Concentrated Positions in Low Cap Stocks

The margin requirement for accounts holding concentrated positions in low cap stocks is as follows:

- An alternative stress test will be considered following the margin calculation currently in place. Here, each stock and its derivatives will be subject to a stress test which simulates a price change reflective of a $500 million decrease in capitalization (e.g., 25% in the case of a stock with a market capitalization of $2 billion; 30% for a stock with a market capitalization of $1.5 billion; etc.). Stocks with a market capitalization of $500 million or below will be subject to a stress test as if the price has fallen to $0.

- For the stock which projects the greatest loss assuming a $500 million decrease in capitalization, that loss will be compared to the initial margin as determined under the preceding calculation for the aggregate portfolio and, if greater, will become the initial margin requirement.

- If the initial margin requirement is increased, the maintenance margin for that same stock and its derivatives will increase to approximately 90% of the initial requirement for the aggregate portfolio.

ESMA差价合约新规推行概述 - 仅限零售客户

|

差价合约属于复杂金融产品,其交易存在高风险,由于杠杆的作用,可能会出现迅速亏损。

在通过IBKR交易差价合约时,有63.7%的零售投资者账户出现了亏损。

您应考虑自己是否理解差价合约的运作机制以及自己是否能够承受亏损风险。 |

欧洲证券与市场管理局(ESMA)颁布了适用于交易差价合约(CFD)的零售客户的新法规,自2018年8月1日起生效。专业客户不受影响。

法规包含:1) 杠杆限制;2) 以单个账户为单位的保证金平仓规则;3) 以单个账户为单位的负余额保护规则;4) 对交易差价合约激励措施的限制;以及 5) 标准的风险警告。

大多数客户(受监管的实体除外)一开始都会被分类为零售客户。某些情况下,IBKR可能会同意将零售客户重新分类为专业客户或将专业客户重新分类为零售客户。更多详细信息,请参见MiFID分类。

以下板块详细说明了IBKR(英国)是如何贯彻ESMA规定的。

1 杠杆限制

1.1 ESMA保证金

ESMA针对不同的底层证券设置了不同的杠杆限制:

- 货币对为3.33%;主要货币对为美元、加元、欧元、英镑、瑞郎、日元间的任意组合

- 非主要货币对及主要指数为5%;

- 非主要货币对为包括上方未列出的货币的任意组合,如美元/离岸人民币

- 主要指数为IBUS500、IBUS30、IBUST100、IBGB100、IBDE40、IBEU50、IBFR40、IBJP225、IBAU200

- 非主要股票指数为10%,包括IBES35、IBCH20、IBNL25、IBHK50

- 个股为20%

1.2应用的保证金 - 标准保证金要求

除ESMA的保证金要求外,IBKR(英国)还基于底层证券的历史波动率及其它因素实施其自有的保证金要求(IB保证金) 如果IB的保证金率高于ESMA规定的比例,则应用IB的保证金率。

点此可查看适用的IB和ESMA保证金要求详情。

1.2.1应用的保证金 - 最低集中保证金要求

如果您的投资组合包含一小部分CFD头寸,或者如果最大的两种头寸占据了绝大多数份额,则您的账户将应用集中保证金。我们会通过对最大的两种头寸假设30%的跌幅、对其余头寸假设5%的跌幅来对您的投资组合进行压力测试。如果总亏损额高于标准要求,则将用总亏损额作为维持保证金要求。

1.3可用于初始保证金的资金

您只可使用现金作为初始保证金开立差价合约头寸。已实现的差价合约盈利将包括在现金中且立即可用;现金无需先结算。然而,未实现的盈利不得用于满足初始保证金要求。

1.4自动转移资金以满足初始保证金要求(账户F账户段)

IBKR(英国)会自动将您主账户中的资金转移至账户的F账户段,用于满足差价合约的初始保证金要求。

然而,需注意的是,系统不会转移资金用于满足差价合约维持保证金要求。因此,如符合条件的资产(参照下方定义)不足以满足保证金要求,则即使您的主账户中有足够的资金,账户仍会被清算。如您想避免被清算,您必须在账户管理中将多余的资金转移至账户的F账户段。

2 保证金平仓规则

2.1维持保证金计算与清算

如果符合条件的资产跌至开仓初始保证金的50%以下,ESMA要求IBKR最后清算差价合约仓位。如果我们的风险观更为保守,IBKR可能会更早平仓仓位。符合条件的资产包括F账户段下的现金(不包括账户任何其它账户段下的现金)及未实现的差价合约盈亏(盈利及亏损)。

计算的基础为开立差价合约头寸时存入的初始保证金。 换言之,当差价合约头寸的价值发生变动时,初始保证金的金额不会变化,这与非差价合约头寸适用的保证金计算方式不同。

2.1.1举例

您的差价合约账户中有2000欧元现金。您想以100欧元的限价买入100份XYZ的差价合约。首先成交了50份合约,然后再成交其余的50份。随着您的交易成交,您的可用现金如下减少:

| 现金 | 净资产* | 头寸 | 价格 | 价值 | 未实现盈亏 | 初始保证金 | 维持保证金 | 可用现金 | 维持保证金不足 | |

| 交易前 | 2000 | 2000 | 2000 | |||||||

| 第一次交易后 | 2000 | 2000 | 50 | 100 | 5000 | 0 | 1000 | 500 | 1000 | 否 |

| 第二次交易后 | 2000 | 2000 | 100 | 100 | 10000 | 0 | 2000 | 1000 | 0 | 否 |

*净资产等于现金加未实现盈亏

价格上涨至110。您的净资产现为3000,但由于您的可用现金仍为0,且在ESMA规则下初始保证金和维持保证金不变,您不得开立新的头寸:

| 现金 | 股票 | 头寸 | 价格 | 价值 | 未实现盈亏 | 初始保证金 | 维持保证金 | 可用现金 | 维持保证金不足 | |

| 变化 | 2000 | 3000 | 100 | 110 | 11000 | 1000 | 2000 | 1000 | 0 | 否 |

然后价格下跌至95。您的净资产跌至1500,但鉴于净资产仍大于1000,无需追加保证金:

| 现金 | 股票 | 头寸 | 价格 | 价值 | 未实现盈亏 | 初始保证金 | 维持保证金 | 可用现金 | 维持保证金不足 | |

| 变化 | 2000 | 1500 | 100 | 95 | 9500 | (500) | 2000 | 1000 | 0 | 否 |

价格进一步跌至85,导致保证金不足并触发清算:

| 现金 | 股票 | 头寸 | 价格 | 价值 | 未实现盈亏 | 初始保证金 | 维持保证金 | 可用现金 | 维持保证金不足 | |

| 变化 | 2000 | 500 | 100 | 85 | 8500 | (1500) | 2000 | 1000 | 0 | 是 |

3 负资产保护

ESMA规则规定,您交易差价合约的损失以划拨的专项资金为上限。不得清算其它金融产品(如股票或期货)来填补差价合约的保证金缺口。*

因此,您主账户证券和大宗商品账户段的资产,以及F账户段中持有的非差价合约资产不列入差价合约交易的风险资本。但是,F账户段中的所有现金都可用以弥补差价合约交易产生的亏损。

