Overview of IBKR issued Share CFDs

The following article is intended to provide a general introduction to share-based Contracts for Differences (CFDs) issued by IBKR.

For Information on IBKR Index CFDs click here. For Forex CFDs click here. For Precious Metals click here.

Topics covered are as follows:

I. CFD Definition

II. Comparison Between CFDs and Underlying Shares

III. CFD Tax and Margin Advantage

IV. US ETFs

V. CFD Resources

VI. Frequently Asked Questions

Risk Warning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

61% of retail investor accounts lose money when trading CFDs with IBKR.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

ESMA Rules for CFDs (Retail Clients of IBKRs European entities, including so-called F segments)

The European Securities and Markets Authority (ESMA) has enacted new CFD rules effective 1st August 2018.

The rules include: 1) leverage limits on the opening of a CFD position; 2) a margin close out rule on a per account basis; and 3) negative balance protection on a per account basis.

The ESMA Decision is only applicable to retail clients. Professional clients are unaffected.

Please refer to the following articles for more detail:

ESMA CFD Rules Implementation at IBKR (UK) and IBKR LLC

ESMA CFD Rules Implementation at IBIE and IBCE

I. Overview

IBKR CFDs are OTC contracts which deliver the return of the underlying stock, including dividends and corporate actions (read more about CFD corporate actions).

Said differently, it is an agreement between the buyer (you) and IBKR to exchange the difference in the current value of a share, and its value at a future time. If you hold a long position and the difference is positive, IBKR pays you. If it is negative, you pay IBKR.

Our Share CFDs offer Direct Market Access (DMA). Our Share CFD quotes are identical to the Smart-routed quotes for shares that you can observe in the Trader Workstation. Similar to shares, your non-marketable (i.e. limit) orders have the underlying hedge directly represented on the deep book of those exchanges at which it trades. This also means that you can place orders to buy the CFD at the underlying bid and sell at the offer.

To compare IBKR’s transparent CFD model to others available in the market please see our Overview of CFD Market Models.

We currently offer approximately 8500 Share CFDs covering the principal markets in the US, Europe and Asia. Eligible shares have minimum market capitalization of USD 500 million and median daily trading value of at least USD 600 thousand. Please see CFD Product Listings for more detail.

Most order types are available for CFDs, including auction orders and IBKR Algos.

CFDs on US share can also be traded during extended exchange hours and overnight. Other CFDs are traded during regular hours.

II. Comparison Between CFDs and Underlying Shares

| BENEFITS of IBKR CFDs | DRAWBACKS of IBKR CFDs |

|---|---|

| No stamp duty or financial transaction tax (UK, France, Belgium, Spain) | No ownership rights |

| Generally lower margin rates than shares* | Complex corporate actions may not always be exactly replicable |

| Tax treaty rates for dividends without need for reclaim | Taxation of gains may differ from shares (please consult your tax advisor) |

| Exemption from day trading rules | |

| US ETFs tradable as CFDs** |

*IB LLC and IB-UK accounts.

**EEA area clients cannot trade US ETFs directly, as they do not publish KIDs.

III. CFD Tax and Margin Advantage

Where stamp duty or financial transaction tax is applied, currently in the UK (0.5%), France (0.3%), Belgium (0.35%) and Spain (0.2%), it has a substantially detrimental impact on returns, particular in an active trading strategy. The taxes are levied on buy-trades, so each time you open a long, or close a short position, you will incur tax at the rates described above.

The amount of available leverage also significantly impacts returns. For European IBKR entities, margin requirements are risk-based for both stocks and CFDs, and therefore generally the same. IB-UK and IB LLC accounts however are subject to Reg T requirements, which limit available leverage to 2:1 for positions held overnight.

To illustrate, let's assume that you have 20,000 to invest and wish to leverage your investment fully. Let's also assume that you hold your positions overnight and that you trade in and out of positions 5 times in a month.

