Risk Navigator : Calcul de marge alternatif

IB vérifie systématiquement les niveaux de marge et mettra en place les changements qui serviront à augmenter les exigences au-dessus des minimums réglementaires, comme le justifient les conditions de marché. Pour aider les clients à comprendre les effets de tels changements sur leur portefeuille, une fonctionnalité appelée Calcul de marge alternatif est fournie dans l'application Risk Navigator. Retrouvez ci-dessous les étapes pour créer un portefuille what-if pour déterminer l'impact de ces changements de marge.

Étape 1 : Ouvrir un nouveau portefeuille What-if

Depuis la plateforme de trading Classic TWS, sélectionnez Outils d'analyse, Risk Navigator puis Ouvrir un nouveau portefeuille What-if (Image 1).

Image 1

.png)

Depuis la pateforme de trading Mosaic TWS, sélectionnez Nouvelle fenêtre, Risk Navigator, puis Ouvrir un nouveau portefuille What-if.

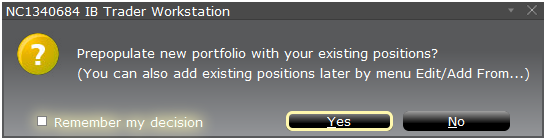

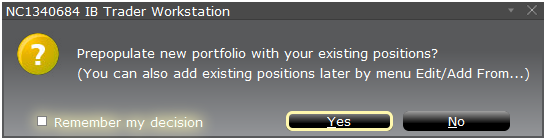

Étape 2 : Définir le portefeuille de départ

Une fenêtre apparaîtra (Image 2). Il vous y sera demandé de définir si vous souhaitez créer un portefeuille hypothétique depuis votre portefeuille actuel ou depuis un nouveau portefeuille. En cliquant sur Oui, les positions existantes seront téléchargées dans le nouveau portefeuille What-if.

Image 2

En cliquant sur Non, le portefeuille What-is s'ouvrira sans position.

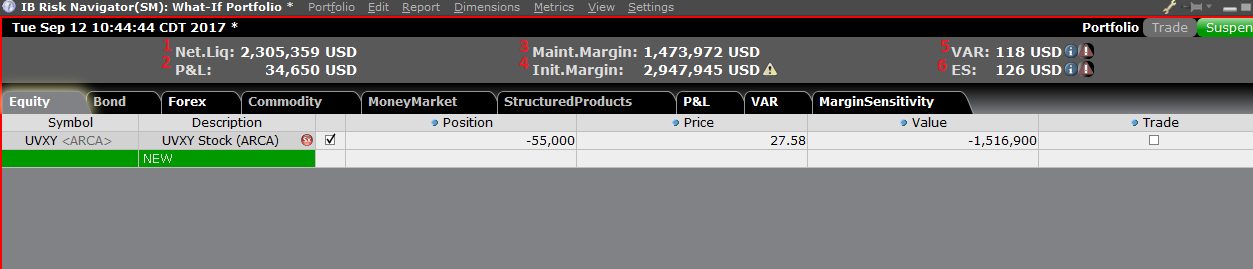

Tableau de bord de risque

Le tableau de bord de risque est épinglé en haut de l'onglet Produit et est disponible aussi bien pour les portefeuilles actifs que pour les portefeuilles what-if. Les valeurs sont calculées sur demande pour les portefeuilles what-if. Le tableau de bord fournit des informations de comptes, notamment :

1) Valeur nette liquidative : la valeur nette liquidative totale du compte

2) P&L : le P&L total journalier pour le portefeuille entier

3) Marge de maintien : marge de maintien totale actuelle

4) Marge initiale : exigences de marge initiale totale

5) VAR : la Value at risk du portefeuille entier

6) Déficit prévu (ES) : le déficit prévu (value at risk moyenne) correspond au rendement du portefeuille dans le pire des cas

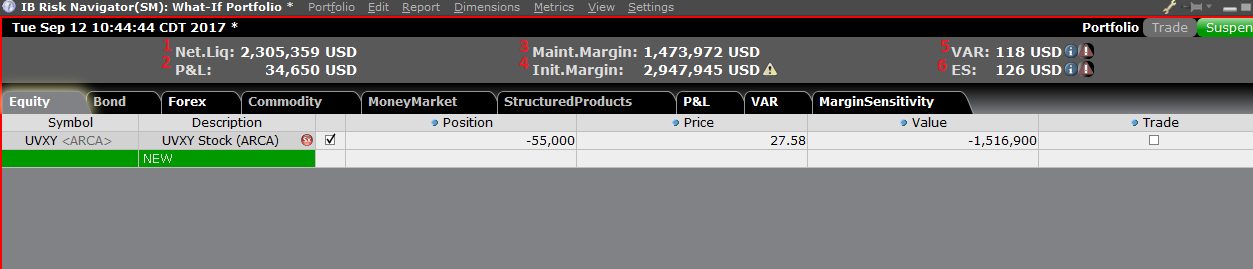

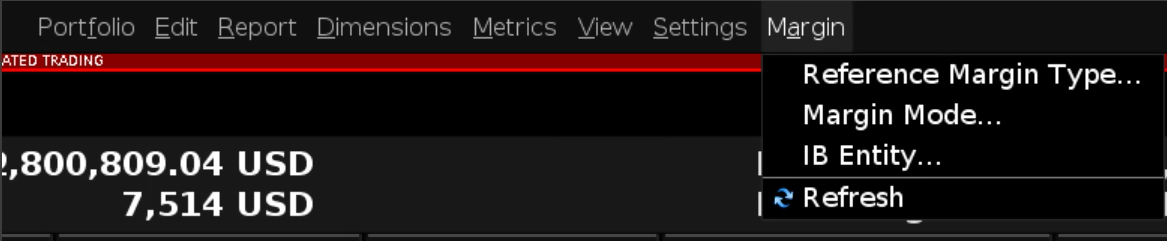

Calcul de marge alternatif

Le Calcul de marge alternatif, accessible depuis le menu Paramètres > Mode marge (Image 3), montre comment le changement de marge touchera les exigences de marge générales, une fois mis en place.

Image 3

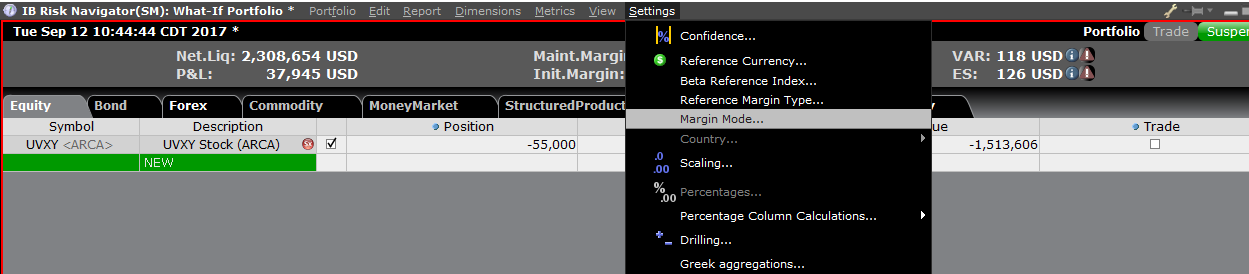

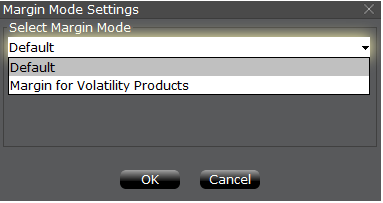

Étape 3 : Sélectionner les paramètres de mode marge

Une fenêtre intitulée Paramètres mode marge apparaîtra (Image 4). Vous pouvez utiliser le menu déroulant de cette fenêtre pour changer le calcul de marge de Défaut (mode actuel) au nouveau titre du nouveau paramètre de marge (nouveau mode). Une fois votre sélection faite, cliquez sur OK.

