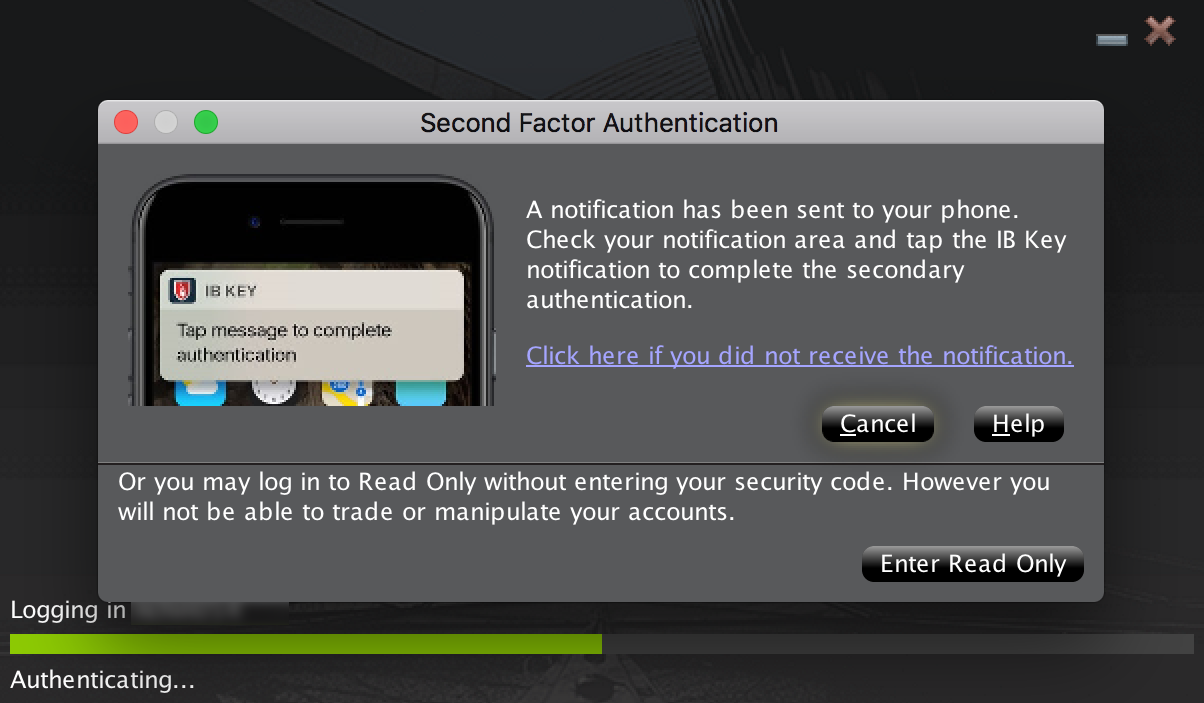

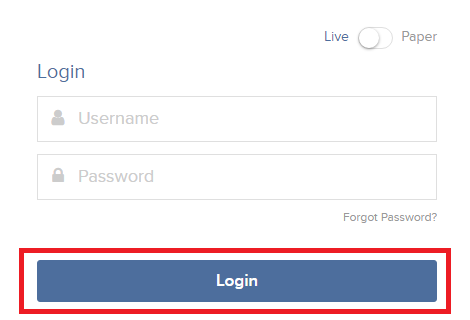

1. Enter your IBKR Account credentials into your trading platform or Client Portal login screen and click Login. If your credentials have been accepted, a notification will be sent to your phone.

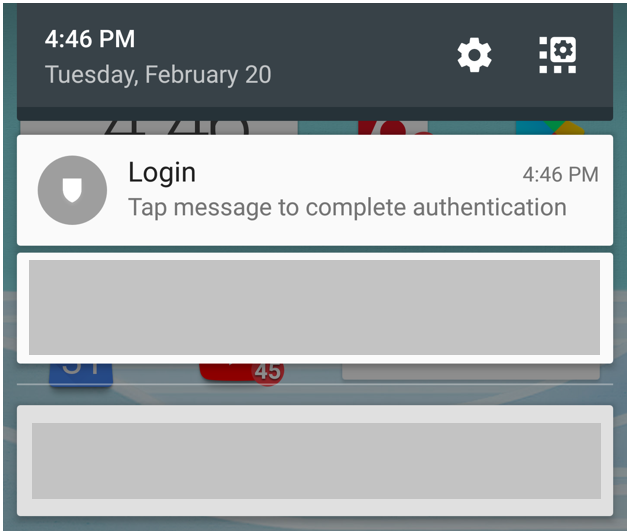

2. On your phone, swipe down from the top and check your notification drawer. Tap on the IBKR Mobile notification. If you have not received the notification, please refer to KB3234.

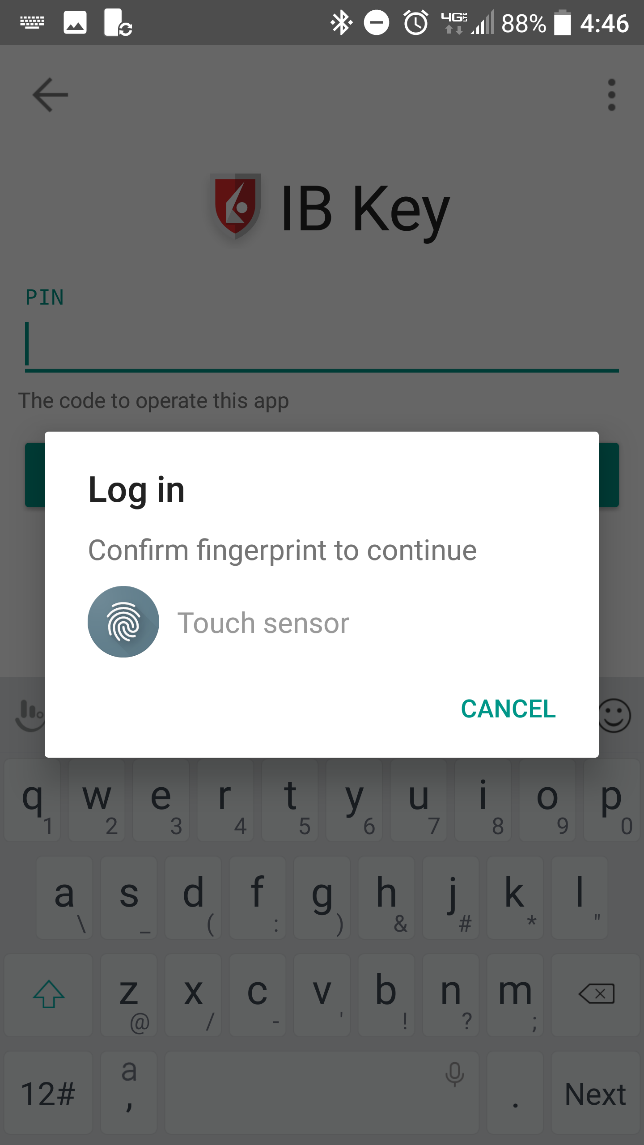

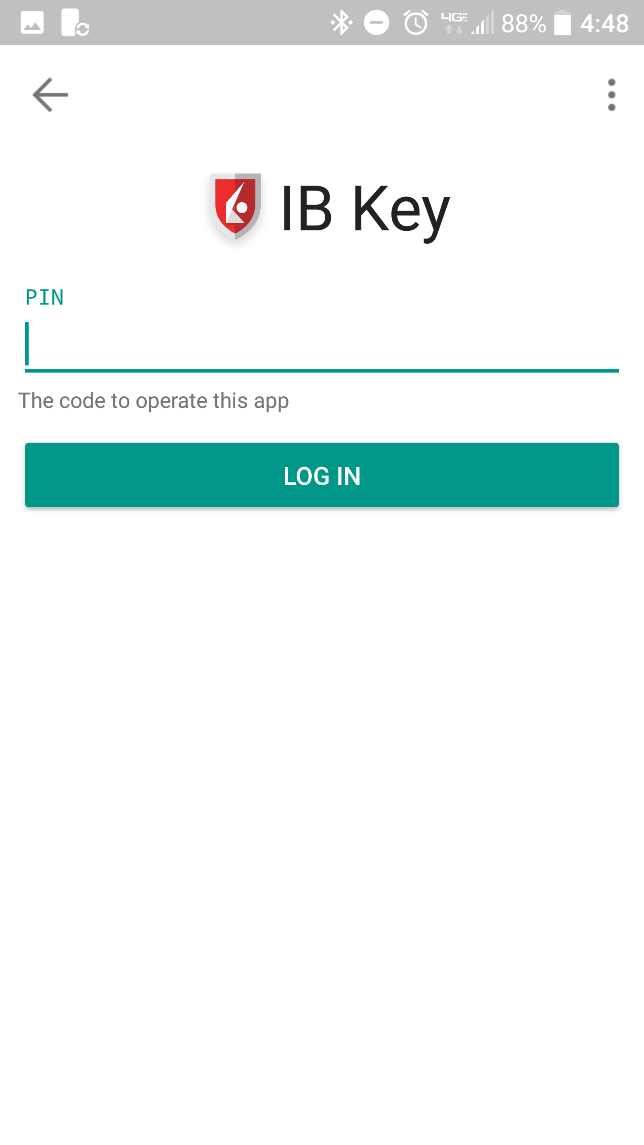

3. The IBKR Mobile Authentication (IB Key) will open, prompting you for your fingerprint or your PIN, according to the hardware capabilities of your phone. Please provide the requested security element.

4. If the authentication has succeeded, the trading platform or Client Portal login process will automatically move ahead to the next phases.

What if I do not receive the notification?

If notifications are disabled, no internet access is available or if you have a poor, unstable connection, the notifications may not reach your phone. In these cases the seamless authentication may not be available but you can still use the manual Challenge/Response authentication method as described below:

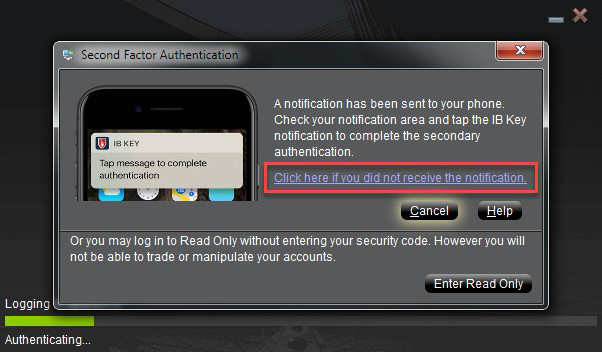

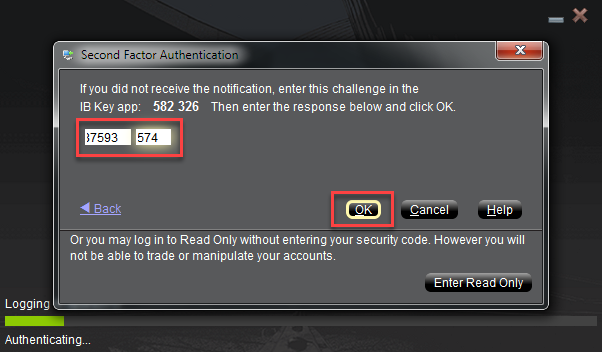

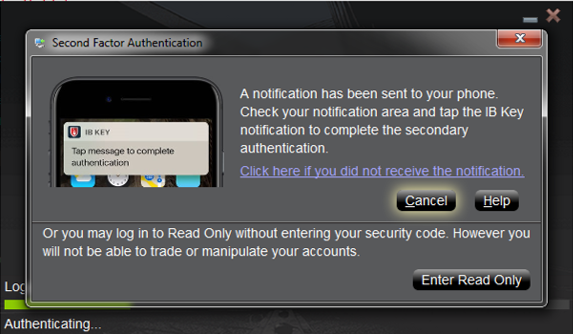

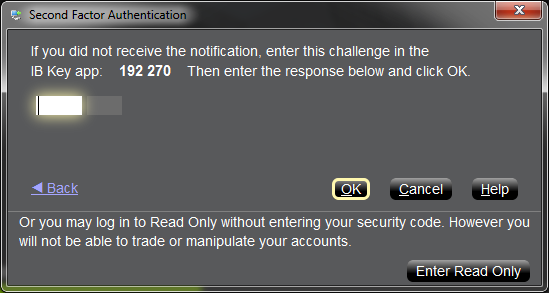

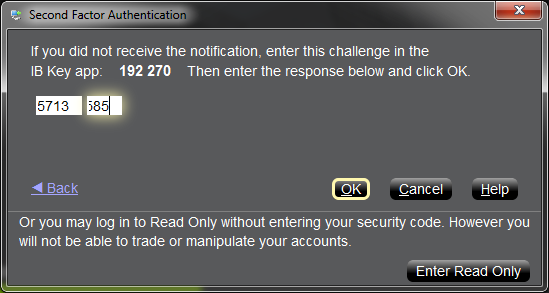

1. On your trading platform or Client Portal login screen, click the link "Click here if you do not receive the notification".

