Mobile Phone Verification during the account application

Introduction

IB requires that clients verify their mobile phone in order to receive account and trade related communication directly via SMS. Clients who fail to verify their phone will be subject to trade restrictions pending completion of this process. Verification is performed online and the steps for doing so are outlined below.

In case your account has been already opened but your mobile number has not been yet verified, please jump directly to KB2552 to complete the verification process.

Phone Verification

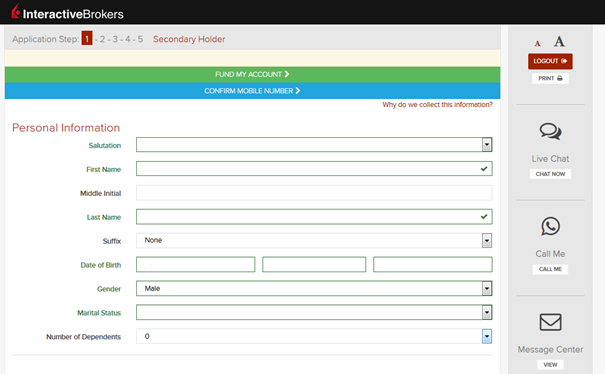

When completing your Interactive Brokers Account Application, you will see a blue bar at the top of the page that says "CONFIRM MOBILE NUMBER."

You can click on that bar any time during steps 1-4. Once you do, you will see this window:

Once you have entered your full number, it will be recognized and a confirmation message is sent immediately. Validate your phone number by entering the SMS Code received in the Confirmation Code field and click Submit.

If you are unable to do this during the application process, you can always confirm it on the Application Status page

.png)

Please consider the following as certain restrictions may apply:

- SMS messages may be blocked if you participate in your Countries NDNC (National Do Not Call) registry.

- Due to fraud prevention measures, virtual number providers may be blocked.

- Some carriers may restrict the Hours of delivery for SMS messages.

Multiple 2-Factor System (M2FS)

Overview

This page covers specific points on what the Multiple 2-Factor System (M2FS) is and how it functions. For general questions on the Secure Login System, please refer to KB1131.

Table of contents

What is M2FS?

M2FS allows any client to maintain more than one active security device at the same time. You no longer need to choose between a physical security device and the IBKR Mobile app as either can be used interchangeably. If you already possess an active security device, any further device activation will result in both devices remaining simultaneously active.

Activation

In case you currently use the Security Code Card / Digital Security Card+: if you use a physical security device, you may download and activate the IBKR Mobile app. Please refer to the directions for Android and iOS.

In case you currently use the IBKR Mobile app: If you use the IBKR Mobile app and have an account with a balance equal or greater than USD 500K, you qualify for the Digital Security Card+ . You may log in to Client Portal and request the DSC+ by following the instructions here.

Operation

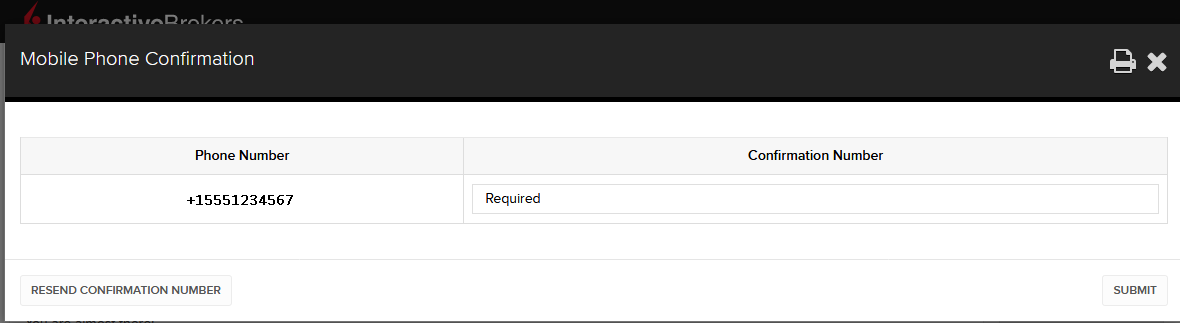

Once you have both a physical device and the IBKR Mobile app enabled, M2FS is represented by a drop-down menu upon login. You can now choose the device you wish to authenticate with, following the below steps:

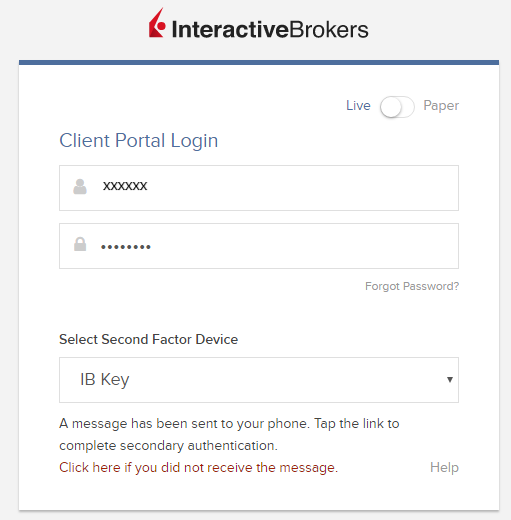

1. Enter your username and password into the trading platform or Client Portal login screen and click Login. If the credentials have been accepted, a drop down will appear, allowing you to Select Second Factor Device. If you log in to the TWS, please notice that the M2FS is supported from version 966.

TWS:

Client Portal:

.png)

2. Once you select a security device, you will now be presented with the corresponding screen for authentication. Refer to the directions for:

- IB Key via IBKR Mobile (iOS)

- IB Key via IBKR Mobile (Android)

- Security Code Card

- Digital Security Card+

3. If the second factor authentication succeeds, the Log-in will now automatically proceed.

Withdrawal limits

The device used to authenticate your withdrawal will define your withdrawal limits, according to the below table:

|

Security Device |

Maximum Withdrawal |

Maximum Withdrawal |

| Security Code Card1 | USD 200,000 | USD 600,000 |

| IBKR Mobile app | USD 1,000,000 | USD 1,000,000 |

| Digital Security Card1 | USD 1,000,000 | USD 1,500,000 |

| Digital Security Card+ | Unlimited | Unlimited |

| Gold Device1 | Unlimited | Unlimited |

| Platinum Device1 | Unlimited | Unlimited |

1: Represents a legacy device that is no longer issued.

Example: You have both the IBKR Mobile app and the Digital Security Card+ enabled and you need to withdrawal more than USD 200K. You can use either device to login to Client Portal but you will be required to use the Digital Security Card+ to confirm your withdrawal request.

Benefits

M2FS provides even more flexibility to IBKR's Secure Login System by allowing you to choose what security device you want to authenticate with. In addition to the convenience of using a device which is trusted and routinely accessible, you can eliminate delays associated with authenticating at times a trade needs to be entered quickly.

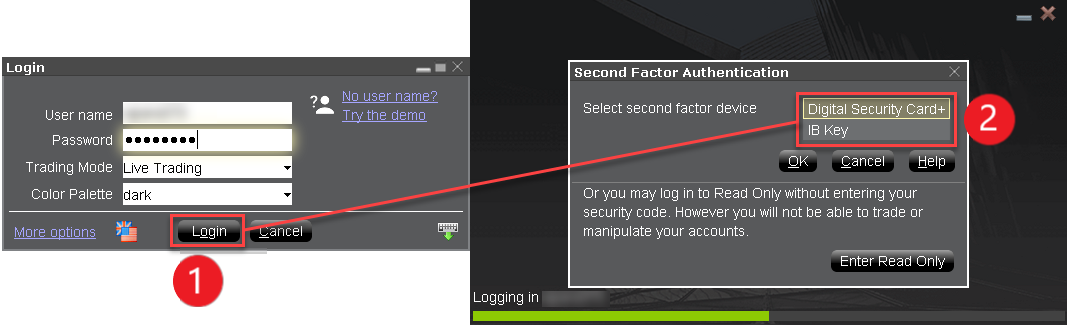

IBKR Mobile Authentication as a Two-Factor Solution

At IBKR, we are committed to protecting your account through the use of 2-Factor log in protection. With 2-factor protection, account access is provided through use of "Something you Know" (i.e. entry of user name and password combination) along with "Something you Have" (i.e., a tool which generates a random code to be entered after the user name and password). This 2-Factor protection is intended to mitigate the risk of online hackers (who've acquired your password via malware or social engineering) accessing your account.