Image 4

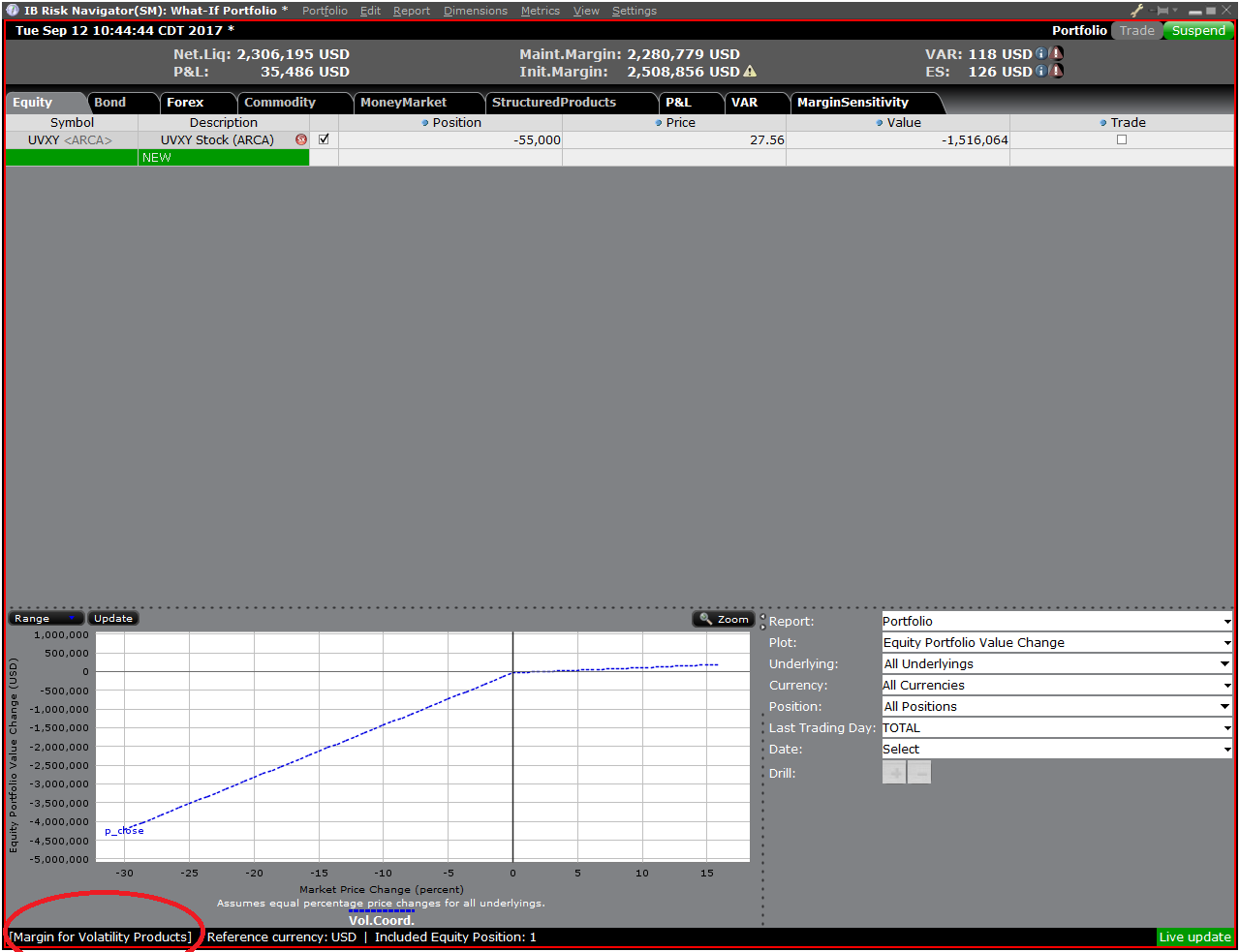

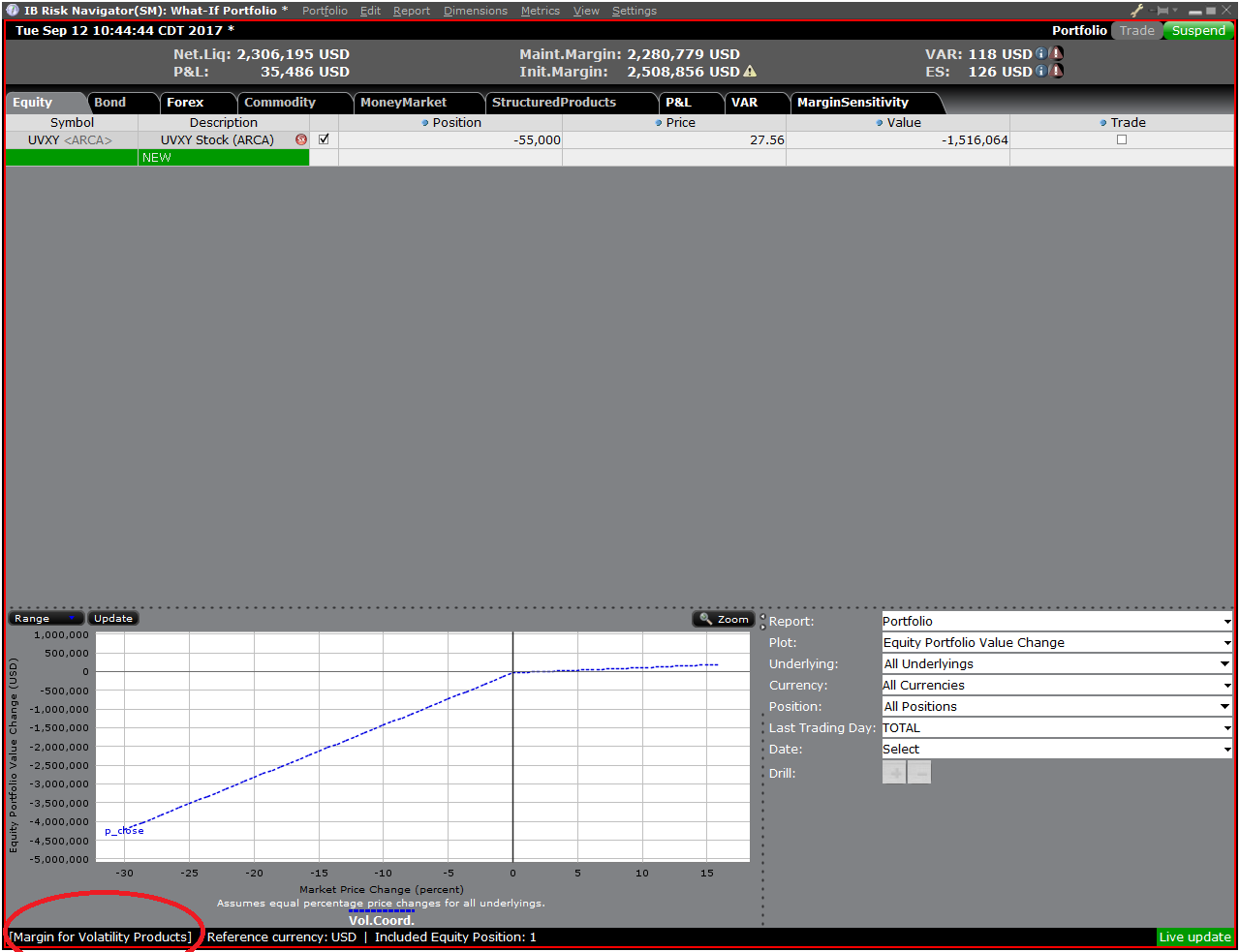

Une fois le nouveau mode de marge choisi, le tableau de bord du Risk Navigator sera mis à jour automatiquement pour refléter votre choix. Vous pouvez aller et venir entre les paramètres mode de marge. Veuillez noter que le mode marge actuel sera affiché dans le coin inférieur gauche de la fenêtre Risk Navigator (Image 5).