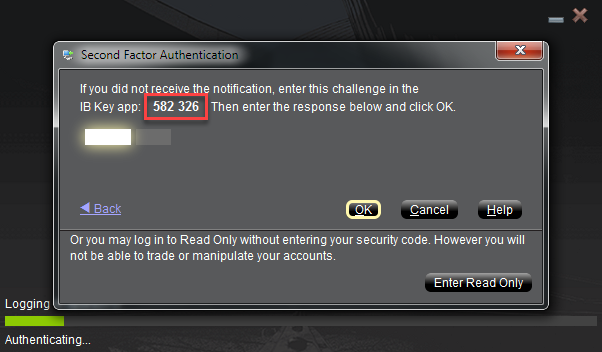

2. A Challenge code will be displayed on the screen.

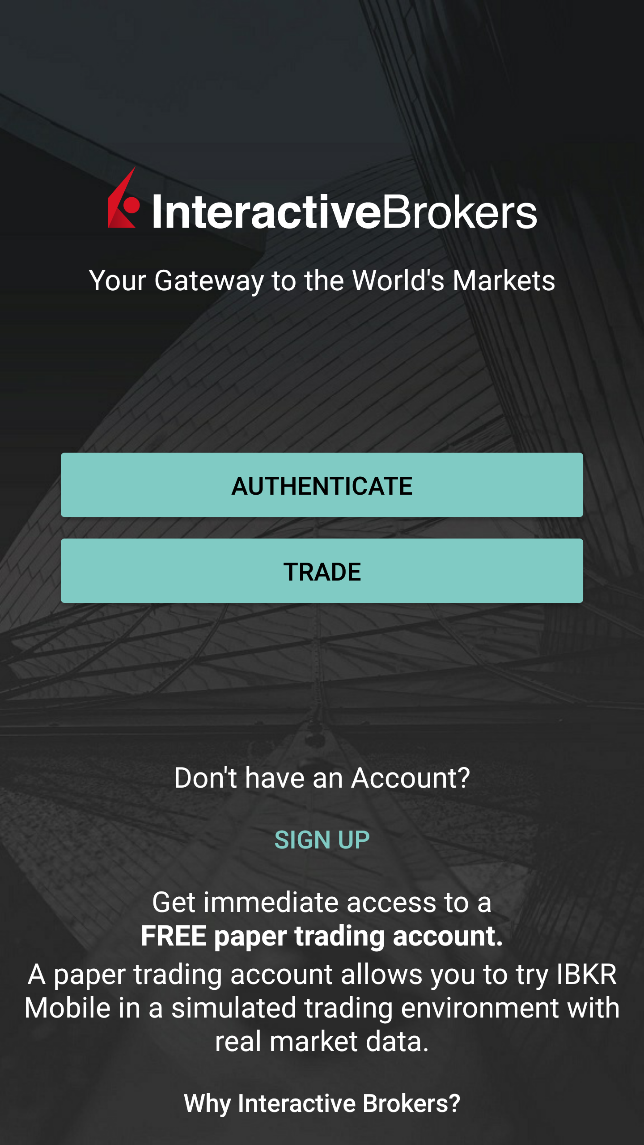

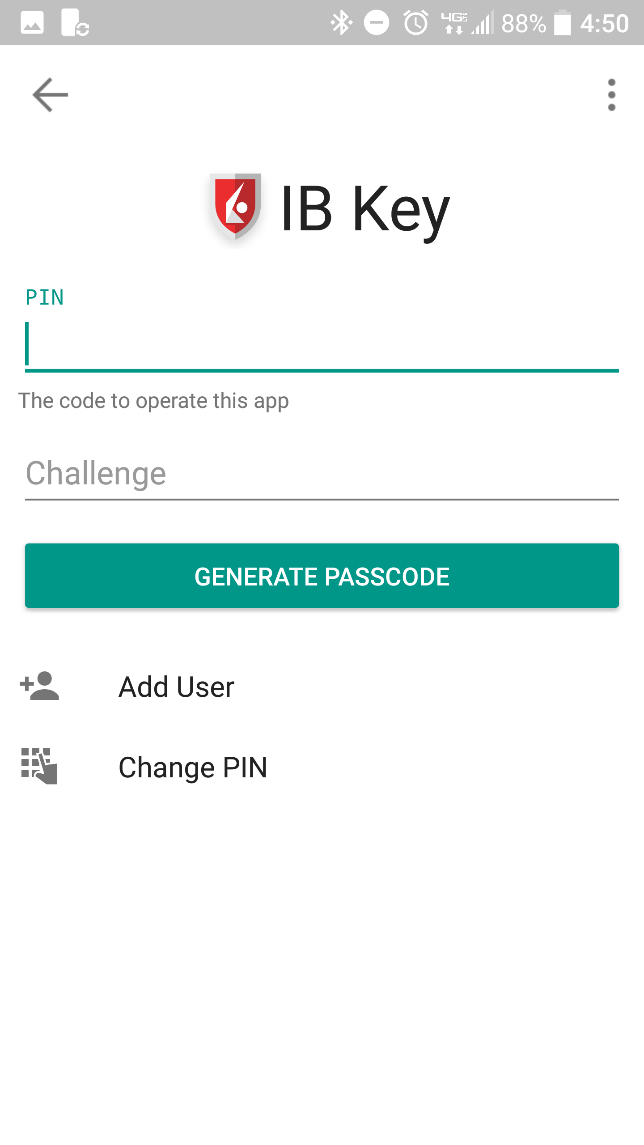

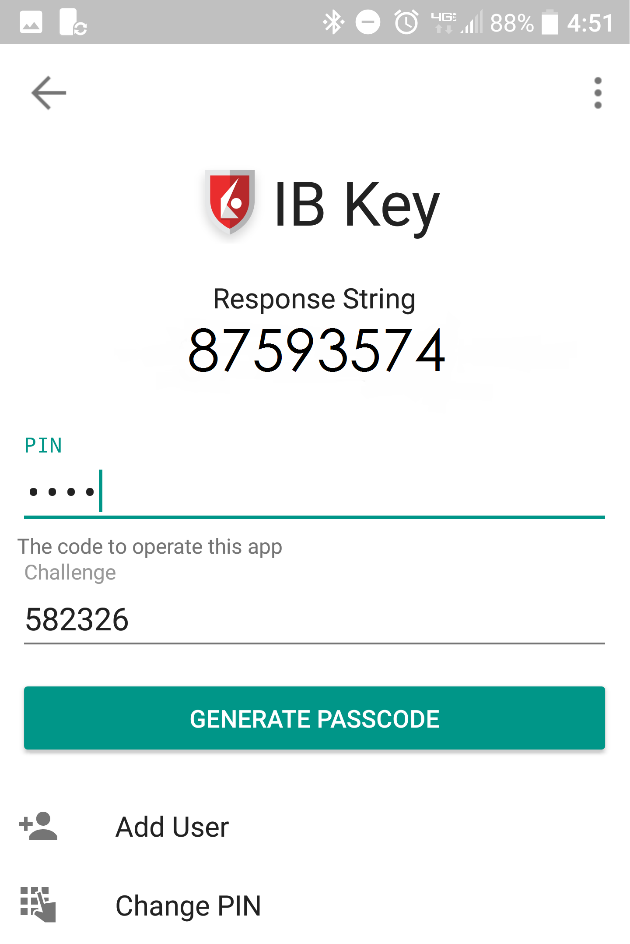

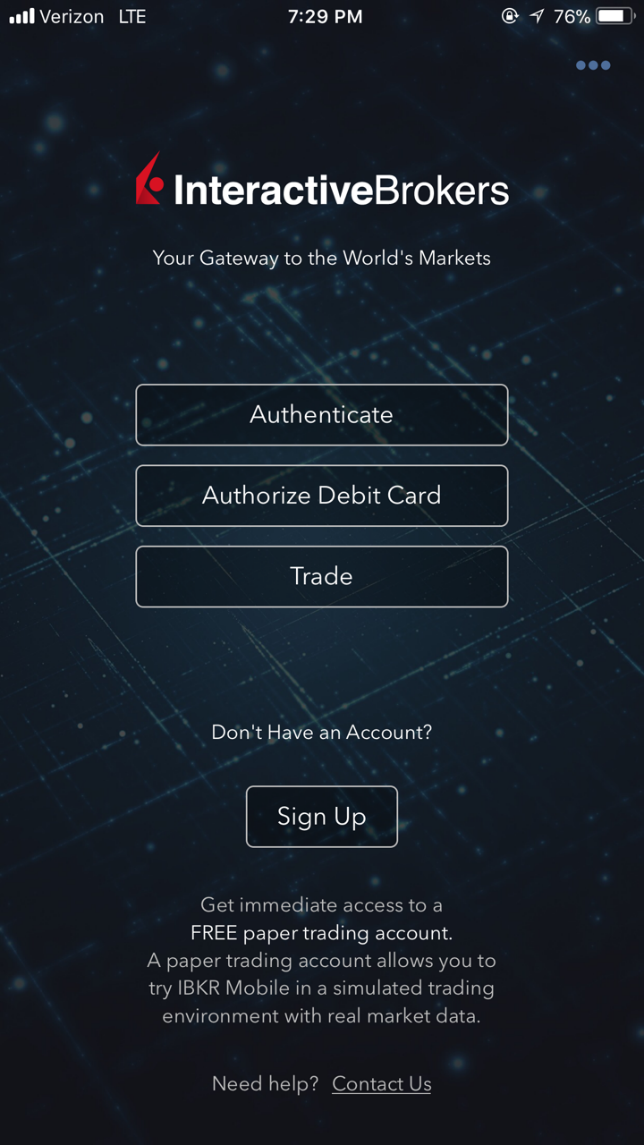

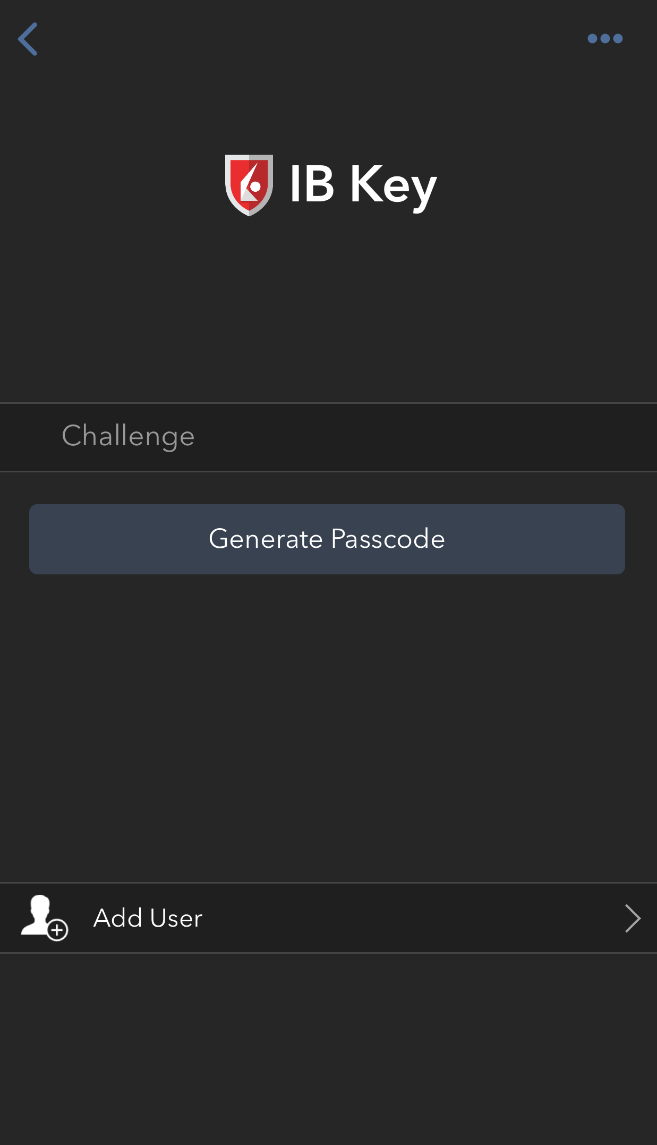

3. Launch the IBKR Mobile app on your Smartphone, select Authenticate (if necessary), enter your PIN and the Challenge code you obtained in the previous step. Tap Generate Passcode.

4. A Response String will be displayed.

5. Enter the Response String into your trading platform or Client Portal login screen. Then click OK.

6. If the authentication has succeeded, the trading platform or Client Portal login process will automatically move ahead to the next phases.

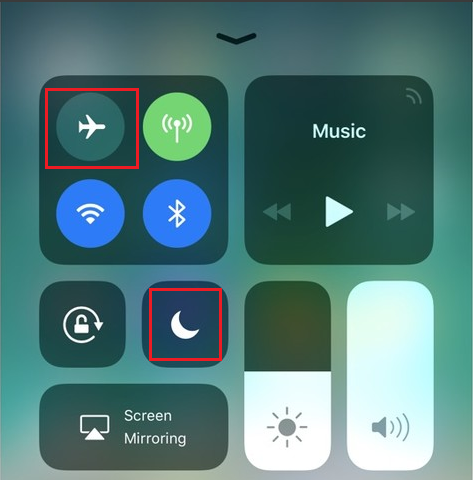

iPhone

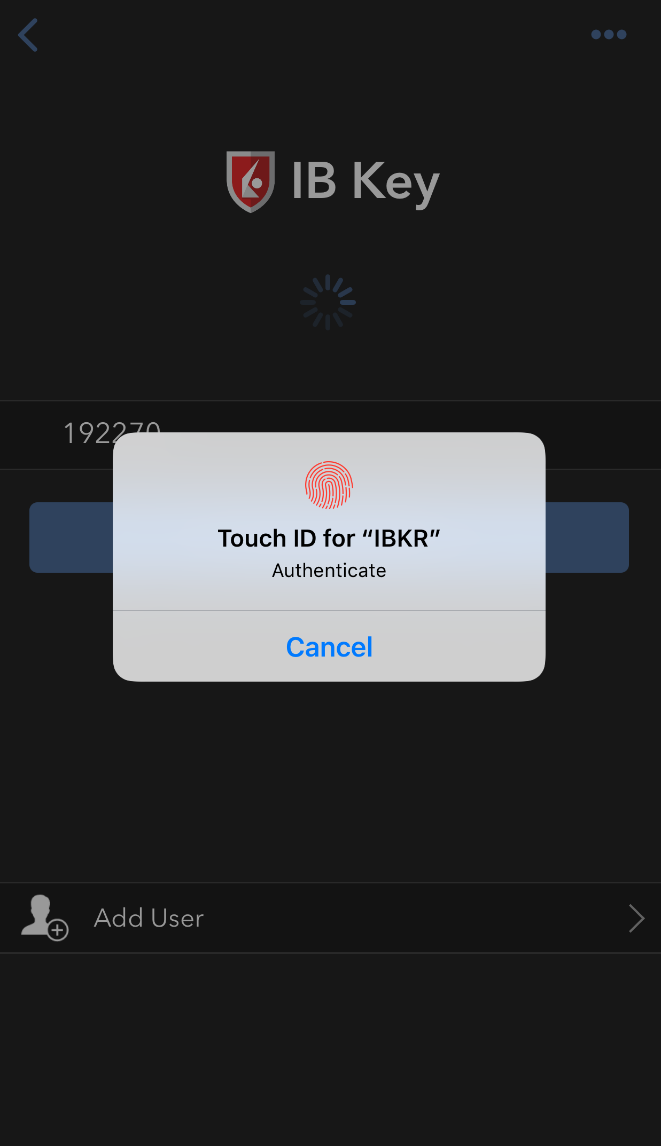

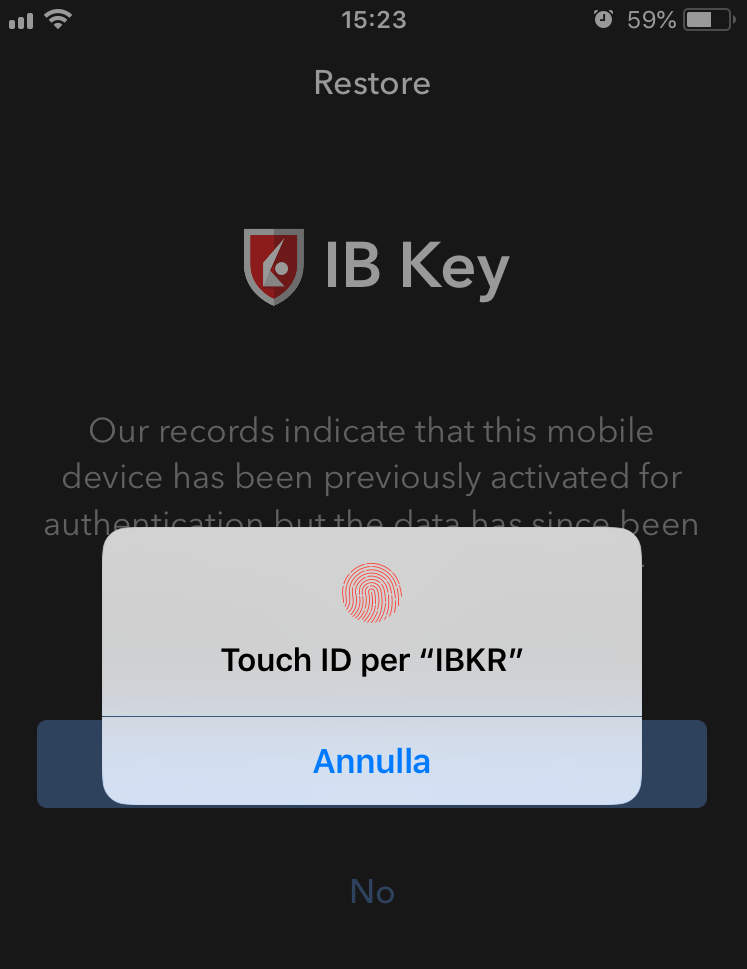

Operation with Touch ID

Once activated, operation of IBKR Mobile Authentication (IB Key) using Touch ID is as follows:

IMPORTANT NOTE: If you do not have Internet access while operating the IBKR Mobile app, please refer to the section "What if I don't receive the notification?"

