非美國居民要繳納預扣稅嗎?

納稅義務相關信息根據要求上報給您居住國家以及其它國家(如果交易的産品有地方預扣稅要求)的稅務機關。除非有稅務機關明確要求,某則IBKR不會就證券交易收入扣繳稅款。根據美國稅法規定,我們對美國公司向外國人士支付的股息按30%的稅率進行扣稅。如果美國與您的所在國有稅務協定,稅率可能會有一定優惠。此外,投資利息收入沒有美國預扣稅。非美國人士和大多數實體的所有預扣稅均將在每年年末通過表格1042-S申報。更多信息,請參見美國國稅局901和/或諮詢您的稅務顧問。

股票收益提升計劃(SYEP)常見問題

股票收益提升計劃推出的目的是什麽?

股票收益提升計劃可供客戶通過允許IBKR將其賬戶內原本閑置的證券頭寸(即全額支付和超額保證金證券)出借給第三方來賺取額外收益。參與此計劃的客戶會收到用以確保股票在借貸終止時順利歸還的抵押(美國國債或現金)。

什麽是全額支付和超額保證金證券?

全額支付證券是客戶賬戶中全款付清的證券。超額保證金證券是雖然沒有全款付清但本身市場價值已超過保證金貸款餘額的140%的證券。

客戶股票收益提升計劃的借出交易收益如何計算?

客戶借出股票的收益取决于場外證券借貸市場的借貸利率。借出的股票不同,出借的日期不同,都會對借貸利率造成很大差异。通常,IBKR會按自己借出股票所得金額的大約50%向參與計劃的客戶支付利息。

借貸交易的抵押金額如何確定?

證券借貸的抵押(美國國債或現金)金額採用行業慣例確定,即用股票的收盤價乘以特定百分比(通常爲102-105%),然後向上取整到最近的美元/分。每個幣種的行業慣例不同。例如,借出100股收盤價爲$59.24美元的美元計價股票,現金抵押應爲$6,100 ($59.24 * 1.02 = $60.4248;取整到$61,再乘以100)。下表爲各個幣種的行業慣例:

| 美元 | 102%;向上取整到最近的元 |

| 加元 | 102%;向上取整到最近的元 |

| 歐元 | 105%;向上取整到最近的分 |

| 瑞士法郎 | 105%;向上取整到最近的生丁 |

| 英鎊 | 105%;向上取整到最近的便士 |

| 港幣 | 105%;向上取整到最近的分 |

更多信息,請參見KB1146。

股票收益提升計劃下的抵押如何保管以及保管在何處?

對於IBLLC的客戶,抵押將採用現金或美國國債的形式,並將轉入IBLLC的聯營公司IBKR Securities Services LLC (“IBKRSS”)進行保管。您在該計劃下借出股票的抵押會由IBKRSS以您爲受益人保管在一個賬戶中,您將享有第一優先級擔保權益。如果IBLLC違約,您將可以直接從IBKRSS取得抵押,無需經過IBLLC。請參見 此處的《證券賬戶控制協議》瞭解更多信息。對于非IBLLC的客戶,抵押將由賬戶所在實體保管。例如,IBIE的賬戶其抵押將由IBIE保管。

退出IBKR股票收益提升計劃或賣出/轉帳通過此計劃借出的股票會對利息造成什麽影響?

交易日的下一個工作日(T+1)停止計息。對於轉帳或退出計劃,利息也會在發起轉帳或退出計劃的下一個工作日停止計算。

參加IBKR股票收益提升計劃有什麽資格要求?

| 可參加股票收益提升計劃的實體* |

| 盈透證券有限公司(IB LLC) |

| 盈透證券英國有限公司(IB UK)(SIPP賬戶除外) |

| 盈透證券愛爾蘭有限公司(IB IE) |

| 盈透證券中歐有限公司(IB CE) |

| 盈透證券香港有限公司(IB HK) |

| 盈透證券加拿大有限公司(IB Canada)(RRSP/TFSA賬戶除外) |

| 盈透證券新加坡有限公司(IB Singapore) |

| 可參加股票收益提升計劃的賬戶類型 |

| 現金帳戶(申請參加時賬戶資産超過$50,000美元) |

| 保證金賬戶 |

| 財務顧問客戶賬戶* |

| 介紹經紀商客戶賬戶:全披露和非披露* |

| 介紹經紀商綜合賬戶 |

| 獨立交易限制賬戶(STL) |

*參加的賬戶必須是保證金賬戶或滿足上述現金帳戶最低資産要求的現金帳戶。

盈透證券日本、盈透證券盧森堡、盈透證券澳大利亞和盈透證券印度公司的客戶不能參加此計劃。賬戶開在IB LLC下的日本和印度客戶可以參加。

此外,滿足上方條件的財務顧問客戶賬戶、全披露介紹經紀商客戶和綜合經紀商可以參加此計劃。如果是財務顧問和全披露介紹經紀商,必須由客戶自己簽署協議。綜合經紀商由經紀商簽署協議。

IRA賬戶可以參加股票收益提升計劃嗎?

可以。

IRA賬戶由盈透證券資産管理公司(Interactive Brokers Asset Management)管理的賬戶分區可以參加股票收益提升計劃嗎??

不是。

英國SIPP賬戶可以參加股票收益提升計劃嗎?

不是。

如果參加計劃的現金帳戶資産跌破最低資産要求$50,000美元會怎麽樣?

現金帳戶只有在申請參加計劃當時必須滿足這一最低資産要求。之後資産跌破此要求並不會對現有借貸造成任何影響,也不影響您繼續借出股票。

如何申請參加IBKR股票收益提升計劃?

