How to determine if you are borrowing funds from IBKR

If the aggregate cash balance in a given account is a debit, or negative, then funds are being borrowed and the loan is subject to interest charges. A loan may still exist, however, even if the aggregate cash balance is a credit, or positive, as a result of balance netting or timing differences. The most common examples of this are as follows:

Aperçu des CFD sur actions émis par IB

L’article qui suit constitue une introduction générale aux CFD (contrat sur différence) sur actions émis par IBKR.

Pour des informations concernant les CFD sur indices IBKR, cliquez ici. Pour les CFD sur Forex, cliquez ici.

Table des matières :

I. Définition d'un CFD

II. Comparaison entre les CFD et les actions sous-jacentes

III. Coûts et marge

IV. Exemples

V. Ressources

VI. Foire aux questions

Avertissement concernant les risques

Les CFD sont des instruments complexes associés à un risque élevé de perte financière rapide en raison de l'effet de levier.

67% des comptes d'investisseurs de détail perdent de l'argent lorsqu'ils tradent des CFD avec IBKR (UK).

Vous devez vous assurer que vous comprenez la manière dont fonctionnent les CFD et que vous pouvez vous permettre de courir un risque élevé de perdre de l'argent.

Règles ESMA relatives aux CFD (Pour les clients de détail uniquement)

L'Autorité européenne des marchés financiers (ESMA) a édicté de nouvelles règles relatives aux CFD qui entreront en vigueur à compter du 1er août 2018.

Les règles consistent en: 1) des limites sur les effets de levier à l'ouverture de positions de CFD; 2) une règle de clôture des positions ouvertes par compte basée sur la marge 3) une protection contre les soldes négatifs par compte.

Les mesures de l'ESMA s'appliquent aux clients de détail. Les clients professionnels ne sont pas affectés.

Veuillez vous référer au document Application des règles de l'ESMA sur les CFD à IBKR pour plus d'informations.

I. Définition d'un CFD sur actions

Les CFD IBKR sont des contrats de gré à gré (OTC) qui offrent le rendement de l’action sous-jacente, y compris les dividendes et les opérations sur titres (en savoir plus sur les Opérations sur titres pour les CFD).

En d’autres termes, il s’agit d’un accord entre l’acheteur (vous) et IBKR visant à échanger la différence entre la valeur actuelle d’une action et sa valeur à une date ultérieure. Si vous détenez une position longue et que la différence est positive, IBKR vous paie. Si la différence est négative, vous payez IBKR.

Les CFD sur actions IBKRsont négociés sur votre compte de marge; vous pouvez donc trader aussi bien des positions longues que courtes avec effet de levier. Le prix des CFD correspond au prix coté sur la Bourse de l’action sous-jacente. Les prix des CFD IBKR sont en fait identiques aux prix "Smart-routed" pour les actions, comme vous pouvez l'observer sur la Trader Workstation. Par ailleurs, IB offre un accès direct au marché (DMA). Comme pour les actions, vos ordres non négociables (par ex. les ordres à cours limité) voient le hedge du sous-jacent directement inscrit dans la profondeur du carnet d’ordres des Bourses où il est négocié. Cela signifie également que vous pouvez acheter le CFD au cours acheteur du sous-jacent et le vendre au cours vendeur.

Pour comparer le modèle transparent d’IBKR à d’autres modèles disponibles sur le marché, consultez notre Aperçu des modèles du marché CFD.

IBKRoffre actuellement environ 7100 CFD sur actions couvrant les marchés principaux des États-Unis, de l'Europe et d' Asie. Les constituants des indices majeurs mentionnés ci-dessous sont actuellement disponibles sous forme de CFD sur actions IBKR. Dans de nombreux pays, IBKR offre également le trading d’actions liquides de faible capitalisation. Il s’agit d’actions dont la capitalisation boursière ajustée du flottant est de 500 millions d'USD minimum pour une valeur de trading médiane journalière de 600,000 USD minimum. Pour en savoir plus, consultez notre liste de produits CFD . D’autres pays seront bientôt ajoutés.

| États-Unis | S&P 500, DJA, Nasdaq 100, S&P 400 (Moy. Cap), Small cap liquides |

| Royaume-Uni | FTSE 350 + Small cap liquides (y compris. IOB) |

| Allemagne | Dax, MDax, TecDax + Small cap liquides |

| Suisse | Portion suisse du STOXX Europe 600 (48 actions) + Small cap liquides |