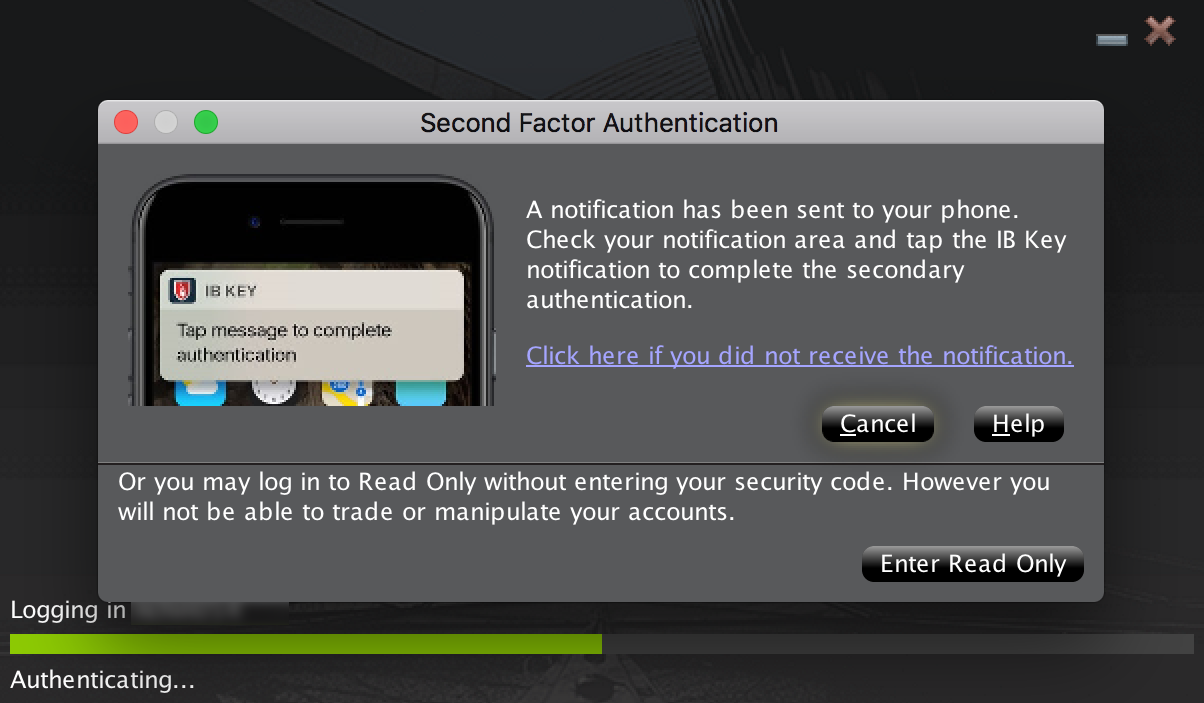

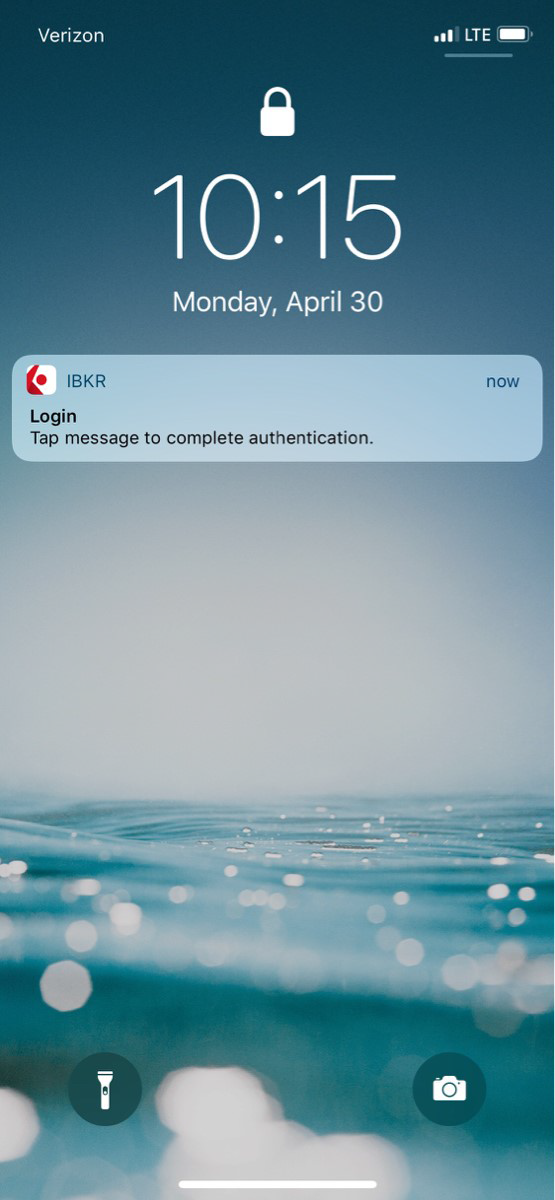

1. Enter your username and password into the trading platform or Client Portal login screen and click Login. If correct, a notification will be sent to your iPhone.

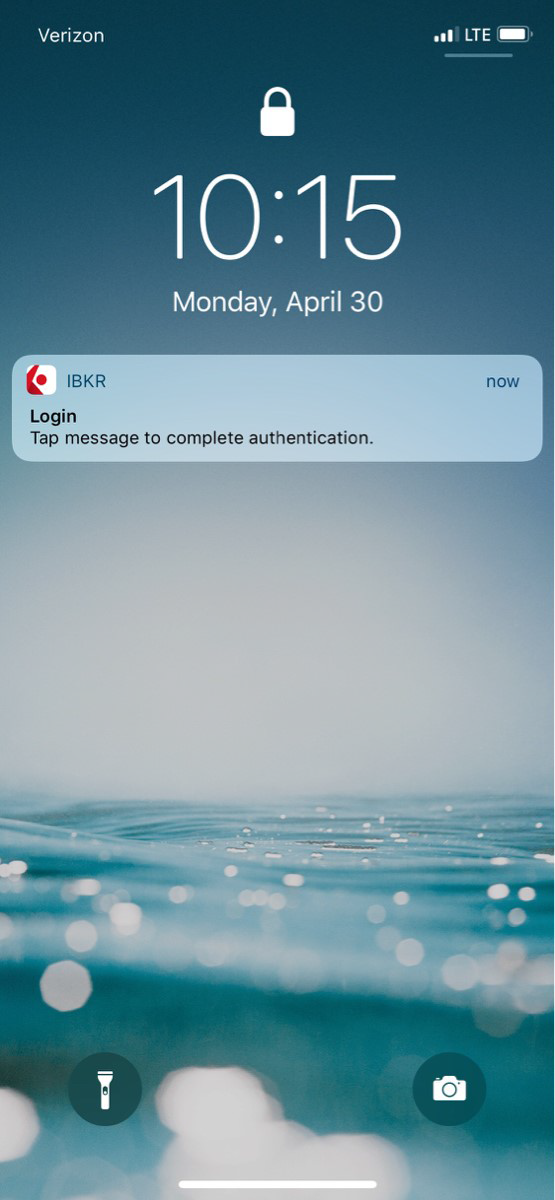

2. On your iPhone, check your notifications panel and select the IBKR Mobile app notification

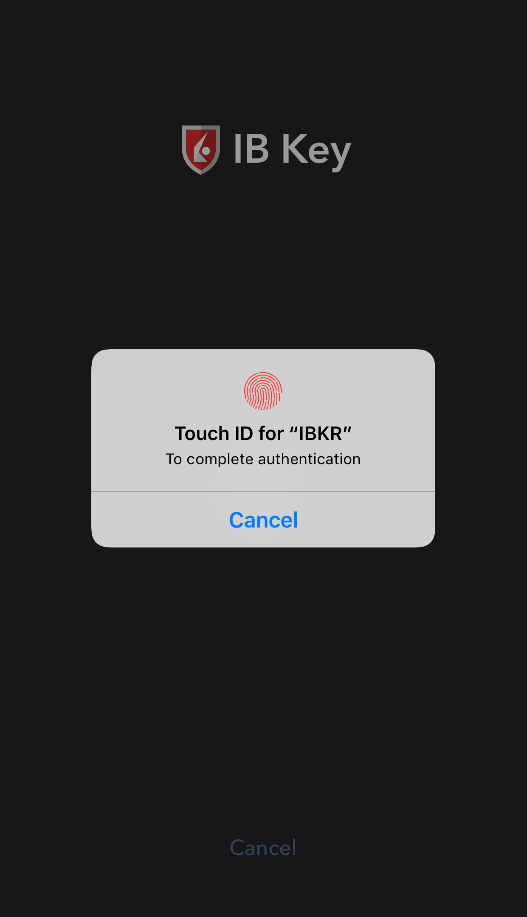

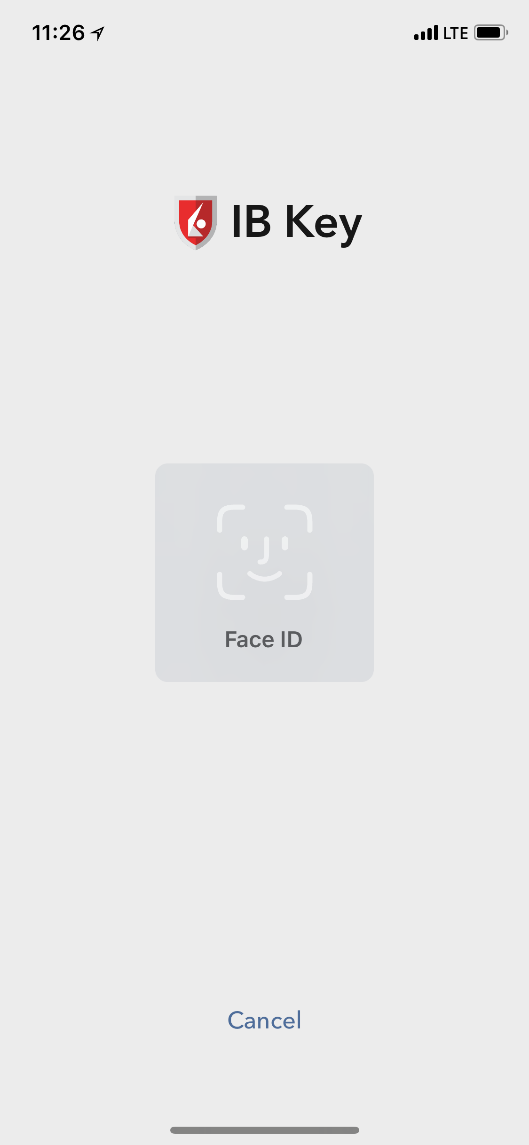

3. Selecting the notification will launch the IBKR Mobile Authentication (IB Key). On your iPhone, place your finger that was registered for Touch ID on the Home Button. If the Touch ID has not been activated, IB Key will prompt you to enter the Passcode.