Image 5

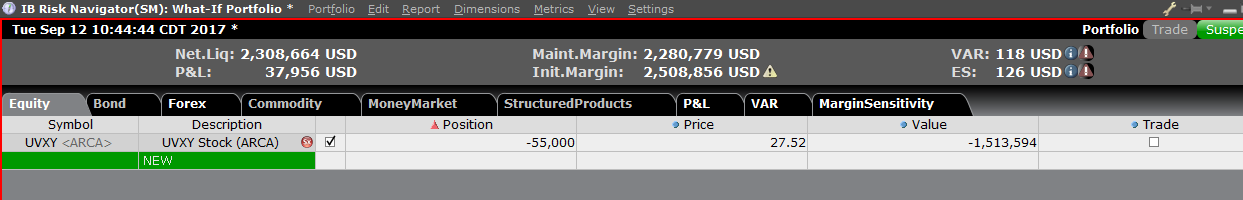

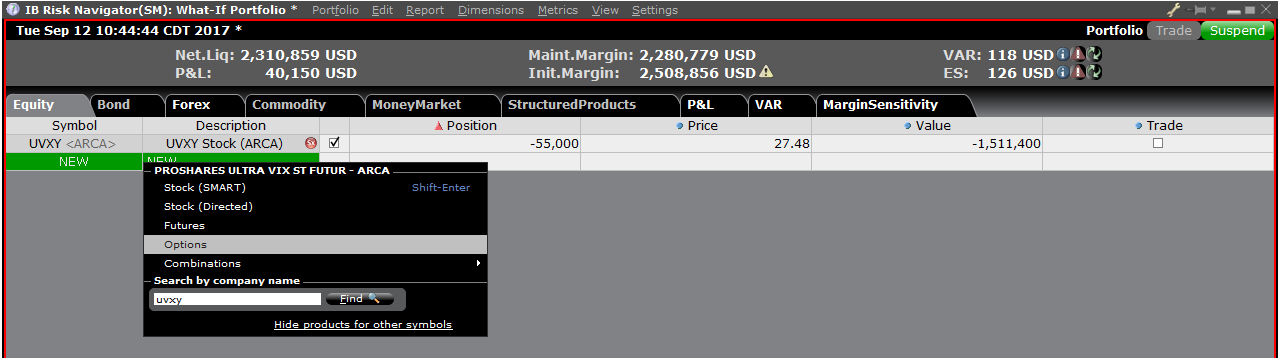

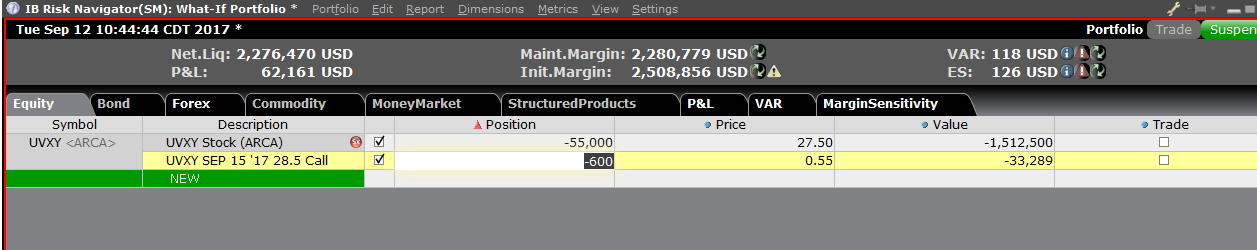

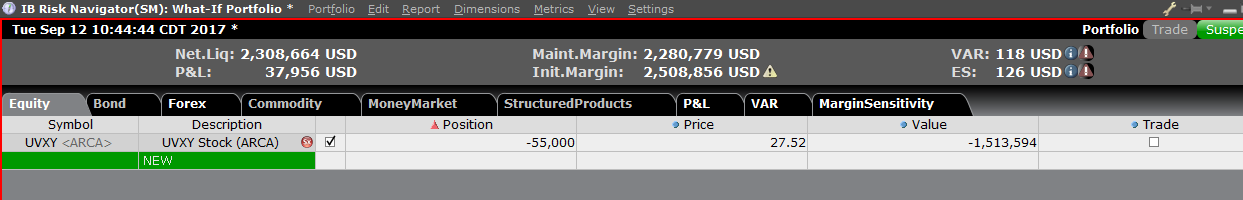

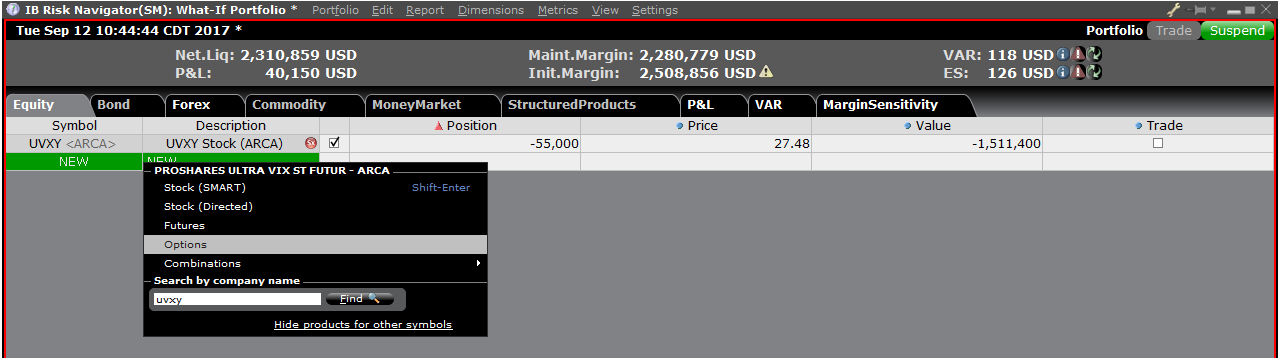

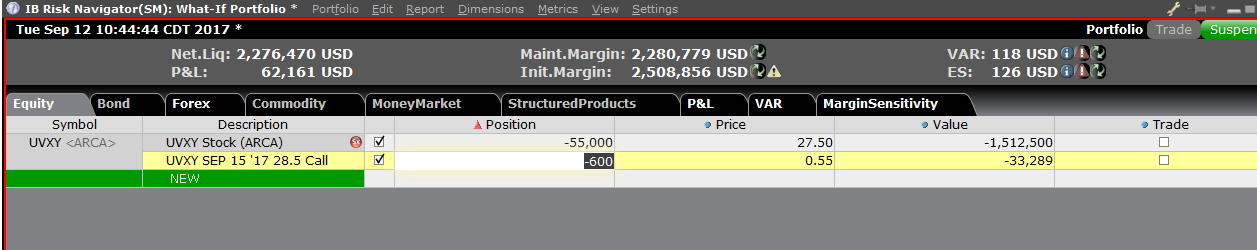

Étape 4 : Ajouter des positions

Pour ajouter une position au portefeuille What-if, cliquez sur la ligne verte « Nouveau » puis saisissez le symbole sous-jacent (Image 6), définissez le type de produit (Image 7) et saisissez la taille de la position (Image 8).

Image 6

Image 7

Image 8

Vous pouvez modifier les positions pour voir comment elles impactent la marge. Après avoir modifier vos positions, il vous faudra cliquer sur l'icône Recalculer (![]() ) à droite des chiffres de marge pour les mettre à jour. Quand cette icône est visible, les chiffres de marge ne sont pas à jour avec le contenu du portefeuille What-if.

) à droite des chiffres de marge pour les mettre à jour. Quand cette icône est visible, les chiffres de marge ne sont pas à jour avec le contenu du portefeuille What-if.

Augmentation de marge - Élections 2020 aux États-Unis

Compte tenu de la volatilité probable des marchés liée aux élections présidentielles américaines à venir, Interactive Brokers va mettre en place une augmentation des exigences de marge pour tous les contrats à terme sur indice boursier et leurs dérivés tradés aux États-Unis ainsi que les contrats à terme Dow Jones cotés sur la Bourse OSE.JPN.

Les clients détenant une position dans un contrat à terme sur indice boursier et leurs dérivés, et/ou des contrats à terme Dow Jones cotés sur la Bourse OSE.JPN doivent s'attendre à une augmentation des exigences de marge de 35 % supérieure aux exigences de marge normales. L'augmentation sera mise en place progressivement sur une période de 20 jours, du 5 octobre 2020 au 30 octobre 2020.

Le tableau ci-dessous fournit des exemples de l'augmentation de marge prévue pour certains des produits les plus détenus

| Symbole contrat à terme |

Description | Bourse | Catégorie de trading |

Taux actuel (Plage de détection)* | Taux prévu (Plage de détection) |

| ES | E-mini S&P 500 | GLOBEX | ES | 7.13 | 9.63 |

| YM | MINI DJIA | ECBOT | YM | 6.14 | 8.29 |

| RTY | Russell 2000 | GLOBEX | RTY | 6.79 | 9.17 |

| NQ | NASDAQ E-MINI | GLOBEX | NQ | 6.57 | 8.87 |

| DJIA | OSE Dow Jones Industrial Average | OSE.JPN | DJIA | 5.14 | 6.94 |

*À l'ouverture du 02/10/2020.

REMARQUE : Le Risk Navigator d'IBKR peut vous aider à déterminer l'impact des nouvelles exigences de marge de maintien sur votre portefeuille actuel ou tout autre portefeuille que vous souhaiteriez développer ou tester. Pour plus d'informations sur la fonctionnalité de calcul de marge alternative, veuillez consulter notre article KB Article 2957 : Risk Navigator : Calcul de marge alternative et dans les paramètres de mode de marge du Risk Navigator, sélectionnez « US Election Margin ».

U.S. 2020 Election Margin Increase

In light of the potential market volatility associated with the upcoming United States presidential election, Interactive Brokers will implement an increase in the margin requirement for all U.S. traded equity index futures and derivatives and Dow Jones Futures listed on the OSE.JPN exchange.