| France | CAC Large Caps, CAC Mid Caps + Small Cap liquides |

| Pays-Bas | AEX, AMS Mid Cap + Small Cap liquides |

| Belgique | BEL 20, BEL Mid Cap + Small Cap liquides |

| Espagne | IBEX 35 + Small Cap liquides |

| Portugal | PSI 20 |

| Suède | OMX Stockholm 30 + Small Cap liquides |

| Finlande | OMX Helsinki 25 + Small Cap liquides |

| Danemark | OMX Copenhagen 30 + Small Cap liquides |

| Norvège | OBX |

| République Tchèque | PX |

| Japon | Nikkei 225 + Small Cap liquides |

| Hong Kong | HSI + Small Cap liquides |

| Australie | ASX 200 + Small Cap liquides |

| Singapour* | STI + Small Cap liquides |

| Afrique du sud | Top 40 + Small Cap liquides |

*non disponible pour les résidents de Singapour

II. Comparaison entre les CFD et les actions sous-jacentes

| AVANTAGES des CFD IBKR | INCONVÉNIENTS DES CFD IBKR |

|---|---|

| Pas de droit de timbre ou taxe sur les transactions financières (Royaume-Uni, Belgique, France) | Pas de droit de propriété |

| En général, les commissions et taux de marge sont moins élevés que pour les actions | Les opérations sur titres complexes ne peuvent pas toujours être reproduites |

| Taux de convention fiscale sans la nécessité de récupération | L'imposition des gains peut différer des actions (veuillez consulter votre conseiller fiscal) |

| Exemption des règles de day trading |

III. Coûts et marge

Les CFD IBKR peuvent être un moyen encore plus efficace de négocier sur les marchés boursiers européens plutôt que d’utiliser l’offre déjà très compétitive d'actions proposée par IB.

Tout d’abord, les CFD IBKR sont soumis à des commissions moins élevées que les actions, tout en offrant les mêmes spreads à faible financement:

| EUROPE | CFD | ACTION | |

|---|---|---|---|

| Commission | GBP | 0.05% | 6.00 + 0.05% GBP* |

| EUR | 0.05% | 0.10% | |

| Financement** | Benchmark +/- | 1.50% | 1.50% |

*par ordre + 0.05% plus franchise au delà de 50,000 GBP

**Financement CFD sur valeur totale de position, financement action sur montant emprunté

Plus vous négociez et plus les commissions des CFD baissent, jusqu'à 0,02%. Pour les positions portant sur des volumes importants, les frais de financement sont réduits et peuvent être de 0.5% seulement. Pour en savoir plus, consultez nos commissions CFD et Taux de financement CFD.

De plus, les CFD ont des exigences de marge moindre par rapport aux actions. Les clients de détail sont soumis à des exigences de marge supplémentaires comme l'impose l'ESMA, l'organisme régulateur européen. Veuillez consulter le document Application des règles de l'ESMA sur les CFD à IBKR pour plus d'informations.

| CFD | ACTION | ||

|---|---|---|---|

| Tous | Standard | Portfolio margin | |

| Exigence de marge de maintien* |

10% |

25% - 50% | 15% |

*Marge type pour les blue-chips. Les clients de détail sont soumis à une marge initiale minimum de 20%. Marge de maintien standard intraday de 25% pour les actions, 50% overnight. La marge de portefeuille (Portfolio Margin) indiquée est la marge de maintien (y compris overnight). Les émissions plus volatiles sont soumises à des exigences de marge plus importantes

Veuillez vous référer aux Exigences de marge pour les CFD pour plus d'informations.

IV. Exemple (Client professionnel)

Examinons l'exemple ci-dessous. Le listing d’Unilever Amsterdam a augmenté de 3.2% au cours du dernier mois (20 jours de trading au 14 mai 2012) et vous pensez que sa performance va se maintenir. , Vous souhaitez créer une exposition de 200,000 EUR et la conserver pendant 5 jours. Vous passez 10 ordres pour développer et 10 ordres pour déboucler. Vos coûts directs seraient comme suit:

ACTION

| CFD | ACTION | ||

|---|---|---|---|

| Position 200,000 EUR | Standard | Portfolio margin | |

| Exigence de marge | 20,000 | 100,000 | 30,000 |

| Commission (Aller Retour) | 200.00 | 400.00 | 400.00 |

| Taux d'intérêt (Simplifié) | 1.50% | 1.50% | 1.50% |

| Montant financé | 200,000 | 100,000 | 170,000 |

| Jours financés | 5 | 5 | 5 |

| Dépense en intérêts (1.5% Taux simplifié) | 41.67 | 20.83 | 35.42 |

| Coût total direct (Commission + Intérêt) | 241.67 | 420.83 | 435.42 |

| Différence de coût | 74% plus élevé | 80% plus élevé | |

Remarque: les intérêts des CFD sont calculés sur la position totale tandis que les intérêts des actions sont calculés sur le montant emprunté. Les taux appliqués sont les mêmes pour les CFD et les actions. Les intérêts applicables sont les mêmes pour les actions et pour les CFD

