Cosa accade se faccio trading con un prodotto denominato in una valuta che non detengo nel mio conto?

La valuta specifica, necessaria per l’acquisto e il regolamento di qualunque prodotto, viene stabilita dalla Borsa e non da IBKR. Se per esempio, decidi di effettuare una transazione per acquistare un titolo denominato in una valuta che non detieni e ipotizzando che tu abbia un conto con margine ed un eccesso di margine sufficiente, IBKR creerà un prestito per tali fondi. Ti ricordiamo che questa procedura è necessaria in quanto IBKR ha l’obbligo di regolare la transazione con la camera di compensazione esclusivamente nella valuta designata per la denominazione. Nel caso in cui tu preferisca non creare questo prestito ed evitare di incorrere nei costi degli interessi associati a questa operazione, avrai due opzioni: 1) versare i fondi nel tuo conto usando la valuta e l’importo richiesti; oppure 2) convertire i fondi esistenti nel tuo conto usando il nostro servizio IdealPro (per gli importi superiori a 25.000 USD o equivalenti) oppure ricorrendo alle sedi per spezzature (odd lot), entrambe le possibilità sono disponibili su TWS.

Ti ricordiamo inoltre che una volta liquidata la posizione sul titolo denominato in una determinata valuta, i proventi rimarranno in quella valuta indipendentemente se questa coincida o meno con la valuta di base che hai scelto per il tuo conto. I proventi saranno inoltre soggetti ad un tasso di cambio sul rischio relativo alla tua valuta base a meno che tu non decida di eseguire una conversione valutaria oppure di usare i proventi per un prodotto denominato nella stessa valuta.

Per quale motive la sezione del Resoconto Liquidità nel mio Rendiconto delle Attività riporta un trasferimento interno fra titoli e commodity?

Al fine di rispettare la normativa vigente, IBKR deve segregare gli asset relativi ai titoli presenti nel tuo conto dagli asset legati a commodity. Quest’ultimo tipo di asset potrebbe includere il valore di mercato delle opzioni su future e in più qualsiasi saldo di liquidità richiesto come margine per posizioni relative a futures su commodity e opzioni su futures. Verrà ricalcolato periodicamente il requisito di margine delle tue posizioni su commodity e nel caso in cui questo requisito dovesse scendere, la liquidità in eccesso usata come margine delle commodity verrà trasferita dal comparto commodity del tuo conto a quello dedicato ai titoli. Allo stesso modo, nel caso in cui il margine delle commodity dovesse aumentare, IBKR provvederà a trasferire la liquidità disponibile dal comparto titoli a quello delle commodity. Considerato che l’assicurazione della SIPC viene garantita per gli asset presenti nel comparto titoli del tuo conto (ma non per quello delle commodity), questo trasferimento periodico verrà effettuato per garantire che il tuo saldo di cassa possa mantenere la maggiore protezione possibile. Va ricordato che questi movimenti di liquidità rappresentato delle voci quotidiane nel tuo conto che hanno l’obiettivo di compensarsi l’un l’altra e dunque non avranno alcun impatto sul saldo di liquidità aggregato all’interno del conto (si veda la colonna del Totale nella sezione “Resoconto Liquidità” nel Rendiconto delle Attività).

In che modo IBKR ritarderà la liquidazione mentre effettuo un versamento di fondi sul mio conto?

La politica aziendale di IBKR in materia di rispetto del margine non consente i trasferimenti o altri versamenti nel caso di una violazione/deficit di margine nel conto. Nel caso in cui venga stabilito che si tratti di violazione/deficit, il conto in deficit sarà immediatamente messo in liquidazione. Le liquidazioni automatiche vengono eseguite con ordini a mercato e qualsiasi/tutte le posizioni nel conto potranno essere liquidate. In alcuni casi, tendendo in considerazione specifiche condizioni di mercato, il deficit potrà essere affrontato attraverso la procedura di liquidazione manuale.

I fondi versati o inviati nel conto non verranno presi in considerazione dal punto di vista del rischio fino a quando non saranno stati regolati e vagliati dai canali bancari e quindi ufficialmente accreditati nel conto. Il sistema di liquidazione è automatico ed è programmato per attivarsi immediatamente in caso di violazione o deficit di margine.

Avviso ai Clienti Prime: effettuare un grande numero di transazioni non è probabilmente il modo migliore per risolvere i deficit in tempo reale. Le transazioni non verranno prese in considerazione per vantaggi relativi al margine fino alle 21:00 ET della giornata di trading oppure fino a quando le transazioni non siano state rendicontate e assegnate a revisori esterni; ciò dipenderà da quale dei due orari sarà posteriore. Invitiamo inoltre i nostri clienti a non eseguire molte transazioni per le opzioni in scadenza (nel giorno stesso della scadenza) in quanto potrebbero verificarsi problemi legati all’accuratezza o causare eventuali ritardi per quanto riguarda la rendicontazione. Tali problemi potrebbero dare luogo inoltre ad errori di calcolo del margine oppure all’esercizio errato di opzioni e/o infine ad attività di assegnazione inesatte. I clienti che desiderino eseguire transazioni su opzioni nel giorno di scadenza e in maniera autonoma rispetto a IB, dovranno inviare il loro file FTP entro le 14:50 ET e assumersi qualunque rischio derivante da questa scelta.

Restrizioni circa i Titoli Microcap statunitensi

Introduzione

Per rispettare i regolamenti in materia di vendita di titoli non registrati e per minimizzare l’elaborazione manuale associata con le azioni che non sono quotate in borsa, IBKR impone alcune restrizioni sui cosiddetti titoli Microcap USA. Una lista delle restrizioni assieme ad alcune Domande Frequenti viene fornita qui di seguito.