While IBKR offers multiple 2-Factor options, IBKR Mobile Authentication is generally viewed as the most convenient to access and operate. Outlined below are some of the convenience factors offered by this app.

1. Always Available:

Your smartphone is always with you, as well as your tool to grant you secure access to your IBKR account.

2. Convenient:

No additional devices to carry, track and watch out for. In the event of loss or change of phone, IBKR Client Services can assist you to get the app back up and running at a moment’s notice.

3. Quick Activation:

A couple of minutes within the download of the app, you can already use it to authenticate into your account.

4. No Shipping, Delivery or Return:

No delivery delays, no return of devices with depleted batteries. A quick download suffices.

5. Secure, but quick and No-Hassle Login with our Seamless Authentication:

When logging into the Trading Platforms or the Client Portal, you only need to enter your username and password - IBKR will send you a notification and you will use the IB Key protocol to complete the authentication, via your mobile biometrics or PIN, depending on your configuration.

6. Allows for multiple users to authenticate with the same app:

If you have one security device for your personal IBKR account, one for your joint account with your spouse and one for your business account you will be happy to know that you can activate the same app for all those users (and more).

7. Available for every smartphone, everywhere:

IBKR Mobile can be downloaded from the Apple App Store if you have an iPhone. Android phone users can get the app as usual from the Google Play store. Clients in China can obtain the application on both Baidu and the 360.cn stores.

8. Works even Offline:

Should your phone be offline (e.g. when on vacation or with a bad reception), you can still use IBKR Mobile Authentication. Even though Seamless Authentication won't be accessible, the application can generate the codes you need to access your account and trade.

9. Secure delivery for your Password Reset:

With IBKR Mobile installed and the IB Key authentication activated, you can have the IBKR Client Services send you a temporary password to your phone in a secure way without exposing it through text messages and other means of communication.

10. Small footprint:

IBKR Mobile can be downloaded even on the most restrictive data plans and be installed on your smartphone without hogging resources. The application size and its operational use of resources are limited to the absolute minimum, while not compromising on its security.

For a general overview of IBKR Mobile Authentication including installation, activation and operation, please see KB2260.

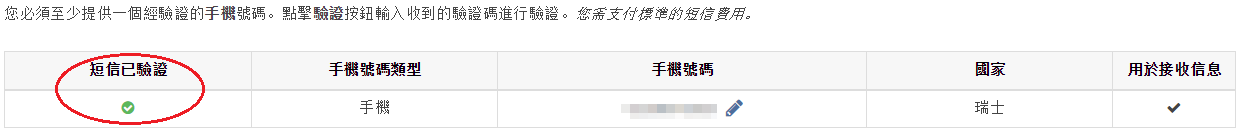

如何驗證您的手機號碼

本文將向您說明如何驗證您的手機號碼。

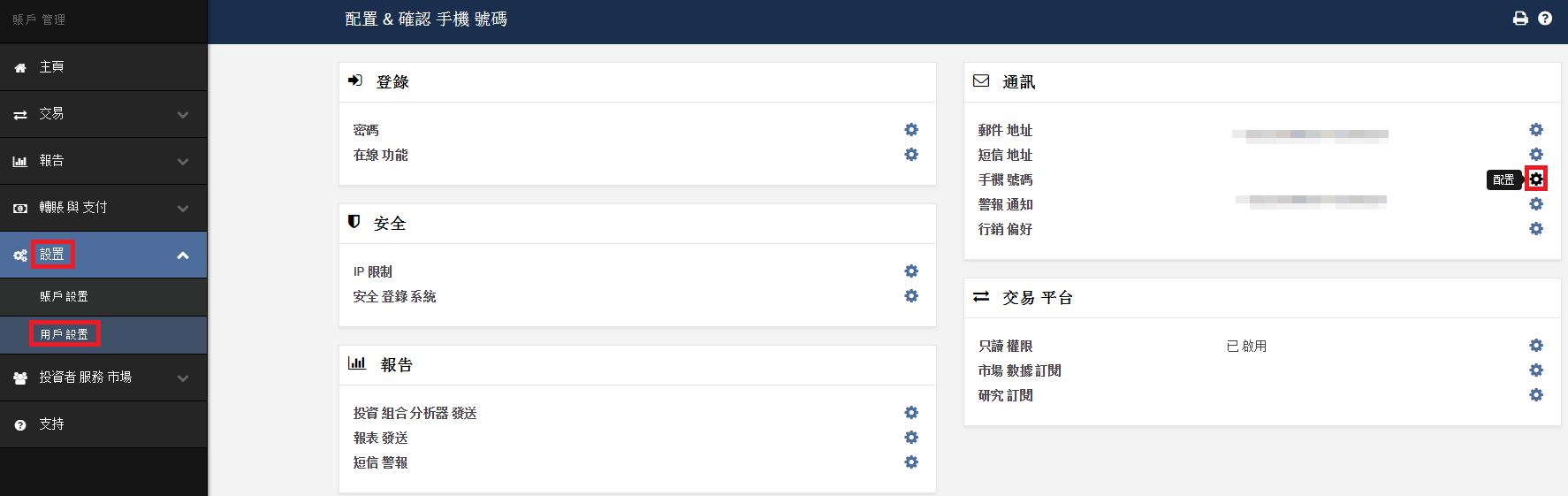

如您在申請賬戶時未驗證過您的手機號碼,您可隨時通過以下步驟完成驗證:

- 登錄賬戶管理。

- 在側邊欄菜單中,依次點擊設置 和用戶設置。點擊手機號碼對應的配置齒輪圖標。如您使用的是傳統賬戶管理,您可通過管理賬戶 -> 賬戶信息 -> 詳情 -> 個人信息菜單,點擊“修改”鏈接找到該板塊。

- 點擊驗證

.png)

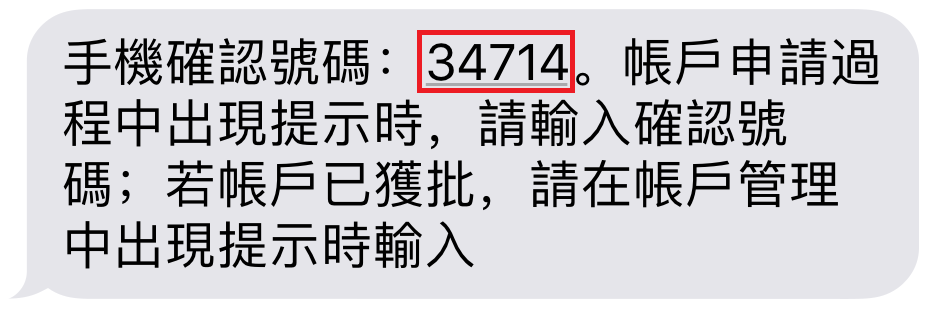

- 打開您手機的短信應用,您將看到我們發送給您的帶有確認碼的短信。

注意:短信發送的時間有長有短,在某些情況下可能需要几分鐘。

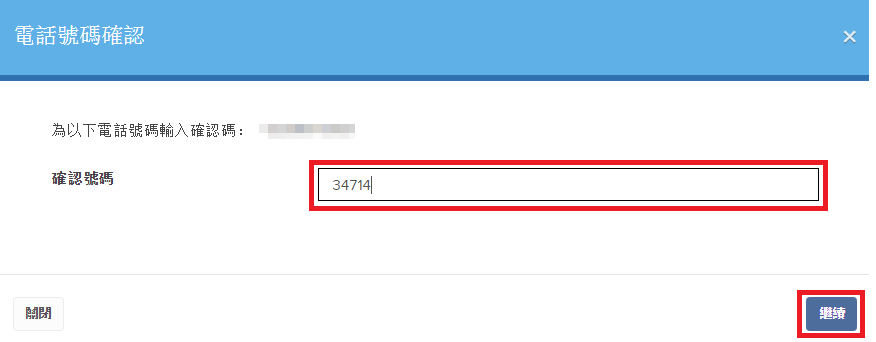

- 在確認號碼區域輸入您收到的確認碼 ,然后點擊繼續。

- 如該確認碼被接受,則“短信已驗證”欄目下會出現一個綠色的勾。點擊繼續完成操作。

- 如您的用戶沒有活躍的SLS設備,該用戶將很快自動被納入短信雙因素驗證項目。有關如何通過短信完成登錄驗證的說明,請見KB3196。

IBKR Mobile Authentication (IB Key) Reinstallation on the Same Phone

The recovery procedure explained in this article is required in case:

Procedure:

In order to re-enable IBKR Mobile Authentication (IB Key), please click on one of the below links, according to your smartphone Operating System

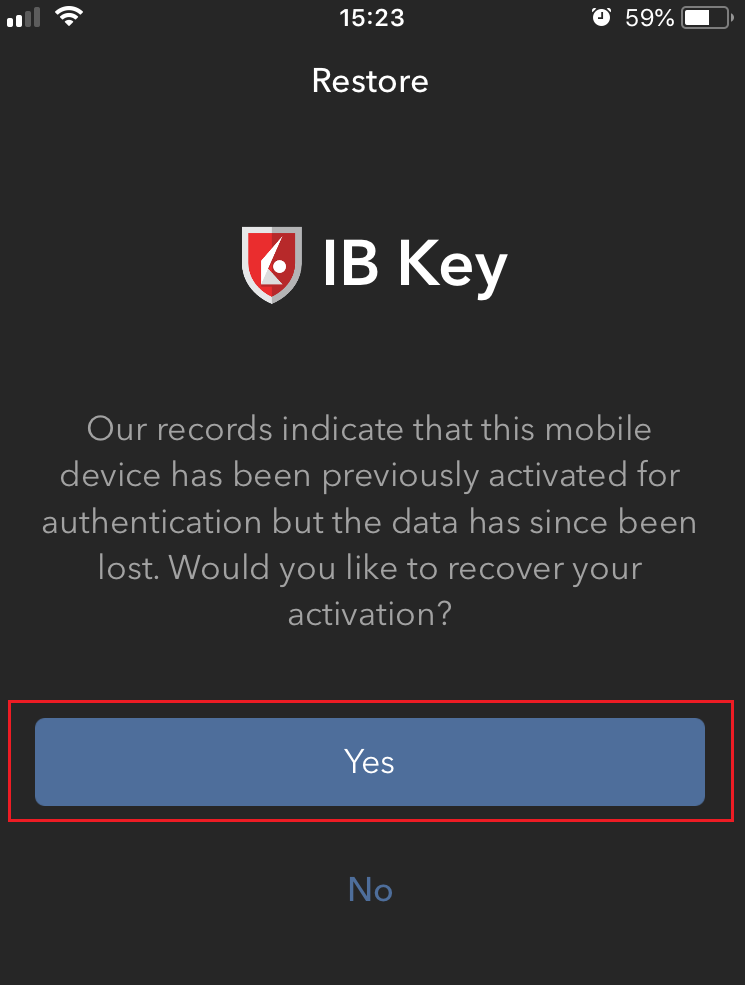

Apple iOS

-

Launch the IBKR Mobile app. Whenever possible, the app will ask you to recover the setup. Tap Yes

-

According to your phone hardware capabilities, you will be prompted to provide the security element originally used to secure the app (Fingerprint, Face ID, PIN). Please follow the on-screen instructions for this step

-

If the reactivation has been successfully completed, you will see a confirmation message. Tap Done to finalize the procedure

.png)

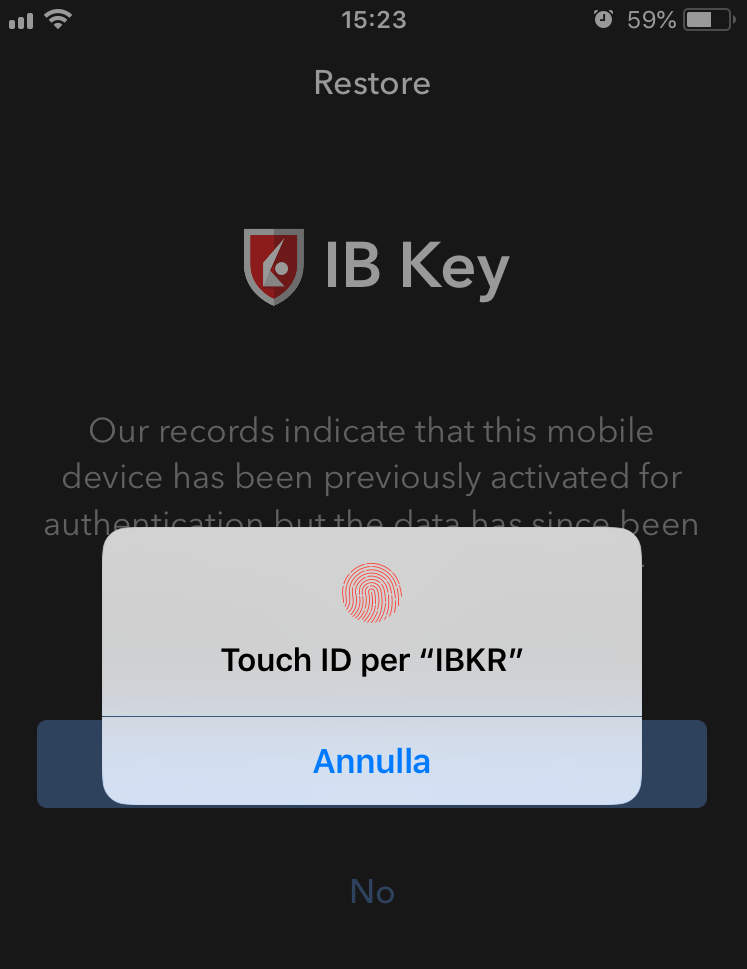

Android

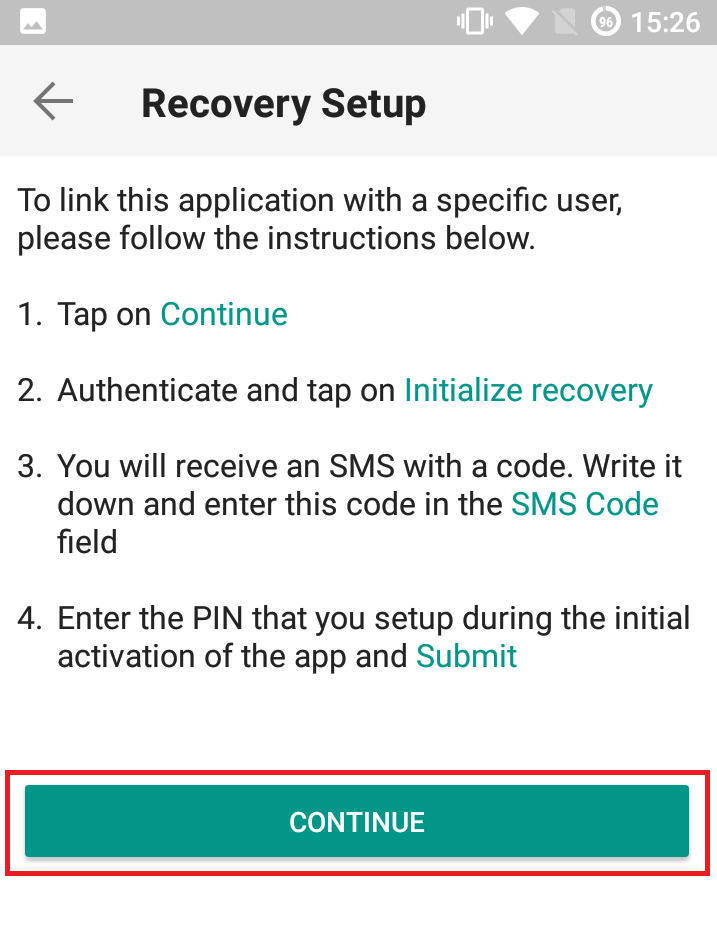

-

Launch the IBKR Mobile app. Whenever possible, the app will ask you to recover the setup. Tap Recover Setup