Mais supposons que vous n'ayez que 20,000 EUR de disponible pour financer la marge. Si Unilever maintient le même niveau de performance qu'au cours du mois passé, votre gain potentiel serait aux alentours de:

| GAIN EFFET DE LEVIER | CFD | ACTION | |

|---|---|---|---|

| Marge disponible | 20,000 | 20,000 | 20,000 |

| Total investi | 200,000 | 40,000 | 133,333 |

| Rendement brut (5 Days) | 1,600 | 320 | 1,066.66 |

| Commission | 200.00 | 80.00 | 266.67 |

| Dépense en intérêts (1.5% Taux simplifié) | 41.67 | 4.17 | 23.61 |

| Coût total direct (Commission + Interest) | 241.67 | 84.17 | 290.28 |

| Rendement net (Rendement brut moins coût direct) | 1,358.33 | 235.83 | 776.39 |

| Montant d'investissement du rendement sur marge | 0.07 | 0.01 | 0.04 |

| Différence | 83% moins Gain | 43% moins Gain | |

| RISQUE EFFET DE LEVIER | CFD | ACTION | |

|---|---|---|---|

| Marge disponible | 20,000 | 20,000 | 20,000 |

| Total investi | 200,000 | 40,000 | 133,333 |

| Rendement brut (5 Days) | -1,600 | -320 | -1,066.66 |

| Commission | 200.00 | 80.00 | 266.67 |

| Dépense en intérêts (1.5% Taux simplifié) | 41.67 | 4.17 | 23.61 |

| Coût total direct (Commission + Interest) | 241.67 | 84.17 | 290.28 |

| Rendement net (Rendement brut moins coût direct) | -1,841.67 | -404.17 | -1,356.94 |

| Différence | 78% Moins Perte | 26% Moins Perte | |

V. Ressources CFD

Vous trouverez ci-dessous des liens utiles contenant des informations plus détaillées sur l’offre des CFD IBKR:

Le tutoriel suivant est également disponible:

Comment passer un ordre de CFD sur la Trader Workstation

VI. Foire aux questions

Quelles actions sont disponibles en tant que CFD?

Les actions de forte et moyenne capitalisation aux États-Unis, en Europe de l'ouest, dans les pays nordiques et au Japon. Les actions de faible capitalisation liquides sont également disponibles sur de nombreux marchés. Veuillez consulter la page Liste de produits CFD pour plus d'informations. D'autres pays seront ajoutés très prochainement.

Avez-vous des CFD pour des indices sur actions et Forex?

Oui. Veuillez consulter la page CFD sur indices IBKR - Informations et questions et CFD sur Forex - Informations et questions.

Comment sont déterminées les cotations des CFD sur actions?

Le prix des CFD IBKR correspond à la cotation via Smartrouting de l’action sous-jacente. IBKR n'élargit pas le spread ni ne détient de positions en votre défaveur. Pour en savoir plus, veuillez consulter l'aperçu des modèles du marché CFD.

Puis-je voir mes ordres à cours limité sur la Bourse?

Oui. IBKRoffre un accès direct au marché (DMA). Comme les actions, les ordres qui ne sont pas négociables (par ex. les ordres à cours limité) bénéficient de la protection du sous-jacent qui est directement inscrit sur le carnet d’ordres des bourses où il est négocié. Cela signifie également que vous pouvez acheter le CFD au cours acheteur du sous-jacent et le vendre au cours vendeur. De plus, vous recevrez peut-être une amélioration de prix si l'ordre d'un autre client peut être croisé au vôtre à un meilleur prix que celui disponible sur les marchés.

Comment déterminez-vous les marges des CFD sur actions?

IBKR établit des exigences de marge sur la base de la volatilité historique de chaque action sous-jacente. La marge minimum est de 10% Ce taux de marge est généralement appliqué à la plupart des CFD IBKR, ce qui rend le trading de CFD plus attractif en termes de marge que le trading du sous-jacent. Les investisseurs de détail sont soumis à des exigences de marge supplémentaires imposées par ESMA, l'organisme

régulateur européen. Veuillez consulter le document Application des règles de l'ESMA sur les CFD à IBKR pour plus d'informations. Il n'y a pas de compensation de portefeuille entre des positions CFD individuelles ou entre des positions CFD et l'exposition à l’action sous-jacente. Les positions concentrées et portant sur de gros volumes peuvent être soumises à des marges supplémentaires. Pour en savoir plus, veuillez consulter les exigences de marge des CFD.

Les CFD sur action courts sont-ils soumis à des rachats forcés ?

Oui. Si l’action sous-jacente devient difficile ou impossible à emprunter, le détenteur de la position sera soumis à un rachat.

Comment traitez-vous les dividendes et opérations sur titre?

En règle générale, IBKR reflète l'effet économique de l’opération sur titre pour les détenteurs de CFD comme s'ils détenaient les titres sous-jacent*. Les dividendes sont comptabilisés sous forme d'ajustement de liquidité, tandis que d'autres actions peuvent être comptabilisées sous forme d'ajustement de liquidité, d'ajustement de position ou une combinaison des deux. Par exemple, si les actions d'entreprise se traduisent par un changement du nombre d’actions (par ex. dans le cas de fractionnement d'actions ou fractionnement d'actions inversé), le nombre de CFD est ajusté en conséquence. Lorsque l’action devient une nouvelle entité et qu'IBKR décide de la proposer comme CFD, de nouvelles positions courtes et longues sont créées dans la quantité appropriée. Pour en savoir plus, consultez la page CFD - Opérations sur titre.

