移动IBKR验证程序(IB Key)

目录

简介

IBKR高度重视您的资产和个人信息安全,并致力于采取必要措施确保您的账户自开立起便受到保护。 这其中非常重要的一项便是安全登录系统(SLS),这一登录程序采用双因素验证防止任何其他人访问或使用您的账户,即使他们掌握了您的用户名和密码。一旦加入SLS,便只可通过使用两项安全因素访问账户:1) 您已知的(用户名和密码);2) 您已有的(实物安全设备或手机应用程序生成的随机代码)。

IBKR提供多种SLS设备,每种设备的技术设计对应一种资产水平(参见KB1131)。下方文章概述了移动IBKR验证程序(IB Key),一种可直接在手机上启用的双因素安全应用程序。

优势

可直接在手机上通过移动IBKR启用移动IBKR验证程序(IB Key),功能与安全设备一样,因此在登录IBKR账户时便无需再另行携带实物设备。除了具备与实物设备同样的可靠性和便利外,这款程序可在数分钟内完成下载与激活,因此避免了邮寄实物设备所带来的延迟问题。此外,与实物设备不同,持有多个账户且用户名各不相同的客户完全可以从同一个移动IBKR应用访问移动IBKR验证程序(IB Key)。更多详情,请参见KB2879。

回到顶部

安装、激活及运行

移动IBKR验证程序(IB Key)目前仅可在使用安卓或iOS且可安装移动IBKR应用程序的智能手机上使用。安装、激活及运行说明请见下方链接:

请注意:禁用或更换任何安全设备,包括移动IBKR验证程序(IB Key),均需满足一定条件。该过程中如需帮助,请联系客户服务。

回到顶部

常见问题解答

如果忘记了移动IBKR的PIN码,请在手机上卸载并重新安装移动IBKR。打开应用程序。如果系统提示您进行恢复,请选择“否”拒绝。点击“注册双因素”,再次选择“否”拒绝进行恢复。然后根据屏幕上的说明操作,继续进行激活。 请注意,您会需要最初用来激活移动IBKR验证程序(IB Key)的手机号码,因为IBKR会向该号码发送激活短信(SMS)。

如果您丢了手机并希望禁用移动IBKR验证程序(IB Key),请拨打此页面上列出的号码联系客户服务。

有些国家,尤其是印度提供“请勿拨打”或“请勿打扰”服务以防止电信营销。如果您使用的是印度手机号码或明确请求手机运营商将您从公共联系方式中剔除,您可能需要联系您的无线运营商对账户进行适当地设置以接收IB的短信。

请注意,上述步骤因国家和手机供应商而异。如果您对此类“请勿打扰”服务有任何疑问,请联系您的手机供应商。

您的Pin码可以是字母数字,也可包含特殊字符。请点击此处查看有关Pin码指南的详细信息。

您的用户名一次只能激活一个手机/设备。

○ 移动IBKR验证程序(IB Key)只在启用使用者时需要联网

○ 安卓6.0及以上版本。

○ iOS 13.0或以上版本。

[1] 某些特殊机构账户类型可能会有一定限制。

[2] 没有有效数据连接(wifi或蜂窝数据),移动IBKR验证程序将无法接收登录通知信息,但仍能以挑战—响应码模式进行操作。参见KB2277(安卓)或KB2278(iOS)了解在两种模式下如何使用移动IBKR验证程序(IB Key)的详细说明。

Overview of IBKR Mobile Authentication (IB Key) for iPhone

This page covers specific points of installing and using IBKR Mobile Authentication (IB Key) on iOS devices. For general questions on IBKR Mobile Authentication (IB Key), please refer to KB2260.

Table of contents

Requirements

- Must be installed on an iOS device with Touch ID (fingerprint reader) or Face ID (facial recognition).

- Device's software version must be iOS 13.0 or later.

- Device must have either Touch ID, Face ID or Passcode enabled. Touch ID or Face ID is the recommended choice. Refer to Set up Touch ID or Set up Face ID for directions.

Installation

You can download IBKR Mobile app on your iPhone directly from the App Store.

How to download IBKR Mobile from the App Store:

1. On your iPhone tap on the App Store ![]() icon.

icon.

2. Click on the Search icon (magnifying glass) in the lower right corner, then click in the search bar at the top, type IBKR Mobile then click Search.

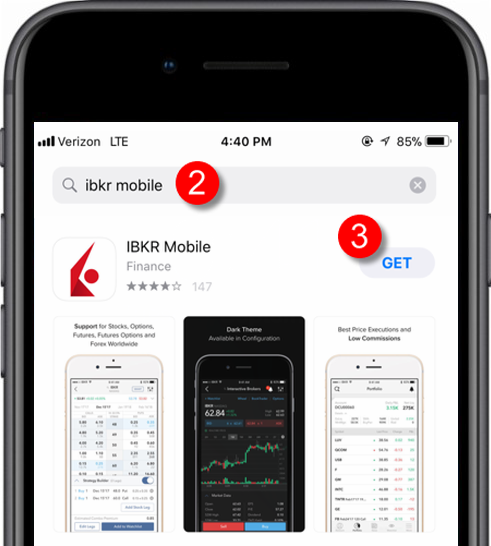

3. Look for IBKR Mobile from Interactive Brokers LLC, tap on GET to the right, then tap INSTALL (Figure 1.).

(if prompted, enter your Apple ID password or provide your fingerprint.)

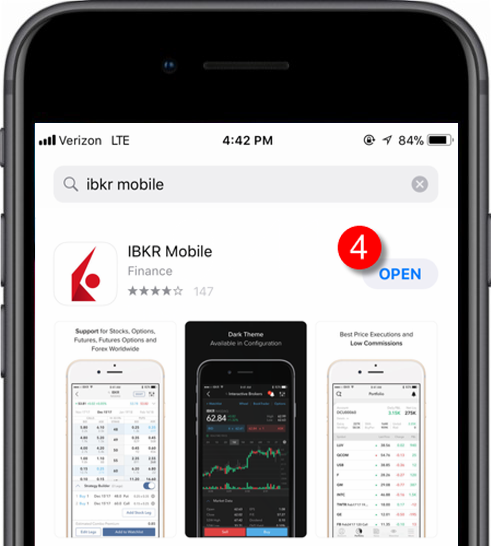

4. Once the installation has completed, tap on Open to launch the IBKR Mobile app (Figure 2.).

Figure 1. Figure 2.

Activation

Once the app is installed on your device you will need to activate it for the username you would like to enroll. This operation happens entirely on your phone, requires Internet access and the ability to receive SMS (text message).

- On your phone, open the IBKR Mobile app:

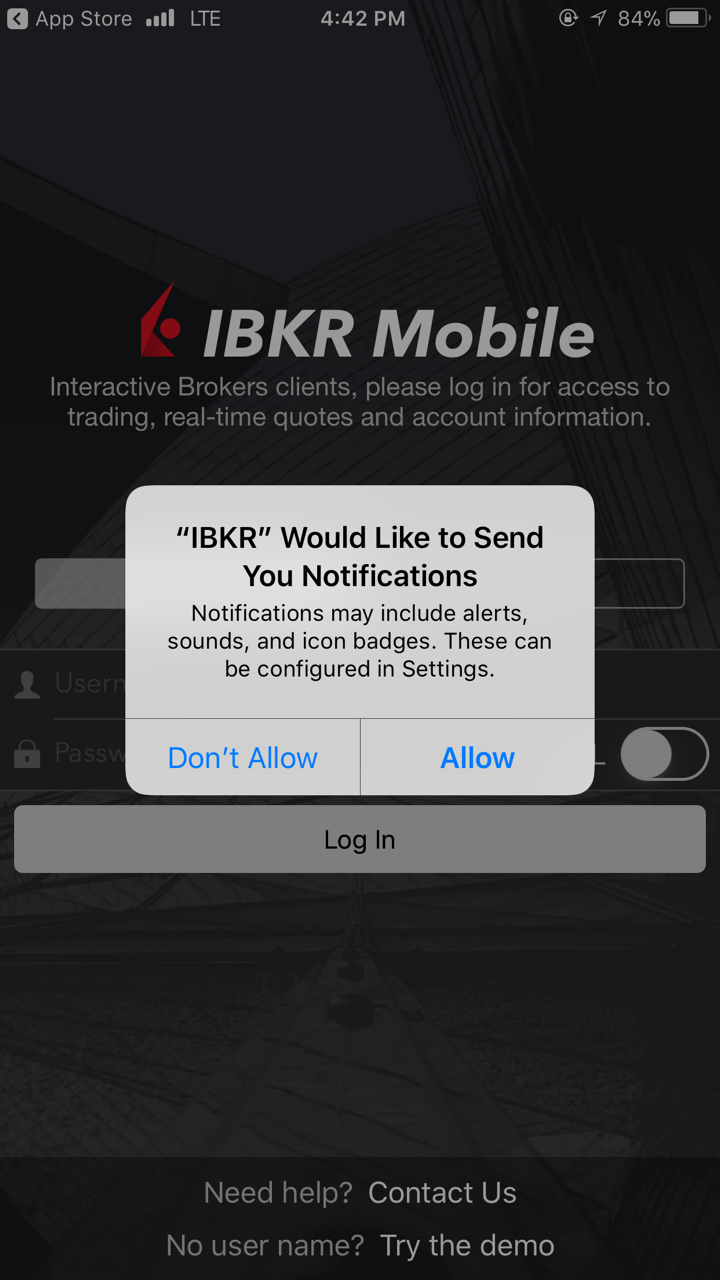

1.a. If you're opening IBKR Mobile for the first time since its installation, you will receive a message asking your consent for IBKR notifications (Figure 3.), tap Allow and proceed with step 2.

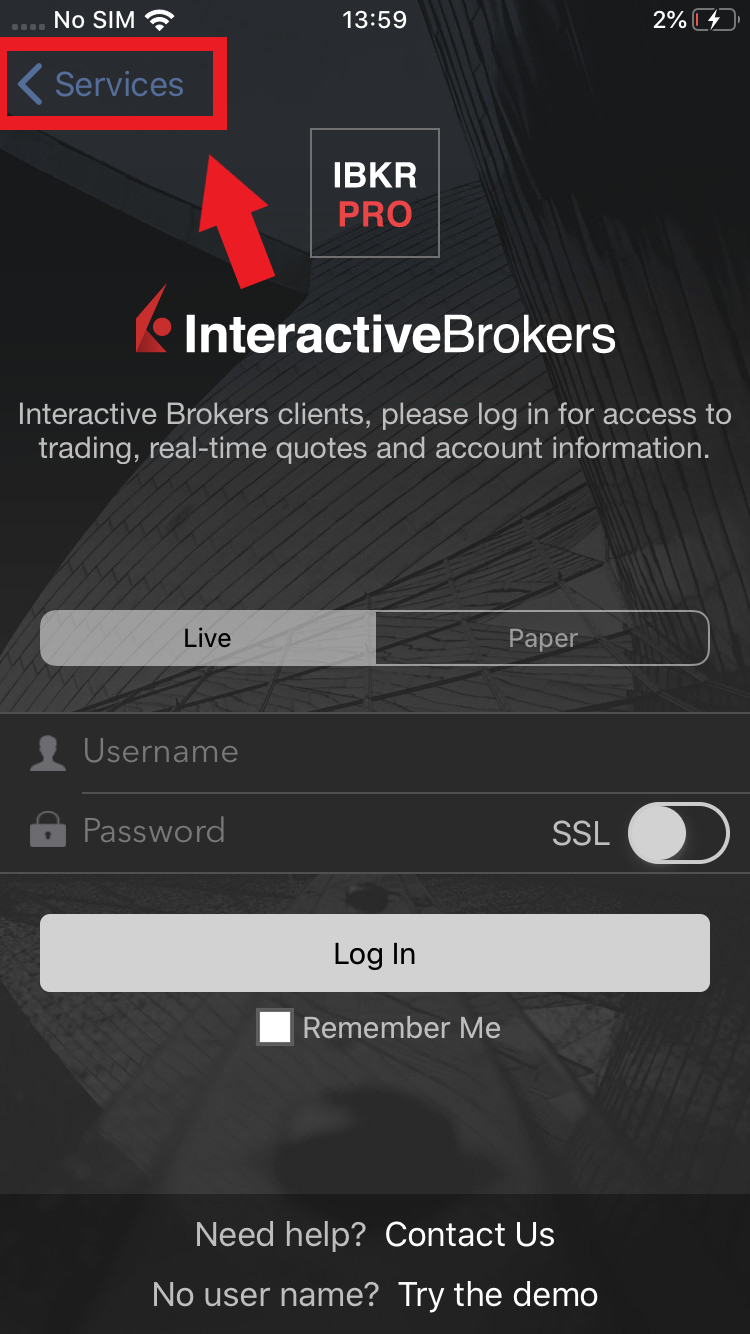

1.b. If when opening IBKR Mobile you land on the login screen, tap Services on the top left (Figure 4.) and proceed with step 2.

1.c. If when opening IBKR Mobile you land on your Home Page, Portfolio, Watchlists, or similar, tap More on the bottom-right (Figure 5.). Then tap Two-Factor Authentication (Figure 6.), followed by Activate IB Key (Figure 7.) and proceed with step 2.

Figure 3. Figure 4.

Figure 5. Figure 6. Figure 7.

.png)

.jpeg)

.jpeg)

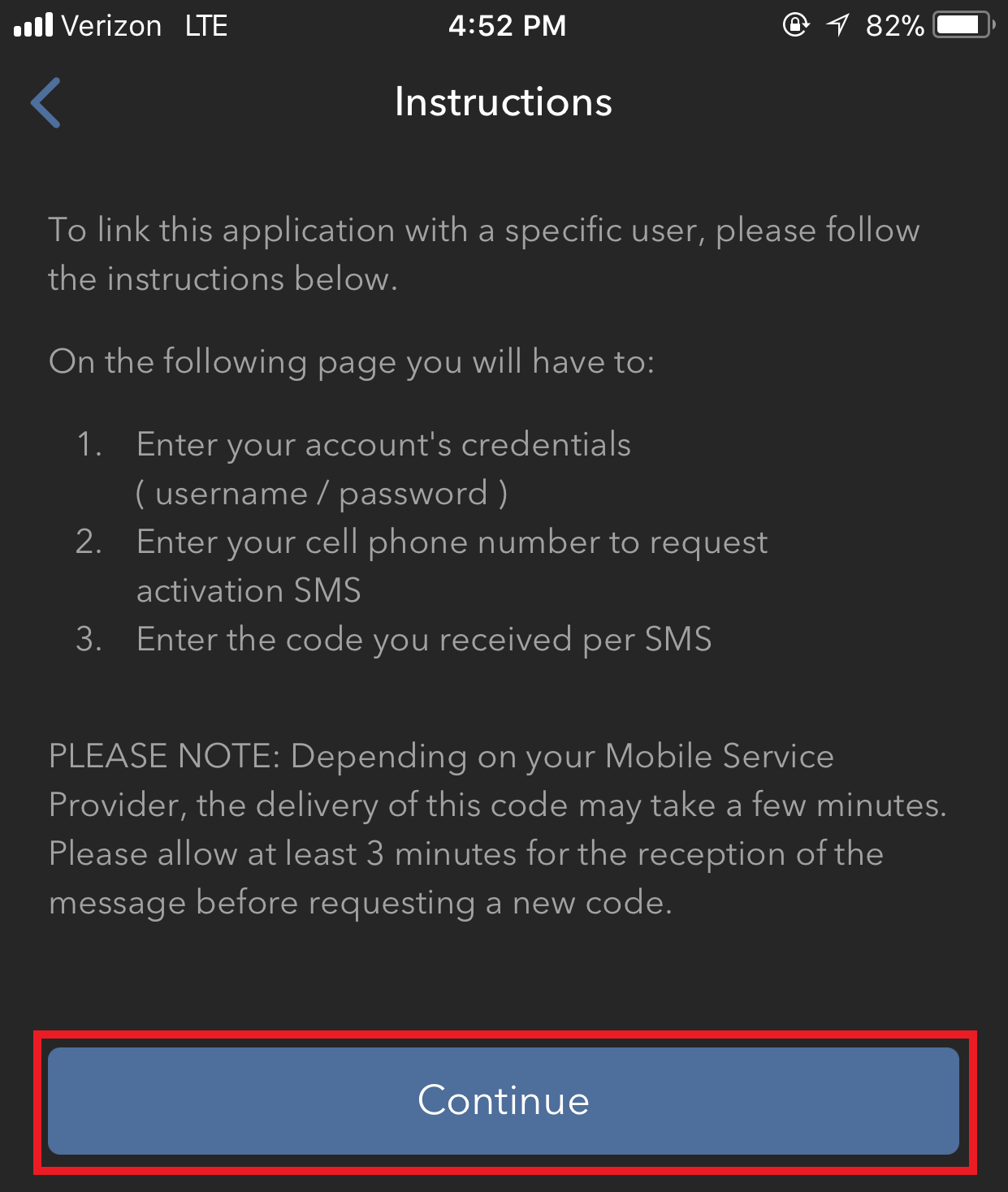

2. Tap on Register Two-Factor (Figure 8.), review the instructions and click Continue (Figure 9.).

Figure 8. Figure 9.

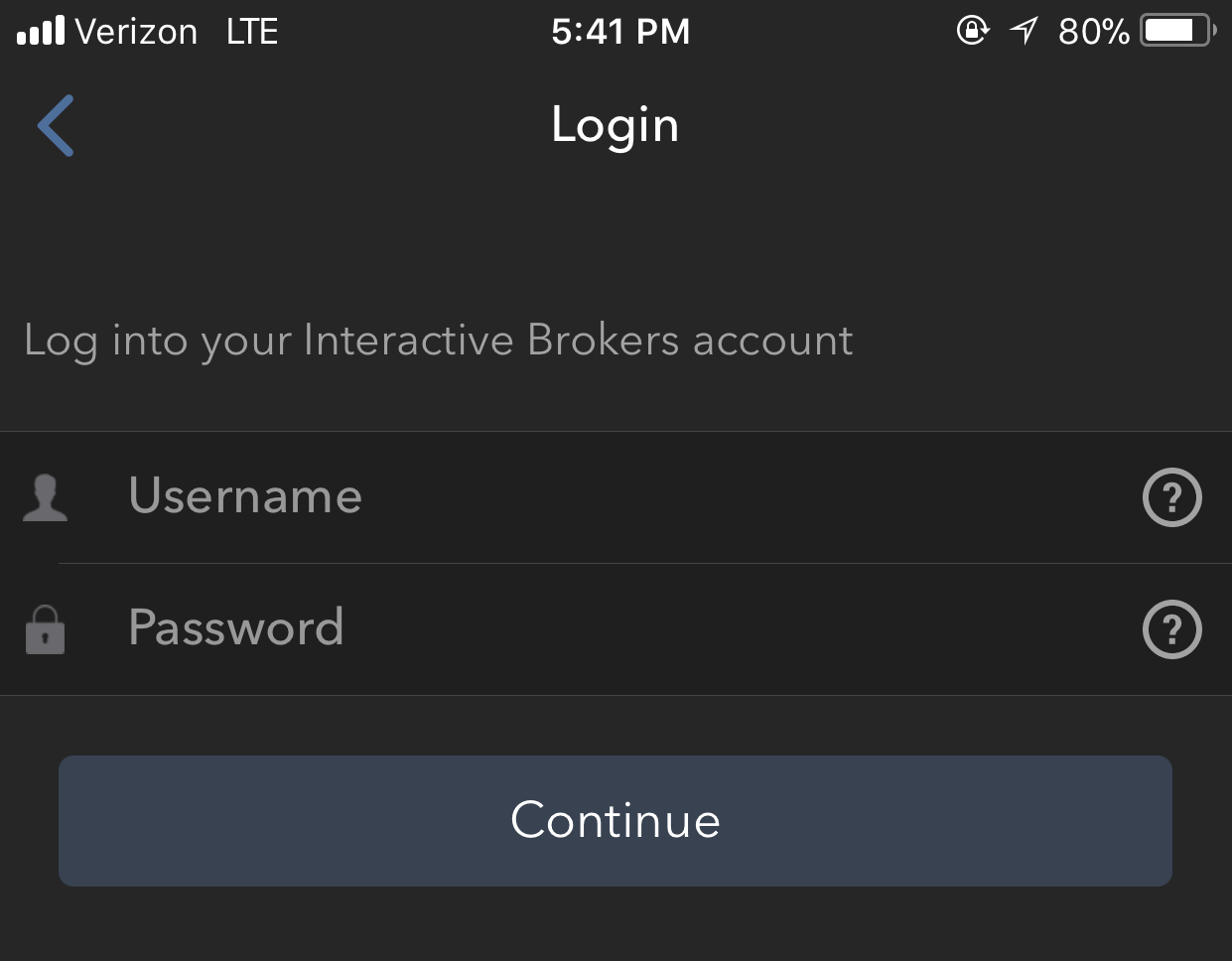

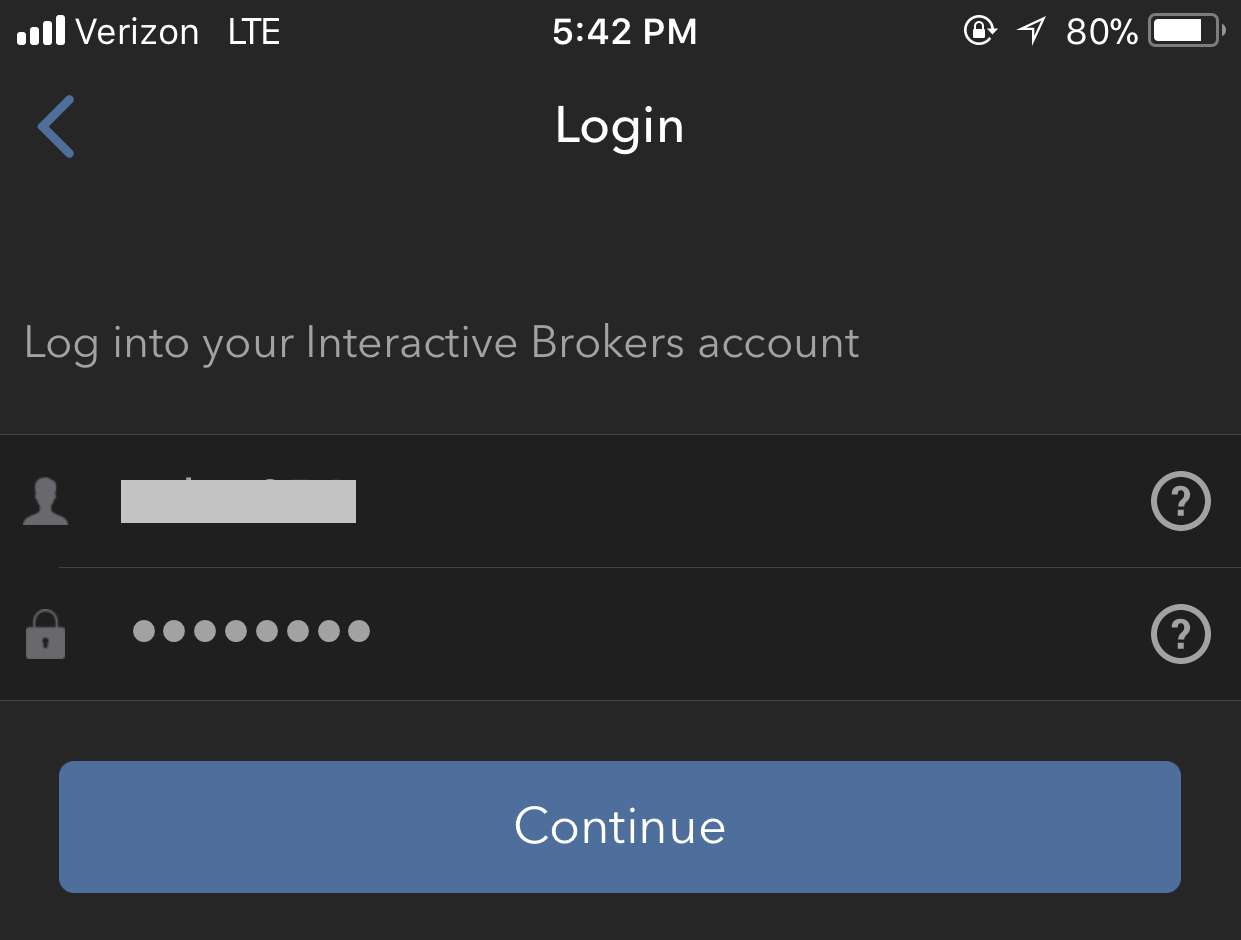

3. Enter your Account Username and Password then tap Continue.

Figure 10. Figure 11.