Let's finally assume that your strategy is successful and that you have earned a 5% return on your gross (fully leveraged) investment.

The table below shows the calculation in detail for a UK security. The calculations for France, Belgium and Spain are identical, except for the tax rates applied.

| UK CFD | UK Stock | UK Stock | |

|---|---|---|---|

| All Entities |

EU Account

|

IB LLC or IBUK Acct

|

|

| Tax Rate | 0% | 0.50% | 0.50% |

| Tax Basis | N/A | Buy Orders | Buy Orders |

| # of Round trips | 5 | 5 | 5 |

| Commission rate | 0.05% | 0.05% | 0.05% |

| Overnight Margin | 20% | 20% | 50% |

| Financing Rate | 1.508% | 1.508% | 1.508% |

| Days Held | 30 | 30 | 30 |

| Gross Rate of Return | 5% | 5% | 5% |

| Investment | 100,000 | 100,000 | 40,000 |

| Amount Financed | 100,000 | 80,000 | 20,000 |

| Own Capital | 20,000 | 20,000 | 20,000 |

| Tax on Purchase | 0.00 | 2,500.00 | 1,000.00 |

| Round-trip Commissions | 500.00 | 500.00 | 200.00 |

| Financing | 123.95 | 99.16 | 24.79 |

| Total Costs | 623.95 | 3099.16 | 1224.79 |

| Gross Return | 5,000 | 5,000 | 2,000 |

| Return after Costs | 4,376.05 | 1,900.84 | 775.21 |

| Difference | -57% | -82% |

The following table summarizes the reduction in return for a stock investment, by country where tax is applied, compared to a CFD investment, given the above assumptions.

| Stock Return vs cfD | Tax Rate | EU Account | IB LLC or IBUK Acct |

|---|---|---|---|

| UK | 0.50% | -57% | -82% |

| France | 0.30% | -34% | -73% |

| Belgium | 0.35% | -39% | -75% |

| Spain | 0.20% | -22% | -69% |

IV. US ETFs

EEA area residents who are retail investors must be provided with a key information document (KID) for all investment products. US ETF issuers do not generally provide KIDs, and US ETFs are therefore not available to EEA retail investors.

CFDs on such ETFs are permitted however, as they are derivatives for which KIDs are available.

Like for all share CFDs, the reference price for CFDs on ETFs is the exchange-quoted, SMART-routed price of the underlying ETF, ensuring economics that are identical to trading the underlying ETF.

V. Extended and Overnight Hours

US CFDs can be traded from 04:00 to 20:00EST, and the again overnight from 20:00 to 03:30 the following day. Trades in the overnight session are attributed to the day when the session ends, even if a trade is entered before midnight the previous day. This has implications for corporate actions and financing.

Trades entered before midnight on the day before ex-date will not have a dividend entitlement. Trades before midnight will settle as if they had been traded the following day, delaying the start of financing.

VI. CFD Resources

Below are some useful links with more detailed information on IBKR’s CFD offering:

The following video tutorial is also available:

How to Place a CFD Trade on the Trader Workstation

VII. Frequently Asked Questions

What Stocks are available as CFDs?

Large and Mid-Cap stocks in the US, Western Europe, Nordic and Japan. Liquid Small Cap stocks are also available in many markets. Please see CFD Product Listings for more detail. More countries will be added in the near future.

Do you have CFDs on other asset classes?

Yes. Please see IBKR Index CFDs - Facts and Q&A, Forex CFDs - Facts and Q&A and Metals CFDs - Facts and Q&A.

How do you determine your Share CFD quotes?

IBKR CFD quotes are identical to the Smart routed quotes for the underlying share. IBKR does not widen the spread or hold positions against you. To learn more please go to Overview of CFD Market Models.

Can I see my limit orders reflected on the exchange?

Yes. IBKR offers Direct market Access (DMA) whereby your non-marketable (i.e. limit) orders have the underlying hedges directly represented on the deep books of the exchanges on which they trade. This also means that you can place orders to buy the CFD at the underlying bid and sell at the offer. In addition, you may also receive price improvement if another client's order crosses yours at a better price than is available on public markets.