*Dans certains cas, il ne sera pas possible d'ajuster de manière exacte le CFD, comme pour une opération sur titres complexe telle qu'une fusion par exemple. Dans ce cas, IBKR pourra clôturer la position de CFD avant la date de détachement.

Tout le monde peut-il trader des CFD IBKR?

Tous les clients peuvent trader des CFD IBKR à l'exception des résidents des États-Unis, du Canada et de Hong Kong. Les résidents de Singapour peuvent trader des CFD IBKR à l'exception de ceux basés sur des actions cotées à Singapour. Il n'existe pas d'exemption aux exclusions sur la base de la résidence en fonction du type d'investisseur.

Que dois-je faire pour commencer à trader des CFD avec IBKR?

Vous devez mettre en place les autorisations de trading pour les CFD dans la Gestion de compte et accepter les déclarations adéquates. Si vous détenez un compte auprès d'IB LLC, IBKR créera un nouveau segment de compte (identifié avec votre numéro de compte existant par le suffixe “F”). Une fois le segment confirmé, vous pourrez commencer à trader. Vous n'avez pas besoin d'approvisionner le compte "F" séparément, les fonds seront automatiquement transférés en fonction des exigences de marge de votre compte principal.

Existe t-il des conditions en termes de données de marché?

Les données de marché pour les CFD sur actions IBKR sont les mêmes que les données de marché des actions sous-jacentes. Il est par conséquent nécessaire d'obtenir les autorisations de données de marché pour les Bourses correspondantes. Si vous avez déjà mis en place des autorisations de données de marché pour une Bourse afin de pouvoir trader des actions, aucune autre action n'est requise. Si vous souhaitez trader des CFD sur une Bourse pour laquelle vous n'avez pas actuellement d'autorisation de données de marché, vous pouvez mettre en place des autorisations de trading de la même manière que si vous envisagiez de trader les actions sous-jacentes.

Mes transactions de CFD apparaissent-elles dans mes relevés de compte?

Si vous détenez un compte auprès d'IBLLC, vos positions de CFD sont détenues dans un segment de compte distinct identifié par le suffixe "F" et votre numéro de compte principal. Vous pouvez choisir de visualiser les relevés de compte pour ce segment "F" soit séparément, soit de manière consolidée avec votre compte principal. Vous pouvez sélectionner l'option de votre choix dans la fenêtre des relevés de la Gestion de compte. Pour les autres comptes, les CFD sont affichés normalement dans le relevé de compte comme les autres produits de trading.

Puis-je transférer mes positions CFD depuis un autre courtier?

IBKR ne permet pas le transfert de positions de CFD à l'heure actuelle.

Des graphiques sont-ils disponibles pour les CFD?

Oui.

Quelles protections de compte s’appliquent au trading de CFD émis pas IBKR?

Les CFD sont des contrats émis par IB UK qui agit en tant que contrepartie. Ils ne sont donc pas négociés sur un marché réglementé et ne sont pas compensés par une chambre de compensation centrale. Étant donné qu’IB UK est votre contrepartie pour les CFD, vous êtes exposé à des risques financiers et commerciaux, y compris le risque de crédit associé à la réalisation de transactions avec IB Royaume-Uni. Veuillez noter cependant que tous les fonds des clients sont toujours totalement ségrégés, y compris ceux des clients institutionnels. IB UK est membre du programme UK Financial Services Compensation Scheme (FSCS). IB UK n'est pas un membre de la U.S. Securities Investor Protection Corporation (“SIPC”). Veuillez consulter la déclaration des risques liés aux CFD IB UK pour davantage d'informations sur les risques liés au trading de CFD.

Avec quel type de compte IBKR puis-je négocier des CFD (par ex. compte individuel, institutionnel, Amis et famille, etc.)?

Tous les comptes de marge sont éligibles au trading de CFD. Les comptes au comptant et SIPP ne sont pas éligibles.

Combien de positions maximum puis-je avoir pour un CFD spécifique?

Pas de limite pré-établie. Cependant, rappelez-vous que les positions très importantes peuvent être soumises à une augmentation des exigences de marge. Pour en savoir plus, veuillez consulter les exigences de marge des CFD.

Puis-je trader des CFD par téléphone?

Non. Cependant, dans certains cas exceptionnels, nous pouvons accepter de traiter des ordres de fermeture par téléphone mais jamais des ordres d'ouverture.

Overview of IBKR issued Share CFDs

The following article is intended to provide a general introduction to share-based Contracts for Differences (CFDs) issued by IBKR.

For Information on IBKR Index CFDs click here. For Forex CFDs click here. For Precious Metals click here.