要參加股票收益提升計劃,請登錄客戶端。登錄後,點擊 使用者菜單(右上角的小人圖標),然後點擊設置。然後,在賬戶設置內,尋找交易板塊並點擊股票收益提升計劃 以申請參加。您將會看到參加該計劃所需填寫的表格和披露。閱讀並簽署表格後,您的申請便會提交處理。可能需要24到48小時才能完成激活。

如何終止股票收益提升計劃?

要退出股票收益提升計劃,請登錄客戶端。登錄後,點擊使用者菜單 (右上角的小人圖標),然後點擊 設置。在賬戶 設置板塊內會找到交易,然後點擊股票 收益 提升 計劃,然後依照所需步驟。您的申請便會提交處理。 中止參加的請求通常會在當日結束時進行處理。

如果一個賬戶參加了計劃然後又退出,那麽該賬戶多久可以重新參加計劃?

退出計劃後,賬戶需要等待90天才能重新參加。

哪些證券頭寸可以出借?

| 美國市場 | 歐洲市場 | 香港市場 | 加拿大市場 |

| 普通股(交易所掛牌、粉單和OTCBB) | 普通股(交易所掛牌) | 普通股(交易所掛牌) | 普通股(交易所掛牌) |

| ETF | ETF | ETF | ETF |

| 優先股 | 優先股 | 優先股 | 優先股 |

| 公司債券* |

*市政債券不適用。

借出IPO後在二級市場交易的股票有什麽限制嗎?

沒有,只要賬戶本身沒有就相應的證券受到限制就可以。

IBKR如何確定可以借出的股票數量?

第一步是確定IBKR有保證金扣押權從而可以在沒有客戶參與的情况下通過股票收益提升計劃借出的證券的價值(如有)。根據規定,通過保證金貸款借錢給客戶購買證券的經紀商可以將該客戶的證券借出或用作抵押,金額最高不超過貸款金額的140%。例如,如果客戶現金餘額爲$50,000美元,買入市場價值爲$100,000美元的證券,則貸款金額爲$50,000美元,那麽經紀商對$70,000美元($50,000的140%)的證券享有扣押權。客戶持有的證券超出這一金額的部分被稱爲超額保證金證券(此例子中爲$30,000),需要記在隔離賬戶,除非客戶授權IBKR通過股票收益提升計劃將其借出。

計算貸款金額首先要將所有非美元計價的現金餘額轉換成美元,然後减去股票賣空所得(轉換成美元)。如果結果爲負數,則我們最高可抵押此數目的140%。此外,商品賬戶段中持有的現金餘額和現貨金屬和差價合約相關現金不納入考慮範圍。 詳細說明請參見此處。

例1: 客戶在基礎貨幣爲美元的賬戶內持有100,000歐元,歐元兌美元匯率爲1.40。客戶買入價值$112,000美元(相當於80,000歐元)的美元計價股票。由於轉換成美元後現金餘額爲正數,所有證券被視爲全額支付。

| 項目 | 歐元 | 美元 | 基礎貨幣(美元) |

| 現金 | 100,000 | (112,000) | $28,000 |

| 多頭股票 | $112,000 | $112,000 | |

| 淨清算價值 | $140,000 |

例2: 客戶持有80,000美元、多頭持有價值$100,000美元的美元計價股票並且做空了價值$100,000美元的美元計價股票。總計$28,000美元的多頭證券被視爲保證金證券,剩餘的$72,000美元爲超額保證金證券。計算方法是用現金餘額减去賣空所得($80,000 - $100,000),所得貸款金額再乘以140% ($20,000 * 1.4 = $28,000)

| 項目 | 基礎貨幣(美元) |

| 現金 | $80,000 |

| 多頭股票 | $100,000 |

| 空頭股票 | ($100,000) |

| 淨清算價值 | $80,000 |

IBKR會把所有符合條件的股票都借出去嗎?

不保證賬戶內所有符合條件的股票都能通過股票收益提升計劃借出去,因爲某些證券可能沒有利率有利的市場,或者IBKR無法接入有意願的借用方所在的市場,也有可能IBKR不想借出您的股票。

通過股票收益提升計劃借出股票是否都要以100爲單位?

不是。只要是整股都可以,但是借給第三方的時候我們只以100爲倍數借出。這樣,如果有第三方需要借用100股,就可能發生我們從一個客戶那裏借出75股、從另一個客戶那裏借出25股的情况。

如果可供借出的股票超過借用需求,如何在多個客戶之間分配借出份額?

如果我們股票收益提升計劃的參與者可用以借出的股票數量大於借用需求,則借出份額將按比例分配。例如,可供借出XYZ數量爲20,000股,而對於XYZ的需求只有10,000股的情况下,每個客戶可以借出其所持股數的一半。

股票是只借給其它IBKR客戶還是也會借給其它第三方?

股票可以借給IBKR客戶和第三方。

股票收益提升計劃的參與者可以自行决定哪些股票IBKR可以借出嗎?

不是。此計劃完全由IBKR管理,IBKR在確定了自己因保證金貸款扣押權可以借出的證券後,可自行决定哪些全額支付或超額保證金證券可以借出,並發起借貸。

通過股票收益提升計劃借出去的證券其賣出是否會受到限制?

借出去的股票可隨時賣出,沒有任何限制。賣出交易的結算並不需要股票及時歸還,賣出收益會按正常結算日記入客戶的賬戶。此外,借貸會於證券賣出的下一個工作日開盤終止。

客戶就通過股票收益提升計劃借出去的股票沽出持保看張期權還能享受持保看漲期權保證金待遇嗎?

可以。由於借出去的股票其盈虧風險仍然在借出方身上,借出股票不會對相關保證金要求造成任何影響。

借出去的股票由於看漲期權被行權或看跌期權行權被交付會怎麽樣?

借貸將於平倉或减倉操作(交易、被行權、行權)的T+1日終止。

借出去的股票被暫停交易會怎麽樣?

