How to Complete CFTC Form 40

Clients maintaining a U.S. futures or futures option position at a quantity exceeding the CFTC's reportable thresholds may be contacted directly by the CFTC file with a request that they complete a Form 40. Contact will generally be made via email and clients are encouraged to respond to such requests in a timely manner to avoid trading restrictions and/or fines imposed by CFTC upon their account at the FCM.

Completion of the Form requires the following steps:

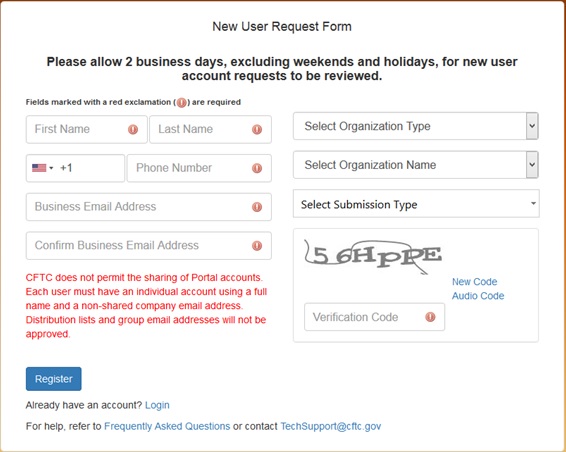

- Register for a CFTC Portal Account - performed online at: https://portal.cftc.gov/Account/Register.aspx Registration will require entry of the 9-digit code that the CFTC provided to you within the email requesting that you register. If you cannot locate your code or receive an invalid entry message, contact TechSupport@cftc.gov. When entering "Organization Type" from the drop-down selector, choose "LTR (Large Traders)".

2. Complete Form 40 - You will receive an email notification from the CFTC once your Portal Account has been approved. Note that this approval may take up to 2 business days from the date you complete the New User Request Form. The email will contain a link to the Portal where you will be prompted to log in: https://portal.cftc.gov/

Instructions for completing the form are available at: https://www.ecfr.gov/cgi-bin/text-idx?node=ap17.1.18_106.a

Note that Portal provides the opportunity to save a copy of your submission in XML format, a recommended step, as this allows for uploading the file to the Portal should you need to make modifications at a later date. This will eliminate the need to renter the form in its entirety.

The CFTC will send a confirmation email upon successful completion of your Form 40.

3. Confirm with IBKR - forward your confirmation email, or other evidence that you have submitted the Form 40 to cftc_form40_filing@interactivebrokers.com. This will assist to ensure that your account is not subject to CFTC directed restrictions or fines.

Overview of CFTC Form 40

The CFTC, the primary regulator of U.S. commodity futures markets and Futures Commission Merchants (FCMs), operates a comprehensive system of collecting information on market participants as part of its market surveillance and large trader reporting program.

IBKR, as a registered FCM providing clients with access to those markets, is obligated to report to the CFTC information on clients who hold a position in a quantity that exceeds defined thresholds (i.e., a "reportable position"). In order to report this information, IBKR requires clients trading U.S. futures or futures options to complete an online CFTC Ownership and Control Reporting form at the point the client requests futures trading permissions.

Once a client holds a "reportable position", the CFTC may then contact that client directly and require them to file more detailed information via CFTC Form 40. The information required of this report includes the following:

- Trader's name and address

- Principal business

- Form of ownership (e.g., individual, joint, partnership, corporation, trust, etc.)

- Whether the reporting trader is registered under the Commodity Exchange Act

- Whether the reporting trader controls trading for others

- Whether any other person controls the trading of the reportable trader

- Name and location of all firms through which the reportable trader carries accounts

- Name and location of other persons providing a trading guarantee or having a financial interest in account of 10% or greater

- Name of accounts not in the reporting trader's name in which the trader provides a guarantee or has a financial interest of 10% or more.

Clients who fail to complete this Form in a timely manner may be subject to trading restrictions and/or fines imposed by CFTC upon their account at the FCM. It is therefore imperative that clients immediately respond to these CFTC requests.

To complete the CFTC Form 40, clients must first register for a CFTC Portal Account, an online process which is subject to a review period of 2 business days from the point of initial registration to acknowledgement of approval by the CFTC. For information regarding this registration process and completing the Form 40, see KB3149.

MiFIR下EEA投資公司委託交易報告及其增強版

全新的2014/65/EC號指引(“MiFID II”)和(歐盟)600/2014號法規(“MiFIR”)為報告由EEA投資公司執行的MiFID II下金融產品交易提出了新要求。(“MiFIR交易報告”)

誰受MiFIR交易報告要求約束?

所有歐洲經濟區(“EEA”)投資公司均受新規約束,須在MiFIR覆蓋的金融產品交易執行的一個工作日內報告所有交易。

盈透證券(英國)有限公司(“IBUK”)將向所有符合EEA投資公司定義的盈透證券集團(“IB”)客戶提供協助,使其遵守新規要求。

除了使用IB平台的綜合經紀商(其所有下屬客戶的頭寸都保有在一個或多個綜合賬戶中)外,所有作為EEA投資公司的IB客戶都可選擇要求IBUK代其履行報告義務。IBUK將通過法規要求的兩種不同的報告機制代客戶報告,即增強版交易報告和委託交易報告。

增強版交易報告

根據委員會委託監管條款(歐盟)2017/590第4條的規定,若IBUK將EEA投資公司(“定單傳遞公司”)提交的定單之詳情納入了其自己的交易報告,則定單傳遞公司可免於報告此類交易。

增強版交易報告僅適用於EEA投資公司代表其客戶就IBUK提供服務的金融產品提交執行指令的交易(比如,財務顧問、基金經理或介紹經紀商賬戶為其客戶子賬戶提交定單)。

委託交易報告

委託交易報告是IBUK向EEA投資公司提供的服務,幫助後者報告其提交的所有其他交易。

這包括投資公司通過其自營賬戶下達的交易、根據客戶給出的全權委託指令提交的交易、以及IBUK不作為服務經紀商的金融產品之交易(即,由另一家IB關聯公司擔任服務經紀商的金融產品交易)。當交易是由投資公司的客戶直接提交時,委託交易報告不適用。

此類報告將被提交給賬戶“法定住所”的國家主管部門(“NCA”),其中“法定住所”在啟用了委託交易報告功能的賬戶的法律實體識別信息下記錄(如,若投資公司的法定住所是荷蘭,則交易將被報告給金融市場管理局(AFM))。

客戶只需與IBUK簽署一份協議即可同時覆蓋增強版交易報告和委託交易報告。

如何使用增強版和委託交易報告服務

EEA投資公司(非披露介紹經紀商和綜合介紹經紀商除外)將被要求在賬戶管理中完成一份電子表格,屆時投資公司可選擇使用IB的增強版或委託交易報告服務。

鑑於IB可能沒有非披露介紹經紀商下屬客戶的完整身份信息,作為非披露介紹經紀商的投資公司不會收到以上電子表格,除非他們主動聯繫IB的客戶服務部門,請求使用IBUK的增強版交易報告或委託交易報告服務並提供相應的信息。