Topics covered are as follows:

I. CFD Definition

II. Comparison Between CFDs and Underlying Shares

III. CFD Tax and Margin Advantage

IV. US ETFs

V. CFD Resources

VI. Frequently Asked Questions

Risk Warning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

61% of retail investor accounts lose money when trading CFDs with IBKR.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

ESMA Rules for CFDs (Retail Clients of IBKRs European entities, including so-called F segments)

The European Securities and Markets Authority (ESMA) has enacted new CFD rules effective 1st August 2018.

The rules include: 1) leverage limits on the opening of a CFD position; 2) a margin close out rule on a per account basis; and 3) negative balance protection on a per account basis.

The ESMA Decision is only applicable to retail clients. Professional clients are unaffected.

Please refer to the following articles for more detail:

ESMA CFD Rules Implementation at IBKR (UK) and IBKR LLC

ESMA CFD Rules Implementation at IBIE and IBCE

I. Overview

IBKR CFDs are OTC contracts which deliver the return of the underlying stock, including dividends and corporate actions (read more about CFD corporate actions).

Said differently, it is an agreement between the buyer (you) and IBKR to exchange the difference in the current value of a share, and its value at a future time. If you hold a long position and the difference is positive, IBKR pays you. If it is negative, you pay IBKR.

Our Share CFDs offer Direct Market Access (DMA). Our Share CFD quotes are identical to the Smart-routed quotes for shares that you can observe in the Trader Workstation. Similar to shares, your non-marketable (i.e. limit) orders have the underlying hedge directly represented on the deep book of those exchanges at which it trades. This also means that you can place orders to buy the CFD at the underlying bid and sell at the offer.

To compare IBKR’s transparent CFD model to others available in the market please see our Overview of CFD Market Models.

We currently offer approximately 8500 Share CFDs covering the principal markets in the US, Europe and Asia. Eligible shares have minimum market capitalization of USD 500 million and median daily trading value of at least USD 600 thousand. Please see CFD Product Listings for more detail.

Most order types are available for CFDs, including auction orders and IBKR Algos.

CFDs on US share can also be traded during extended exchange hours and overnight. Other CFDs are traded during regular hours.

II. Comparison Between CFDs and Underlying Shares

| BENEFITS of IBKR CFDs | DRAWBACKS of IBKR CFDs |

|---|---|

| No stamp duty or financial transaction tax (UK, France, Belgium, Spain) | No ownership rights |

| Generally lower margin rates than shares* | Complex corporate actions may not always be exactly replicable |

| Tax treaty rates for dividends without need for reclaim | Taxation of gains may differ from shares (please consult your tax advisor) |

| Exemption from day trading rules | |

| US ETFs tradable as CFDs** |

*IB LLC and IB-UK accounts.

**EEA area clients cannot trade US ETFs directly, as they do not publish KIDs.

III. CFD Tax and Margin Advantage

Where stamp duty or financial transaction tax is applied, currently in the UK (0.5%), France (0.3%), Belgium (0.35%) and Spain (0.2%), it has a substantially detrimental impact on returns, particular in an active trading strategy. The taxes are levied on buy-trades, so each time you open a long, or close a short position, you will incur tax at the rates described above.

The amount of available leverage also significantly impacts returns. For European IBKR entities, margin requirements are risk-based for both stocks and CFDs, and therefore generally the same. IB-UK and IB LLC accounts however are subject to Reg T requirements, which limit available leverage to 2:1 for positions held overnight.

To illustrate, let's assume that you have 20,000 to invest and wish to leverage your investment fully. Let's also assume that you hold your positions overnight and that you trade in and out of positions 5 times in a month.

Let's finally assume that your strategy is successful and that you have earned a 5% return on your gross (fully leveraged) investment.

The table below shows the calculation in detail for a UK security. The calculations for France, Belgium and Spain are identical, except for the tax rates applied.

| UK CFD | UK Stock | UK Stock | |

|---|---|---|---|

| All Entities |

EU Account

|

IB LLC or IBUK Acct

|

|

| Tax Rate | 0% | 0.50% | 0.50% |

| Tax Basis | N/A | Buy Orders | Buy Orders |

| # of Round trips | 5 | 5 | 5 |

| Commission rate | 0.05% | 0.05% | 0.05% |

| Overnight Margin | 20% | 20% | 50% |

| Financing Rate | 1.508% | 1.508% | 1.508% |

| Days Held | 30 | 30 | 30 |

| Gross Rate of Return | 5% | 5% | 5% |

| Investment | 100,000 | 100,000 | 40,000 |

| Amount Financed | 100,000 | 80,000 | 20,000 |

| Own Capital | 20,000 | 20,000 | 20,000 |

| Tax on Purchase | 0.00 | 2,500.00 | 1,000.00 |

| Round-trip Commissions | 500.00 | 500.00 | 200.00 |

| Financing | 123.95 | 99.16 | 24.79 |

| Total Costs | 623.95 | 3099.16 | 1224.79 |

| Gross Return | 5,000 | 5,000 | 2,000 |

| Return after Costs | 4,376.05 | 1,900.84 | 775.21 |

| Difference | -57% | -82% |

The following table summarizes the reduction in return for a stock investment, by country where tax is applied, compared to a CFD investment, given the above assumptions.

| Stock Return vs cfD | Tax Rate | EU Account | IB LLC or IBUK Acct |

|---|---|---|---|

| UK | 0.50% | -57% | -82% |

| France | 0.30% | -34% | -73% |

| Belgium | 0.35% | -39% | -75% |

| Spain | 0.20% | -22% | -69% |

IV. US ETFs

EEA area residents who are retail investors must be provided with a key information document (KID) for all investment products. US ETF issuers do not generally provide KIDs, and US ETFs are therefore not available to EEA retail investors.