.png)

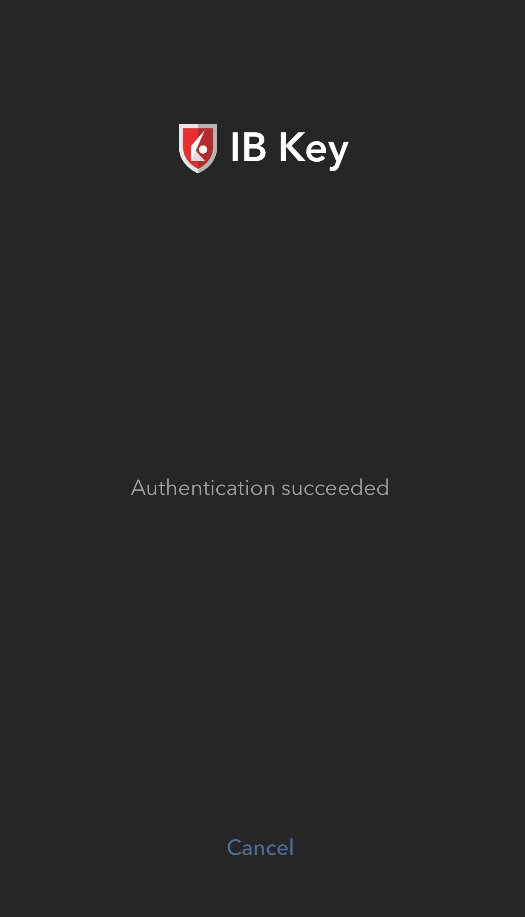

4. If authentication succeeds, the log in will now automatically proceed.

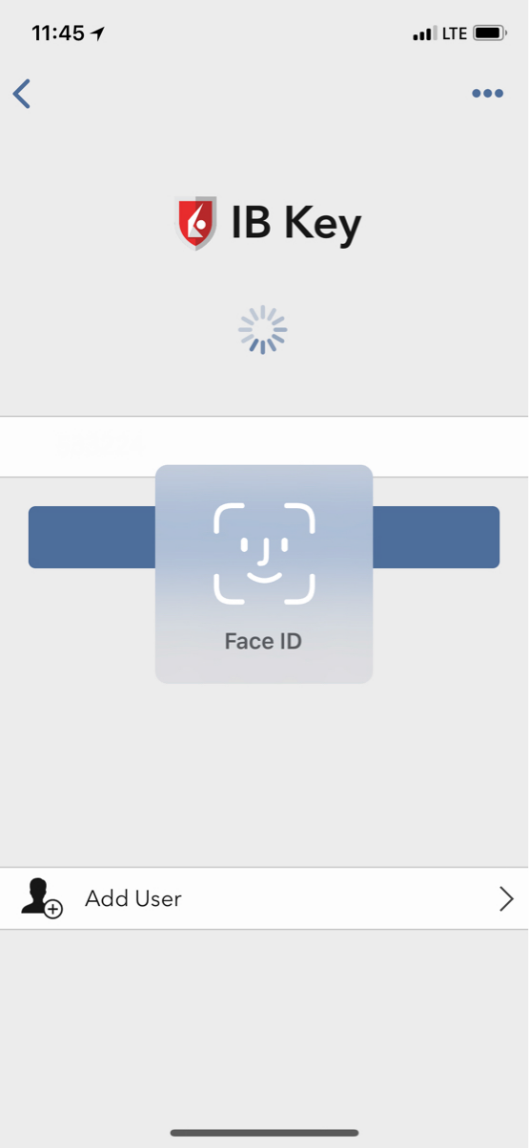

Operation with Face ID

Once activated, operation of IBKR Mobile Authentication (IB Key) using Face ID is as follows:

IMPORTANT NOTE: If you do not have Internet access while operating the IBKR Mobile app, please refer to the section "What if I don't receive the notification?"

1. Enter your username and password into the trading platform or Client Portal login screen and click Login. If correct, a notification will be sent to your iPhone.

2. On your iPhone, check your notifications panel and select the IBKR Mobile app notification

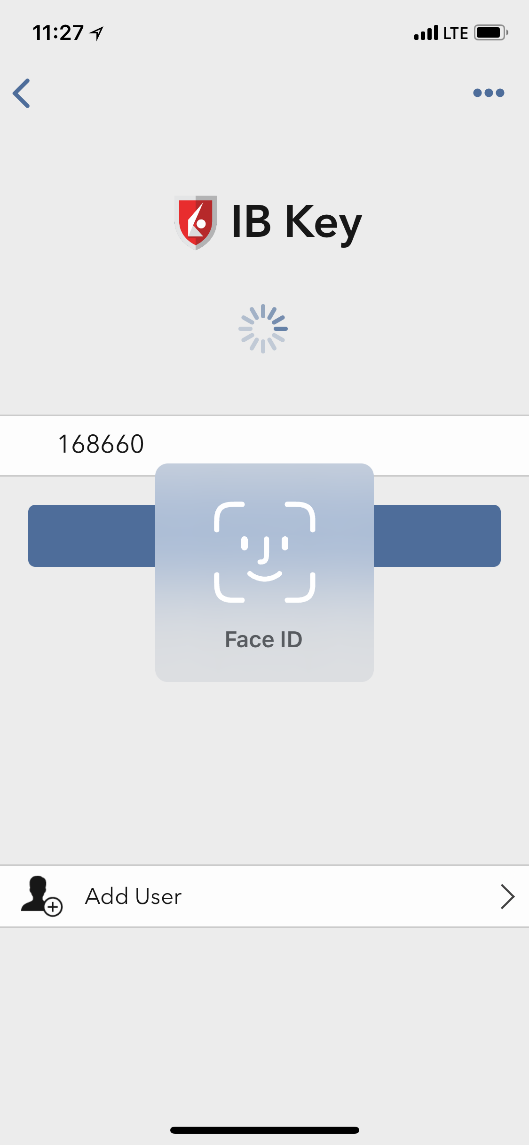

3. Selecting the notification will launch the IBKR Mobile Authentication (IB Key). On your iPhone, look at the screen to authenticate via Face ID. If Face ID has not been activated, IB Key will prompt you to enter the Passcode.

4. If authentication succeeds, the log in will now automatically proceed.

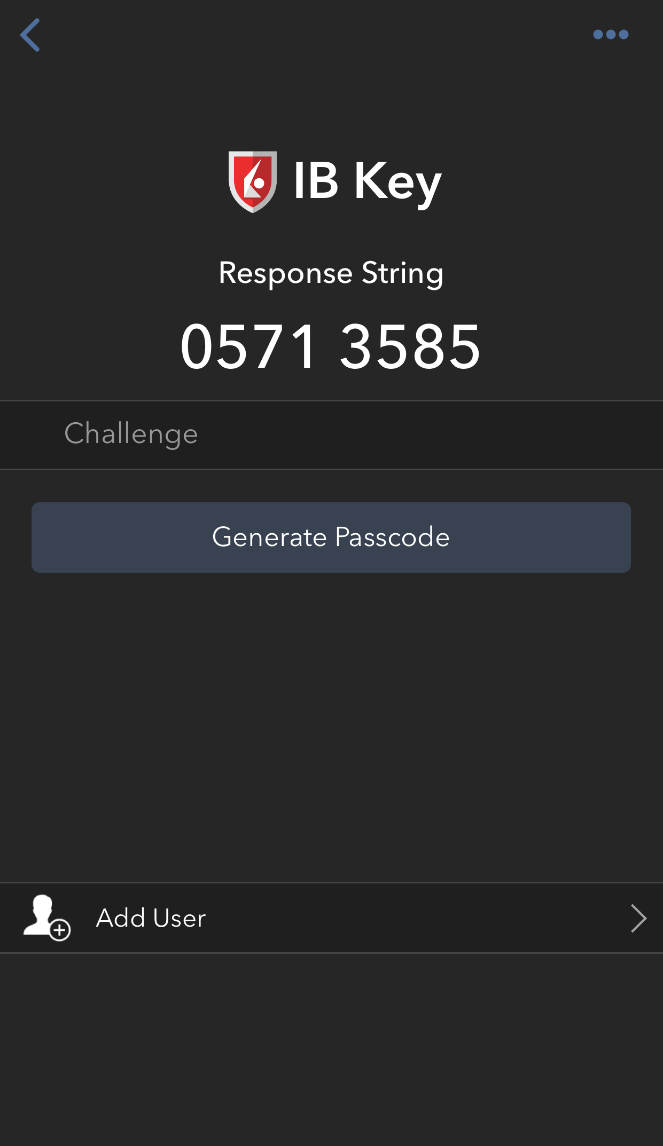

What if I don't receive the notification?

If notifications are disabled, no internet access is available or if you have a poor, unstable connection it is possible the notification may not arrive. In these cases operation of the IBKR Mobile app is as follows:

1. Click the link Click here if you do not receive the notification.

2. This will generate challenge code and box to enter response.

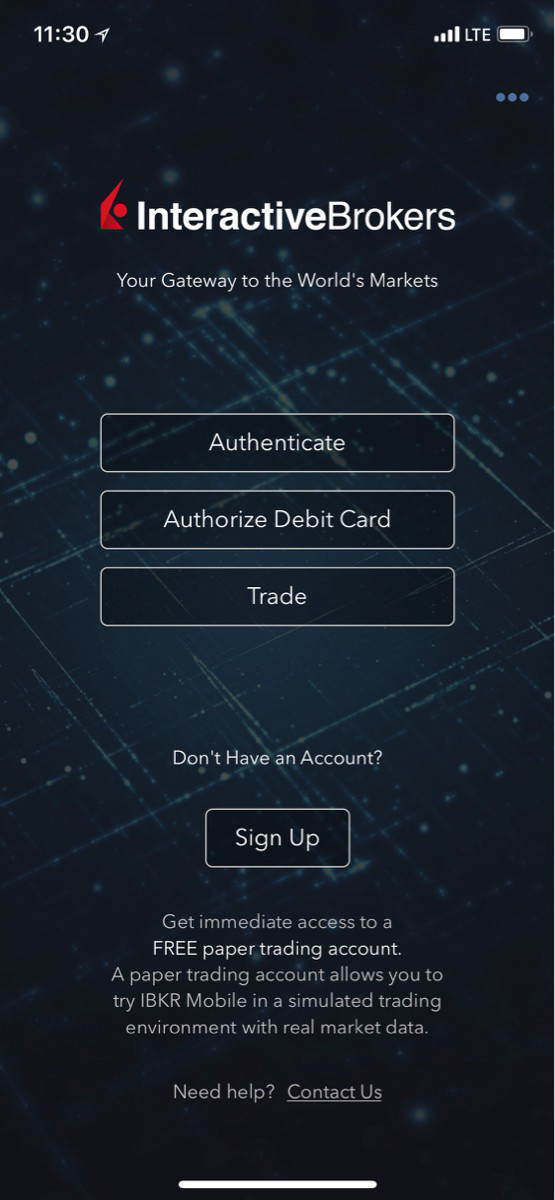

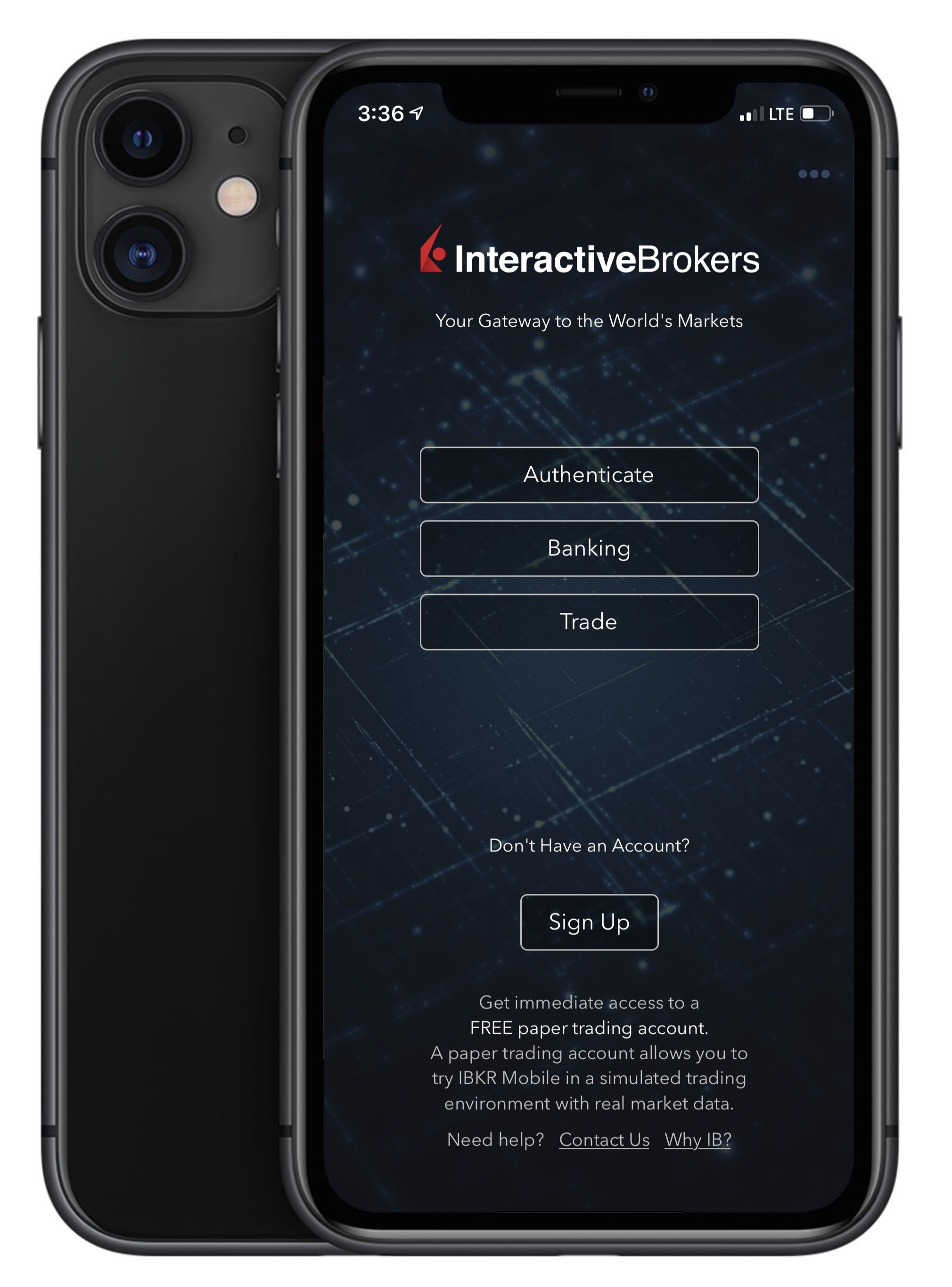

3. Launch IBKR Mobile on your Smartphone, then select Authenticate. Type the Challenge number into the corresponding box.

4. If you use Touch ID, place your finger that was registered on the Home Button. If the Touch ID has not been activated, the IBKR Mobile Authentication (IB Key) will prompt you to enter the Passcode. A response string will be generated. If you use Face ID, skip this step and go to the next one.

5. If you use Face ID, look at the screen to authenticate via Face ID. If Face ID has not been activated, IB Key will prompt you to enter the Passcode. A response string will be generated.

