IBKR Mobile Authentication (IB Key)

Table of contents

Introduction

The security of your assets and personal information is of utmost concern to IBKR and we are committed to taking the steps necessary to make certain that you are protected from the moment you open your account. A key component of protection is the Secure Login System (SLS), a login process which relies upon Two-Factor Authentication to prevent anyone from accessing or using your account, even if they know your User Name and password. Once SLS enrolled, your account can only be accessed through use of 2 security factors: 1) something you know (entry of your User Name and password combination); and 2) something you have (entry of a random code generated from a physical security device or Smartphone application).

IBKR offers a variety of SLS devices, with the technical design of each corresponding to the level of assets maintained (see KB1131). The following article provides an overview of the IBKR Mobile Authentication (IB Key), a Two-Factor security solution which can be enabled directly onto your Smartphone.

Benefits

IBKR Mobile Authentication (IB Key) is available on your Smartphone via our IBKR Mobile app and can function as a security device, thereby eliminating the need to carry a separate physical device when logging into your IBKR account. In addition to the convenience of using a device which is trusted and routinely accessible, this app can be downloaded and activated in minutes, thereby eliminating the delays associated with the mailing of physical devices. Moreover, unlike in the case of physical devices, clients maintaining multiple accounts with distinct User Names may access IBKR Mobile Authentication (IB Key) all from the same IBKR Mobile app. Please refer to KB2879 for more details.

Back to top

Installation, Activation, and Operation

IBKR Mobile Authentication (IB Key) is currently supported on smartphones that use either Android or iOS operating system and can install IBKR Mobile. Installation, activation, and operating instructions can be found at the following links:

PLEASE NOTE: Disabling and replacing any security device, including IBKR Mobile Authentication (IB Key), is subject to conditions. Please contact Client Services for assistance in this process.

Back to top

FAQ

If you have forgotten your PIN, please uninstall and reinstall the IBKR Mobile app on your smartphone. Launch the app. When you are prompted to perform the recovery, reject by answering "No". Tap on "Register Two-Factor", reject again the recovery by answering "No". Then proceed with the activation, following the on-screen instructions. Please notice you would need to have access to the mobile phone number you originally used for the IBKR Mobile Authentication (IB Key) activation, since IBKR will send the Activation SMS to that number.

If you have lost your phone and require that the IBKR Mobile Authentication (IB Key) be disabled, please contact Client Services at one of the numbers found here.

Some countries, most notably India, provide national "Do Not Call" or "Do Not Disturb" services to prevent telemarketing to mobile numbers. If you have an Indian phone number, or have explicitly requested your phone carrier to exclude you from public lists, you might need to contact your wireless carrier, and ask them for your account to be configured appropriately in order to receive SMS messages from Interactive Brokers.

Please note that the required steps will vary by country and mobile phone provider. It is best to contact your mobile phone provider if you have any questions regarding such "Do Not Disturb" services.

Your PIN can be alphanumeric and can contain special characters. Please click here for details on PIN guidelines.

Only ONE phone/device can be active at a time for use with your username.

○ IBKR Mobile Authentication (IB Key) requires an Internet connection ONLY during the Enable User process

○ Android version 6.0 or higher.

○ iOS version 13.0 or higher.

[1] Restrictions for some specialized Institutional Account types may apply.

[2] Without a working data connection (WiFi or cellular), IBKR Mobile Authentication will not receive the login notification message but can still be operated in Challenge-Response mode. Refer to KB2277 (Android) or KB2278 (iOS) for detailed instructions on how to use IBKR Mobile Authentication (IB Key) in both available modes.

Как вернуть устройство безопасности в Interactive Brokers ?

