Methodology for Determining Effective Rates

BACKGROUND

In determining the interest that account holders are paid on cash credit balances and charged on debit balances, each currency is assigned an IBKR Reference Benchmark rate. The IBKR Reference Benchmark rate is determined from short-term market rates but capped above/below widely used external reference rates or, where appropriate, bank deposit rates. This page explains how IBKR Reference Benchmark rates are determined.

Reference Rates

Reference rates are determined using a three-step process. The rates are capped above/below traditional external reference rates. For currencies and IBKR affiliates where Forex swap market pricing does not affect the rates we pay and charge our customers, Step 1 is omitted from the final rate determination.

1. Market implied rates

For market pricing, we utilize short-term Forex swap markets. Since most of the transactions involve the US dollar, Forex swap prices of currencies vs. the US dollar are sampled over a pre-determined time period referred to as the "Fixing Time Window" that is intended to be representative of liquid trading hours and primary turnover. The specific swap tenor and fixing windows used depend on the currency. We use the best bid and ask from a group of up to 12 of the largest Forex dealing banks to calculate the implied non-USD short-term rates - generally Overnight (T/T+1), Tom Next (T+1/T+2) or Spot Next (T+2/T+3). At the Fixing Time Window close, these calculations are sorted with the lowest and highest rates disregarded and the remainder averaged to determine the market implied reference rate.

2. Traditional external benchmark reference rates

For traditional benchmarks, we utilize published reference rates and, where appropriate, bank deposit rates. These rates generally are determined by either bank survey or actual transactions. The Hong Kong Inter-Bank Offered Rate (HIBOR), for example, is determined by surveying a panel of banks for the rate at which they could borrow funds from other banks at a specific time each day. In contrast, the US dollar Fed Funds effective rate is calculated as the weighted average of interbank lending rates transacted in the Fed Funds market.

The reform on interest rate benchmarks (IBOR reform), launched in 2013 by the G20 nations and conducted by regulatory authorities and public and private sector working groups, is gradually replacing bank survey based rates with new transaction driven reference rates.

3. IBKR Reference Benchmark Rates

The final IBKR Reference Benchmark rates are then determined by using the market implied reference rate, as described in 1. above, but capped by a certain amount above/below the traditional external benchmark reference rate as described in 2. above. For currencies and IBKR affiliates where Forex swap market pricing is not relevant, the final IBKR Reference Benchmark rates are determined by using traditional benchmarks or bank deposit rates, capped as above. The caps can change at any time without explicit prior notice and are listed in the table below, along with relevant currency and benchmark reference rates.

Examples

a. Assume the market implied overnight rate for GBP is 0.55%. The Sterling Overnight Index Average (SONIA) reference rate is 0.65%. The effective rate is then equal to the market implied rate of 0.55%, as it is still within the 1.00% cap around the SONIA reference rate at 0.65%.

b. If, for example, the market implied rate for CNH was 4.5% but the overnight CNH reference rate for the same period was 1.0%, the effective rate would be capped at 2.0% above the CNH reference rate, or 3.0% (1.0% reference rate + 2.0% cap).

|

Currency

|

Benchmark Description

|

Cap Below1

|

Cap Above1

|

|

USD

|

Fed Funds Effective (Overnight Rate)

|

0.00%

|

0.00%

|

|

AUD

|

RBA Daily Cash Rate Target

|

1.00%

|

1.00%

|

| AED | EIBOR, Emirates Interbank Offered Rate | 3.00% | 3.00% |

|

CAD

|

Bank of Canada Overnight Lending Rate

|

1.00%

|

1.00%

|

|

CHF

|

Swiss Average Rate Overnight (SARON)

|

1.00%

|

1.00%

|

|

CNY/CNH

|

CNH HIBOR Overnight Fixing Rate (TMA)

|

2.00%

|

2.00%

|

|

CZK

|

Prague ON Interbank Offered Rate

|

1.00%

|

1.00%

|

|

DKK

|

Danish Tom/Next Index

|

1.00%

|

1.00%

|

|

EUR

|

Euro Short-Term Rate (€STR)

|

1.00%

|

1.00%

|

|

GBP

|

Sterling Overnight Index Average (SONIA)

|

1.00%

|

1.00%

|

|

HKD

|

HKD HIBOR (Overnight rate)

|

1.00%

|

1.00%

|

|

HUF

|

Budapest Interbank Offered Rate

|

1.00%

|

1.00%

|

|

ILS

|

Tel Aviv Interbank Offered O/N Rate

|

1.00%

|

1.00%

|

|

INR

|

Central Bank of India Base Rate

|

0.00%

|

0.00%

|

|

JPY

|

Tokyo Overnight Average Rate (TONAR)

|

1.00%

|

1.00%

|

|

KRW

|

Korean Won KORIBOR (1 week)

|

0.00%

|

0.00%

|

|

MXN

|

Mexican Interbank TIIE (28 day rate)

|

3.00%

|

3.00%

|

|

NOK

|

Norwegian Overnight Weighted Average

|

1.00%

|

1.00%

|

|

NZD

|

New Zealand Dollar Official Cash Daily Rate

|

1.00%

|

1.00%

|

|

PLN

|

WIBOR (Warsaw Interbank Overnight Rate)

|

1.00%

|

1.00%

|

| SAR | SAIBOR Saudi Arabia Interbank Offered Rate | 3.00% | 3.00% |

|

SEK

|

SEK STIBOR (Overnight Rate)

|

1.00%

|

1.00%

|

|

SGD

|

Singapore Dollar SOR (Swap Overnight) Rate

|

1.00%

|

1.00%

|

|

TRY

|

TRLIBOR (Turkish Lira Overnight Interbank offered rate)

|

NO CAP

|

NO CAP

|

|

ZAR

|

South Africa Benchmark Overnight Rate on Deposits (Sabor)

|

3.00%

|

3.00%

|

Introduction to Market Implied Rates

BACKGROUND

In determining the interest that account holders are paid on cash credit balances and assessed on debit balances, each currency is assigned a reference or benchmark rate, from which a spread is deducted for credit interest and added for debit interest.1 As account holders may withdraw unencumbered cash balances upon demand and regulations generally restrict the reinvestment of such balances to short-term instruments of high credit quality, benchmarks typically represent the rate at which local banks may borrow on an overnight or short-term basis (e.g., EONIA, Fed Funds).