4. The default mobile phone number on record for your account will be already selected. If you are not able to receive text messages (SMS) on that number, you should choose a different one from the list (if applicable) or add a new one. To add a new mobile phone number, tap Add Phone number, enter the new number1 and corresponding Country. Once you have selected your preferred mobile number from the list or added the new mobile number, tap Get Activation SMS (Figure 12.).

Figure 12.

.png)

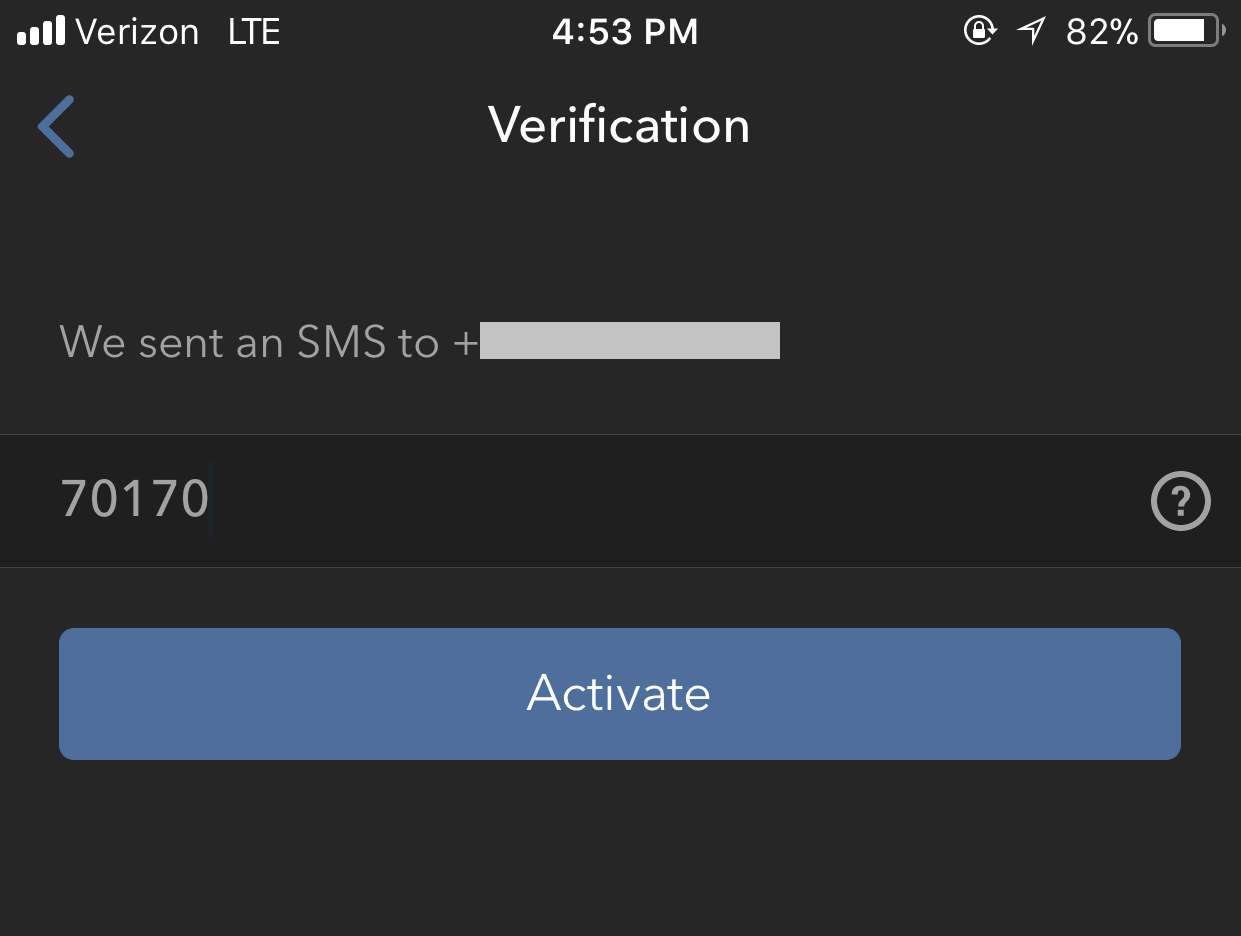

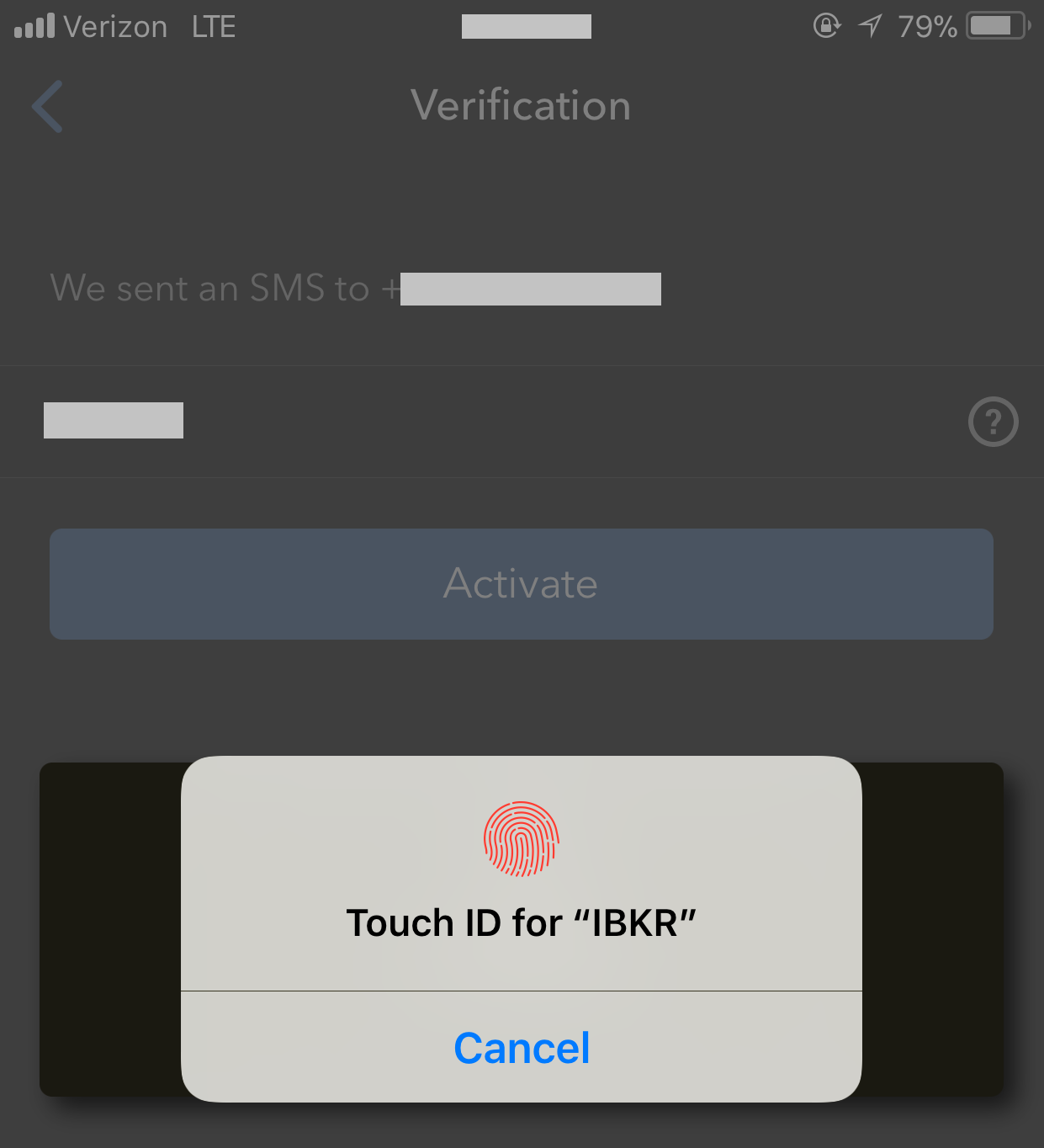

5. An SMS message will be sent with an Activation Token. Enter the token in the Activation Code field. Then tap Activate.

Figure 13. Figure 14. Figure 15.

.png)

.png)

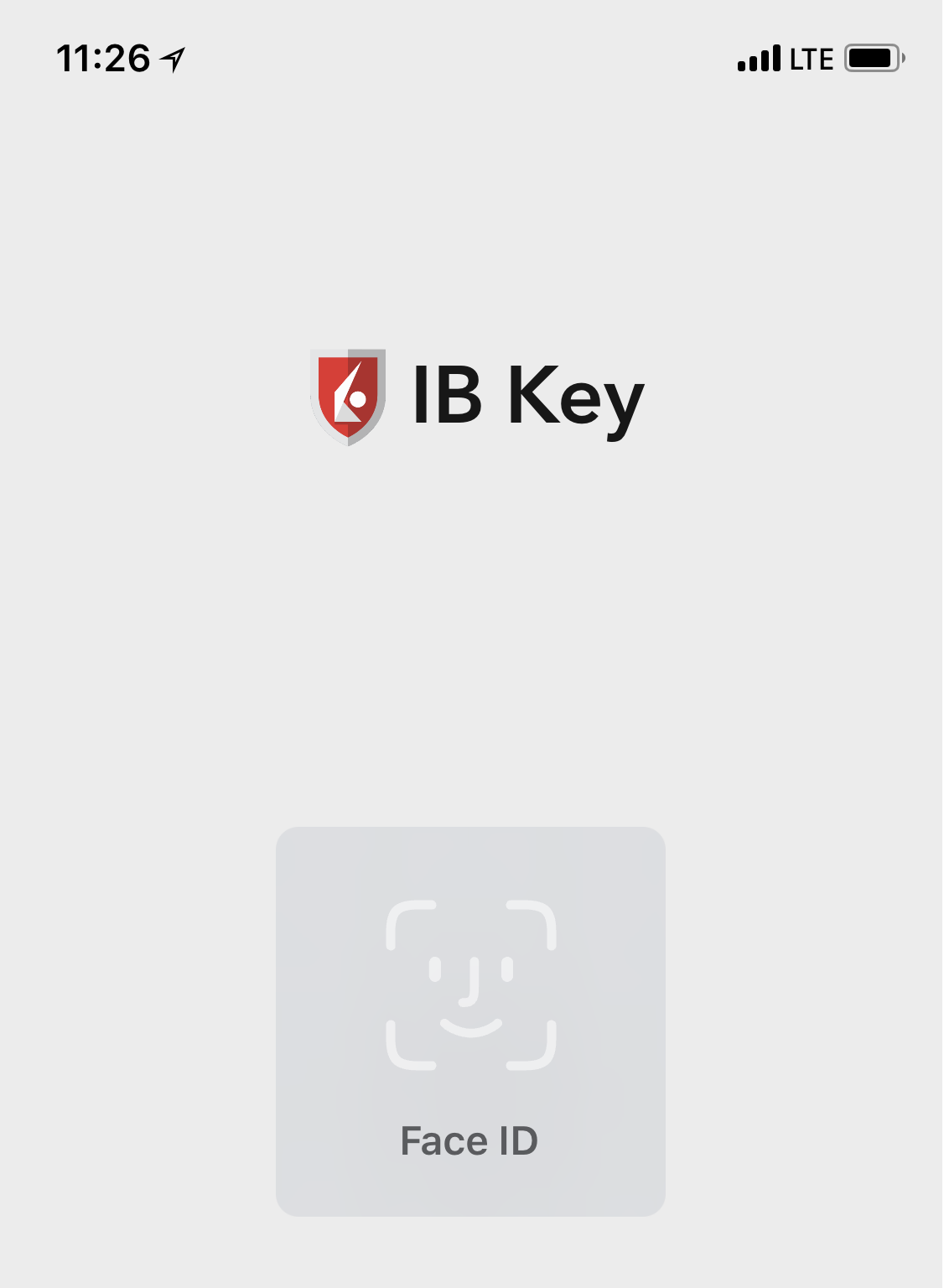

6. According to your phone hardware capabilities, you might be prompted to provide or define the security element used to secure the app (Fingerprint, Face ID or PIN2). Please provide the requested security element.

Figure 16.

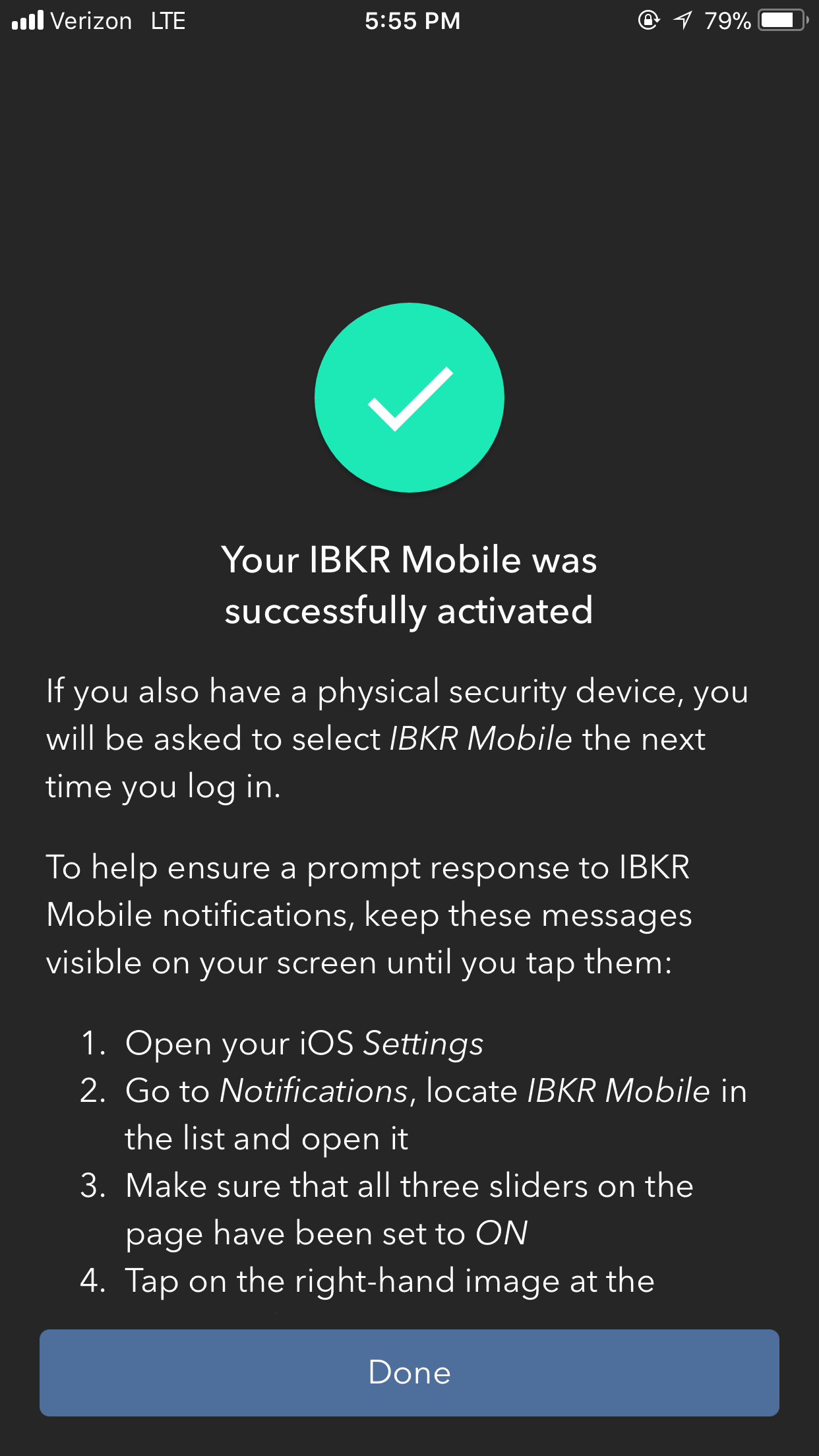

7. If the activation has been successful, you will see a confirmation screen. Tap Done to finalize the procedure.

Figure 17. Figure 18.

Once the IBKR Mobile Authentication (IB Key) has been activated, you can close the app. Refer to Operation with Touch ID or Operation with Face ID below on how to use IBKR Mobile for authentication.

- You must enter your phone number without your country's trunk prefix (123 instead of 1123 or 0123) and only enter numbers without any spacing or special characters.

-

The recovery PIN will be used to enable additional users or re-enable IBKR Mobile if it has been uninstalled. It must be at least 4 and up to 6 characters (letters, numbers and special characters allowed). Refer to KB2269 for additional guidelines.

Operation with Touch ID

Once activated, operation of IBKR Mobile Authentication (IB Key) using Touch ID is as follows:

IMPORTANT NOTE: If you do not have Internet access while operating IBKR Mobile, please refer to the section "What if I don't receive the notification?"

1) Enter your username and password into the trading platform or Client Portal login screen and click Login. If correct, a notification will be sent to your iPhone.

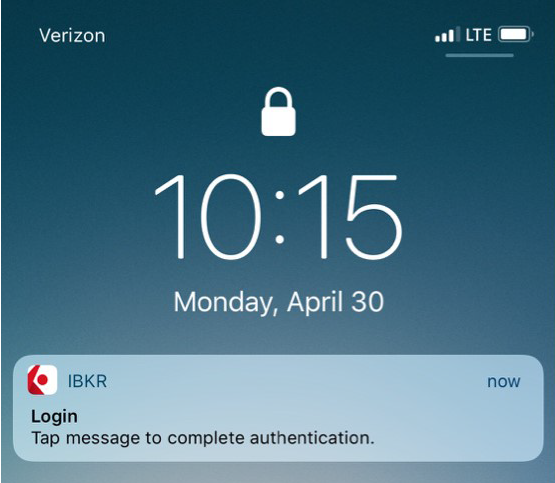

Figure 19.

2) On your iPhone, check your notifications panel and select the IBKR Mobile app notification.

Figure 20.