6. Enter the response from your iPhone into the log in screen and click OK.

7. If authentication succeeds, the log in will now automatically proceed.

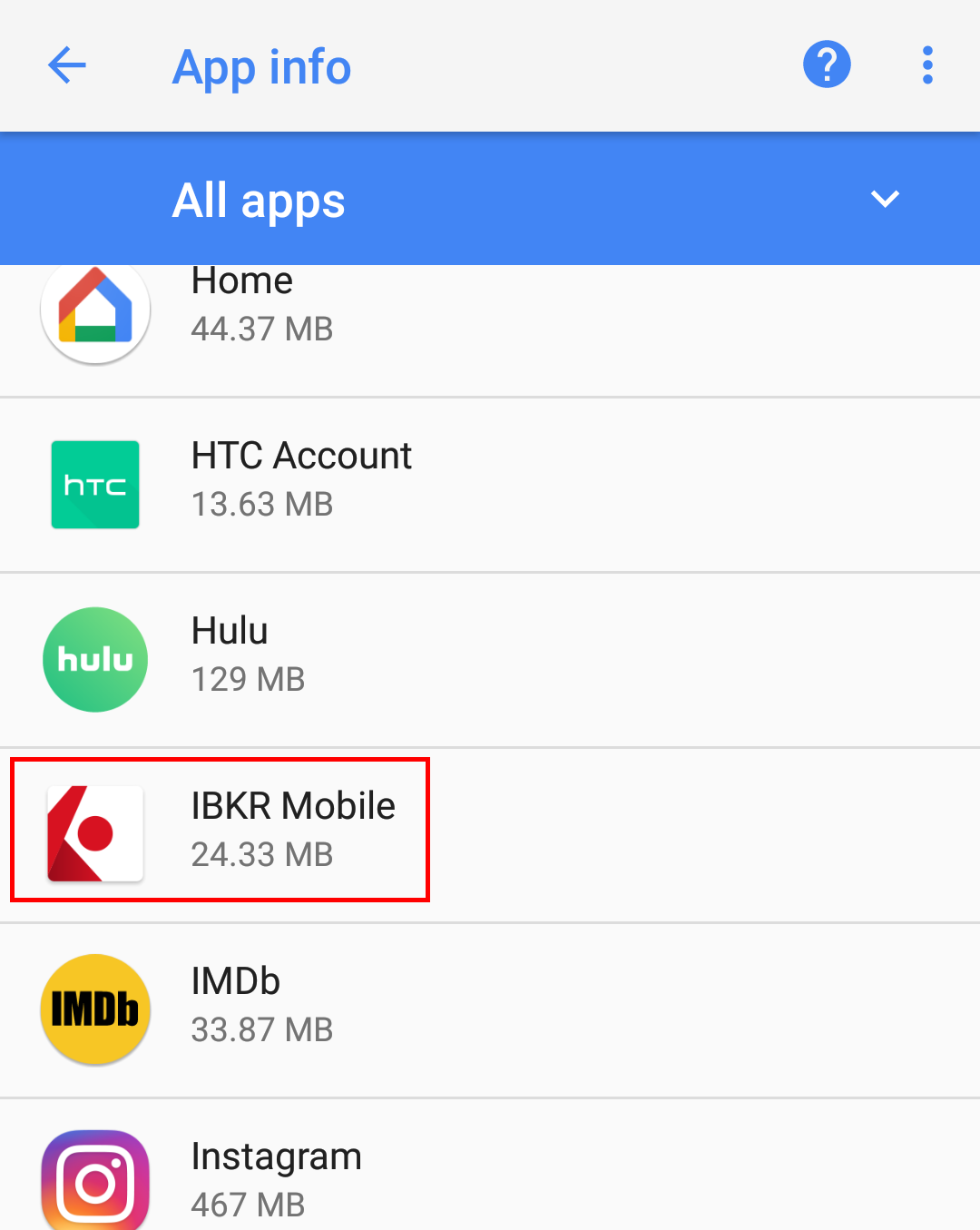

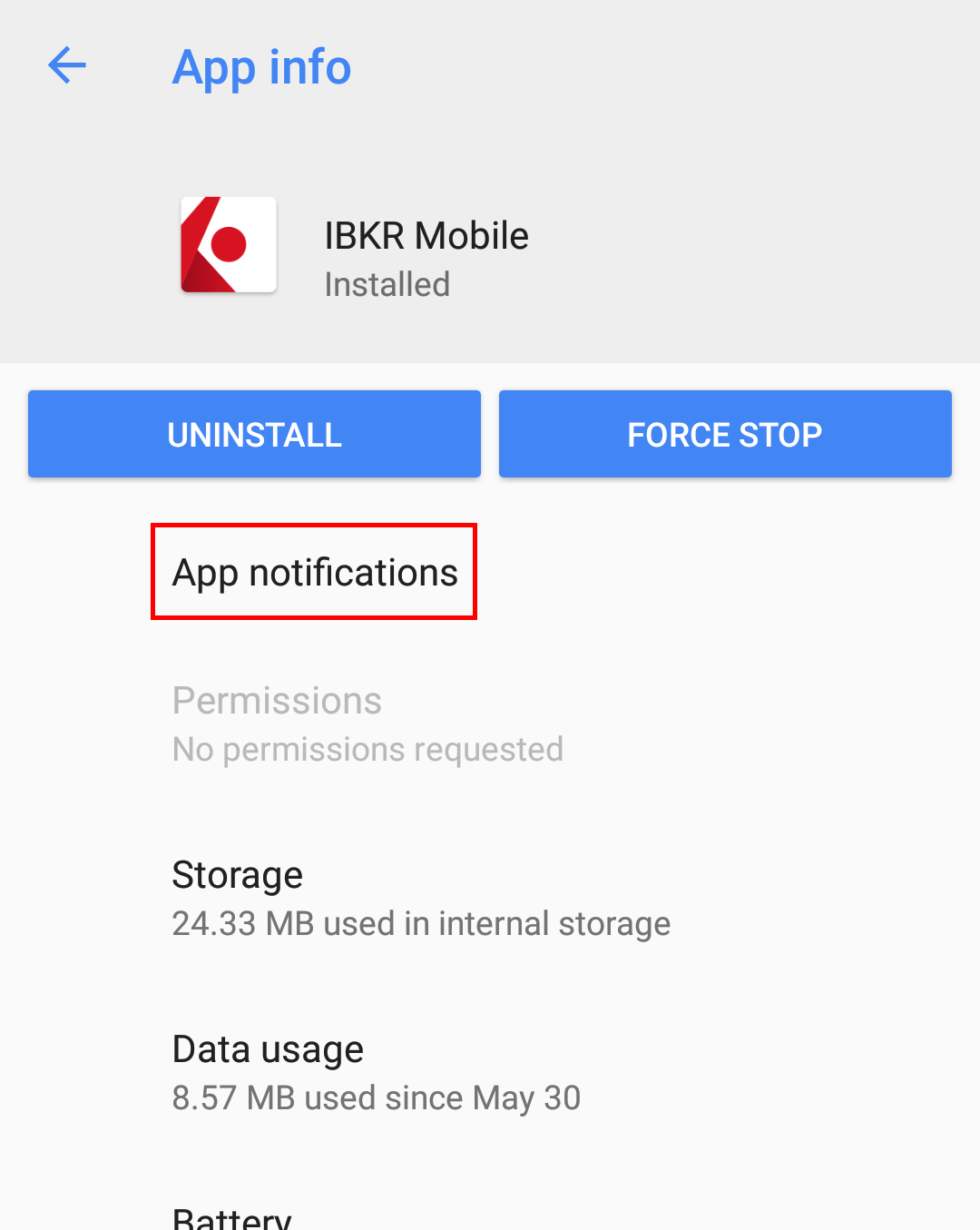

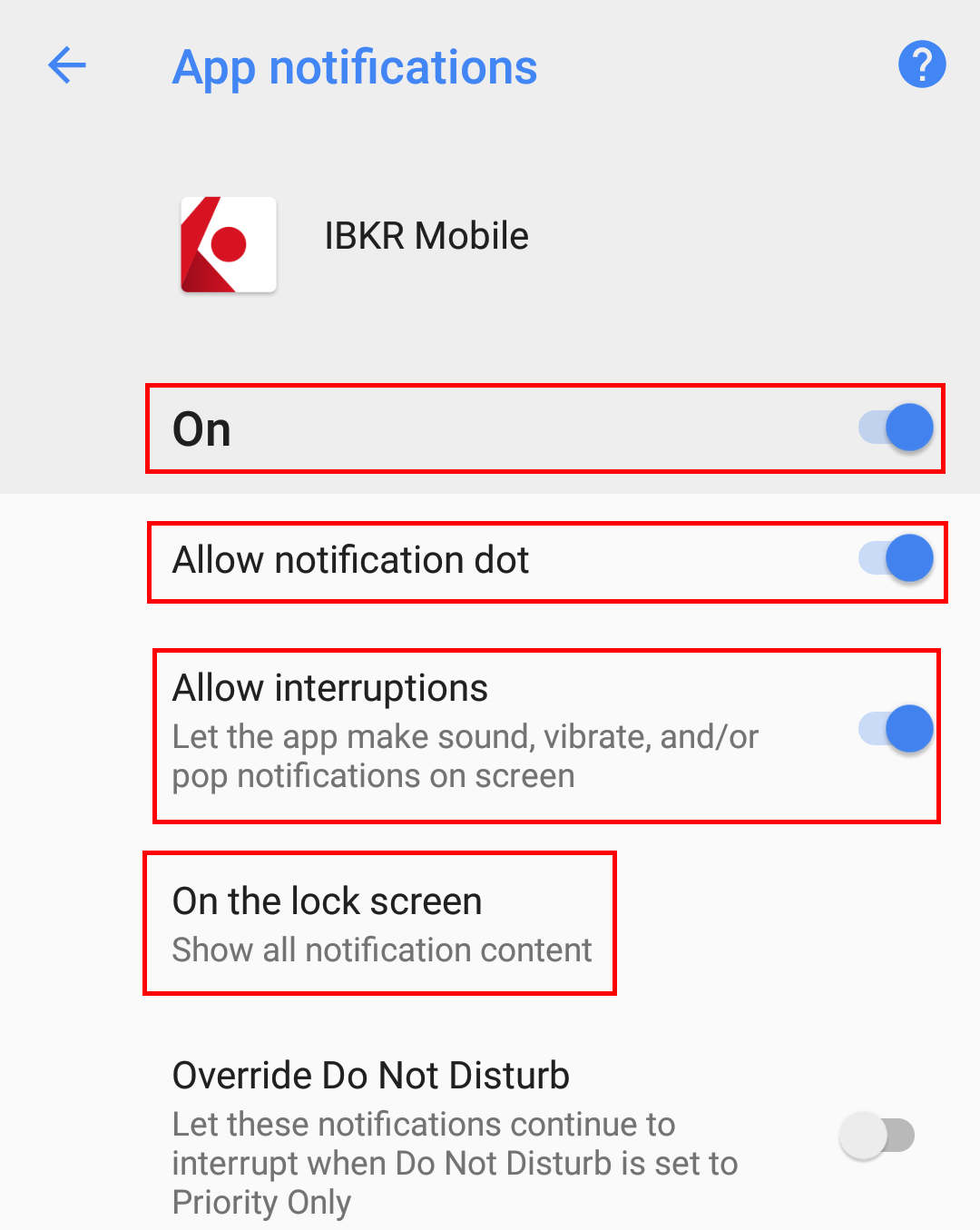

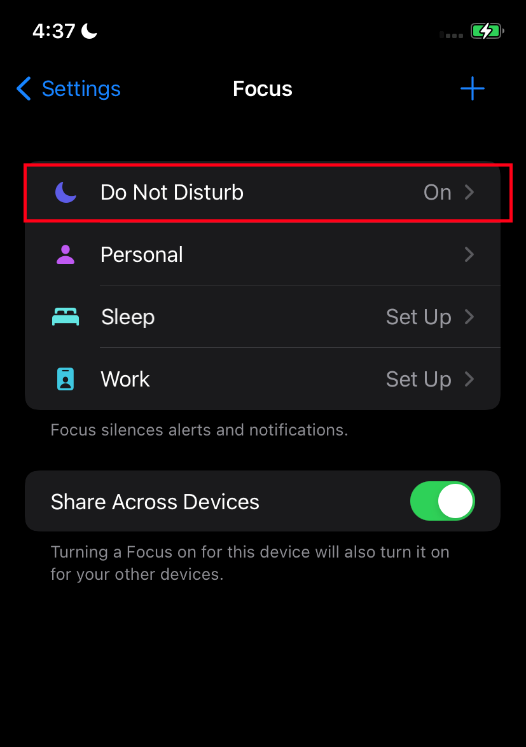

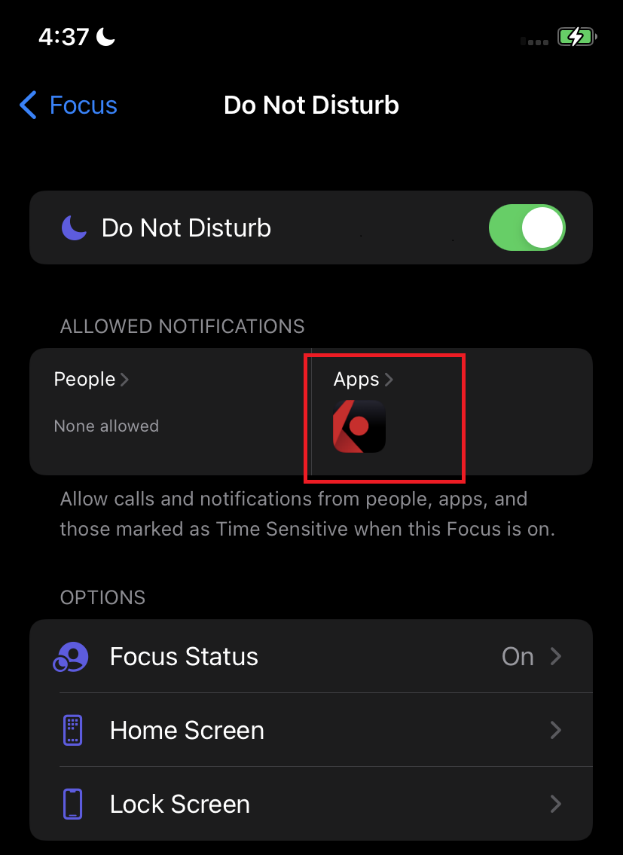

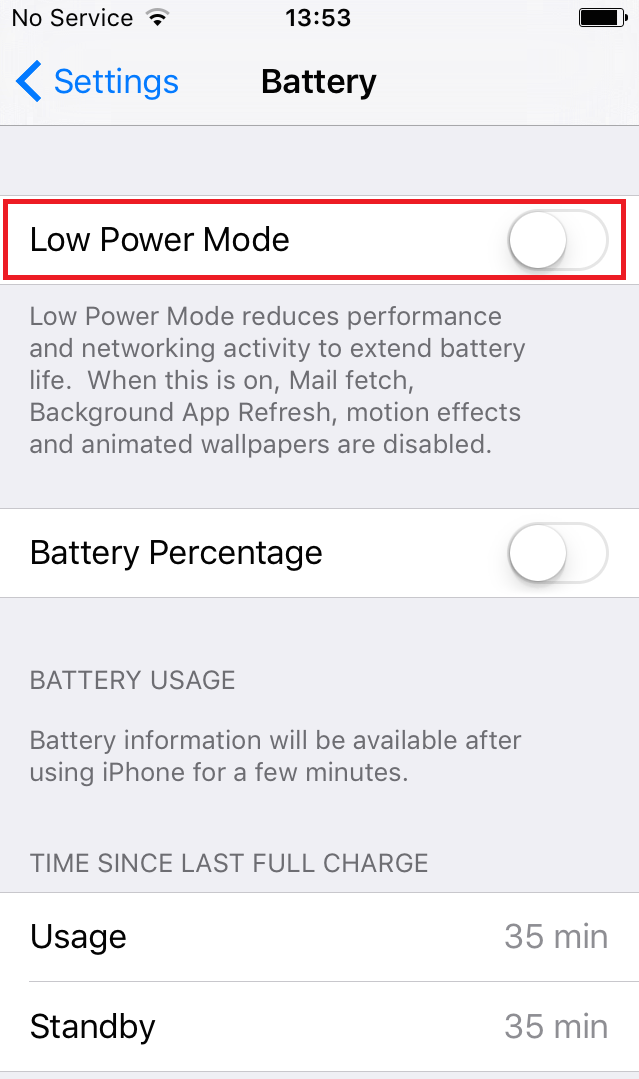

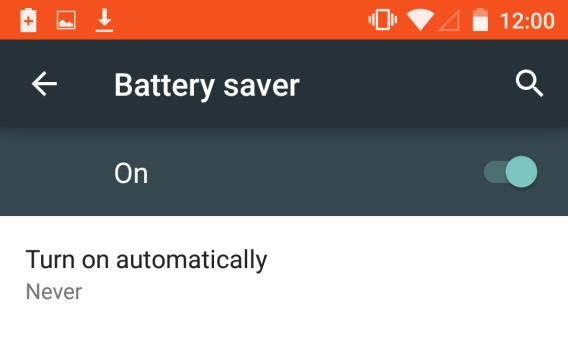

How do I enable the Notifications for the IBKR Mobile app

What is a notification?