暫停交易對股票借出沒有直接影響,只要IBKR能繼續借出該等股票,則無論股票是否被暫停交易,借貸都可以繼續進行。

借貸股票的抵押可以劃至商品賬戶段沖抵保證金和/或應付行情變化嗎?

不是。股票借貸的抵押不會對保證金或融資造成任何影響。

計劃參與者發起保證金貸款或提高現有貸款金額會怎麽樣?

如果客戶有全額支付的證券通過股票收益提升計劃借出,之後又發起保證金貸款,則不屬於超額保證金證券的部分將被終止借貸。同樣,如果客戶有超額保證金證券通過此計劃借出,之後又要增加現有保證金貸款,則不屬於超額保證金證券的部分也將被終止借貸。

什麽情况下股票借貸會被終止?

發生以下情况(但不限于以下情况),股票借貸將被自動終止:

- 客戶選擇退出計劃

- 轉帳股票

- 以股票作抵押借款

- 賣出股票

- 看漲期權被行權/看跌期權行權

- 賬戶關閉

股票收益提升計劃的參與者是否會收到被借出股票的股息?

通過股票收益提升計劃借出的股票通常會在除息日前召回以獲取股息、避免股息替代支付。但是仍然有可能獲得股息替代支付。

股票收益提升計劃的參與者是否對被借出的股票保有投票權?

不是。如果登記日或投票、給予同意或採取其它行動的截止日期在貸款期內,則證券的借用者有權就證券相關事項進行投票或决斷。

股票收益提升計劃的參與者是否能就被借出的股票獲得權利、權證和分拆股份?

可以。被借出股票分配的任何權利、權證和分拆股份都將屬於證券的借出方。

股票借貸在活動報表中如何呈現?

借貸抵押、借出在外的股數、活動和收益在以下6個報表區域中反映:

1. 現金詳情 – 詳細列出了期初抵押(美國國債或現金)餘額、借貸活動導致的淨變化(如果發起新的借貸則爲正;如果股票歸還則爲負)和期末現金抵押餘額。

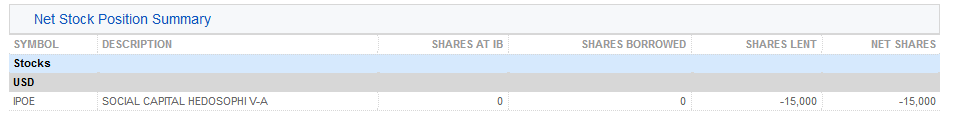

2. 淨股票頭寸總結 – 按股票詳細列出了在IBKR持有的總股數、借入的股數、借出的股數和淨股數(=在IBKR持有的總股數 + 借入的股數 - 借出的股數)。

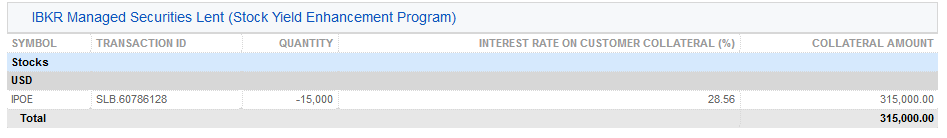

3. 借出的IBKR管理證券(股票收益提升計劃) – 對通過股票收益提升計劃借出的股票按股票列出了借出的股數以及利率(%)。

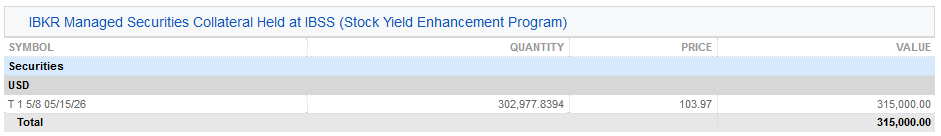

3a. 在IBSS保管的IBKR管理證券的抵押(股票收益提升計劃) – IBLLC的客戶會看到其報表中多出來一欄,顯示作爲抵押的美國國債以及抵押的數量、價格和總價值。

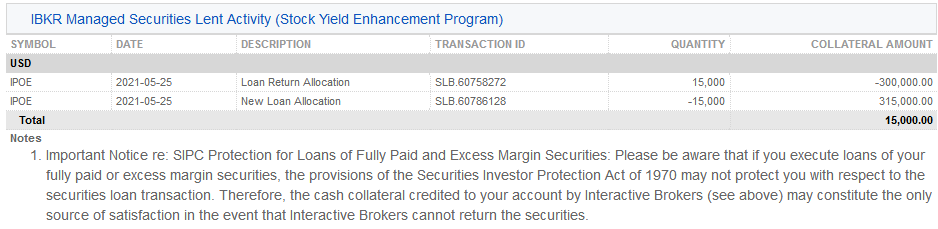

4. IBKR管理證券借出活動 (股票收益提升計劃)– 詳細列出了各證券的借貸活動,包括歸還份額分配(即終止的借貸);新借出份額分配(即新發起的借貸);股數;淨利率(%);客戶抵押金額及其利率(%)。

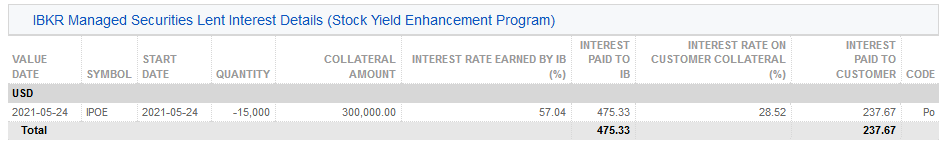

5. IBKR管理的證券借出活動利息詳情 (股票收益提升計劃)– 按每筆借出活動詳細列出了IBKR賺取的利率(%);IBKR賺取的收益(爲IBKR從該筆借出活動賺取的總收益,等于{抵押金額 * 利率}/360);客戶抵押的利率(爲IBKR從該筆借出活動賺取的收益的一半)以及支付給客戶的利息(爲客戶的現金抵押賺取的利息收入)