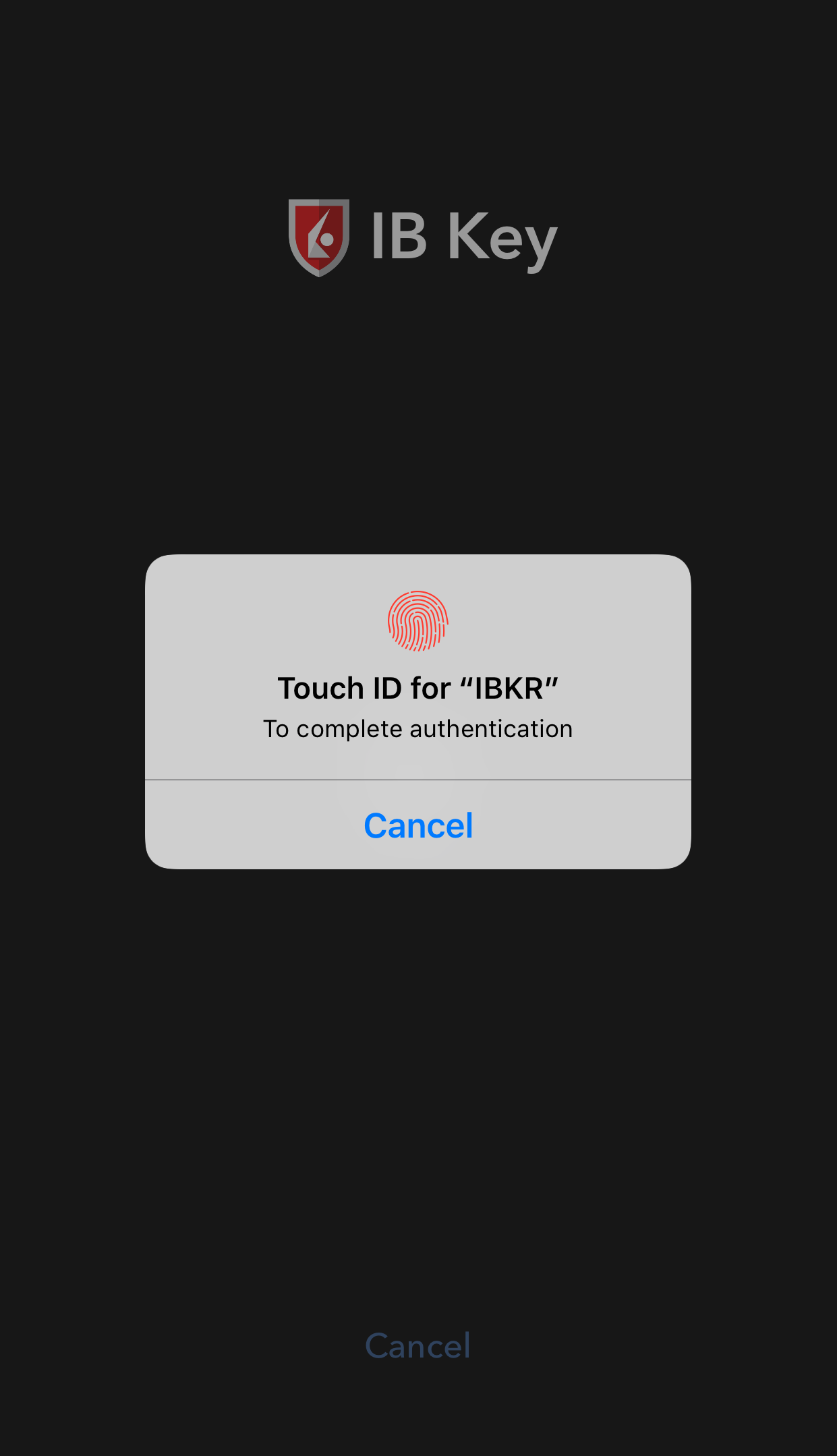

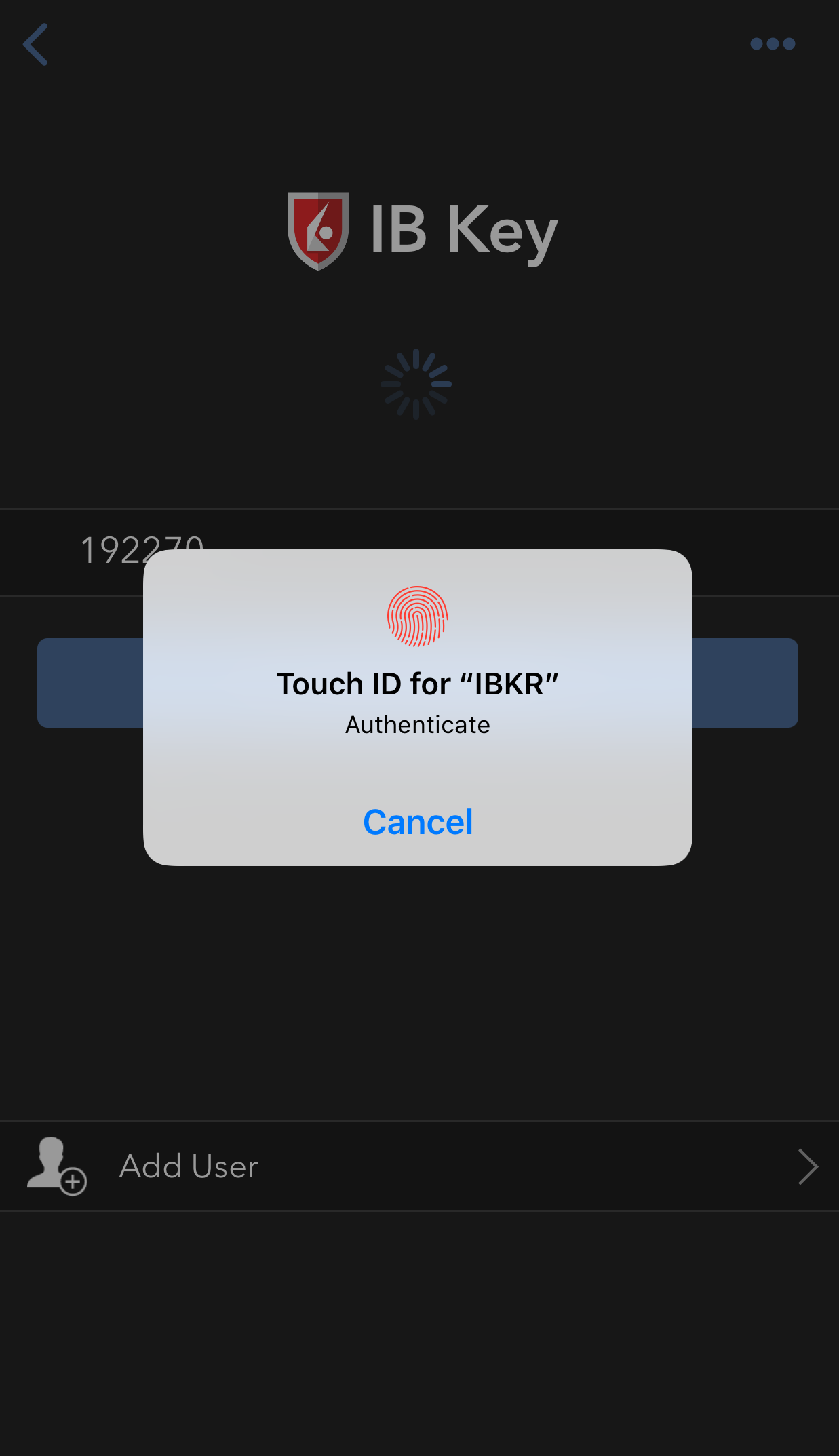

3) Selecting the notification will launch the IBKR Mobile Authentication (IB Key). On your iPhone, place your finger that was registered for Touch ID on the Home Button. If the Touch ID has not been activated, IB Key will prompt you to enter the Passcode.

Figure 21. Figure 22. Figure 23.

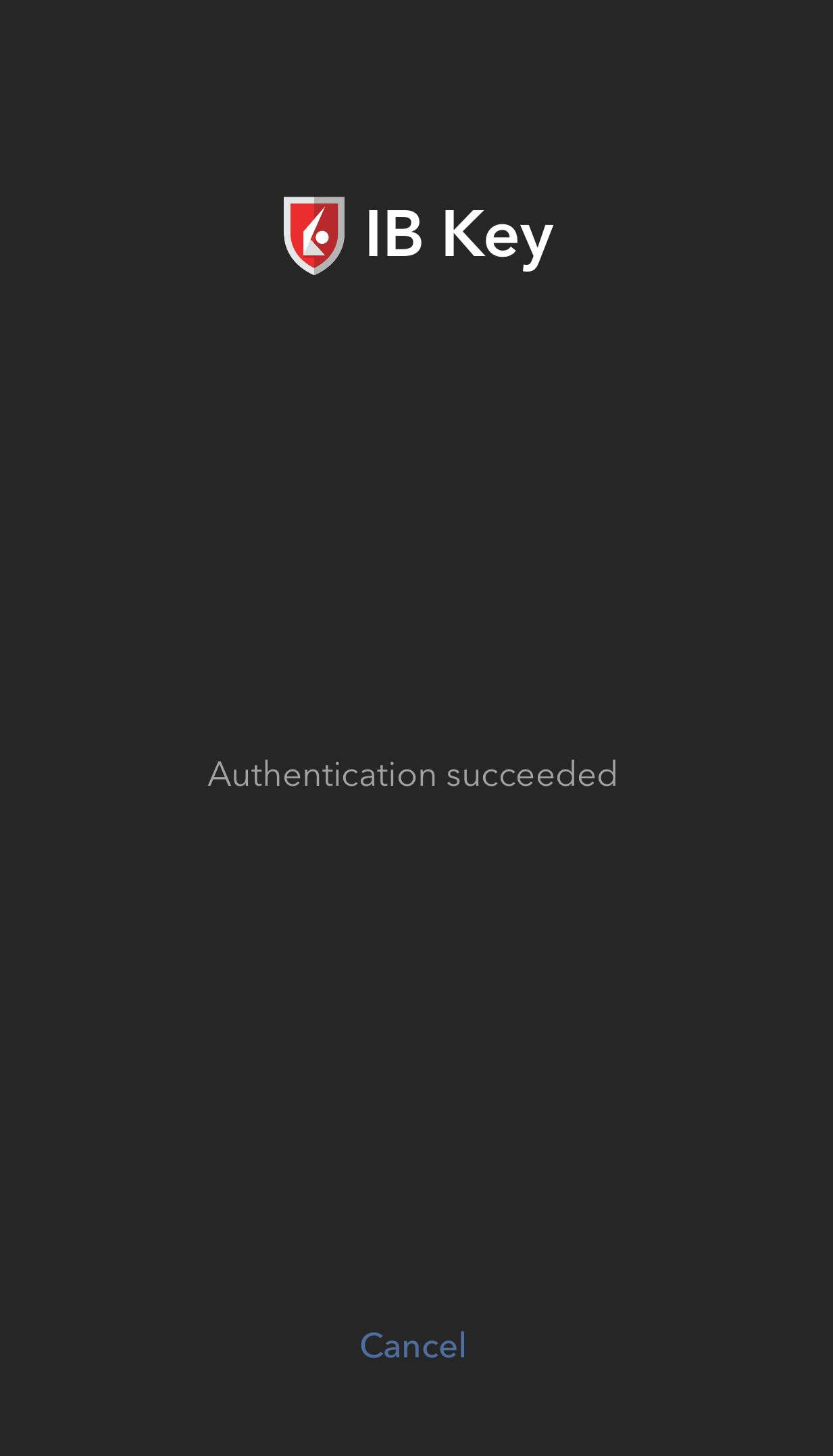

4) If authentication succeeds, the log in will now automatically proceed.

Figure 24.

Operation with Face ID

Once activated, operation of IBKR Mobile Authentication (IB Key) using Face ID is as follows:

IMPORTANT NOTE: If you do not have Internet access while operating IBKR Mobile, please refer to the section "What if I don't receive the notification?"

1) Enter your username and password into the trading platform or Client Portal login screen and click Login. If correct, a notification will be sent to your iPhone.

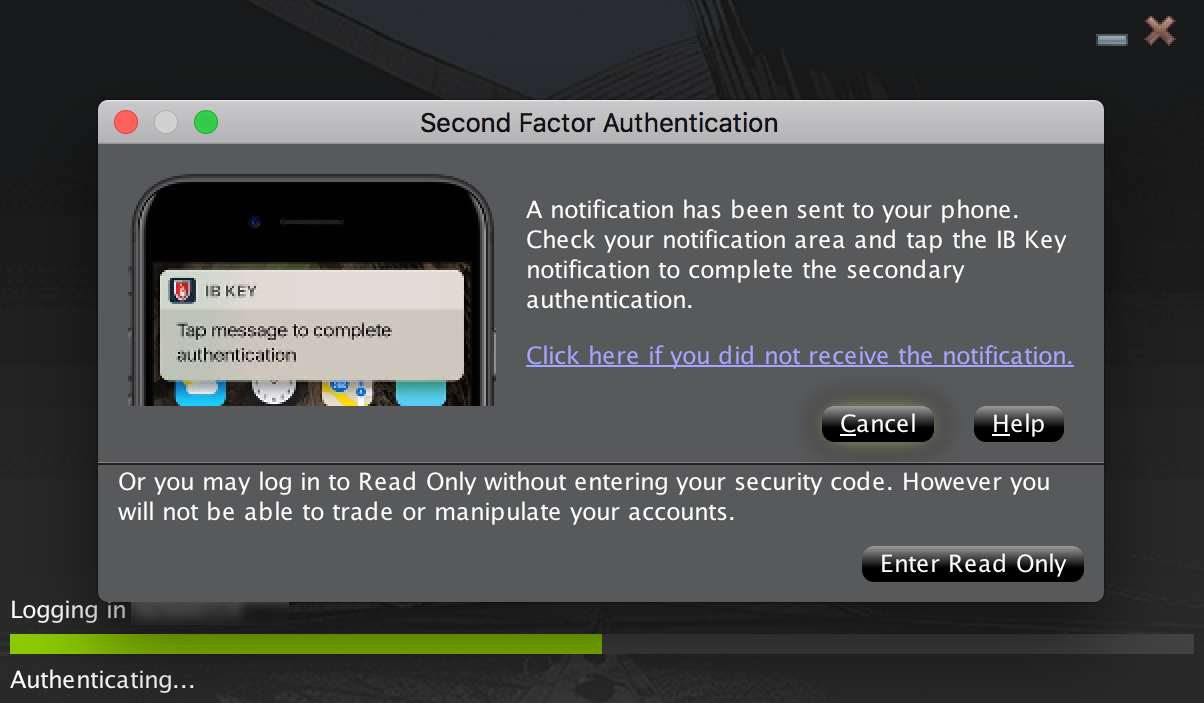

Figure 25.

2) On your iPhone, check your notification menu and select the IBKR Mobile app notification.

Figure 26.

.png)

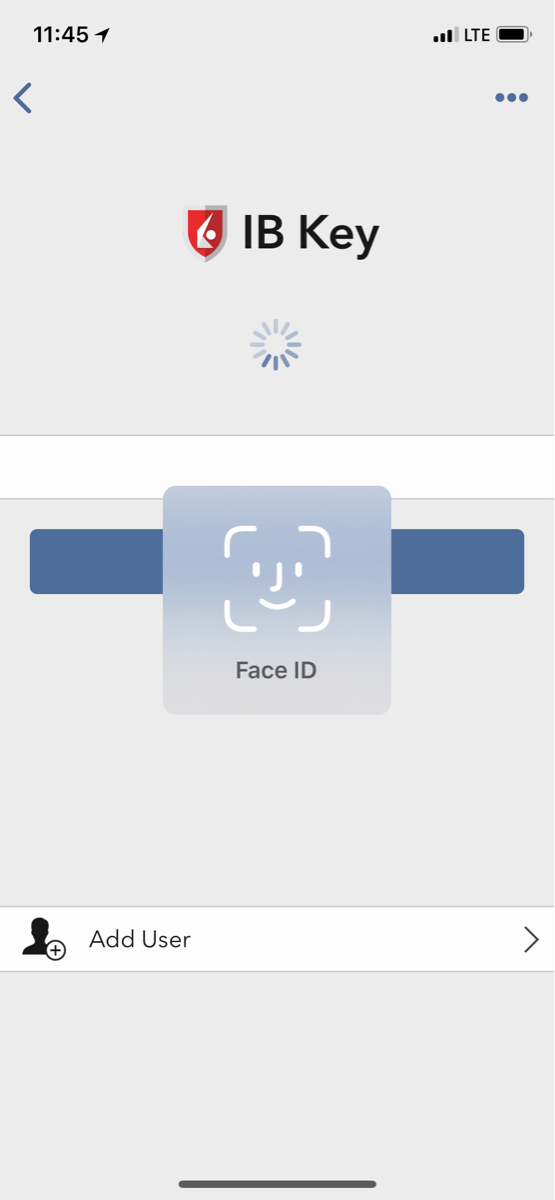

3) Selecting the notification will launch the IBKR Mobile Authentication (IB Key). On your iPhone, look at the screen to authenticate via Face ID. If Face ID has not been activated, IB Key will prompt you to enter the Passcode.

Figure 27. Figure 28. Figure 29.

4) If authentication succeeds, the log in will now automatically proceed.

Figure 30.

What if I don't receive the notification?

If the notification does not reach your phone, it may be because notifications are disabled, no internet access is available or you have a poor, unstable connection. In these cases operation of IBKR Mobile Authentication (IB Key) is as follows:

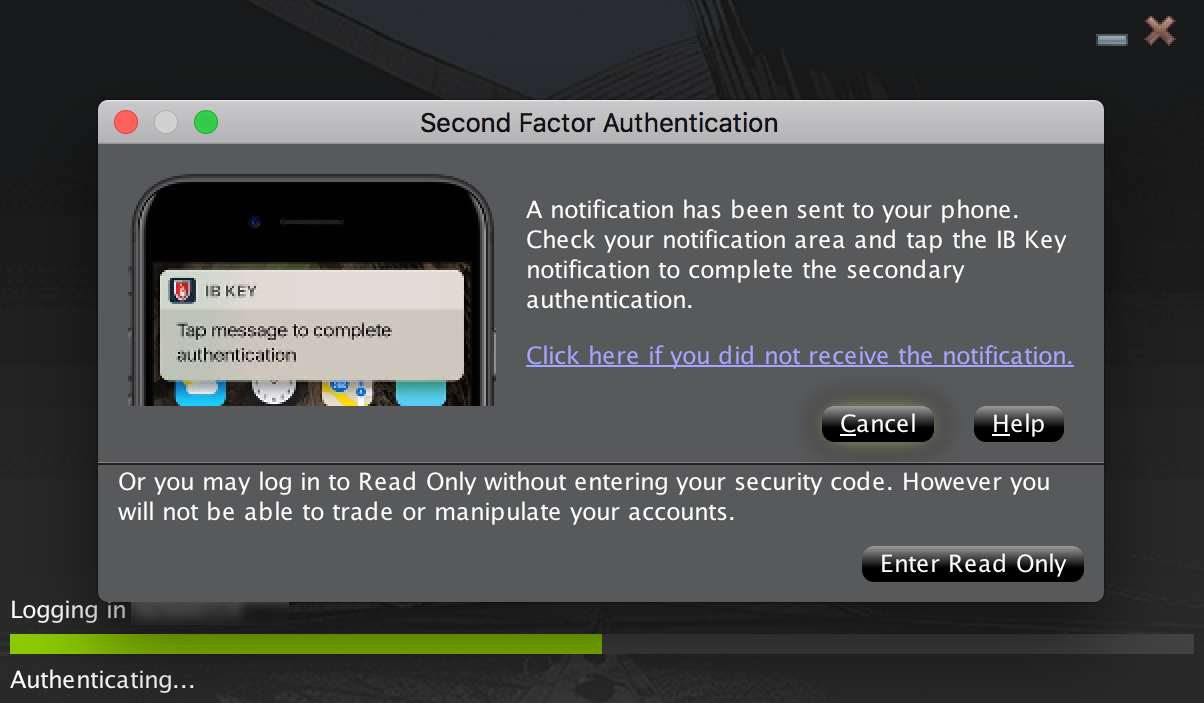

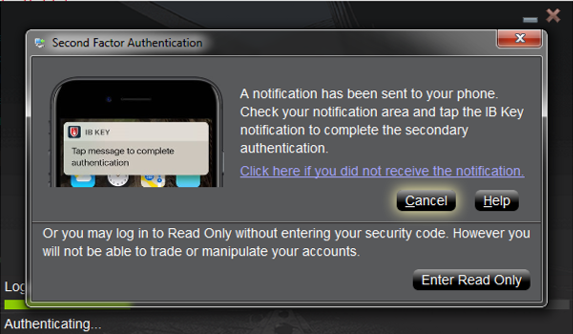

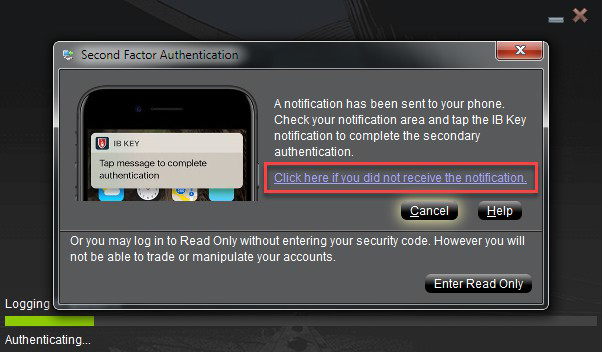

1) Click the link Click here if you do not receive the notification.

Figure 31.

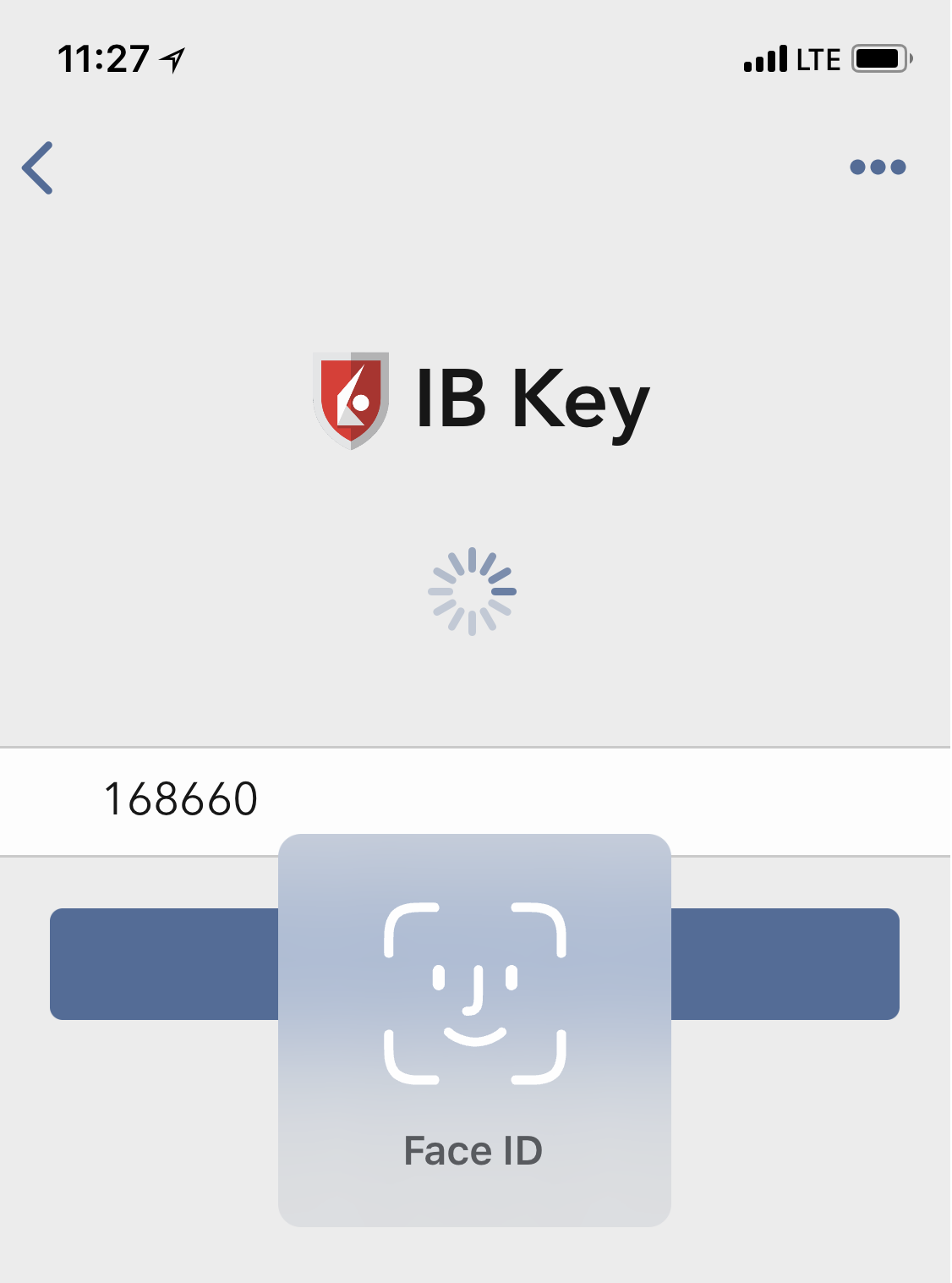

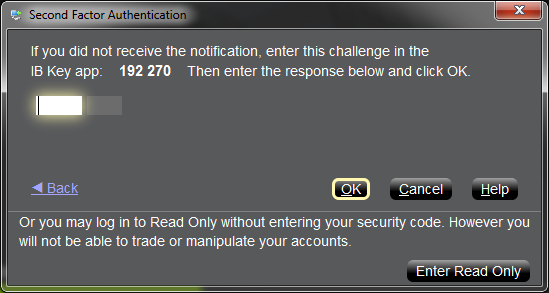

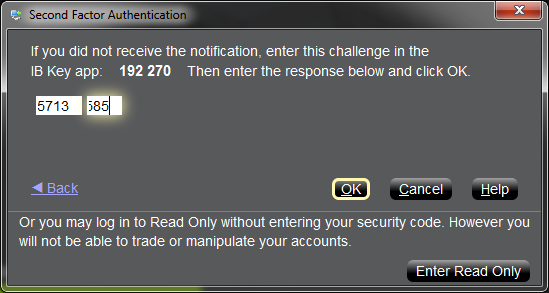

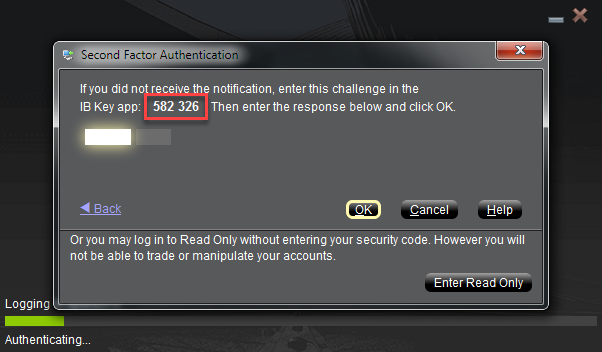

2) This will generate challenge code and box to enter response.