CFDs on such ETFs are permitted however, as they are derivatives for which KIDs are available.

Like for all share CFDs, the reference price for CFDs on ETFs is the exchange-quoted, SMART-routed price of the underlying ETF, ensuring economics that are identical to trading the underlying ETF.

V. Extended and Overnight Hours

US CFDs can be traded from 04:00 to 20:00EST, and the again overnight from 20:00 to 03:30 the following day. Trades in the overnight session are attributed to the day when the session ends, even if a trade is entered before midnight the previous day. This has implications for corporate actions and financing.

Trades entered before midnight on the day before ex-date will not have a dividend entitlement. Trades before midnight will settle as if they had been traded the following day, delaying the start of financing.

VI. CFD Resources

Below are some useful links with more detailed information on IBKR’s CFD offering:

The following video tutorial is also available:

How to Place a CFD Trade on the Trader Workstation

VII. Frequently Asked Questions

What Stocks are available as CFDs?

Large and Mid-Cap stocks in the US, Western Europe, Nordic and Japan. Liquid Small Cap stocks are also available in many markets. Please see CFD Product Listings for more detail. More countries will be added in the near future.

Do you have CFDs on other asset classes?

Yes. Please see IBKR Index CFDs - Facts and Q&A, Forex CFDs - Facts and Q&A and Metals CFDs - Facts and Q&A.

How do you determine your Share CFD quotes?

IBKR CFD quotes are identical to the Smart routed quotes for the underlying share. IBKR does not widen the spread or hold positions against you. To learn more please go to Overview of CFD Market Models.

Can I see my limit orders reflected on the exchange?

Yes. IBKR offers Direct market Access (DMA) whereby your non-marketable (i.e. limit) orders have the underlying hedges directly represented on the deep books of the exchanges on which they trade. This also means that you can place orders to buy the CFD at the underlying bid and sell at the offer. In addition, you may also receive price improvement if another client's order crosses yours at a better price than is available on public markets.

How do you determine margins for Share CFDs?

IBKR establishes risk-based margin requirements based on the historical volatility of each underlying share. The minimum margin is 10%, making CFDs more margin-efficient than trading the underlying share in many cases. Retail investors are subject to additional margin requirements mandated by the European regulators. There are no portfolio off-sets between individual CFD positions or between CFDs and exposures to the underlying share. Concentrated positions and very large positions may be subject to additional margin. Please refer to CFD Margin Requirements for more detail.

Are short Share CFDs subject to forced buy-in?

Yes. In the event the underlying stock becomes difficult or impossible to borrow, the holder of the short CFD position may become subject to buy-in.

How do you handle dividends and corporate actions?

IBKR will generally reflect the economic effect of the corporate action for CFD holders as if they had been holding the underlying security. Dividends are reflected as cash adjustments, while other actions may be reflected through either cash or position adjustments, or both. For example, where the corporate action results in a change of the number of shares (e.g. stock-split, reverse stock split), the number of CFDs will be adjusted accordingly. Where the action results in a new entity with listed shares, and IBKR decides to offer these as CFDs, then new long or short positions will be created in the appropriate amount. For an overview please CFD Corporate Actions.

*Please note that in some cases it may not be possible to accurately adjust the CFD for a complex corporate action such as some mergers. In these cases IBKR may terminate the CFD prior to the ex-date.

Can anyone trade IBKR CFDs?

All clients can trade IBKR CFDs, except residents of the USA, Canada, Hong Kong, New Zealand and Israel. There are no exemptions based on investor type to the residency based exclusions.

What do I need to do to start trading CFDs with IBKR?

You need to set up trading permission for CFDs in Client Portal, and agree to the relevant disclosures. If your account is with IBKR (UK) or with IBKR LLC, IBKR will then set up a new account segment (identified with your existing account number plus the suffix “F”). Once the set-up is confirmed you can begin to trade. You do not need to fund the F-account separately, funds will be automatically transferred to meet CFD initial margin requirements from your main account.

If your account is with another IBKR entity, only the permission is required; an additional account segment is not necessary.

Are there any market data requirements?

The market data for IBKR Share CFDs is the market data for the underlying shares. It is therefore necessary to have market data permissions for the relevant exchanges. If you already have market data permissions for an exchange for trading the shares, you do not need to do anything. If you want to trade CFDs on an exchange for which you do not currently have market data permissions, you can set up the permissions in the same way as you would if you planned to trade the underlying shares.