Clients holding a position in a U.S. equity index future and their derivatives and/or Down Jones Futures listed on the OSE.JPN exchange should expect the margin requirement to increase by approximately 35% above the normal margin requirement. The increase is scheduled to be implemented gradually over a 20-calendar day period with the maintenance margin increase starting on October 5, 2020 through October 30, 2020.

The table below provides examples of the margin increases projected for some of the more widely held products

| Future Symbol |

Description | Listing Exchange | Trading Class | Current Rate (Price scan range)* | Projected Rate (Price scan range) |

| ES | E-mini S&P 500 | CME | ES | 7.13 | 9.63 |

| YM | MINI DJIA | CBOT | YM | 6.14 | 8.29 |

| RTY | Russell 2000 | CME | RTY | 6.79 | 9.17 |

| NQ | NASDAQ E-MINI | CME | NQ | 6.57 | 8.87 |

| DJIA | OSE Dow Jones Industrial Average | OSE.JPN | DJIA | 5.14 | 6.94 |

*As of 10/2/20 open.

NOTE: IBKR's Risk Navigator can help you determine the impact the new maintenance margin requirements will have on your current portfolio or any other portfolio you would like to construct or test. For more information about the Alternative Margin Calculator feature, please see KB Article 2957: Risk Navigator: Alternative Margin Calculator and from the margin mode setting in Risk Navigator, select " US Election Margin".

Overview of Central Bank of Ireland CFD Rules Implementation for Retail Clients at IBIE

|

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with IBKR. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. |

The Central Bank of Ireland (CBI) enacted new rules applicable to retail clients trading CFDs, effective 1st August 2019. Professional clients are unaffected.

The rules consist of: 1) leverage limits; 2) a margin close out rule on a per account basis; 3) negative balance protection on a per account basis; 4) a restriction on the incentives offered to trade CFDs; and 5) a standardized risk warning.

Most clients (excepting regulated entities) are initially categorised as Retail Clients. IBKR may in certain circumstances agree to reclassify a Retail Client as a Professional Client, or a Professional Client as a Retail Client. Please see MiFID Categorisation for further detail.

The following sections detail how IBKR has implemented the CBI Decision.

1 Leverage Limits

1.1 Margins

Leverage limits were set by CBI at different levels depending on the underlying:

- 3.33% for major currency pairs; Major currency pairs are any combination of USD; CAD; EUR; GBP; CHF; JPY

- 5% for:

- Non-major currency pairs are any combination that includes a currency not listed above, e.g., USD.CNH

- Major indices are IBUS500; IBUS30; IBUST100; IBGB100; IBDE40; IBEU50; IBFR40; IBJP225; IBAU200

- Gold

- 10% for non-major equity indices; IBES35; IBCH20; IBNL25; IBHK50

- 20% for individual equities

1.2 Applied Margins - Standard Requirement

In addition to the CBI Margins, IBKR establishes its own margin requirements (IB Margins) based on the historical volatility of the underlying, and other factors. We will apply the IB Margins if they are higher than those prescribed by CBI .

Details of applicable IB and CBI margins can be found here.