IB平台上作為綜合介紹經紀商的EEA投資公司無法使用增強版交易報告和委託交易報告服務。

使用IB的增強版和委託交易報告服務的EEA投資公司需簽署相關法律協議並提供以下信息:

- 法律實體識別信息(“LEI”)。沒有法律實體標識的客戶可通過IBUK申請一個標識;

- 相關國家客戶識別要求規定的每個經授權交易者的公民身份及更多信息;

- 投資公司內負責做投資決策的個人或算法;

- 之前被選為公司內部的投資決策者的活躍個人交易者。只允許是被授權作為賬戶交易者的個人;

- 公司可能用來做投資決策的算法的識別信息。客戶有義務根據法規要求確定並提供算法識別信息。

新規將如何影響IB賬戶管理和定單輸入系統

提交交易報告所需的某些信息可能視單個定單而不同,也可能要求提交交易的人提供信息。因此,IB已升級了IB賬戶管理系統及定單輸入系統,使交易者得以提供所需的信息。

想要使用IB增強版和委託交易報告服務的賬戶應指定經授權的交易者,並提供做投資決策的算法的ID列表。

賬戶管理中列出的交易者和算法會在提交定單時於交易者工作站新增的下拉列表中顯示。該區域會顯示賬戶管理中選擇的默認值。客戶可在下拉列表中選擇其他值。

IB交易者工作站將允許啟用了增強版和委託交易報告功能的賬戶下經授權交易者就提交的特定定單選擇公司內負責做投資決策的個人或算法。

注 :常見MiFIR定義和條款列表,請見KB2980

注意:以上信息不作為全面窮盡式指南,也不是對法規的權威性解釋,而是對MiFIR交易報告義務的總結。

MiFIR定義和條款

歐洲經濟區(EEA) - 截至2017年10月,EEA由以下國家組成:奧地利、比利時、保加利亞、克羅地亞、塞浦路斯共和國、捷克共和國、丹麥、愛沙尼亞、芬蘭、法國、德國、希臘、匈牙利、冰島、愛爾蘭、意大利、拉脫維亞、列支敦士登、立陶宛、盧森堡、馬耳他、荷蘭、挪威、波蘭、葡萄牙、羅馬尼亞、斯洛伐克、斯洛文尼亞、西班牙、瑞典和英國。

投資公司 - MiFID II第4 (1) (1)條將投資公司定義爲以向第三方提供一項或多項投資服務爲常規職能或業務的法人,及/或以專業的方式開展一項或多項投資活動的法人。該框架涉及的投資服務和活動在MiFID II附錄I的第A部分列出。

執行的交易 - 就MiFIR交易報告而言,“交易”指完成買賣MiFIR覆蓋的金融産品。當一筆交易是由于投資公司完成以下活動而産生時,該筆交易視爲被執行:

- 接收或傳遞與一種或多種金融産品有關的定單(委員會委托監管條款(歐盟)2017/590號第4條規定的特例除外);

- 代表客戶執行定單;

- 用自有賬戶交易;

- 根據客戶給出的投資指令做投資决策;

- 向賬戶中轉入或從賬戶中轉出金融産品。

[參考:委員會委托監管條款(歐盟)2017/590號第2條和第3條]

IB經紀商 - 交易由以下盈透證券集團實體(“IB經紀商”)接收和/或傳遞之金融産品的賬戶:

- 盈透證券(英國)有限公司

- 盈透證券(中歐)有限公司

- 盈透證券(愛爾蘭)有限公司

MiFIR覆蓋的金融産品 - (歐盟)法規第600/2014號第26 (2)條(MiFIR)規定了與以下金融産品交易有關的交易報告義務,不論此類交易是否在交易場所進行:

- 在交易場所交易、獲准在交易場所交易或已提交申請、希望獲准在交易場所交易的金融産;

- 底層證券是在交易場所交易的金融産品的金融産品;以及

- 底層證券是由在交易場所交易的金融産品構成的指數或籃子的金融産品。

該法規覆蓋的金融産品在MiFID II的C部分作了法律上的列舉:

(1) 可轉讓證券;

(2) 貨幣市場産品;

(3) 集合投資活動的單位;

(4) 與證券、貨幣、利率或回報率、排放配額或其它衍生産品、金融指數或金融指標有關的,且可用實物或現金結算的期權、期貨、互換、遠期利率協議及任意其它衍生品合約;

(5) 與大宗商品有關的,且必須以現金結算或在未發生違約或其它終止事件的情况下可由交易的一方選擇以現金結算的期權、期貨、互換、遠期及任意其它衍生品合約;

(6) 與大宗商品有關、且可用實物結算的期權、期貨、互換及任意其它衍生品合約,前提是此類合約在受監管的市場、多邊交易設施(MTF)或有組織交易設施(OTF)上交易,但在OTF上交易且必須以實物結算的批發能源産品除外;

(7) 可用實物結算但未在本段第6點中提及的與大宗商品有關的期權、期貨、互換、遠期及任意其它衍生品合約,此類合約不用于商業用途,而具有其它衍生金融産品的特點;

(8) 用于轉移信用風險的衍生品;

(9) 金融差價合約;

(10) 與氣候變量、運費率、通貨膨脹率或其它官方經濟指標有關的,且必須以現金結算或在未發生違約或其它終止事件的情况下可由交易的一方選擇以現金結算的期權、期貨、互換、遠期利率協議及任意其它衍生品合約,以及與資産、權利、義務、指數及本部分未提及的指標有關、且在某些方面(包括但不限于是否在受監管的市場、OTF或MTF上交易)具有其它衍生金融産品的特徵的任意其它衍生品合約;

(11) 由2003/87/EC號法令(排放交易機制)承認的任意單位構成的排放配額。

國民身份識別信息 - 在MiFIR下,自然人必須根據特定國民識別信息的優先級要求報告該識別信息,其中優先級取决于MiFIR認可的國籍。身份識別信息可爲護照、身份證、稅務代碼、個人代碼或全名和生日的串聯(“串聯”)。IB經紀商只要求客戶提供IBUK尚未獲得的國民身份識別信息。

法律實體標識(“LEI”)= 一個基于ISO 17442的由20字符構成的獨特識別信息,用于在全球範圍內識別參與金融交易的法律實體。

能以客觀可衡量的方式降低風險的大宗商品衍生品交易- 在報告大宗商品衍生品交易時,IB經紀商須說明該交易根據2014/65/EU號指引第57條(第57條)是否能以客觀可衡量的方式降低風險。 僅當此類交易是來自非金融實體持有的賬戶,且根據第57條,此類實體通過該賬戶交易大宗商品衍生品的目的是客觀降低與其業務活動直接有關的風險時,IB經紀商才會允許此類交易。(如生産小麥的公司交易此類衍生品以對沖業務活動的風險)。(如生産小麥的公司交易此類衍生品以對沖業務活動的風險)。