How are my CFD trades and positions reflected in my statements?

If you are a client of IBKR (U.K.) or IBKR LLC, your CFD positions are held in a separate account segment identified by your primary account number with the suffix “F”. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. You can make the choice in the statement window in Client Portal.

If you are a client of other IBKR entities, there is no separate segment. You can view your positions normally alongside your non-CFD positions.

Can I transfer in CFD positions from another broker?

IBKR does not facilitate the transfer of CFD positions at this time.

Are charts available for Share CFDs?

Yes.

In what type of IBKR accounts can I trade CFDs e.g., Individual, Friends and Family, Institutional, etc.?

All margin and cash accounts are eligible for CFD trading.

What are the maximum a positions I can have in a specific CFD?

There is no pre-set limit. Bear in mind however that very large positions may be subject to increased margin requirements. Please refer to CFD Margin Requirements for more detail.

Can I trade CFDs over the phone?

No. In exceptional cases we may agree to process closing orders over the phone, but never opening orders.

Cash Sweeps

These regulations further require that all securities transactions be effected and margined in the securities segment of the Universal account and commodities transactions in the commodities segment.1 While the regulations allow for the custody of fully-paid securities positions in the commodities segment as margin collateral, IB does not do so, thereby limiting their hypothecation to the more restrictive rules of the SEC. Given the regulations and policies which direct the decision to hold positions in one segment vs. the other, cash remains the only asset eligible to be transferred between the two and for which customer discretion is provided.

Outlined below is a discussion as to the cash sweep options offered, the process for selecting an option as well as selection considerations.

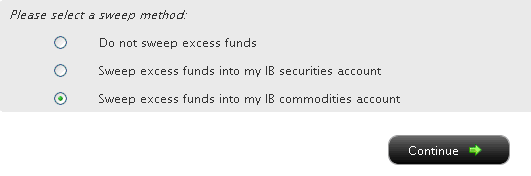

You may then select the radio button alongside the option of your choice and select the Continue button. Your choice will take effect as of the next business day and will remain in effect until a different option has been selected. Note that subject to the trading permission settings noted above, there is no restriction upon when or how often you may change your sweep method.

A Comparison of U.S. Segregation Models

Why does the "price" on hard to borrow stocks not agree to the closing price of the stock?

In determining the cash deposit required to collateralize a stock borrow position, the general industry convention is for the lender to require a deposit equal to 102% of the prior business day's** settlement price, rounded up to the nearest whole dollar and then multiplied by the number of shares borrowed. As borrow rates are determined based upon the value of the loan collateral, this convention impacts the cost of maintaining the short position, with the impact being most significant in the case of low-priced and hard-to-borrow shares. Note, for shares not denominated in USD the calculation will differ. Find below a table summarizing the calculations per currency:

| Currency | Calculation Method |

| USD | 102%; rounded up to the nearest dollar |

| CAD | 102%; rounded up to the nearest dollar |

| EUR | 105%; rounded up to the nearest cent |

| CHF | 105%; rounded up to the nearest rappen |

| GBP | 105%; rounded up to the nearest pence |

| HKD | 105%; rounded up to the nearest cent |

For US Treasuries and corporate bonds, the collateral amount on which the borrow fee is charged will include the accrued interest.

Account holders may view this adjusted price for a given transaction in the "Borrow Fee Details" section of the daily account statement. Two examples of this collateral calculation and its impact upon borrow fees are provided below.

Example 1

Sell short 100,000 shares of ABC at a price of $1.50

Short sale proceeds received = $150,000.00

Assume the price of ABC falls to $0.25 and the stock has a borrow fee rate of 50%

Short stock collateral value calculation

Price = 0.25 x 102% = 0.255; round up to $1.00

Value = 100,000 shares x $1.00 = $100,000.00

Borrow fee = $100,000 x 50% / 360 days in year = $138.89 per day

Assuming the account holder's cash balance does not include proceeds from any other short sale transaction then this borrow fee will not be offset by any credit interest on the short sale proceeds as the balance does not exceed the minimum $100,000 Tier 1 threshold necessary to accrue interest.

Example 2 (EUR denominated stock)

Sell short 100,000 shares of ABC at a price of EUR 1.50

Assume a prior business day's close price of EUR 1.55 and a borrow fee rate of 50%

Short stock collateral value calculation

Price = EUR 1.55 x 105% = 1.6275; round up to EUR 1.63

Value = 100,000 shares x 1.63 = $163,000.00

Borrow fee = EUR 163,000 x 50% / 360 days in year = EUR 226.38 per day

** Please note, Saturdays and Sundays are treated as a Friday and will use Thursday's settlement price to calculate the required deposit.

Interest Benchmark Definitions

Fed Funds Effective (USD only) is the volume weighted average of the transactions processed through the Federal Reserve between member banks. It is intended to reflect the best estimate of interbank financing activity for Reserve Bank members and is the reference for many short term money market transactions in the broader market.