由于负资产保护对IBKR来说意味着要承担额外风险,对于隔夜持有的差价合约头寸我们会向零售客户额外收取1%的融资息差。您可在此处查看详细的差价合约融资利率。

*我们无法清算非差价合约头寸来弥补差价合约不足,但可以清算差价合约头寸来弥补非差价合约不足。

4 交易差价合约的激励措施

ESMA规定对与差价合约交易相关的金钱及某些非金钱激励均予以禁止。IBKR不对交易差价合约提供任何奖金或其它激励。

Overview of ESMA CFD Rules Implementation at IBKR (UK) - Retail Investors Only

|

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

61% of retail investor accounts lose money when trading CFDs with IBKR.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. |

The European Securities and Markets Authority (ESMA) enacted new rules applicable to retail clients trading CFDs, effective 1st August 2018. Professional clients are unaffected.

The rules consist of: 1) leverage limits; 2) a margin close out rule on a per account basis; 3) negative balance protection on a per account basis; 4) a restriction on the incentives offered to trade CFDs; and 5) a standardized risk warning.

Most clients (excepting regulated entities) are initially categorised as Retail Clients. IBKR may in certain circumstances agree to reclassify a Retail Client as a Professional Client, or a Professional Client as a Retail Client. Please see MiFID Categorisation for further detail.

The following sections detail how IBKR (UK) has implemented the ESMA Decision.

1 Leverage Limits

1.1 ESMA Margins

Leverage limits were set by ESMA at different levels depending on the underlying:

- 3.33% for major currency pairs; Major currency pairs are any combination of USD; CAD; EUR; GBP; CHF; JPY

- 5% for non-major currency pairs and major indices;

- Non-major currency pairs are any combination that includes a currency not listed above, e.g. USD.CNH

- Major indices are IBUS500; IBUS30; IBUST100; IBGB100; IBDE40; IBEU50; IBFR40; IBJP225; IBAU200

- 10% for non-major equity indices; IBES35; IBCH20; IBNL25; IBHK50

- 20% for individual equities

1.2 Applied Margins - Standard Requirement

In addition to the ESMA Margins, IBKR (UK) establishes its own margin requirements (IB Margins) based on the historical volatility of the underlying, and other factors. We will apply the IB Margins if they are higher than those prescribed by ESMA.

Details of applicable IB and ESMA margins can be found here.

1.2.1 Applied Margins - Concentration Minimum

A concentration charge is applied if your portfolio consists of a small number of CFD positions, or if the three largest positions have a dominant weight. We stress the portfolio by applying a 30% adverse move on the three largest positions and a 5% adverse move on the remaining positions. The total loss is applied as the maintenance margin requirement if it is greater than the standard requirement.

1.3 Funds Available for Initial Margin

You can only use cash to post initial margin to open a CFD position. Realized CFD profits are included in cash and are available immediately; the cash does not have to settle first. Unrealized profits however cannot be used to meet initial margin requirements.

1.4 Automatic Funding of Initial Margin Requirements (F-segments)

IBKR (UK) automatically transfers funds from your main account to the F-segment of your account to fund initial margin requirements for CFDs.

Note however that no transfers are made to satisfy CFD maintenance margin requirements. Therefore if qualifying equity (defined below) becomes insufficient to meet margin requirements, a liquidation will occur even if you have ample funds in your main account. If you wish to avoid a liquidation you must transfer additional funds to the F-segment in Account Management.

2 Margin Close Out Rule

2.1 Maintenance Margin Calculations & Liquidations

ESMA requires IBKR to liquidate CFD positions latest when qualifying equity falls below 50% of the initial margin posted to open the positions. IBKR may close out positions sooner if our risk view is more conservative. Qualifying equity for this purpose includes cash in the F-segment (excluding cash in any other account segment) and unrealized CFD P&L (positive and negative).

The basis for the calculation is the initial margin posted at the time of opening a CFD position. In other words, and unlike margin calculations applicable to non-CFD positions, the initial margin amount does not change when the value of the open position changes.

2.1.1 Example

You have EUR 2000 cash in your CFD account. You want to buy 100 CFDs of XYZ at a limit price of EUR 100. You are first filled 50 CFDs and then the remaining 50. Your available cash reduces as your trades are filled:

| Cash | Equity* | Position | Price | Value | Unrealized P&L | IM | MM | Available Cash | MM Violation | |

| Pre Trade | 2000 | 2000 | 2000 | |||||||

| Post Trade 1 | 2000 | 2000 | 50 | 100 | 5000 | 0 | 1000 | 500 | 1000 | No |

| Post Trade 2 | 2000 | 2000 | 100 | 100 | 10000 | 0 | 2000 | 1000 | 0 | No |

*Equity equals Cash plus Unrealized P&L

The price increases to 110. Your equity is now 3000, but you cannot open additional positions because your available cash is still 0, and under the ESMA rules IM and MM remain unchanged:

| Cash | Equity | Position | Price | Value | Unrealized P&L | IM | MM | Available Cash | MM Violation | |

| Change | 2000 | 3000 | 100 | 110 | 11000 | 1000 | 2000 | 1000 | 0 | No |

The price then drops to 95. Your equity declines to 1500 but there is no margin violation since it is still greater than the 1000 requirement:

| Cash | Equity | Position | Price | Value | Unrealized P&L | IM | MM | Available Cash | MM Violation | |

| Change | 2000 | 1500 | 100 | 95 | 9500 | (500) | 2000 | 1000 | 0 | No |

The price falls further to 85, causing a margin violation and triggering a liquidation:

| Cash | Equity | Position | Price | Value | Unrealized P&L | IM | MM | Available Cash | MM Violation | |

| Change | 2000 | 500 | 100 | 85 | 8500 | (1500) | 2000 | 1000 | 0 | Yes |

3 Negative Equity Protection

The ESMA Decision limits your CFD-related liability to the funds dedicated to CFD-trading. Other financial instruments (e.g. shares or futures) cannot be liquidated to satisfy a CFD margin-deficit.*

Therefore assets in the security and commodity segments of your main account, and non-CFD assets held in the F-segment, are not part of your capital at risk for CFD trading. However, all cash in the F-segment can be used to cover losses arising from CFD trading.

As Negative Equity Protection represents additional risk to IBKR, we will charge retail investors an additional financing spread of 1% for CFD positions held overnight. You can find detailed CFD financing rates here.

*Although we cannot liquidate non-CFD positions to cover a CFD deficit, we can liquidate CFD positions to cover a non-CFD deficit.