How do you determine margins for Share CFDs?

IBKR establishes risk-based margin requirements based on the historical volatility of each underlying share. The minimum margin is 10%, making CFDs more margin-efficient than trading the underlying share in many cases. Retail investors are subject to additional margin requirements mandated by the European regulators. There are no portfolio off-sets between individual CFD positions or between CFDs and exposures to the underlying share. Concentrated positions and very large positions may be subject to additional margin. Please refer to CFD Margin Requirements for more detail.

Are short Share CFDs subject to forced buy-in?

Yes. In the event the underlying stock becomes difficult or impossible to borrow, the holder of the short CFD position may become subject to buy-in.

How do you handle dividends and corporate actions?

IBKR will generally reflect the economic effect of the corporate action for CFD holders as if they had been holding the underlying security. Dividends are reflected as cash adjustments, while other actions may be reflected through either cash or position adjustments, or both. For example, where the corporate action results in a change of the number of shares (e.g. stock-split, reverse stock split), the number of CFDs will be adjusted accordingly. Where the action results in a new entity with listed shares, and IBKR decides to offer these as CFDs, then new long or short positions will be created in the appropriate amount. For an overview please CFD Corporate Actions.

*Please note that in some cases it may not be possible to accurately adjust the CFD for a complex corporate action such as some mergers. In these cases IBKR may terminate the CFD prior to the ex-date.

Can anyone trade IBKR CFDs?

All clients can trade IBKR CFDs, except residents of the USA, Canada, Hong Kong, New Zealand and Israel. There are no exemptions based on investor type to the residency based exclusions.

What do I need to do to start trading CFDs with IBKR?

You need to set up trading permission for CFDs in Client Portal, and agree to the relevant disclosures. If your account is with IBKR (UK) or with IBKR LLC, IBKR will then set up a new account segment (identified with your existing account number plus the suffix “F”). Once the set-up is confirmed you can begin to trade. You do not need to fund the F-account separately, funds will be automatically transferred to meet CFD initial margin requirements from your main account.

If your account is with another IBKR entity, only the permission is required; an additional account segment is not necessary.

Are there any market data requirements?

The market data for IBKR Share CFDs is the market data for the underlying shares. It is therefore necessary to have market data permissions for the relevant exchanges. If you already have market data permissions for an exchange for trading the shares, you do not need to do anything. If you want to trade CFDs on an exchange for which you do not currently have market data permissions, you can set up the permissions in the same way as you would if you planned to trade the underlying shares.

How are my CFD trades and positions reflected in my statements?

If you are a client of IBKR (U.K.) or IBKR LLC, your CFD positions are held in a separate account segment identified by your primary account number with the suffix “F”. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. You can make the choice in the statement window in Client Portal.

If you are a client of other IBKR entities, there is no separate segment. You can view your positions normally alongside your non-CFD positions.

Can I transfer in CFD positions from another broker?

IBKR does not facilitate the transfer of CFD positions at this time.

Are charts available for Share CFDs?

Yes.

In what type of IBKR accounts can I trade CFDs e.g., Individual, Friends and Family, Institutional, etc.?

All margin and cash accounts are eligible for CFD trading.

What are the maximum a positions I can have in a specific CFD?

There is no pre-set limit. Bear in mind however that very large positions may be subject to increased margin requirements. Please refer to CFD Margin Requirements for more detail.

Can I trade CFDs over the phone?

No. In exceptional cases we may agree to process closing orders over the phone, but never opening orders.

Cash Sweeps

These regulations further require that all securities transactions be effected and margined in the securities segment of the Universal account and commodities transactions in the commodities segment.1 While the regulations allow for the custody of fully-paid securities positions in the commodities segment as margin collateral, IB does not do so, thereby limiting their hypothecation to the more restrictive rules of the SEC. Given the regulations and policies which direct the decision to hold positions in one segment vs. the other, cash remains the only asset eligible to be transferred between the two and for which customer discretion is provided.