Restrizioni sui titoli Microcap

- IBKR accetterà esclusivamente trasferimenti di blocchi di titoli Microcap USA provenienti dai cosiddetti "clienti idonei". Per “clienti idonei” s’intendono tutti coloro con un conto per il quale: (1) viene mantenuta un capitale – pre o post-trasferimento – pari almeno a 5 milioni di USD, oppure per clienti di consulenti finanziari il cui valore degli asset aggregati e gestiti è di almeno 20 milioni di USD; e (2) possiedono meno della metà del proprio capitale investita in titoli Microcap USA.

- IBKR accetterà solo trasferimenti 1 di blocchi di titoli Microcap USA nel caso in cui un cliente idoneo abbia confermato che l’acquisto delle azioni sia avvenuto sul libero mercato oppure sia registrato presso la SEC

- IBKR non accetterà trasferimenti 1 né ordini di apertura da qualunque cliente per titoli Microcap USA contrassegnati come OTC come "Caveat Emptor" oppure "Grey Market". I clienti avranno la facoltà di chiudere le posizioni esistenti su questi titoli;

- IBKR non accetterà trasferimenti di titoli Microcap USA per coprire una posizione short stabilita tramite IBKR;

- I clienti di tipo “sola esecuzione” (ossia coloro che eseguono i trade attraverso IBKR ma regolano tali transazioni con altri operatori del settore) non potranno fare trading su titoli Microcap USA attraverso il loro conto presso IBKR. (IBKR potrebbe fare un’eccezione per i broker registrati negli Stati Uniti);

Domande Frequenti sui Microcap

Che cos'è un titolo Microcap USA?

Con il termine di “Titolo Microcap” si fa riferimento ad azioni (1) scambiate in modalità OTC – ossia over the counter oppure (2) che sono quotate sul NASDAQ oppure sul NYSE e hanno una capitalizzazione di mercato compresa fra i 50 e i 300 milioni di USD e che vengono scambiate ad un prezzo pari o inferiore ai 5 USD. Ai fini di questo documento il termine Titolo Microcap indicherà le azioni di società statunitensi ad azionariato diffuso che hanno una capitalizzazione di mercato pari o inferiore ai 50 milioni di USD, ai quali si far riferimento talvolta con il termine di “nanocap” oppure che vengono scambiate sul mercato ed in genere vengono associate con i titoli Microcap.

Per evitare situazioni in cui fluttuazioni minori a breve termine nel prezzo di un titolo possano causare ripetutamente nuove classificazioni, qualunque titolo segnalato come Microcap USA rimarrà in questa classificazione fino a quando saranno rispettate due condizioni: la capitalizzazione di mercato deve aver superato i 300 milioni di USD e il prezzo delle azioni sarà superiore a 5 USD; entrambi questi fattori devono perdurare per un periodo di 30 giorni solari consecutivi.

Dato che i titoli Microcap hanno spesso dei prezzi molto bassi, spesso ci si riferisce a questi prodotti con il termine di "penny stock". IBKR potrà fare alcune eccezioni, incluso per titoli scambiati a prezzi molto bassi che di recente hanno una capitalizzazione di mercato più ampia. Inoltre, IBKR non considererà gli ADR su compagnie non statunitensi come dei titoli Microcap.

Dove vengono scambiati i titoli Microcap?

I titoli Microcap in genere vengono scambiati sul mercato OTC, invece che sulle borse di cambio nazionali. Spesso questi prodotti vengono quotati elettronicamente dai marker maker su sistemi OTC come la OTC Bulletin Board (OTCBB) e nei mercati amministrati dall’ OTC Markets Group (es. OTCQX, OTCQB e Pink). In questa categoria vanno inclusi anche titoli che non sono quotati in borsa ma contrassegnati come "Caveat Emptor", "Altri OTC" oppure "Grey Market".

Inoltre le autorità statunitense considerano come Titoli Microcap quei titoli quotati nel NASDAQ oppure nel NYSE il cui valore delle azioni è pari o inferiore ai 5 USD e con una capitalizzazione di mercato pari o inferiore ai 300 milioni di USD.

Cosa succede se IBKR dovesse ricevere un trasferimento da un Cliente idoneo nel quale una o più posizioni trasferite corrisponde ad un Titolo Microcap?

In tal caso IBKR si riserva il diritto di limitare la vendita di qualunque posizione Microcap includendo con questo anche il trasferimento, a meno che il Cliente idoneo non fornisca la documentazione appropriata per stabilire che le azioni sono state acquistate nel libero mercato (ossia presso una borsa o tramite un altro broker) oppure una prova che le azioni sono state registrate presso al SEC in ottemperanza con il modulo S-1* o con un altro modulo di registrazione (*documento utilizzato dalle società che intendono registrare i propri titoli presso la US Securities and Exchange Commission in base a quanto stabilito dal Securities Act del 1933).

I clienti idonei potranno dimostrare di aver acquistato le azioni sul libero mercato fornendo una dichiarazione del broker oppure una conferma di esecuzione (ottenuta da un broker affidabile) che rifletta l’acquisto presso una borsa dei titoli in questione. I clienti idonei possono inoltre stabilire che le azioni sono registrate avendo cura di fornire il numero di archiviazione (sistema Edgar) in base al quale le azioni sono state registrate dalla compagnia (e qualunque altro documento necessario alla conferma che le azioni sono a tutti gli effetti quelle elencate nella dichiarazione di registrazione).

NOTA: Tutti i clienti avranno la facoltà di trasferire in qualsiasi momento le azioni che abbiamo sottoposto a restrizioni.

Quali restrizioni verranno applicate da IBKR sui conti Prime?