4 Incentives Offered to trade CFDs

The ESMA Decision imposes a ban on monetary and certain types of non-monetary benefits related to CFD trading. IBKR does not offer any bonus or other incentives to trade CFDs.

Risk Navigator: Alternative Margin Calculator

IB routinely reviews margin levels and will implement changes which serve to increase requirements above statutory minimums as market conditions warrant. To assist clients with understanding the effects of such changes on their portfolio, a feature referred to as the "Alternative Margin Calculator" is provided within the Risk Navigator application. Outlined below are the steps for creating a “what-if” portfolio for the purpose of determining the impact of such margin changes.

Step 1: Open a new “What-if” portfolio

From the Classic TWS trading platform, select the Analytical Tools, Risk Navigator, and then Open New What-If menu options (Exhibit1).

Exhibit 1

.png)

From the Mosaic TWS trading platform, select New Window, Risk Navigator, and then Open New What-If menu options.

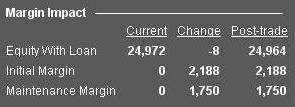

Step 2: Define starting portfolio

A pop-up window will appear (Exhibit 2) from which you will be prompted to define whether you would like to create a hypothetical portfolio starting from your current portfolio or a newly created portfolio. Clicking on the "yes" button will serve to download existing positions to the new “What-If” portfolio.

Exhibit 2

Clicking on the "No" button will open up the “What – If” Portfolio with no positions.

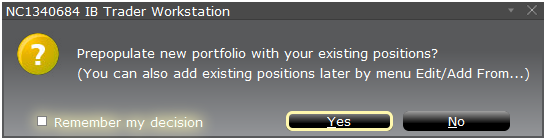

Risk Dashboard

The Risk Dashboard is pinned along the top of the product tab-sets, and is and is available for what-if as well as active portfolios. The values are calculated on demand for what-if portfolios. The dashboard provides at-a-glance account information including:

1) Net Liquidation Value: The total Net Liquidation Value for the account

2) P&L: The total daily P&L for the entire portfolio

3) Maintenance Margin: Total current maintenance margin

4) Initial Margin: Total initial margin requirements

5) VAR: Shows the Value at risk for the entire portfolio

6) Expected Shortfall (ES): Expected Shortfall (average value at risk) is expected return of the portfolio in the worst case

Alternative Margin Calculator

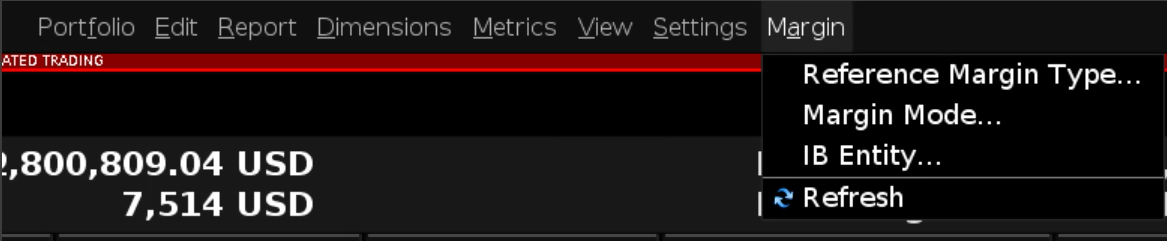

The Alternative Margin Calculator, accessed from the Margin menu and clicking on the Margin Mode (Exhibit 3), shows how the margin change will affect the overall margin requirement, once fully implemented.

Exhibit 3

Step 3: Selecting Margin Mode Settings

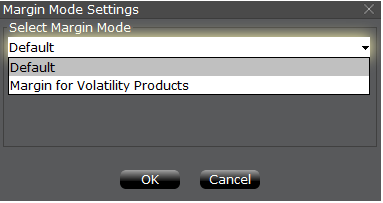

A pop-up window will appear (Exhibit 4) entitled Margin Mode Setting. You can use the drop-down menu in that window to change the margin calculations from Default (being the current policy) to the new title of the new Margin Setting (being the new margin policy). Once you have made a selection click on the OK button in that window.