A push notification is a brief message which is sent ("pushed") from a back-end server to your device over the Internet. Apps developers use those attention-grabbing messages to quickly and effectively reach the recipients, even if they are not currently engaging with their application. Notifications can deliver information to users or advise them of a specific action they are invited or required to perform.

Why does the IBKR Mobile app use notifications?

The IBKR Mobile application uses notifications for informational purposes, as well as two-factor authentication. In the latter case, the user is invited to tap on the notification, which will automatically open the IBKR Mobile app and begin the authentication process.

This procedure explains how to manually enable notifications for the IBKR Mobile app. Please click the link below that matches your smartphone's operating system.

(1).png)

(1).png)

-

Allow Notifications: enabled

-

Lock Screen, Notification Center, Banners: selected

-

Banner style: Persistent

-

Badges: enabled

-

Show Previews: Always

.png)

Figure 1 Figure 2 Figure 3

Figure 4

Please note that menu items labels and positions may vary according to your device vendor and software version.

1. The Apps & notifications item may be called Sound & notification on certain devices

- See KB2260 for instruction on how to activate and operate IBKR Mobile Authentication

- See KB3234 for troubleshooting missing IBKR Mobile notifications

- See KB2748 for information about IBKR Mobile Authentication recovery

I am not receiving IBKR Mobile notifications.

In this article, we explain what notifications are, how they are used within the IB Key authentication process and which troubleshooting actions you can perform if you do not receive them on your smartphone.

Table of contents:

-

What is a notification?

-

How does the IBKR Mobile app use notifications?

-

What are the prerequisites for receiving IBKR Mobile notifications?

-

I do not receive IBKR Mobile notifications. What can I do?

-

You can log in even without receiving notifications.

What is a notification?

A push notification is a brief message sent ("pushed") from a back-end server to your device over the Internet. Apps developers use those messages to quickly and effectively attract the user's attention, even if they are currently not engaging with their application. Notifications can deliver information to users or advise them of a specific action they are invited or required to perform.

How does the IBKR Mobile app use notifications?

The IBKR Mobile application uses notifications:

- to deliver alerts and other information

- for the needs of the two-factor authentication (IB Key)

In the second case, the user is invited to tap on the notification - this will automatically open the IBKR Mobile app, through which the authentication process needs to be completed.

What are the prerequisites for receiving IBKR Mobile notifications?

To receive the IBKR Mobile notifications, the following requirements have to be met:

- The IBKR Mobile app must be installed and activated on your device. For details, please see KB2260.

- Your device must be connected to the Internet (through Wi-Fi or mobile phone/wireless carrier networks, such as EDGE / 3G / 4G / LTE). If you are located in China, please check additionally Note A. on this topic.

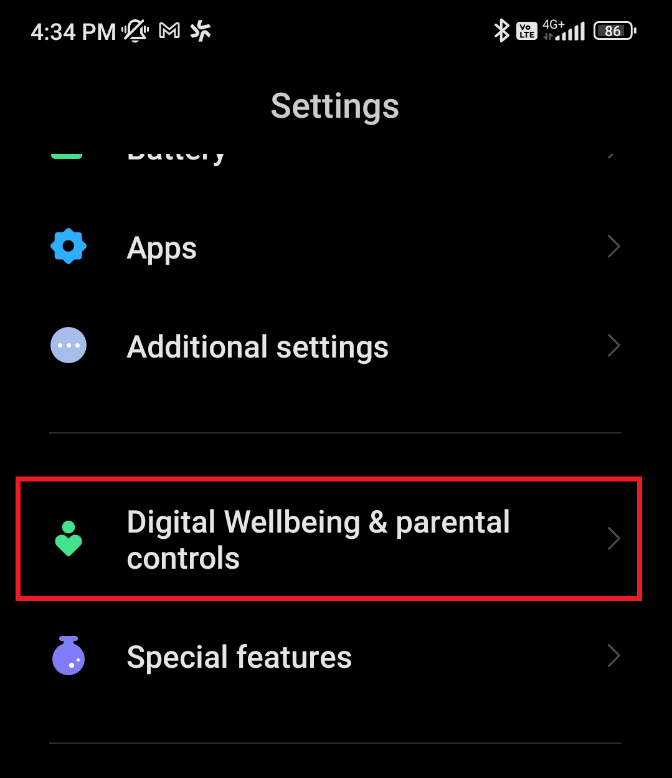

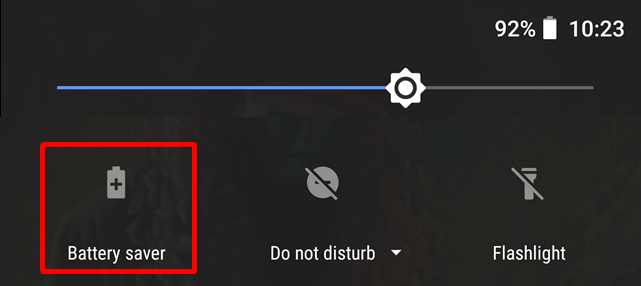

I do not receive IBKR Mobile notifications. What can I do?

If you meet the prerequisites but are still not receiving IBKR Mobile push notifications, please check the instructions below.

Click here if you want to skip those instructions and jump directly to the next item - point 5.

.png)

.png)

Click here if you want to skip those instructions and jump directly to the next item - point 7.

.png)

.png)

.png)

.png)

Note: The position and name of the items may vary according to the Android device vendor and software version.

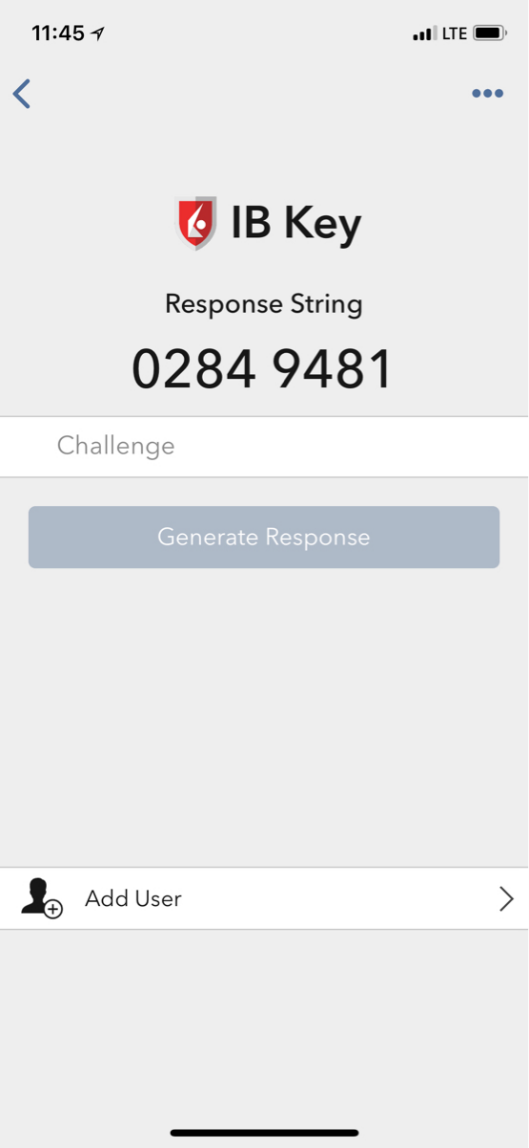

a. On ibkr.com click on LOG IN --> PORTAL LOGIN

b. Enter your credentials and click on Login

c. Should you have multiple SLS devices active, select "IB Key" from the device drop-down

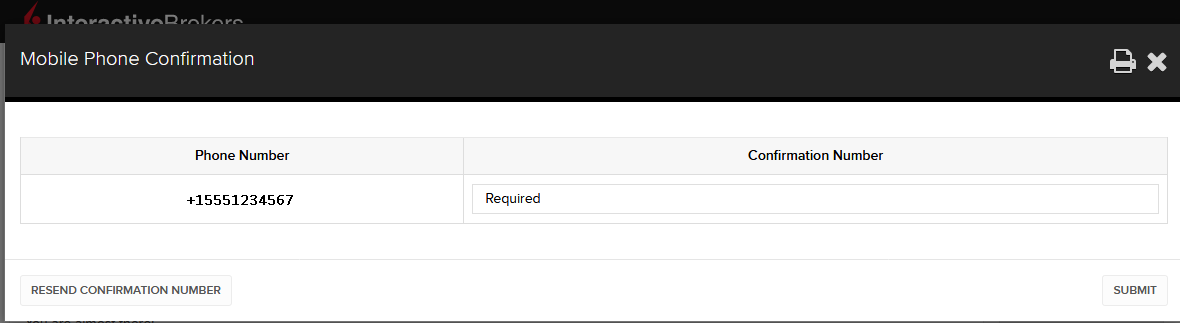

d. If you see a note stating that a message has been sent to your phone, click the link "Click here if you did not receive the message" and the system will show you a six-digit Challenge number

e. On your mobile device, open the IBKR Mobile app, then tap Authenticate (should you not see the button Authenticate, tap first on the link Services on the top left of the screen)

f. Enter the Challenge number you obtained at point d. in the Challenge field and tap Generate Response. Once you have provided your security element (PIN, FaceID, Passcode), you will receive an 8 digits Response String

g. On the Client Portal login screen, enter now the Response String you obtained at point f.

h. If the code has been accepted, you will be logged in to the Client Portal.

i. Logout from the Client Portal and try to log in again. This time you should receive the notification on your mobile device.

You can log in even without receiving notifications.

In case your smartphone is unable to receive IB Key notifications, you can still complete the login process using the IB Key Challenge/Response method, described on the following pages (according to your device operating system):

- See KB2260 for instructions on how to activate and operate IBKR Mobile Authentication

- See KB3236 for instructions on how to enable notifications for the IBKR Mobile app

- See KB2748 for information about IBKR Mobile Authentication recovery

How to enable and use SMS as Two-Factor Authentication method

SMS as Two-Factor method is a quick and easy way to carry out your authentication tasks. This article explains how to set up your mobile phone number to receive authentication codes via SMS.

How to Enroll into SMS authentication

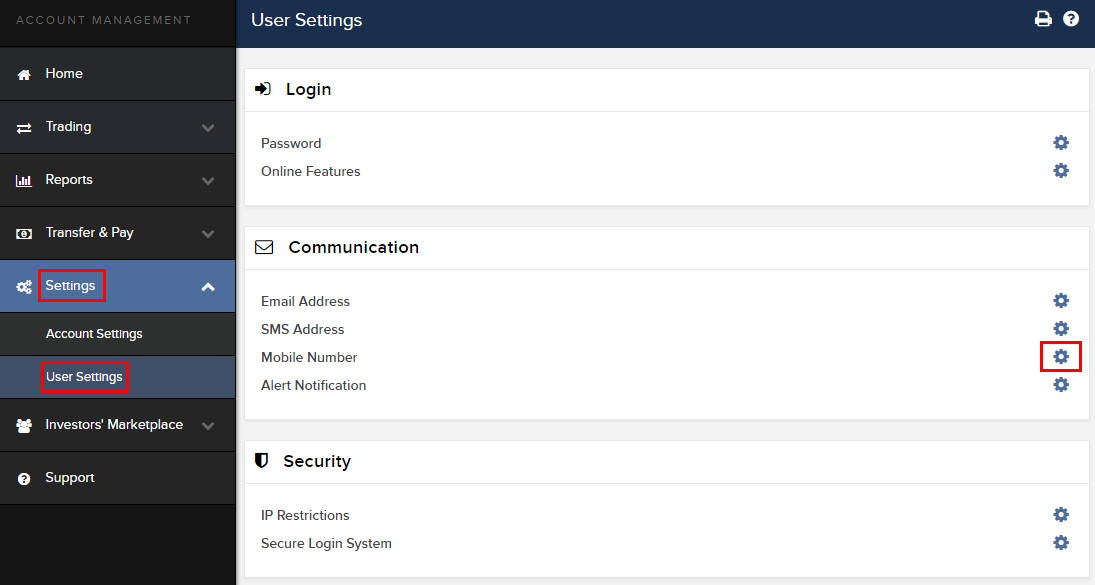

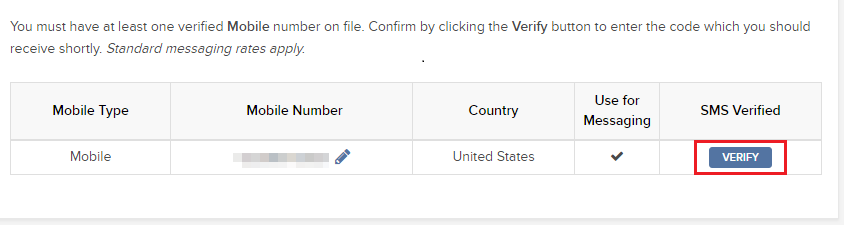

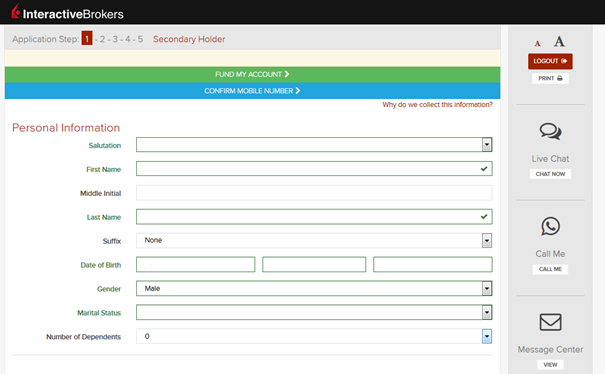

To enroll into SMS Two-Factor Authentication, you would need to have a verified mobile phone number on record. If the verification of your phone number was not completed during the account application, you can complete it at any time by following these steps:

- Log in to Client Portal.