I clienti le cui attività includano dei servizi Prime vengono considerati Clienti idonei solo ai fini di quelle transazioni che IBKR ha accettato dai propri broker di esecuzione. Tuttavia anche se i conti Prime potrebbero avere Titoli Microcap USA presso IBKR, queste azioni saranno comunque sottoposte a restrizioni fino al momento in cui IBKR confermerà che le azioni sono idonee per una nuova vendita nei termini delle procedure descritte sopra.

Per rimuovere le restrizioni relative alle azioni acquistate sul libero mercato, ti preghiamo di fare in modo che il broker incaricato dell'esecuzione fornisca una lettera firmata su carta intestata della sua compagnia oppure un estratto conto nel quale si dichiara che le azioni sono state acquistate sul libero mercato. La lettera o l'estratto conto dovranno rispettare i criteri indicati qui di seguito. In alternativa, se le azioni sono state acquistate attraverso un'offerta, la lettera oppure l'estratto conto dovranno riportare informazioni oppure collegamenti alla dichiarazione di registrazione e infine indicare che le azioni fanno parte di tale registrazione.

Criteri per la lettera del broker:

1) Numero del conto presso IBKR

2) Titolare del conto presso IBKR

3) Data del trade

4) Data di regolamento

5) Simbolo

6) Lato del book di acquisto o vendita

7) Prezzo

8) Quantità

9) Orario di esecuzione

10) Borsa

11) La lettera deve essere firmata

12) La lettera deve essere su carta intestata della società

In sintesi: le transazioni di vendita long verranno accettate se la posizione long non è più sottoposta a restrizioni. Le transazioni di vendita short verranno accettate. Le transazioni di acquisto long verranno accettate e la posizione verrà sottoposta a restrizioni fino a quando il dipartimento Conformità non avrà ricevuto le informazioni necessarie. Le transazioni di acquisto e intragiornaliere di tipo “round trip” non verranno accettate.

Cosa accede se un titolo che hai acquistato viene riclassificato come Grey Market o Caveat Emptor?

Nel caso in cui tu abbia un titolo nel tuo conto IBKR che in data successiva all’acquisto venisse classificato come "Caveat Emptor" o "Grey Market", ti verrà consentito di mantenere/chiudere oppure trasferire la posizione. Tuttavia, non avrai modo di aumentare la posizione sul titolo in questione.

Quali sono i motivi per i quali un Titolo Microcap presente nel mio conto potrebbe subire delle restrizioni?

Vi sono essenzialmente due motivi che potrebbero causare delle restrizioni sul trading di un Titolo Microcap:

- Potenziale affiliazione all’emittente: la Regola 144 della U.S. Securities and Exchange Commission (“SEC”) stabilisce alcuni limiti al trading di titoli (inclusi Titoli Microcap) attraverso un “affiliata” dell’emittente. Se IBKR rileva attività di trading o detenzione di un titolo Microcap che è vicino alle soglie di trading stabilite dalla Regola 144 (si veda “Regola 144 Soglie”) IBKR potrebbe limitare le attività di trading del cliente relative al titolo Microcap in questione, fino a quando non sarà stata completata una verifica di conformità.

- Trasferimento di Titolo Microcap: se il cliente ha di recente trasferito un Titolo Microcap sul proprio conto IBKR, la società si riserva il diritto di limitare l’attività di trading fino a quando non sarà stata completata una verifica di conformità.

Nel caso si verifichi una delle motivazioni indicate qui sopra, il trading verrà limitato e verrà inviata una notifica al centro messaggi del cliente in Gestione Conto. Questa notifica descriverà la ragione della restrizione attivata e quali passaggi il cliente dovrà completare prima che IBKR possa rimuovere la restrizione.

Per quale motivo IBKR mi considera un potenziale affiliato di un’emittente di Titoli Microcap?

Un “affiliato/a”, come ad esempio un dirigente, oppure un azionista di maggioranza è un soggetto che ha un rapporto di controllo con l’emittente.

La Regola 144 si applica a tutti i tipi di titoli, inclusi i Titoli Microcap. Tuttavia, dato il rischio elevato associato con questa tipologia di prodotto, se l’attività di trading o il possesso di Titoli Microcap si avvicinano alle soglie indicate nella Regola 144, IBKR dovrà limitare l’attività di trading del cliente per quanto riguarda il Titolo Microcap. Tale restrizione resterà in vigore fino al completamento di una verifica di conformità circa il potenziale status di affiliato del cliente.

Nel caso di una potenziale revisione del mio status di affiliato, perché devo richiedere una nuova revisione ogni due settimane?

Lo status di affiliazione di un cliente potrebbe cambiare rapidamente poco dopo il completamento della verifica di IBKR. Di conseguenza IBKR ritiene appropriato valutare nuovamente lo status di potenziale affiliato ogni due settimane se l’attività di trading il possesso di titoli Microcap di un cliente resta vicino alle soglie fissate nella Regola 144.

Dove posso trovare una lista di tutti i titoli che IBKR ha classificato come Microcap USA?

Una lista di questi titoli elaborata da IBKR è disponibile al seguente link: www.ibkr.com/download/us_microcaps.csv

Ti ricordiamo che questa lista viene aggiornata quotidianamente.

Dove posso trovare maggiori informazioni sui Titoli Microcap?

Maggiori informazioni sui Titoli Microcap, inclusi i rischi associati con questa tipologia di titolo, sono disponibili sul sito web della SEC: https://www.sec.gov/reportspubs/investor-publications/investorpubsmicrocapstockhtm.html

-----------------------------------------------------------

1Sono inclusi i trasferimenti attraverso qualsiasi metodo (es. ACATS, DWAC, FOP) la conversione di titoli canadesi nei loro equivalenti americani attraverso i trasferimenti di tipo “Southbound”, i trasferimenti per coprire posizioni short esistenti, l’esecuzione di transazioni da parte di clienti IB Prime con altri brokers e regolamento tramite IBKR, ecc.