While the current benchmarks are useful in that they tend to be longstanding, widely accepted and published rates, often used as the basis for determining consumer borrowing, some have characteristics which limit their effectiveness, particularly in the case of brokerage accounts where the spread as applied by IBKR is relatively narrow. A discussion of these limitations is provided in the overview below.

OVERVIEW

Benchmark rates are often determined by either bank survey or actual transactions. The Hong Kong Interbank Offered Rate (HKD HIBOR), for example, is determined by surveying a panel of banks for the rate at which they could borrow funds from other banks of at a specific time each day. The final rate is determined by discarding a set of the top and bottom survey responses and averaging the remainder. Transaction based benchmarks such as EONIA are determined using a weighted average of all overnight unsecured lending transactions by panel banks in the interbank market as reported to the European Central Bank.

There are shortcomings to both methods which, at times, causes them to be an inadequate mechanism for establishing client debit and credit interest rates. Examples of these are provide below:

- Survey rates often represent an offer rate which, by definition stands above the bid rate and can be skewed well above the mid-point when spreads are large;

- Survey rates are typically based upon an inquiry performed at a specific time of the day and may not represent the rates available over a broader period of time;

- The population of institutions surveyed or whose transactions are considered may be small and/or may have borrowing characteristics that are not representative of financial institutions as a whole;

- During periods of market stress, interbank transactions may suffer from reduced liquidity, on either a regional or global basis, thereby distorting benchmark rates.2

- Survey processes often provide little transparency as to how the benchmark was determined and in the past have been subject to manipulation.

AN ALTERNATIVE APPROACH - MARKET IMPLIED RATES

To address these shortcomings, IBKR proposes to implement an alternative method for determining benchmark rates which we refer to as Market Implied Rates. This method combines the optimal attributes of each of the survey and transaction methods and uses as its basis Forex swap prices and the interest rate differentials embedded therein. The Forex swap market is one of the largest and most competitive markets with a daily turnover of 2.4 trillion USD3, representing aggregate transactions well in excess of that used for the current transaction-based benchmarks.

As over 90% of these transactions involve the U.S. Dollar, Forex swap prices of currencies vs. the U.S. Dollar will be sampled over a pre-determined time period referred to as the “Fixing Time Window” that is intended to be representative of liquid hours and primary turnover. The specific swap tenor and fixing windows used depend on the currency. Using the best bid and ask from a group of up to 12 of the largest Forex dealing banks4, implied non-USD short-term rates (generally Overnight (T/T+1, Tom Next (T+1/T+2) or Spot Next (T+2/T+3) ) will be calculated. At the Fixing Time Window close, these calculations will be sorted with the lowest and highest disregarded and the remainder averaged to determine the Final Fixing Rate. This Final Fixing Rate will then be used as part of the effective rate for that day’s interest calculations.

To provide complete transparency as to the rates used to determine interest on client credit and debit balances, IBKR has historically posted and updated to the public website each day all of the information an account holder would need to determine the interest they might pay or receive on cash balances (e.g., the stated benchmark, current and historical benchmark levels, spreads and tiers). Similar transparency will be provided with the implementation of Market Implied Rates. Here, rates will be posted to the website in 3 stages:

- Live – the last benchmark rate calculated prior to the start of the current day’s Fixing Time Window;

- Fixing Period – represents a running calculation of the current day’s benchmark rate using available data obtained while Fixing Time Window remains open.

- Fixing – the benchmark rate as calculated upon close of the Fixing Time This rate will remain unchanged for the remainder of the day and serve as the benchmark rate.

NEXT STEPS

Merging interest rate benchmarks and Market Implied Rates is intended to better align the rates offered to clients to the true funding costs and opportunities available to IBKR. The analysis performed thus far suggests that for certain currencies the new benchmark (effective rate) resulting from Forex swap implied rates but capped 25 bps5 above/below the benchmark fixing will be higher at various times and for others lower. As for the impact to clients, a higher benchmark generally benefits depositors and a lower, borrowers. What is important is that the new methodology is calculated in a consistent manner, using readily available and substantially representative data.

As the proposed change is significant in terms of its logic and its potential impact to certain clients, IBKR has been calculating and displaying, but not yet applying, market implied rates until clients have had sufficient opportunity to review the data. By August 1, 2017 we will start migrating the benchmarks from fixed to the new system where we use effective rates which are composed of market implied interest rates capped 25 bps above or below the current benchmark fixings.

______________________________________________________________________________________

1 In the case of the USD, a spread of 0.50% is deducted from the benchmark for purposes of credit interest and a spread of 1.50% added for purposes of debit interest. The benchmark rate for the USD is the Fed Funds Effective Overnight Rate.

