Проверка влияния на плату за риск при предпросмотре ордера

IB дает владельцам счетов возможность проверить, какое влияние ордер окажет на прогнозируемую плату за риск. Эту функцию следует использовать перед отправкой ордера для определения изменений, необходимых, чтобы снизить или избежать такую плату.

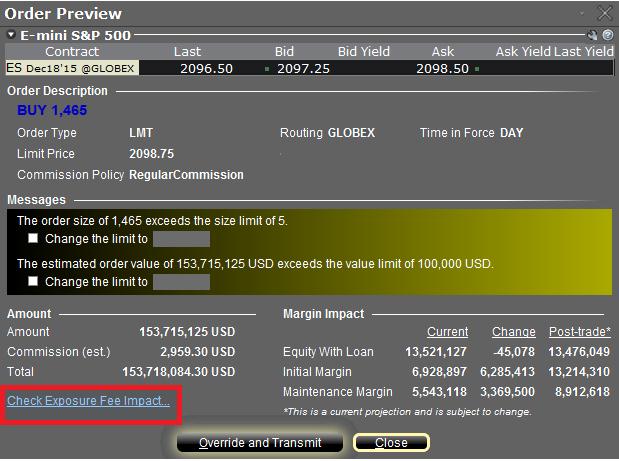

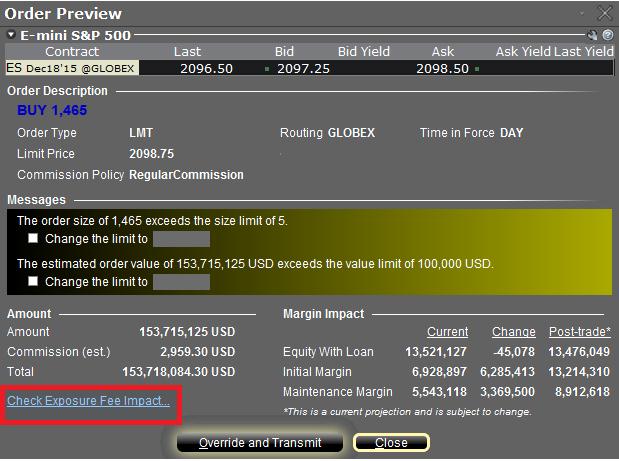

Для доступа к инструменту нужно открыть окно предварительного просмотра, щелкнув правой кнопкой мыши по строке ордера. В нем можно будет увидеть ссылку "Проверка влияния на плату за риск" (см. отмеченную красным область на Изображении 1).