Come inviare documenti a IBKR grazie al tuo smartphone

Interactive Brokers ti consente di inviarci una copia di un documento anche se non hai al momento uno scanner. Puoi scattare una foto del documento richiesto semplicemente utilizzando il tuo smartphone.

Qui di seguito troverai le istruzioni su come scattare una foto e inviarla tramite e-mail a Interactive Brokers per i seguenti sistemi operativi su smartphone:

Se sai già come scattare e inviare foto tramite e-mail con il tuo smartphone, ti invitiamo a cliccare QUI – Dove inviare l’e-mail e cosa inserire nel campo oggetto.

iOS

1. Dal fondo dello schermo del tuo smartphone scorri verso l’alto e seleziona l’icona della fotocamera.

Se non hai l’icona della Fotocamera, tocca l’icona dell’app Fotocamera presente sulla schermata Home del tuo iPhone.

In genere il tuo telefono dovrebbe attivare la fotocamera posteriore. Se si attiva quella anteriore, ti basterà toccare il pulsante cerchiato in rosso nell’immagine qui sotto.

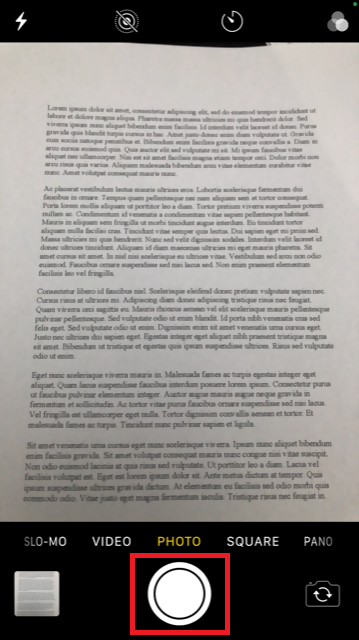

2. Disponi l’iPhone sopra il documento e inquadra una porzione o una pagina intera.

3. Assicurati che la luce sia uniforme e basti a illuminare il testo. Fai in modo che non ci siano ombre sul documento per via della tua posizione. Reggi lo smartphone in maniera decisa evitando scosse o tremolii. Tocca il pulsante dell’otturatore per scattare la foto.

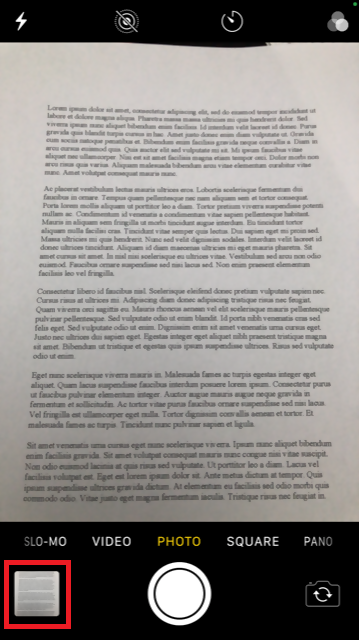

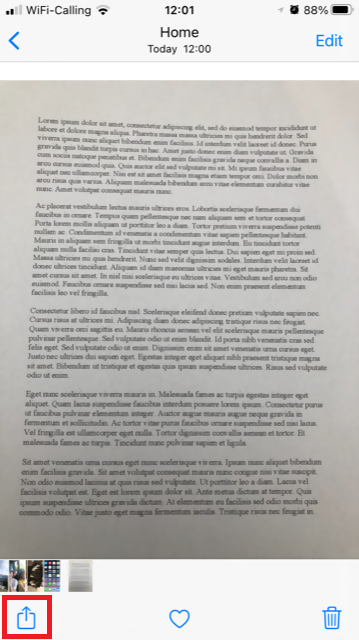

4. Tocca la miniatura della foto nell’angolo in basso a sinistra per visualizzare a schermo intero la foto che hai appena scattato.

5. Assicurati che la foto sia chiara e che il documento sia leggibile. Puoi ingrandire la foto e vedere nel dettaglio l’immagine facendo scorrere le due dita come mostrato nell’immagine qui sotto.

Se la foto non è di buona qualità oppure non c'è abbastanza luce, ripeti i passaggi precedenti per scattare una foto migliore.

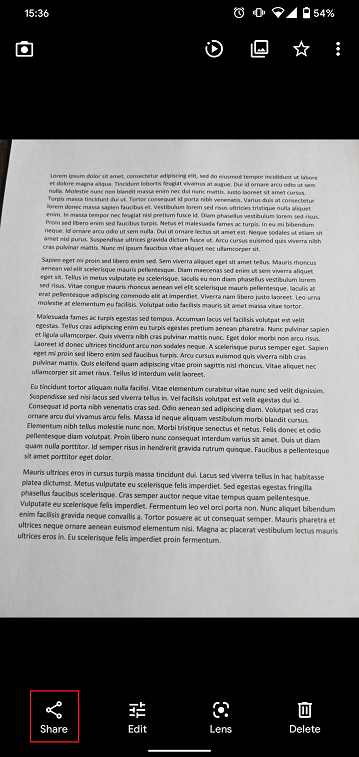

6. Tocca l’icona di condivisione nell’angolo in basso a sinistra dello schermo.

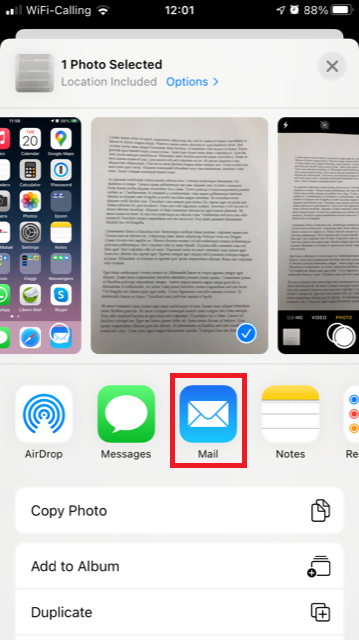

7. Tocca l’icona della posta elettronica.

Nota bene: per inviare e-mail il tuo telefono deve essere configurato per questo scopo. Ti invitiamo a contattare il tuo e-mail provider se non hai familiarità con questa procedura.