在賬戶管理的交易權限部分作出以上聲明的賬戶持有人同意,該賬戶執行的所有大宗商品衍生品交易的目的都是第57條規定的降低風險,且IB經紀商會相應地報告相關交易。

在有報告義務的公司負責做投資决策的個人或算法 - 在MiFIR下,投資公司有義務在交易報告中列明公司內負責就買/賣金融産品做投資决策的主要負責人或算法。只有單個個人或算法可被認定爲是某筆交易的負責人,而投資公司必須根據委員會委托監管條款(歐盟)2017/590號第8條的規定報告此類個人或算法。

考慮到此類報告要求,IB經紀商已在賬戶管理和IB交易者工作站中推出了新的板塊和新功能,幫助通過IB經紀商報告交易的投資公司按新法規的要求報告相關個人和算法。

在有報告義務的公司負責執行交易的個人 - 委員會委托監管條款(歐盟)2017/590號第9條要求投資公司報告决定接入哪個交易場所[…]、向哪家公司傳遞委托單或與委托單執行有關的任意其它條件的個人或算法。對于大多數交易報告,本要求僅適用于IB經紀商,但由于IB經紀商通常是執行交易的實體,當一家通過委托交易報告計劃委托IB經紀商報告交易的投資公司提交委托單時,提交委托單的特定用戶將被作爲負責執行交易的個人進行報告。

委員會委托監管條款(歐盟)2017/590號第4條 - 委托單傳遞

1. 僅當以下條件被滿足後,根據(歐盟)第600/2014號法規第26(4)條傳遞定單的投資公司(定單傳遞公司)才被視爲傳遞了該委托單:

(a) 委托單來自其客戶或源于其根據一位或多位客戶向其提供的全權委托指令購入或處置特定金融産品的决定;

(b) 委托單傳遞公司已將第2段中提及的定單詳情傳遞給了另一家投資公司(定單接收公司);

(c) 委托單接收公司受(歐盟)第600/2014號法規第26(1)條之約束,且同意報告該定單的交易或根據本條款將委托單詳情傳遞給另一家投資公司。

就上述第一子段第(c)點而言,協議應明確委托單傳遞公司向委托單接收公司提供委托單詳情的時間限制,幷規定委托單接收公司應核實其收到的定單詳情是否包含明顯的錯誤或遺漏,然後方可提交交易報告或根據本條款傳遞委托單。

2. 就某個給定的委托單而言,應根據第1段傳遞以下委托單詳情:

(a) 金融産品的識別碼;

(b) 委托單的目的是收購還是處置金融産品;

(c) 委托單中列明的價格和數量;

(d) 委托單傳遞公司的客戶就定單而言的標識和詳細信息;

(e) 當投資决策是根據代理權做出時,應表明客戶的决策者的標識和詳情;

(f) 識別做空交易的標識;

(g) 識別在委托單傳遞公司內負責做投資决策的的個人或算法的指示;

(h) 投資公司內負責監督做投資决策的個人的分支所在的國家,及從客戶處收到委托單或根據客戶的全權委托指令代表客戶做投資决策的分支所在的國家;

(i) 對于大宗商品衍生品委托單,表明該交易根據2014/65/EU號指引第57條是否旨在以客觀可衡量的方式降低風險;

(j) 委托單傳遞公司的識別碼。

就第一子段第(d)點而言,當客戶爲自然人時,應根據第6條標識客戶。就第一子段第(j)點而言,當傳遞的委托單是接收自未按本條款的要求傳遞委托單的前一家公司,識別碼應爲識別委托單傳遞公司的代碼。當傳遞的委托單是接收自按本條款的要求傳遞委托單的前一家傳遞公司,則第一子段第(j)點中的代碼應爲識別前一家傳遞公司的代碼。

3. 當某個委托單涉及一家以上傳遞公司時,第2段第一子段(d)到(i)點中所指的委托單詳情應針對第一家傳遞公司的客戶。

4. 當委托單包含多個客戶時,第2段所指的信息應針對單個客戶傳遞。

更多信息請見:

無報告義務的賬戶持有人需提供的MiFIR信息

MiFIR交易報告體系要求諸如您的IB經紀商的投資公司在其交易報告中包括特定的客戶識別信息。

交易由以下盈透證券集團實體(“IB經紀商”)接收和/或傳遞之金融産品的賬戶需使用特定的識別信息在IB經紀商的報告中標識自己的身份,IB經紀商目前可能已知此類識別信息,也可能未知。

- 盈透證券(英國)有限公司

- 盈透證券(中歐)有限公司

- 盈透證券(愛爾蘭)有限公司

同樣地,使用IB平臺執行客戶委托單幷選擇由IB經紀商處理交易報告的投資公司將需就其客戶委托單使用類似的識別信息。如您爲此類公司的客戶,IB經紀商需向您請求額外的信息以完成交易報告。

需提供的信息

如果還需要其它信息,我們會要求客戶在賬戶管理中填寫電子表格來提供信息。

此類賬戶需提供的信息包括:

- 作爲賬戶持有人或被授權交易者的自然人的國籍;

- 作爲賬戶持有人或被授權交易者的自然人的特定國民身份信息;

- 法律實體需提供法律實體識別號碼(LEI)。沒有法律實體識別號碼的客戶可通過其IB經紀商申請。

- 機構賬戶需表明該法律實體是否爲非金融實體且使用該賬戶進行大宗商品衍生品交易、根據MiFID II第57條以客觀可衡量的方式降低風險。

注:常見MiFIR定義和條款列表,請見 KB2980

本信息僅用于指導使用盈透證券清算服務的客戶。本信息不適用于僅使用執行服務的賬戶。

注意:以上信息不作爲全面窮盡式指南,也不是對法規的權威性解釋,而是對MiFIR交易報告義務的總結。

MIFIR交易報告概況

背景

2018年1月3日起,全新的2014/65/EC號指引(“MiFID II”)和(歐盟)600/2014 號法規(“MiFIR”)將生效,届時將爲2007年通過金融工具市場指引(“MiFID I”)創建的交易報告(“MiFIR交易報告”)框架帶來重大變革。

盈透證券推出了一套全新的交易報告體系,以幫助在新法規下有直接報告義務的客戶遵守新的MiFIR要求。

MiFIR交易報告義務的範圍

MiFIR交易報告適用于歐洲經濟區(“EEA”)和英國的投資公司,也適用于使用盈透證券集團內的經紀商執行委托單的投資公司。如您是投資公司的客戶且使用的是IB平臺,則您將被要求提供額外的信息以便申報交易報告。

投資公司有義務在交易執行的次日收市前向相關國家主管機構(“NCA”)報告MiFIR覆蓋的金融産品的交易之完整及準確細節。

MiFIR拓展了需報告的金融産品範圍,覆蓋了在EEA/英國監管的交易所、多邊交易設施(“MTFs”)及有組織交易設施(“OTFs”)內交易的産品。除了在EEA/英國交易所執行的交易外,MiFIR還覆蓋場外(“OTC”)交易及在非EEA/英國交易場所執行的EEA/英國上市金融産品交易,如在倫敦證交所(LSE)上市、但在紐交所(NYSE)交易的股票。(詳見MiFIR覆蓋的金融産品)。