2 Examples of this were experienced during the financial crisis of 2007-2010.

3 Source: BIS Triennial Central Bank Survey, Forex turnover April 2016. http://www.bis.org/publ/rpfx16fx.pdf

4 The actual number of banks selected may vary by currency.

5 The 25 basis points is subject to change at any time without advance notice.

如何確定您有無從IBKR借入資金

若某賬戶內的總現金餘額爲負,則存在資金借入,借款需支付利息。 然而,有時即使賬戶的總現金餘額爲正,由于餘額軋差或時間差,仍可能存在資金借入。 以下是最常見的例子:

IBKR股票差價合約概述

下方文章對IBKR發行的股票差價合約(CFD)進行了總體介紹。

有關IBKR指數差價合約的信息,請點擊此處。有關外匯差價合約的信息,請點擊此處。

涵蓋主題如下:

I. 差價合約定義

II. 差價合約與底層股票之比較

III. 成本與保證金

IV. 范例

V. 差價合約的相關資源

VI. 常見問題

風險警告

差價合約屬於復雜金融產品,其交易存在高風險,由於杠杆的作用,可能會出現迅速虧損。

在通過IBKR(UK)交易差價合約時,有67%的零售投資者賬戶出現了虧損。

您應考慮自己是否理解差價合約的運作機制以及自己是否能夠承受虧損風險。

ESMA差價合約規定(僅限零售客戶)

歐洲證券與市場管理局(ESMA)頒布了新的差價合約規定,自2018年8月1日起生效。

新規包括:1) 開倉差價合約頭寸的杠杆限制;2) 以單個賬戶為單位的保證金平倉規則;以及3) 以單個賬戶為單位的負余額保護規則;

ESMA新規僅適用於零售客戶。專業客戶不受影響。

請參見ESMA差價合約新規推行了解更多詳細信息。

I. 股票差價合約定義

IBKR差價合約是場外交易合約,提供底層股票的收益,包括股息與公司行動(了解更多有關差價合約公司行動的信息)。

換句話說,這是買家(您)與IBKR就交易一只股票當前價值與未來價值之差額而達成的協定。如果您持有多頭頭寸,且差額為正,則IBKR會付錢給您。而如果差額為負,則您應向IBKR付錢。

IBKR股票差價合約通過您的保證金賬戶進行交易,因此您可建立多頭以及空頭杠杆頭寸。差價合約的價格即是底層股票的交易所報價。實際上,IBKR差價合約報價與股票的智能傳遞報價(可在TWS中查看)相衕,且IBKR提供直接市場接入(DMA)。與股票類似,您的非適銷(即限價)定單會使底層對沖直接呈現在其進行交易之交易所的深度定單冊中。 這也意味著您可以下單以底層買價買入差價合約或以底層賣價賣出差價合約。

要將IBKR透明的差價合約模型與市場上其他差價合約進行比較,請參見我們的差價合約市場模型概述。

IBKR目前提供約7100只股票差價合約,覆蓋美國、歐洲和亞洲的主要市場。下表所列的主要指數其成分股目前都可做IBKR股票差價合約。在許多國家,IBKR還可供交易高流動性小槃股。這些股票自由流通量調整市值至少為5億美元,每日交易量中間值至少為60萬美元。 詳情請見差價合約產品列表。不久將會增加更多國家。

| 美國 | 標普500、道瓊斯股價平均指數、納斯達克100、標普400中槃股、高流動性小槃股 |

| 英國 | 富時350 + 高流動性小槃股(包括IOB) |

| 德國 | Dax、MDax、TecDax + 高流動性小槃股 |

| 瑞士 | 斯托克歐洲600指數(48只股票)+ 高流動性小槃股 |

| 法國 | CAC大槃股、CAC中槃股 + 高流動性小槃股 |

| 荷蘭 | AEX、AMS中槃股 + 高流動性小槃 |

| 比利時 | BEL 20、BEL中槃股 + 高流動性小槃 |

| 西班牙 | IBEX 35 + 高流動性小槃股 |

| 葡萄牙 | PSI 20 |

| 瑞典 | OMX斯德哥爾摩30指數 + 高流動性小槃股 |

| 芬蘭 | OMX赫爾辛基25指數 + 高流動性小槃股 |

| 丹麥 | OMX哥本哈根30指數 + 高流動性小槃股 |

| 挪威 | OBX |

| 捷克 | PX |

| 日本 | 日經225指數 + 高流動性小槃股 |

| 香港 | 恆生指數 + 高流動性小槃股 |

| 澳大利亞 | ASX 200指數 + 高流動性小槃股 |

| 新加坡* | 海峽時報指數 + 高流動性小槃股 |

| 南非 | Top 40 + 高流動性小槃股 |

*對新加坡居民不可用

II. 差價合約與底層股票之比較

| IBKR差價合約的優勢 | IBKR差價合約的缺點 |

|---|---|

| 無印花稅和金融交易稅(英國、法國、比利時) | 無股權 |

| 佣金和保證金利率通常比股票低 | 復雜公司行動并不總能完全復制 |

| 股息享受稅務協定稅率,無需重新申請 | 收益的徵稅可能與股票有所不衕(請咨詢您的稅務顧問) |

| 不受即日交易規則限制 |

III. 成本與保證金

在歐洲股票市場,IBKR差價合約可以比IB極具競爭力的股票產品更加高效。

首先,IBKR差價合約佣金比股票低,且有著與股票一樣低的融資點差:

| 歐洲 | 差價合約 | 股票 | |

|---|---|---|---|

| 佣金 | GBP | 0.05% | 英鎊6.00 + 0.05%* |

| EUR | 0.05% | 0.10% | |

| 融資** | 基准+/- | 1.50% | 1.50% |

*每單 + 超出5萬英鎊部分的0.05%

**對於差價合約是總頭寸價值的融資;對於股票是借用金額的融資

交易量更大時,差價合約佣金會變得更低,最低至0.02%。頭寸更大時,融資利率也會降低,最低至0.5%。 詳情請參見差價合約佣金和差價合約融資利率。

其次,差價合約的保證金要求比股票低。零售客戶須滿足歐洲監管機搆ESMA規定的額外保證金要求。請參見ESMA差價合約新規推行了解詳細信息。

| 差價合約 | 股票 | ||

|---|---|---|---|

| 所有 | 標准 | 投資組合保證金 | |

| 維持保證金要求* |

10% |

25% - 50% | 15% |

*藍籌股特有保證金。零售客戶最低初始保證金要求為20%。股票標准的25%日內維持保證金,50%隔夜保證金。 顯示的投資組合保證金為維持保證金(包括隔夜)。波動較大的股票保證金要求更高