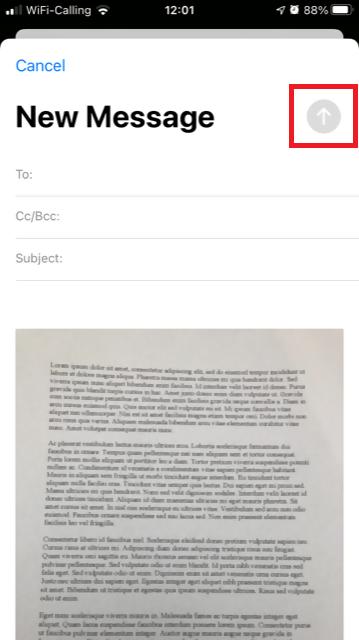

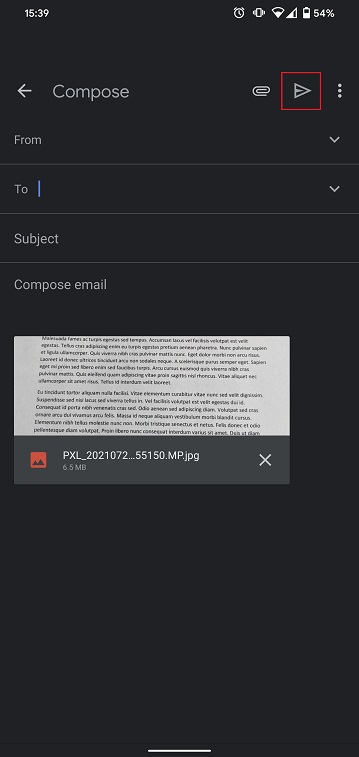

8. Ti invitiamo a leggere QUI per vedere come compilare i campi A: e Oggetto: della tua e-mail. Una volta completata l’e-mail, tocca l’icona della freccia in alto a destra per l’invio.

Android

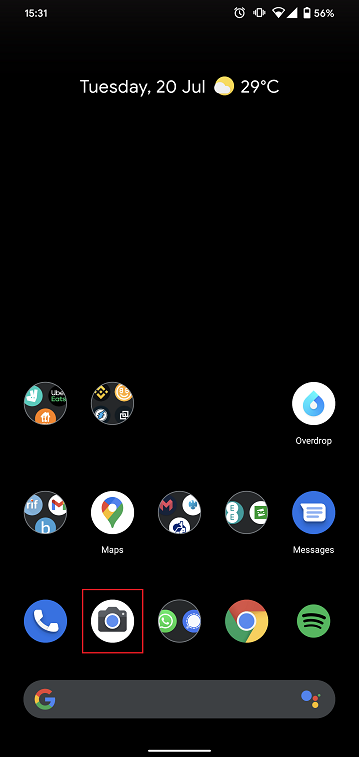

1. Apri la lista delle applicazioni e avvia l’app Fotocamera. In alternativa puoi accedervi dalla tua schermata Home. L’applicazione potrebbe avere un nome diverso a seconda del modello di telefono, della marca o delle impostazioni.

In genere il tuo telefono dovrebbe attivare la fotocamera posteriore. Se si attiva quella anteriore, ti basterà toccare il pulsante cerchiato in rosso nell’immagine qui sotto.

2. Disponi il tuo dispositivo Android sopra il documento e inquadra una porzione o una pagina intera.

3. Assicurati che la luce sia uniforme e basti a illuminare il testo. Fai in modo che non ci siano ombre sul documento per via della tua posizione. Reggi lo smartphone in maniera decisa evitando scosse o tremolii. Tocca il pulsante dell’otturatore per scattare la foto.

4. Assicurati che la foto sia chiara e che il documento sia leggibile. Puoi ingrandire la foto e vedere nel dettaglio l’immagine facendo scorrere le due dita come mostrato nell’immagine qui sotto.

Se la foto non è di buona qualità oppure la luce non basta, ripeti i passaggi precedenti per scattare una foto migliore.

5. Tocca l’icona del cerchio vuoto nell’angolo in basso a destra dello schermo.

6. Tocca l’icona di condivisione nell’angolo in basso a sinistra dello schermo.

7. Nel menu di condivisione tocca l’icona del servizio e-mail impostato sul tuo telefono. Nell’esempio qui in basso viene selezionata Gmail, ma il nome potrebbe variare in base alle impostazioni del tuo smartphone.

.png)

Nota bene: per inviare e-mail il tuo telefono deve essere configurato per questo scopo. Ti invitiamo a contattare il tuo e-mail provider se non hai familiarità con questa procedura.

8. Ti invitiamo a leggere QUI per vedere come compilare i campi "A" e "Oggetto" della tua e-mail. Una volta completata l'e-mail, tocca l’icona della freccia in alto a destra per l’invio.