面向EEA投資公司的MiFIR交易報告解决方案:增强版委托交易報告

確認自身爲有MiFIR交易報告義務的投資公司的IB客戶可選擇將其報告義務委托給相關IB經紀商。

IB經紀商將根據“增强版報告”義務報告某些由此類投資公司執行的交易。對于此類交易,IB經紀商會在其自身的報告中增加有關投資公司的詳細信息,以滿足投資公司的報告義務。其它交易將僅以委托的形式代表投資公司報告,即在IB經紀商自身報告外以獨立報告的形式呈現。客戶只需與IB經紀商簽署一份協議即可覆蓋這兩種報告形式。

需報告的信息

需報告的項目已從MiFID I體系下的23項增長至MIFIR下的65項。新增的信息要求包括:

- 每筆交易買賣雙方的詳細信息。具體地,法規要求法律實體提供法律實體標識(“LEI”)、自然人提供國民身份識別信息(基于國籍)。

- 當由第三方行使自由裁量權時,需明確買賣雙方的决策者:

- 對于個人或聯名賬戶,指賬戶持有人以外的個人或第三方實體。

- 對于機構賬戶,指賬戶授權交易者(如爲客戶子賬戶交易的財務顧問)以外的第三方。

當賬戶持有人爲自己交易或被授權的交易者是爲其自己的機構交易時,不要求提供本信息。

- 有報告義務的公司負責做投資决策或負責執行交易的個人或算法。使用我們的報告服務的EEA投資公司須提供該信息。

- 對于大宗商品衍生品交易,表明此類大宗商品衍生品交易根據MiFID II第57條是否能以客觀可衡量的方式降低風險;當賬戶持有人爲非金融實體時,本規則僅適用于機構賬戶。

新信息要求會以不同的方式影響盈透證券的客戶,其影響取决于客戶是EEA投資公司,還是投資公司以外的機構或個人,還取决于被交易的金融産品是由其IB經紀商還是其它盈透證券集團的關聯公司接收和/或傳遞。

對無MiFIR交易報告義務的IB客戶的影響

爲履行IBUK自身的報告義務,IB經紀商須識別幷報告每筆由其執行的直接客戶。該報告必須包含法規規定的新的客戶識別信息。

因此,每個IB經紀商都需從以下客戶處收集識別信息幷報告:

- 持有由IB經紀商接收和/或傳遞之金融産品的賬戶的IB經紀商直接客戶;

- 使用盈透證券報告服務的EEA投資公司客戶;

- 使用盈透證券平臺及報告服務的EEA投資公司的子賬戶客戶。

有關不直接受MiFIR管轄的賬戶持有人需要提供哪些信息,詳情請見知識庫文章 KB2976。

注:常見MiFIR定義和條款列表,請見 KB2980

本信息僅用于指導使用盈透證券清算服務的客戶。本信息不適用于僅使用執行服務的賬戶。

注:以上信息不作爲全面窮盡式指南,也不是對法規的權威性解釋,而是對MiFIR交易報告義務的總結。

PRIIPs Regulation

The Packaged Retail and Insurance-based Investment Products Regulation - EU No 1286/2014 (“PRIIPs Regulation” or “PRIIPs”) became applicable on 1 January 2018.

A PRIIP is defined as any investment where the amount repayable to the investor is subject to fluctuations because of exposure to reference values. PRIIPs include ETFs, options, futures, CFDs, structured products, etc.

The Regulation requires product manufacturers to create Key Information Documents (KIDs) and persons advising or selling PRIIPs to provide retail investors based in the European Economic Area (EEA) with KIDs to enable those investors to better understand and compare products. The UK Financial Conduct Authority (FCA) has equivalent requirements for UK residents.

As a broker, IBKR is required to block trading in a PRIIP if a KID is not available.

The objectives of the PRIIPs Regulation.

Since the financial crisis of 2008, one of the main objectives of the European Commission has been to increase consumer protection and rebuild confidence in financial markets.

The Regulation specifies that the Key Information Document (KID) must be prepared in a standardised format.

By defining a standard format and content for the KID, the Regulation aims to:

- Ensure that the information provided is complete and comparable between similar products in order to help investors make informed investment decisions.

- Improve transparency and increase confidence in the retail investment market.

What is a KID?

The KID is a 3-page document that contains important details of the product including general description, cost, risk reward profile and possible performance scenarios.

Who is the regulation applicable to?

The Regulation applies to both PRIIPs manufacturers and distributors. The responsibility to create and maintain the document falls to the product manufacturer. However, any distributor or financial intermediary that sells or provides advice about PRIIPs to a retail investor, or receives a buy order for a PRIIP from a retail investor, must provide the investor with a KID. This also applies to execution-only, online environments.

Who should receive a KID?

Retail investors domiciled in the EEA and the UK should receive a KID prior to investing in a PRIIP. If no KID is available from the manufacturer, the PRIIP will be restricted from trading for EEA and UK retail clients.

Generally KIDs must be provided in an official language of the country in which a client is resident.

However, clients of IBKR have agreed to receive communications in English, and therefore if a KID is available in English all EEA and UK clients can trade the product regardless of their country of residence.

If a KID is not available in English, but one is available in another language, German for example, the PRIIP can only be traded by retail clients who are citizens of, or resident in countries where that language is an official language, in this example Germany, Austria, Belgium, Luxembourg or Liechtenstein.

Special Case – US ETFs

U.S. clients are not impacted by PRIIPs, so the issuers of U.S. listed ETFs do not as a rule create KIDs. This means that EEA and UK Retail clients may not purchase the product. Clients nevertheless have several options:

- Many US ETF issuers have equivalent ETFs issued by their European entities. European-issued ETFs have KIDs and are therefore freely tradable.

- Clients can trade most large US ETFs as CFDs. The CFDs are issued by IBKRs European entities and as such meet all KID requirements.

- Clients may be eligible for re-classification as a professional client, for whom KIDs are not required.

CLIENT CATEGORISATION

We categorize all individual clients as “Retail” by default as this affords clients the broadest level of protection afforded by MiFID. Client who are categorised as “Professional” do not receive the same level of protection as “Retail” but are not subject to the KIDs requirement. As defined under MiFID II rules, “Professional” clients include regulated entities, large clients and individuals who have asked to be re-categorised as “elective professional clients” and meet the MiFID II requirements based on their knowledge, experience and financial capability.

We provide an online step-by-step process that allows “Retail” to request that their categorisation be changed to “Professional". The qualifications for re-categorisation along with the steps for requesting that one’s categorisation be considered are outlined here or, to directly apply for a change in categorisation, the questionnaire is available in the Client Portal/Account Management.