注:此部分只有在報表期內客戶賺取的應計利息超過1美元的情况下才會顯示。

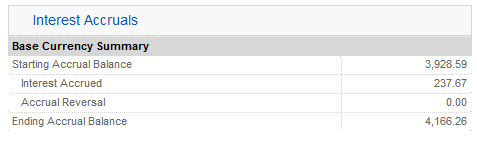

6. 應計利息 – 此處利息收入列爲應計利息,與任何其它應計利息一樣處理(累積計算,但只有超過$1美元才會顯示並按月過帳到現金)。年末申報時,該筆利息收入將上報表格1099(美國納稅人)。

Special Dividends: "Due Bill" Process

In some cases, special dividends may have different rules than regular dividends concerning the ex-dividend date. If a special dividend is less than 25% of the stock price, standard rules apply regarding the ex-dividend date (ex-date is before the record and pay date). However, if a special dividend is greater than 25% of the stock price*, the ex-dividend date will be after the record date and pay date.

In the case of a regular dividend or a special dividend of less than 25% of the share price, one would need to own a stock by the record date in order to be entitled to the dividend. However, this is not the case for special dividends that are more than 25% of the stock price. If one were to sell a stock after the record date but before the ex-dividend date, they would no longer be entitled to the dividend. The shares would be tagged with something called a "due bill" which means that the seller is obligated to pay the dividend to the buyer. Likewise, if one were to buy a stock after the record date but before the ex-dividend date (and hold it through the ex-date), they would be entitled to the dividend from the seller.

*Please note, the 25% or more rule is a general rule and will not apply in all cases. Certain foreign stock dividends will not follow the rule and some domestic stocks are granted an exclusion. For information regarding regular dividends, please reference KB 47.

T+2結算概述

簡介

- 降低金融系統的風險 –由於證券價格變動的可能性會隨時間上升,縮短結算週期能降低由於未付款或未交付證券導致的信用風險敞口。通過降低待結算義務的名義價值,能夠提高金融系統對嚴重市場衝擊帶來的潛在系統性後果的抵禦能力。

- 提高現金調用效率 –對於持“現金”賬戶的客戶,若資金結算未完成,則無法交易(即不得空買空賣/在不支付的情況下買賣證券)。實施T+2制度後,銷售證券所得的資金將比之前早一個工作日到賬,因此客戶將能更快地將資金用於後續交易。

- 提高全球結算一致性 -當前歐洲和亞洲等市場實行T+2制度,向T+2結算週期的轉變將使美國和加拿大市場更好地與其它主要國際市場接軌。

買賣期權、期貨或期貨期權合約的結算規則有無變化?

無變化。此類產品當前在T+1日結算,結算週期不變。

股息等值支付預征稅款 - 常見問題

背景

重要提示: 我方不提供稅務、法律或財務建議。客戶應諮詢其自有顧問,以確定法規871(m)對其交易活動的影響。

Withholding Tax on Dividend Equivalent Payments - FAQs

Background

IMPORTANT NOTE: We do not provide tax, legal or financial advice. Each customer must speak with the customer’s own advisors to determine the impact that the Section 871(m) rules may have on the customer’s trading activity.

IBKR股票差價合約概述

下方文章對IBKR發行的股票差價合約(CFD)進行了總體介紹。

有關IBKR指數差價合約的信息,請點擊此處。有關外匯差價合約的信息,請點擊此處。

涵蓋主題如下:

I. 差價合約定義

II. 差價合約與底層股票之比較

III. 成本與保證金

IV. 范例

V. 差價合約的相關資源

VI. 常見問題

風險警告

差價合約屬於復雜金融產品,其交易存在高風險,由於杠杆的作用,可能會出現迅速虧損。

在通過IBKR(UK)交易差價合約時,有67%的零售投資者賬戶出現了虧損。

您應考慮自己是否理解差價合約的運作機制以及自己是否能夠承受虧損風險。

ESMA差價合約規定(僅限零售客戶)

歐洲證券與市場管理局(ESMA)頒布了新的差價合約規定,自2018年8月1日起生效。

新規包括:1) 開倉差價合約頭寸的杠杆限制;2) 以單個賬戶為單位的保證金平倉規則;以及3) 以單個賬戶為單位的負余額保護規則;

ESMA新規僅適用於零售客戶。專業客戶不受影響。

請參見ESMA差價合約新規推行了解更多詳細信息。

I. 股票差價合約定義

IBKR差價合約是場外交易合約,提供底層股票的收益,包括股息與公司行動(了解更多有關差價合約公司行動的信息)。

換句話說,這是買家(您)與IBKR就交易一只股票當前價值與未來價值之差額而達成的協定。如果您持有多頭頭寸,且差額為正,則IBKR會付錢給您。而如果差額為負,則您應向IBKR付錢。

IBKR股票差價合約通過您的保證金賬戶進行交易,因此您可建立多頭以及空頭杠杆頭寸。差價合約的價格即是底層股票的交易所報價。實際上,IBKR差價合約報價與股票的智能傳遞報價(可在TWS中查看)相衕,且IBKR提供直接市場接入(DMA)。與股票類似,您的非適銷(即限價)定單會使底層對沖直接呈現在其進行交易之交易所的深度定單冊中。 這也意味著您可以下單以底層買價買入差價合約或以底層賣價賣出差價合約。