Outlined below is a discussion as to the cash sweep options offered, the process for selecting an option as well as selection considerations.

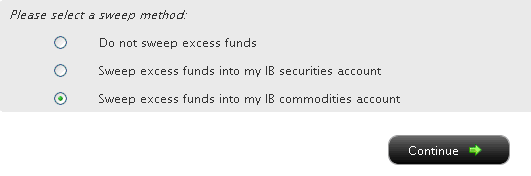

You may then select the radio button alongside the option of your choice and select the Continue button. Your choice will take effect as of the next business day and will remain in effect until a different option has been selected. Note that subject to the trading permission settings noted above, there is no restriction upon when or how often you may change your sweep method.

A Comparison of U.S. Segregation Models

Can I set a maximum dollar exposure for my account?

Unless an account holds solely long stock, bond, option or forex positions which have been paid for in full (i.e., no margin) and/or contains limited risk derivative positions such as option spreads, it is at risk of losing more than the original investment.

In the case of portfolios where the risk is indeterminable, there is no mechanism whereby the account holder can specify, at the portfolio level, a maximum dollar threshold of losses which, if reached, would limit their liability. IB does, however, provide a variety of tools and settings designed to assist account holders with managing and monitoring their exposure, including specialized order types, alerts and the Risk Navigator. A brief overview of each is provided below:

Order Types

Account holders may manage exposure on an individual trade level through several order types designed to limit risk. These order types include, but are not limited to: Stop, Adjustable Stop, Stop Limit, Trailing Stop and Trailing Stop Limit Orders. All of these order types allow you to specify an exit level for your individual positions based on your risk tolerance. For example, an account holder long 200 shares of hypothetical stock XYZ at an average price of $20.00 seeking to limit their loss to $500.00 could create a Stop Limit order having a Stop Price of $18.00 (the price at which a limit sell order is triggered) and a Limit Price of $17.50 (the lowest price at which the shares would be sold). It's important to note, however, that while a Stop Limit eliminates the price risk associated with a Stop order where the execution price is not guaranteed, it exposes the account holder to the risk that the order may never be filled even if the Stop Price is reached. For instructions on creating a Stop Limit order, click here.

Alerts

Alerts provide account holders the ability to specify events or conditions which, if met, trigger an action. The conditions can be based on time, trades that occur in the account, price levels, trade volume, or a margin cushion. For example, if the account holder wanted to be notified if their account was nearing a margin deficiency and forced liquidation, an alert could be set up to send an email if the margin cushion fell to some desired percentage, say 10% of equity. The action may consist of an email or text notification or the triggering of a risk reducing trade. For instructions on creating an Alert, click here.

Risk Navigator

The Risk Navigator is a real-time market risk management platform contained within the TraderWorkstation, which provides the account holder with the ability to create 'what-if' scenarios to measure exposure given user-defined changes to positions, prices, date and volatility variables which may impact their risk profile. For information on using an Risk Navigator, click here.

India Intra-Day Shorting Risk Disclosure

Interactive Brokers currently offers the ability to short sell stocks before taking delivery on an intra-day basis. In accordance with IB’s intra-day shorting rules, traders are required to deliver shares sold or close short stock positions prior to the end of the trading session.

Should traders establish a short stock position intra-day and still hold the position ten minutes prior to the end of the trading session at 15:20 IST, Interactive Brokers may, on a best efforts basis, close the position on your behalf. If the position is not closed by the end of the day and the shares are not delivered by the customer before settlement, the loss on account of auction will be borne by the customer. Please note that prices in the auction market are highly variable and typically not favorable compared to the normal market.