請參見CFD保證金要求了解更多詳細信息。

IV. 范例(專業客戶)

讓我們來看一下例子。聯合利華在阿姆斯特丹的掛牌股票在過去一個月(2012年5月14日前20個交易日)回報率為3.2%,您認為其會繼續有良好表現。您想建立20萬歐元的倉位,并持倉5天。您以10筆交易建倉并以10筆交易平倉。您的直接成本如下:

股票

| 差價合約 | 股票 | ||

|---|---|---|---|

| 200,000歐元頭寸 | 標准 | 投資組合保證金 | |

| 保證金要求 | 20,000 | 100,000 | 30,000 |

| 佣金(雙向) | 200.00 | 400.00 | 400.00 |

| 利率(簡化) | 1.50% | 1.50% | 1.50% |

| 融資金額 | 200,000 | 100,000 | 170,000 |

| 融資天數 | 5 | 5 | 5 |

| 利息支出(1.5%的簡化利率) | 41.67 | 20.83 | 35.42 |

| 總計直接成本(佣金+利息) | 241.67 | 420.83 | 435.42 |

| 成本差額 | 高74% | 高80% | |

注意:差價合約的利息支出根據總的合約頭寸進行計算,而股票的利息支出則是根據借用金額進行計算。股票和差價合約的適用利率相衕。

但是,假設您只有2萬歐元可用來做保證金。如果聯合利華繼續上月的表現,您的潛在盈利比較如下:

| 杠杆回報 | 差價合約 | 股票 | |

|---|---|---|---|

| 可用保證金 | 20,000 | 20,000 | 20,000 |

| 總投入 | 200,000 | 40,000 | 133,333 |

| 總收益(5天) | 1,600 | 320 | 1,066.66 |

| 佣金 | 200.00 | 80.00 | 266.67 |

| 利息支出(1.5%的簡化利率) | 41.67 | 4.17 | 23.61 |

| 總計直接成本(佣金+利息) | 241.67 | 84.17 | 290.28 |

| 淨收益(總收益減去直接成本) | 1,358.33 | 235.83 | 776.39 |

| 保證金投資金額回報 | 0.07 | 0.01 | 0.04 |

| 差額 | 收益少83% | 收益少43% | |

| 杠杆風險 | 差價合約 | 股票 | |

|---|---|---|---|

| 可用保證金 | 20,000 | 20,000 | 20,000 |

| 總投入 | 200,000 | 40,000 | 133,333 |

| 總收益(5天) | -1,600 | -320 | -1,066.66 |

| 佣金 | 200.00 | 80.00 | 266.67 |

| 利息支出(1.5%的簡化利率) | 41.67 | 4.17 | 23.61 |

| 總計直接成本(佣金+利息) | 241.67 | 84.17 | 290.28 |

| 淨收益(總收益減去直接成本) | -1,841.67 | -404.17 | -1,356.94 |

| 差額 | 損失少78% | 損失少26% | |

V. 差價合約相關資源

下方鏈接可幫助您了解更多有關IBKR差價合約產品的詳細信息:

還可參看以下視頻教程:

VI. 常見問題

什么股票可進行差價合約交易?

美國、西歐、北歐與日本的大槃和中槃股股票。許多市場上的高流動性小槃股也可以。請參見差價合約產品列表了解更多詳細信息。不久將會增加更多國家。

IB提供股票指數和外匯的差價合約嗎?

是的。請參見IBKR指數差價合約 - 事實與常見問題以及外匯差價合約 - 事實與常見問題。

IB如何確定股票差價合約報價?

IBKR差價合約報價與底層股票的智能傳遞報價相衕。IBKR不會擴大價差或與您對賭。要了解更多信息,請參見差價合約市場模型概述。

我能看到自己的限價定單反映在交易所中嗎?

是的。IBKR提供直接市場接入(DMA),這樣您的非適銷(即限價)定單會使底層對沖直接呈現在其進行交易之交易所的深度定單冊中。這也意味著您可以下單以底層買價買入差價合約或以底層賣價賣出差價合約。此外,如果其他客戶的定單以優於公開市場的價格與您的定單交叉,您還可能會獲得價格改善。

IB如何確定股票差價合約的保證金?

IBKR根據每只底層股票的曆史波動率建立了基於風險的保證金要求機制。最低保證金為10%。 大多數IBKR差價合約都應用該保證金率,這使差價合約在大多數情況下都比底層股票交易更具效率。 零售客戶須滿足歐洲監管機搆ESMA規定的額外保證金

要求。 請參見ESMA差價合約新規推行了解詳細信息。單個差價合約頭寸之間或差價合約與底層股票頭寸之間沒有投資組合抵消。集中頭寸和超大頭寸可能需要准備額外的保證金。請參見差價合約保證金要求了解更多詳細信息。

空頭股票差價合約會要強制補倉嗎?

是的。如果底層股票很難或者根本不可能借到,則空頭差價合約頭寸的持有者將需要進行補倉。

IB如何處理股息和公司行動?