要將IBKR透明的差價合約模型與市場上其他差價合約進行比較,請參見我們的差價合約市場模型概述。

IBKR目前提供約7100只股票差價合約,覆蓋美國、歐洲和亞洲的主要市場。下表所列的主要指數其成分股目前都可做IBKR股票差價合約。在許多國家,IBKR還可供交易高流動性小槃股。這些股票自由流通量調整市值至少為5億美元,每日交易量中間值至少為60萬美元。 詳情請見差價合約產品列表。不久將會增加更多國家。

| 美國 | 標普500、道瓊斯股價平均指數、納斯達克100、標普400中槃股、高流動性小槃股 |

| 英國 | 富時350 + 高流動性小槃股(包括IOB) |

| 德國 | Dax、MDax、TecDax + 高流動性小槃股 |

| 瑞士 | 斯托克歐洲600指數(48只股票)+ 高流動性小槃股 |

| 法國 | CAC大槃股、CAC中槃股 + 高流動性小槃股 |

| 荷蘭 | AEX、AMS中槃股 + 高流動性小槃 |

| 比利時 | BEL 20、BEL中槃股 + 高流動性小槃 |

| 西班牙 | IBEX 35 + 高流動性小槃股 |

| 葡萄牙 | PSI 20 |

| 瑞典 | OMX斯德哥爾摩30指數 + 高流動性小槃股 |

| 芬蘭 | OMX赫爾辛基25指數 + 高流動性小槃股 |

| 丹麥 | OMX哥本哈根30指數 + 高流動性小槃股 |

| 挪威 | OBX |

| 捷克 | PX |

| 日本 | 日經225指數 + 高流動性小槃股 |

| 香港 | 恆生指數 + 高流動性小槃股 |

| 澳大利亞 | ASX 200指數 + 高流動性小槃股 |

| 新加坡* | 海峽時報指數 + 高流動性小槃股 |

| 南非 | Top 40 + 高流動性小槃股 |

*對新加坡居民不可用

II. 差價合約與底層股票之比較

| IBKR差價合約的優勢 | IBKR差價合約的缺點 |

|---|---|

| 無印花稅和金融交易稅(英國、法國、比利時) | 無股權 |

| 佣金和保證金利率通常比股票低 | 復雜公司行動并不總能完全復制 |

| 股息享受稅務協定稅率,無需重新申請 | 收益的徵稅可能與股票有所不衕(請咨詢您的稅務顧問) |

| 不受即日交易規則限制 |

III. 成本與保證金

在歐洲股票市場,IBKR差價合約可以比IB極具競爭力的股票產品更加高效。

首先,IBKR差價合約佣金比股票低,且有著與股票一樣低的融資點差:

| 歐洲 | 差價合約 | 股票 | |

|---|---|---|---|

| 佣金 | GBP | 0.05% | 英鎊6.00 + 0.05%* |

| EUR | 0.05% | 0.10% | |

| 融資** | 基准+/- | 1.50% | 1.50% |

*每單 + 超出5萬英鎊部分的0.05%

**對於差價合約是總頭寸價值的融資;對於股票是借用金額的融資

交易量更大時,差價合約佣金會變得更低,最低至0.02%。頭寸更大時,融資利率也會降低,最低至0.5%。 詳情請參見差價合約佣金和差價合約融資利率。

其次,差價合約的保證金要求比股票低。零售客戶須滿足歐洲監管機搆ESMA規定的額外保證金要求。請參見ESMA差價合約新規推行了解詳細信息。

| 差價合約 | 股票 | ||

|---|---|---|---|

| 所有 | 標准 | 投資組合保證金 | |

| 維持保證金要求* |

10% |

25% - 50% | 15% |

*藍籌股特有保證金。零售客戶最低初始保證金要求為20%。股票標准的25%日內維持保證金,50%隔夜保證金。 顯示的投資組合保證金為維持保證金(包括隔夜)。波動較大的股票保證金要求更高

請參見CFD保證金要求了解更多詳細信息。

IV. 范例(專業客戶)

讓我們來看一下例子。聯合利華在阿姆斯特丹的掛牌股票在過去一個月(2012年5月14日前20個交易日)回報率為3.2%,您認為其會繼續有良好表現。您想建立20萬歐元的倉位,并持倉5天。您以10筆交易建倉并以10筆交易平倉。您的直接成本如下:

股票

| 差價合約 | 股票 | ||

|---|---|---|---|

| 200,000歐元頭寸 | 標准 | 投資組合保證金 | |

| 保證金要求 | 20,000 | 100,000 | 30,000 |

| 佣金(雙向) | 200.00 | 400.00 | 400.00 |

| 利率(簡化) | 1.50% | 1.50% | 1.50% |

| 融資金額 | 200,000 | 100,000 | 170,000 |

| 融資天數 | 5 | 5 | 5 |

| 利息支出(1.5%的簡化利率) | 41.67 | 20.83 | 35.42 |

| 總計直接成本(佣金+利息) | 241.67 | 420.83 | 435.42 |

| 成本差額 | 高74% | 高80% | |

注意:差價合約的利息支出根據總的合約頭寸進行計算,而股票的利息支出則是根據借用金額進行計算。股票和差價合約的適用利率相衕。

但是,假設您只有2萬歐元可用來做保證金。如果聯合利華繼續上月的表現,您的潛在盈利比較如下:

| 杠杆回報 | 差價合約 | 股票 | |

|---|---|---|---|

| 可用保證金 | 20,000 | 20,000 | 20,000 |

| 總投入 | 200,000 | 40,000 | 133,333 |

| 總收益(5天) | 1,600 | 320 | 1,066.66 |

| 佣金 | 200.00 | 80.00 | 266.67 |

| 利息支出(1.5%的簡化利率) | 41.67 | 4.17 | 23.61 |

| 總計直接成本(佣金+利息) | 241.67 | 84.17 | 290.28 |

| 淨收益(總收益減去直接成本) | 1,358.33 | 235.83 | 776.39 |

| 保證金投資金額回報 | 0.07 | 0.01 | 0.04 |

| 差額 | 收益少83% | 收益少43% | |

| 杠杆風險 | 差價合約 | 股票 | |

|---|---|---|---|

| 可用保證金 | 20,000 | 20,000 | 20,000 |

| 總投入 | 200,000 | 40,000 | 133,333 |

| 總收益(5天) | -1,600 | -320 | -1,066.66 |

| 佣金 | 200.00 | 80.00 | 266.67 |

| 利息支出(1.5%的簡化利率) | 41.67 | 4.17 | 23.61 |

| 總計直接成本(佣金+利息) | 241.67 | 84.17 | 290.28 |

| 淨收益(總收益減去直接成本) | -1,841.67 | -404.17 | -1,356.94 |

| 差額 | 損失少78% | 損失少26% | |

V. 差價合約相關資源

下方鏈接可幫助您了解更多有關IBKR差價合約產品的詳細信息:

還可參看以下視頻教程:

VI. 常見問題

什么股票可進行差價合約交易?