-

Review the Recovery directions and tap Continue

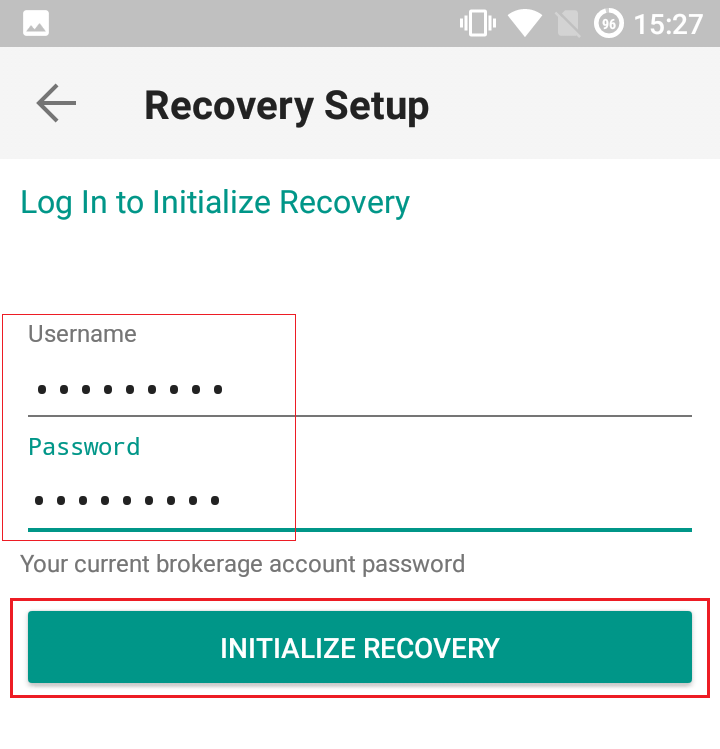

-

Enter your credentials and tap Initialize Recovery

-

You will receive an text message (SMS)containing an Activation Token. Enter it in the Activation Code field. According to your phone operating system and hardware capabilities, you might be prompted to provide as well the security element you originally used to secure the app (PIN, Fingerprint). Once done, tap Submit

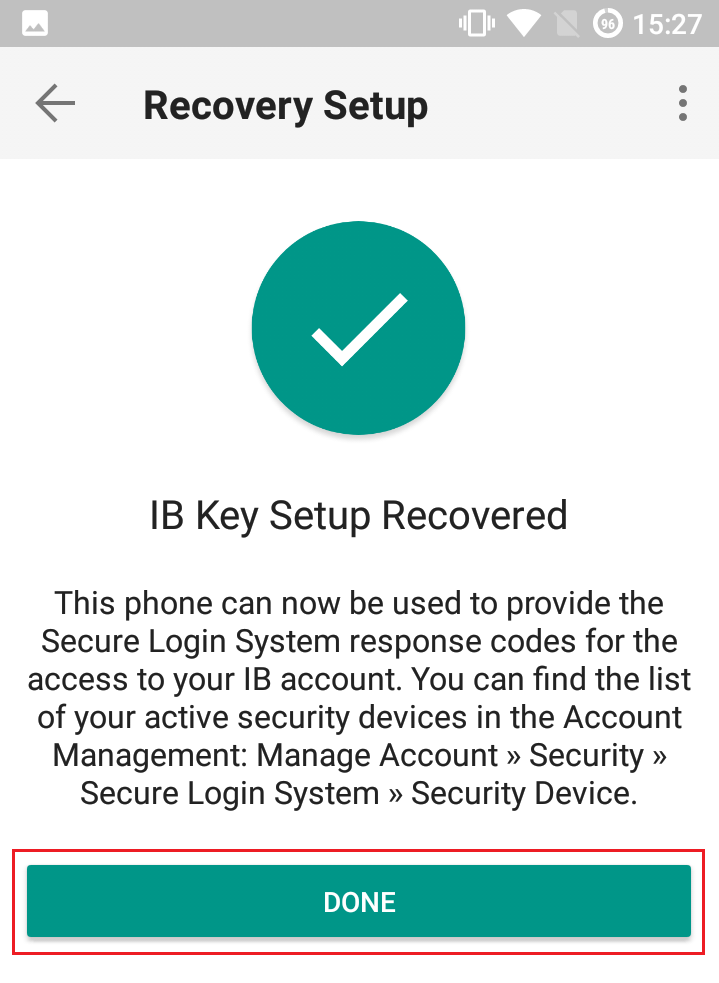

.png)

-

If the reactivation has been successfully completed, you will see a confirmation message. Tap Done to finalize the procedure

References

Cache Maintenance for IB apps on Android

This procedure has proved to work as a solution for several issues, since it produces a complete reset of the malfunctioning IBKR app.