1.2.1 Applied Margins - Concentration Minimum

A concentration charge is applied if your portfolio consists of a small number of CFD and/or Stock positions, or if the three largest positions have a dominant weight. We stress the portfolio by applying a 30% adverse move on the three largest positions and a 5% adverse move on the remaining positions. The total loss is applied as the maintenance margin requirement if it is greater than the standard requirement for the combined Stock and CFD positions. Note that the concentration charge is the only instance where CFD and Stock positions are margined together.

1.3 Funding of Initial Margin Requirements

You can only use cash to post initial margin to open a CFD position.

Initially all cash used to fund the account is available for CFD trading. Any initial margin requirements for other instruments and cash used to purchase cash stock reduce the available cash. If your cash stock purchases have created a margin loan, no funds are available for CFD trades even if your account has significant equity. We cannot increase a margin loan to fund CFD margin under the CBI rules.

Realized CFD profits are included in cash and are available immediately; the cash does not have to settle first. Unrealized profits however cannot be used to meet initial margin requirements.

2 Margin Close Out Rule

2.1 Maintenance Margin Calculations & Liquidations

The CBI requires IBKR to liquidate CFD positions latest when qualifying equity falls below 50% of the initial margin posted to open the positions. IBKR may close out positions sooner if our risk view is more conservative. Qualifying equity for this purpose includes CFD cash and unrealized CFD P&L (positive and negative). Note that CFD cash excludes cash supporting margin requirements for other instruments.

The basis for the calculation is the initial margin posted at the time of opening a CFD position. In other words, and unlike margin calculations applicable to non-CFD positions, the initial margin amount does not change when the value of the open position changes.

2.1.1 Example

You have EUR 2000 cash in your account and no open positions. You want to buy 100 CFDs of XYZ at a limit price of EUR 100. You are first filled 50 CFDs and then the remaining 50. Your available cash reduces as your trades are filled:

|

|

Cash |

Equity* |

Position |

Price |

Value |

Unrealized P&L |

IM |

MM |

Available Cash |

MM Violation |

|

Pre Trade |

2000 |

2000 |

|

|

|

|

|

|

2000 |

|

|

Post Trade 1 |

2000 |

2000 |

50 |

100 |

5000 |

0 |

1000 |

500 |

1000 |

No |

|

Post Trade 2 |

2000 |

2000 |

100 |

100 |

10000 |

0 |

2000 |

1000 |

0 |

No |

*Equity equals Cash plus Unrealized P&L

The price increases to 110. Your equity is now 3000, but you cannot open additional positions because your available cash is still 0, and under the CBI rules IM and MM remain unchanged:

|

|

Cash |

Equity |

Position |

Price |

Value |

Unrealized P&L |

IM |

MM |

Available Cash |

MM Violation |

|

Change |

2000 |

3000 |

100 |

110 |

11000 |

1000 |

2000 |

1000 |

0 |

No |

The price then drops to 95. Your equity declines to 1500 but there is no margin violation since it is still greater than the 1000 requirement:

|

|

Cash |

Equity |

Position |

Price |

Value |

Unrealized P&L |

IM |

MM |

Available Cash |

MM Violation |

|

Change |

2000 |

1500 |

100 |

95 |

9500 |

(500) |

2000 |

1000 |

0 |

No |

The price falls further to 85, causing a margin violation and triggering a liquidation:

|

|

Cash |

Equity |

Position |

Price |

Value |

Unrealized P&L |

IM |

MM |

Available Cash |

MM Violation |

|

Change |

2000 |

500 |

100 |

85 |

8500 |

(1500) |

2000 |

1000 |

0 |

Yes |

3 Negative Equity Protection

The CBI Decision limits your CFD-related liability to the funds dedicated to CFD-trading. Other financial instruments (e.g., shares or futures) cannot be liquidated to satisfy a CFD margin-deficit.*

Therefore, non-CFD assets are not part of your capital at risk for CFD trading.

Should you lose more than the cash dedicated to CFD trading, IB must write off the loss.

As Negative Equity Protection represents additional risk to IBKR, we will charge retail investors an additional financing spread of 1% for CFD positions held overnight. You can find detailed CFD financing rates here.

*Although we cannot liquidate non-CFD positions to cover a CFD deficit, we can liquidate CFD positions to cover a non-CFD deficit.

Margin Considerations for Intramarket Futures Spreads

Background

Clients who simultaneously hold both long and short positions of a given futures contract having different delivery months are often provided a spread margin rate that is less than the margin requirement for each position if considered separately. However, as the settlement prices of each contract may deviate significantly as the front month contract approaches its close out date, IBKR will reduce the benefit of the spread margin rate to reflect the risk of this price deviation.

Spread Margin Adjustment

This reduction is accomplished by effectively decoupling or breaking the spread in phases on each of the 3 business days preceding the close out date of the front contract month, as follows:

- On the 3rd business day prior to close out, the initial and maintenance margin requirements will be equal to 10% of their respective requirements on each contract month as if there was no spread, plus 90% of the spread requirement;

- On the 2nd business day prior to close out, the initial and maintenance margin requirements will be equal to 20% of their respective requirements on each contract month as if there was no spread, plus 80% of the spread requirement;

- On the business day prior to close out, the initial and maintenance margin requirements will be equal to 30% of their respective requirements on each contract month as if there was no spread, plus 70% of the spread requirement.

Working Example

Assume a hypothetical futures contract XYZ with the margin requirements as outlined in the table below:

| XYZ | Front Month - 1 Short Contract (Uncovered) | Back Month - 1 Long Contract (Uncovered) | Spread - 1 Short Front Month vs. 1 Long Back Month |

| Initial Margin | $1,250 | $1,500 | $500 |

| Maintenance Margin | $1,000 | $1,200 | $400 |

Further assume a position consisting of 1 short front month contract and 1 long back month contract with the front month contract close out date = T. using this hypothetical example, the initial margin requirement over the 3 business day period preceding close out date is outlined in the table below:

| Day | Initial Margin Requirement | Calculation Details |

| T-4 | $500 | Unadjusted |

| T-3 | $725 | .1($1,250 + $1,500) + .9($500) |

| T-2 | $950 | .2($1,250 + $1,500) + .8($500) |

| T-1 | $1,175 | .3($1,250 + $1,500) + .7($500) |

| T | $1,175 | Positions not in compliance with close out requirements are subject to liquidation. |

Concentrated Positions in Low Cap Stocks

The margin requirement for accounts holding concentrated positions in low cap stocks is as follows:

- An alternative stress test will be considered following the margin calculation currently in place. Here, each stock and its derivatives will be subject to a stress test which simulates a price change reflective of a $500 million decrease in capitalization (e.g., 25% in the case of a stock with a market capitalization of $2 billion; 30% for a stock with a market capitalization of $1.5 billion; etc.). Stocks with a market capitalization of $500 million or below will be subject to a stress test as if the price has fallen to $0.

- For the stock which projects the greatest loss assuming a $500 million decrease in capitalization, that loss will be compared to the initial margin as determined under the preceding calculation for the aggregate portfolio and, if greater, will become the initial margin requirement.

- If the initial margin requirement is increased, the maintenance margin for that same stock and its derivatives will increase to approximately 90% of the initial requirement for the aggregate portfolio.