Exhibit 4

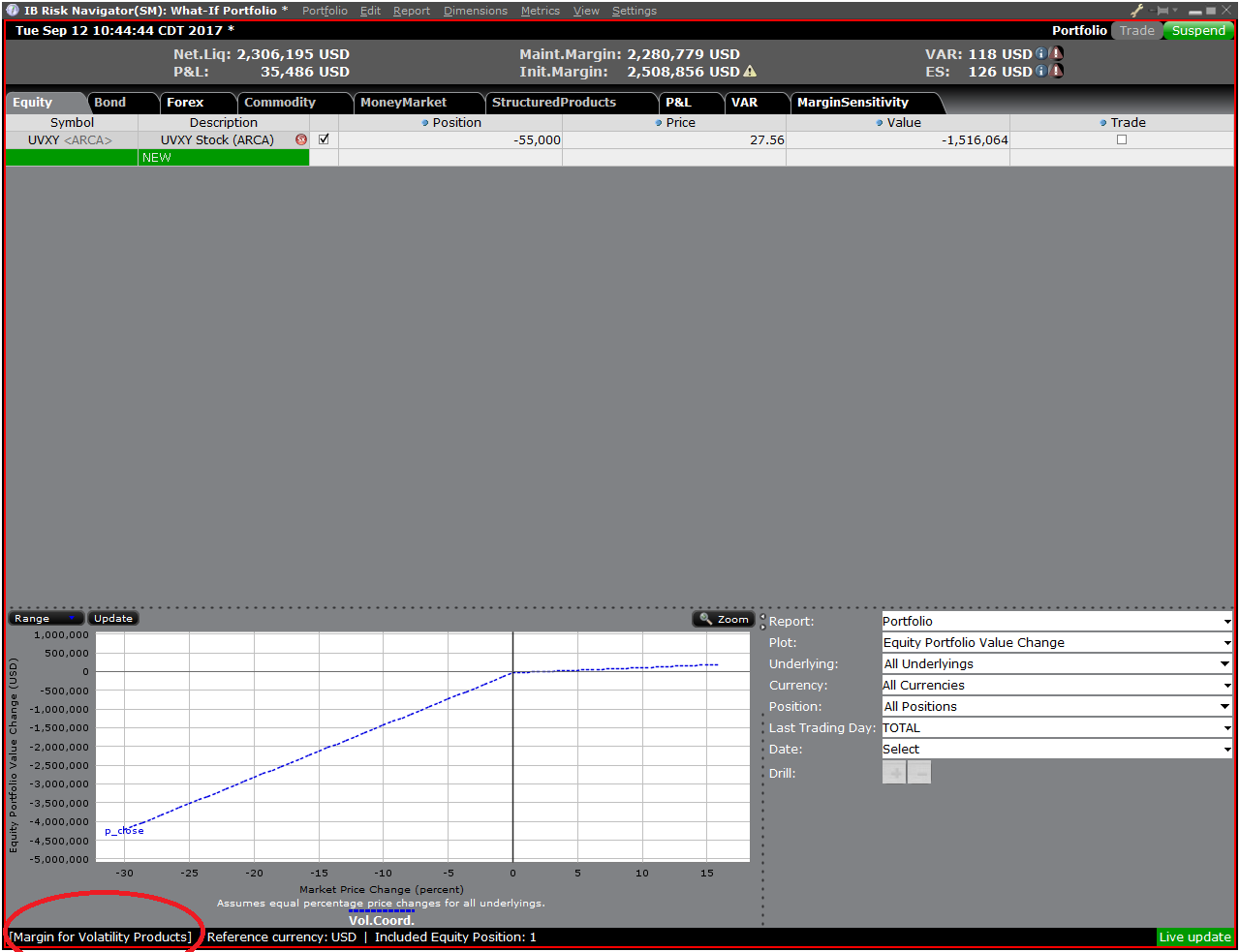

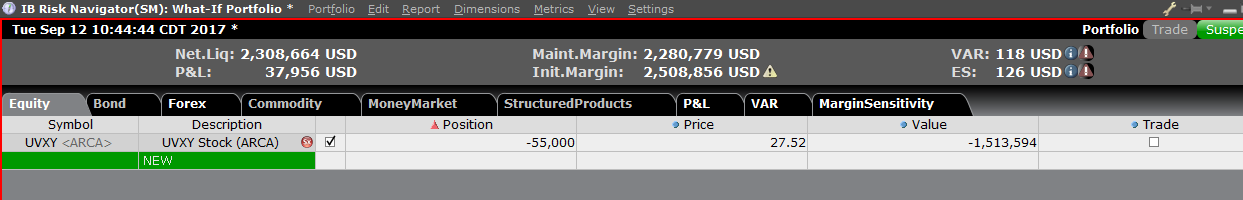

Once the new margin mode setting is specified, the Risk Navigator Dashboard will automatically update to reflect your choice. You can toggle back and forth between the Margin Mode settings. Note that the current Margin Mode will be shown in the lower left hand corner of the Risk Navigator window (Exhibit 5).

Exhibit 5

Step 4: Add Positions

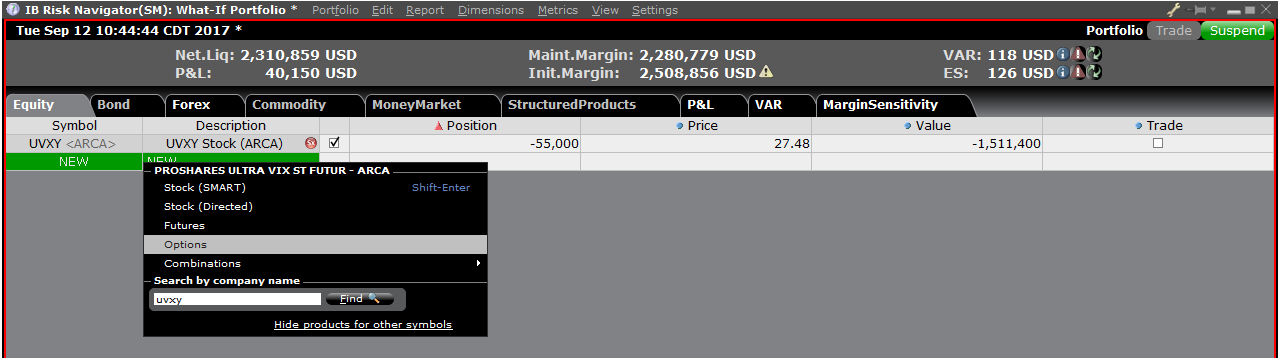

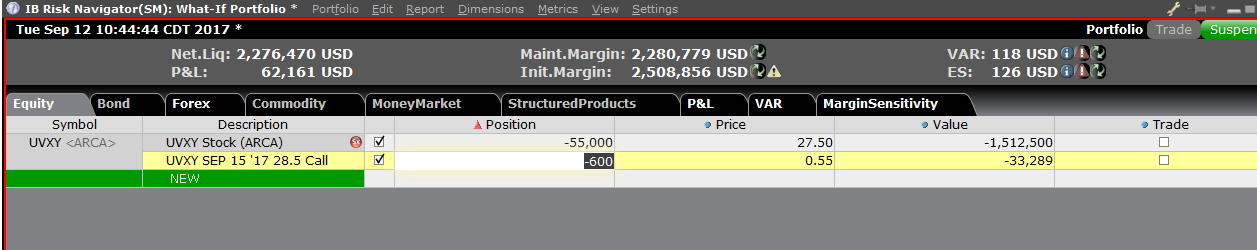

To add a position to the "What - If" portfolio, click on the green row titled "New" and then enter the underlying symbol (Exhibit 6), define the product type (Exhibit 7) and enter position quantity (Exhibit 8)

Exhibit 6

Exhibit 7

Exhibit 8

You can modify the positions to see how that changes the margin. After you altered your positions you will need to click on the recalculate icon (![]() ) to the right of the margin numbers in order to have them update. Whenever that icon is present the margin numbers are not up-to-date with the content of the What-If Portfolio.

) to the right of the margin numbers in order to have them update. Whenever that icon is present the margin numbers are not up-to-date with the content of the What-If Portfolio.

Margin Considerations for IB LLC Commodities Accounts

Introduction

As a global broker offering futures trading in 19 countries, IB is subject to various regulations, some of which retain the concept of margin as a single, end of day computation as opposed to the continuous, real-time computations IB performs. To satisfy commodity regulatory requirements and manage economic exposure in a pragmatic fashion, two margin computations are performed at the market close, both which must be met to remain fully margin compliant. An overview of these computations is outlined below.

Overview

All orders are subject to an initial margin check prior to execution and continuous maintenance margin checks thereafter. As certain products may be offered intraday margin at rates less than the exchange minimum and to ensure end of day margin compliance overall, IB will generally liquidate positions prior to the close rather than issue a margin call. If, however, an account remains non-compliant at the close, our practice is to issue a margin call, restrict the account to margin reducing transactions and liquidate positions by the close of the 3rd business day if the initial requirement has not then been satisfied.

In determining whether a margin call is required, IB performs both a real-time and regulatory computation, which in certain circumstances, can generate different results:

Real-Time: under this method, initial margin is computed using positions and prices collected at a common point in time, regardless of a product’s listing exchange and official closing time; an approach we believe appropriate given the near continuous trading offered by most exchanges.

Regulatory: under this method, initial margin is computed using positions and prices collected at the official close of regular trading hours for each individual exchange. So, for example, a client trading futures listed on each of the Hong Kong, EUREX and CME exchanges would have a requirement calculated based upon information collected at the close of each respective exchange.