美國、西歐、北歐與日本的大槃和中槃股股票。許多市場上的高流動性小槃股也可以。請參見差價合約產品列表了解更多詳細信息。不久將會增加更多國家。

IB提供股票指數和外匯的差價合約嗎?

是的。請參見IBKR指數差價合約 - 事實與常見問題以及外匯差價合約 - 事實與常見問題。

IB如何確定股票差價合約報價?

IBKR差價合約報價與底層股票的智能傳遞報價相衕。IBKR不會擴大價差或與您對賭。要了解更多信息,請參見差價合約市場模型概述。

我能看到自己的限價定單反映在交易所中嗎?

是的。IBKR提供直接市場接入(DMA),這樣您的非適銷(即限價)定單會使底層對沖直接呈現在其進行交易之交易所的深度定單冊中。這也意味著您可以下單以底層買價買入差價合約或以底層賣價賣出差價合約。此外,如果其他客戶的定單以優於公開市場的價格與您的定單交叉,您還可能會獲得價格改善。

IB如何確定股票差價合約的保證金?

IBKR根據每只底層股票的曆史波動率建立了基於風險的保證金要求機制。最低保證金為10%。 大多數IBKR差價合約都應用該保證金率,這使差價合約在大多數情況下都比底層股票交易更具效率。 零售客戶須滿足歐洲監管機搆ESMA規定的額外保證金

要求。 請參見ESMA差價合約新規推行了解詳細信息。單個差價合約頭寸之間或差價合約與底層股票頭寸之間沒有投資組合抵消。集中頭寸和超大頭寸可能需要准備額外的保證金。請參見差價合約保證金要求了解更多詳細信息。

空頭股票差價合約會要強制補倉嗎?

是的。如果底層股票很難或者根本不可能借到,則空頭差價合約頭寸的持有者將需要進行補倉。

IB如何處理股息和公司行動?

IBKR通常會為差價合約持有者反映公司行動的經濟效應,就好像他們一直持有著底層證券一樣。股息會表現為現金調整,而其他行動則會通過現金或頭寸調整表現。例如,如果公司行動導致股票數量發生變化(如股票分隔和逆向股票分隔),差價合約的數量也會相應地進行調整。如果行動導致產生新的上市實體,且IBKR決定將其股票作為差價合約交易,則需要創建適當數量之新的多頭或空頭頭寸。要了解概述信息,請參見差價合約公司行動。

*請注意,某些情況下對於合并等復雜公司行動可能無法對差價合約進行准確調整。這時候,IBKR可能會在除息日前終止差價合約。

任何人都能交易IBKR差價合約嗎?

除美國、加拿大和香港的居民,其他所有客戶都能交易IBKR差價合約。新加坡居民可交易除新加坡上市之股票差價合約以外的其它IBKR差價合約。任何投資者類型都不能免於這一基於居住地的限制。

我需要做什么才可以開始在IBKR交易差價合約?

您需要在賬戶管理中設置差價合約交易許可,并衕意相關交易披露。如果您的賬戶是在IB LLC開立,則IBKR將設置一個新的賬戶板塊(即您當前的賬戶號碼加上后綴“F”)。設置確認后您便可以開始交易了。您無需單獨為F賬戶注資,資金會從您的主賬戶自動轉入以滿足差價合約保證金要求。

有什么市場數據要求嗎?

IBKR股票差價合約的市場數據便是底層股票的市場數據。因此需要具備相關交易所的市場數據許可。如果您已經為股票交易設置了交易所的市場數據許可,那么就無需再進行任何操作。如果您想在當前并無市場數據許可的交易所交易差價合約,您可以設置許可,操作與底層股票的市場數據許可設置相衕。

差價合約交易與頭寸在報表中如何反映?

如果您是在IB LLC持有賬戶,且您的差價合約頭寸持有在單獨的賬戶板塊(主賬戶號碼加后綴“F”)中。您可以選擇單獨查看F板塊的活動報表,也可以選擇與主賬戶合并查看。您可在賬戶管理的報表窗口進行選擇。對於其他賬戶,差價合約通常會與其他交易產品一起在您的賬戶報表中顯示。

我可以從其他經紀商處轉入差價合約頭寸嗎?

IBKR當前不支持差價合約頭寸轉賬。

股票差價合約可以使用圖表功能嗎?

是的。

在IBKR交易差價合約有什么賬戶保護?

差價合約以IB英國作為您的交易對方,不是在受監管的交易所進行交易,也不是在中央結算所進行結算。因IB英國是您差價合約交易的對方,您會面臨與IB英國交易相關的財務和商業風險,包括信用風險。但請注意,所有客戶資金永遠都是完全隔離的,包括對機搆客戶。IB英國是英國金融服務補償計划(“FSCS”)參與者。IB英國不是美國證券投資者保護公司(“SIPC”)成員。請參見IB英國差價合約風險披露文件了解有關差價合約交易風險的詳細信息。

在哪種類型(如個人、朋友和家庭、機搆等)的IBKR賬戶中可交易差價合約?