Figure 32.

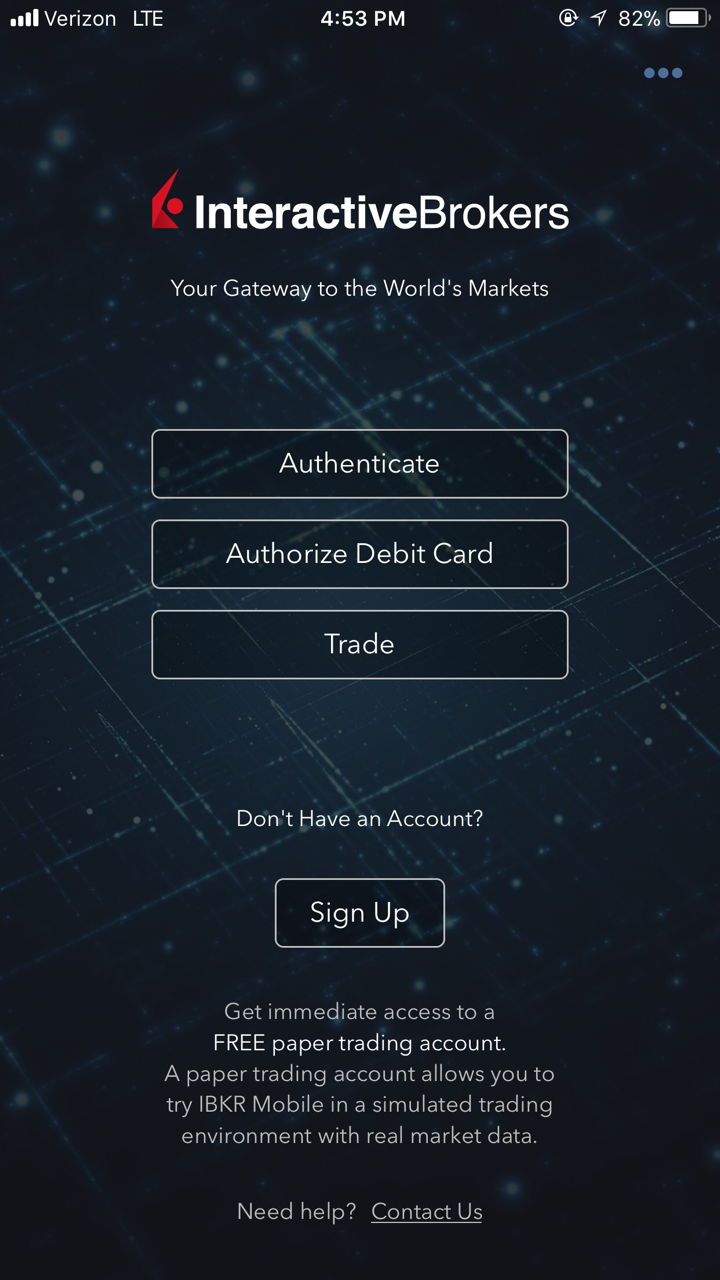

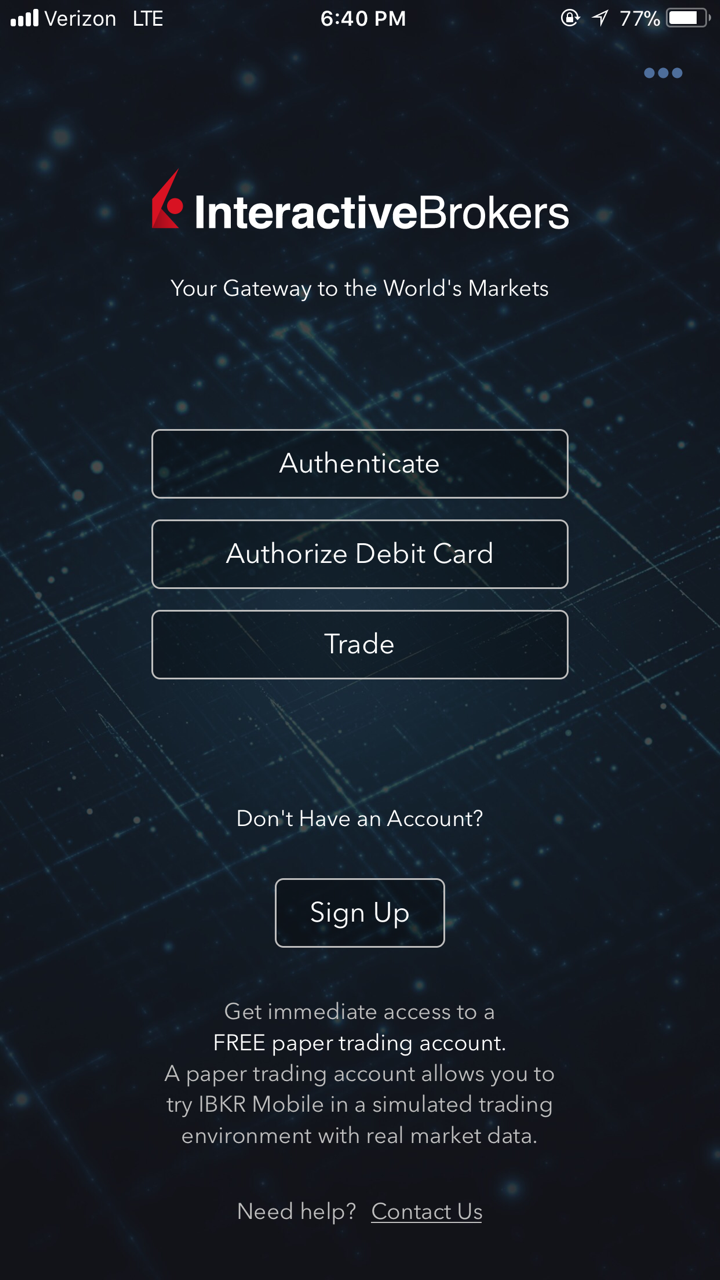

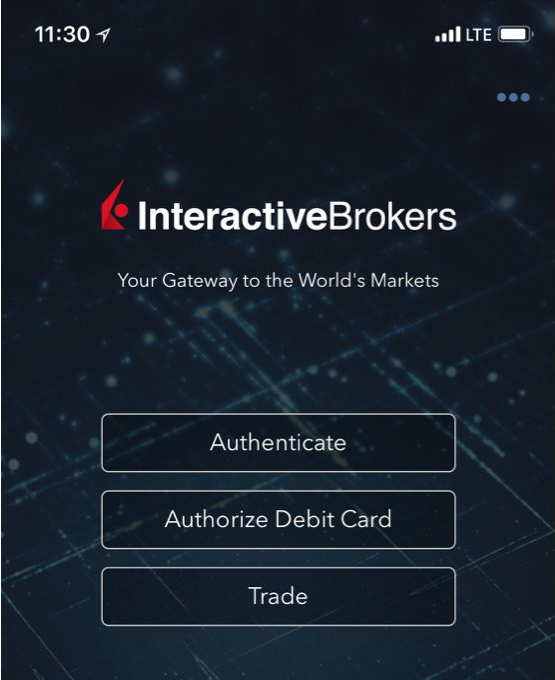

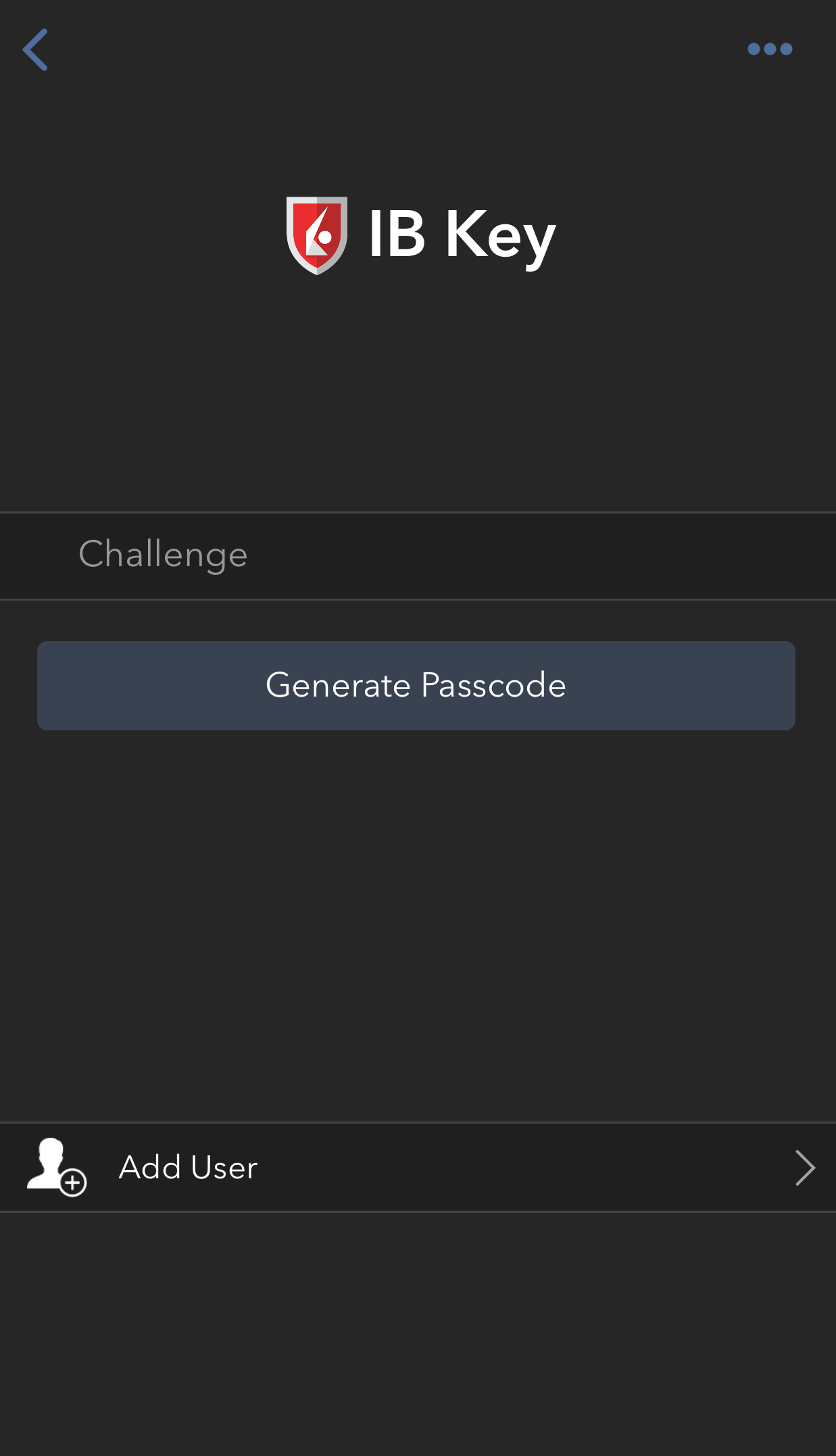

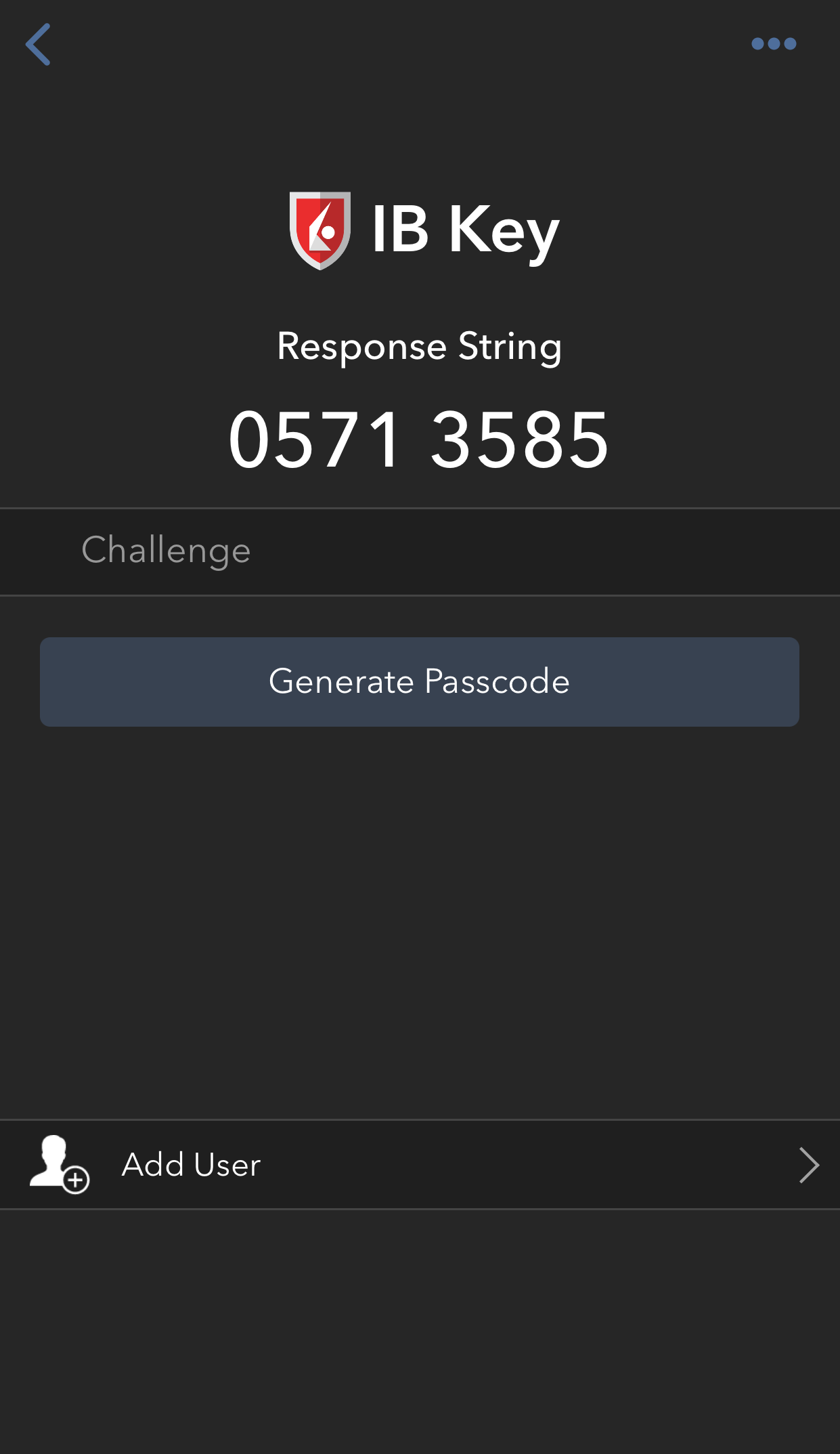

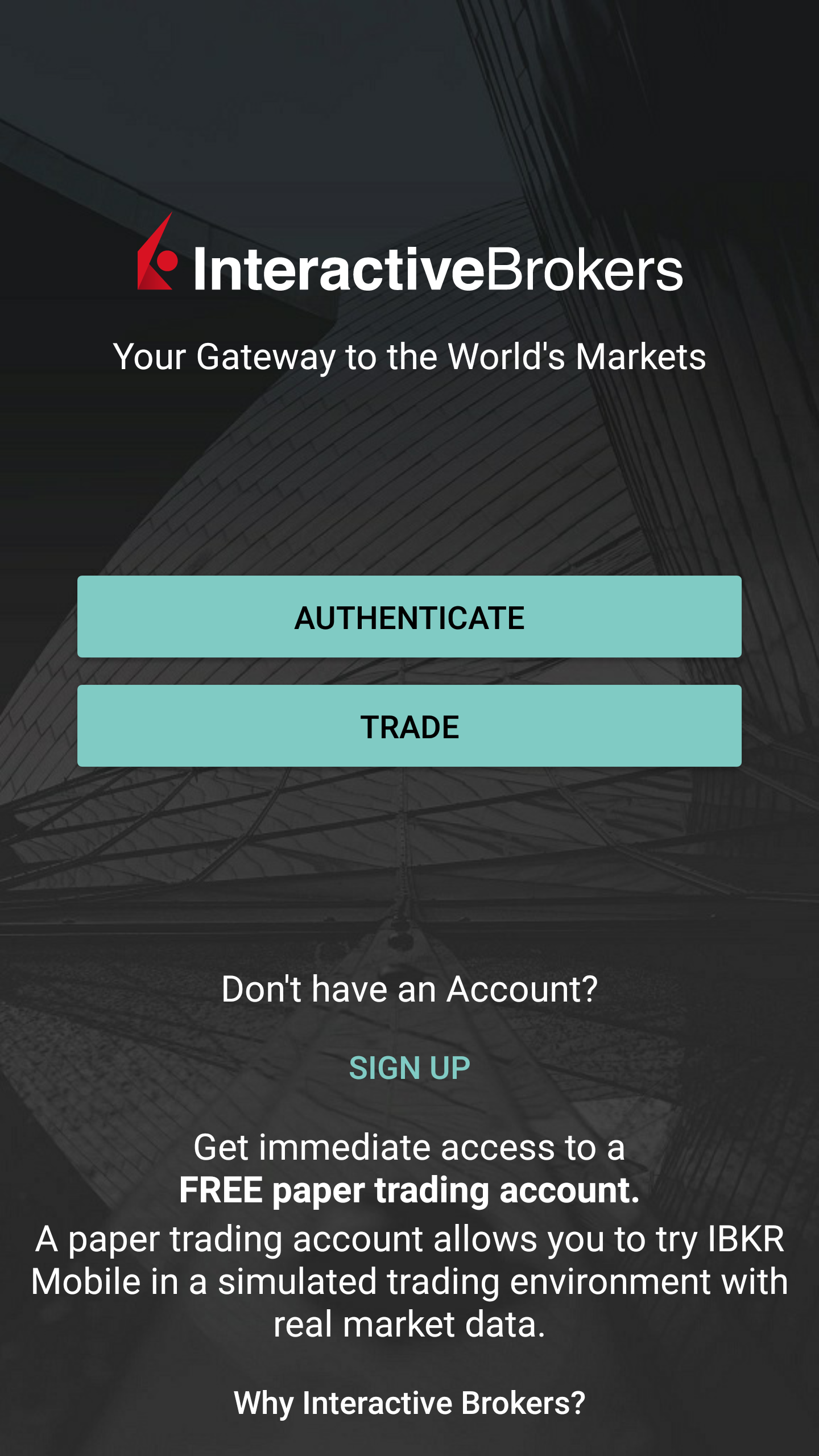

3) Launch IBKR Mobile on your Smartphone, then select Authenticate. Type the Challenge number into the corresponding box.

Figure 33. Figure 34.

4) If you use Touch ID, place your finger that was registered on the Home Button. If the Touch ID has not been activated, IBKR Mobile will prompt you to enter the Passcode. A response string will be generated. If you use Face ID, skip this step and go to the next one.

Figure 35. Figure 36.

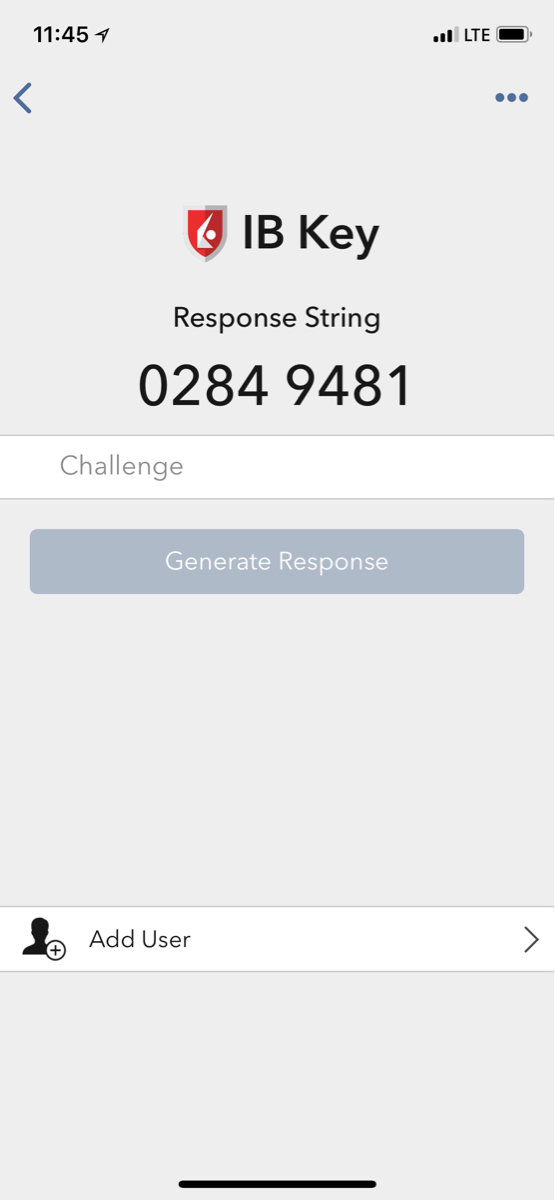

5) If you use Face ID, look at the screen to authenticate via Face ID. If Face ID has not been activated, IB Key will prompt you to enter the Passcode. A response string will be generated.

Figure 37. Figure 38.

6) Enter the response from your iPhone into the log in screen and click OK.

Figure 39.

7) If authentication succeeds, the log in will now automatically proceed.

Figure 40.

Back to top

References:

- See KB2748 for instructions on how to recover IBKR Mobile Authentication (IB Key).

- See KB3234 for troubleshooting missing IBKR Mobile notifications

- See KB2745 for instructions on how to clear the cache for the IBKR Mobile app.

Overview of IBKR Mobile Authentication (IB Key) for Android

This page covers specific points of installing IBKR Mobile and using the IBKR Mobile Authentication (IB Key) for Android devices. For general questions on the IBKR Mobile Authentication (IB Key), please refer to KB2260.

Table of contents

Requirements

- Must be installed on an Android Phone that has not been rooted.

- Device's Android Version must be 7 or later.

Installation

You can download the IBKR Mobile app on your smartphone directly from;

Google Play Store , 360 Mobile Assistant or Baidu Mobile Assistant.

How to install IBKR Mobile from the Google Play Store:

- On your Android phone tap on the Play Store

app.

