Overview of MIFIR Transaction Reporting

Background

On 3 January 2018, a new Directive 2014/65/EC (“MiFID II”) and Regulation (EU) No 600/2014 (“MiFIR”) became effective, introducing significant changes to the transaction reporting (“MiFIR Transaction Reporting”) framework that was created in 2007 with the Markets in Financial Instrument Directive (“MiFID I”).

Interactive Brokers has implemented a new transaction reporting system that will enable clients that have direct reporting obligations under the new Regulation to comply with the new MiFIR requirements.

Scope of MiFIR Transaction Reporting Obligations

MiFIR Transaction Reporting applies to European Economic Area (“EEA”) and United Kingdom ("UK") Investment Firms ("Investment Firms") and also to Investment Firms that use a broker within the IB Group ("IB Group") to execute orders. As a client of an Investment Firm that uses the IB platform, you may be required to provide additional information to allow the proper transaction reports to be filed.

Investment Firms are obliged to report complete and accurate details of transactions executed in financial instruments covered by MiFIR to the relevant National Competent Authority (“NCA”) no later than the close of the next working day.

MiFIR has widened the scope of reportable financial instruments to cover those that are traded on EEA/UK Regulated Exchanges, Multilateral Trading Facilities (“MTFs”) and Organised Trading Facilities (“OTFs”). In addition to transactions executed on EEA/UK exchanges, MiFIR will capture Over the Counter (“OTC”) transactions and transactions of EEA/UK listed financial instruments that are executed on non-EEA/UK trading venues, e.g., a stock listed on the LSE traded on NYSE. (see financial instruments covered by MiFIR).

MiFIR Transaction Reporting Solutions for IB Clients that are EEA Investment Firms: Enriched and Delegated Transaction Reporting

IB clients that have confirmed that they are an Investment Firm subject to MiFIR transaction reporting obligations will be offered the option to delegate their reporting obligations to their relevant IB Broker.

Some transactions executed by these Investment Firms will be reported under “Enriched Reporting” obligations. For these trades the IB Broker will add details about the Investment Firm to its own reports, satisfying the reporting obligations of the Investment Firm. Other transactions will only be reported on behalf of Investment Firms on a delegated basis, as separate reports in addition to the IB Broker's own reports. Clients will only need to sign one agreement with their IB Broker to cover both types of reporting.

Information to Be Reported

The reporting fields increased from 23 under the MiFID I regime to 65 under MIFIR. The new information requirements now include, among other items:

- Detailed identification of the buyer and the seller for each transaction. In particular, the Regulation requires the provision of Legal Entity Identifiers (“LEI”) for legal entities and National Identifiers for natural persons (based on their countries of citizenship).

- Identification of the Decision Maker for the buyer and the seller when a third-party exercises discretion:

- A person other than the account holder on an individual or joint account, or a third-party entity.

- A third-party other than the authorised traders on the account for an organisation account (e.g. a Financial Advisor trading for its clients’ subaccounts).

This information is not required where the account holder is self-trading or where authorised traders are trading for their own organisation.

- Identification of the person or algorithm that is responsible at the reporting firm for making the investment decision or for the execution of a transaction. This information is required for EEA Investment Firms that use our reporting services.

- For Commodity Derivatives Transactions, an indication as to whether such Commodity Derivatives Transactions reduce risk in an objectively measurable way in accordance with Article 57 of MiFID II; This is applicable to organisation accounts only when the holder is a non-financial entity.

The new information affects Interactive Brokers clients in different ways depending on whether the client is an EEA Investment Firm, or an organisation/person that is not an Investment Firm, and also depending on whether the financial instruments being traded are received and/or transmitted by their IB Broker or another Interactive Brokers Group affiliate.

Implications for IB Clients that are not Subject to MiFIR Transaction Reporting Obligations

In order to meet its own reporting obligations, each IB Broker is obliged to identify and report its immediate client for each transaction executed. The reporting must contain the new client identifiers mandated by the Regulations.

Therefore, each IB Broker will need to obtain and report a client identifier for:

- The IB Broker's direct clients that hold an account to trade financial instruments received and/or transmitted by the IB Broker;

- Clients that are EEA Investment Firms and utilise the Interactive Brokers reporting services;

- Clients that are subaccounts of an EEA Investment Firm that uses the Interactive Brokers platform and utilises our reporting services.