DOVE INVIARE L’E-MAIL E COSA INSERIRE NEL CAMPO OGGETTO

L’e-mail deve essere scritta rispettando le seguenti istruzioni:

1. Nel campo "A:" bisogna inserire quanto segue:

- newaccounts@interactivebrokers.com se hai la residenza in un Paese al di fuori del continente europeo

- newaccounts.uk@interactivebrokers.co.uk se hai la residenza in un Paese europeo

2. Il campo dell' Oggetto:deve contenere tutte le seguenti informazioni:

- Il tuo numero di conto (in genere nel formato Uxxxxxxx, dove a ogni x corrisponde un numero) oppure il tuo nome utente.

- Il motivo per il quale hai inviato il documento. Ti invitiamo a utilizzare i seguenti acronimi a seconda dei casi:

- PoRes per un documento comprovante il tuo indirizzo di residenza

- PID per un documento comprovante l’identità

Restrizioni al trasferimento di fondi

INTRODUZIONE

Nel quadro degli sforzi attuati per contrastare il riciclaggio di denaro, IBKR ha introdotto delle restrizioni su versamenti e prelievi di alcuni clienti. Queste restrizioni riguardano i trasferimenti da o verso alcuni Paesi considerati "altamente rischiosi" dal punto di vista del riciclaggio di denaro e sono basati su fattori come il Paese di residenza del cliente, il Paese di destinazione del prelievo e la valuta coinvolta1.

PANORAMICA DELLE RESTRIZIONI

- I clienti residenti in uno dei Paesi considerati "altamente rischiosi" dal punto di vista del riciclaggio del denaro; inoltre i clienti con un indirizzo in uno di tali Paesi non potranno effettuare prelievi diretti verso un conto aperto presso un istituto finanziario situato in un altro Paese altamente rischioso, salvo il caso in cui il cliente possieda un indirizzo in tale Paese.

- I clienti residenti in uno dei Paesi considerati "altamente rischiosi" dal punto di vista del riciclaggio oppure con un indirizzo in uno di tali Paesi non potranno versare fondi provenienti da un conto aperto presso un istituto finanziario situato in un altro Paese altamente rischioso, salvo il caso in cui il cliente possieda un indirizzo in tale Paese.

- I clienti residenti in uno dei Paesi considerati "altamente rischiosi" dal punto di vista del riciclaggio oppure con un indirizzo in uno di tali Paesi potranno effettuare prelievi diretti esclusivamente verso conti intestati a sé stessi e tramite i quali abbiano già effettuato almeno un versamento di fondi nel proprio conto IB.

- I clienti potranno prelevare fondi esclusivamente nella propria valuta di base, nella valuta del proprio Paese di residenza e in una serie di valute tra le più diffuse (es. USD, EUR, HKD, AUD, GBP, CHF, CAD, JPY e SGD).

- I clienti di IBSG potranno effettuare prelievi solamente con le seguenti valute: SGD, USD, CNH, HKD e GBP.

- IBKR si riserva inoltre il diritto di stabilire che i clienti non possano trasferire fondi in conti aperti presso determinate banche, indipendentemente dal Paese di residenza del cliente o da quello dove ha sede la banca.

- Modificare la valuta di base richiede un minimo di 5 giorni per consentire l'inserimento delle istruzioni e la successiva elaborazione della richiesta di prelievo.

Ricordiamo infine che i clienti che tentino di creare delle istruzioni per il banking online oppure che cerchino di avviare un versamento/prelievo non consentito si vedranno bloccare tali operazioni e riceveranno un messaggio di errore online.

1 La lista dei Paesi considerati "altamente rischiosi" dal punto di vista del riciclaggio di denaro sarà stilata e periodicamente aggiornata in base a una serie di fattori tra cui le informazioni fornite dal Gruppo di azione finanziaria internazionale (GAFI), un organismo intergovernativo che promuove misure per la lotta al riciclaggio di denaro, al finanziamento del terrorismo e ad altri fenomeni che minacciano l'integrità del sistema finanziario internazionale, e ad altri indici pubblici sul riciclaggio di denaro.

Funds Transfer Restrictions

INTRODUCTION

As part of its anti-money laundering efforts, IBKR implements restrictions on certain client deposits and withdrawals. These restrictions apply to transfers associated with countries considered to have elevated AML risk and consider factors such as the client’s residency, the withdrawal destination and the denomination of the currency being transferred.1 An outline of these restrictions is provided below.

OVERVIEW OF RESTRICTIONS

- Clients residing or maintaining an address in a country designated as having elevated AML risk may not withdraw funds to an account located in another country that has elevated AML risk unless they also maintain an address in that country.

- Clients residing or maintaining an address in a country designated as having elevated AML risk may not deposit funds from an account located in another country having elevated AML risk unless they also maintain an address in that country.

- Clients residing or maintaining an address in a country designated as having elevated AML risk may only withdraw funds to an account from which that client received a first-party deposit.

- Clients may only withdraw funds in their base currency, their home country’s currency or common currencies (e.g. USD, EUR, HKD, AUD, GBP, CHF, CAD, JPY and SGD).

- IBSG clients may only withdraw in SGD, USD, CNH, EUR, GBP and HKD.

- IBKR may restrict the number of banks that a client may send money to, regardless of the domicile of the client or the bank.

- A change to your base currency requires a minimum of 5 days before withdrawal instructions can be entered and a withdrawal request can be processed.

Note that clients who attempt to create an online banking instruction or initiate a deposit or withdrawal which is restricted will be blocked from creating that instruction or initiating that transaction and will be presented with an online error message.

1In determining whether a country is associated with elevated AML risk, consideration is given to information provided by the Financial Action Task Force (FATF), an intergovernmental organization which promotes measures for combating money laundering, terrorist financing and other related threats to the integrity of the international financial system and other public AML indices.

Deposit Funds with IBKR Mobile Check Deposit

US clients using IBKR Mobile with IB Key two-factor authentication can deposit endorsed checks drawn on a US bank into their account from anywhere using Mobile Check Deposit.