Impact

Clients trading futures listed within a single country and session are not expected to be impacted. Clients trading both the daytime and after hours sessions of a given exchange or on exchanges located in different countries where the closing times don’t align are more likely to be impacted. For example, a client opening a futures contract during the Hong Kong daytime session and closing it during U.S. hours, would have only the opening position considered for purposes of determining the margin requirement. This implies a different margin requirement and a possible margin call under the revised computation that may not have existed under the current. An example of this is provided in the chart below.

Example

This example attempts to demonstrate how a client trading futures in both the Asia and U.S. timezones would be impacted were that client to trade in an extended hours trading session (i.e., outside of the regular trading hours after which the day's official close had been determined). Here, the client opens a position during the Hong Kong regular hours trading session, closes it during the extended hours session, thereby freeing up equity to open a position in the U.S. regular hours session. For purposes of illustration, a $1,000 trading loss is assumed. This example illustrates that the regulatory end of day computation may not recognize margin reducing trades conducted after the official close, thereby generating an initial margin call.

| Day | Time (ET) | Event |

Start Position |

End Position | IB Margin | Regulatory Margin | |||

| Equity With Loan | Maintenance | Initial | Overnight | Margin Call | |||||

| 1 | 22:00 | Buy 1 HHI.HK | None | Long 1 HHI.HK | $10,000 | $3,594 | $4,493 | N/A | N/A |

| 2 | 04:30 | Official HK Close | Long 1 HHI.HK | Long 1 HHI.HK | $10,000 | $7,942 | $9,927 | $4,493 | N/A |

| 2 | 08:00 | Sell 1 HHI.HK | Long 1 HHI.HK | None | $9,000 | $0 | $0 | $0 | N/A |

| 2 | 10:00 | Buy 1 ES | None | Long 1 ES | $9,000 | $2,942 | $3,677 | N/A | N/A |

| 2 | 17:00 | Official U.S. Close | Long 1 ES | Long 1 ES | $9,000 | $5,884 | $7,355 | $9,993 | Yes |

| 3 | 17:00 | Official U.S. Close | Long 1 ES | Long 1 ES | $9,000 | $5,884 | $7,355 | $5,500 | No |

预览定单/检查保证金

预览定单/检查保证金功能可供您在定单传递前了解其预计成本、佣金和保证金影响。该功能在TWS和WebTrader上均可使用,TWS版本显示的信息更为详尽。

交易者工作站(TWS)

TWS检查保证金功能可将建议定单的保证金影响与现有头寸隔离开来,并在假设定单执行的基础上显示新的保证金要求。包括初始和维持保证金要求在内的关键保证金余额报告为含贷款价值资产。要使用该功能,请将鼠标停留在定单行,右键点击并从下拉菜单中选择检查保证金。

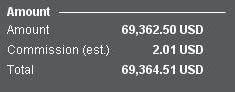

举例:以1387.25的价格买入1手2012年6月的ES期货

定单预览的第一部分显示该证券的买价、卖价和最后交易价。

第二部分显示基本定单详情。

金额部分显示定单的价值以及适用的估算佣金。

保证金影响部分显示下方信息的明细:

当前 = 当前账户价值,不包含正在传递的定单。

变化 = 正在传递之定单的影响,忽略账户的所有头寸。

交易后 = 正在传递之定单执行并计入账户投资组合后的预期账户价值。

网络交易者(WebTrader)

WebTrader定单预览显示仅显示TWS交易后价值的对应值。

如何确定您有无从IBKR借入资金

若某账户内的总现金余额为负,则存在资金借入,借款需支付利息。 然而,有时即使账户的总现金余额为正,由于余额轧差或时间差,仍可能存在资金借入。 以下是最常见的例子:

IBKR股票差价合约概述

下方文章对IBKR发行的股票差价合约(CFD)进行了总体介绍。

有关IBKR指数差价合约的信息,请点击此处。有关外汇差价合约的信息,请点击此处。

涵盖主题如下:

I. 差价合约定义

II. 差价合约与底层股票之比较

III. 成本与保证金

IV. 范例

V. 差价合约的相关资源

VI. 常见问题

风险警告

差价合约属于复杂金融产品,其交易存在高风险,由于杠杆的作用,可能会出现迅速亏损。

在通过IBKR(UK)交易差价合约时,有67%的零售投资者账户出现了亏损。

您应考虑自己是否理解差价合约的运作机制以及自己是否能够承受亏损风险。

ESMA差价合约规定(仅限零售客户)

欧洲证券与市场管理局(ESMA)颁布了新的差价合约规定,自2018年8月1日起生效。

新规包括:1) 开仓差价合约头寸的杠杆限制;2) 以单个账户为单位的保证金平仓规则;以及3) 以单个账户为单位的负余额保护规则;

ESMA新规仅适用于零售客户。专业客户不受影响。

请参见ESMA差价合约新规推行了解更多详细信息。

I. 股票差价合约定义

IBKR差价合约是场外交易合约,提供底层股票的收益,包括股息与公司行动(了解更多有关差价合约公司行动的信息)。

换句话说,这是买家(您)与IBKR就交易一只股票当前价值与未来价值之差额而达成的协定。如果您持有多头头寸,且差额为正,则IBKR会付钱给您。而如果差额为负,则您应向IBKR付钱。

IBKR股票差价合约通过您的保证金账户进行交易,因此您可建立多头以及空头杠杆头寸。差价合约的价格即是底层股票的交易所报价。实际上,IBKR差价合约报价与股票的智能传递报价(可在TWS中查看)相同,且IBKR提供直接市场接入(DMA)。与股票类似,您的非适销(即限价)定单会使底层对冲直接呈现在其进行交易之交易所的深度定单册中。 这也意味着您可以下单以底层买价买入差价合约或以底层卖价卖出差价合约。

要将IBKR透明的差价合约模型与市场上其他差价合约进行比较,请参见我们的差价合约市场模型概述。

IBKR目前提供约7100只股票差价合约,覆盖美国、欧洲和亚洲的主要市场。下表所列的主要指数其成分股目前都可做IBKR股票差价合约。在许多国家,IBKR还可供交易高流动性小盘股。这些股票自由流通量调整市值至少为5亿美元,每日交易量中间值至少为60万美元。 详情请见差价合约产品列表。不久将会增加更多国家。