Изображение 1

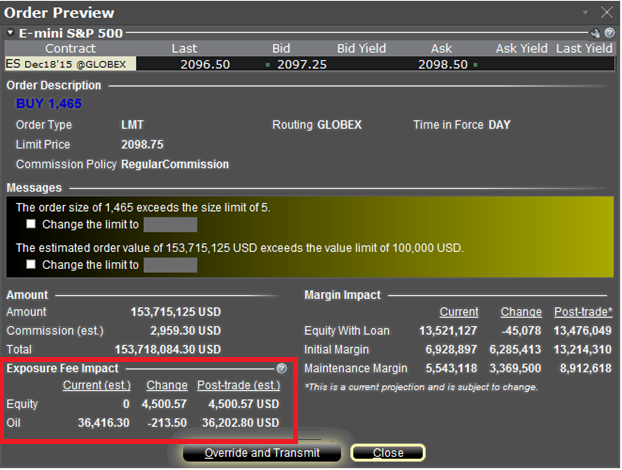

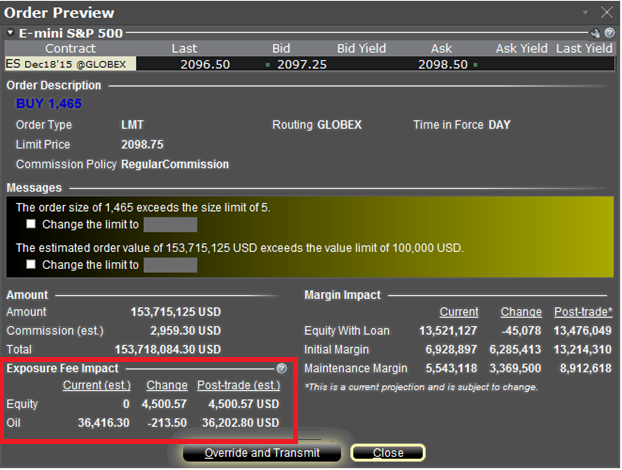

Щелкнув по ссылке, можно расширить окно и увидеть плату за риск (если она требуется), связанную с текущими позициями, ее изменение при исполнении данного ордера, а также конечную плату после исполнения (см. отмеченную красным область на Изображении 2). Дальнейшие показатели делятся по классам инструментов, подвергающимся упомянутой плате (напр. акции, нефть). Владелец счета может просто закрыть окно, не отправив ордер, если рост итоговой платы за риск покажется ему избыточным.

Изображение 2

Узнайте больше об управлении платой за риск и ее прогнозировании при помощи "Навигатора риска" IB в статье KB2275, а также об ее отслеживании в статье KB2344.

Order Preview - Check Exposure Fee Impact

IB provides a feature which allows account holders to check what impact, if any, an order will have upon the projected Exposure Fee. The feature is intended to be used prior to submitting the order to provide advance notice as to the fee and allow for changes to be made to the order prior to submission in order to minimize or eliminate the fee.

The feature is enabled by right-clicking on the order line at which point the Order Preview window will open. This window will contain a link titled "Check Exposure Fee Impact" (see red highlighted box in Exhibit I below).

Exhibit I

Clicking the link will expand the window and display the Exposure fee, if any, associated with the current positions, the change in the fee were the order to be executed, and the total resultant fee upon order execution (see red highlighted box in Exhibit II below). These balances are further broken down by the product classification to which the fee applies (e.g. Equity, Oil). Account holders may simply close the window without transmitting the order if the fee impact is determined to be excessive.

Exhibit II

Please see KB2275 for information regarding the use of IB's Risk Navigator for managing and projecting the Exposure Fee and KB2344 for monitoring fees through the Account Window

Important Notes

1. The Estimated Next Exposure Fee is a projection based upon readily available information. As the fee calculation is based upon information (e.g., prices and implied volatility factors) available only after the close, the actual fee may differ from that of the projection.

2. The Check Exposure Fee Impact is only available for accounts that have been charged an exposure fee in the last 30 days

Welcome to Interactive Brokers

Now that your account is funded and approved you can start trading. The information below will help you getting

started as a new customer of Interactive Brokers.

- Your Money

- Configure your account to trade

- How to trade

- Trade all over the World

- Five points to enrich your IB experience

1. Your Money

Deposits & Withdrawals General Info. All transactions are administered through your secure Account Management

Deposits

First, you create a deposit notification through your Account Management > Funding > Fund Transfers > Transaction Type: “Deposit” How to create a deposit notification. The second step is to instruct your Bank to do the wire transfer with the bank details provided in your Deposit Notification.

Withdrawals

Create a withdrawal instruction via your secure Account Management > Funding > Fund Transfers > Transaction Type: "Withdrawals" How to create a withdrawal instruction

If you instruct a withdrawal over the Withdrawal limits, it will be considered an exceptional withdrawal and we will therefore need to match bank account holder and IB account. If destination bank account has been used for a deposit, withdrawal will be processed; otherwise, you must contact customer service and provide the documents needed.