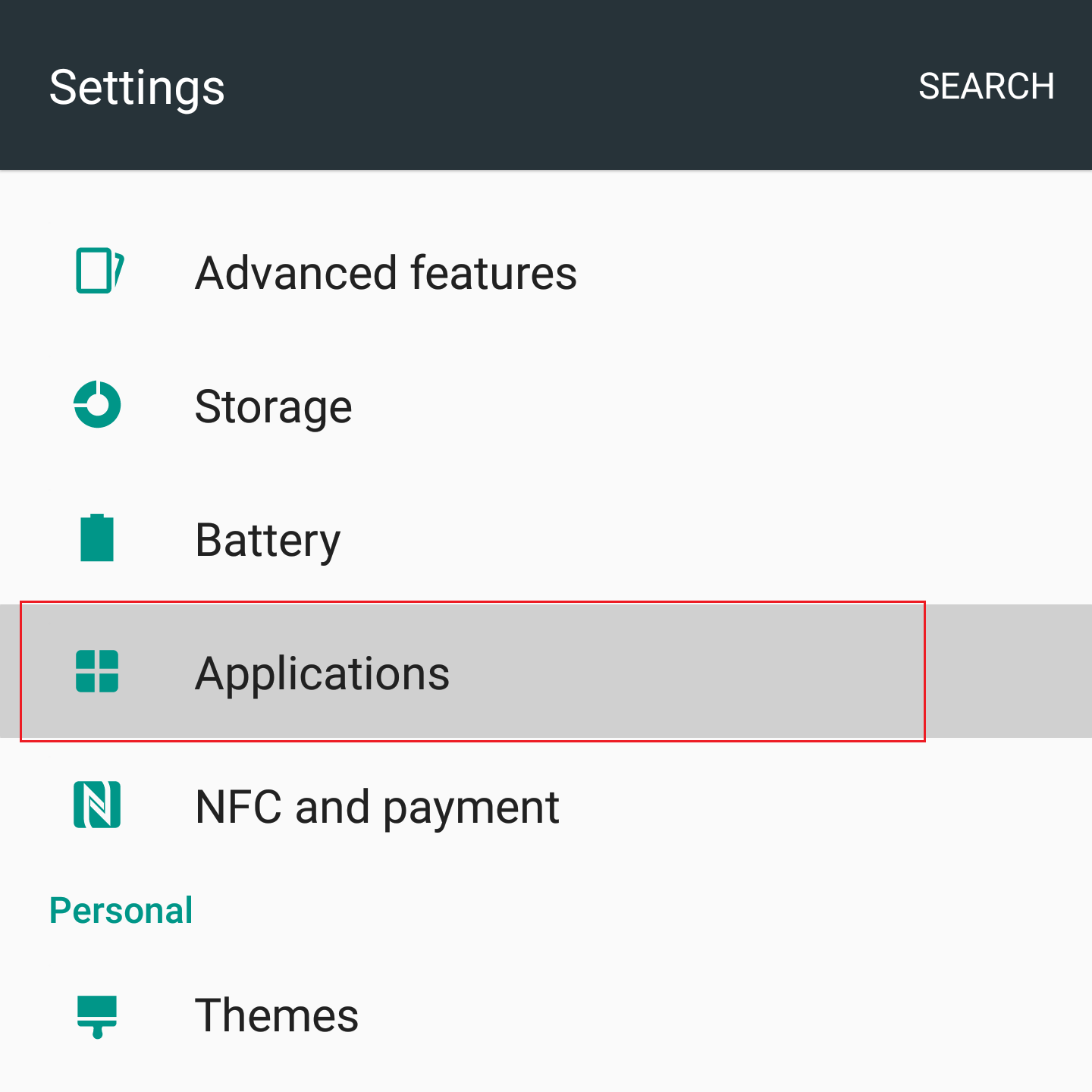

For Android OS 6.0 (Marshmallow) and higher

1. Go to your phone's Settings Menu

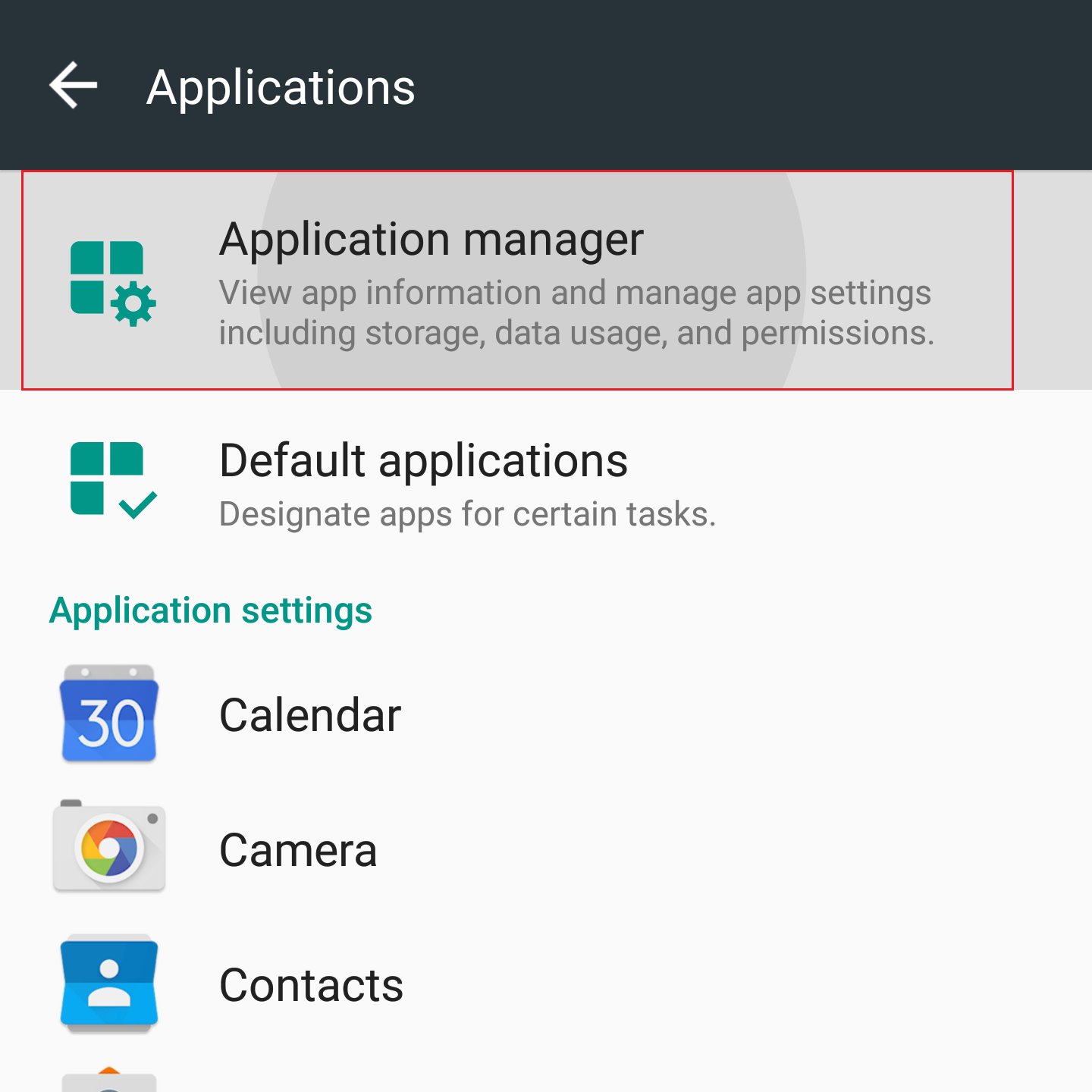

2. Below the Phone section, select Applications ![]() Application Manager

Application Manager

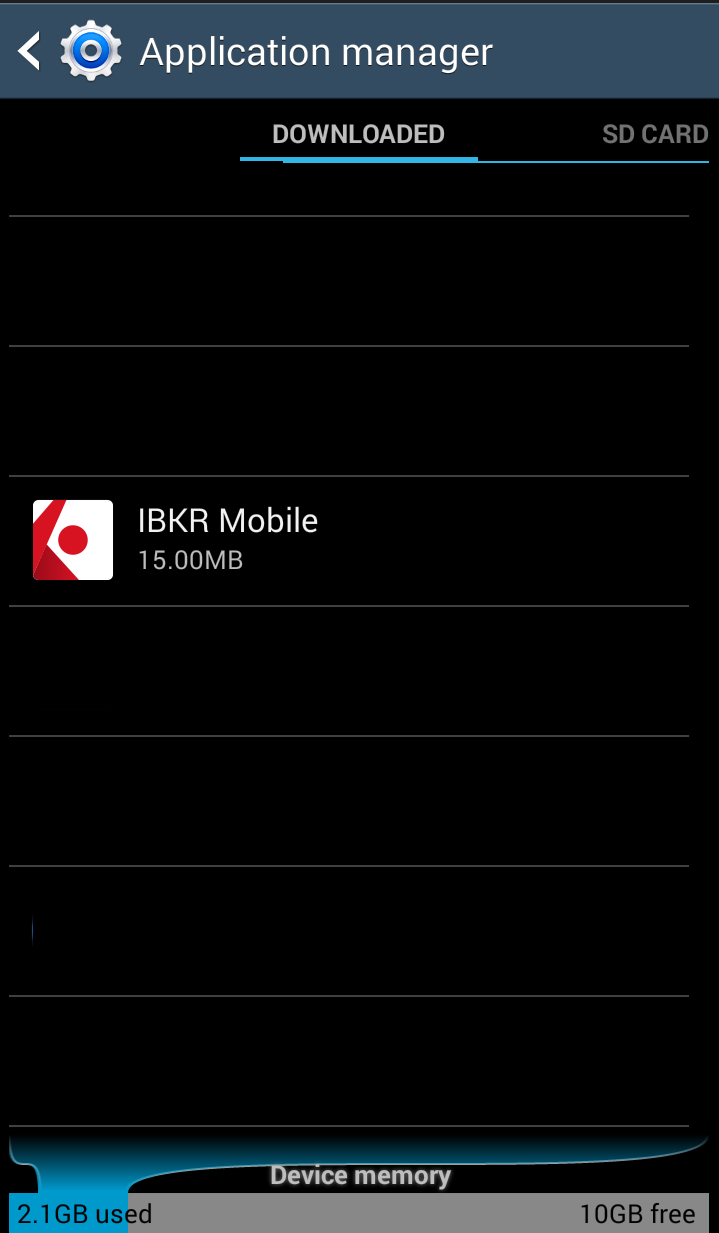

3. Scroll down and select the corresponding IB app which needs to be reset.

.png)

4. Tap on Storage

.png)