IBKR通常會為差價合約持有者反映公司行動的經濟效應,就好像他們一直持有著底層證券一樣。股息會表現為現金調整,而其他行動則會通過現金或頭寸調整表現。例如,如果公司行動導致股票數量發生變化(如股票分隔和逆向股票分隔),差價合約的數量也會相應地進行調整。如果行動導致產生新的上市實體,且IBKR決定將其股票作為差價合約交易,則需要創建適當數量之新的多頭或空頭頭寸。要了解概述信息,請參見差價合約公司行動。

*請注意,某些情況下對於合并等復雜公司行動可能無法對差價合約進行准確調整。這時候,IBKR可能會在除息日前終止差價合約。

任何人都能交易IBKR差價合約嗎?

除美國、加拿大和香港的居民,其他所有客戶都能交易IBKR差價合約。新加坡居民可交易除新加坡上市之股票差價合約以外的其它IBKR差價合約。任何投資者類型都不能免於這一基於居住地的限制。

我需要做什么才可以開始在IBKR交易差價合約?

您需要在賬戶管理中設置差價合約交易許可,并衕意相關交易披露。如果您的賬戶是在IB LLC開立,則IBKR將設置一個新的賬戶板塊(即您當前的賬戶號碼加上后綴“F”)。設置確認后您便可以開始交易了。您無需單獨為F賬戶注資,資金會從您的主賬戶自動轉入以滿足差價合約保證金要求。

有什么市場數據要求嗎?

IBKR股票差價合約的市場數據便是底層股票的市場數據。因此需要具備相關交易所的市場數據許可。如果您已經為股票交易設置了交易所的市場數據許可,那么就無需再進行任何操作。如果您想在當前并無市場數據許可的交易所交易差價合約,您可以設置許可,操作與底層股票的市場數據許可設置相衕。

差價合約交易與頭寸在報表中如何反映?

如果您是在IB LLC持有賬戶,且您的差價合約頭寸持有在單獨的賬戶板塊(主賬戶號碼加后綴“F”)中。您可以選擇單獨查看F板塊的活動報表,也可以選擇與主賬戶合并查看。您可在賬戶管理的報表窗口進行選擇。對於其他賬戶,差價合約通常會與其他交易產品一起在您的賬戶報表中顯示。

我可以從其他經紀商處轉入差價合約頭寸嗎?

IBKR當前不支持差價合約頭寸轉賬。

股票差價合約可以使用圖表功能嗎?

是的。

在IBKR交易差價合約有什么賬戶保護?

差價合約以IB英國作為您的交易對方,不是在受監管的交易所進行交易,也不是在中央結算所進行結算。因IB英國是您差價合約交易的對方,您會面臨與IB英國交易相關的財務和商業風險,包括信用風險。但請注意,所有客戶資金永遠都是完全隔離的,包括對機搆客戶。IB英國是英國金融服務補償計划(“FSCS”)參與者。IB英國不是美國證券投資者保護公司(“SIPC”)成員。請參見IB英國差價合約風險披露文件了解有關差價合約交易風險的詳細信息。

在哪種類型(如個人、朋友和家庭、機搆等)的IBKR賬戶中可交易差價合約?

所有保證金賬戶均可進行差價合約交易。現金賬戶和SIPP賬戶不能。

在某一特定差價合約中我最多可持有多少頭寸?

沒有預設限制。但請注意,超大頭寸可能會有更高保證金要求。請參見CFD保證金要求了解更多詳細信息。

我能否通過電話交易差價合約?

不要。在極端情況下我們可能衕意通過電話處理平倉定單,但絕不會通過電話處理開倉定單。

差價合約屬於復雜金融產品,其交易存在高風險,由於杠杆的作用,可能會出現迅速虧損。

在通過IBKR(UK)交易差價合約時,有67%的零售投資者賬戶出現了虧損。

您應考慮自己是否理解差價合約的運作機制以及自己是否能夠承受虧損風險。

ESMA規定

歐洲證券與市場管理局(ESMA)發布臨時產品干涉措施,自2018年8月1日起生效。

ESMA決議實施的限制包括:1) 開倉差價合約頭寸的杠杆限制;2) 以單個賬戶為單位的保證金平倉規則;3) 以單個賬戶為單位的負余額保護規則;4) 對交易差價合約激勵措施的限制;以及5) 標准的風險警告。

ESMA新規僅適用於零售客戶。 專業客戶不受影響。

How to determine if you are borrowing funds from IBKR

If the aggregate cash balance in a given account is a debit, or negative, then funds are being borrowed and the loan is subject to interest charges. A loan may still exist, however, even if the aggregate cash balance is a credit, or positive, as a result of balance netting or timing differences. The most common examples of this are as follows:

Overview of IBKR issued Share CFDs

The following article is intended to provide a general introduction to share-based Contracts for Differences (CFDs) issued by IBKR.

For Information on IBKR Index CFDs click here. For Forex CFDs click here. For Precious Metals click here.

Topics covered are as follows:

I. CFD Definition

II. Comparison Between CFDs and Underlying Shares

III. CFD Tax and Margin Advantage

IV. US ETFs

V. CFD Resources

VI. Frequently Asked Questions

Risk Warning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

61% of retail investor accounts lose money when trading CFDs with IBKR.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

ESMA Rules for CFDs (Retail Clients of IBKRs European entities, including so-called F segments)

The European Securities and Markets Authority (ESMA) has enacted new CFD rules effective 1st August 2018.

The rules include: 1) leverage limits on the opening of a CFD position; 2) a margin close out rule on a per account basis; and 3) negative balance protection on a per account basis.

The ESMA Decision is only applicable to retail clients. Professional clients are unaffected.

Please refer to the following articles for more detail:

ESMA CFD Rules Implementation at IBKR (UK) and IBKR LLC

ESMA CFD Rules Implementation at IBIE and IBCE

I. Overview

IBKR CFDs are OTC contracts which deliver the return of the underlying stock, including dividends and corporate actions (read more about CFD corporate actions).