所有保證金賬戶均可進行差價合約交易。現金賬戶和SIPP賬戶不能。

在某一特定差價合約中我最多可持有多少頭寸?

沒有預設限制。但請注意,超大頭寸可能會有更高保證金要求。請參見CFD保證金要求了解更多詳細信息。

我能否通過電話交易差價合約?

不要。在極端情況下我們可能衕意通過電話處理平倉定單,但絕不會通過電話處理開倉定單。

差價合約屬於復雜金融產品,其交易存在高風險,由於杠杆的作用,可能會出現迅速虧損。

在通過IBKR(UK)交易差價合約時,有67%的零售投資者賬戶出現了虧損。

您應考慮自己是否理解差價合約的運作機制以及自己是否能夠承受虧損風險。

ESMA規定

歐洲證券與市場管理局(ESMA)發布臨時產品干涉措施,自2018年8月1日起生效。

ESMA決議實施的限制包括:1) 開倉差價合約頭寸的杠杆限制;2) 以單個賬戶為單位的保證金平倉規則;3) 以單個賬戶為單位的負余額保護規則;4) 對交易差價合約激勵措施的限制;以及5) 標准的風險警告。

ESMA新規僅適用於零售客戶。 專業客戶不受影響。

Dividend Accruals

If you are a shareholder of record as of the close of business on a dividend Record Date (see KB47), you are entitled to receive the dividend on its Payment Date. While the actual dividend amount is not assured until the payment has been made by the issuer on the Payment Date, information deemed reliable is available such that IB will accrue the value of the dividend, net of any withholding taxes, on the Ex-Date. This information can be confirmed via the Daily Activity Statement posted to Account Management. The details of the accrual will be reflected in the statement section titled "Change in Dividend Accruals" and the net amount in a line item titled "Dividend Accruals" under the "Net Asset Value" section. If you wish to see information regarding dividends that you held through the Ex Date but which have not yet been paid out, choose "Legacy Full" from the Statements drop down when launching your statement. This will include an additional section called "Open Dividend Accruals" which will give you information on any pending dividends.

Note that dividend accruals may be either a debit (if short and borrowing the stock on the Record Date) or a credit (if long the stock on the Record date). In terms of account valuation, the dividend accrual is included in Equity with Loan Value as well as equity for purposes of determining compliance with the Pattern day Trading rules. A dividend credit accrual does not increase Available Funds and can therefore not be withdrawn until paid. A dividend accrual which is a debit does reduce Available Funds to ensure that funds are available to meet the obligation when payment is due.

Overview of IBKR's Dividend Reinvestment Program (DRIP)

IBKR offers a dividend reinvestment program whereby accountholders may elect to reinvest qualifying cash dividends to purchase shares in the issuing company. Outlined below are a series of FAQs which describe the program and its operation.

1. How can I participate in the program?

Requests to participate are initiated online via Client Portal. The menu options vary by account type and are outlined below:

• Individual, Joint, Trust, IRA, Small Business Accounts – click on the User menu (head and shoulders icon in the top right corner) followed by Settings. Under Trading, click Dividend Election where you can enable the program. Read the agreement, type your signature in the field provided and click Subscribe.

• Advisor and Broker Master and Proprietary Trading Group STL Master Users – Select the Contacts tab from the Dashboard on the Home page. Click the Information icon “I” for the desired client account or service account to open the Client Account Details page. Enable dividend reinvestment by clicking the Edit link in the Account Configuration section.

Once enabled, you’ll be provided with an acknowledgement requiring entry of your electronic signature in order to click the Continue button. Automatic dividend reinvestment will be effective the next business day.

2. What accounts are eligible to participate in IBKR's Dividend Reinvestment Program?

Dividend Reinvestment is available to IB LLC, IB AU, IB CAN, IB HK, IB IE, IB JP, IB SG and IB UK clients only.

3. Which securities are eligible for dividend reinvestment?

Only U.S. and Canada-listed common and preferred stocks paying cash dividends are eligible for reinvestment.

4. When does reinvestment occur?

If you are a shareholder of record as of the close of the dividend record date (see KB47) and enrolled in the dividend reinvestment program prior to the dividend payment date, IBKR will use the dividend payment to purchase additional shares of that stock on the morning of the trading day which follows confirmation of our receipt of the dividend. For accounts with AutoFX enabled, when the DRIP system runs that what-if credit check, the Credit Manager will now consider the cash balances across all the currencies the account has, allowing for FX to be booked to fund the DRIP trade if needed. If a customer's credit-check fails on the day dividend was paid, the system continues to check for the next 30 days and may include it in the DRIP file when the credit-check passes. In this case the system may book a delayed DRIP trade (i.e. trade date after paydate). IBKR will also look back 30 days from the date of enrollment and will reinvest any dividends paid to the account within that 30 day time period. Note that shares are not purchased via an issuer-sponsored reinvestment plan but rather in the open market.

5. At what price does reinvestment take place?

As shares are purchased in the open market, generally at or near the opening of trading and subject to market conditions, the price cannot determined until the total number of shares for all program participants have been purchased using combined funds. In the event that the purchase is executed in multiple smaller trades at varying prices, participants will receive the weighted-average price of such shares (i.e., each participant receives the same price). In the event IBKR is unable to reinvest the combined proceeds, each participant will receive shares on a pro rata basis (based on the dividend amount to which each participating client is entitled).

6. Are the full proceeds of the cash dividend available for reinvestment?

No. Only the proceeds net of commissions and taxes (if the account is subject to withholding) is reinvested.

7. Are dividends from shares purchased on margin and loaned by IBKR eligible for reinvestment?

Yes. If IBKR maintains a lien on shares as a result of a margin loan, the account holder will receive a cash payment in lieu of and equal to the dividend payment. This payment in lieu will be used to purchase additional shares of that stock.