Mobile Check Deposit is NOT supported for: IRAs, MMCs, partitioned accounts or Advisor Masters (Advisors cannot deposit into client accounts).

To use Mobile Check Deposit:

- You must be a US client.

- The check must be drawn on a US bank.

- The check must be properly endorsed.

- You must have IBKR Mobile installed on your phone.

- You must have activated IB Key two-factor authentication on the IBKR Mobile app.

- It must not be your first deposit.

To find out more about how to install IBKR Mobile, visit the IBKR Mobile web page.

- Log into IBKR Mobile, and tap the More menu followed by Transfer & Pay.

- From the Transfer & Pay menu tap Deposit Check.

- If prompted, read and accept the disclosure.

- Set up your deposit:

- a. If you hold multiple accounts with IBKR, select the account for the deposit in the Deposit to field.

- b. Enter the amount of the deposit in the Amount field.

- c. Scan the front and back of your check using the camera function on your phone. You may be asked to allow IBKR Mobile to access your camera. Please be sure that you have properly endorsed your check.

- When you are satisfied with your scanned images, tap Deposit Check at the bottom of the screen.

- Validate with IB Key as required.

- Once the deposit has been approved and processed, the funds are deposited into your IBKR account. Funds are generally available to use within six (6) business days after the deposit has been approved.

- Currently available for US clients and for checks drawn on US banks.

- Requires active IB Key protocol for two-factor authentication.

- To find out the daily limit and 30 day limit on check deposits, tap “What is my daily limit?” on the Deposit Check screen.

U.S. Microcap Stock Restrictions

Introduction

To comply with regulations regarding the sale of unregistered securities and to minimize the manual processing associated with trading shares that are not publicly quoted, IBKR imposes certain restrictions on U.S. Microcap Stocks. A list of those restrictions, along with other FAQs relating to this topic are provided below.

Microcap Restrictions

- IBKR will only accept transfers of blocks of U.S. Microcap stocks from Eligible Clients. Eligible Clients include accounts that: (1) maintain equity (pre or post-transfer) of at least $5 million or, clients of financial advisors with aggregate assets under management of at least $20 million; and (2) have less than half of their equity in U.S. Microcap Stocks.

- IBKR will only accept transfers1 of blocks of U.S. Microcap Stocks where the Eligible Client can confirm the shares were purchased on the open market or registered with the SEC;

- IBKR will not accept transfers1 of or opening orders for U.S. Microcap Stocks designated by OTC as Caveat Emptor or Grey Market from any client. Clients with existing positions in these stocks may close the positions;

- IBKR will not accept transfers of U.S. Microcap Stocks to cover a short position established at IBKR;

- Execution-only clients (i.e., execute trades through IBKR, but clear those trades elsewhere) may not trade U.S. Microcap Stocks within their IBKR account. (IBKR may make exceptions for U.S.-registered brokers);

Microcap FAQs

What is a U.S. Microcap Stock?

The term “Microcap Stock” refers to shares (1) traded over the counter or (2) that are listed on Nasdaq and NYSE American that have a market capitalization of between $50 million to $300 million and are trading at or below $5. For purposes of this policy, the term Microcap Stock will include the shares of U.S. public companies which have a market capitalization at or below $50 million, which are sometimes referred to as nanocap stocks or trade on a market generally associated with Microcap Stocks.

To avoid situations where minor, short-term fluctuations in a stock price cause repeated reclassification, any stock classified as U.S. Microcap will remain in that classification until both its market capitalization and share price exceed $300 million and $5, respectively, for a 30 consecutive calendar day period.

As Microcap Stocks are often low-priced, they are commonly referred to as penny stocks. IBKR may make exceptions, including for stocks traded at low prices that recently had a greater market cap. In addition, IBKR will not consider ADRs on non-US companies to be Micro-Cap stocks.

Where do Microcap Stocks trade?

Microcap Stocks typically trade in the OTC market, rather than on a national securities exchange. They are often electronically quoted by market makers on OTC systems such as the OTC Bulletin Board (OTCBB) and the markets administered by the OTC Markets Group (e.g., OTCQX, OTCQB & Pink). Also included in this category are stocks which may not be publicly quoted and which are designated as Caveat Emptor, Other OTC or Grey Market.

In addition, U.S. regulators also consider stocks listed on Nasdaq or NYSE American trading at or below $5 with a market capitalization at or less than $300 million to be Microcap Stocks.

What happens if IBKR receives a transfer from an Eligible Client where one or more of the positions transferred is a Microcap Stock?

If IBKR receives a transfer containing a block of a Microcap stock, IBKR reserves the right to restrict the sale of any Microcap position(s) included in the transfer unless the Eligible Client provides appropriate documentation establishing that the shares were either purchased on the open market (i.e., on a public exchange through another broker) or were registered with the SEC pursuant to an S-1 or similar registration statement.

Eligible Clients can prove that shares were purchased on the open market by providing a brokerage statement or trade confirm from a reputable broker reflecting the purchase of the shares on a public exchange. Eligible Clients can establish that the shares are registered by providing the SEC (Edgar system) File number under which their shares were registered by the company (and any documents necessary to confirm the shares are the ones listed in the registration statement).

NOTE: All customers are free to transfer out any shares we have restricted at any time.

What restrictions will IBKR apply to Prime accounts?

Clients whose activities include Prime services are considered Eligible Clients solely for the purposes of those trades which IBKR has agreed to accept from its executing brokers. However, while Prime accounts may clear U.S. Microcap Stocks at IBKR, those shares will be restricted until such time IBKR confirms that the shares are eligible for re-sale under the procedures discussed above.