В случае необходимости вернуть устройство безопасного входа в Interactive Brokers (в связи с повреждением, поломкой, консолидацией или закрытием счета), выполните следующие шаги:

- Скачайте и распечатайте форму возврата устройства безопасности

- Заполните форму и вложите в конверт вместе с устройством

- Отправьте конверт по адресу соответствующего офиса (указаны ниже)

В целях безопасности мы настоятельно рекомендуем использовать конверты из воздушно-пузырчатой пленки и службу доставки с возможностью отслеживания отправлений (например, UPS, FedEx, DHL или USPS Express Mail), поскольку Вы несете ответственность за возврат устройства. Обращаем Ваше внимание, что подтверждение возврата в IBKR станет доступно в личном кабинете не ранее чем через 3 - 5 рабочих дней после отправки. Срок доставки зависит от скорости работы конкретной почтовой службы.

Дополнительные шаги для возврата с заменой

Если Вы возвращаете устройство не в связи с закрытием счета, а желаете получить замену, обратитесь в нашу службу безопасности по телефону, указанному ниже, и сообщите о повреждении устройства. Вам будет предоставлен временный код безопасности для доступа к своему счету до получения нового устройства. Ниже представлены дополнительные условия замены различных устройств, которые предлагает IBKR:

Пользователи Цифровой карты безопасности+ (ЦКБ+):