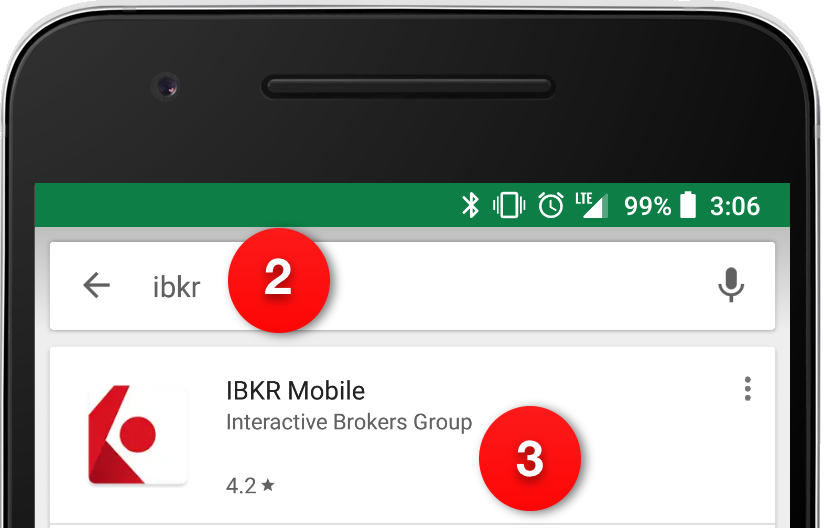

app. - Tap on the search bar at the top, type IBKR Mobile then tap Search.

- Locate the app IBKR Mobile from Interactive Brokers Group, then select it (Figure 1.).

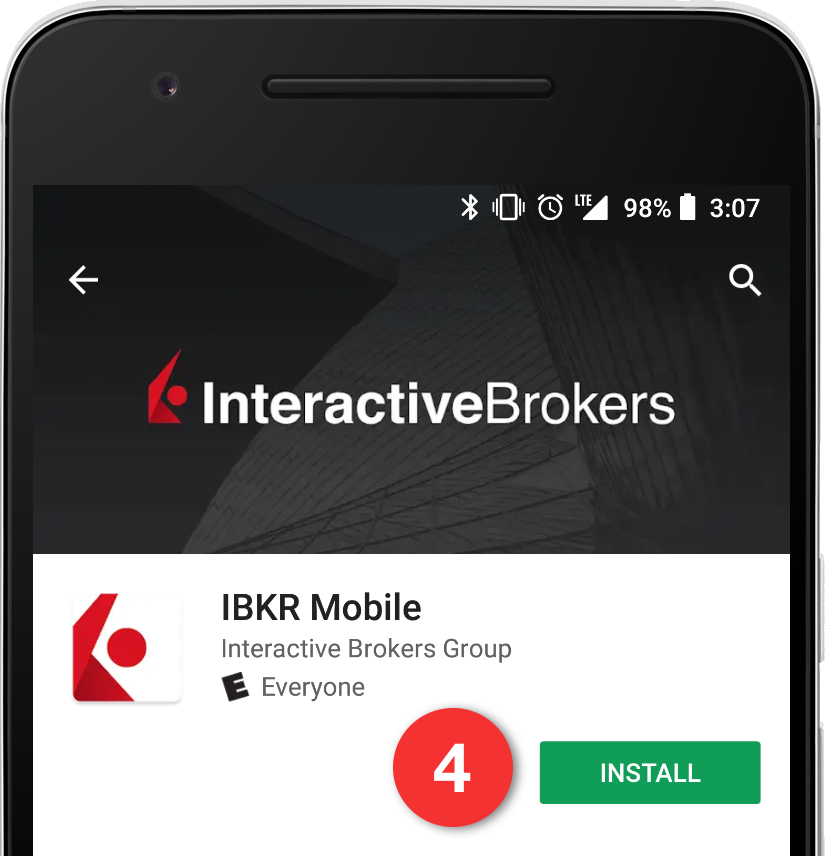

- Tap on Install to the right (Figure 2.).

- Once the installation completes, tap on Open to launch the IBKR Mobile app.

Figure 1. Figure 2.

Back to top

Activation

Once the app has been installed on your device you will need to activate it for the username you would like to enroll. This operation happens entirely on your phone, requires Internet access and the ability to receive SMS (text message).

1. On your phone open the IBKR Mobile app:

1.a. If you're opening IBKR Mobile for the first time since its installation, proceed to step 2.

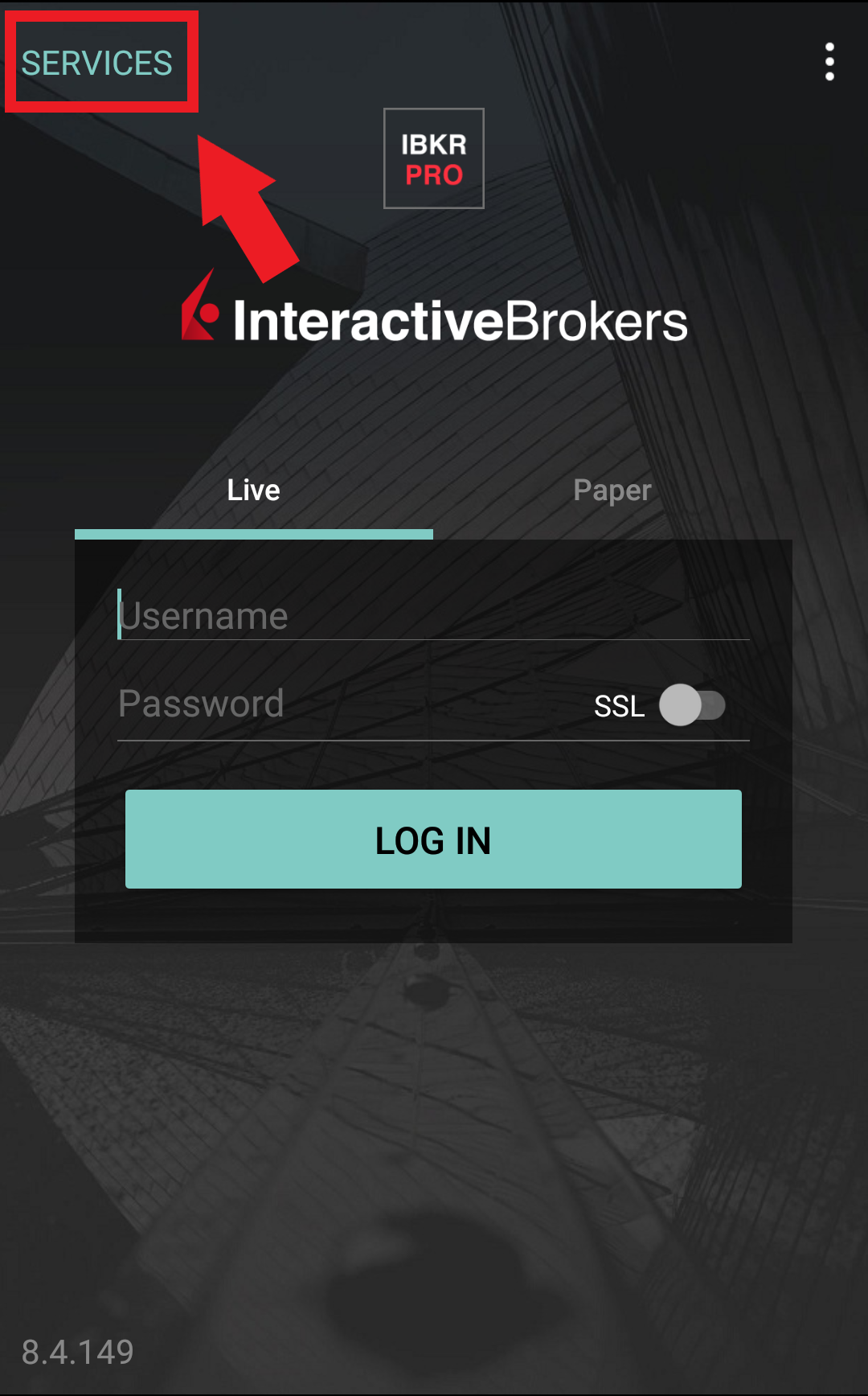

1.b. If when opening IBKR Mobile you land on the login screen, tap Services on the top left (Figure 3.) and proceed with step 2.

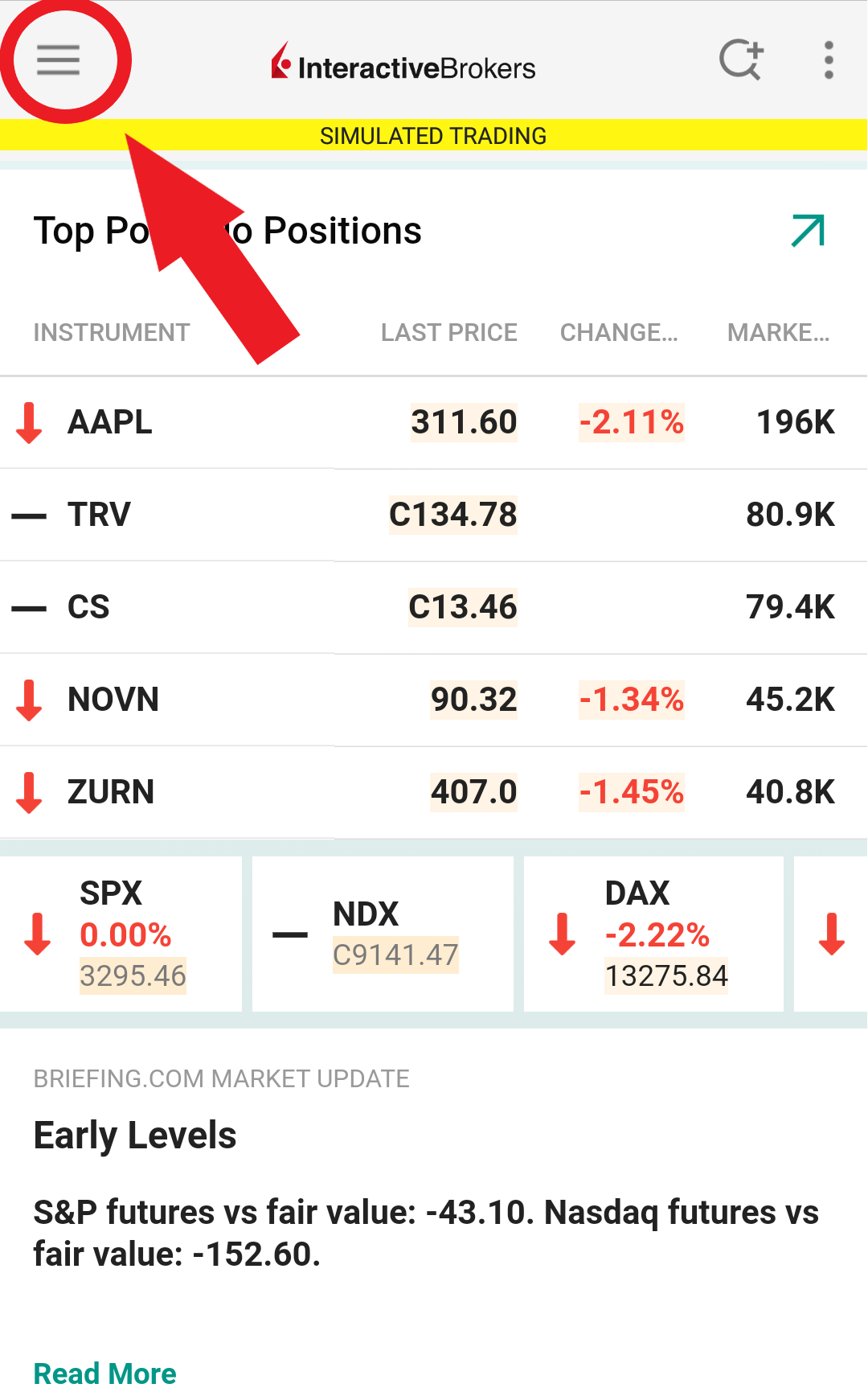

1.c. If when opening IBKR Mobile you land on your Home Page, Portfolio, Watchlists, or similar, tap the Menu icon on the top-left (Figure 4.). Then tap Two-factor Authentication (Figure 5.), followed by Activate IB Key (Figure 6.) and proceed with step 2.

Figure 3. Figure 4. Figure 5.

.jpeg)

Figure 6.

.jpeg)

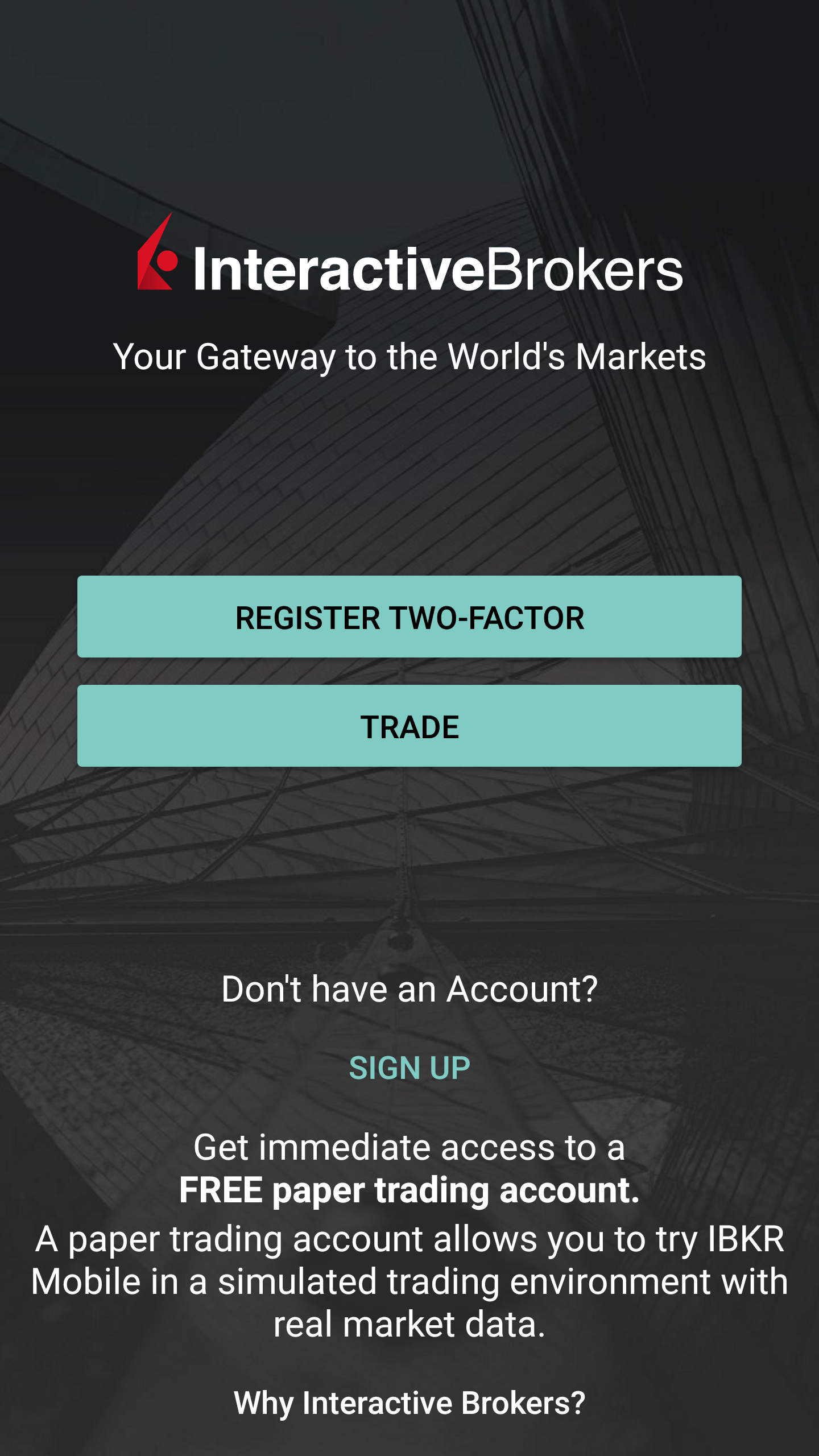

2. Tap Register Two-Factor (Figure 7.), review the instructions and tap Continue (Figure 8.).

Figure 7. Figure 8.

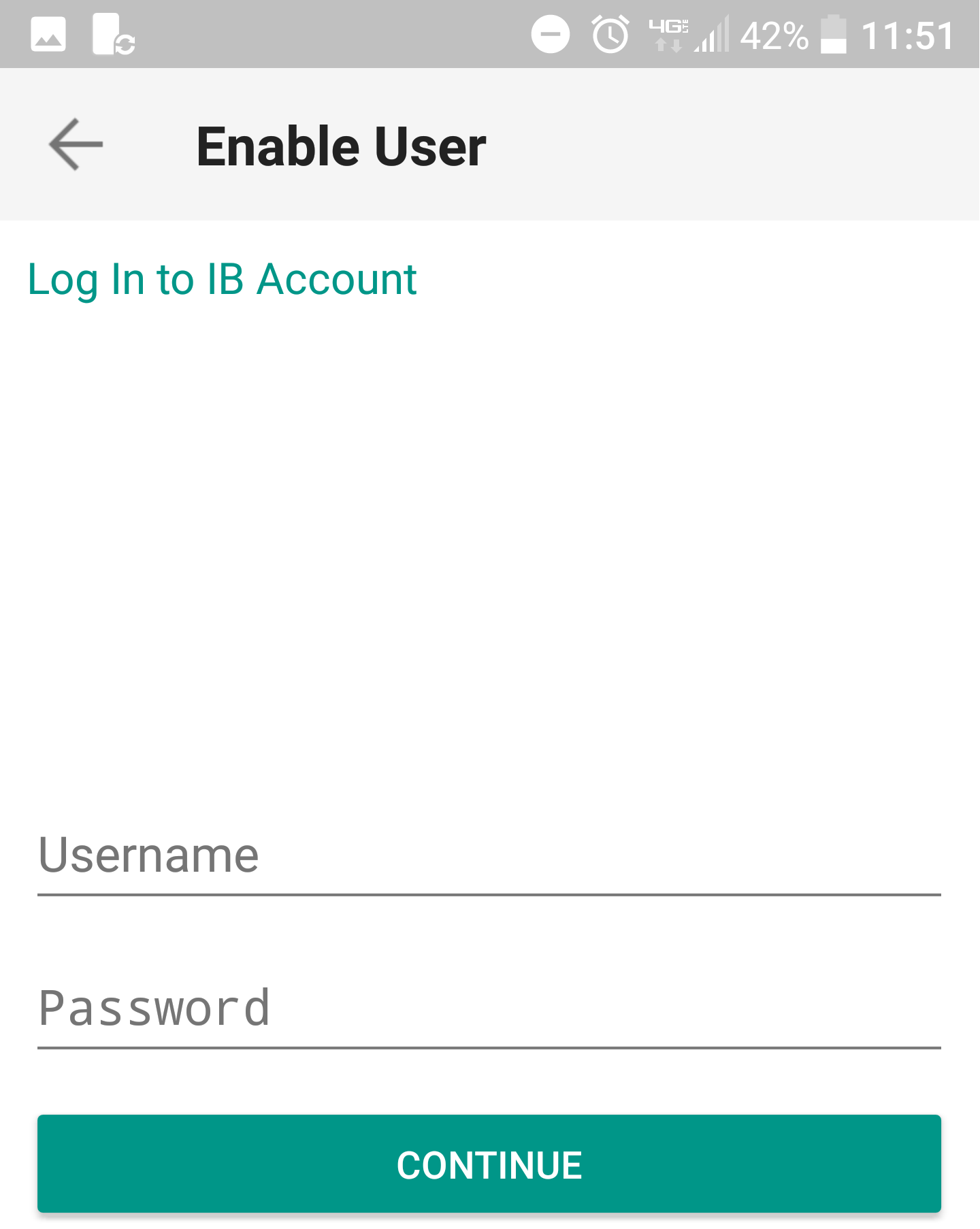

3. Enter your IBKR Account Username and Password then tap Continue.

Figure 9.

4. The default mobile phone number on record for your account will be already selected. If you are not able to receive text messages (SMS) on that number, you should choose a different one from the list (if applicable) or add a new one. To add a new mobile phone number, tap Add Phone Number, enter the new number1 and corresponding Country. Once you have selected your preferred mobile number from the list or added the new mobile number, tap Get Activation Code.

Figure 10.