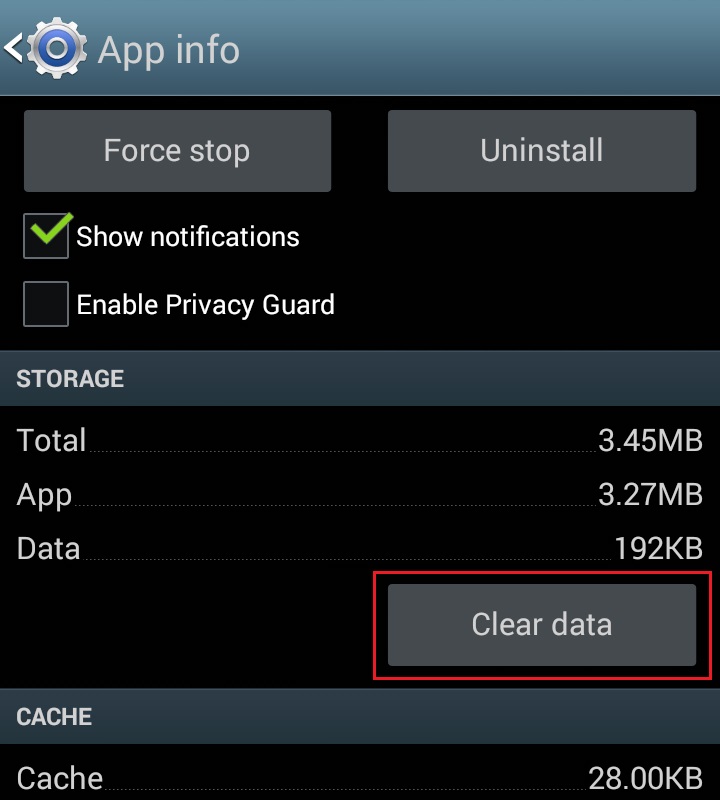

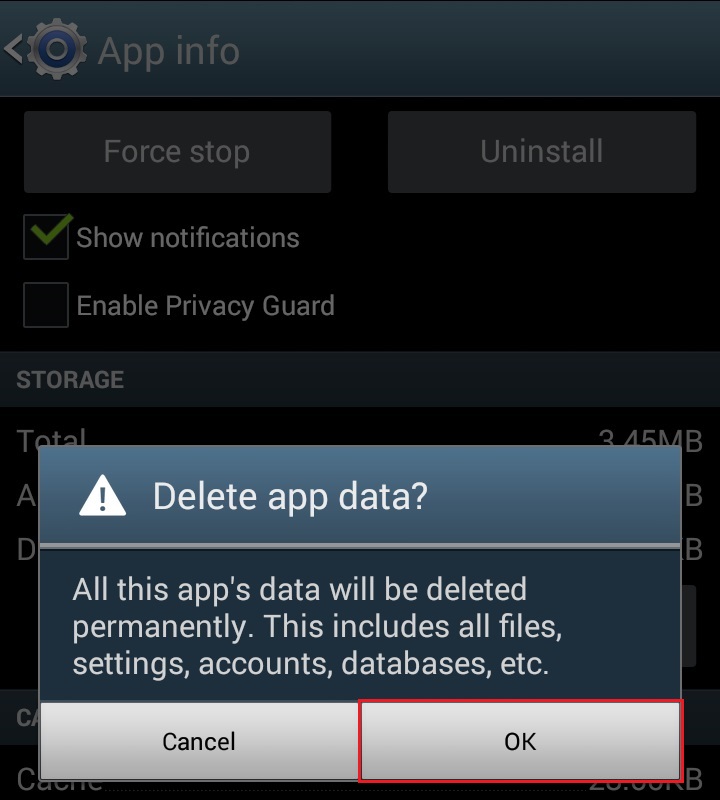

5. Tap on Clear Data ![]() OK

OK

.png)

.png)

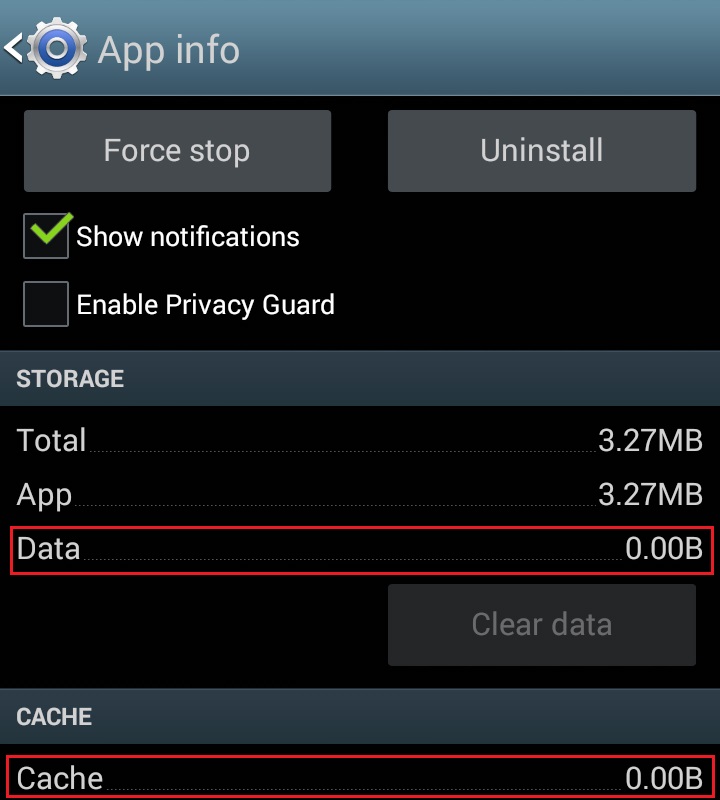

6. Confirm Data has been cleared.

.png)

7. Reboot the phone

8. Re-Launch app

For Android OS 5.0 (Lollipop) and previous versions

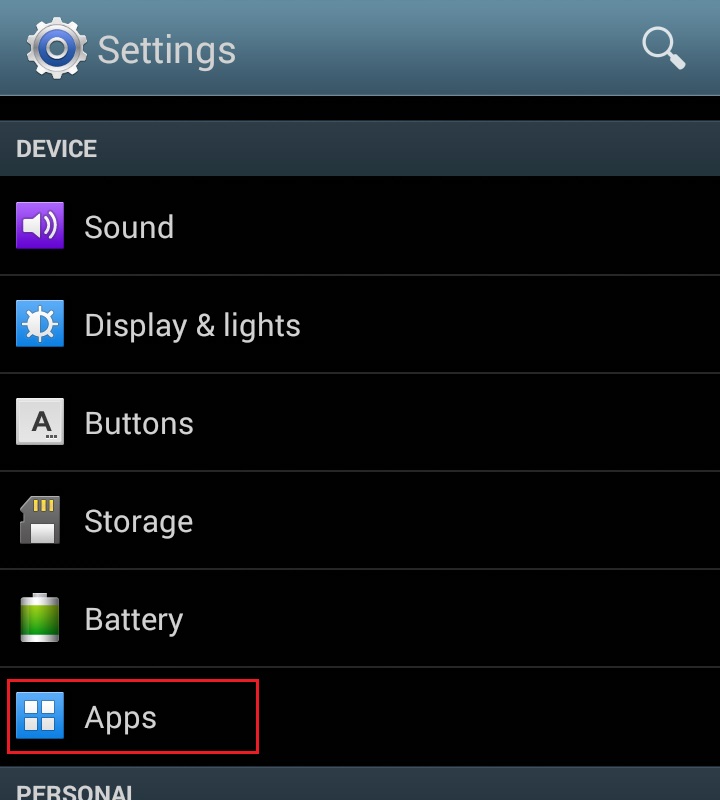

- Go to your phone Settings Menu

- Below the Device section, select Apps

- Scroll down and select the corresponding IB app which needs to be reset.

- Tap on Clear data

OK

OK

- Confirm Data has been cleared

- Reboot Phone

- Re-Launch app

Note: If after clearing the cache, manually adjusting the permissions and restarting your Android Device, the issue persists, please contact IB Customer Service for further troubleshooting.