Troubleshooting

Deposits: My bank sent the money but I do not see it credited into my IB account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) A Deposit Notification is missing. You have to create it via your Account Management and send a ticket to Customer Service

c) Amending details are missing. Your name or IB account number is missing in the transfer details. You have to contact your bank and ask for the full amending details.

d) ACH initiated by IB is limited to 100k USD in a 7 business period. If you opened a Portfolio Margin account where the initial requirement is 110k, a wire deposit might be the better deposit option to reduce wait time for your first trade. If selecting ACH a wait time of almost 2 weeks or a temporary downgrade to RegT can be possible solutions.

Withdrawals: I have requested a withdrawal but I do not see the money credited to my bank account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) Rejected. Over the max it can be withdrawn. Please check your account cash balance. Note that for regulatory requirements, when the funds are deposited, there is a 3 day holding period before they can be withdrawn.

c) Your bank returned the funds. Probably because receiving bank account and remitting bank account names do not match.

2. Configure your account to trade

Difference between Cash and Margin accounts: If you have chosen the FastTrack application, by default your account type is a cash account with US stock permission. If you would like to get leverage and trade on margin, here how to upgrade to a RegT Margin account

Trading Permissions

In order to be able to trade a particular asset class in a particular country, you need to get the trading permission for it via your Account Management. Please note that trading permissions are free. You might however be asked to sign risk

disclosures required by local regulatory authorities. How to Request Trading Permissions

Market Data

If you want to have market data in real-time for a particular product/exchange, you need to subscribe to a market data package charged by the exchange. How to subscribe to Market data

The Market data assistant will help you choose the right package. Please watch this Video explaining how it works.

Customers have the option to receive delayed market data for free by clicking the Free Delayed Data button from a non-subscribed ticker row.

Advisor Accounts

Have a look at the user guide getting started as advisors. Here you see how to create additional users to your advisor account and grant them access and much more.

3. How to trade

The Trader's University is the place to go when you want to learn how to use our Platforms. Here you will find our webinars, live and recorded in 10 languages and tours and documentation about our various Trading Platforms.

Trader Workstation (TWS)

Traders who require more sophisticated trading tools can use our market maker-designed Trader Workstation (TWS), which optimizes your trading speed and efficiency with an easy-to-use spreadsheet interface, support for more than 60 order types, task-specific trading tools for all trading styles, and real-time account balance and activity monitoring. Try the two models

TWS Mosaic: for intuitive usability, easy trading access, order management, watchlist, charts all in one window or

TWS Classic: the Advanced Order Management for traders who need more advanced tools and algos.

General Description and Information / Quick start guide / Usersguide

Interactive Tours: TWS Basics / TWS configuration / TWS Mosaic

How to place a trade: Video Classic TWS / Video Mosaic

Trading tools: General Description and Information / Users guide

Requirements: How to install Java for Windows / How to install Java for MAC / Port 4000 and 4001 needs to be open

Login TWS / Download TWS

WebTrader

Traders who prefer a clean and simple interface can use our HTML-based WebTrader, which makes it easy to view market data, submit orders, and monitor your account and executions. Use the latest WebTrader from every browser

Quick Start Guide / WebTrader User's Guide

Introduction: Video WebTrader

How to place a Trade: Video WebTrader

Login WebTrader

MobileTrader

Our mobile solutions allow you to trade your IB account on the go. The mobileTWS for iOS and the mobileTWS for BlackBerry are custom-designed for these popular models, while the generic MobileTrader supports most other Smart phones.

General Description and Information

Order Types Order Types available and Description / Videos / Tour / Users guide

Paper Trading General Description and Information / How to get a Paper Trading Account

Once your paper account is created, you can share the market data of your real account with your paper trading account: Account Management > Manage Account > Settings > Paper trading

4. Trade all over the World

IB accounts are multi-currency accounts. Your account can hold different currencies at the same time, this allows you to trade multiple products around the world from a single account.

Base Currency

Your base currency determines the currency of translation for your statements and the currency used for determining margin requirements. Base currency is determined when you open an account. Customers may change their base currency at any time through Account Management.