8. Are dividends from shares loaned through IBKR’s Yield Enhancement Program eligible for reinvestment?

Yes. While IBKR makes every effort to recall shares loaned through this program prior to the dividend record date, if such shares are not recalled the account holder will receive a cash payment in lieu of and equal to the dividend payment. This payment in lieu will be used to purchase additional shares of that stock.

9. Is the dividend reinvestment subject to a commission charge?

Yes, standard commissions as listed on the IBKR website are applied for the purchase. Please note that the minimum commission charge is the lesser of the stated minimums (USD 1 for the Fixed structure and USD 0.35 for the Tiered structure) or 1% of the trade value.

10. What happens if my account is subject to a margin deficiency when reinvestment occurs?

If your account is in a margin deficit and can’t initiate new positions, dividends will not be reinvested, even if you have dividend reinvestment enabled. Please note that dividend reinvestment orders are credit-checked at the time of entry—should an account go into margin deficiency at any time after that, including as a result of the end-of-day SMA check and the end of Soft Edge Margin, the account will become subject to automated liquidation.

11. Can account holders elect which securities are eligible for reinvestment?

Yes, account holders may elect which securities are eligible for dividend reinvestment.

12. Are fractional shares eligible for the Dividend Reinvestment Program (DRIP)?

Yes, it is possible to receive fractional shares for a reinvested dividend through the Dividend Reinvestment Program (DRIP) as long as the account has fractional share permissions.

13. Does dividend reinvestment cover solely regular cash dividends or are special cash dividends reinvestment as well?

All cash dividends are reinvested.

14. What are the tax considerations associated with dividend reinvestment?

The purchase of a shares via DRIP is similar to that of any other share purchase for purposes of tax reporting. In the case of U.S. taxpayers:

- When the shares purchased via DRIP are sold they will be reported on the Form 1099B for US taxpayers in the year in which they are sold. The gain or loss will be calculated based on the FIFO method unless the account holder has selected a different method. The cost basis will be that price at which the shares were purchased and the acquisition date the date of reinvestment or purchase (not the day the dividend is paid).

- Shares purchased via dividend reinvestment are subject to wash sale calculations (i.e., if you sold a security for a loss within 30 days before or after the purchase, a wash sale will occur and that loss deferred).

- Dividend payments are subject to reporting on the Form 1099DIV as current year income even when reinvested.

In the case of non-U.S. taxpayers:

- The cash dividend is subject to U.S. tax withholding prior to reinvestment. Withholding is performed at the statutory rate or at the treaty rate, where available. All income and withholding will be reported on the Form 1042-S for the year in which the dividend payment was received.

Overview of Dividend Payments in Lieu ("PIL")

Payment In Lieu of a Dividend (“payment in lieu” or “PIL”) is a term commonly used to describe a cash payment to an account in an amount equivalent to the ordinary dividend. Generally, the amount paid is per share owned. In addition, the dividend in most cases is paid quarterly (i.e., four times per year). The dividend payment is classified as follows: (1) ordinary dividend; and/or (2) payment in lieu of dividend. The former designation is for a payment received directly from the issuer or its paying agent. The latter designation is used when a cash payment is received from other than the issuer or the issuer’s agent.

Payment in lieu of an ordinary dividend may be received when the shares have been bought on margin, or when the account has a subsequent margin loan due to borrowing money to facilitate the payment for additional purchases of shares or as the result of a withdrawal from the margin account. Payment in lieu of a dividend may also be received when shares are owed to the brokerage firm and have not been received by the dividend record date.

To better understand the difference between an ordinary dividend and a payment in lieu, we will explain the steps taken by IB to comply with US regulations. Each business day, the Firm analyzes the positions in each customer account, every borrow, every loan, every pledge of shares for each security held by its customers to determine how many shares are held on margin and the associated margin loan balances. For each security that is fully paid, we are required to segregate those shares in a good control location (for example, a depository or a US bank. See KB1964). For shares that are held as collateral for a margin loan we are allowed to hypothecate and re-hypothecate shares valued up to 140 percent of the total debit balance in the customer account (See KB1967).

While the guidelines noted above for segregation of securities are clear, there are exceptions that are outside of the Firm's control. For instance, through no fault of its own, IB may have a deficit in segregated shares due to customer activity that changes the Firm’s overall segregation requirement for a security. This may be for a variety of reasons including a delay in receiving shares that have been loaned out to a counterparty after segregation requirements are recalculated and the Firm has issued a stock loan recall, sales of securities by one or more customers that reduce or eliminate margin loans, the deposit of cash by customers that similarly reduce or eliminate margin loans, or a failure of a counterparty to deliver shares for a trade settlement.

Upon issuing a recall of shares loaned, rules permit the borrower of the shares up to 3 business days to return them. The borrower of the shares is required to return them to us when we issue a recall, but if by business day 3 the shares have not been returned, IB may then issue a buy-in notice to begin the process of regaining possession of the shares. An additional 3 business days is generally needed for the purchased shares to settle and be delivered to the firm. Similarly if a counterparty fails to deliver by settlement date, shares to IB to settle a customer purchase, IB can issue a buy-in notice but the purchase of such shares are also subject to trade settlement in 3 days.

To summarize, if by the record date of a dividend certain shares have not been delivered to IB, the Firm will be paid an amount of cash that is equivalent to the dividend amount, but IB will not receive a qualified dividend payment directly from the issuer. In such cases, the Firm will receive PIL and will have no choice but to allocate such payment in lieu to customer accounts. The firm first allocates PIL to those accounts who hold the shares as collateral for a margin loan. If, after PIL is allocated to all shareholders whose accounts are not fully paid, any portion of PIL remains to be paid, it is allocated on a pro-rata basis to each remaining client account.

Account holders should be aware that a PIL may have different tax consequences than an ordinary dividend and should consult a tax advisor to understand such differences and whether they apply to their particular situation.