Implications for Interactive Brokers:

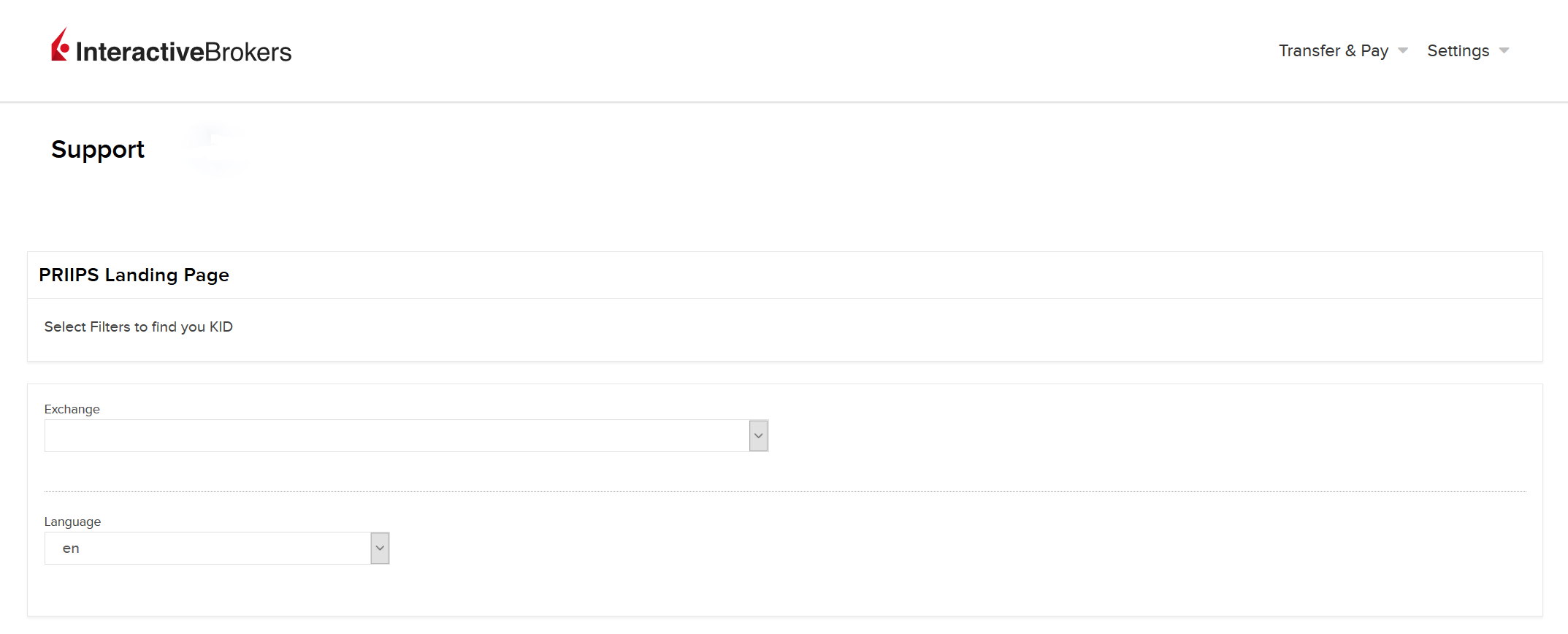

In order to meet the PRIIPs Regulation, where required, IB UK will provide KIDs electronically by means of a website (“PRIIPs KID Landing Page”).

Where can I find the PRIIPs KID Landing Page?

The KIDs can be accessed from our designated PRIIPs KID Landing Page. There are three different ways you can find the KIDs. They are available through the IBKR Trader Workstation (“TWS”), the IBKR website and Client Portal.

1. Find KIDs through TWS:

- Log into TWS

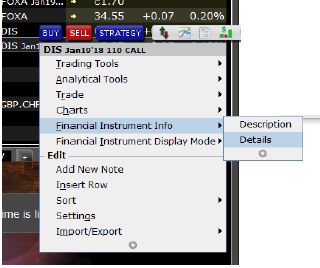

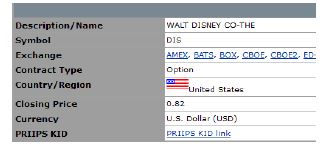

- Right click on the symbol of the product for which you want the KID.

- Under Financial Instrument Info select Details.

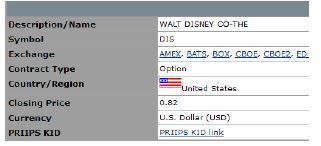

- From the Contract Details page, you can select the PRIIPs KID link. This will take you to our PRIIPs KID Landing Page in Client Portal.

2. Find KIDs through the IBKR website:

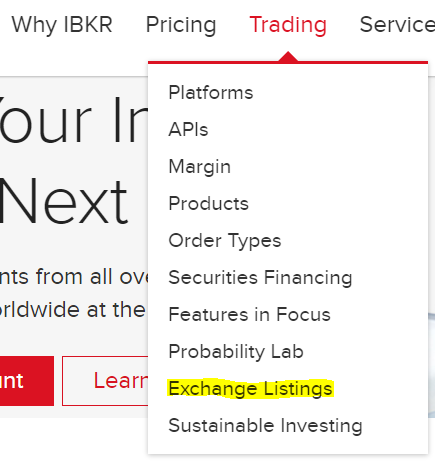

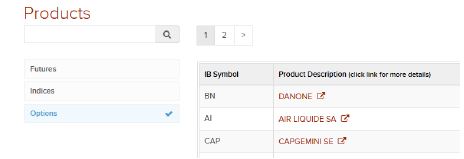

- Open the Trading tab and select Exchange Listings.

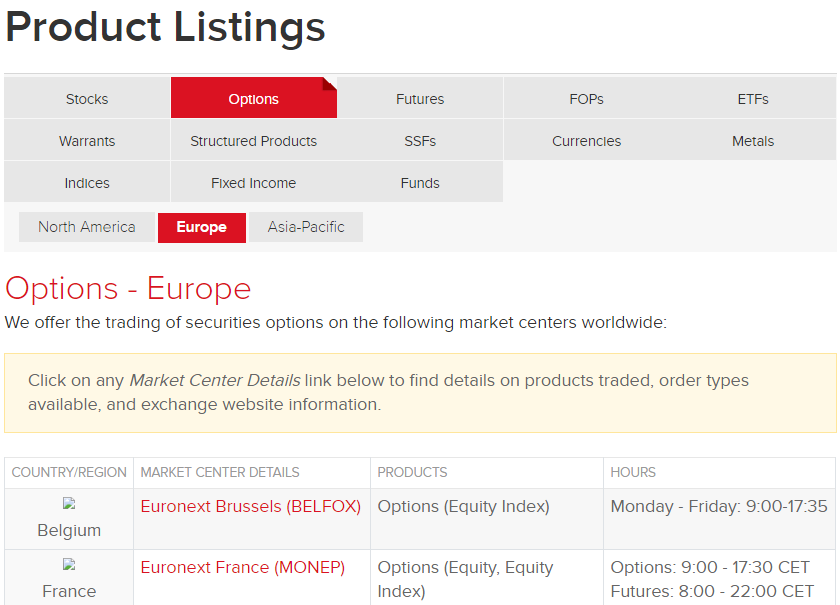

- From there, select Product Listings. Select the derivative type, region and exchange of the product for which you would like to find the contract information.

- Select the product you would like to see the KID of, which will take you to the Contract Details page.

- From the Contract Details page, as above, you can select the PRIIPs KID link, which will take you to our PRIIPs KID Landing Page in Client Portal.