We do not automatically convert currencies into your Base currency

Currency conversions must be done manually by the customer. In this video you can learn how to do a currency conversion.

In order to open a position denominated in a currency that you do not have in your account, you have two possibilities:

A) Currency conversion.

B) IB Margin Loan. (Not available for Cash Accounts)

Please see this course explaining the mechanics of a foreign transaction.

5. Five points to enrich your IB experience

1. Contract Search

Here you will find all our products, symbols and specifications.

2. IB Knowledge Base

The Knowledge Base is a repository of glossary terms, how-to articles, troubleshooting tips and guidelines designed to assist IB customers with the management of their IB accounts. Just enter in the search button what you are looking for and you will get the answer.

3. Account Management

As our trading platforms give you access to the markets, the Account Management grants you access to your IB account. Use Account Management to manage account-related tasks such as depositing or withdrawing funds, viewing your statements, modifying market data and news subscriptions, changing your trading permissions, and verifying or changing your personal information.

Log In Account Management / AM Quick Start Guide / AM Users Guide

4. Secure Login System

To provide you with the highest level of online security, Interactive Brokers has implemented a Secure Login System (SLS) through which access to your account is subject to two-factor authentication. Two-factor authentication serves to confirm your identity at the point of login using two security factors: 1) Something you know (your username and password combination); and 2) Something you have (an IB issued security device which generates a random, single-use security code). As both knowledge of your username/password and physical possession of the security device are required to login to your account, participation in the Secure Login System virtually eliminates the possibility of anyone other than you accessing your account.

How to Activate your Security Device / How to Obtain a Security Code Card / How to return Security device

In case you forgot your password or lost your security code card, please call us for immediate assistance.

5. Statements and Reports

Easy to view and customize, our statements and reports cover all aspects of your Interactive Brokers account. How to view an Activity Statement

Overview of Margin Methodologies

Introduction

Where to Learn More

Tools provided to monitor and manage margin

How to determine if you are borrowing funds from IBKR

Why does IBKR calculate and report a margin requirement when I am not borrowing funds?

Margin Treatment for Foreign Stocks Carried by a U.S. Broker

As a U.S. broker-dealer registered with the Securities & Exchange Commission (SEC) for the purpose of facilitating customer securities transactions, IB LLC is subject to various regulations relating to the extension of credit and margining of those transactions. In the case of foreign equity securities (i.e., non-U.S. issuer), Reg T. allows a U.S. broker to extend margin credit to those which either appear on the Federal Reserve Board's periodically published List of Foreign Margin Stocks, or are deemed to have a have a "ready market" under SEC Rule 15c3-1 or SEC no-action letter.

Prior to November 2012, "ready market" was deemed to include equity securities of a foreign issuer that are listed on what is now known as the FTSE World Index. This definition was based upon a 1993 SEC no-action letter and was premised upon the fact that, while there may not have been a ready market for such securities within the U.S., the securities could be readily resold in the applicable foreign market. In November of 2012, the SEC issued a follow-up no-action letter (www.sec.gov/divisions/marketreg/mr-noaction/2012/finra-112812.pdf) which expanded the population of foreign equity securities deemed to have a ready market to also include those not listed on the FTSE World Index provided that the following four conditions are met:

1. The security is listed on a foreign exchange located within a FTSE World Index recognized country, where the security has been trading on the exchange for at least 90 days;

2. Daily bid, ask and last quotations for the security as provided by the foreign listing exchange are made continuously available to the U.S. broker through an electronic quote system;

3. The median daily trading volume calculated over the preceding 20 business day period of the security on its listing exchange is either at least 100,000 shares or $500,000 (excluding shares purchased by the computing broker);

4. The aggregate unrestricted market capitalization in shares of the security exceed $500 million over each of the preceding 10 business days.

Note: if a security previously meeting the above conditions no longer does so, the broker is provided with a 5 business day window after which time the security will no longer be deemed readily marketable and must be treated as non-marginable.