- From the side menu, click on Settings and then on User Settings. Click on the configuration gear correspondent to Mobile Number.

- Click on VERIFY

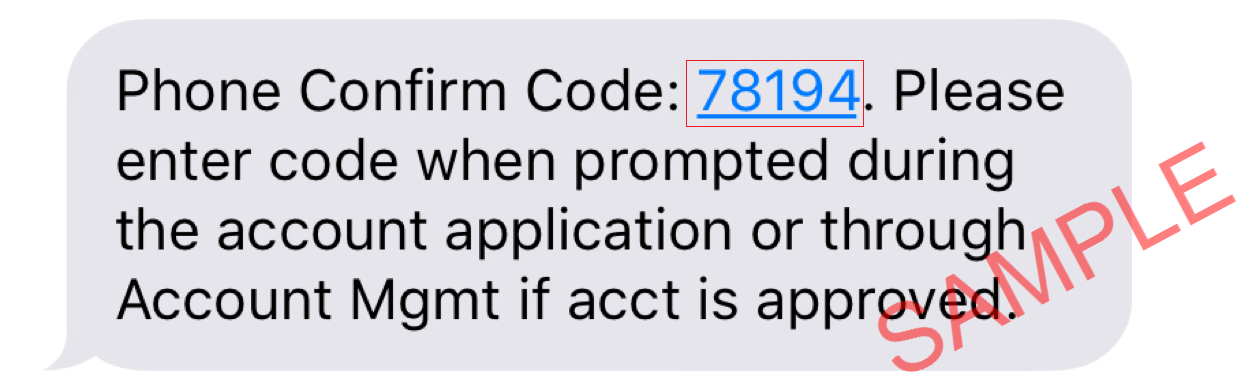

- Open your phone's text messages app and you will find the SMS with the Confirm Code we sent you.

NOTE: message delivery time may vary and in some circumstances it can take few minutes. A new SMS may only be requested every 2 minutes.

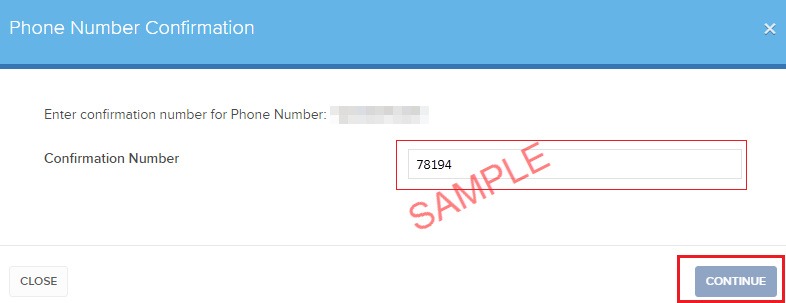

- Enter the Confirm Code you have received into the Confirmation Number field, then click CONTINUE.

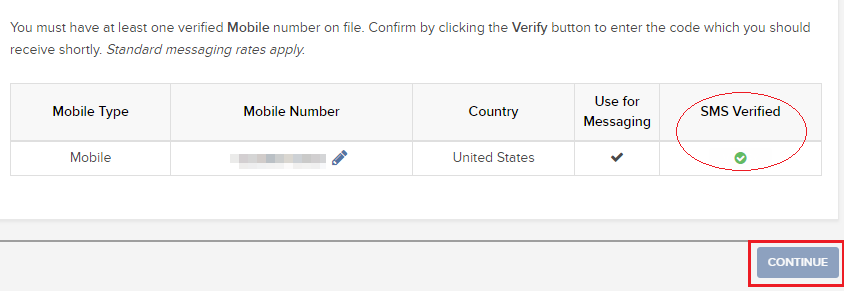

- If the code has been accepted, a green check mark will appear in the column SMS Verified. Click CONTINUE to finalize the procedure.

- If your user does not have an active SLS device, it will be automatically enrolled in SMS for Two-Factor Authentication shortly afterwards.

Back to top

How to login using SMS authentication

Once SMS has been enabled as 2-Factor Authentication method, you will be able to use it in the following way:

- Launch the TWS or go to the Client Portal

- Enter your username and password in the correspondent fields and click Login

- You will then be prompted to enter the authentication code sent to you via SMS. Please open your phone's messages app and look for the message containing the code.

.png)

- Enter the authentication code in the Security Code field present on the login screen, and then click on Login or OK

.png)

.png)

Regulations Mandating Two-Factor Protection

Regulators in certain jurisdictions have imposed requirements that brokerage clients use Two-Factor Authentication when accessing their account. These requirements currently impact residents of Hong Kong and India with details provided below.

Hong Kong-based accounts

On 27 Oct 2017, the Securities & Futures Commission of Hong Kong (SFC) issued revised guidelines aimed at reducing the information security risks associated with internet trading. All registered and licensed persons engaged in internet trading are required to comply. The Hong Kong Monteary Authority (HKMA) simultaneously issued a circular on the same day requiring all registered institutions to implement the requirements listed in the guidelines.

Per article 1.1 of the SFC guidelines, all clients are required to be enrolled in Two-Factor Authentication. As a result, we are no longer able to provide Hong Kong accounts with the ability to opt out of the Secure Login System.

India-based accounts

On March 25, 2014 the National Stock Exchange of India (NSEI) issued a circular with new requirements for stock brokers that operate in India. Per regulation 3b, all brokers must implement Two-Factor Authentication for Indian clients. As a result, we are no longer able to provide India accounts with the ability to opt out of the Secure Login System.

How to reactivate or transfer IBKR Mobile Authentication (IB Key)?

This article details the steps needed to reactivate the IB Key Authentication (IB Key) via IBKR Mobile.

This state of the application or its installation might be due, but not limited to, reinstallation of the app or the purchase of a new phone.

You can perform the reactivation without the involvement of IBKR Client Services in the following cases:

Case A) Reactivation on the same smartphone

-

You uninstalled and reinstalled the IBKR Mobile app on the same smartphone

Please click on one of the links below according to your phone operating system.

-

Android: IBKR Mobile PIN + Access to the mobile phone number originally used for the app activation

-

Apple iOS: Smartphone PIN / Fingerprint / FaceID + Access to the mobile phone number originally used for the app activation

Case B) Reactivation on a different smartphone

-

You are replacing your smartphone with a new one

-

You have lost your smartphone and you are now in possession of a new one

-

You activated the IBKR Mobile Authentication (IB Key) on your primary smartphone but you now want to transfer

the activation (either temporarily or permanently) to the secondary one.

Please click on one of the links below according to your phone operating system.

In any other case, we would kindly ask you to request a temporary account access by contacting IBKR Client Services (Secure Login department) on the phone number best suitable for your location, among the ones listed on ibkr.com/support

References:

- See KB2879, KB2260 for General information about IBKR Mobile Authentication (IB Key)

- See KB2260 for instructions on how to install/activate/operate the IBKR Mobile app

-

See KB2278 for instructions on how to operate IBKR Mobile Authenticaton (IB Key) for iPhone

-

See KB2277 for instructions on how to operate your IBKR Mobile Authentication (IB Key) for Android:

- See KB3279 for instructions on how to log in to IBKR Mobile when IBKR Mobile Authentication (IB Key) is enabled on another phone

Mobile Phone Verification during the account application

Introduction

IB requires that clients verify their mobile phone in order to receive account and trade related communication directly via SMS. Clients who fail to verify their phone will be subject to trade restrictions pending completion of this process. Verification is performed online and the steps for doing so are outlined below.

In case your account has been already opened but your mobile number has not been yet verified, please jump directly to KB2552 to complete the verification process.

Phone Verification

When completing your Interactive Brokers Account Application, you will see a blue bar at the top of the page that says "CONFIRM MOBILE NUMBER."

You can click on that bar any time during steps 1-4. Once you do, you will see this window:

Once you have entered your full number, it will be recognized and a confirmation message is sent immediately. Validate your phone number by entering the SMS Code received in the Confirmation Code field and click Submit.

If you are unable to do this during the application process, you can always confirm it on the Application Status page

.png)

Please consider the following as certain restrictions may apply:

- SMS messages may be blocked if you participate in your Countries NDNC (National Do Not Call) registry.

- Due to fraud prevention measures, virtual number providers may be blocked.

- Some carriers may restrict the Hours of delivery for SMS messages.

Multiple 2-Factor System (M2FS)

Overview

This page covers specific points on what the Multiple 2-Factor System (M2FS) is and how it functions. For general questions on the Secure Login System, please refer to KB1131.

Table of contents

What is M2FS?

M2FS allows any client to maintain more than one active security device at the same time. You no longer need to choose between a physical security device and the IBKR Mobile app as either can be used interchangeably. If you already possess an active security device, any further device activation will result in both devices remaining simultaneously active.

Activation

In case you currently use the Security Code Card / Digital Security Card+: if you use a physical security device, you may download and activate the IBKR Mobile app. Please refer to the directions for Android and iOS.

In case you currently use the IBKR Mobile app: If you use the IBKR Mobile app and have an account with a balance equal or greater than USD 500K, you qualify for the Digital Security Card+ . You may log in to Client Portal and request the DSC+ by following the instructions here.

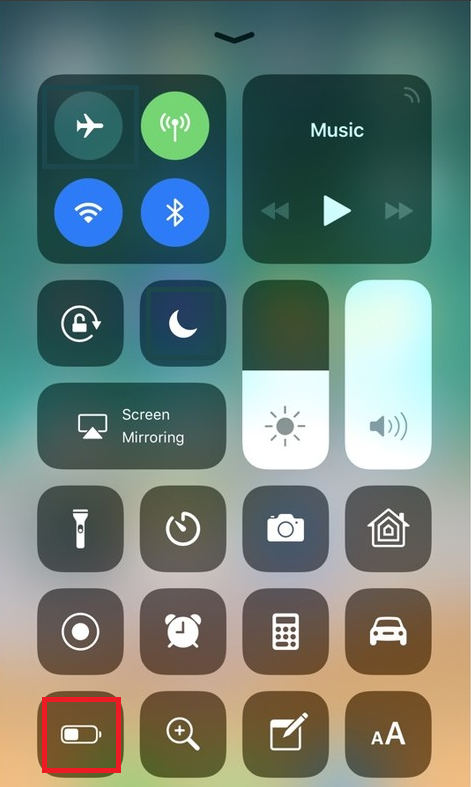

Operation

Once you have both a physical device and the IBKR Mobile app enabled, M2FS is represented by a drop-down menu upon login. You can now choose the device you wish to authenticate with, following the below steps:

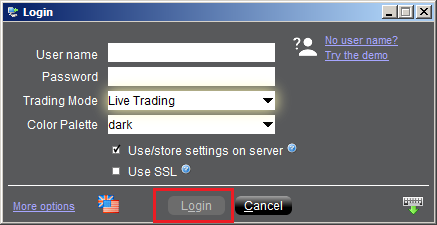

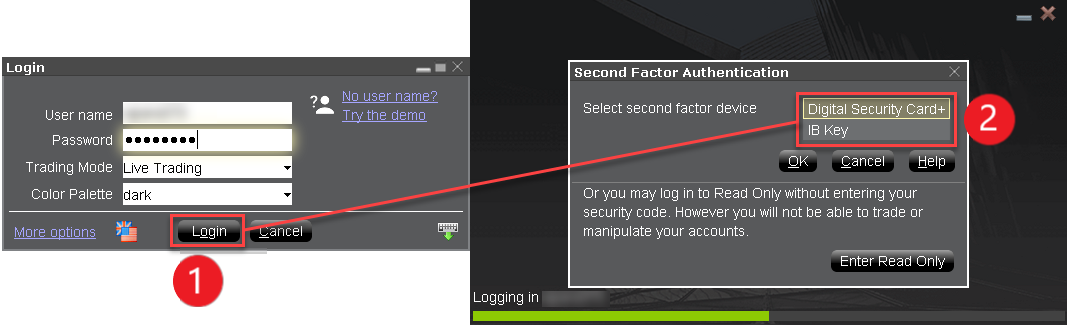

1. Enter your username and password into the trading platform or Client Portal login screen and click Login. If the credentials have been accepted, a drop down will appear, allowing you to Select Second Factor Device. If you log in to the TWS, please notice that the M2FS is supported from version 966.

TWS:

Client Portal:

.png)

2. Once you select a security device, you will now be presented with the corresponding screen for authentication. Refer to the directions for:

- IB Key via IBKR Mobile (iOS)

- IB Key via IBKR Mobile (Android)

- Security Code Card

- Digital Security Card+

3. If the second factor authentication succeeds, the Log-in will now automatically proceed.

Withdrawal limits

The device used to authenticate your withdrawal will define your withdrawal limits, according to the below table:

|

Security Device |

Maximum Withdrawal |

Maximum Withdrawal |

| Security Code Card1 | USD 200,000 | USD 600,000 |

| IBKR Mobile app | USD 1,000,000 | USD 1,000,000 |

| Digital Security Card1 | USD 1,000,000 | USD 1,500,000 |

| Digital Security Card+ | Unlimited | Unlimited |

| Gold Device1 | Unlimited | Unlimited |

| Platinum Device1 | Unlimited | Unlimited |

1: Represents a legacy device that is no longer issued.

Example: You have both the IBKR Mobile app and the Digital Security Card+ enabled and you need to withdrawal more than USD 200K. You can use either device to login to Client Portal but you will be required to use the Digital Security Card+ to confirm your withdrawal request.