It is important to note, IB will not take into consideration any closing orders for short stock positions placed by the customer which may still be working. If your account holds a short position ten minutes prior to the end of the trading session and you have placed working orders to close those positions, there is the possibility your closing order will execute and that IB will act to close out your short position. In this situation you will be responsible for both executions and will need to manage your long position accordingly.

A fee of INR 2,000 will be charged for this manual processing in addition to any external penalties in the case of short stock positions resulting in auction trades. As such, we strongly urge customers to monitor their positions and take appropriate action themselves in order to avoid this.

Key Margin Definitions

Below is a listing of some of the more commonly used margin terms:

Equity with Loan Value (ELV) – Forms the basis for determining whether a client has the necessary assets to either initiate or maintain security positions. Equals cash + stock value + bond value + mutual fund value + European and Asian options value (excludes market value U.S. securities & futures options and cash maintained in futures segment).

Currency Conversion for Trading Products in a Non-Base Currency

How to convert a currency if you wish to trade products in a currency other than the currency your account was initially funded in

For additional information on currency conversions please refer to the Knowledge base articles:

Why Are There Two Currencies Shown When Trading Forex and How Do They Work?

What Happens if I Trade a Product Denominated in a Currency Which I Do Not Hold in My Account?

Margin oversight for U.S. listed securities & commodities products

The particular regulation which determines the minimum amount of margin collateral that each broker is required to collect from clients transacting in U.S. exchange listed products generally depends upon the following 3 factors:

1. Product Classification - the principal determinant of regulatory oversight is based upon whether the product is classified as a security or commodity. Security products, including stocks, bonds, options and mutual funds are regulated by the Securities and Exchange Commission (SEC). Commodity products, which include futures contracts and options on futures contracts, are regulated by the Commodities Futures Trading Commission (CFTC). Single stock futures, a special class of futures contracts, are considered a hybrid product subject to joint regulation by the SEC and CFTC.

In the case of security products, the US central bank referred to as the Federal Reserve (FRB) holds responsibility for regulating the extension of credit by brokers and dealers. This is accomplished through Regulation T, or Reg T as it is commonly referred, which provides for establishment of a margin account and which imposes the initial margin requirement and payment rules on certain securities transactions. For example, on stock purchases, Reg T currently requires an initial margin deposit by the client equal to of 50% of the purchase value, allowing the broker to extend credit or finance the remaining 50%. Reg T does not establish margin requirements for securities options which fall under the jurisdiction of exchange rules (subject to SEC approval). In addition, the FRB has excluded from Reg T the authority to establish either initial or maintenance margin requirements on securities positions held in a portfolio margining account. here margin authority resides with the security exchanges whose rules are subject to SEC approval.

The authority for establishing margin rates on commodity products resides with the listing exchanges, with the exception of broad based stock index futures, for which the FRB has delegated authority to the CFTC.

In the case of single stock futures, margin is set by the listing exchange and subject to SEC approval to the extent the position is carried in a securities account, and subject to an agreement that the margin be equivalent whether held in a securities or commodities account. Margin for single stock futures are currently set at 20% of the underlying stock value.

2. Initial or Maintenance - initial margin generally refers to the amount of money or its equivalent that the customer must deposit in order to initiate the position and maintenance margin the amount of equity which must be maintained in order to continue holding the position. As noted above, Reg T controls the initial margin requirement on securities transactions. The rules of the listing exchanges specify the maintenance margin requirements on security transactions subject to SEC approval. The maintenance margin requirement for long stock positions is currently set at 25% although brokers often establish 'house margin' requirements in excess of that, particularly where the security is considered low-priced or subject to volatile price changes.

Commodities exchanges establish both the initial and maintenance margin requirements for products which they list (subject to provisions for broad based index futures and single stock futures as noted above).

3. Listing Exchange - as noted above, in the case of US securities products the listing exchange has the authority to establish rules for the maintenance margin requirement on positions held in a Reg T margin account and initial and maintenance margin (currently the same) for positions held in a portfolio margin account. Exchange margin rules, however, require prior SEC approval which acts to ensure that margin requirements are set in a consistent manner across exchanges.