Said differently, it is an agreement between the buyer (you) and IBKR to exchange the difference in the current value of a share, and its value at a future time. If you hold a long position and the difference is positive, IBKR pays you. If it is negative, you pay IBKR.

Our Share CFDs offer Direct Market Access (DMA). Our Share CFD quotes are identical to the Smart-routed quotes for shares that you can observe in the Trader Workstation. Similar to shares, your non-marketable (i.e. limit) orders have the underlying hedge directly represented on the deep book of those exchanges at which it trades. This also means that you can place orders to buy the CFD at the underlying bid and sell at the offer.

To compare IBKR’s transparent CFD model to others available in the market please see our Overview of CFD Market Models.

We currently offer approximately 8500 Share CFDs covering the principal markets in the US, Europe and Asia. Eligible shares have minimum market capitalization of USD 500 million and median daily trading value of at least USD 600 thousand. Please see CFD Product Listings for more detail.

Most order types are available for CFDs, including auction orders and IBKR Algos.

CFDs on US share can also be traded during extended exchange hours and overnight. Other CFDs are traded during regular hours.

II. Comparison Between CFDs and Underlying Shares

| BENEFITS of IBKR CFDs | DRAWBACKS of IBKR CFDs |

|---|---|

| No stamp duty or financial transaction tax (UK, France, Belgium, Spain) | No ownership rights |

| Generally lower margin rates than shares* | Complex corporate actions may not always be exactly replicable |

| Tax treaty rates for dividends without need for reclaim | Taxation of gains may differ from shares (please consult your tax advisor) |

| Exemption from day trading rules | |

| US ETFs tradable as CFDs** |

*IB LLC and IB-UK accounts.

**EEA area clients cannot trade US ETFs directly, as they do not publish KIDs.

III. CFD Tax and Margin Advantage

Where stamp duty or financial transaction tax is applied, currently in the UK (0.5%), France (0.3%), Belgium (0.35%) and Spain (0.2%), it has a substantially detrimental impact on returns, particular in an active trading strategy. The taxes are levied on buy-trades, so each time you open a long, or close a short position, you will incur tax at the rates described above.

The amount of available leverage also significantly impacts returns. For European IBKR entities, margin requirements are risk-based for both stocks and CFDs, and therefore generally the same. IB-UK and IB LLC accounts however are subject to Reg T requirements, which limit available leverage to 2:1 for positions held overnight.

To illustrate, let's assume that you have 20,000 to invest and wish to leverage your investment fully. Let's also assume that you hold your positions overnight and that you trade in and out of positions 5 times in a month.

Let's finally assume that your strategy is successful and that you have earned a 5% return on your gross (fully leveraged) investment.

The table below shows the calculation in detail for a UK security. The calculations for France, Belgium and Spain are identical, except for the tax rates applied.

| UK CFD | UK Stock | UK Stock | |

|---|---|---|---|

| All Entities |

EU Account

|

IB LLC or IBUK Acct

|

|

| Tax Rate | 0% | 0.50% | 0.50% |

| Tax Basis | N/A | Buy Orders | Buy Orders |

| # of Round trips | 5 | 5 | 5 |

| Commission rate | 0.05% | 0.05% | 0.05% |

| Overnight Margin | 20% | 20% | 50% |

| Financing Rate | 1.508% | 1.508% | 1.508% |

| Days Held | 30 | 30 | 30 |

| Gross Rate of Return | 5% | 5% | 5% |

| Investment | 100,000 | 100,000 | 40,000 |

| Amount Financed | 100,000 | 80,000 | 20,000 |

| Own Capital | 20,000 | 20,000 | 20,000 |

| Tax on Purchase | 0.00 | 2,500.00 | 1,000.00 |

| Round-trip Commissions | 500.00 | 500.00 | 200.00 |

| Financing | 123.95 | 99.16 | 24.79 |

| Total Costs | 623.95 | 3099.16 | 1224.79 |

| Gross Return | 5,000 | 5,000 | 2,000 |

| Return after Costs | 4,376.05 | 1,900.84 | 775.21 |

| Difference | -57% | -82% |

The following table summarizes the reduction in return for a stock investment, by country where tax is applied, compared to a CFD investment, given the above assumptions.

| Stock Return vs cfD | Tax Rate | EU Account | IB LLC or IBUK Acct |

|---|---|---|---|

| UK | 0.50% | -57% | -82% |

| France | 0.30% | -34% | -73% |

| Belgium | 0.35% | -39% | -75% |

| Spain | 0.20% | -22% | -69% |

IV. US ETFs

EEA area residents who are retail investors must be provided with a key information document (KID) for all investment products. US ETF issuers do not generally provide KIDs, and US ETFs are therefore not available to EEA retail investors.

CFDs on such ETFs are permitted however, as they are derivatives for which KIDs are available.

Like for all share CFDs, the reference price for CFDs on ETFs is the exchange-quoted, SMART-routed price of the underlying ETF, ensuring economics that are identical to trading the underlying ETF.

V. Extended and Overnight Hours

US CFDs can be traded from 04:00 to 20:00EST, and the again overnight from 20:00 to 03:30 the following day. Trades in the overnight session are attributed to the day when the session ends, even if a trade is entered before midnight the previous day. This has implications for corporate actions and financing.

Trades entered before midnight on the day before ex-date will not have a dividend entitlement. Trades before midnight will settle as if they had been traded the following day, delaying the start of financing.

VI. CFD Resources

Below are some useful links with more detailed information on IBKR’s CFD offering:

The following video tutorial is also available:

How to Place a CFD Trade on the Trader Workstation

VII. Frequently Asked Questions

What Stocks are available as CFDs?