Foreign equity securities which do not meet the above conditions, will be treated as non-marginable and will therefore have no loan value. Note that for purposes of this no-action letter foreign equity securities do not include options.

Key Margin Definitions

Below is a listing of some of the more commonly used margin terms:

Equity with Loan Value (ELV) – Forms the basis for determining whether a client has the necessary assets to either initiate or maintain security positions. Equals cash + stock value + bond value + mutual fund value + European and Asian options value (excludes market value U.S. securities & futures options and cash maintained in futures segment).

Will IBKR delay liquidation while I deposit funds in my account?

IBKR's margin compliance policy does not allow for transfers or other deposits if there is a margin violation/deficit in the account. In the case of a margin violation/deficit, the account in deficit is immediately subject to liquidation. Automated liquidations are accomplished with market orders, and any/all positions in the account can be liquidated. There are cases where, due to specific market conditions, a deficit is better addressed via a manual liquidation.

Funds deposited or wired into the account are not taken into consideration from a risk standpoint until those funds have cleared all the appropriate funds and banking channels and are officially in the account. The liquidation system is automated and programmed to act immediately if there is a margin violation/deficit.

Note for Prime Clients: Executing away is not a means to resolve real time deficits as away trades will not be taken into consideration for beneficial margin purposes until 9 pm ET on Trade Date or when the trades have been reported and matched with external confirms, whichever is later. Trading away for expiring options, on expiration day, is also discouraged due to the potential for late or inaccurate reporting which can lead to erroneous margin calculations or incorrect exercise and assignment activity. Clients who wish to trade expiring options on expiration day and away from IB, must load their FTP file no later than 2:50 pm ET, and do so at their own risk.

What formulas do you use to calculate the margin on options?

There are many different formulas used to calculate the margin requirement on options. Which formula is used will depend on the option type or strategy determined by the system. There are a significant number of detailed formulas that are applied to various strategies. To find this information go to the IBKR home page at www.interactivebrokers.com. Go to the Trading menu and click on Margin. From the Margin Requirements page, click on the Options tab. There is a table on this page which will list all possible strategies, and the various formulas used to calculate margin on each.

The information above applies to equity options and index options. Options on futures employ an entirely different method known as SPAN margining. For information on SPAN margining, conduct a search on this page for “SPAN” or “Futures options margin”.

When I sell stock, how much does it increase SMA?

When an account holder sells a marginable security, it will typically increase their SMA by 50% of the value of the security sold.

Why was I liquidated?

The majority of all liquidations occur due to margin violations. There are two main types of margin violations that apply to margins accounts, Maintenance Margin and Reg. T Margin.

In addition to a margin deficit, liquidations may occur as a result of post expiration exposure or various other account-specific reasons which may be dependent upon the account type as well as the specific holdings within the account. For a detailed list of Risk Management algorithms applied to ensure account compliance and which may result in account liquidations, please review IBKR's website under Trading - Margin.

1. Maintenance Margin violation: In an account, the Equity with Loan Value (ELV) must always be greater than the Current Maintenance Margin Requirement (MMR) on the positions that are being held in the account. The difference between ELV and MMR is Current Excess Liquidity; therefore, an easier way for some people to monitor their account is to remember that the Current Excess Liquidity in their account must always be positive. If the Current Excess Liquidity in an account goes negative, this is a maintenance margin violation.

2. Reg T violation: In the Balances section of the Account Window there is a figure titled Special Memorandum Account (SMA). The US Fed has an enforcement period for this account; 15:50-17:20 ET each trading day. During this window, the SMA balance must be positive. If the SMA is negative at any point between 15:50 and 17:20 EST, this constitutes a Reg T margin violation.

In the event of a margin violation, the account is subject to automatic liquidation on a real-time basis. Liquidations are accomplished with market orders, and any/all positions in the account can be liquidated.