See KB2976 for further details on the information required from account holders that are not directly subject to MiFIR.

Note: For a listing of common MiFIR definitions and terms, see KB2980

THIS INFORMATION IS GUIDANCE FOR INTERACTIVE BROKERS CLEARED CLIENTS ONLY. THIS GUIDANCE DOES NOT APPLY TO EXECUTION ONLY ACCOUNTS.

NOTE: THE INFORMATION ABOVE IS NOT INTENDED TO BE A COMPREHENSIVE OR EXHAUSTIVE GUIDANCE AND IT IS NOT A DEFINITIVE INTERPRETATION OF THE REGULATION, BUT A SUMMARY OF MiFIR TRANSACTION REPORTING OBLIGATIONS.

Common Reporting Standard (CRS)

The Common Reporting Standard (CRS), referred to as the Standard for Automatic Exchange of Financial Account Information (AEOI), calls on countries to obtain information from their financial institutions and exchange that information with other countries automatically on an annual basis. The CRS sets out the financial account information to be exchanged, the financial institutions required to report, the different types of accounts and taxpayers covered, as well as common due diligence procedures to be followed by financial institutions. For more information about CRS, please visit the OECD website.

Interactive Brokers entities comply with the requirements of CRS as implemented in the jurisdictions where they are located, and report account information to the applicable government authorities. Clients reported by Interactive Brokers under CRS will receive a CRS Client Report in the Client Portal shortly after the reporting deadlines specified below. The CRS Client Report provides an overview of the information that was reported by Interactive Brokers.

- What information is reported under CRS:

- Account number

- Name

- Address

- Tax ID Number

- Tax residency country

- Date of birth

- Year-end account balance

- Gross proceeds (all sales)

- Interest income

- Dividend income

- Other income

- When and where is the information reported:

- Interactive Brokers Australia Pty. Ltd. reports to the Australian Taxation Office (ATO) by July 31.

- Interactive Brokers Canada Inc. reports to the Canada Revenue Agency (CRA) by May 1.

- Interactive Brokers Central Europe Zrt. reports to the National Tax and Customs Administration of Hungary (NAV) by June 30.

- Interactive Brokers Hong Kong Limited reports to the Inland Revenue Department of Hong Kong SAR (IRD) by May 31.

- Interactive Brokers India Pvt. Ltd. reports to the Reserve Bank of India/Central Board of Direct Taxes (RBI/CBDT) by May 31.

- Interactive Brokers Ireland Limited reports to the Office of the Revenue Commissioners of Ireland by June 30.

- Interactive Brokers Securities Japan Inc. reports to the National Tax Agency of Japan (NTA) by April 30.

- Interactive Brokers Singapore Pte. Ltd. reports to the Inland Revenue Authority of Singapore (IRAS) by May 31.

- Interactive Brokers U.K. Limited reports to Her Majesty's Revenue and Customs of the United Kingdom (HMRC) by May 31.

- Additional Notes:

- Information relating to clients of Introducing Brokers is not reported by Interactive Brokers. Introducing Brokers are responsible for their own reporting under CRS.

- Accounts held by Interactive Brokers LLC are not reported under CRS as the United States has not signed the CRS.

SEC Tick Size Pilot Program

Background

Effective October 3, 2016, securities exchanges registered with the SEC will operate a Tick Size Pilot Program ("Pilot") intended to determine what impact, if any, widening of the minimum price change (i.e., tick size) will have on the trading, liquidity, and market quality of small cap stocks. The Pilot will last for 2 years and it will include approximately 1,200 securities having a market capitalization of $3 billion or less, average daily trading volume of 1 million shares or less, and a volume weighted average price of at least $2.00.

For purposes of the Pilot, these securities will be organized into groups that will determine a minimum tick size for both quote display and trading purposes. For example, Test Group 1 will consist of securities to be quoted in $0.05 increments and traded in $0.01 increments and Test Group 2 will include securities both quoted and traded in $0.05 increments. Test Group 3 will include also include securities both quoted and traded in $0.05 increments, but subject to Trade-at rules (more fully explained in the Rule). In addition, there will be a Control Group of securities that will continue to be quoted and traded in increments of $0.01. Details as to the Pilot and securities groupings are available on the FINRA website.