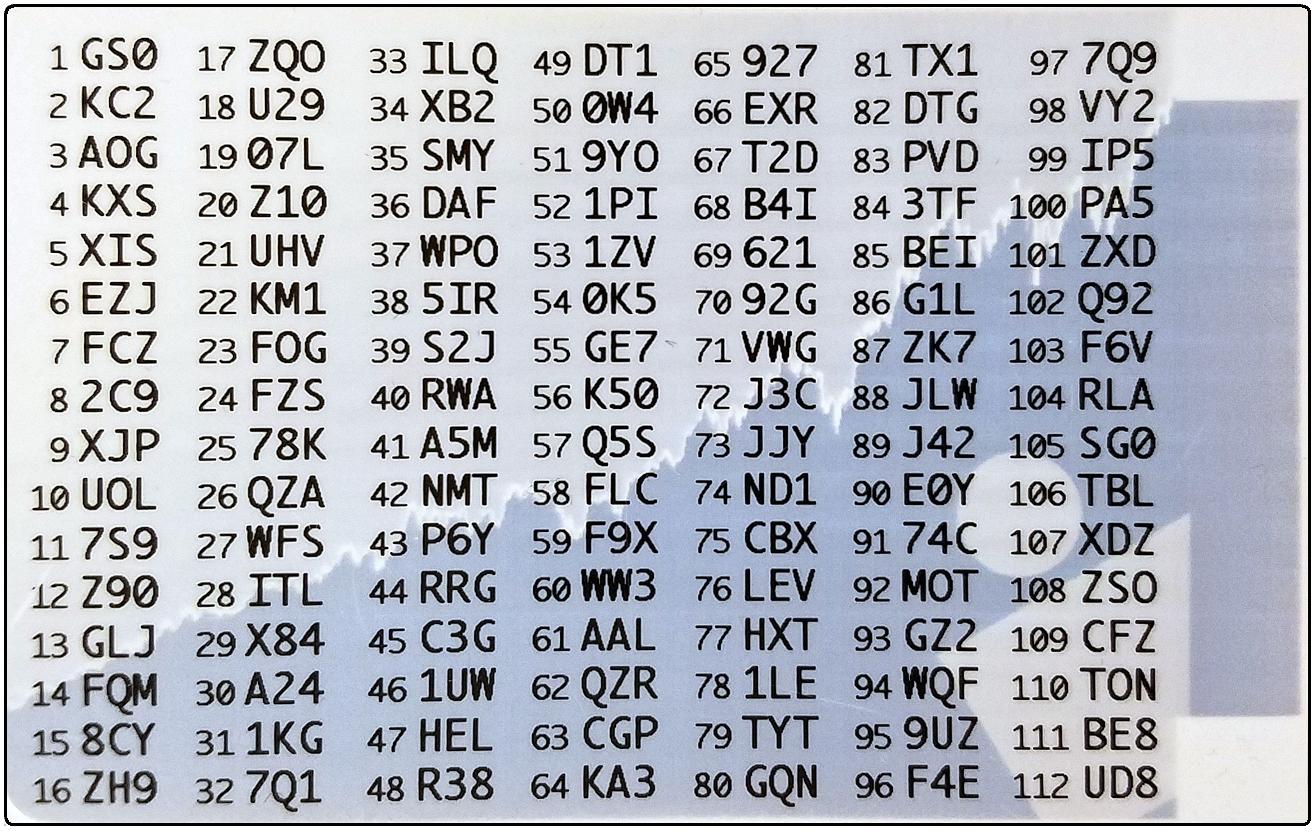

Для возврата и замены Цифровой карты безопасности+ (Рис. 1) войдите в Портал клиентов и запросите новую ЦКБ+ (инструкция доступна здесь).

Рис. 1

Пользователи Карты кодов безопасности:

Устройства такого вида (Рис. 4) не требуют возврата в IBKR. Их следует разрезать и выбросить. Если Вам необходимо замещающее устройство, мы рекомендуем активировать аутентификацию IB Key через IBKR Mobile (инструкция доступна здесь).

Рис. 4

Адреса и контактная информация:

| США / Канада |

Европа |

Адрес: Interactive Brokers, LLC. Кому: Token Return Department 3 Pickwick Plaza Greenwich, CT 06830 USA Телефон в США: 1 (877) 442-2757 (бесплатный) 1 (312) 542-6901 (прямой номер) Телефон в Канаде: 1 (877) 745-4222 (бесплатный) 1 (514) 847-3499 (прямой номер) |

Адрес: Interactive Brokers(U.K.)LTD. Кому: Token Return Department Gubelstrasse 28 CH-6301 Zug Switzerland Телефон в ЕС: 00800-42-276537 (бесплатный) +41-41-726-9500 (прямой номер) Телефон в России: 8-800-100-8556 (бесплатный) +41-41-726-9506 (рyсский) |

| Азия |

Австралия |

Адрес: Interactive Brokers, LLC. Кому: Token Return Department Suite 1512, Two Pacific Place 88 Queensway Admiralty Hong Kong Телефон: +852-2156-7907 (廣東話) +86 (21) 6086 8586 (普通话) |

Адрес: Interactive Brokers, LLC. Кому: Token Return Department PO Box R229 Royal Exchange, NSW, 1225 Australia Телефон: +61 (2) 8093-7300 |

| Япония | |

Адрес: Interactive Brokers Securities Japan, Inc. Кому: Token Return Department Kasumigaseki Building 25F, 2-5 Kasumigaskei 3 Chome, Chiyoda Ku, Tokyo 100-6025 Japan Телефон: +81 (3) 4588 9710 прямой номер (английский) |

送り先: インタラクティブ・ブローカーズ証券株式会社 〒100-6025 東京都千代田区霞ヶ関3-2-5 霞ヶ関ビルディング25階 セキュリティデバイス部 接触: +81 (3) 4588 9700 直通 (日本語) |

Закрытие счета

Доступ к Порталу клиентов для просмотра и/или печати отчетов по операциям и любых налоговых форм предоставляется только после возврата устройства и закрытия счета. Закрыв счет, вы сможете осуществлять вход без устройства безопасности используя только Ваш действующий логин и пароль.

Как запросить замену Цифровой карты безопасности+ (ЦКБ+)

Приведенные ниже шаги необходимы, чтобы:

- Заменить утерянную, украденную или ставшую непригодной цифровую карту безопасности+;

- Запросить ЦКБ+ вместе с текущим устройством безопасности (если Вы являетесь новым или существующим клиентом с капиталом больше $ 1 000 000 или эквивалетной суммы в другой валюте).

1. Сообщите в службу поддержки IBKR: обратитесь в службу поддержки IBKR для получения временного доступа к счету. Обратиться в поддержку можно только по телефону; во время звонка Вам будет необходимо подтвердить свою личность (подробнее см. в "Базе знаний" IBKR).