Subject to the provisions noted above, commodities exchanges maintain authority to establish both initial and maintenance margin requirements. As a general rule, US commodities exchanges employ the same risk-based margining methodology referred to as SPAN for determining the margin requirement on listed positions with each exchange specifying the relevant SPAN input factors (e.g., Price Scan Range, Volatility Scan Range, Spread Charges, Combined Commodity offsets).

Margin Requirement on Leveraged ETF Products

Leveraged Exchange Traded Funds (ETFs) are a subset of general ETFs and are intended to generate performance in multiples of that of the underlying index or benchmark (e.g. 200%, 300% or greater). In addition, some of these ETFs seek to generate performance which is not only a multiple of, but also the inverse of the underlying index or benchmark (e.g., a short ETF). To accomplish this, these leveraged funds typically include among their holdings derivative instruments such as options, futures or swaps which are intended to provide the desired leverage and/or inverse performance.

Exchange margin rules seek to recognize the additional leverage and risk associated with these instruments by establishing a margin rate which is commensurate with that level of leverage (but not to exceed 100% of the ETF value). Thus, for example, whereas the base strategy-based maintenance margin requirement for a non-leveraged long ETF is set at 25% and a short non-leveraged ETF at 30%, examples of the maintenance margin change for leveraged ETFs are as follows:

1. Long an ETF having a 200% leverage factor: 50% (= 2 x 25%)

2. Short an ETF having a 300% leverage factor: 90% (= 3 x 30%)

A similar scaling in margin is also in effect for options. For example, the Reg. T maintenance margin requirement for a non-leveraged, short broad based ETF index option is 100% of the option premium plus 15% of the ETF market value, less any out-of-the-money amount (to a minimum of 10% of ETF market value in the case of calls and 10% of the option strike price in the case of puts). In the case where the option underlying is a leveraged ETF, however, the 15% rate is increased by the leverage factor of the ETF.

In the case of portfolio margin accounts, the effect is similar, with the scan ranges by which the leveraged ETF positions are stress tested increasing by the ETF leverage factor. See NASD Rule 2520 and NYSE Rule 431 for further details.

Special risk relating to offsets between options and futures

Account holders hedging or offsetting the risk of futures contracts with option contracts are encouraged to pay particular attention to a potential scenario whereby a change in the underlying price may subject the account to a forced liquidation even if the account remains in margin compliance. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs. options contracts coupled with IB's requirement that the commodity segment of one's account maintain a positive cash balance at all times.

Gains and losses in a futures contract, by design, are settled in cash and IB updates the account holder's cash balance through the TWS on a real-time basis for any changes in the futures contract price. An option contract is also marked-to-the-market on a real-time basis but this change in value represents an unrealized (i.e., non-cash) profit or loss with the actual cash proceeds not reflected in the account until such time the contract is either sold, exercised or expires.

To illustrate this scenario, assume, for example, at time 'X' a hypothetical portfolio consisting of a credit cash balance of $6,850, 2 short Sep ES futures contracts, 2 Long Sep ES $1,000 strike call options on the futures contract marked at $31.50 each, with the cash index at $1,006. Also assume that at time 'X+1' the cash index increases by 100 points or approximately 10%. A snapshot of the account equity and margin balances for each date is reflected in the table below.

| Portfolio | Time 'X' | Time 'X+1' | Change |

| Cash | $6,850 | ($3,150) | ($10,000) |

| 2 Long Sep ES $1,000 Calls* | $3,150 | $10,300 | $7,150 |

| 2 Short Sep ES Futures* | - | - | - |

| Total Equity | $10,000 | $7,150 | ($2,850) |

| Margin Requirement | $2,712 | $666 | ($2,046) |

| Margin Excess | $7,288 | $6,484 | ($804) |

*Note: the contract multiplier for the ES future and option is 50.