Impact to IB Account Holders

In order to comply with the SEC Rules associated with this Pilot, IB will change the way that it accepts orders in stocks included in the Pilot. Specifically, starting October 3, 2016 and in accordance with the phase-in schedule, IB will reject the following orders associated with Pilot Securities assigned to Test Groups:

- Limit orders having an explicit limit that is not entered in an increment of $0.05;

- Stop or Stop Limit orders having an explicit limit that is not entered in an increment of $0.05; and

- Orders having a price offset that is not entered in an increment of $0.05. Note that this does not apply to offsets which are percentage based and which therefore allow IB to calculate the permissible nickel increment

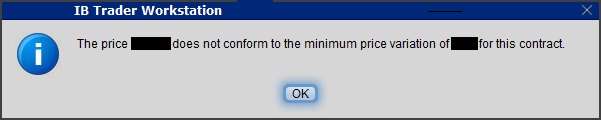

Clients submitting orders via the trading platform that are subject to rejection will receive the following pop-up message:

The following order types will continue to be accepted for Pilot Program Securities:

- Market orders;

- Benchmark orders having no impermissible offsets (e.g., VWAP, TVWAP);

- Pegged orders having no impermissible offsets ;

- Retail Price Improvement Orders routed to the NASDAQ-BX and NYSE as follows:

- Test Group 1 in .001

- Test Group 2 and 3 in .005

Other Items of Note

- GTC limit and stop orders entered prior to the start of the Pilot will be adjusted as allowed (e.g., a buy limit order at $5.01 will be adjusted to $5.00 and a sell limit at $5.01 adjusted to $5.05).

- Clients generating orders via third-party software (e.g., signal provider), order management system, computer to computer interfaces (CTCI) or through the API, should contact their vendor or review their systems to ensure that all systems recognize the Pilot restrictions.

- Incoming orders to IB that are marked with TSP exception codes from other Broker Dealers will not be acted upon by IB. For example, IB will not accept incoming orders marked with the Retail Investor Order or Trade-At ISO exception codes.

- The SEC order associated with this Pilot is available via the following link: https://www.sec.gov/rules/sro/nms/2015/34-74892-exa.pdf

- For a list of Pilot Program related FAQs, please see KB2750

Please note that the contents of this article are subject to revision as further regulatory guidance or changes to the Pilot Program are issued.

Amendment Requirements for SEC 13D and 13G Filers

Introduction

The following article is intended to provide an overview of U.S. Securities and Exchange Commission (“SEC”) Sections 13(d) and 13(g) Amendment Requirements. The overview is general in nature, and readers are encouraged to review the specific regulations and/or consult with a compliance professional to determine the applicability to their particular situation.

Amendment Requirements for 13D Filers

Rule 13d-2 of the Securities Exchange Act of 1934 (the "Act") requires you to promptly, within two business days, amend Schedule 13D whenever material changes in the information disclosed on a Schedule 13D occur. A material change includes any material increase or decrease in the percentage of the class of securities you are deemed to "beneficially own." For instance, if you manage more than 5% in the shares of an issuer and the percentage managed increases or decrease by more than 1% (whether through a transaction or other event), you must amend your 13D filing.

You must continue to make appropriate amendments so long as you continue to manage more than 5% of any class of an issuer's voting shares. If you fall below the 5% threshold, you must make one (final) amendment notifying the SEC of this.

There are also other circumstances that qualify as a material change requiring an amendment. For instance, if you acquire warrants that are not exercisable within 60 days, you may still need to amend Schedule 13D to revise your discussion of your plans concerning the acquisition of additional securities and related contracts, even if the amount of voting shares you manage has not yet changed.

Amendment Requirements for 13G Filers

Qualified institutional investors, including investment advisors registered with the SEC or a state, must amend their Schedule 13G within 10 days after the end of the first time their "beneficial ownership" exceeds 10% of the class of equity securities at month end.

After that, qualified institutional investors must amend their Schedule 13G within 10 days from when their "beneficial ownership" increases or decreases by more than 5% of the class of securities over the amount held at the previous month end.

Qualified institutional investors must also file a Schedule 13D within 10 calendar days after they cease being eligible to file a Schedule 13G rather than a Schedule 13D.

In addition, passive investors beneficially owning less than 20% of an equity security must amend their Schedule 13G promptly, within two business days, after acquiring beneficial ownership of more than 10% of the class of equity securities, and after that, within two business days of increasing or decreasing their ownership by more than 5%.