| 美国 | 标普500、道琼斯股价平均指数、纳斯达克100、标普400中盘股、高流动性小盘股 |

| 英国 | 富时350 + 高流动性小盘股(包括IOB) |

| 德国 | Dax、MDax、TecDax + 高流动性小盘股 |

| 瑞士 | 斯托克欧洲600指数(48只股票)+ 高流动性小盘股 |

| 法国 | CAC大盘股、CAC中盘股 + 高流动性小盘股 |

| 荷兰 | AEX、AMS中盘股 + 高流动性小盘 |

| 比利时 | BEL 20、BEL中盘股 + 高流动性小盘 |

| 西班牙 | IBEX 35 + 高流动性小盘股 |

| 葡萄牙 | PSI 20 |

| 瑞典 | OMX斯德哥尔摩30指数 + 高流动性小盘股 |

| 芬兰 | OMX赫尔辛基25指数 + 高流动性小盘股 |

| 丹麦 | OMX哥本哈根30指数 + 高流动性小盘股 |

| 挪威 | OBX |

| 捷克 | PX |

| 日本 | 日经225指数 + 高流动性小盘股 |

| 香港 | 恒生指数 + 高流动性小盘股 |

| 澳大利亚 | ASX 200指数 + 高流动性小盘股 |

| 新加坡* | 海峡时报指数 + 高流动性小盘股 |

| 南非 | Top 40 + 高流动性小盘股 |

*对新加坡居民不可用

II. 差价合约与底层股票之比较

| IBKR差价合约的优势 | IBKR差价合约的缺点 |

|---|---|

| 无印花税和金融交易税(英国、法国、比利时) | 无股权 |

| 佣金和保证金利率通常比股票低 | 复杂公司行动并不总能完全复制 |

| 股息享受税务协定税率,无需重新申请 | 收益的征税可能与股票有所不同(请咨询您的税务顾问) |

| 不受即日交易规则限制 |

III. 成本与保证金

在欧洲股票市场,IBKR差价合约可以比IB极具竞争力的股票产品更加高效。

首先,IBKR差价合约佣金比股票低,且有着与股票一样低的融资点差:

| 欧洲 | 差价合约 | 股票 | |

|---|---|---|---|

| 佣金 | GBP | 0.05% | 英镑6.00 + 0.05%* |

| EUR | 0.05% | 0.10% | |

| 融资** | 基准+/- | 1.50% | 1.50% |

*每单 + 超出5万英镑部分的0.05%

**对于差价合约是总头寸价值的融资;对于股票是借用金额的融资

交易量更大时,差价合约佣金会变得更低,最低至0.02%。头寸更大时,融资利率也会降低,最低至0.5%。 详情请参见差价合约佣金和差价合约融资利率。

其次,差价合约的保证金要求比股票低。零售客户须满足欧洲监管机构ESMA规定的额外保证金要求。请参见ESMA差价合约新规推行了解详细信息。

| 差价合约 | 股票 | ||

|---|---|---|---|

| 所有 | 标准 | 投资组合保证金 | |

| 维持保证金要求* |

10% |

25% - 50% | 15% |

*蓝筹股特有保证金。零售客户最低初始保证金要求为20%。股票标准的25%日内维持保证金,50%隔夜保证金。 显示的投资组合保证金为维持保证金(包括隔夜)。波动较大的股票保证金要求更高

请参见CFD保证金要求了解更多详细信息。

IV. 范例(专业客户)

让我们来看一下例子。联合利华在阿姆斯特丹的挂牌股票在过去一个月(2012年5月14日前20个交易日)回报率为3.2%,您认为其会继续有良好表现。您想建立20万欧元的仓位,并持仓5天。您以10笔交易建仓并以10笔交易平仓。您的直接成本如下:

股票

| 差价合约 | 股票 | ||

|---|---|---|---|

| 200,000欧元头寸 | 标准 | 投资组合保证金 | |

| 保证金要求 | 20,000 | 100,000 | 30,000 |

| 佣金(双向) | 200.00 | 400.00 | 400.00 |

| 利率(简化) | 1.50% | 1.50% | 1.50% |

| 融资金额 | 200,000 | 100,000 | 170,000 |

| 融资天数 | 5 | 5 | 5 |

| 利息支出(1.5%的简化利率) | 41.67 | 20.83 | 35.42 |

| 总计直接成本(佣金+利息) | 241.67 | 420.83 | 435.42 |

| 成本差额 | 高74% | 高80% | |

注意:差价合约的利息支出根据总的合约头寸进行计算,而股票的利息支出则是根据借用金额进行计算。股票和差价合约的适用利率相同。

但是,假设您只有2万欧元可用来做保证金。如果联合利华继续上月的表现,您的潜在盈利比较如下:

| 杠杆回报 | 差价合约 | 股票 | |

|---|---|---|---|

| 可用保证金 | 20,000 | 20,000 | 20,000 |

| 总投入 | 200,000 | 40,000 | 133,333 |

| 总收益(5天) | 1,600 | 320 | 1,066.66 |

| 佣金 | 200.00 | 80.00 | 266.67 |

| 利息支出(1.5%的简化利率) | 41.67 | 4.17 | 23.61 |

| 总计直接成本(佣金+利息) | 241.67 | 84.17 | 290.28 |

| 净收益(总收益减去直接成本) | 1,358.33 | 235.83 | 776.39 |

| 保证金投资金额回报 | 0.07 | 0.01 | 0.04 |

| 差额 | 收益少83% | 收益少43% | |

| 杠杆风险 | 差价合约 | 股票 | |

|---|---|---|---|

| 可用保证金 | 20,000 | 20,000 | 20,000 |

| 总投入 | 200,000 | 40,000 | 133,333 |

| 总收益(5天) | -1,600 | -320 | -1,066.66 |

| 佣金 | 200.00 | 80.00 | 266.67 |

| 利息支出(1.5%的简化利率) | 41.67 | 4.17 | 23.61 |

| 总计直接成本(佣金+利息) | 241.67 | 84.17 | 290.28 |

| 净收益(总收益减去直接成本) | -1,841.67 | -404.17 | -1,356.94 |

| 差额 | 损失少78% | 损失少26% | |

V. 差价合约相关资源

下方链接可帮助您了解更多有关IBKR差价合约产品的详细信息:

还可参看以下视频教程:

VI. 常见问题

什么股票可进行差价合约交易?

美国、西欧、北欧与日本的大盘和中盘股股票。许多市场上的高流动性小盘股也可以。请参见差价合约产品列表了解更多详细信息。不久将会增加更多国家。

IB提供股票指数和外汇的差价合约吗?

是的。请参见IBKR指数差价合约 - 事实与常见问题以及外汇差价合约 - 事实与常见问题。

IB如何确定股票差价合约报价?

IBKR差价合约报价与底层股票的智能传递报价相同。IBKR不会扩大价差或与您对赌。要了解更多信息,请参见差价合约市场模型概述。

我能看到自己的限价定单反映在交易所中吗?

是的。IBKR提供直接市场接入(DMA),这样您的非适销(即限价)定单会使底层对冲直接呈现在其进行交易之交易所的深度定单册中。这也意味着您可以下单以底层买价买入差价合约或以底层卖价卖出差价合约。此外,如果其他客户的定单以优于公开市场的价格与您的定单交叉,您还可能会获得价格改善。

IB如何确定股票差价合约的保证金?