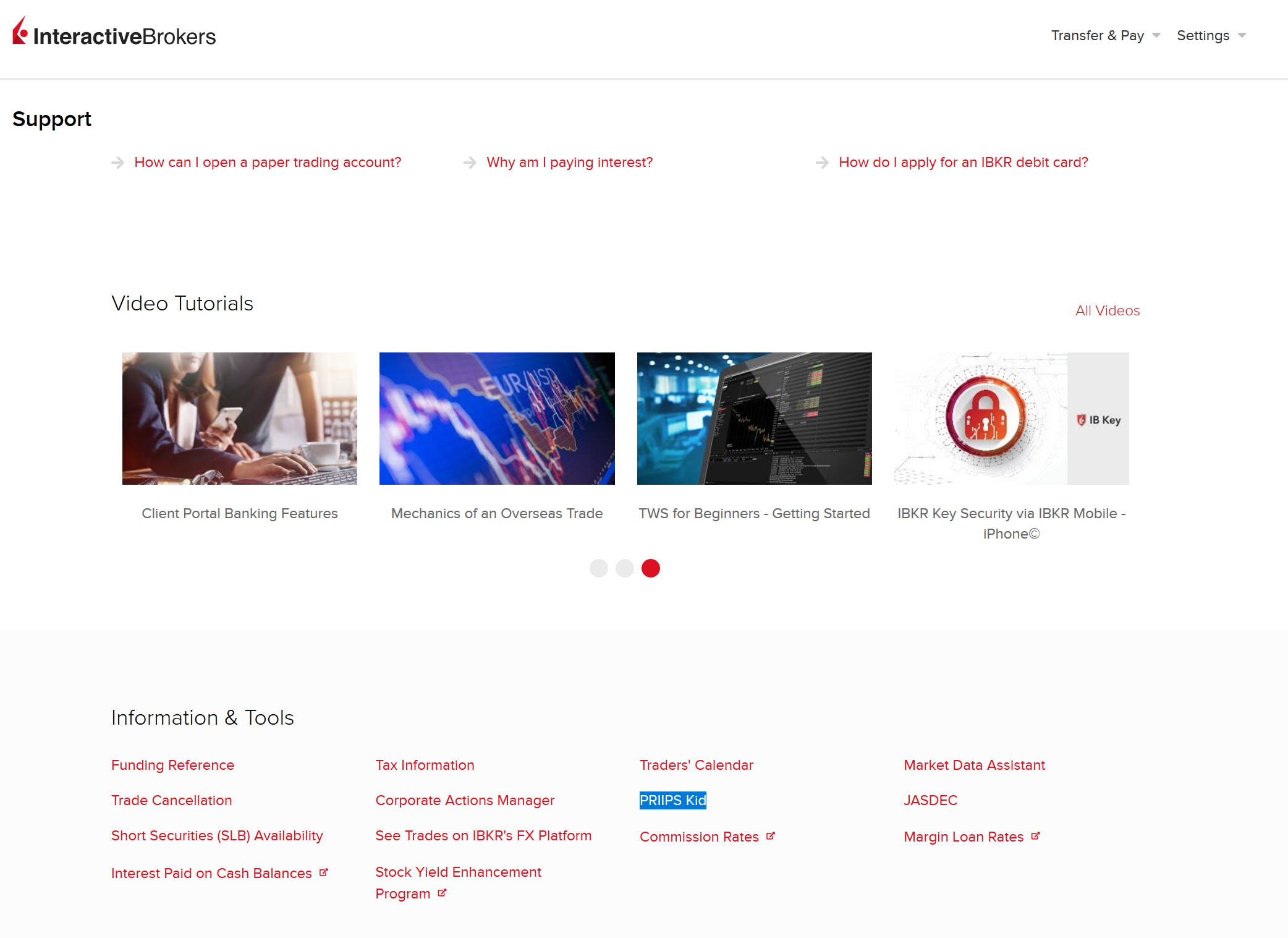

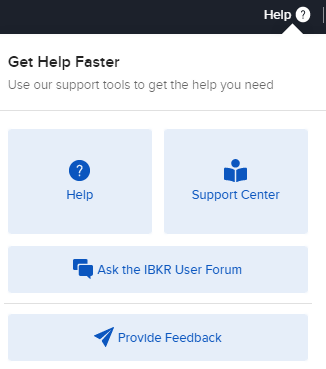

3. Find KIDs through Client Portal:

- Log into Client Portal.

- Click the Help (?) icon followed by Support Center.

- In the Information & Tools section, select PRIIPs Kid, which will take you to our PRIIPs KID Landing Page.

Can I potentially get exposure to a US ETF/other PRIIPs restricted product through a CFD?

An investor could potentially get exposure to a U.S. ETF or other PRIIPs restricted product when trading a CFD (Contract for Difference) as some CFDs are designed to track the performance of underlying assets, including ETFs and other PRIIPs products.

If an investor trades a CFD that is designed to track the performance of a U.S. ETF or other PRIIPs product, the investor may be indirectly investing in that underlying asset. This is because the CFD's value is based on the value of the underlying asset, and any gains or losses in the value of the underlying asset will be reflected in the value of the CFD.

MiFIR Definitions & Terms

European Economic Area (EEA) - As of October 2017, the EEA consists of the following countries: Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden and the United Kingdom.

Investment Firms - Article 4 (1) (1) of MiFID II defines investment firm as any legal person whose regular occupation or business is the provision of one or more investment services to third parties and/or the performance of one or more investment activities on a professional basis. The investment services and activities covered by the framework are listed in Section A of Annex I of MiFID II.

Transactions Executed - For the purposes of MiFIR Transaction Reporting, a transaction is the conclusion of an acquisition or disposal of one of the financial instruments covered by MiFIR. A transaction is considered to be executed when it resulted from one of the following activities performed by an Investment Firm:

- Reception or transmission of orders in relation to one or more financial instruments (exceptions apply under Article 4 of Commission Delegated Regulation (EU) 2017/590);

- Execution of orders on behalf of clients;

- Dealing on own account;

- Making an investment decision in accordance with a discretionary mandate given by a client;

- Transfer of financial instruments to or from accounts.

[Ref: Articles 2 and 3 of Commission Delegated Regulation (EU) 2017/590]

IB Broker - Accounts that trade financial instruments which are received and/or transmitted by one of the following Interactive Brokers Group entities ("IB Brokers"):

- Interactive Brokers (U.K.) Limited

- Interactive Brokers Central Europe Zrt.

- Interactive Brokers Ireland Limited

Financial Instruments Covered by MiFIR - Article 26 (2) of Regulation (EU) No 600/2014 (MiFIR) lays out the transaction reporting obligation with regard to transactions in financial instruments listed below, irrespective of whether or not such transactions are carried out on the trading venue:

- Financial instruments which are admitted to trading or traded on a trading venue or for which a request for admission to trading has been made;

- Financial instruments where the underlying is a financial instrument traded on a trading venue; and

- Financial instruments where the underlying is an index or a basket composed of financial instruments traded on a trading venue.