You must also file an annual amendment to the 13G if there have been any changes - immaterial or material - to your filed 13G. This must be done within 45 days of year end. You do not need to file an amendment if there have been no changes to the information filed or if the only change is to the percentage of securities owned resulting solely from a change in the number of shares outstanding.

Important Notes

· You should independently review your Schedule 13D and 13G filing obligations. There are many factual determinations that may impact whether you must make a filing or amend a prior filing, which Schedule you must file (or amend), and when you must make your filing.

· Interactive Brokers will provide you with notices, on a best efforts basis, only when you cross certain thresholds (5%, 10%, 20%) or a significant change in the percentage of shares you manage occurs. There may be other situations that give rise to the need to file or amend a Schedule 13D or Schedule 13G for which you will not receive an alert from Interactive Brokers.

· You should monitor holdings of specific classes of issuer equity securities in the accounts you manage to ensure compliance with your Schedule 13D or 13G filing and amendment obligations.

· Notices do not cover (nor will they take into account) certain securities not commonly traded through Interactive Brokers, namely equities in:

a. an insurance company that would have to be registered except for the exemption from registration in Section 12(g)(2)(G) of the Act;

b. a closed-end investment company registered under the Investment Company Act of 1940; or

c. a Native Corporation pursuant to Section 1639c(d)(6) of title 43.

You should therefore separately account for and analyze any holdings of such equity securities you may have to comply with Section 13(d) of the Act.

· Alerts sent are based exclusively on the beneficial ownership of relevant securities of the specific advisor identified. It does not account for any group aggregation rules that may apply when two or more persons agree to act together for the purpose of acquiring, holding, voting or disposing of the equity securities of an issuer.

· Alerts sent relate solely to holdings in accounts maintained at Interactive Brokers and not any accounts maintained elsewhere. But you should take any accounts you maintain elsewhere into consideration when determining whether you must file or amend a Schedule 13D or 13G and what information to include in those schedules.

· Alerts sent will not take into consideration your Schedule 13D or 13G filing obligations arising prior to the date of Interactive Broker's implementation of this alert program.

· The data we receive about US Micro-Cap securities—generally OTC listed stocks, as well as Nasdaq or NYSE American stocks with a market cap of less than $300MM that trade under $5 per share--from our data provider is not consistently reliable so we have removed those securities from this program. As a result, you will not receive Schedule 13D/13G alerts when you come close to crossing or cross thresholds triggering filing obligations regarding U.S. Micro-Cap securities. You should separately review your holdings in US Micro-Cap stocks to determine your related filing obligations for those holdings.

For Additional Information

For more information on Schedules 13D and 13G, please visit the SEC website at

http://www.sec.gov/answers/sched13.htm and

https://www.sec.gov/divisions/corpfin/guidance/reg13d-interp.htm

SEC Sections 13(d) and 13(g) Filing Requirements

Introduction

The following article is intended to provide an overview of U.S. Securities and Exchange Commission (“SEC”) Sections 13(d) and 13(g) Filing Requirements. The overview is general in nature, and readers are encouraged to review the specific regulations and/or consult with a compliance professional to determine the applicability to their particular situation.

Background on Schedules 13D and 13G

These rules apply to anyone who “beneficially owns” Section 12 securities as defined in the Securities Exchange Act of 1934 (the "Act"). This generally includes shares you own or manage. Specifically, you are deemed to “beneficially own” for purposes of Section 13(d) a security if you have, either directly or indirectly:

• The power to vote or direct the voting of a security;

• The power to dispose or direct the disposition of a security; or

• The right to acquire “beneficial ownership” of such security within 60 days through the exercise of an option or warrant or the exercise of a conversion right in a convertible security.

To determine whether you “beneficially own” more than 5% of a class of equity security, measure the amount you are deemed to “beneficially own” against the total amount of outstanding securities of that class. You may rely upon the issuer’s most recent quarterly or annual report (10-Q or 10-K) filed with the SEC and any current report (Form 8-K) filed later in identifying the amount of outstanding shares. You must include any equity securities you may obtain within 60 days through the conversion or exercise of options, warrants or other as outstanding shares in this calculation. But you do not need to include similar non-exercised or converted shares held by anyone else.