IBKR根据每只底层股票的历史波动率建立了基于风险的保证金要求机制。最低保证金为10%。 大多数IBKR差价合约都应用该保证金率,这使差价合约在大多数情况下都比底层股票交易更具效率。 零售客户须满足欧洲监管机构ESMA规定的额外保证金

要求。 请参见ESMA差价合约新规推行了解详细信息。单个差价合约头寸之间或差价合约与底层股票头寸之间没有投资组合抵消。集中头寸和超大头寸可能需要准备额外的保证金。请参见差价合约保证金要求了解更多详细信息。

空头股票差价合约会要强制补仓吗?

是的。如果底层股票很难或者根本不可能借到,则空头差价合约头寸的持有者将需要进行补仓。

IB如何处理股息和公司行动?

IBKR通常会为差价合约持有者反映公司行动的经济效应,就好像他们一直持有着底层证券一样。股息会表现为现金调整,而其他行动则会通过现金或头寸调整表现。例如,如果公司行动导致股票数量发生变化(如股票分隔和逆向股票分隔),差价合约的数量也会相应地进行调整。如果行动导致产生新的上市实体,且IBKR决定将其股票作为差价合约交易,则需要创建适当数量之新的多头或空头头寸。要了解概述信息,请参见差价合约公司行动。

*请注意,某些情况下对于合并等复杂公司行动可能无法对差价合约进行准确调整。这时候,IBKR可能会在除息日前终止差价合约。

任何人都能交易IBKR差价合约吗?

除美国、加拿大和香港的居民,其他所有客户都能交易IBKR差价合约。新加坡居民可交易除新加坡上市之股票差价合约以外的其它IBKR差价合约。任何投资者类型都不能免于这一基于居住地的限制。

我需要做什么才可以开始在IBKR交易差价合约?

您需要在账户管理中设置差价合约交易许可,并同意相关交易披露。如果您的账户是在IB LLC开立,则IBKR将设置一个新的账户板块(即您当前的账户号码加上后缀“F”)。设置确认后您便可以开始交易了。您无需单独为F账户注资,资金会从您的主账户自动转入以满足差价合约保证金要求。

有什么市场数据要求吗?

IBKR股票差价合约的市场数据便是底层股票的市场数据。因此需要具备相关交易所的市场数据许可。如果您已经为股票交易设置了交易所的市场数据许可,那么就无需再进行任何操作。如果您想在当前并无市场数据许可的交易所交易差价合约,您可以设置许可,操作与底层股票的市场数据许可设置相同。

差价合约交易与头寸在报表中如何反映?

如果您是在IB LLC持有账户,且您的差价合约头寸持有在单独的账户板块(主账户号码加后缀“F”)中。您可以选择单独查看F板块的活动报表,也可以选择与主账户合并查看。您可在账户管理的报表窗口进行选择。对于其他账户,差价合约通常会与其他交易产品一起在您的账户报表中显示。

我可以从其他经纪商处转入差价合约头寸吗?

IBKR当前不支持差价合约头寸转账。

股票差价合约可以使用图表功能吗?

是的。

在IBKR交易差价合约有什么账户保护?

差价合约以IB英国作为您的交易对方,不是在受监管的交易所进行交易,也不是在中央结算所进行结算。因IB英国是您差价合约交易的对方,您会面临与IB英国交易相关的财务和商业风险,包括信用风险。但请注意,所有客户资金永远都是完全隔离的,包括对机构客户。IB英国是英国金融服务补偿计划(“FSCS”)参与者。IB英国不是美国证券投资者保护公司(“SIPC”)成员。请参见IB英国差价合约风险披露文件了解有关差价合约交易风险的详细信息。

在哪种类型(如个人、朋友和家庭、机构等)的IBKR账户中可交易差价合约?

所有保证金账户均可进行差价合约交易。现金账户和SIPP账户不能。

在某一特定差价合约中我最多可持有多少头寸?

没有预设限制。但请注意,超大头寸可能会有更高保证金要求。请参见CFD保证金要求了解更多详细信息。

我能否通过电话交易差价合约?

不要。在极端情况下我们可能同意通过电话处理平仓定单,但绝不会通过电话处理开仓定单。

差价合约属于复杂金融产品,其交易存在高风险,由于杠杆的作用,可能会出现迅速亏损。

在通过IBKR(UK)交易差价合约时,有67%的零售投资者账户出现了亏损。

您应考虑自己是否理解差价合约的运作机制以及自己是否能够承受亏损风险。

ESMA规定

欧洲证券与市场管理局(ESMA)发布临时产品干涉措施,自2018年8月1日起生效。

ESMA决议实施的限制包括:1) 开仓差价合约头寸的杠杆限制;2) 以单个账户为单位的保证金平仓规则;3) 以单个账户为单位的负余额保护规则;4) 对交易差价合约激励措施的限制;以及5) 标准的风险警告。

ESMA新规仅适用于零售客户。 专业客户不受影响。

Allocation of Partial Fills

How are executions allocated when an order receives a partial fill because an insufficient quantity is available to complete the allocation of shares/contracts to sub-accounts?

Overview:

From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed (i.e. market closes, contract expires, halts due to news, prices move in an unfavorable direction, etc.). In such cases, IB determines which customers (who were originally included in the order group and/or profile) will receive the executed shares/contracts. The methodology used by IB to impartially determine who receives the shares/contacts in the event of a partial fill is described in this article.

Background:

Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. They can do so by first creating a group (i.e. ratio/percentage) or profile (i.e. specific amount) wherein a distinct number of shares/contracts are specified per client account (i.e. pre-trade allocation). These amounts can be prearranged based on certain account values including the clients’ Net Liquidation Total, Available Equity, etc., or indicated prior to the order execution using Ratios, Percentages, etc. Each group and/or profile is generally created with the assumption that the order will be executed in full. However, as we will see, this is not always the case. Therefore, we are providing examples that describe and demonstrate the process used to allocate partial executions with pre-defined groups and/or profiles and how the allocations are determined.

Here is the list of allocation methods with brief descriptions about how they work.

· AvailableEquity

Use sub account’ available equality value as ratio.

· NetLiq

Use subaccount’ net liquidation value as ratio

· EqualQuantity

Same ratio for each account

· PctChange1:Portion of the allocation logic is in Trader Workstation (the initial calculation of the desired quantities per account).

· Profile

The ratio is prescribed by the user

· Inline Profile

The ratio is prescribed by the user.

· Model1:

Roughly speaking, we use each account NLV in the model as the desired ratio. It is possible to dynamically add (invest) or remove (divest) accounts to/from a model, which can change allocation of the existing orders.

Basic Examples:

Details:

CTA/FA has 3-clients with a predefined profile titled “XYZ commodities” for orders of 50 contracts which (upon execution) are allocated as follows:

Account (A) = 25 contracts

Account (B) = 15 contracts

Account (C) = 10 contracts

Example #1:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 10 am (ET) the order begins to execute2but in very small portions and over a very long period of time. At 2 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 7 of the 50 contracts are filled or 14%). For each account the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 14% of 25 = 3.5 rounded down to 3

Account (B) = 14% of 15 = 2.1 rounded down to 2

Account (C) = 14% of 10 = 1.4 rounded down to 1

To Summarize:

A: initially receives 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: initially receives 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. Account C which currently has a ratio of 0.10).