Large and Mid-Cap stocks in the US, Western Europe, Nordic and Japan. Liquid Small Cap stocks are also available in many markets. Please see CFD Product Listings for more detail. More countries will be added in the near future.

Do you have CFDs on other asset classes?

Yes. Please see IBKR Index CFDs - Facts and Q&A, Forex CFDs - Facts and Q&A and Metals CFDs - Facts and Q&A.

How do you determine your Share CFD quotes?

IBKR CFD quotes are identical to the Smart routed quotes for the underlying share. IBKR does not widen the spread or hold positions against you. To learn more please go to Overview of CFD Market Models.

Can I see my limit orders reflected on the exchange?

Yes. IBKR offers Direct market Access (DMA) whereby your non-marketable (i.e. limit) orders have the underlying hedges directly represented on the deep books of the exchanges on which they trade. This also means that you can place orders to buy the CFD at the underlying bid and sell at the offer. In addition, you may also receive price improvement if another client's order crosses yours at a better price than is available on public markets.

How do you determine margins for Share CFDs?

IBKR establishes risk-based margin requirements based on the historical volatility of each underlying share. The minimum margin is 10%, making CFDs more margin-efficient than trading the underlying share in many cases. Retail investors are subject to additional margin requirements mandated by the European regulators. There are no portfolio off-sets between individual CFD positions or between CFDs and exposures to the underlying share. Concentrated positions and very large positions may be subject to additional margin. Please refer to CFD Margin Requirements for more detail.

Are short Share CFDs subject to forced buy-in?

Yes. In the event the underlying stock becomes difficult or impossible to borrow, the holder of the short CFD position may become subject to buy-in.

How do you handle dividends and corporate actions?

IBKR will generally reflect the economic effect of the corporate action for CFD holders as if they had been holding the underlying security. Dividends are reflected as cash adjustments, while other actions may be reflected through either cash or position adjustments, or both. For example, where the corporate action results in a change of the number of shares (e.g. stock-split, reverse stock split), the number of CFDs will be adjusted accordingly. Where the action results in a new entity with listed shares, and IBKR decides to offer these as CFDs, then new long or short positions will be created in the appropriate amount. For an overview please CFD Corporate Actions.

*Please note that in some cases it may not be possible to accurately adjust the CFD for a complex corporate action such as some mergers. In these cases IBKR may terminate the CFD prior to the ex-date.

Can anyone trade IBKR CFDs?

All clients can trade IBKR CFDs, except residents of the USA, Canada, Hong Kong, New Zealand and Israel. There are no exemptions based on investor type to the residency based exclusions.

What do I need to do to start trading CFDs with IBKR?

You need to set up trading permission for CFDs in Client Portal, and agree to the relevant disclosures. If your account is with IBKR (UK) or with IBKR LLC, IBKR will then set up a new account segment (identified with your existing account number plus the suffix “F”). Once the set-up is confirmed you can begin to trade. You do not need to fund the F-account separately, funds will be automatically transferred to meet CFD initial margin requirements from your main account.

If your account is with another IBKR entity, only the permission is required; an additional account segment is not necessary.

Are there any market data requirements?

The market data for IBKR Share CFDs is the market data for the underlying shares. It is therefore necessary to have market data permissions for the relevant exchanges. If you already have market data permissions for an exchange for trading the shares, you do not need to do anything. If you want to trade CFDs on an exchange for which you do not currently have market data permissions, you can set up the permissions in the same way as you would if you planned to trade the underlying shares.

How are my CFD trades and positions reflected in my statements?

If you are a client of IBKR (U.K.) or IBKR LLC, your CFD positions are held in a separate account segment identified by your primary account number with the suffix “F”. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. You can make the choice in the statement window in Client Portal.

If you are a client of other IBKR entities, there is no separate segment. You can view your positions normally alongside your non-CFD positions.

Can I transfer in CFD positions from another broker?

IBKR does not facilitate the transfer of CFD positions at this time.

Are charts available for Share CFDs?

Yes.

In what type of IBKR accounts can I trade CFDs e.g., Individual, Friends and Family, Institutional, etc.?

All margin and cash accounts are eligible for CFD trading.

What are the maximum a positions I can have in a specific CFD?

There is no pre-set limit. Bear in mind however that very large positions may be subject to increased margin requirements. Please refer to CFD Margin Requirements for more detail.

Can I trade CFDs over the phone?

No. In exceptional cases we may agree to process closing orders over the phone, but never opening orders.

Cash Sweeps

These regulations further require that all securities transactions be effected and margined in the securities segment of the Universal account and commodities transactions in the commodities segment.1 While the regulations allow for the custody of fully-paid securities positions in the commodities segment as margin collateral, IB does not do so, thereby limiting their hypothecation to the more restrictive rules of the SEC. Given the regulations and policies which direct the decision to hold positions in one segment vs. the other, cash remains the only asset eligible to be transferred between the two and for which customer discretion is provided.

Outlined below is a discussion as to the cash sweep options offered, the process for selecting an option as well as selection considerations.

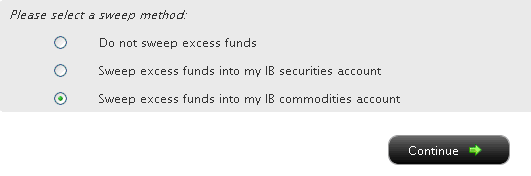

You may then select the radio button alongside the option of your choice and select the Continue button. Your choice will take effect as of the next business day and will remain in effect until a different option has been selected. Note that subject to the trading permission settings noted above, there is no restriction upon when or how often you may change your sweep method.

A Comparison of U.S. Segregation Models

Why does the "price" on hard to borrow stocks not agree to the closing price of the stock?