What filings you must make

Your initial Schedule 13D filing must be made within 10 days of the trade date on which you first exceeded the 5% threshold. Disclosures in Schedule 13D must be current through the date of filing.

Schedule 13D filings must also be promptly amended, within two business days, to reflect any material changes. This includes the acquisition or disposition of 1% or more of the reported securities or significant changes in any intent you may have to control the issuer.

Some traders may be able to file an abbreviated filing—called a 13G—instead of a 13D. This option is available to passive investors owning less than 20% of the security or exempt investors owning more than 5% of an issuer’s shares before the issuer’s registration of the class of securities. In addition, SEC or state-registered advisors can only file a Schedule 13G if they have acquired the relevant securities in the ordinary course of the firm’s advisory business and not for the purpose of or with the effect of influencing control of the issuer. Also, the advisor must have notified any discretionary account owner on whose behalf the advisor holds more than 5% of relevant equity securities of his potential reporting obligation. Very specific filing thresholds and deadlines apply to initial and amended Schedule 13G filings.

Important Notes

• Please keep in mind that your clients and your firm’s direct and indirect control persons (which may include partners, shareholders and parent companies) may have their own independent reporting obligations.

• You should independently review your Schedule 13D and 13G filing obligations. There are many factual determinations that may impact whether you must make a filing or amend a prior filing, which Schedule you must file (or amend), and when you must make your filing.

• Interactive Brokers will provide you, on a best efforts basis, with notices only when you cross certain thresholds (5%, 10%, 20%) or a significant change in the percentage of shares you manage occurs. There may be other situations that give rise to the need to file a Schedule 13D or 13G for which you will not receive an alert from Interactive Brokers.

• Interactive Brokers will only send you one initial filing alert for each threshold you cross. We will only resend you an initial filing alert if you cross one of the three thresholds (5%, 10% or 20%) that is higher than the threshold you have crossed before. (i.e., we will not tell you if you crossed the 5% threshold if you have already crossed the 10% threshold.) Therefore, please continually monitor your positions and make the appropriate filing(s) after you receive an initial filing or amendment notice.

• You should monitor holdings of specific classes of issuer equity securities in the accounts you manage to ensure compliance with your Schedule 13D or 13G filing and amendment obligations.

• Notices do not cover (nor will they take into account) certain securities not commonly traded through Interactive Brokers, namely equities in:

a. an insurance company that would have to be registered except for the exemption from registration in Section 12(g)(2)(G) of the Act;

b. a closed-end investment company registered under the Investment Company Act of 1940; or

c. a Native Corporation pursuant to Section 1639c(d)(6) of title 43.

You should therefore separately account for and analyze any holdings of such equity securities you may have to comply with Section 13(d) of the Act.

• Alerts sent are based exclusively on the beneficial ownership of relevant securities of the specific advisor identified. The alerts will not account for any group aggregation rules that may apply when two or more persons agree to act together for the purpose of acquiring, holding, voting or disposing of the equity securities of an issuer.

• Alerts sent relate solely to holdings in accounts maintained at Interactive Brokers and not any accounts maintained elsewhere. But you should take any accounts you maintain elsewhere into consideration when determining whether you must file or amend a Schedule 13D or 13G and what information to include in those schedules.

• Alerts sent will not take into consideration your Schedule 13D or 13G filing obligations arising prior to the date of Interactive Broker's implementation of this alert program.

• The data we receive about US Micro-Cap securities—generally OTC listed stocks, as well as Nasdaq or NYSE American stocks with a market cap of less than $300MM that trade under $5 per share--from our data provider is not consistently reliable so we have removed those securities from this program. As a result, you will not receive Schedule 13D/13G alerts when you come close to crossing or cross thresholds triggering filing obligations regarding U.S. Micro-Cap securities. You should separately review your holdings in US Micro-Cap stocks to determine your related filing obligations for those holdings.