.png)

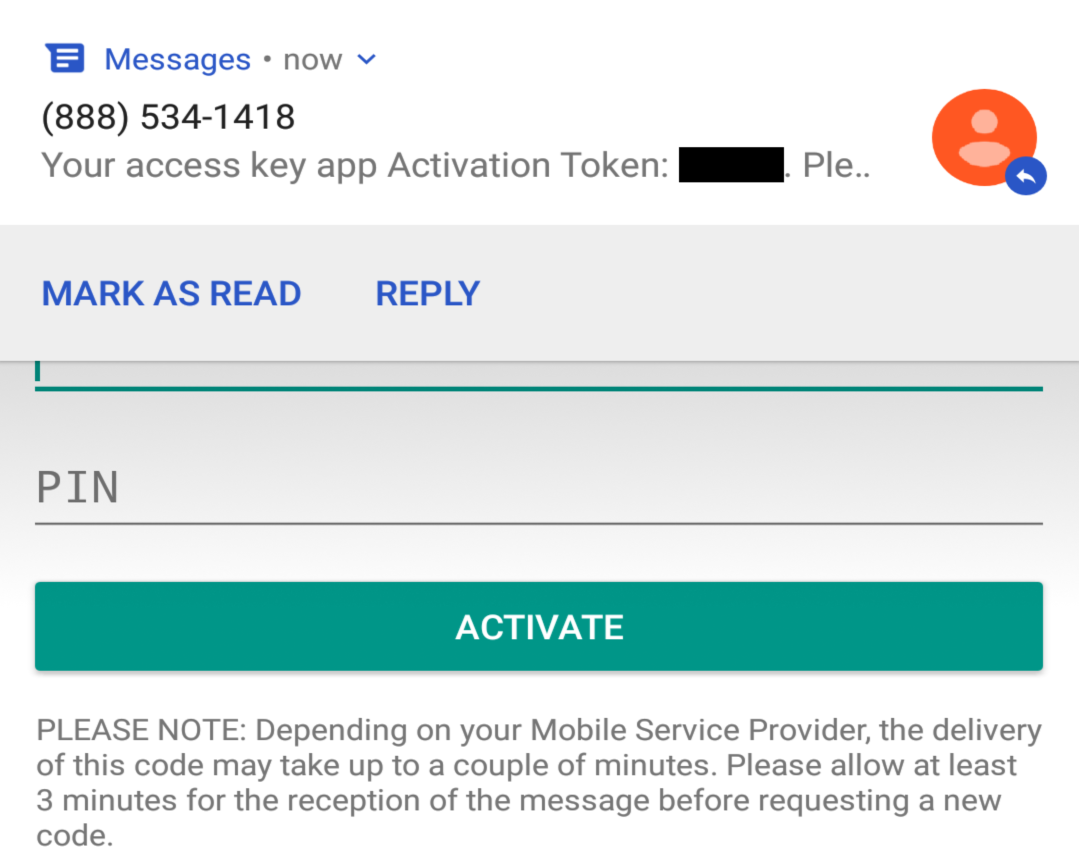

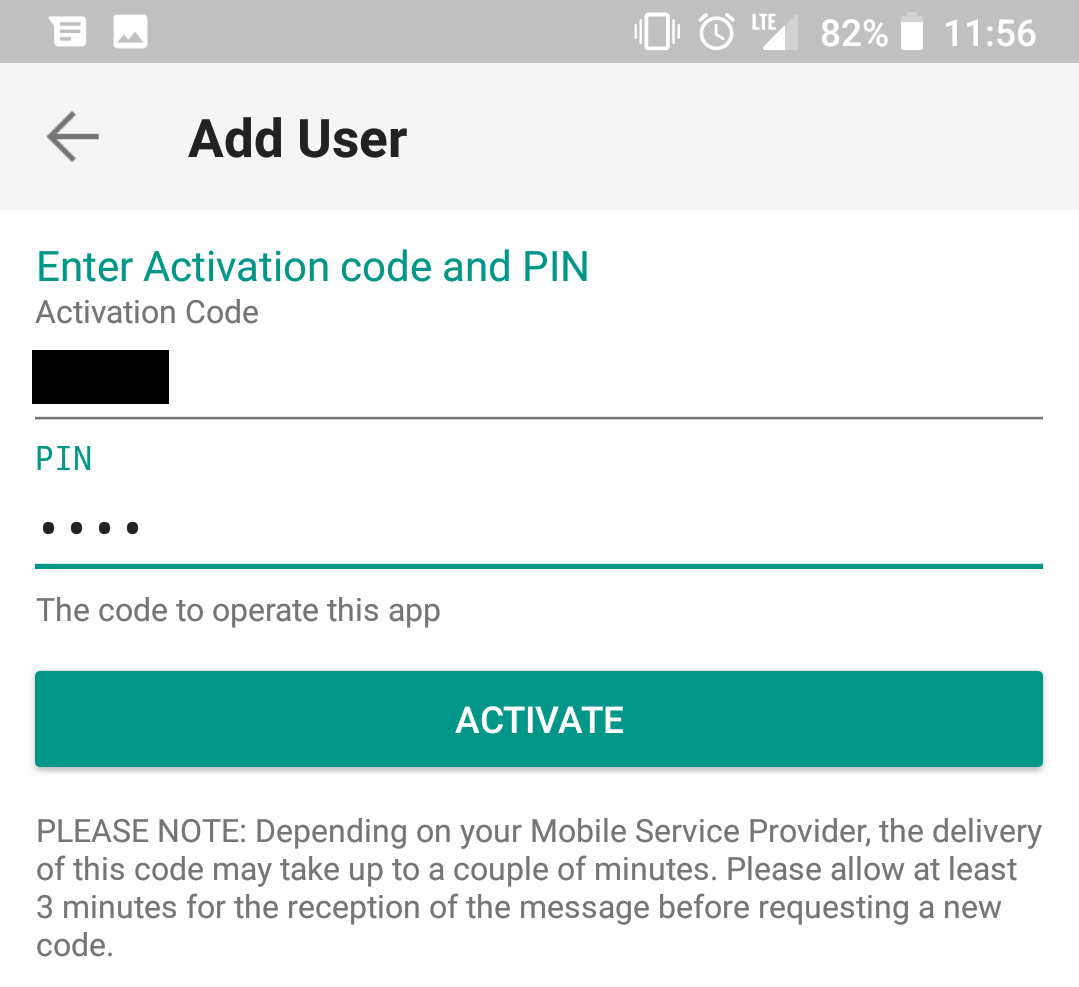

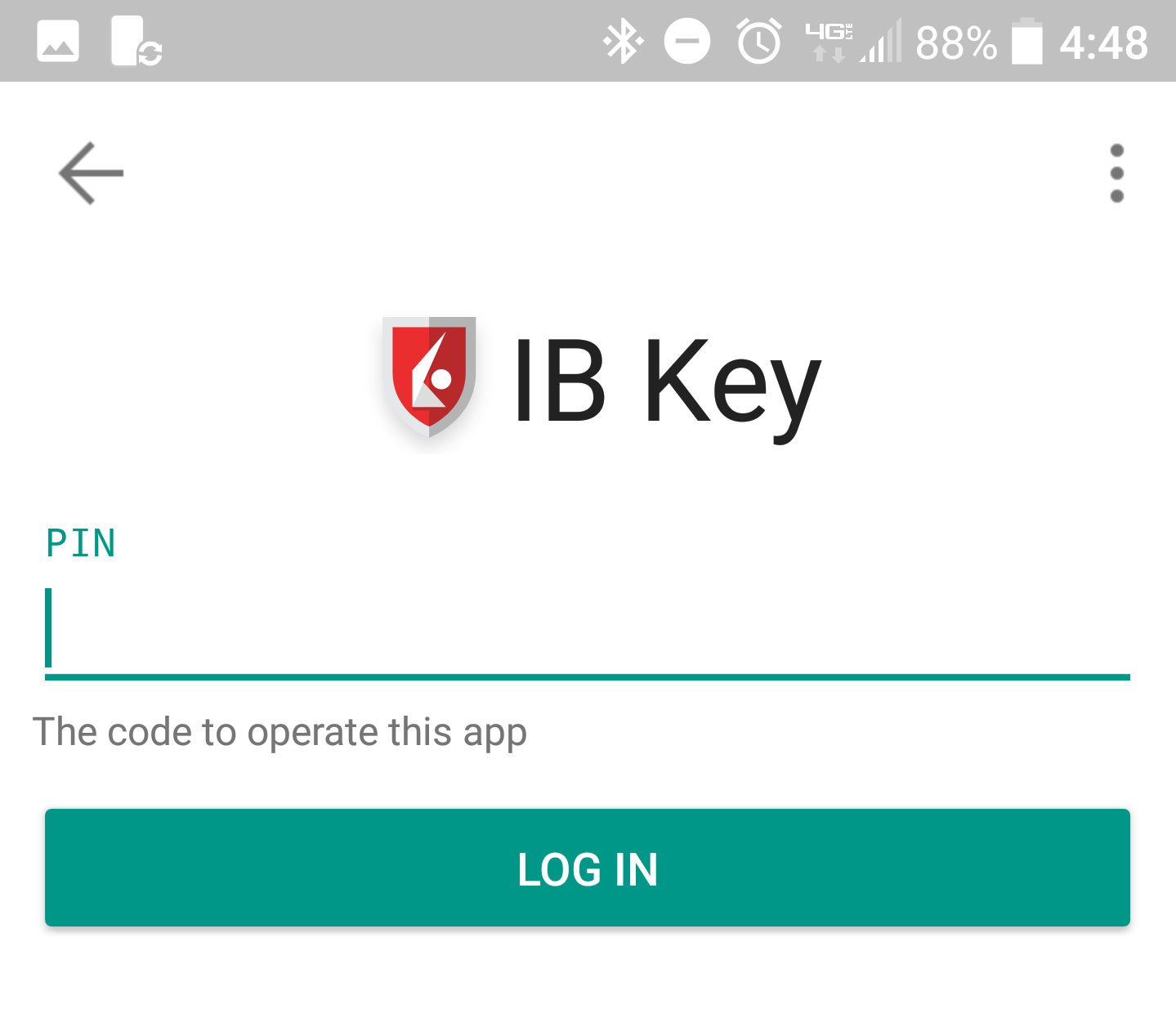

5. An SMS message will be sent with an Activation Token. Enter the token in the Activation Code field, create a PIN2 then tap Activate.

Figure 11. Figure 12.

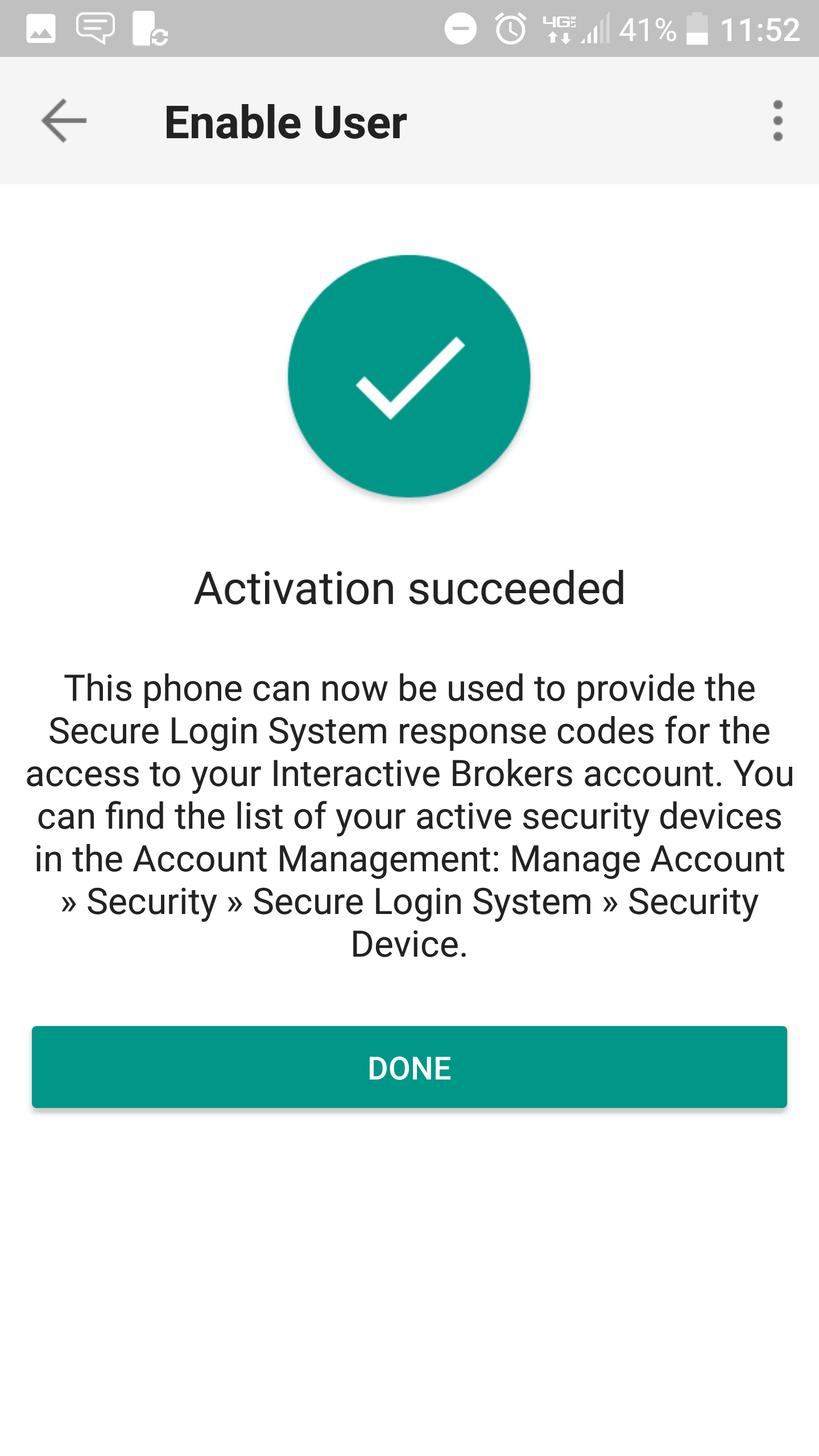

6. You will receive a message with the outcome of the operation. Tap Done to finalize the procedure (Figure 13.).

Figure 13. Figure 14.

Once the IBKR Mobile Authentication (IB Key) has been activated, you can close the app. Refer to Operation instructions below on how to use the authentication module.

-

You must enter your phone number without your country's trunk prefix (123 instead of 1123 or 0123) and only enter numbers without any spacing or special characters.

-

The PIN must be at least 4 and up to 6 characters (letters, numbers and special characters allowed). Refer to KB2269 for additional guidelines.

Operation

Once activated, you can use the IBKR Mobile Authentication (IB Key) to validate your login attempt as follows:

IMPORTANT NOTE: If you do not have Internet access while operating the IBKR Mobile, please refer to the section "What if I do not receive the notification?"

1) Enter your IBKR Account credentials into your trading platform or Client Portal login screen and click Login. If your credentials have been accepted, a notification will be sent to your phone.

Figure 15.

.png)

2) On your phone, swipe down from the top and check your notification drawer. Tap on the IBKR Mobile notification. If you have not received the notification, please refer to KB3234.

Figure 16.

.png)

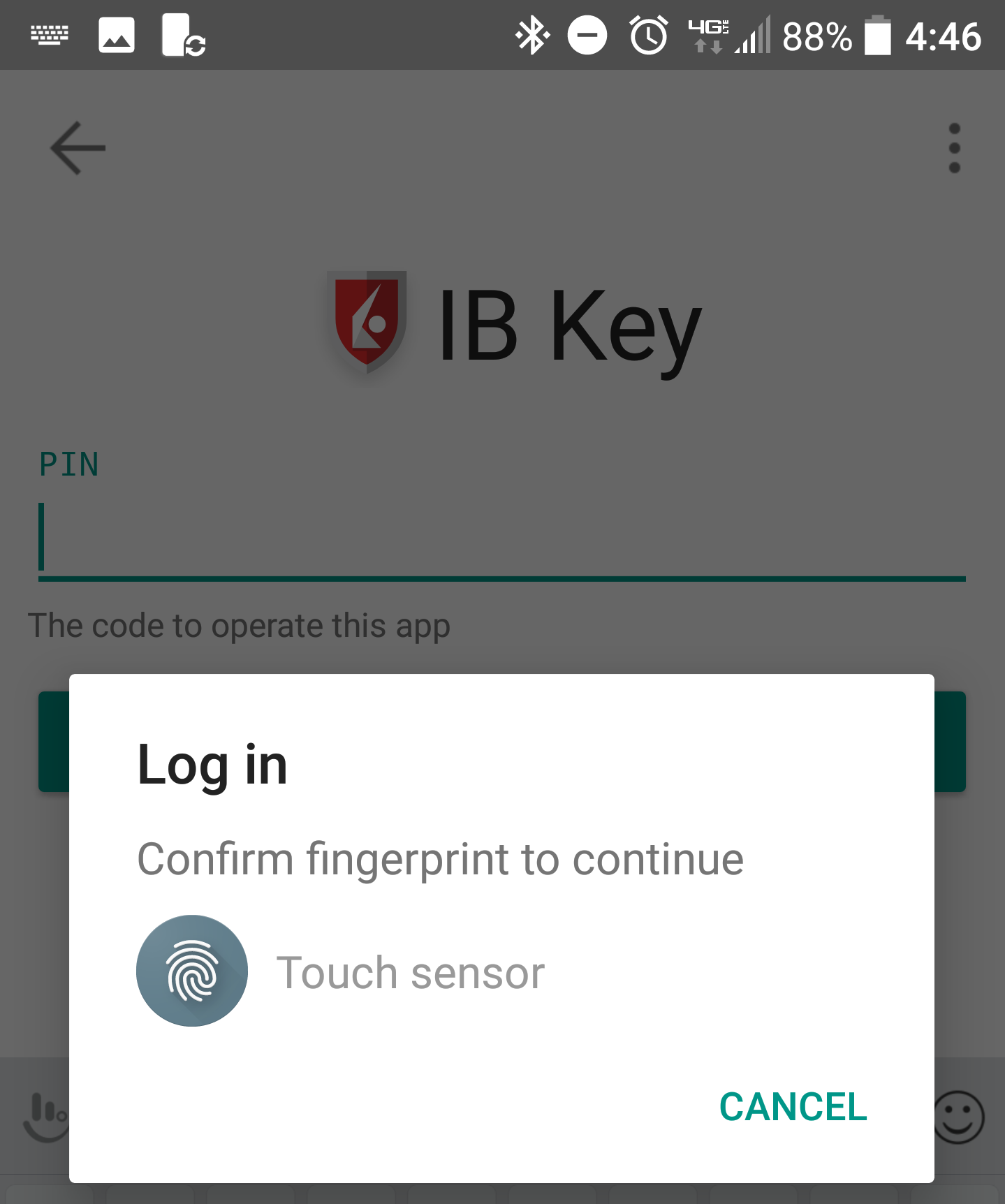

3) The IBKR Mobile Authentication (IB Key) will open, prompting you for your fingerprint or your PIN, according to the hardware capabilities of your phone. Please provide the requested security element.

Figure 17. Figure 18.

4) If the authentication has succeeded, the trading platform or Client Portal login process will automatically move ahead to the next phases.

Figure 19.

What if I do not receive the notification?

If the notification does not reach your phone, it may be because notifications are disabled, no internet access is available or you have a poor, unstable connection. In these cases the seamless authentication may not be available but you can still use the manual Challenge/Response authentication method as described below:

1) On your trading platform or Client Portal login screen, click the link "Click here if you do not receive the notification" .

Figure 20.

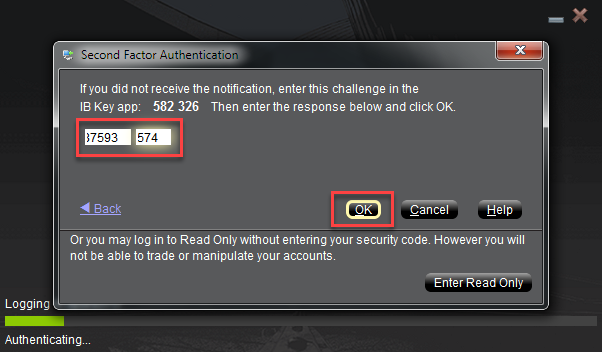

2) A Challenge code will be displayed on the screen.

Figure 21.

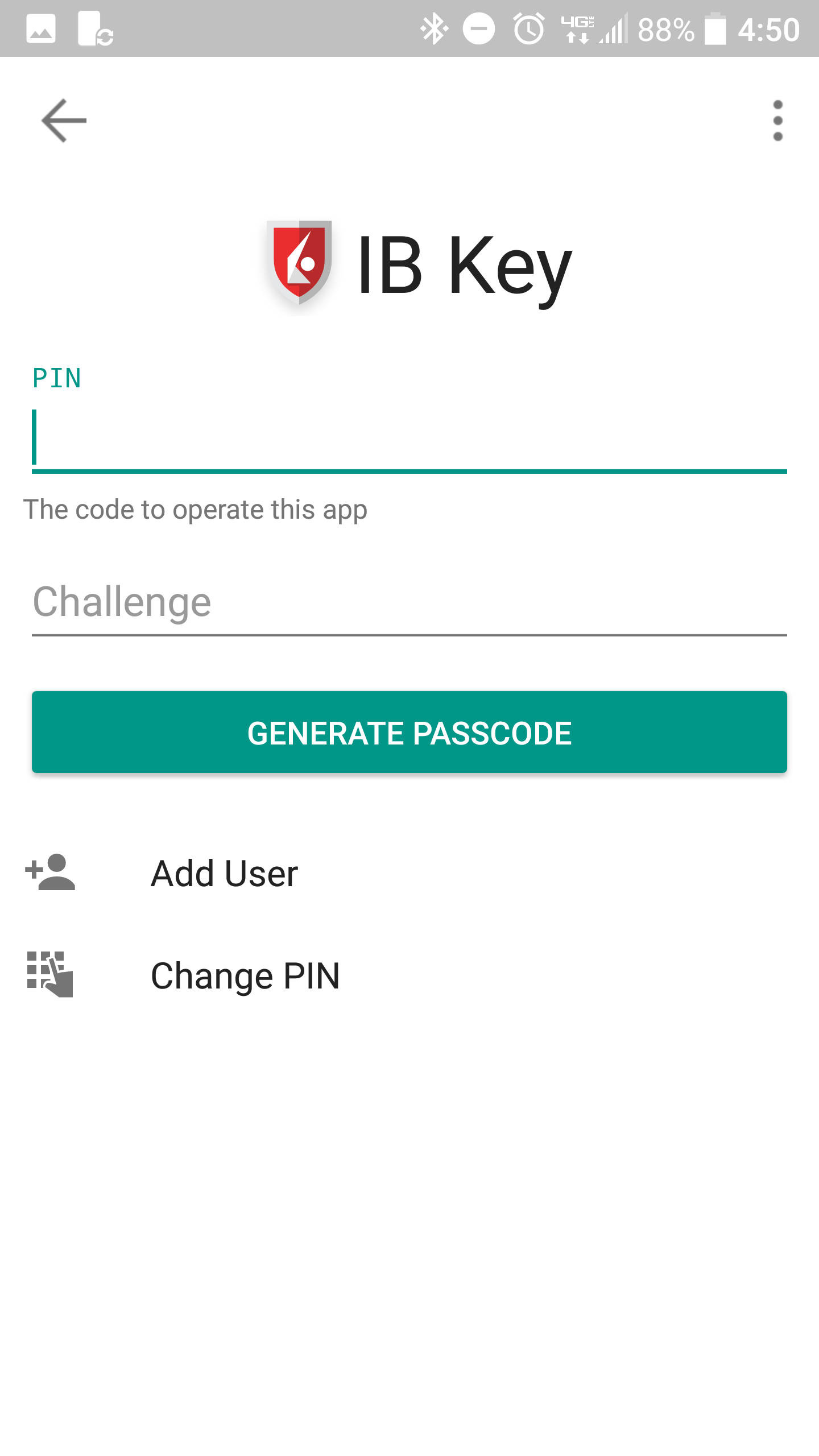

3) Launch the IBKR Mobile app on your Smartphone, select Authenticate (if necessary), enter your PIN and the Challenge code you obtained in the previous step. Tap Generate Passcode.

Figure 22. Figure 23.