The financial instruments covered by this requirement are legally enumerated in Section C of MiFID II:

(1) Transferable securities;

(2) Money-market instruments;

(3) Units in collective investment undertakings;

(4) Options, futures, swaps, forward rate agreements and any other derivative contracts relating to securities, currencies, interest rates or yields, emission allowances or other derivatives instruments, financial indices or financial measures which may be settled physically or in cash;

(5) Options, futures, swaps, forwards and any other derivative contracts relating to commodities that must be settled in cash or may be settled in cash at the option of one of the parties other than by reason of default or other termination event;

(6) Options, futures, swaps, and any other derivative contract relating to commodities that can be physically settled provided that they are traded on a regulated market, a MTF, or an OTF, except for wholesale energy products traded on an OTF that must be physically settled;

(7) Options, futures, swaps, forwards and any other derivative contracts relating to commodities, that can be physically settled not otherwise mentioned in point 6 of this Section and not being for commercial purposes, which have the characteristics of other derivative financial instruments;

(8) Derivative instruments for the transfer of credit risk;

(9) Financial contracts for differences;

(10) Options, futures, swaps, forward rate agreements and any other derivative contracts relating to climatic variables, freight rates or inflation rates or other official economic statistics that must be settled in cash or may be settled in cash at the option of one of the parties other than by reason of default or other termination event, as well as any other derivative contracts relating to assets, rights, obligations, indices and measures not otherwise mentioned in this Section, which have the characteristics of other derivative financial instruments, having regard to whether, inter alia, they are traded on a regulated market, OTF, or an MTF;

(11) Emission allowances consisting of any units recognised for compliance with the requirements of Directive 2003/87/EC (Emissions Trading Scheme).

National Identifiers - Under MiFIR, natural persons must be reported by using specific national identifiers required under a priority order that depends and varies on the Country of citizenship that is identified as relevant under MiFIR. The identifier can be a passport, a national ID card, a tax or personal code or a concatenation of full name and date of birth (“CONCAT”). The IB Broker will only request clients to provide national identifiers that are not already available.

Legal Entity Identifiers (“LEI”) = 20-character unique identifier based on the ISO 17442 for the global identification of legal entities that engage in financial transactions.

Commodity Derivatives Transactions that reduce risk in an objectively measurable way - When reporting transactions in commodity derivatives, the IB Broker will have to specify whether the transaction reduces risk in an objectively measurable way in accordance with Article 57 of Directive 2014/65/EU (“Art 57”). The IB Broker will allow such transactions only from accounts held by entities that are non-financial entities using the account for trades in commodity derivatives that are intended to objectively reduce risk directly relating to their commercial activity in accordance with Art 57. (e.g. company that produces wheat that trades in such derivatives to hedge its commercial activity).

Account holders that make such a declaration in the Trading Permission section of their Account Management, agree that all the transactions executed in commodity derivatives for that account will be executed for reducing the risk under Art 57, and the IB Broker will report the relevant transactions accordingly.

Individual or algorithm responsible at the reporting firm for making the investment decision - Under MiFIR, Investment Firms are required to include in their transaction reports the identification of the individual or algorithm that was primarily responsible for making the investment decision within the firm to acquire or dispose of a financial instrument. Only one individual or algorithm can be identified as responsible with regard to a transaction, and Investment Firms must identify such individual or algorithm as specified in Article 8 of commission delegated regulation (EU) 2017/590.

In accordance with these requirements, your IB Broker has implemented a new section in Account Management and new features in the IB Trader Workstation to allow Investment Firms that report their transactions through an IB Broker to identify individuals and algorithms in compliance with the new obligations.

Individual responsible at the reporting firm for the execution of a transaction - Art 9 of Commission Delegated Regulation (EU) 2017/590 requires Investment Firms to identify individuals or algorithms responsible for determining which trading venue to access […], which firms to transmit orders to or any other condition related to the execution of an order. While this requirement applies only to IB Brokers for the majority of the transactions reports (because the IB Broker is usually the entity that executes the transaction), when an order is submitted by an Investment Firm that transaction reports through an IB Broker via the Delegated Transaction Reporting, the specific user that has submitted the order will be reported as responsible for executing the transaction.

Article 4 of commission delegated regulation (EU) 2017/590 - Transmission of an order

1. An investment firm transmitting an order pursuant to Article 26(4) of Regulation (EU) No 600/2014 (transmitting firm) shall be deemed to have transmitted that order only if the following conditions are met:

(a) the order was received from its client or results from its decision to acquire or dispose of a specific financial instrument in accordance with a discretionary mandate provided to it by one or more clients;

(b) the transmitting firm has transmitted the order details referred to in paragraph 2 to another investment firm (receiving firm);

(c) the receiving firm is subject to Article 26(1) of Regulation (EU) No 600/2014 and agrees either to report the transaction resulting from the order concerned or to transmit the order details in accordance with this Article to another investment firm.

For the purposes of point (c) of the first subparagraph the agreement shall specify the time limit for the provision of the order details by the transmitting firm to the receiving firm and provide that the receiving firm shall verify whether the order details received contain obvious errors or omissions before submitting a transaction report or transmitting the order in accordance with this Article.

2. The following order details shall be transmitted in accordance with paragraph 1, insofar as pertinent to a given order:

(a) the identification code of the financial instrument;

(b) whether the order is for the acquisition or disposal of the financial instrument;

(c) the price and quantity indicated in the order;

(d) the designation and details of the client of the transmitting firm for the purposes of the order;

(e) the designation and details of the decision maker for the client where the investment decision is made under a power of representation;

(f) a designation to identify a short sale;

(g) a designation to identify a person or algorithm responsible for the investment decision within the transmitting firm;

(h) country of the branch of the investment firm supervising the person responsible for the investment decision and country of the investment firm's branch that received the order from the client or made an investment decision for a client in accordance with a discretionary mandate given to it by the client;

(i) for an order in commodity derivatives, an indication whether the transaction is to reduce risk in an objectively measurable way in accordance with Article 57 of Directive 2014/65/EU;

(j) the code identifying the transmitting firm.

For the purposes of point (d) of the first subparagraph, where the client is a natural person, the client shall be designated in accordance with Article 6. For the purposes of point (j) of the first subparagraph, where the order transmitted was received from a prior firm that did not transmit the order in accordance with the conditions set out in this Article, the code shall be the code identifying the transmitting firm. Where the order transmitted was received from a prior transmitting firm in accordance with the conditions set out in this Article, the code provided pursuant to point (j) referred to in the first subparagraph shall be the code identifying the prior transmitting firm.

3. Where there is more than one transmitting firm in relation to a given order, the order details referred to in points (d) to (i) of the first subparagraph of paragraph 2 shall be transmitted in respect of the client of the first transmitting firm.

4. Where the order is aggregated for several clients, information referred to in paragraph 2 shall be transmitted for each client.

Also see:

Overview of MIFIR Transaction Reporting

MiFIR Enriched and Delegated Transaction Reporting for EEA Investment Firms

MiFIR Information Required from Account Holders that do not have Reporting Obligations

MiFIR Information Required from Account Holders that do not have Reporting Obligations

The MiFIR Transaction Reporting regime requires Investment Firms, like your IB Broker, to include specific client identifiers in their transaction reports.