For Additional Information

For more information on Schedules 13D and 13G, please visit the SEC website at:

http://www.sec.gov/answers/sched13.htm and

https://www.sec.gov/divisions/corpfin/guidance/reg13d-interp.htm

Schedule 13D and 13G Reporting by Certain Beneficial Owners of Voting Equity Securities

Form 13F Reporting by Institutional Investment Managers

Overview

Important Notes regarding Schedules 13D and 13G initial and amended filing alerts provided by Interactive Brokers

The following are important things that advisors trading through Interactive Brokers (“IBKR”) should keep in mind when reviewing any Schedule 13D and/or Schedule 13G filing alerts they receive from IBKR:

Important Notes regarding Form 13F filing alerts and reports provided by Interactive Brokers

The following are important things that advisors trading through Interactive Brokers (“IB”) should keep in mind when reviewing any Form 13 F-related alerts and reports they receive from IB:

Notice to Financial and Non-Financial Counterparties trading OTC products (e.g. CFDs) not cleared by Central Counterparties

European regulators, as part of EMIR, issued technical rules concerning Risk Mitigation Techniques for derivatives not cleared by a Central Counterparty (“CCP”), which detail how the regulators expect these products to be margined from 1st March 2017. In general customers trading products subject to these rules are required to exchange variation margin.

Interactive Brokers (U.K.) Ltd. (“IBUK”) provides Contracts for Difference (‘CFDs’) that fall under these rules, and is your counter party to these trades. IBUK wishes to inform you how IBUK provides information regarding variation margin and reconciliation arrangements. This does not represent a material change from our current practice.

Variation Margin – Applicable where you are classified as FC or NFC+

All financial counterparties (‘FC’) and larger non financial counterparties (‘NFC+’) are subject to the EMIR variation margin rules for OTC derivatives. Whether larger non financial counterparties are subject to the rules is determined by reference to whether their 30-day rolling average of the gross notional OTC derivative positions entered into for non-hedging purposes are above specified clearing thresholds (eg EUR1bn for equity derivatives). IBUK ensures variation margin is exchanged with its counterparties with respect to OTC derivative transactions not centrally cleared by CCP.

IBUK provides customers with timely confirmations of trades each day via two secure platforms: by displaying them on our Trader Work Station (“TWS”) and via the Trade Confirmations and Daily Activity Statements in Account Management. The marked-to-market value of your OTC derivative contracts are shown in your Daily Activity statement.

The variation margin rule requires that variation margin is calculated on a daily basis based on the values of all the outstanding derivatives contracts under the IBUK Client Agreement for Products Carried by IBUK (the “Agreement”) on the previous business day.

Where this marked-to-market value of your transactions reflects a credit exposure for IBUK, IBUK collects variation margin equal to the positive mark-to-market value of its OTC derivatives. The variation margin collection is achieved through reduction in the net equity value available, an offset and/or liquidation of positions in the posting account. You may refer to the supplemental information about margin and the Agreement on the IB UK website for further details. Where the marked-to-market value reflects a credit to you, IBUK will reflect this via an increase in your net

equity.

Whilst the variation margin rule requires that variation margin is calculated on a daily basis, IBUK further expects that clients monitor their accounts continuously, including intraday, so that at all times the account contains sufficient equity to meet margin requirement as calculated by IBUK.

Reconciliation

Activity Statements are provided on a daily, monthly and annual basis. Customers can download this information using a "flex query" tool (which is available in our "account management system) in CSV type format.

You may reconcile the OTC positions detailed on these Trade Confirmations and Activity Statements account against your own records. The regulations state that you should reconcile your positions, contract information, valuation(s) and profits and losses and any related information.

If you note any discrepancies, you can contact IBUK customer service. Contact information for Interactive Brokers customer service is available on the IB website at:

https://www.interactivebrokers.com/en/?f=customerService.

The process for resolving any dispute is discussed in your client agreement with us.

Please note that the rules also require customers of firms that carry portfolios on a gross basis to carry out portfolio compression with the firm but this is not relevant as IBUK maintains your OTC positions on a net basis.

The rules also detail how often particular types of customers need to conduct these

reconciliations:

If you are an FC or a an NFC+ the rules require you to conduct portfolio reconciliations at the following frequencies:

• Daily, whenever you have 500 or more open OTC contracts;

• Weekly, if you have between 51 and 499 OTC contracts open at any time during the week;

• Quarterly, if you have 50 or fewer contracts open at any time during the quarter.

If you are a non-financial counter party not meeting the criteria to be an NFC+ (ie “NFC-“) you are required under the rules to carry out portfolio reconciliations at least:

• Quarterly, if you have more than 100 open OTC contracts open at any time in the quarter;

• Annually, if you have 100 or fewer open contracts at any time in the year.

Please note that this communication is not intended to serve as legal advice.

Interactive Brokers (U.K.) Limited