EONIA (EUR only) is the global standard for overnight Euro deposits and is determined by a weighted average of the actual transactions between major continental European banks mediated through the European Central Bank.

HIBOR (CNY and HKD) is a daily fixing based on a group of large Hong Kong banks.

KORIBOR (KRW only) is an average of the leading interest rates for KRW as determined by a group of large Korean banks. The benchmark utilizes the KORIBOR with 1 week maturity.

STIBOR (SEK only) is a daily fixing based on a group of large Swedish banks.

TIIE (MXN only) is the interbank "equilibrium" rate based on the quotes provided by money center banks as calculated by the Mexican Central Bank. The benchmark TIIE is based on 28-day deposits so is atypical as a measure for short term funds (most currencies have an overnight or similar short term benchmark).

Overnight (O/N - CZK, HUF, ILS and SGD) rate is the most widely used short term benchmark and represents the rate for balances held from today until the next business day.

Spot-Next (S/N - DKK only) refers to the rate on balances from the next business day to the business day thereafter. Due to time zone and other criteria, Spot-Next rates are sometimes used as the short-term reference.

Day-Count conventions: it is beyond the scope of this document to describe day-count conventions and their use in interest calculations. IBKR conforms to the international standards for day-counting wherein deposits rates for most currencies are expressed in terms of a 360 day year, while for exceptional currencies (ex: GBP) the convention is a 365 day year.

Understanding interest charges when the net cash balance is a credit

An account will be subject to interest charges despite maintaining an overall net long or credit cash balance under the following circumstances:

1. The account maintains a short or debit balance in a given currency.

For example, an account maintaining a net cash credit balance equivalent to USD 5,000 comprised of a long USD balance of 8,000 and a short EUR balance equivalent to USD 3,000 would be subject to an interest debit based upon the short EUR balance. There would be no offsetting credit on the long USD balance as it is less than the USD 10,000 Tier I level above which interest is earned.

Account holders should note that in the event they purchase a security which is denominated in a currency that they do not hold in their account, IBKR will create a loan in that currency in order to settle the trade with the clearinghouse. If one wishes to avoid such loans and their associated interest charges, they would need to either deposit funds denominated in that particular currency or convert existing cash balances via the Ideal Pro (for balances of USD 25,000 or above) or odd lot (for balances less than USD 25,000) venue prior to entering into your trade.

2. The credit balance is comprised principally of proceeds from the short sale of securities.

For example, an account maintaining a net cash credit balance of USD 12,000 which is comprised of a USD debit of 6,000 in the security sub-account (less the market value of any short stock positions) and a short stock market value credit of USD 18,000 would be charged interest on the Tier 1 debit of USD 6,000 and would earn no interest on the short stock credit as it falls below the USD 100,000 Tier I level.

3. The credit balance includes unsettled funds.

IBKR determines interest debits and credits solely based upon settled funds. Just as an account holder is not assessed interest charges on funds borrowed to purchase a security until such time that purchase transaction settles, the account holder will not receive an interest credit, or offset against a debit balance, on funds originating from the sale of a security until such time the transaction has settled (and IBKR has been credited funds by the clearinghouse).

Are there any particular risks that one should be aware of when using SSFs to either invest excess funds or borrow funds at available synthetic rates?

While the High and Low Synthetic strategies are both hedged positions, the futures leg is subject to a daily cash variation of the mark-to-market gain or loss whereas the stock leg is not (mark-to-market gain or loss is reflected in account equity but there is no cash impact until the position is closed). If, for example, an account holds a High Synthetic position and the stock prices increases significantly, the resultant variation pay on the short futures leg may erode the account’s cash balance resulting in a debit balance which is subject to interest payments. The net effect in this example would be to reduce and potentially erase the earnings on the High Synthetic position

Does a deposit subject to a "Credit Hold” accrue credit interest during the hold period?

The answer depends upon the method of deposit. In the case of deposits made via ACH, any interest accrues from the date the deposit arrives through the four-business day credit hold period after which it is credited to the account. In the case of check deposits other than Bank Checks, no interest is accrued during the credit hold period. Bank Checks and wire transfers are credited to the account effective upon receipt and are therefore not subject to any credit hold.

Interest paid to you varies with market conditions. For information regarding the amount of interest currently paid on credit balances see www.interactivebrokers.com/interest

What does the Interest Accrual Reversal line item on the Activity Statement represent?

Each day, IBKR calculates and reports in the Interest Accruals section of the Activity Statement a forecast or accrual of interest earned or to be paid for the statement period. Around the first week of each month the interest which has been accrued during the prior month is "backed-out" or reversed and actual interest for the month is posted in the Cash Report section. These reversals, which occur once a month, should be close to the actual interest, although they may not always be exactly equal since accruals are a forecast of actual interest.

Account holders should also note that accrued interest is only posted for any given reporting period when the amount exceeds $1, either positive or negative. Balances below $1 are retained and posted once, when aggregated with future accruals, the amount exceeds $1.