As reflected in the table above, the projected effect of this market move would be to decrease the cash balance to a deficit level based upon the mark-to-market or variation on the futures contracts of $10,000 (100 * 50 * 2). While the effect of this upon equity would be largely offset by a $7,150 increase in the market value of the long calls, the unrealized gain on the options has no effect upon cash until such time they are either sold, exercised or expire. In this instance, IB would act to liquidate positions in an amount sufficient to eliminate the cash deficit while maintaining margin compliance and attempting to preserve the greatest level of account equity.

While hypothetical in nature, this sample portfolio is intended to be illustrative of the liquidity risk associated with any portfolio containing futures and long options where the funding of any variation on the futures position must be supported by available cash or buying power from the securities segment of the account and not unrealized option gains.

Mutual Offset System

A special arrangement between CME Group and the Singapore Exchange (SGX), referred to as the Mutual Offset System (MOS), allows traders of both the Yen and USD denominated Nikkei 225 futures to take positions in the products at one exchange and offset them at the other one. The effect of this arrangement is to create one marketplace crossing different time zones as well as fungibility of contracts between the exchanges.

IBKR account holders may avail themselves of the MOS functionality by specifying at the point of trade entry both the proper underlying symbol and exchange. In the case of the Yen Denominated Nikkei 225 Index contract the IB underlying symbol is 'NIY' and the exchange either 'CME' (for contracts listed at and trading during CME hours) or 'SGXCME' (for contracts listed at and trading during SGX hours). In the case of the USD Denominated Nikkei 225 Index contract the IB underlying symbol is 'NKD' and the exchange either 'CME' (for contracts listed at the CME) or 'SGXCME' (for contracts listed at the SGX).

To illustrate the concept of fungibility, were an account holder to enter into a long futures position on the CME exchange and thereafter enter into a short futures position having the same underlying symbol and expiration date but listed on the SGXCME exchange, the effect would be the same as if that short position was executed on the CME exchange and that is to close the long position.

MOS also provides margin offset for positions entered into on either of the two exchanges in the manner noted above. Here, for example, a long futures position entered into from the CME exchange would be afforded spread margin treatment against a short position having the same underlying but a different expiration month which was entered into from the the SGXCME exchange. This effect is intended to be similar to that which would take place if both the long and short position were entered into from the same exchange.

IMPORTANT NOTE

IBKR also offers trading in the identical SGX-listed futures contracts but without the MOS features of fungibility and margin offset as outlined above. In the case of the Yen Denominated Nikkei 225 Index, the contract having the underlying symbol 'SGXNK' and exchange of SGX is the functional equivalent of the 'NIY' contract having the exchange of SGXCME. Similarly, in the case of the USD Denominated Nikkei 225 Index, the contract having the underlying symbol 'N225U' and exchange of SGX is the functional equivalent of the 'NKD' contract having the exchange of SGXCME. It should be noted, however, that a long (short) position of a given expiration entered into on SGX exchange will not close out a short (long) position entered into on the SGXCME, or the CME for that matter. In addition, there is no margin offset provided between SGX-listed and SGXCME or CME contracts.

A table of trading hours for the MOS eligible products is provided below:

| Symbol | Description | Exchange | Trading Hours (ET)* |

| NIY | Yen Denominated Nikkei 225 Index | CME |

Mon-Fri 16:30 - 16:15 the next day (closing at 15:15 Friday); Daily maintenance shutdown 17:30 - 18:00 |

| NIY | Yen Denominated Nikkei 225 Index | SGXCME | Mon - Fri 18:30 - 01:30 |

| NKD | USD Denominated Nikkei 225 Index | CME | Mon-Fri 03:00 - 16:15; 16:30 - 17:30 & 18:00 - 19:00 |

| NKD | USD Denominated Nikkei 225 Index | SGXCME | Mon - Fri 02:15 - 09:55 & 18:30 - 01:30 |

*Please refer to the respective websites of each exchange for adjustments which take place during periods when US Daylight Savings Time is in effect.