To remove the restriction for shares purchased on the open market, please have the executing broker provide a signed letter on company letterhead or an official Account Statement stating that the shares were purchased in the open market. The letter or statement must also include the below required criteria. Alternatively, if the shares were acquired through an offering the letter or statement must provide documents or links to the relevant registration statement and state that the shares were part of it.

Required Broker Letter Criteria:

1) IBKR Account Number

2) IBKR Account Title

3) Trade Date

4) Settlement Date

5) Symbol

6) Side

7) Price

8) Quantity

9) Time of Execution

10) Exchange

11) Must be signed

12) Must be on Firm's official letterhead

To summarize: Sell Long trades will be accepted if the long position is no longer restricted. Sell Short trades will be accepted. Buy Long trades will be accepted and the position will be restricted until Compliance is provided with sufficient information to remove the restriction. Buy Cover trades and intraday round trip trades will not be accepted.

What happens if a stock you purchase gets reclassified as Grey Market or Caveat Emptor?

If you purchase a stock in your IBKR account that at a later date becomes classified as a Caveat Emptor or Grey Market stock, you will be allowed to maintain, close or transfer the position but will not be able to increase your position.

What are some of the reasons why Microcap Stock trading may be restricted in my account?

There are two primary reasons why you might be restricted from trading in a Microcap Stock:

- Potential Affiliation to Issuer: U.S. Securities and Exchange Commission (“SEC”) Rule 144 places certain limitations on trading of stocks (including Microcap Stocks) by an “affiliate” of the issuer. If IBKR observes trading activity or holdings in a Microcap Stock that are close to the trading volume thresholds under Rule 144 (“Rule 144 Thresholds”), IBKR may restrict the customer from trading the Microcap Stock until a compliance review is completed.

- Transfer of Microcap Stock: If the customer has recently transferred a Microcap Stock into their IBKR account, IBKR may restrict the customer from trading in that security until a compliance review is completed.

If one of the above reasons apply, trading will be restricted in the security and a notification will be sent to the customer’s message center in Account Management. This notification will describe the reason for the restriction and the steps the customer must take before IBKR will consider lifting the restriction.

Why does IBKR consider me to be a potential affiliate of a Microcap Stock issuer?

An “affiliate” is a person, such as an executive officer, a director or large shareholder, in a relationship of control with the issuer.

Rule 144 applies to all securities, including Microcap Stocks. However, given the heightened risks associated with trading Microcap Stocks, if a customer’s trading and/or holdings in a Microcap Stock are close to the Rule 144 Thresholds, IBKR will restrict the customer’s trading in the Microcap Stock. This restriction will remain in effect pending a compliance review into the customer’s potential affiliate status.

For the Potential Affiliate review, why do I need to ask for a new review every two weeks?

A customer’s affiliate status may change soon after IBKR completes the above-referenced Potential Affiliate review. As such, IBKR believes it is appropriate to refresh a Potential Affiliate review every two weeks if a customer’s trading activity and/or holdings in the Microcap Stock remain close to the Rule 144 Thresholds.

Where can I find a list of stocks that IBKR has designated as U.S. Microcaps?

A list of stocks designated as U.S. Microcaps by IBKR is available via the following link: www.ibkr.com/download/us_microcaps.csv

Note that this list is updated daily.

Where can I find additional information on Microcap Stocks?

Additional information on Microcap Stocks, including risks associated with such stocks may be found on the SEC website: https://www.sec.gov/reportspubs/investor-publications/investorpubsmicrocapstockhtm.html

-----------------------------------------------------------

1This includes transfers by any method (e.g., ACATS, DWAC, FOP), conversion of Canadian listings to their U.S. equivalent via “Southbound” transfer, transfers to cover existing short positions, IB Prime customers executing with other brokers and clearing to IBKR, etc.

South African Rand (ZAR) - Onshore/Offshore

Explanation of Onshore/Offshore South African Rand (ZAR)

Background

The South African Reserve Bank (SARB) has currency exchange control rules in place for South African residents. A South African resident is a person (i.e. a natural person, body corporate, foundation, trust or partnership) whether of South African or any other nationality who has taken up residence, is domiciled or registered in the Republic of South Africa (RSA). A resident account is also the account of persons resident, domiciled or registered in the Common Monetary Area (CMA). The CMA comprises of the Republic of South Africa, Lesotho, Namibia and Swaziland. There are no exchange control restrictions between the members of the CMA and they form a single exchange control territory.

The rules stipulate that there is a yearly limit placed on the amount of ZAR that can be taken out of the country by South African residents – i.e. taken "Offshore". ZAR that remain in South Africa are deemed “Onshore”.

Each resident can take the following amounts offshore per calendar year:

- ZAR 1 million can be taken offshore as a “Single Discretionary Allowance”

- ZAR 10 million can be taken offshore as an “Foreign Capital Allowance”

Only institutions licensed as “Authorised Dealers” (AD) are able to send ZAR outside of South Africa and so offshore. An AD is responsible for reporting the offshoring of any ZAR to the SARB. As a result, residents sending ZAR offshore must accurately state the purpose for which the ZAR is being sent. Residents must receive approval from an AD before they are able to send any ZAR offshore. Prior to taking ZAR offshore as part of the Foreign Capital Allowance, residents must also have additional clearance from the SA tax authorities.

The full exchange control rulebook from the SARB can be found here: https://www.resbank.co.za/RegulationAndSupervision/FinancialSurveillanceAndExchangeControl/EXCMan/Pages/default.aspx

Current Situation

Our cashiering account is a non-resident account. Therefore, we are permitted to:

- Receive deposits in ZAR from other non-resident accounts.

- Disburse ZAR from our cashiering account to non-resident accounts.

- Receive deposits from accounts of South African residents.

- Disburse ZAR to accounts of South African residents.