A: final allocation of 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 2 contract, which is 2/10 of desired (fill ratio = 0.20)

The execution(s) received have now been allocated in full.

Example #2:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be filled3 but in very small portions and over a very long period of time. At 1 pm (ET) the order is canceled prior being executed in full. As a result, only a portion of the order is executed (i.e., 5 of the 50 contracts are filled or 10%).For each account, the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 10% of 25 = 2.5 rounded down to 2

Account (B) = 10% of 15 = 1.5 rounded down to 1

Account (C) = 10% of 10 = 1 (no rounding necessary)

To Summarize:

A: initially receives 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: initially receives 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. to Account B which currently has a ratio of 0.067).

A: final allocation of 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Example #3:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be executed2 but in very small portions and over a very long period of time. At 12 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 3 of the 50 contracts are filled or 6%). Normally the system initially allocates by rounding fractional amounts down to whole numbers, however for a fill size of less than 4 shares/contracts, IB first allocates based on the following random allocation methodology.

In this case, since the fill size is 3, we skip the rounding fractional amounts down.

For the first share/contract, all A, B and C have the same initial fill ratio and fill quantity, so we randomly pick an account and allocate this share/contract. The system randomly chose account A for allocation of the first share/contract.

To Summarize3:

A: initially receives 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: initially receives 0 contracts, which is 0/15 of desired (fill ratio = 0.00)

C: initially receives 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

Next, the system will perform a random allocation amongst the remaining accounts (in this case accounts B & C, each with an equal probability) to determine who will receive the next share/contract.

The system randomly chose account B for allocation of the second share/contract.

A: 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

The system then allocates the final [3] share/contract to an account(s) with the smallest ratio (i.e. Account C which currently has a ratio of 0.00).

A: final allocation of 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: final allocation of 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Available allocation Flags

Besides the allocation methods above, user can choose the following flags, which also influence the allocation:

· Strict per-account allocation.

For the initially submitted order if one or more subaccounts are rejected by the credit checking, we reject the whole order.

· “Close positions first”1.This is the default handling mode for all orders which close a position (whether or not they are also opening position on the other side or not). The calculation are slightly different and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases.

Other factor affects allocations:

1) Mutual Fund: the allocation has two steps. The first execution report is received before market open. We allocate based onMonetaryValue for buy order and MonetaryValueShares for sell order. Later, when second execution report which has the NetAssetValue comes, we do the final allocation based on first allocation report.

2) Allocate in Lot Size: if a user chooses (thru account config) to prefer whole-lot allocations for stocks, the calculations are more complex and will be described in the next version of this document.

3) Combo allocation1: we allocate combo trades as a unit, resulting in slightly different calculations.

4) Long/short split1: applied to orders for stocks, warrants or structured products. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex.

5) For non-guaranteed smart combo: we do allocation by each leg instead of combo.

6) In case of trade bust or correction1: the allocations are adjusted using more complex logic.

7) Account exclusion1: Some subaccounts could be excluded from allocation for the following reasons, no trading permission, employee restriction, broker restriction, RejectIfOpening, prop account restrictions, dynamic size violation, MoneyMarketRules restriction for mutual fund. We do not allocate to excluded accountsand we cancel the order after other accounts are filled. In case of partial restriction (e.g. account is permitted to close but not to open, or account has enough excess liquidity only for a portion of the desired position).

Footnotes:

Overview of Dividend Payments in Lieu ("PIL")

Payment In Lieu of a Dividend (“payment in lieu” or “PIL”) is a term commonly used to describe a cash payment to an account in an amount equivalent to the ordinary dividend. Generally, the amount paid is per share owned. In addition, the dividend in most cases is paid quarterly (i.e., four times per year). The dividend payment is classified as follows: (1) ordinary dividend; and/or (2) payment in lieu of dividend. The former designation is for a payment received directly from the issuer or its paying agent. The latter designation is used when a cash payment is received from other than the issuer or the issuer’s agent.

Payment in lieu of an ordinary dividend may be received when the shares have been bought on margin, or when the account has a subsequent margin loan due to borrowing money to facilitate the payment for additional purchases of shares or as the result of a withdrawal from the margin account. Payment in lieu of a dividend may also be received when shares are owed to the brokerage firm and have not been received by the dividend record date.

To better understand the difference between an ordinary dividend and a payment in lieu, we will explain the steps taken by IB to comply with US regulations. Each business day, the Firm analyzes the positions in each customer account, every borrow, every loan, every pledge of shares for each security held by its customers to determine how many shares are held on margin and the associated margin loan balances. For each security that is fully paid, we are required to segregate those shares in a good control location (for example, a depository or a US bank. See KB1964). For shares that are held as collateral for a margin loan we are allowed to hypothecate and re-hypothecate shares valued up to 140 percent of the total debit balance in the customer account (See KB1967).

While the guidelines noted above for segregation of securities are clear, there are exceptions that are outside of the Firm's control. For instance, through no fault of its own, IB may have a deficit in segregated shares due to customer activity that changes the Firm’s overall segregation requirement for a security. This may be for a variety of reasons including a delay in receiving shares that have been loaned out to a counterparty after segregation requirements are recalculated and the Firm has issued a stock loan recall, sales of securities by one or more customers that reduce or eliminate margin loans, the deposit of cash by customers that similarly reduce or eliminate margin loans, or a failure of a counterparty to deliver shares for a trade settlement.

Upon issuing a recall of shares loaned, rules permit the borrower of the shares up to 3 business days to return them. The borrower of the shares is required to return them to us when we issue a recall, but if by business day 3 the shares have not been returned, IB may then issue a buy-in notice to begin the process of regaining possession of the shares. An additional 3 business days is generally needed for the purchased shares to settle and be delivered to the firm. Similarly if a counterparty fails to deliver by settlement date, shares to IB to settle a customer purchase, IB can issue a buy-in notice but the purchase of such shares are also subject to trade settlement in 3 days.

To summarize, if by the record date of a dividend certain shares have not been delivered to IB, the Firm will be paid an amount of cash that is equivalent to the dividend amount, but IB will not receive a qualified dividend payment directly from the issuer. In such cases, the Firm will receive PIL and will have no choice but to allocate such payment in lieu to customer accounts. The firm first allocates PIL to those accounts who hold the shares as collateral for a margin loan. If, after PIL is allocated to all shareholders whose accounts are not fully paid, any portion of PIL remains to be paid, it is allocated on a pro-rata basis to each remaining client account.

Account holders should be aware that a PIL may have different tax consequences than an ordinary dividend and should consult a tax advisor to understand such differences and whether they apply to their particular situation.