In determining the cash deposit required to collateralize a stock borrow position, the general industry convention is for the lender to require a deposit equal to 102% of the prior business day's** settlement price, rounded up to the nearest whole dollar and then multiplied by the number of shares borrowed. As borrow rates are determined based upon the value of the loan collateral, this convention impacts the cost of maintaining the short position, with the impact being most significant in the case of low-priced and hard-to-borrow shares. Note, for shares not denominated in USD the calculation will differ. Find below a table summarizing the calculations per currency:

| Currency | Calculation Method |

| USD | 102%; rounded up to the nearest dollar |

| CAD | 102%; rounded up to the nearest dollar |

| EUR | 105%; rounded up to the nearest cent |

| CHF | 105%; rounded up to the nearest rappen |

| GBP | 105%; rounded up to the nearest pence |

| HKD | 105%; rounded up to the nearest cent |

For US Treasuries and corporate bonds, the collateral amount on which the borrow fee is charged will include the accrued interest.

Account holders may view this adjusted price for a given transaction in the "Borrow Fee Details" section of the daily account statement. Two examples of this collateral calculation and its impact upon borrow fees are provided below.

Example 1

Sell short 100,000 shares of ABC at a price of $1.50

Short sale proceeds received = $150,000.00

Assume the price of ABC falls to $0.25 and the stock has a borrow fee rate of 50%

Short stock collateral value calculation

Price = 0.25 x 102% = 0.255; round up to $1.00

Value = 100,000 shares x $1.00 = $100,000.00

Borrow fee = $100,000 x 50% / 360 days in year = $138.89 per day

Assuming the account holder's cash balance does not include proceeds from any other short sale transaction then this borrow fee will not be offset by any credit interest on the short sale proceeds as the balance does not exceed the minimum $100,000 Tier 1 threshold necessary to accrue interest.

Example 2 (EUR denominated stock)

Sell short 100,000 shares of ABC at a price of EUR 1.50

Assume a prior business day's close price of EUR 1.55 and a borrow fee rate of 50%

Short stock collateral value calculation

Price = EUR 1.55 x 105% = 1.6275; round up to EUR 1.63

Value = 100,000 shares x 1.63 = $163,000.00

Borrow fee = EUR 163,000 x 50% / 360 days in year = EUR 226.38 per day

** Please note, Saturdays and Sundays are treated as a Friday and will use Thursday's settlement price to calculate the required deposit.

Interest Benchmark Definitions

Fed Funds Effective (USD only) is the volume weighted average of the transactions processed through the Federal Reserve between member banks. It is intended to reflect the best estimate of interbank financing activity for Reserve Bank members and is the reference for many short term money market transactions in the broader market.

EONIA (EUR only) is the global standard for overnight Euro deposits and is determined by a weighted average of the actual transactions between major continental European banks mediated through the European Central Bank.

HIBOR (CNY and HKD) is a daily fixing based on a group of large Hong Kong banks.

KORIBOR (KRW only) is an average of the leading interest rates for KRW as determined by a group of large Korean banks. The benchmark utilizes the KORIBOR with 1 week maturity.

STIBOR (SEK only) is a daily fixing based on a group of large Swedish banks.

TIIE (MXN only) is the interbank "equilibrium" rate based on the quotes provided by money center banks as calculated by the Mexican Central Bank. The benchmark TIIE is based on 28-day deposits so is atypical as a measure for short term funds (most currencies have an overnight or similar short term benchmark).

Overnight (O/N - CZK, HUF, ILS and SGD) rate is the most widely used short term benchmark and represents the rate for balances held from today until the next business day.

Spot-Next (S/N - DKK only) refers to the rate on balances from the next business day to the business day thereafter. Due to time zone and other criteria, Spot-Next rates are sometimes used as the short-term reference.

Day-Count conventions: it is beyond the scope of this document to describe day-count conventions and their use in interest calculations. IBKR conforms to the international standards for day-counting wherein deposits rates for most currencies are expressed in terms of a 360 day year, while for exceptional currencies (ex: GBP) the convention is a 365 day year.

Understanding interest charges when the net cash balance is a credit

An account will be subject to interest charges despite maintaining an overall net long or credit cash balance under the following circumstances:

1. The account maintains a short or debit balance in a given currency.

For example, an account maintaining a net cash credit balance equivalent to USD 5,000 comprised of a long USD balance of 8,000 and a short EUR balance equivalent to USD 3,000 would be subject to an interest debit based upon the short EUR balance. There would be no offsetting credit on the long USD balance as it is less than the USD 10,000 Tier I level above which interest is earned.

Account holders should note that in the event they purchase a security which is denominated in a currency that they do not hold in their account, IBKR will create a loan in that currency in order to settle the trade with the clearinghouse. If one wishes to avoid such loans and their associated interest charges, they would need to either deposit funds denominated in that particular currency or convert existing cash balances via the Ideal Pro (for balances of USD 25,000 or above) or odd lot (for balances less than USD 25,000) venue prior to entering into your trade.

2. The credit balance is comprised principally of proceeds from the short sale of securities.

For example, an account maintaining a net cash credit balance of USD 12,000 which is comprised of a USD debit of 6,000 in the security sub-account (less the market value of any short stock positions) and a short stock market value credit of USD 18,000 would be charged interest on the Tier 1 debit of USD 6,000 and would earn no interest on the short stock credit as it falls below the USD 100,000 Tier I level.

3. The credit balance includes unsettled funds.

IBKR determines interest debits and credits solely based upon settled funds. Just as an account holder is not assessed interest charges on funds borrowed to purchase a security until such time that purchase transaction settles, the account holder will not receive an interest credit, or offset against a debit balance, on funds originating from the sale of a security until such time the transaction has settled (and IBKR has been credited funds by the clearinghouse).