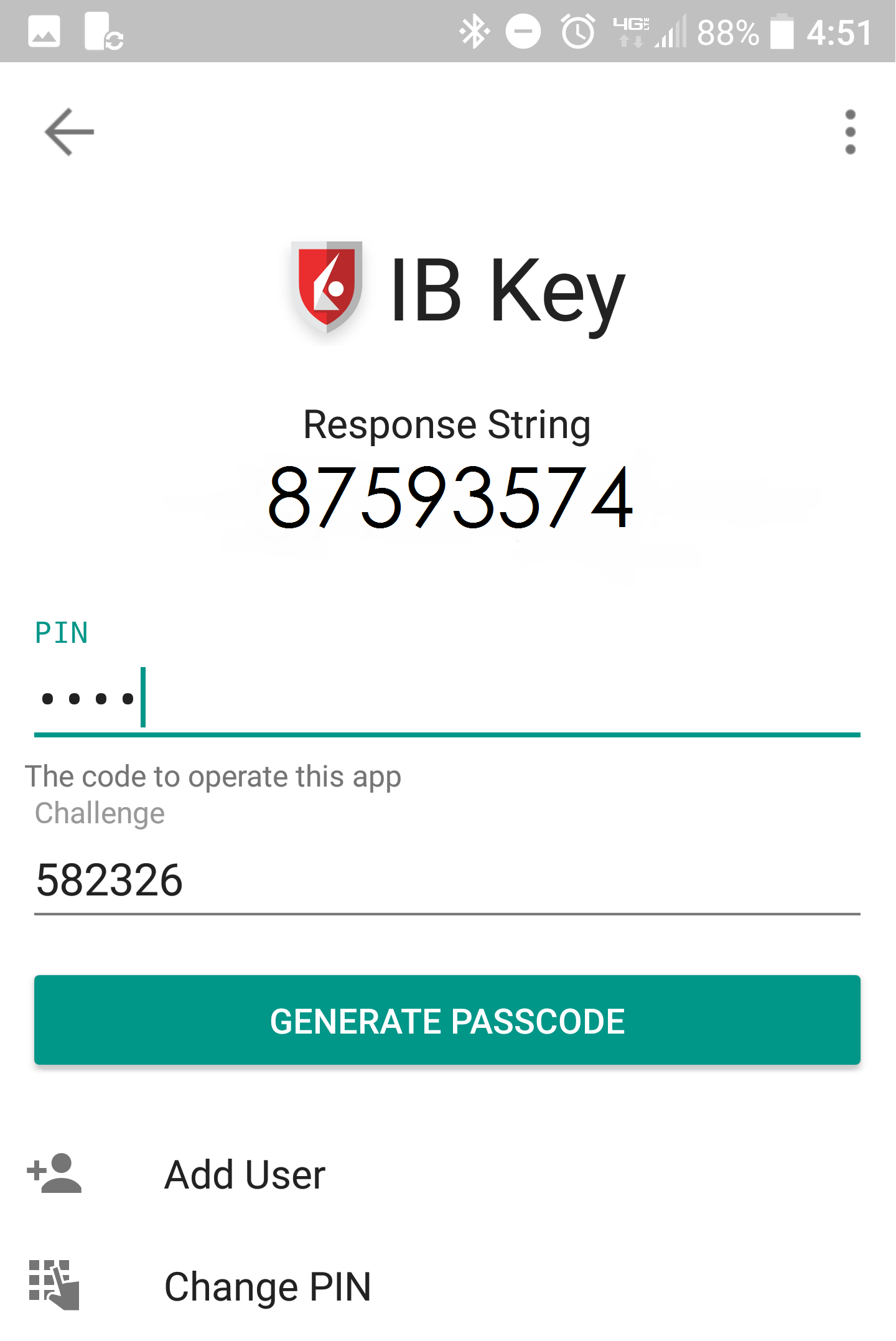

4) A Response String will be displayed.

Figure 24.

5) Enter the Response String into your trading platform or Client Portal login screen. Then click OK.

Figure 25.

6) If the authentication has succeeded, the trading platform or Client Portal login process will automatically move ahead to the next phases.

Figure 26.

References:

- See KB2748 for instructions on how to recover IBKR Mobile Authentication (IB Key).

- See KB3234 for troubleshooting missing IBKR Mobile notifications

- See KB2745 for instructions on how to clear the cache for the IBKR Mobile app.

PIN Guidelines

Certain security devices used for accessing your IBKR account require the creation of a numeric or alphanumeric PIN code at the point of request or activation.

The PIN is intended as an additional layer of protection as it effectively prevents unauthorized individuals who may inadvertently come into possession of your device from operating it. It’s therefore important to select a PIN which you can easily remember, yet which is difficult for others to guess.

Outlined below are a series of guidelines or best practices to be taken into consideration when creating your PIN:

- Do not use your own date of birth

- Do not use the date of birth of your children or any other immediate family member

- Do not use parts of your personal or business address, such as street name and number, ZIP and/or Postal Code

- Do not use any part of your Citizen ID (such as SSN or ID document number)

- Do not use phone numbers

For the non-numeric part of the PIN, avoid using:

- Your, your family's or relatives initials, the name of your city or of sports teams

- Your, your family's or relatives first and/or last names

We recommend including lower and upper case letters and numbers.

A common way to construct a memorable PIN that corresponds to those requirements is to construct a sentence and then use the first letters of its words.

IBKR Mobile Authentication (IB Key)

Table of contents

Introduction

The security of your assets and personal information is of utmost concern to IBKR and we are committed to taking the steps necessary to make certain that you are protected from the moment you open your account. A key component of protection is the Secure Login System (SLS), a login process which relies upon Two-Factor Authentication to prevent anyone from accessing or using your account, even if they know your User Name and password. Once SLS enrolled, your account can only be accessed through use of 2 security factors: 1) something you know (entry of your User Name and password combination); and 2) something you have (entry of a random code generated from a physical security device or Smartphone application).

IBKR offers a variety of SLS devices, with the technical design of each corresponding to the level of assets maintained (see KB1131). The following article provides an overview of the IBKR Mobile Authentication (IB Key), a Two-Factor security solution which can be enabled directly onto your Smartphone.

Benefits

IBKR Mobile Authentication (IB Key) is available on your Smartphone via our IBKR Mobile app and can function as a security device, thereby eliminating the need to carry a separate physical device when logging into your IBKR account. In addition to the convenience of using a device which is trusted and routinely accessible, this app can be downloaded and activated in minutes, thereby eliminating the delays associated with the mailing of physical devices. Moreover, unlike in the case of physical devices, clients maintaining multiple accounts with distinct User Names may access IBKR Mobile Authentication (IB Key) all from the same IBKR Mobile app. Please refer to KB2879 for more details.

Back to top

Installation, Activation, and Operation

IBKR Mobile Authentication (IB Key) is currently supported on smartphones that use either Android or iOS operating system and can install IBKR Mobile. Installation, activation, and operating instructions can be found at the following links:

PLEASE NOTE: Disabling and replacing any security device, including IBKR Mobile Authentication (IB Key), is subject to conditions. Please contact Client Services for assistance in this process.

Back to top

FAQ

If you have forgotten your PIN, please uninstall and reinstall the IBKR Mobile app on your smartphone. Launch the app. When you are prompted to perform the recovery, reject by answering "No". Tap on "Register Two-Factor", reject again the recovery by answering "No". Then proceed with the activation, following the on-screen instructions. Please notice you would need to have access to the mobile phone number you originally used for the IBKR Mobile Authentication (IB Key) activation, since IBKR will send the Activation SMS to that number.

If you have lost your phone and require that the IBKR Mobile Authentication (IB Key) be disabled, please contact Client Services at one of the numbers found here.

Some countries, most notably India, provide national "Do Not Call" or "Do Not Disturb" services to prevent telemarketing to mobile numbers. If you have an Indian phone number, or have explicitly requested your phone carrier to exclude you from public lists, you might need to contact your wireless carrier, and ask them for your account to be configured appropriately in order to receive SMS messages from Interactive Brokers.

Please note that the required steps will vary by country and mobile phone provider. It is best to contact your mobile phone provider if you have any questions regarding such "Do Not Disturb" services.

Your PIN can be alphanumeric and can contain special characters. Please click here for details on PIN guidelines.

Only ONE phone/device can be active at a time for use with your username.

○ IBKR Mobile Authentication (IB Key) requires an Internet connection ONLY during the Enable User process

○ Android version 6.0 or higher.

○ iOS version 13.0 or higher.

[1] Restrictions for some specialized Institutional Account types may apply.

[2] Without a working data connection (WiFi or cellular), IBKR Mobile Authentication will not receive the login notification message but can still be operated in Challenge-Response mode. Refer to KB2277 (Android) or KB2278 (iOS) for detailed instructions on how to use IBKR Mobile Authentication (IB Key) in both available modes.

Welcome to Interactive Brokers

Now that your account is funded and approved you can start trading. The information below will help you getting

started as a new customer of Interactive Brokers.

- Your Money

- Configure your account to trade

- How to trade

- Trade all over the World

- Five points to enrich your IB experience

1. Your Money

Deposits & Withdrawals General Info. All transactions are administered through your secure Account Management

Deposits

First, you create a deposit notification through your Account Management > Funding > Fund Transfers > Transaction Type: “Deposit” How to create a deposit notification. The second step is to instruct your Bank to do the wire transfer with the bank details provided in your Deposit Notification.

Withdrawals

Create a withdrawal instruction via your secure Account Management > Funding > Fund Transfers > Transaction Type: "Withdrawals" How to create a withdrawal instruction

If you instruct a withdrawal over the Withdrawal limits, it will be considered an exceptional withdrawal and we will therefore need to match bank account holder and IB account. If destination bank account has been used for a deposit, withdrawal will be processed; otherwise, you must contact customer service and provide the documents needed.

Troubleshooting

Deposits: My bank sent the money but I do not see it credited into my IB account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) A Deposit Notification is missing. You have to create it via your Account Management and send a ticket to Customer Service

c) Amending details are missing. Your name or IB account number is missing in the transfer details. You have to contact your bank and ask for the full amending details.

d) ACH initiated by IB is limited to 100k USD in a 7 business period. If you opened a Portfolio Margin account where the initial requirement is 110k, a wire deposit might be the better deposit option to reduce wait time for your first trade. If selecting ACH a wait time of almost 2 weeks or a temporary downgrade to RegT can be possible solutions.

Withdrawals: I have requested a withdrawal but I do not see the money credited to my bank account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) Rejected. Over the max it can be withdrawn. Please check your account cash balance. Note that for regulatory requirements, when the funds are deposited, there is a 3 day holding period before they can be withdrawn.

c) Your bank returned the funds. Probably because receiving bank account and remitting bank account names do not match.

2. Configure your account to trade

Difference between Cash and Margin accounts: If you have chosen the FastTrack application, by default your account type is a cash account with US stock permission. If you would like to get leverage and trade on margin, here how to upgrade to a RegT Margin account

Trading Permissions

In order to be able to trade a particular asset class in a particular country, you need to get the trading permission for it via your Account Management. Please note that trading permissions are free. You might however be asked to sign risk

disclosures required by local regulatory authorities. How to Request Trading Permissions

Market Data

If you want to have market data in real-time for a particular product/exchange, you need to subscribe to a market data package charged by the exchange. How to subscribe to Market data

The Market data assistant will help you choose the right package. Please watch this Video explaining how it works.

Customers have the option to receive delayed market data for free by clicking the Free Delayed Data button from a non-subscribed ticker row.

Advisor Accounts

Have a look at the user guide getting started as advisors. Here you see how to create additional users to your advisor account and grant them access and much more.

3. How to trade

The Trader's University is the place to go when you want to learn how to use our Platforms. Here you will find our webinars, live and recorded in 10 languages and tours and documentation about our various Trading Platforms.

Trader Workstation (TWS)

Traders who require more sophisticated trading tools can use our market maker-designed Trader Workstation (TWS), which optimizes your trading speed and efficiency with an easy-to-use spreadsheet interface, support for more than 60 order types, task-specific trading tools for all trading styles, and real-time account balance and activity monitoring. Try the two models

TWS Mosaic: for intuitive usability, easy trading access, order management, watchlist, charts all in one window or

TWS Classic: the Advanced Order Management for traders who need more advanced tools and algos.

General Description and Information / Quick start guide / Usersguide

Interactive Tours: TWS Basics / TWS configuration / TWS Mosaic

How to place a trade: Video Classic TWS / Video Mosaic

Trading tools: General Description and Information / Users guide

Requirements: How to install Java for Windows / How to install Java for MAC / Port 4000 and 4001 needs to be open

Login TWS / Download TWS

WebTrader

Traders who prefer a clean and simple interface can use our HTML-based WebTrader, which makes it easy to view market data, submit orders, and monitor your account and executions. Use the latest WebTrader from every browser

Quick Start Guide / WebTrader User's Guide

Introduction: Video WebTrader

How to place a Trade: Video WebTrader

Login WebTrader

MobileTrader

Our mobile solutions allow you to trade your IB account on the go. The mobileTWS for iOS and the mobileTWS for BlackBerry are custom-designed for these popular models, while the generic MobileTrader supports most other Smart phones.

General Description and Information

Order Types Order Types available and Description / Videos / Tour / Users guide

Paper Trading General Description and Information / How to get a Paper Trading Account

Once your paper account is created, you can share the market data of your real account with your paper trading account: Account Management > Manage Account > Settings > Paper trading

4. Trade all over the World

IB accounts are multi-currency accounts. Your account can hold different currencies at the same time, this allows you to trade multiple products around the world from a single account.

Base Currency

Your base currency determines the currency of translation for your statements and the currency used for determining margin requirements. Base currency is determined when you open an account. Customers may change their base currency at any time through Account Management.

We do not automatically convert currencies into your Base currency

Currency conversions must be done manually by the customer. In this video you can learn how to do a currency conversion.

In order to open a position denominated in a currency that you do not have in your account, you have two possibilities:

A) Currency conversion.

B) IB Margin Loan. (Not available for Cash Accounts)

Please see this course explaining the mechanics of a foreign transaction.

5. Five points to enrich your IB experience

1. Contract Search

Here you will find all our products, symbols and specifications.

2. IB Knowledge Base

The Knowledge Base is a repository of glossary terms, how-to articles, troubleshooting tips and guidelines designed to assist IB customers with the management of their IB accounts. Just enter in the search button what you are looking for and you will get the answer.

3. Account Management

As our trading platforms give you access to the markets, the Account Management grants you access to your IB account. Use Account Management to manage account-related tasks such as depositing or withdrawing funds, viewing your statements, modifying market data and news subscriptions, changing your trading permissions, and verifying or changing your personal information.

Log In Account Management / AM Quick Start Guide / AM Users Guide

4. Secure Login System

To provide you with the highest level of online security, Interactive Brokers has implemented a Secure Login System (SLS) through which access to your account is subject to two-factor authentication. Two-factor authentication serves to confirm your identity at the point of login using two security factors: 1) Something you know (your username and password combination); and 2) Something you have (an IB issued security device which generates a random, single-use security code). As both knowledge of your username/password and physical possession of the security device are required to login to your account, participation in the Secure Login System virtually eliminates the possibility of anyone other than you accessing your account.

How to Activate your Security Device / How to Obtain a Security Code Card / How to return Security device

In case you forgot your password or lost your security code card, please call us for immediate assistance.

5. Statements and Reports

Easy to view and customize, our statements and reports cover all aspects of your Interactive Brokers account. How to view an Activity Statement

有关客户资产保护的信息

下列信息适用于非美国指数期权、场外(OTC)差价合约(CFD)及非美国指数期货(与非美国指数期权相结合时)的交易

盈透证券(英国)有限公司

客户资产

盈透证券(英国)有限公司("IBUK")由金融市场行为监管局(FCA)授权并规管,注册号码208159。IBUK是由盈透证券集团(IBG LLC)全资拥有的子公司。IBUK按照FCA客户资产规则"CASS"提供客户资金与客户资产服务。

客户资金受到下列保护:

客户资金规则适用于所有在从事金融工具市场法规(MiFID)业务及/或指定投资业务的过程中从客户处收取资金,或持有客户资金的规管公司。

客户资金与IBUK自有资金完全分离。如果出现授权公司破产的情况,在分离账户中持有的客户资金将被归还给客户而不是被债权人看做可收回资产。如果出现差额,客户可能有资格向金融服务补偿计划("FSCS")要求补偿。

客户资金圈定在独立银行账户中,以信托形式在客户名义下持有。这些账户分散在多家具有投资等级评级的银行中,以避免一家机构的风险集中性。IBUK选择并指定持有客户资金的银行时会考虑银行的专业性、市场声誉、财务状况及任何可能对客户权利有负面影响的有关客户资金持有的法律要求及市场惯例。

IBUK仅在以下情况下允许交易所、清算所或中介经纪商在客户交易账户中持有客户资金:向其转账资金是用于交易或用于满足客户提供交易抵押的义务。

IBUK每天对在客户资金银行账户及客户交易账户中持有的客户资金及其对客户的负债作详细的对账,确保客户资金被恰当隔离,且足够满足FCA的CASS规则要求的所有债务。所有计入这些银行账户的资金公司均作为受托人持有(或者如果相关,作为代理)。

FCA规则还要求IBUK维持CASS决议,以确保万一公司发生清算的情况下,破产管理人能够查找信息以便向公司客户及时归还客户资金及资产。

金融服务补偿计划

盈透证券(英国)有限公司("IBUK")是由金融市场行为监管局("FCA")授权并规管的投资公司,以及金融服务补偿计划("FSCS")成员。按照FCA补偿规则,某些合格客户有资格获得补偿。

有关合格性的要点为:

- FSCS仅在授权公司欠款的情况下才向合格申请人支付赔偿并将调查是否存在该事实。

- FSCS仅赔偿财务损失,对U.K.投资公司的限制在下面列出。

- FSCS的设立主要为了帮助个人,尽管小型公司也包括在内。

- 大型公司通常排除在外。

投资

如果授权投资公司无法满足索赔,则FSCS提供保护——例如,如果一家授权投资公司破产,不能将资产返还给其客户。FSCS授权投资公司归类为投资的资产包括股票与股份、期货、期权、CFD及其他由客户投入的规管金融工具及资金。

赔偿限制

您收到的实际赔偿水平将基于您的索赔。FSCS仅支付金融损失赔偿。赔偿限制限各授权公司,各个人。

当前对投资的最高赔偿水平为各公司各人5万英镑(向从2010年一月1日起被宣布欠款的公司提出的索赔)。赔偿水平可能变化,要获取最新详情请见FSCS网站://www.fscs.org.uk / 。

下列信息适用于所有曾经或继续通过IB LLC交易所有产品(除金属及OTC CFD)的客户。

盈透证券有限公司("IBLLC")

客户资产

客户资产隔离在指定给IBLLC客户的专用特殊银行或托管账户中。该保护(SEC称为“储备”,CFTC称为“隔离”)是证券和商品经纪的核心原则。通过妥善分离客户资产,如果客户没有借入资金或股票,且未持有期货头寸,那么倘若经纪商违约或破产,客户资产可以返还给客户。

无借贷现金或证券的证券账户

证券客户资金保护如下:

- 一部分存在14家大型美国银行的IBLLC客户专用特殊储备账户中。这些存款分布在多家具投资等级评级的银行,以避免任何单个机构带来的集中风险。每间银行持有的资金不超过IBLLC所持客户资产的5%。

- 一部分投资于美国国债,包括直接投资短期国债和以美国国债作为抵押的反向回购协议。这些交易与第三方进行并通过中央对手方清算所(固定收益结算公司,即 “FICC”)担保。抵押为IBLLC所有并存放在托管银行客户专用的隔离储备保管账户。美国国债也可质押给清算所用以支持客户所持证券期权头寸的保证金要求。

- 客户现金在储备账户中以净值为基础,反映超出客户借方余额的净贷方余额。已达到任一客户在IBLLC有保证金借贷,该借贷都有价值借贷额度200%的股票进行担保的程度。

- 目前美国证券交易委员会(SEC)要求经纪交易商至少每周对客户的资金和证券进行详细核对(也称为“储备计算”),以确保客户的资金准确地与经纪交易商的基金分离。

客户拥有的、全额支付的证券在明确认定的客户专用存管和托管账户中受到保护。IBLLC每日核对客户拥有的证券头寸,确保存管和托管机构已收到这些证券。

商品账户

商品客户资金保护如下:

- 一部分质押给期货清算所用以支持客户所持期货及期货期权头寸的保证金要求,或在确定为用于隔离IB客户资金的托管账户中持有。

- 一部分存放在确定为隔离IBLLC客户资金的商品清算银行/经纪商账户中,以支持客户保证金要求。

- 按商品法规定,客户资金受到实时保护。IBLLC每日对客户资产进行详细核对,以确保客户资金被恰当分离。计算结果每日提交给监管机构。

有保证金借贷的证券账户

向IBLLC借款买入证券的客户,证券法规允许IBLLC最高抵押或借入价值借贷价值140%的股票。通常,IBLLC借出其获许借出股票总数中的一小部分。

- 例如,在2011年6月30日,IBLLC从保证金客户提供的130亿美元股票中借出8亿美元。

- 当IBLLC借出客户的股票时,必须将额外资金存入指定储备账户,为客户设置预留金额。在上面的例子中,借出的客户股票的总价值8亿美元隔离在特殊储备金账户中。

账户保护

IBLLC客户证券账户受到证券投资人保护公司("SIPC")最高达50万美元(现金额度25万美元)的保护,且根据IBLLC与伦敦劳埃德保险公司 (Lloyd's of London)承销商协定的超SIPC赔额政策,证券账户还享有额外最高达3000万美元(现金额度90万美元)的保护,总限额一亿五千万。期货、期货期权不包含在内。与所有证券公司相同,此类保险在经纪交易商倒闭时为客户提供保护,而不是针对证券市场价值的损失。

出于确定客户账户的目的,有相似的名字和名称的账户被合并在一起(例如:John和Jane Smith与Jane和John Smith),但名称不同的账户不合并(例如:个人/John Smith和个人退休账户/John Smith)。

SIPC是一个非盈利性质,由SIPC成员经纪交易商集资的成员性质的公司。查看关于SIPC的更多信息和常见问题解答(例如SIPC怎样运作,什么受到保护,怎样索赔,等等),请参见以下网站:

http://www.finra.org/InvestorInformation/InvestorProtection/SIPCProtecti...

或联系SIPC,地址如下:

Securities Investor Protection Corporation

805 15th Street, N.W. - Suite 800

Washington, D.C. 20005-2215

电话:(202) 371-8300

传真:(202) 371-6728

Information Relating to Customer Protection of Assets

The below information applies to trading of non-US index options, OTC CFDs and non-US index futures (when combined with non-US index options)

Interactive Brokers (U.K.) Limited

Customer Assets

Interactive Brokers (U.K.) Limited (“IBUK)’’ is authorised and regulated by the Financial Conduct Authority (“FCA“), register no. 208159. IBUK is a wholly owned subsidiary of Interactive Brokers Group (IBG LLC). IBUK provides client money and client asset services in accordance with FCA Client Assets regulations “CASS”.

Client money is protected as follows:

Client money rules apply to all regulated firms that receive money from a client, or hold money for a client in the course of carrying out MiFID business and/or designated investment business.

Client money is entirely segregated from IBUK’s own money. In the event of a failure of an authorised firm, clients’ monies held in the segregated accounts will be returned to the clients rather than being treated as a recoverable asset by general creditors. If there was a shortfall, the client may be eligible to claim for compensation from the Financial Services Compensation Scheme (“FSCS”).

Client money is ring-fenced in separate bank accounts which are held in trust on behalf of the clients. These accounts are distributed across a number of banks with investment grade ratings to avoid a concentration risk with any single institution. When IBUK makes the selection and appointment of a bank to hold client money, it takes into account the expertise and market reputation of the bank, its financial standing and any legal requirements or market practices related to the holding of client money that could adversely affect clients' rights.

IBUK will allow client money to be held in a client transaction account by an exchange, a clearing house or an intermediate broker but only if the money is transferred to them for the purpose of a transaction or to meet a client’s obligation to provide collateral for a transaction.

Each day, IBUK performs a detailed reconciliation of client money held in client money bank accounts and client transaction accounts and its liabilities to its clients to ensure that client monies are properly segregated and sufficient to meet all liabilities in accordance with the FCA’s CASS rules. All monies credited to such bank accounts are held by the firm as trustee (or if relevant, as agent).

FCA regulations also require IBUK to maintain a CASS Resolution Pack to ensure that in the unlikely event of the firm's liquidation, the Insolvency Practitioner is able to retrieve information with a view to returning client money and assets to the firm's clients on a timely basis.

Financial Services Compensation scheme

Interactive Brokers (U.K.) Limited (“IBUK”) is authorised and regulated by the Financial Conduct Authority (“FCA”) as an investment firm and a participant in the Financial Services Compensation scheme (“FSCS”). Certain eligible clients qualify for

compensation under the FCA Compensation rules.