Application des règles ESMA relatives aux CFD à IBKR - Investisseurs de détail uniquement

|

Les CFD sont des instruments complexes associés à un risque élevé de perte financière rapide en raison de l'effet de levier.

63,7 % des comptes d'investisseurs de détail perdent de l'argent lorsqu'ils tradent des CFD avec IBKR.

Vous devez vous assurer que vous comprenez la manière dont fonctionnent les CFD et que vous pouvez vous permettre de courir un risque élevé de perdre de l'argent. |

L'Autorité européenne des marchés financiers (ESMA) a édicté de nouvelles règles applicables aux clients de détail qui tradent des CFD, à compter du 1 août 2018. Les clients professionnels ne sont pas affectés.

Les règles consistent en : 1) des limites sur les effets de levier ; 2) une règle de clôture des positions ouvertes par compte basée sur la marge ; 3) une protection contre les soldes négatifs par compte ; 4) une restriction des incitations au trading de CFD ; et 5) un avertissement standardisé concernant les risques.

La plupart des clients (à l'exception des entités régulées) sont initialement classés comme des clients de détail. IBKE peut, dans certaines circonstances accepter de changer la classification d'un client de détail en client professionnel ou un client professionnel en client de détail. Veuillez consulter la classification MiFID pour plus d'informations.

Les sections suivantes expliquent la manière dont IBKR (UK) a appliqué les mesures de l'ESMA.

1 Limites applicables aux effets de levier

1.1 Marges ESMA

Les limites applicables aux effets de levier fixées par l'ESMA à différents niveaux dépendent du sous-jacent:

- 3,33 % pour les paires de devises majeures; les paires de devises majeures sont une combinaison d'USD ; CAD ; EUR ; GBP ; CHF ; JPY

- 5 % pour les paires de devises non majeures et indices majeurs;

- Les paires de devises non majeures sont celles comprenant une devise qui n'est pas listée ci-dessus, ex. : USD.CNH

- Les indices principaux sont IBUS500, IBUS30, IBUST100, IBGB100, IBDE40, IBEU50, IBFR40, IBJP225, IBAU200

- 10 % pour les indices sur titres secondaires : IBES35, IBCH20, IBNL25, IBHK50

- 20 % pour les titres individuels

1.2 Marges appliquées - Exigence standard

En plus des marges de l'ESMA, IBKR (UK) établit ses propres exigences de marges (Marges IB) basées sur la volatilité historique du sous-jacent et autres facteurs. Nous appliquerons les marges IB si elles sont supérieures à celles déterminées par l'ESMA.

Vous trouverez des informations concernant les marges IB et ESMA applicables ici.

1.2.1 Marges appliquées - Marge minimum de concentration

Des frais de concentration sont appliqués si le portefeuille est composé d'un petit nombre de positions CFD, ou si les deux positions les plus importantes dominent. Nous soumettons le portefeuille à un test de résistance en appliquant un mouvement défavorable de 30 % sur les deux positions les plus importantes et un mouvement défavorable de 5 % sur les positions restantes. La perte totale obtenue sera alors utilisée comme exigence de marge de maintien si elle est supérieure à l'exigence standard.

1.3 Fonds disponibles pour la marge initiale

Pour ouvrir une position de CFD, la marge initiale doit correspondre à celle de la trésorerie. Les profits réalisés pour les CFD sont inclus dans la trésorerie et disponibles immédiatement; la trésorerie ne doit pas nécessairement faire d'abord l'objet d'un règlement. Les profits non réalisés ne peuvent cependant pas être utilisés pour satisfaire les exigences de marge initiales.

1.4 Approvisionnement automatique des exigences de marge initiale (segments-F)

IBKR (UK) transfère automatiquement des fonds de votre compte principal vers le segment-F de votre compte pour couvrir les exigences de marge initiale pour les CFD.

Veuillez cependant noter qu'aucun transfert ne sera effectué pour satisfaire les exigences de marge de maintien des CFD. Par conséquent, si la valeur de compte éligible (telle que décrite ci-dessous) devenait insuffisante pour couvrir les exigences de marge, une liquidation aurait lieu même si les fonds sur votre compte principal étaient amplement suffisants. Si vous souhaitez éviter une liquidation, vous devez transférer des fonds supplémentaires vers le segment-F via la Gestion de compte.

2 Règle de clôture des positions ouvertes basée sur la marge

2.1 Calculs de la marge de maintien et liquidations

L'ESMA exige qu'IBKR liquide les positions de CFD lorsque la valeur de compte éligible devient inférieure à 50 % de la marge initiale requise pour ouvrir les positions. IBKR peut clôturer des positions plus tôt si notre analyse des risques est plus prudente. La valeur de compte éligible comprend la trésorerie dans le segment-F (ce qui exclut la trésorerie dans un autre segment de compte) et le P&L de CFD non réalisé (positif et négatif).

La base pour ce calcul est la marge initiale requise au moment de l'ouverture d'une position CFD. En d'autres termes, contrairement aux calculs de marge applicables aux positions autres que CFD, le montant de la marge initiale ne change pas lorsque la valeur de la position ouverte change.

2.1.1 Exemple

Vous avez 2000 EUR de trésorerie dans votre compte CFD. Vous souhaitez acheter 100 CFD de XYZ au prix limite de 100 EUR. 50 CFD sont d'abord exécutés, puis les 50 restants. Votre trésorerie disponible diminue au fur et à mesure des exécutions:

| Trésorerie | Valeur de compte* | Position | Prix | Valeur | P&L non réalisé | MI | MM | Trésorerie disponible | Violation MM | |

| Pré-trade | 2000 | 2000 | 2000 | |||||||

| Post-trade 1 | 2000 | 2000 | 50 | 100 | 5000 | 0 | 1000 | 500 | 1000 | Non |

| Post-trade 2 | 2000 | 2000 | 100 | 100 | 10 000 | 0 | 2000 | 1000 | 0 | Non |

*La valeur de compte est la trésorerie plus le P&L non réalisé

Le prix passe à 110. Votre valeur de compte est maintenant de 3000 mais vous ne pouvez pas ouvrir de positions supplémentaires car la trésorerie disponible est toujours de 0, et en vertu des règles de l'ESMA, les marges initiales (MI) et de maintien (MM) restent inchangées:

| Trésorerie | Titres | Position | Prix | Valeur | P&L non réalisé | MI | MM | Trésorerie disponible | Violation MM | |

| Variation | 2000 | 3000 | 100 | 110 | 11 000 | 1000 | 2000 | 1000 | 0 | Non |

Puis le prix baisse et passe à 95. Votre valeur de compte passe à 1500 mais il n'y a pas de violation de marge puisque elle est toujours supérieure à l'exigence fixée à 1000 :

| Trésorerie | Titres | Position | Prix | Valeur | P&L non réalisé | MI | MM | Trésorerie disponible | Violation MM | |

| Variation | 2000 | 1500 | 100 | 95 | 9500 | (500) | 2000 | 1000 | 0 | Non |

Le prix baisse encore et passe à 85 ce qui se traduit par une violation de la marge et déclenche une liquidation:

| Trésorerie | Titres | Position | Prix | Valeur | P&L non réalisé | MI | MM | Trésorerie disponible | Violation MM | |

| Variation | 2000 | 500 | 100 | 85 | 8500 | (1500) | 2000 | 1000 | 0 | Oui |

3 Protection contre les valeurs négatives

Suite aux mesures de l'ESMA, votre responsabilité sur les CFD se limite aux fonds dédiés au trading de CFD. Les autres instruments financiers (ex. actions ou contrats à terme) ne peuvent pas être liquidés pour satisfaire une insuffisance de marge sur un CFD.*

Par conséquent, les actions dans le segment des titres et contrats de marchandises de votre compte principal ainsi que les actifs autres que des CFD, ne font pas partie de votre capital sous risque pour le trading de CFD. Cependant, toute trésorerie se trouvant dans le segment-F peut être utilisée pour couvrir les pertes générées par le trading de CFD.