Accounts that trade in financial instruments which are received and/or transmitted by one of the following Interactive Brokers Group entities (“IB Brokers”) will need to be identified in the IB Broker’s reports by using specific identifiers that may or may not be already available to it.

- Interactive Brokers (U.K.) Limited

- Interactive Brokers Central Europe Zrt.

- Interactive Brokers Ireland Limited

Similarly, Investment Firms that use the IB platform for their clients’ orders and have elected to transaction report through their IB Broker will have to use the same identifiers for their client orders. If you are the client of such a firm, your IB Broker may need additional information from you to complete the transaction reports.

Information Required

When additional information is necessary for this purpose, clients will be asked to provide it via the completion of an electronic form available in the Account Management.

The information requested for these accounts is:

- All countries of citizenship for natural persons that are account holders and authorised traders;

- A specific National Identifier for natural persons that are account holders and authorised traders;

- The Legal Entity Identifier for legal entities. Clients that do not have an LEI will be able to apply for one through their IB Broker.

- For organisation accounts, an indication as to whether the Legal Entity is a non-financial entity using the account for trades in Commodity Derivatives Transactions to reduce risk in an objectively measurable way in accordance with Article 57 of MiFID II.

Note: For a listing of common MiFIR definitions and terms, see KB2980

THIS INFORMATION IS GUIDANCE FOR INTERACTIVE BROKERS CLEARED CLIENTS ONLY. THIS GUIDANCE DOES NOT APPLY TO EXECUTION ONLY ACCOUNTS.

NOTE: THE INFORMATION ABOVE IS NOT INTENDED TO BE A COMPREHENSIVE OR EXHAUSTIVE GUIDANCE AND IT IS NOT A DEFINITIVE INTERPRETATION OF THE REGULATION, BUT A SUMMARY OF MiFIR TRANSACTION REPORTING OBLIGATIONS.

MiFIR Enriched and Delegated Transaction Reporting for Investment Firms

Who is Subject to the MiFIR Transaction Reporting Requirements?

All EEA and UK investment firms (collectively, "Investment Firms") are subject to the reporting requirements and will have to report all transactions executed in financial instruments covered by MiFIR within one working day from their execution.

The below entities (“IB Brokers”), will offer assistance to IB clients that are Investment Firms in complying with the new requirements:

- Interactive Brokers (U.K.) Limited

- Interactive Brokers Central Europe Zrt.

- Interactive Brokers Ireland Limited

- Interactive Brokers Luxembourg SARL

With the exception of Omnibus Introducing Brokers, where applicable, that utilise the IB platform (in which all their underlying client positions are held in one or more omnibus accounts), all IB clients that are EEA Investment Firms will be able to elect to have their IB Broker report on their behalf. The IB Broker will report for IB clients based on two distinct reporting mechanisms implemented in accordance with the Regulation: Enriched Transaction Reporting and Delegated Transaction Reporting.

ENRICHED TRANSACTION REPORTING

In compliance with Article 4 of Commission Delegated Regulation (EU) 2017/590, if an IB Broker includes details of orders submitted by clients that are Investment Firms (“the transmitting firm”) in its own transaction reports, the transmitting firm is exempt from reporting these transactions.

Enriched Transaction Reporting will only apply to transactions in financial instruments carried by an IB Broker submitted for execution by an Investment Firm for the benefit of the Investment Firm’s clients (for example, a Financial Advisor, Fund Manager or Introducing Broker Account submitting orders for its clients' subaccounts).

DELEGATED TRANSACTION REPORTING

Delegated Transaction Reporting services are provided by an IB Broker to Investment Firms for all other transactions submitted by the Investment Firm.

This includes transactions entered by the Investment Firm for its own proprietary account, transactions submitted on the basis of discretionary mandates given by their clients and transactions in Financial Instruments for which an IB Broker is not the carrying broker (i.e., any transaction in a financial instrument where another IB affiliate is the carrying broker). Delegated transaction reporting does not apply where the trades are submitted directly by clients of the Investment Firm.

These reports will be submitted to the National Competent Authority (“NCA”) of the Country of legal residence recorded in the Legal Entity Identifier of the account for which the Delegated Transaction Reporting was enabled (e.g., if the Investment Firm’s legal residence is Netherlands, transactions will be reported to the Authority for the Financial Markets (AFM)).

Clients will only need to sign one agreement with an IB Broker to cover both Enriched and Delegated Transaction Reporting.

How to Sign Up for the Enriched and Delegated Transaction Reporting Service

Investment Firms (other than Omnibus Introducing Brokers) will be prompted to complete an electronic form in the Account Management system during which it will be possible to accept to use IB’s Enriched and Delegated Transaction Reporting Service.

Investment Firms that are Omnibus Introducing Brokers on the IB platform will not have the ability to activate the Enriched and Delegated Transaction Reporting.

Investment Firms that utilise IB’s Enriched and Delegated Transaction Reporting Service will need to sign the relevant legal agreement and provide the following information:

- Legal Entity Identifier (“LEI”). Clients that do not have an LEI, will be able to apply for one through an IB Broker;

- The citizenship(s) for each authorised trader and further information as required by the national client identifier requirements for the relevant country;

- Individuals or Algorithms that can be responsible for making the investment decision within the investment firm:

- Individual active traders who have been previously selected as possible investment decision makers within the firm. Only individuals that are authorised as traders on the account will be allowed;

- Algorithm identifiers provided for algorithms that the firm may use for making investment decisions. It is the client’s responsibility to determine and provide algorithm identifiers in compliance with the regulation.

How the New Requirements Will Affect the Account Management and the IB Order Entry System

Some of the information required for the submission of a transaction report may change on an order by order basis, and may require input of the person submitting the trade. Hence, IB has amended IB Account Management and the IB Order Entry System to allow traders to provide the necessary information.

Accounts that want to use IB’s Enriched and Delegated Transaction Reporting Service shall select the authorised traders and list the Algorithm IDs that may be responsible for making an investment decision.

The traders and algorithms listed in Account Management will be displayed in a new dropdown field of the IB Trader Workstation at the time of the order submission. This field will show the default value selected in Account Management of the account. The client will be able to change this by selecting another value present in the dropdown list.

The IB Trader Workstation will allow an authorised trader on the account for which the Enriched and Delegated Transaction Reporting was activated to select one person or algorithm as responsible for the investment decision within the firm with regard to the specific order submitted.

Note: For a listing of common MiFIR definitions and terms, see KB2980

THIS INFORMATION IS GUIDANCE FOR INTERACTIVE BROKERS CLEARED CLIENTS THAT ARE INVESTMENT FIRMS ONLY. THIS GUIDANCE DOES NOT APPLY TO EXECUTION ONLY ACCOUNTS.

NOTE: THE INFORMATION ABOVE IS NOT INTENDED TO BE A COMPREHENSIVE OR EXHAUSTIVE GUIDANCE AND IT IS NOT A DEFINITIVE INTERPRETATION OF THE REGULATION, BUT A SUMMARY OF MiFIR TRANSACTION REPORTING OBLIGATIONS.