The main points relating to eligibility are:

- FSCS pays compensation only to eligible claimants when an authorised firm is in default and will carry out an investigation to establish whether or not this is the case.

- FSCS pays compensation only for financial loss and the limits for U.K. Investment firms are covered below.

- The FSCS was set up mainly to assist private individuals, although smaller businesses are also covered.

- Larger businesses are generally excluded.

Investments

FSCS provides protection if an authorised investment firm is unable to pay claims against it e.g. when an authorised investment firm goes out of business and cannot return assets to its clients. Assets classified as investments for authorised investment firms under the FSCS include stocks and shares, futures, options, cfds, other regulated instruments and money deposited by clients.

Compensation Limits

The actual level of compensation you receive will depend on the basis of your claim. The FSCS only pays compensation for financial loss. Compensation limits are per person per authorised firm. Compensation levels are subject to change and for current details please refer to the FSCS website at http://www.fscs.org.uk / .

The below information applies to customers who were or are continuing to trade all products (except metals and OTC CFDs) through IB LLC.

Interactive Brokers LLC (“IBLLC”)

Customer Assets

Customer money is segregated in special bank or custody accounts, which are designated for the exclusive benefit of customers of IBLLC. This protection (the SEC term is “reserve” and the CFTC term is “segregation”) is a core principle of securities and commodities brokerage. By properly segregating the customer's assets, if no money or stock is borrowed and no futures positions are held by the customer, then the customer's assets are available to be returned to the customer in the event of a default by or bankruptcy of the broker.

Securities accounts with no borrowing of cash or securities

Securities customer money is protected as follows:

- A portion is deposited at 14 large U.S. banks in special reserve accounts for the exclusive benefit of IBLLC's customers. These deposits are distributed across a number of banks with investment-grade ratings so that we can avoid a concentration risk with any single institution. No single bank holds more than 5% of total customer funds held by IBLLC.

- A portion may be invested in U.S. Treasury securities, including direct investments in short-term Treasury bills and reverse repurchase agreements, where the collateral received is in the form of U.S. Treasury securities. These transactions are conducted with third parties and guaranteed through a central counterparty clearing house (Fixed Income Clearing Corp., or “FICC”). The collateral remains in the possession of IBLLC and held at a custody bank in a segregated Special Custody Account for the exclusive benefit of customers. U.S. Treasury securities may also be pledged to a clearing house to support customer margin requirements on securities options positions.

- Customer cash is maintained on a net basis in the reserve accounts, which reflects the net credit balances of customers in excess of customer debit balances. To the extent any one customer maintains a margin loan with IBLLC, that loan will be fully secured by stock valued at up to 200% of the loan.

- Current SEC regulations require broker-dealers to perform a detailed reconciliation of customer money and securities (known as the “reserve computation”) at least weekly to ensure that customer monies are properly segregated from the broker-dealer's own funds.

Customer-owned, fully-paid securities are protected in accounts at depositories and custodians that are specifically identified for the exclusive benefit of customers. IBLLC reconciles positions in securities owned by customers daily to ensure that these securities have been received at the depositories and custodians

Commodities accounts

Commodities customer money is protected as follows:

- A portion is pledged to futures clearing houses to support customer margin requirements on futures and options on futures positions or held in custody accounts identified as segregated for the benefit of IB's customers.

- A portion is held at commodities clearing banks/brokers in accounts identified as segregated for the benefit of IBLLC customers to support customer margin requirements.

- Cash in commodities accounts is protected in accordance with US commodities regulations. CFTC rules prohibit an FCM from commingling customer funds with its own money, securities or property. Customer funds must be separately accounted for and segregated as belonging to commodity or option customers. The titles of accounts in which customer funds are deposited must clearly indicate this and show that the funds are segregated as required by the Commodity Exchange Act (“CEA”) and CFTC Rules. Customer funds may not be obligated to anyone except to purchase, margin, guarantee, secure, transfer, adjust or settle trades, contracts or commodity option transactions of commodity or option customers. These requirements also extend to U.S. customers trading on foreign exchanges.

Securities accounts with margin loans

For customers who borrow money from IBLLC to purchase securities, IBLLC is permitted by securities regulations to pledge or borrow stock valued at up to 140% of the value of the loan. Typically, IBLLC lends out a small portion of the total stock it is permitted to lend out.

- As an example, at June 30, 2011, IBLLC lent $800 million value of customers' stock out of the $13.0 billion made available to it by margin customers.

- When IBLLC lends customers' stock, it must put additional money into the special reserve accounts for the exclusive benefit of customers. In the example above, the full value of $800 million of customer stock that was lent was segregated in the special reserve accounts.

Account Protection

Customer securities accounts at IBLLC are protected by the Securities Investor Protection Corporation (“SIPC”) for a maximum coverage of $500,000 (with a cash sublimit of $250,000) and under IBLLC's excess SIPC policy with certain underwriters at Lloyd's of London for up to an additional $30 million (with a cash sublimit of $900,000) subject to an aggregate limit of $150 million. Futures, and options on futures are not covered. As with all securities firms, this coverage provides protection against failure of a broker-dealer, not against loss of market value of securities.

For the purpose of determining a customer account, accounts with like names and titles (e.g. John and Jane Smith and Jane and John Smith) are combined, but accounts with different titles are not (e.g. Individual/John Smith and IRA/John Smith).

SIPC is a non-profit, membership corporation funded by broker-dealers that are members of SIPC. For more information about SIPC and answers to frequently asked questions (such as how SIPC works, what is protected, how to file a claim, etc.), please refer to the following websites:

http://www.finra.org/InvestorInformation/InvestorProtection/SIPCProtecti...

or contact SIPC at:

Securities Investor Protection Corporation

805 15th Street, N.W. - Suite 800

Washington, D.C. 20005-2215

Telephone: (202) 371-8300

Facsimile: (202) 371-6728

How to send documents to IBKR using your smartphone

Interactive Brokers allows you to send us a copy of a document even if you do not currently have access to a scanner. You can take a picture of the requested document with your smartphone.

Below you will find the instructions on how to take a picture and send it per email to Interactive Brokers with the following smartphone operating systems:

If you already know how to take and send pictures per email using your smartphone, please click HERE - Where to send the email to and what to include in the subject.

iOS

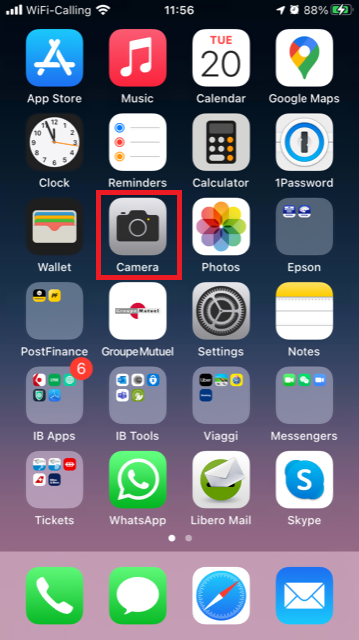

1. Swipe up from the bottom of your smartphone screen and tap the camera icon.

If you do not have the Camera icon, you can tap the Camera app icon from the home screen of your iPhone.

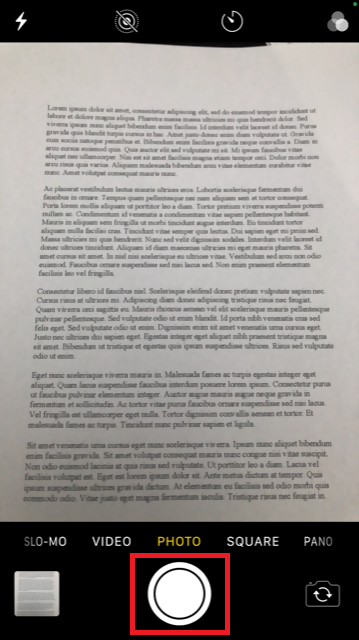

Normally your phone should now activate the rear camera. If it activates the front one, tap the camera switch button.

2. Place your iPhone above the document and frame the desired portion or page of the document.

3. Make sure to have uniform, sufficient lighting and not to cast any shadow on the document due to your position. Hold the smartphone firmly with your hand/s and avoid shaking. Tap on the shutter button to take the photo.

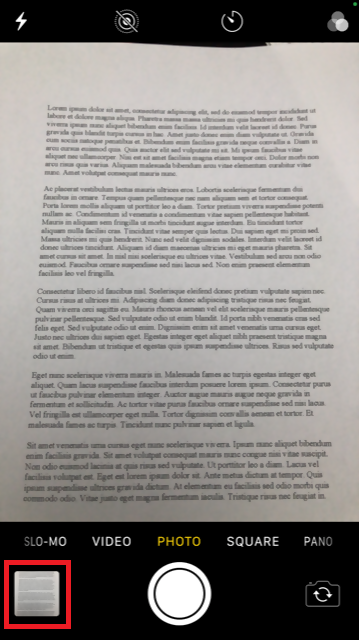

4. Tap the thumbnail image in the lower left-hand corner to access the picture you have just taken.

5. Make sure that the picture is clear and the document is well legible. You can enlarge the picture and see it in detail by swiping apart two fingers on the picture itself.

If the picture does not present a good quality or lighting, please repeat the previous steps in order to take a sharper one.

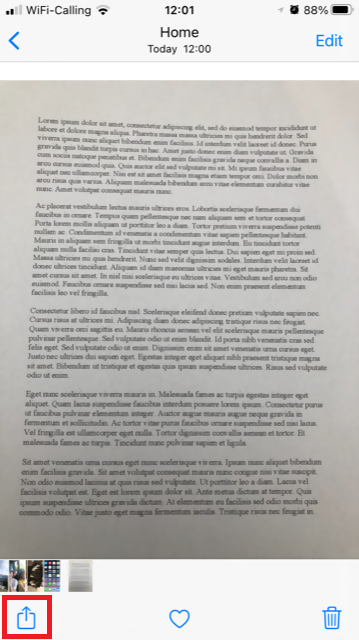

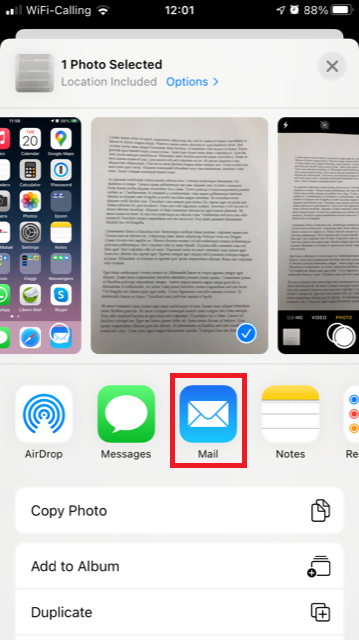

6. Tap the share icon in the lower left-hand corner of the screen.

7. Tap the Mail icon.

Note: to send emails your phone has to be configured for that. Please contact your email provider if you are not familiar with this procedure.

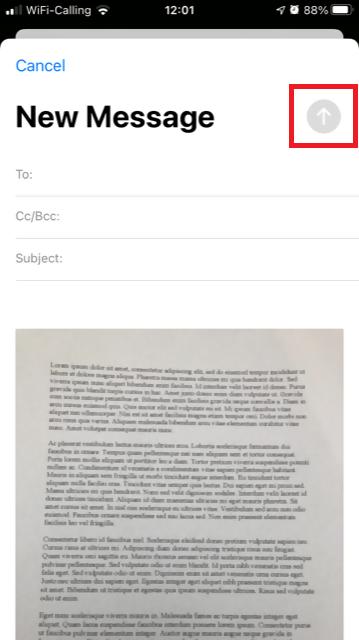

8. Please see HERE how to populate the To: and Subject: fields of your email. Once the email is ready, tap the up arrow icon on the top right to send it.

Android

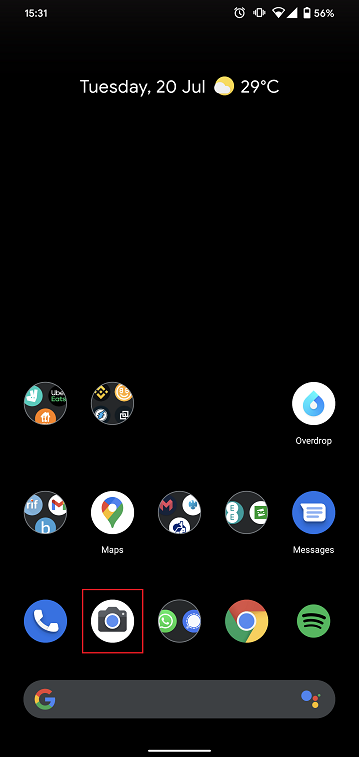

1. Open your applications list and start the Camera app. Alternatively start it from your Home screen. Depending on your phone model, maker or setup, the app might be called differently.

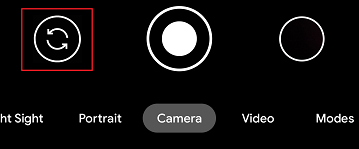

Normally your phone should now activate the rear camera. If it activates the front one, tap the camera switch button.

2. Place your Android above the document and frame the desired portion or page of the document.

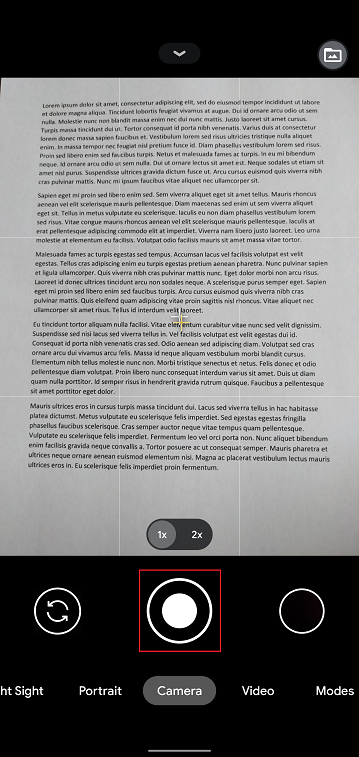

3. Make sure to have uniform, sufficient lighting and not to cast any shadow on the document due to your position. Hold the smartphone firmly with your hand/s and avoid shaking. Tap on the shutter button to take the photo.

4. Make sure that the picture is clear and the document is well legible. You can enlarge the picture and see it in detail by swiping apart two fingers on the picture itself.

If the picture does not present a good quality or lighting, please repeat the previous steps in order to take a sharper one.

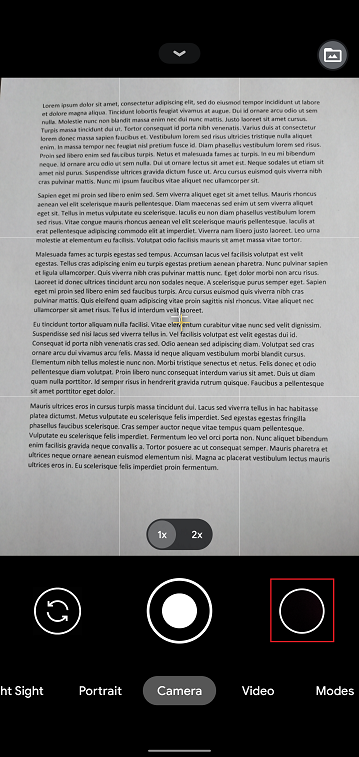

5. Tap the empty circle icon in the lower right-hand corner of the screen.

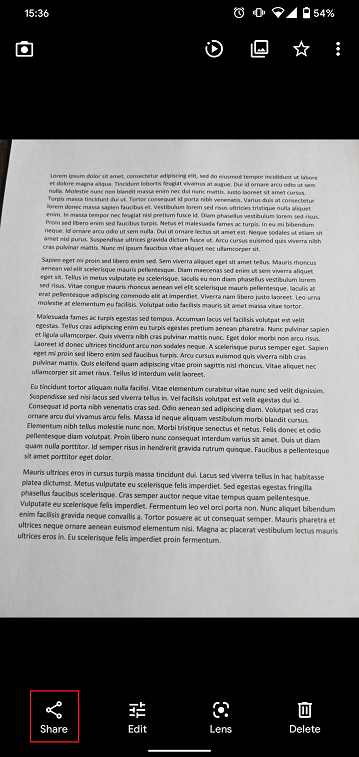

6. Tap the share icon in the lower left-hand corner of the screen.

7. In the sharing menu that will be displayed now tap the icon of the email client set up on your phone. In the example picture below, it is called Gmail but the name may vary according to your specific setup.

.png)

Note: to send emails your phone has to be configured for that. Please contact your email provider if you are not familiar with this procedure.

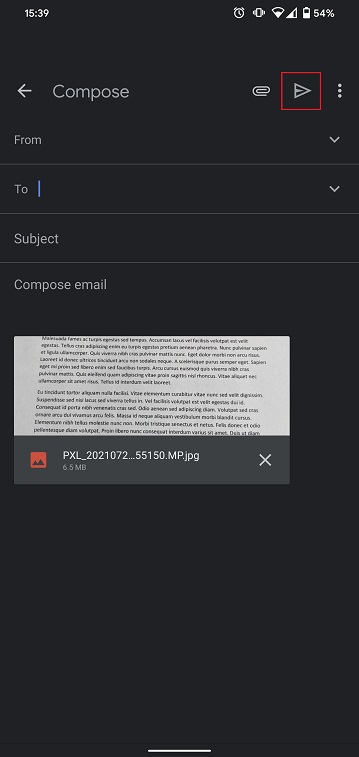

8. Please see HERE how to populate the To and Subject fields of your email. Once the email is ready, tap the airplane icon on the top right to send it.

WHERE TO SEND THE EMAIL AND WHAT TO INCLUDE IN THE SUBJECT

The email has to be created observing the below instructions:

1. In the field To: type:

- newaccounts@interactivebrokers.com if you are a resident of a non-European country

- newaccounts.uk@interactivebrokers.co.uk if you are a European resident

2. The Subject: field must contain all of the below:

- Your account number (it usually has the format Uxxxxxxx, where x are numbers) or your username

- The purpose of sending the document. Please use the below convention:

- PoRes for a proof of residential address

- PID for a proof of identity

如何申请替换数码安全卡+(DSC+)

进行下方操作需遵循以下步骤:

- 更换遗失、被盗或无法使用的数码安全卡+

- 持有当前安全设备的同时申请数码安全卡+(账户资产不低于100万美元)

1. 通知IBKR客户服务- 联系IBKR客户服务获取临时账户访问。此服务只可通过电话提供,并且需要核实账户持有人的身份,详情请见IBKR知识库。

2. 获取在线安全代码卡 - 激活在线安全代码卡,此卡可供您在21天内安全地访问客户端全部功能。如需相关指南,请参见IBKR知识库。

3. 申请替换DSC+ - 完成在线安全代码卡激活后,请前往客户端的安全登录系统界面,申请替换DSC。

申请DSC+

1. 点击请求实物设备按钮。

.png)

.png)

3. 为您的DSC+输入四位Soft PIN码1。请牢记输入的PIN码,之后激活和操作设备需要用到。 如需要,您可更改将暂扣20美元设备预备金的账户2。点击继续完成此步。

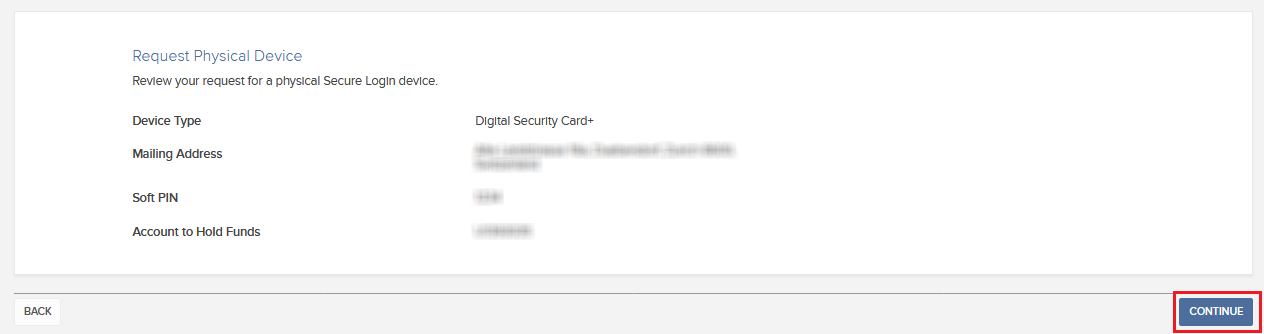

.png)

4. 系统将显示概览信息。请确保显示的信息均准确无误。如果需要修改,请点击页面底部的返回按钮(不是浏览器的返回按钮);如无需修改,请点击继续提交申请。

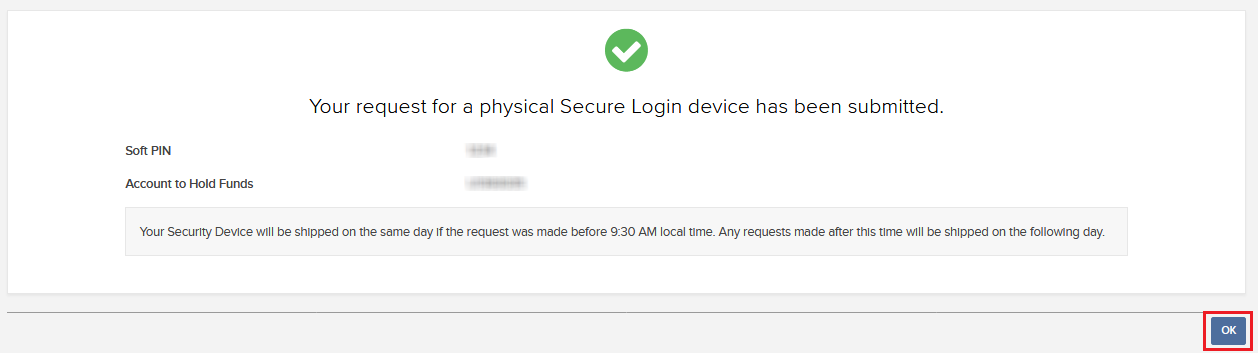

5. 您会看到最终的确认信息,其中会给出预估的寄件日期3。点击确定完成程序。

1. PIN码相关指南请参见IBKR知识库。

2. 安全设备和设备邮寄均为免费。 但是,在您申请设备时,我们会冻结您的一小笔资金(20美元)。 如果设备遗失、故意损坏、被盗或者如果您关闭账户时未能将设备退回IBKR,我们将扣除该笔资金以补偿硬件损失。任何其它情况下,在您将设备退回IBKR后,该笔资金便会解除冻结。更多信息请参见IBKR知识库。

3. 出于安全考虑,替换设备会在寄出之日起三周内自动激活。 临近自动激活时,IBKR会通知您。

IBKR知识库参考

- KB1131:安全登录系统概述

- KB2636:安全设备相关信息与程序

- KB2481:如何在多个使用者之间共享安全登录设备的说明

- KB2545:如何在退出后重新加入安全登录系统的说明

- KB975:如何将安全设备退回IBKR的说明

- KB2260:通过移动IBKR激活IB Key验证的说明

- KB2895:多重双因素系统(M2FS)

- KB1861:安全设备费用信息

- KB69:临时密码有效期的相关信息