Related Articles:

- For IB Key on Android overview refer to KB2277

- For IB Key Recovery process on Android refer to KB2748

安全設備更換費用

通過IBKR安全登錄系統登錄其賬戶的賬戶持有人會獲得一個安全設備,其在用戶名密碼保護外提供了一層額外的保護,用以防止網絡黑客和其他未經授權人士訪問您的賬戶。儘管IBKR對此設備的使用不收取任何費用,但某些版本的設備需賬戶持有人在賬戶關閉時歸還,否則會產生更換費用。如果設備遺失、被盜或者損壞,現有的賬戶持有人也需支付此更換費用(請注意,由於電池故障退回更換的設備不收取更換費用)。

此外,儘管IBKR只有在設備被確認為遺失、被盜、損壞或者未歸還的情況下才會收取更換費用,但在設備發放時賬戶便需留有一筆金額等於更換費用的預備金來確保設備能正常歸還。此預備金不會影響賬戶可用於交易的資產,但在設備歸還前,賬戶會被限制全額取款或轉帳(即不能提取預備金餘額)。

下表為各個設備的更換費用。

| 安全設備 | 更換費用 |

| 安全代碼卡1 | $0.001 |

| 數碼安全卡+ | $20.00 |

要瞭解如何歸還安全設備的說明,請參見KB975

1安全代碼卡在賬戶關閉時無需歸還,可在剩餘資金全部取出且賬戶完全關閉後銷毀或丟棄。賬戶關閉後,若想訪問客戶端查看、獲取活動報表和稅收文件,只需通過現有用戶名和密碼登錄即可。此類安全設備已不再發行。

如何重新加入安全登錄系統

選擇了退出安全登錄系統(SLS)的客戶可能會面臨一定的風險且會受到某些限制(如不能交易粉紙市場和場外櫃檯交易系統股票)。考慮到這些因素以及SLS提供的保護,您可能會决定重新完全加入安全登錄系統。下述文章提供了完成此操作的詳細步驟說明。

請注意,要修改安全設置,您的使用者需具有適當的訪問權限。如果您的使用者沒有權限更改安全設置,系統會給您一則通知並向您指出具備該等權限的使用者。

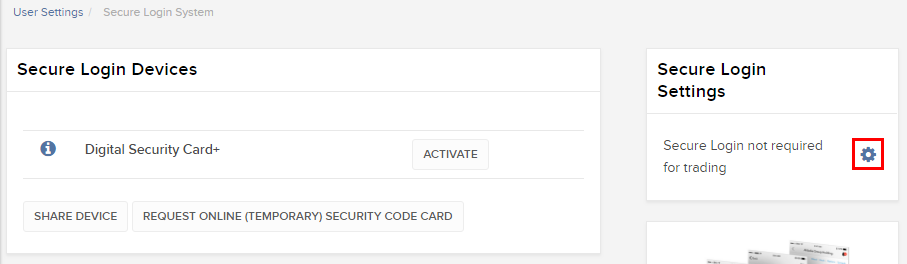

要重新加入安全登錄系統,請按以下步驟操作:

1. 打開瀏覽器,訪問網頁ibkr.com.

(1).png)

.png)

.png)

注

1. 如您使用的是舊版客戶端,請在頂部菜單點擊管理賬戶,然後點擊安全 > 安全登錄系統 > 安全登錄系統退出。然後選擇您的使用者對應的行旁邊的重新加入單選按鈕。

如何在線更改密碼

能登錄客戶端的賬戶持有人可以依次選擇設置>使用者設置,然後在“登錄”部分點擊“密碼”旁邊的齒輪圖標來更改密碼。 密碼必須爲6到40個字符長度,且至少包含一個字母和一個數字字符。

不能登錄客戶端的賬戶持有人可以通過在綫密碼重置工具更改密碼。密碼設置仍須遵循上述規則。您可以點擊此處、或使用客戶端登錄窗口底部的“忘記密碼?”鏈接或點擊TWS登錄失敗時顯示的鏈接請求重置密碼。

IMPORTANT NOTE

只有較新的IBKR軟件版本支持超過8個字符長度的密碼。更多詳情請參見客戶端的密碼重置頁面。賬戶持有人也可以聯繫客戶服務就更改密碼獲取幫助。出于安全目的,所有登錄問題和密碼相關請求只有在核實完賬戶持有人身份之後才會予以處理解决。

盈透證券歡迎您

現在您的賬戶已完成入金并獲批,您可以開始交易了。以下信息可以幫助您入門。

- 您的資金

- 設置您的賬戶以進行交易

- 如何交易

- 在全球範圍進行交易

- 拓展您IB經驗的五個要點

1. 您的資金

存款&取款基本信息。所有轉賬都通過您的賬戶管理進行管理

存款

首先,通過您的賬戶管理 > 資金 > 資金轉賬 > 轉賬類型:“存款”創建一個存款通知(如何創建存款通知)。第二步,通知您的銀行進行電匯轉賬,在存款通知中提供詳細銀行信息。

取款

通過您的賬戶管理 > 資金 > 資金轉賬 > 轉賬類型:“取款”創建一個取款指令(如何創建取款指令)

如果您通知要進行超出取款限額的取款,則會被視為異常取款,我們因此將需要匹配銀行賬戶持有人和IB賬戶。如果目的地銀行賬戶已被用作存款,那麼取款將會被處理;否則,您必須聯繫客戶服務并提供所需文件。

錯誤排查

存款:我的銀行發出了資金,但我沒有看到資金記入我的IB賬戶。可能的原因:

a) 資金轉賬需要1至4個工作日。

b) 存款通知缺失。您必須通過賬戶管理創建存款通知并向客戶服務發送一條咨詢單。

c) 修改詳情缺失。轉賬詳情中缺失您的姓名和IB賬戶號碼。您必須聯繫您的銀行索取完整的修改詳情。

d) IB發起的ACH存款7個工作日內限額為10萬美元。如果您開立的是初始要求為11萬美元的投資組合保證金賬戶,最好選擇電匯存款以減少您第一筆交易的等待時間。如果選擇ACH,會需要等待近2周時間,或者可以選擇臨時升級至RegT。

取款:我已經請求了取款,但我沒有看到資金記入我的銀行賬戶。可能的原因:

a) 資金轉賬需要1至4個工作日。

b) 被拒。超出最大取款限額。請檢查您賬戶的現金餘額。注意,出於監管要求,存入資金時會有三天置存期,之後才可以被取出。

c) 您的銀行退回了資金。可能是因為接收銀行賬戶與匯款銀行賬戶名稱不匹配。

2. 設置您的賬戶以進行交易

現金與保證金賬戶的區別:如果您選擇快速申請,默認您的賬戶類型為配備美國股票許可的現金賬戶。如果您想使用槓桿并以保證金交易,參見此處如何升級為RegT保證金賬戶

交易許可

為了能夠交易特定國家的某一特定資產類別,您需要通過賬戶管理獲得該資產類別的交易許可。請注意,交易許可是免費的。但您可能需要簽署當地監管部門所要求的風險披露。如何請求交易許可

市場數據

如果想獲取某一特定產品/交易所的實時市場數據,您需要訂閱交易所收費的市場數據包。如何訂閱市場數據

市場數據助手會幫助您選擇正確的數據包。請觀看該視頻,其解釋了市場數據助手是如何工作的。

客戶可以通過從未訂閱的代碼行點擊免費延時數據按鈕選擇接收免費的延時市場數據。

顧問賬戶

請閱讀用戶指南顧問入門指南。在這裡,您可以看到如何向您的顧問賬戶創建其他使用者以及如何授予其訪問權限等等。

3. 如何交易

如果想學習如何使用我們的交易平台,您可以訪問交易者大學。在這裡您可以找到我們以10種語言提供的實時與錄製網研會以及有關交易平台的課程與文檔。

交易者工作站(TWS)

要求更高級交易工具的交易者可以使用我們做市商設計的交易者工作站(TWS)。TWS有著便於操作的電子表格式界面,可優化您的交易速度和效率,支持60多種定單類型,配備可適應任何交易風格的特定任務交易工具,并可實時監控賬戶餘額與活動。試試兩種不同模式:

魔方TWS:直觀可用性, 簡便的交易准入,定單管理,自選列表與圖表全部在一個窗口呈現。

標準模式TWS:為需要更高級工具與算法的交易者提供高級定單管理。

基本描述與信息 / 快速入門指南 / 用戶指南

互動課程:TWS基礎 / TWS設置 / 魔方TWS

如何下單交易:標準模式TWS視頻 / 魔方TWS視頻

交易工具:基本描述與信息 / 用戶指南

要求:如何安裝適用於Windows的Java / 如何安裝適用於MAC的Java / 需打開端口4000和4001

登錄TWS / 下載TWS

網絡交易者(WebTrader)

偏好乾淨簡潔界面的交易者可以使用我們基於HTML的網絡交易者。網絡交易者便於查看市場數據、提交定單以及監控您的賬戶與執行。從各瀏覽器使用最新版本網絡交易者

快速入門指南 / 網絡交易者用戶指南

簡介:網絡交易者視頻

如何下單交易:網絡交易者視頻

登錄網絡交易者

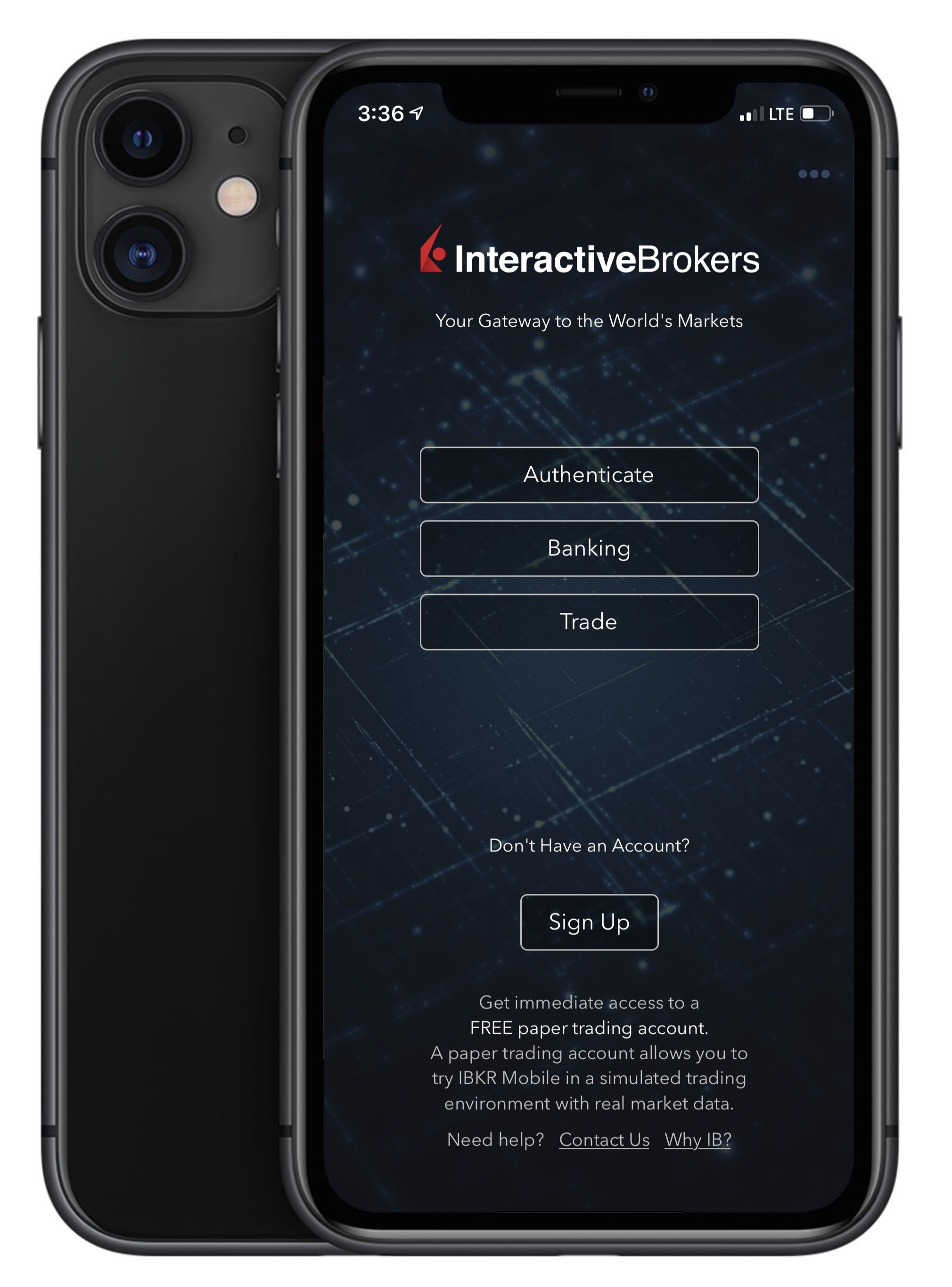

移動交易者(MobileTrader)

我們的移動解決方案可供您隨時隨地用您的IB賬戶進行交易。IB TWS iOS版和IB TWS BlackBerry版是為這些型號定制設計的,而通用的移動交易者支持大多數其他職能手機。

基本描述與信息

定單類型 可用定單類型與描述 / 視頻 / 課程 / 用戶指南

模擬交易 基本描述與信息 / 如何獲得模擬交易賬戶

一旦您的模擬交易賬戶創建成功,您便可用模擬交易賬戶分享您真實賬戶的市場數據:賬戶管理 > 管理賬戶 > 設置 > 模擬交易

4. 在全球範圍進行交易

IB賬戶為多幣種賬戶。您的賬戶可以同時持有不同的貨幣,可供您從一個賬戶交易全球範圍內的多種產品。

基礎貨幣

您的基礎貨幣決定了您報表的轉換貨幣以及用於確定保證金要求的貨幣。基礎貨幣在您開立賬戶時決定。客戶隨時可通過賬戶管理改變其基礎貨幣。

我們不會自動將貨幣轉換為您的基礎貨幣

貨幣轉換必須由客戶手動完成。在該視頻中,您可以學習如何進行貨幣轉換。

要開倉以您賬戶所不持有之貨幣計價的頭寸,您可以有以下兩種選擇:

A) 貨幣轉換。

B) IB保證金貸款。(對現金賬戶不可用)

請查看該課程,其解釋了外匯交易方法。

5. 拓展您IB經驗的五個要點

1. 合約搜索

在這裡,您會找到我們的所有產品、代碼與說明。

2. IB知識庫

IB知識庫包含了一系列術語、指導性文章、錯誤排查技巧以及指南,旨在幫助IB客戶管理其IB賬戶。只需在搜索按鈕輸入您想要了解的內容,您便會得到答案。

3. 賬戶管理

我們的交易平台可供您訪問市場,賬戶管理則可供您訪問自己的IB賬戶。使用賬戶管理可管理賬戶相關任務,如存入或取出資金、查看您的報表、修改市場數據與新聞訂閱、更改交易許可并驗證或更改您的個人信息。

登錄賬戶管理 / 賬戶管理快速入門指南 / 賬戶管理用戶指南

4. 安全登錄系統

為向您提供最高級別的在線安全,盈透證券推出了安全登錄系統(SLS),通過安全登錄系統訪問賬戶需要進行雙因素驗證。雙因素驗證旨在于登錄時採用兩項安全因素確認您的身份:1) 您的用戶名與密碼組合;和2) 生成隨機、一次性安全代碼的安全設備。因為登錄賬戶需要既知曉您的用戶名/密碼又持有實物安全設備,所以參加安全登錄系統基本上可以杜絕除您以外的其他任何人訪問您賬戶的可能性。

如何激活您的安全設備 / 如何獲取安全代碼卡 / 如何退還安全設備

如果忘記密碼或丟失安全代碼卡,請聯繫我們獲取即時幫助。

5. 報表與報告

我們的報表與報告方便查看和進行自定義,覆蓋了您盈透賬戶的方方面面。如何查看活動報表

.png)