Étant donné que la protection contre les valeurs négatives représente un risque supplémentaire pour IBKR, nous facturerons aux investisseurs de détail un spread supplémentaire de 1 % pour les positions de CFD détenues d'une séance à l'autre. Vous trouverez le détail des taux de financement des CFD ici.

*Bien que nous ne puissions pas liquider les positions autres que CFD pour couvrir un déficit de CFD, nous pouvons liquider des positions de CFD pour couvrir un déficit non CFD.

4 Incitations offertes pour trader des CFD

Les mesures de l'ESMA imposent une restriction sur les avantages monétaires et certains types d'avantages non monétaires liés au trading de CFD. IBKR n'offre aucune prime ou autre incitation à trader les CFD.

Overview of ESMA CFD Rules Implementation at IBKR (UK) - Retail Investors Only

|

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

61% of retail investor accounts lose money when trading CFDs with IBKR.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. |

The European Securities and Markets Authority (ESMA) enacted new rules applicable to retail clients trading CFDs, effective 1st August 2018. Professional clients are unaffected.

The rules consist of: 1) leverage limits; 2) a margin close out rule on a per account basis; 3) negative balance protection on a per account basis; 4) a restriction on the incentives offered to trade CFDs; and 5) a standardized risk warning.

Most clients (excepting regulated entities) are initially categorised as Retail Clients. IBKR may in certain circumstances agree to reclassify a Retail Client as a Professional Client, or a Professional Client as a Retail Client. Please see MiFID Categorisation for further detail.

The following sections detail how IBKR (UK) has implemented the ESMA Decision.

1 Leverage Limits

1.1 ESMA Margins

Leverage limits were set by ESMA at different levels depending on the underlying:

- 3.33% for major currency pairs; Major currency pairs are any combination of USD; CAD; EUR; GBP; CHF; JPY

- 5% for non-major currency pairs and major indices;

- Non-major currency pairs are any combination that includes a currency not listed above, e.g. USD.CNH

- Major indices are IBUS500; IBUS30; IBUST100; IBGB100; IBDE40; IBEU50; IBFR40; IBJP225; IBAU200

- 10% for non-major equity indices; IBES35; IBCH20; IBNL25; IBHK50

- 20% for individual equities

1.2 Applied Margins - Standard Requirement

In addition to the ESMA Margins, IBKR (UK) establishes its own margin requirements (IB Margins) based on the historical volatility of the underlying, and other factors. We will apply the IB Margins if they are higher than those prescribed by ESMA.

Details of applicable IB and ESMA margins can be found here.

1.2.1 Applied Margins - Concentration Minimum

A concentration charge is applied if your portfolio consists of a small number of CFD positions, or if the three largest positions have a dominant weight. We stress the portfolio by applying a 30% adverse move on the three largest positions and a 5% adverse move on the remaining positions. The total loss is applied as the maintenance margin requirement if it is greater than the standard requirement.

1.3 Funds Available for Initial Margin

You can only use cash to post initial margin to open a CFD position. Realized CFD profits are included in cash and are available immediately; the cash does not have to settle first. Unrealized profits however cannot be used to meet initial margin requirements.

1.4 Automatic Funding of Initial Margin Requirements (F-segments)

IBKR (UK) automatically transfers funds from your main account to the F-segment of your account to fund initial margin requirements for CFDs.

Note however that no transfers are made to satisfy CFD maintenance margin requirements. Therefore if qualifying equity (defined below) becomes insufficient to meet margin requirements, a liquidation will occur even if you have ample funds in your main account. If you wish to avoid a liquidation you must transfer additional funds to the F-segment in Account Management.

2 Margin Close Out Rule

2.1 Maintenance Margin Calculations & Liquidations

ESMA requires IBKR to liquidate CFD positions latest when qualifying equity falls below 50% of the initial margin posted to open the positions. IBKR may close out positions sooner if our risk view is more conservative. Qualifying equity for this purpose includes cash in the F-segment (excluding cash in any other account segment) and unrealized CFD P&L (positive and negative).

The basis for the calculation is the initial margin posted at the time of opening a CFD position. In other words, and unlike margin calculations applicable to non-CFD positions, the initial margin amount does not change when the value of the open position changes.

2.1.1 Example

You have EUR 2000 cash in your CFD account. You want to buy 100 CFDs of XYZ at a limit price of EUR 100. You are first filled 50 CFDs and then the remaining 50. Your available cash reduces as your trades are filled:

| Cash | Equity* | Position | Price | Value | Unrealized P&L | IM | MM | Available Cash | MM Violation | |

| Pre Trade | 2000 | 2000 | 2000 | |||||||

| Post Trade 1 | 2000 | 2000 | 50 | 100 | 5000 | 0 | 1000 | 500 | 1000 | No |

| Post Trade 2 | 2000 | 2000 | 100 | 100 | 10000 | 0 | 2000 | 1000 | 0 | No |

*Equity equals Cash plus Unrealized P&L

The price increases to 110. Your equity is now 3000, but you cannot open additional positions because your available cash is still 0, and under the ESMA rules IM and MM remain unchanged:

| Cash | Equity | Position | Price | Value | Unrealized P&L | IM | MM | Available Cash | MM Violation | |

| Change | 2000 | 3000 | 100 | 110 | 11000 | 1000 | 2000 | 1000 | 0 | No |

The price then drops to 95. Your equity declines to 1500 but there is no margin violation since it is still greater than the 1000 requirement:

| Cash | Equity | Position | Price | Value | Unrealized P&L | IM | MM | Available Cash | MM Violation | |

| Change | 2000 | 1500 | 100 | 95 | 9500 | (500) | 2000 | 1000 | 0 | No |

The price falls further to 85, causing a margin violation and triggering a liquidation:

| Cash | Equity | Position | Price | Value | Unrealized P&L | IM | MM | Available Cash | MM Violation | |

| Change | 2000 | 500 | 100 | 85 | 8500 | (1500) | 2000 | 1000 | 0 | Yes |

3 Negative Equity Protection

The ESMA Decision limits your CFD-related liability to the funds dedicated to CFD-trading. Other financial instruments (e.g. shares or futures) cannot be liquidated to satisfy a CFD margin-deficit.*

Therefore assets in the security and commodity segments of your main account, and non-CFD assets held in the F-segment, are not part of your capital at risk for CFD trading. However, all cash in the F-segment can be used to cover losses arising from CFD trading.