Benefits

M2FS provides even more flexibility to IBKR's Secure Login System by allowing you to choose what security device you want to authenticate with. In addition to the convenience of using a device which is trusted and routinely accessible, you can eliminate delays associated with authenticating at times a trade needs to be entered quickly.

IBKR Mobile Authentication as a Two-Factor Solution

At IBKR, we are committed to protecting your account through the use of 2-Factor log in protection. With 2-factor protection, account access is provided through use of "Something you Know" (i.e. entry of user name and password combination) along with "Something you Have" (i.e., a tool which generates a random code to be entered after the user name and password). This 2-Factor protection is intended to mitigate the risk of online hackers (who've acquired your password via malware or social engineering) accessing your account.

While IBKR offers multiple 2-Factor options, IBKR Mobile Authentication is generally viewed as the most convenient to access and operate. Outlined below are some of the convenience factors offered by this app.

1. Always Available:

Your smartphone is always with you, as well as your tool to grant you secure access to your IBKR account.

2. Convenient:

No additional devices to carry, track and watch out for. In the event of loss or change of phone, IBKR Client Services can assist you to get the app back up and running at a moment’s notice.

3. Quick Activation:

A couple of minutes within the download of the app, you can already use it to authenticate into your account.

4. No Shipping, Delivery or Return:

No delivery delays, no return of devices with depleted batteries. A quick download suffices.

5. Secure, but quick and No-Hassle Login with our Seamless Authentication:

When logging into the Trading Platforms or the Client Portal, you only need to enter your username and password - IBKR will send you a notification and you will use the IB Key protocol to complete the authentication, via your mobile biometrics or PIN, depending on your configuration.

6. Allows for multiple users to authenticate with the same app:

If you have one security device for your personal IBKR account, one for your joint account with your spouse and one for your business account you will be happy to know that you can activate the same app for all those users (and more).

7. Available for every smartphone, everywhere:

IBKR Mobile can be downloaded from the Apple App Store if you have an iPhone. Android phone users can get the app as usual from the Google Play store. Clients in China can obtain the application on both Baidu and the 360.cn stores.

8. Works even Offline:

Should your phone be offline (e.g. when on vacation or with a bad reception), you can still use IBKR Mobile Authentication. Even though Seamless Authentication won't be accessible, the application can generate the codes you need to access your account and trade.

9. Secure delivery for your Password Reset:

With IBKR Mobile installed and the IB Key authentication activated, you can have the IBKR Client Services send you a temporary password to your phone in a secure way without exposing it through text messages and other means of communication.

10. Small footprint:

IBKR Mobile can be downloaded even on the most restrictive data plans and be installed on your smartphone without hogging resources. The application size and its operational use of resources are limited to the absolute minimum, while not compromising on its security.

For a general overview of IBKR Mobile Authentication including installation, activation and operation, please see KB2260.

IBKR Mobile Authentication (IB Key) Reinstallation on the Same Phone

The recovery procedure explained in this article is required in case:

Procedure:

In order to re-enable IBKR Mobile Authentication (IB Key), please click on one of the below links, according to your smartphone Operating System

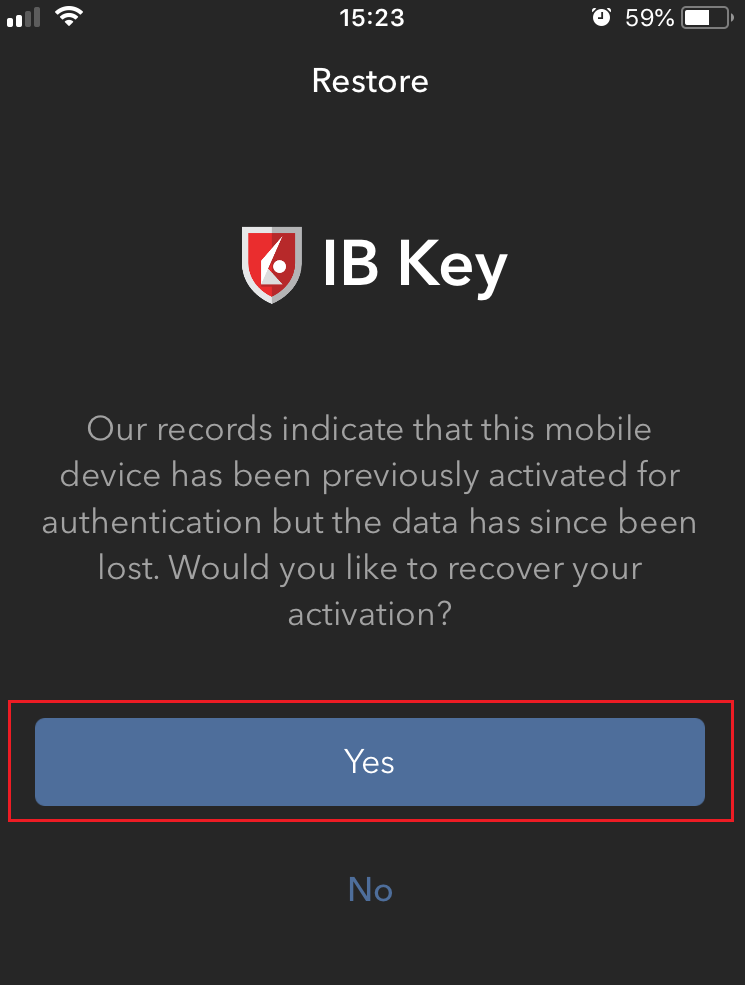

Apple iOS

-

Launch the IBKR Mobile app. Whenever possible, the app will ask you to recover the setup. Tap Yes

-

According to your phone hardware capabilities, you will be prompted to provide the security element originally used to secure the app (Fingerprint, Face ID, PIN). Please follow the on-screen instructions for this step

-

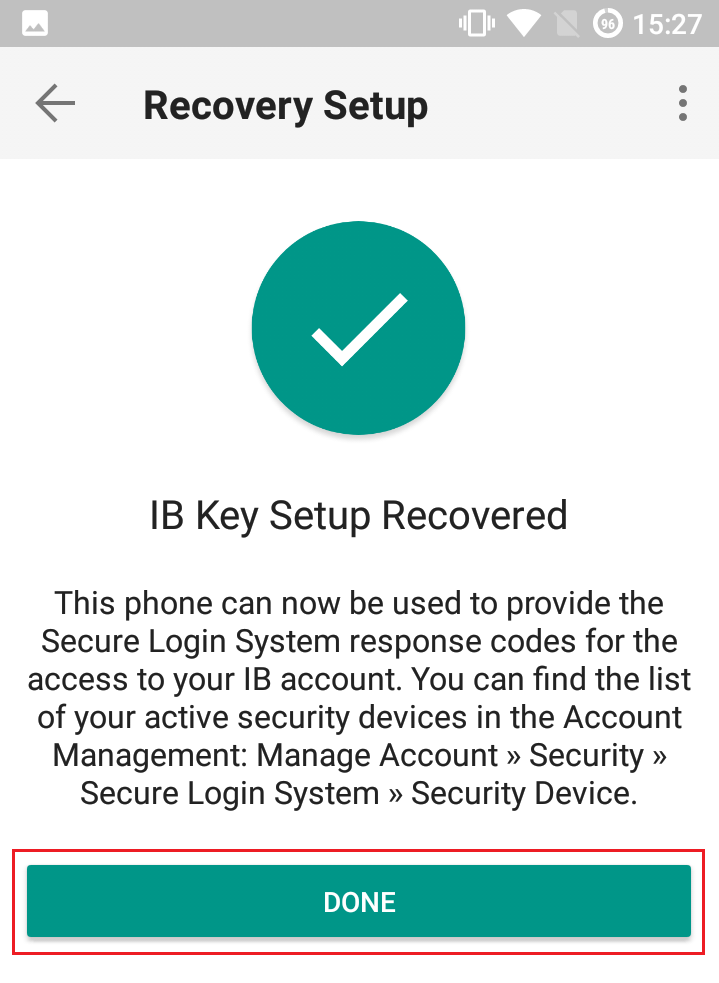

If the reactivation has been successfully completed, you will see a confirmation message. Tap Done to finalize the procedure

.png)

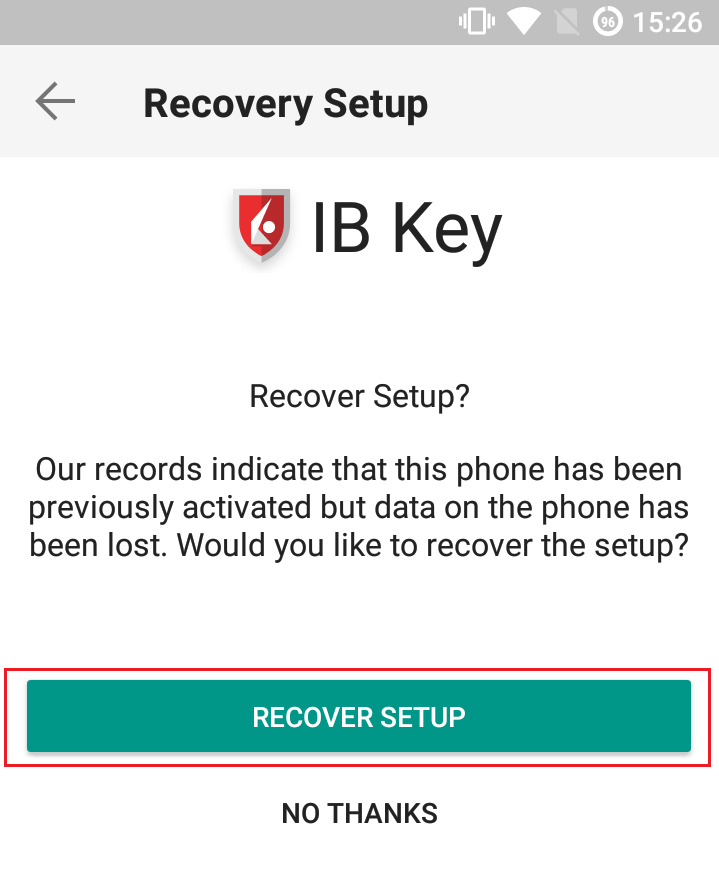

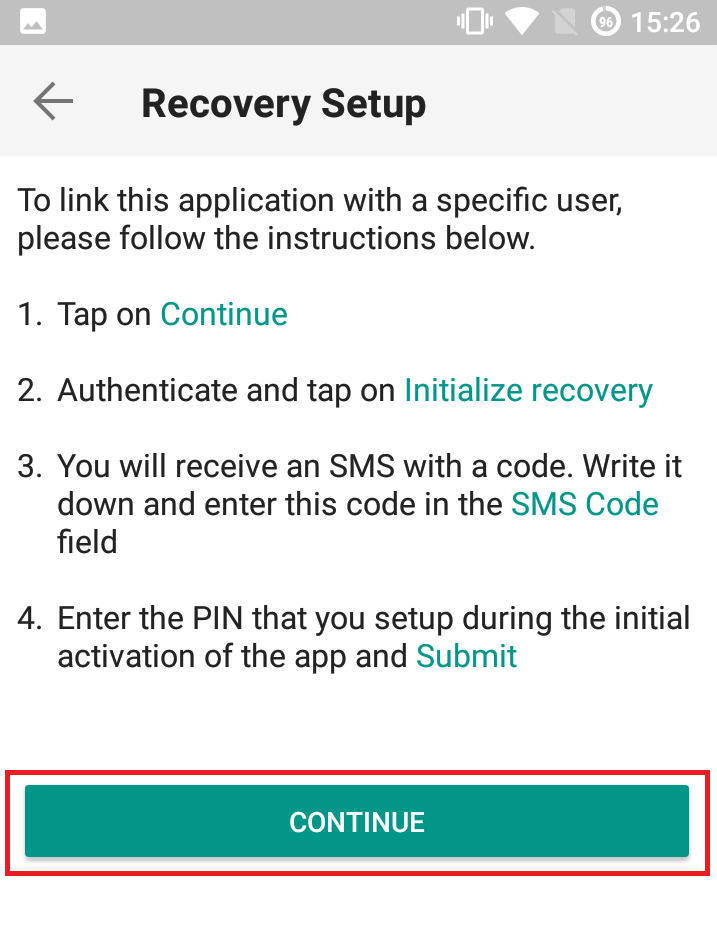

Android

-

Launch the IBKR Mobile app. Whenever possible, the app will ask you to recover the setup. Tap Recover Setup

-

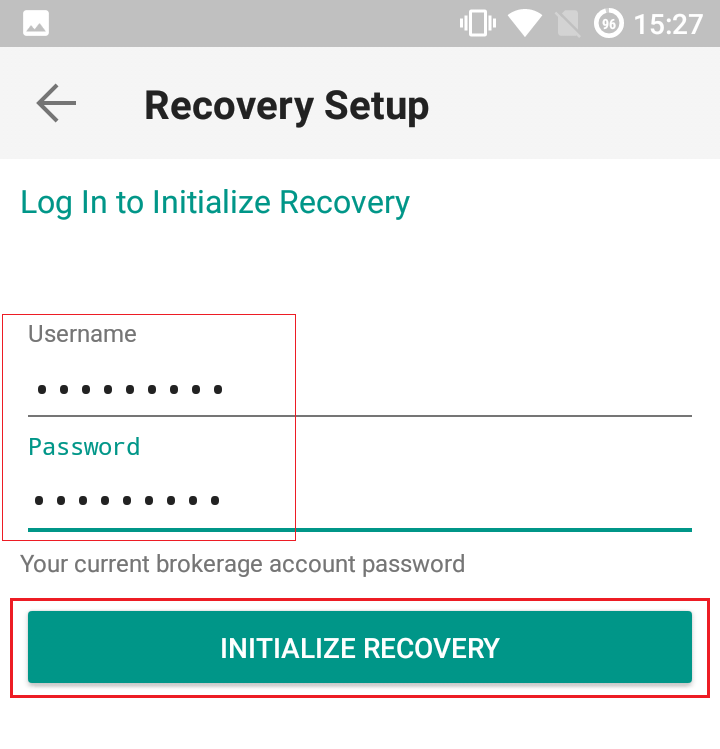

Review the Recovery directions and tap Continue

-

Enter your credentials and tap Initialize Recovery

-

You will receive an text message (SMS)containing an Activation Token. Enter it in the Activation Code field. According to your phone operating system and hardware capabilities, you might be prompted to provide as well the security element you originally used to secure the app (PIN, Fingerprint). Once done, tap Submit

.png)

-

If the reactivation has been successfully completed, you will see a confirmation message. Tap Done to finalize the procedure