As Negative Equity Protection represents additional risk to IBKR, we will charge retail investors an additional financing spread of 1% for CFD positions held overnight. You can find detailed CFD financing rates here.

*Although we cannot liquidate non-CFD positions to cover a CFD deficit, we can liquidate CFD positions to cover a non-CFD deficit.

4 Incentives Offered to trade CFDs

The ESMA Decision imposes a ban on monetary and certain types of non-monetary benefits related to CFD trading. IBKR does not offer any bonus or other incentives to trade CFDs.

Risk Navigator: Alternative Margin Calculator

IB routinely reviews margin levels and will implement changes which serve to increase requirements above statutory minimums as market conditions warrant. To assist clients with understanding the effects of such changes on their portfolio, a feature referred to as the "Alternative Margin Calculator" is provided within the Risk Navigator application. Outlined below are the steps for creating a “what-if” portfolio for the purpose of determining the impact of such margin changes.

Step 1: Open a new “What-if” portfolio

From the Classic TWS trading platform, select the Analytical Tools, Risk Navigator, and then Open New What-If menu options (Exhibit1).

Exhibit 1

.png)

From the Mosaic TWS trading platform, select New Window, Risk Navigator, and then Open New What-If menu options.

Step 2: Define starting portfolio

A pop-up window will appear (Exhibit 2) from which you will be prompted to define whether you would like to create a hypothetical portfolio starting from your current portfolio or a newly created portfolio. Clicking on the "yes" button will serve to download existing positions to the new “What-If” portfolio.

Exhibit 2

Clicking on the "No" button will open up the “What – If” Portfolio with no positions.

Risk Dashboard

The Risk Dashboard is pinned along the top of the product tab-sets, and is and is available for what-if as well as active portfolios. The values are calculated on demand for what-if portfolios. The dashboard provides at-a-glance account information including:

1) Net Liquidation Value: The total Net Liquidation Value for the account

2) P&L: The total daily P&L for the entire portfolio

3) Maintenance Margin: Total current maintenance margin

4) Initial Margin: Total initial margin requirements

5) VAR: Shows the Value at risk for the entire portfolio

6) Expected Shortfall (ES): Expected Shortfall (average value at risk) is expected return of the portfolio in the worst case

Alternative Margin Calculator

The Alternative Margin Calculator, accessed from the Margin menu and clicking on the Margin Mode (Exhibit 3), shows how the margin change will affect the overall margin requirement, once fully implemented.

Exhibit 3

Step 3: Selecting Margin Mode Settings

A pop-up window will appear (Exhibit 4) entitled Margin Mode Setting. You can use the drop-down menu in that window to change the margin calculations from Default (being the current policy) to the new title of the new Margin Setting (being the new margin policy). Once you have made a selection click on the OK button in that window.

Exhibit 4

Once the new margin mode setting is specified, the Risk Navigator Dashboard will automatically update to reflect your choice. You can toggle back and forth between the Margin Mode settings. Note that the current Margin Mode will be shown in the lower left hand corner of the Risk Navigator window (Exhibit 5).

Exhibit 5

Step 4: Add Positions

To add a position to the "What - If" portfolio, click on the green row titled "New" and then enter the underlying symbol (Exhibit 6), define the product type (Exhibit 7) and enter position quantity (Exhibit 8)

Exhibit 6

Exhibit 7

Exhibit 8

You can modify the positions to see how that changes the margin. After you altered your positions you will need to click on the recalculate icon (![]() ) to the right of the margin numbers in order to have them update. Whenever that icon is present the margin numbers are not up-to-date with the content of the What-If Portfolio.

) to the right of the margin numbers in order to have them update. Whenever that icon is present the margin numbers are not up-to-date with the content of the What-If Portfolio.

Margin Considerations for IB LLC Commodities Accounts

Introduction

As a global broker offering futures trading in 19 countries, IB is subject to various regulations, some of which retain the concept of margin as a single, end of day computation as opposed to the continuous, real-time computations IB performs. To satisfy commodity regulatory requirements and manage economic exposure in a pragmatic fashion, two margin computations are performed at the market close, both which must be met to remain fully margin compliant. An overview of these computations is outlined below.

Overview

All orders are subject to an initial margin check prior to execution and continuous maintenance margin checks thereafter. As certain products may be offered intraday margin at rates less than the exchange minimum and to ensure end of day margin compliance overall, IB will generally liquidate positions prior to the close rather than issue a margin call. If, however, an account remains non-compliant at the close, our practice is to issue a margin call, restrict the account to margin reducing transactions and liquidate positions by the close of the 3rd business day if the initial requirement has not then been satisfied.

In determining whether a margin call is required, IB performs both a real-time and regulatory computation, which in certain circumstances, can generate different results:

Real-Time: under this method, initial margin is computed using positions and prices collected at a common point in time, regardless of a product’s listing exchange and official closing time; an approach we believe appropriate given the near continuous trading offered by most exchanges.

Regulatory: under this method, initial margin is computed using positions and prices collected at the official close of regular trading hours for each individual exchange. So, for example, a client trading futures listed on each of the Hong Kong, EUREX and CME exchanges would have a requirement calculated based upon information collected at the close of each respective exchange.

Impact

Clients trading futures listed within a single country and session are not expected to be impacted. Clients trading both the daytime and after hours sessions of a given exchange or on exchanges located in different countries where the closing times don’t align are more likely to be impacted. For example, a client opening a futures contract during the Hong Kong daytime session and closing it during U.S. hours, would have only the opening position considered for purposes of determining the margin requirement. This implies a different margin requirement and a possible margin call under the revised computation that may not have existed under the current. An example of this is provided in the chart below.

Example

This example attempts to demonstrate how a client trading futures in both the Asia and U.S. timezones would be impacted were that client to trade in an extended hours trading session (i.e., outside of the regular trading hours after which the day's official close had been determined). Here, the client opens a position during the Hong Kong regular hours trading session, closes it during the extended hours session, thereby freeing up equity to open a position in the U.S. regular hours session. For purposes of illustration, a $1,000 trading loss is assumed. This example illustrates that the regulatory end of day computation may not recognize margin reducing trades conducted after the official close, thereby generating an initial margin call.

| Day | Time (ET) | Event |

Start Position |

End Position | IB Margin | Regulatory Margin | |||

| Equity With Loan | Maintenance | Initial | Overnight | Margin Call | |||||

| 1 | 22:00 | Buy 1 HHI.HK | None | Long 1 HHI.HK | $10,000 | $3,594 | $4,493 | N/A | N/A |

| 2 | 04:30 | Official HK Close | Long 1 HHI.HK | Long 1 HHI.HK | $10,000 | $7,942 | $9,927 | $4,493 | N/A |

| 2 | 08:00 | Sell 1 HHI.HK | Long 1 HHI.HK | None | $9,000 | $0 | $0 | $0 | N/A |

| 2 | 10:00 | Buy 1 ES | None | Long 1 ES | $9,000 | $2,942 | $3,677 | N/A | N/A |

| 2 | 17:00 | Official U.S. Close | Long 1 ES | Long 1 ES | $9,000 | $5,884 | $7,355 | $9,993 | Yes |

| 3 | 17:00 | Official U.S. Close | Long 1 ES | Long 1 ES | $9,000 | $5,884 | $7,355 | $5,500 | No |