2. Получите онлайн-карту кодов безопасности: активируйте онлайн-карту кодов безопасности, которая обеспечивает усиленную защиту и полный доступ к "Порталу клиентов" на 21 день. Подробнее о том, как получить карту, можно узнать в "Базе знаний" IBKR .

3. Запросите новое устройство защиты: активировав онлайн-карту кодов безопасности, запросите новую "Цифровую карту безопасности+" (ЦКБ+) в том же разделе "Система безопасного входа" на "Портале клиентов".

Запрос ЦКБ+

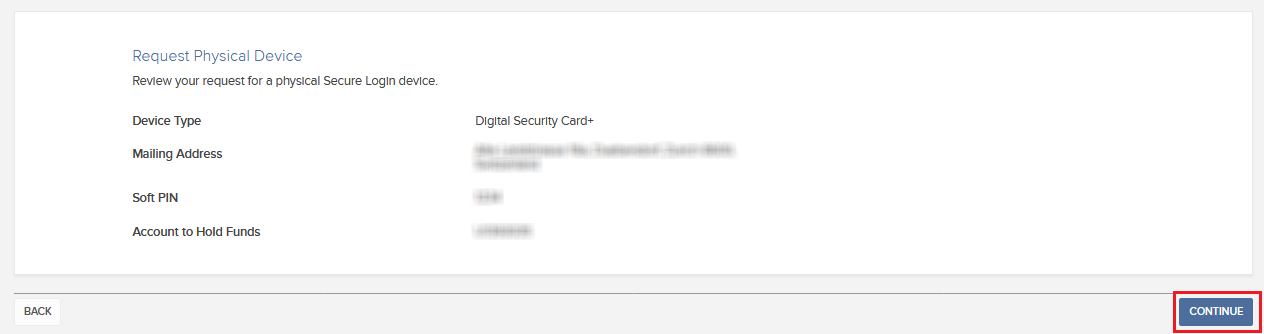

1. Нажмите на кнопку Запрос физического устройства (Request Physical Device).

.png)

.png)

3. Введите четырехзначный Мягкий PIN1 (Soft PIN) для Вашей ЦКБ+. Запомните PIN-код, который Вы ввели, т.к. он понадобится для активации и использования устройства. При желании Вы можете сменить счет, на котором будет заморожен депозит в размере 20 USD2. Нажмите Далее..png)

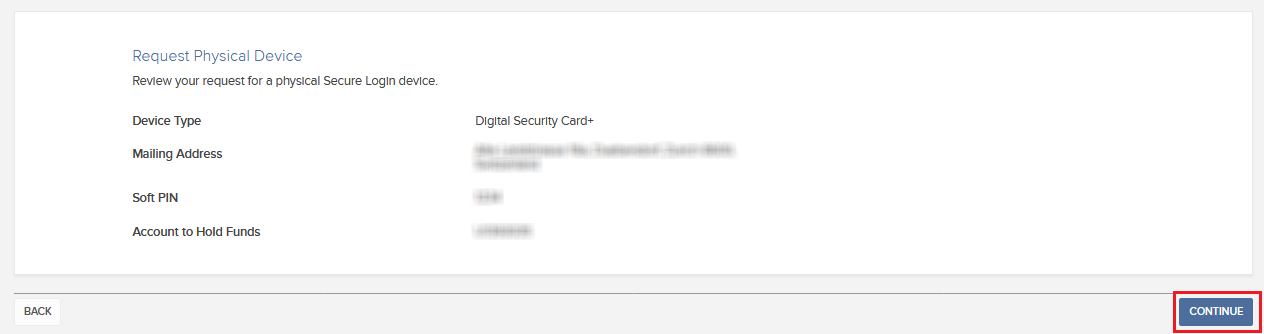

4. Вы увидите данные своего заказа. Убедитесь, что они верны. Если Вы захотите внести изменения, нажмите на белую кнопку Назад под полем с данными (не в браузере). Если данные верны, отправьте запрос, нажав Далее.

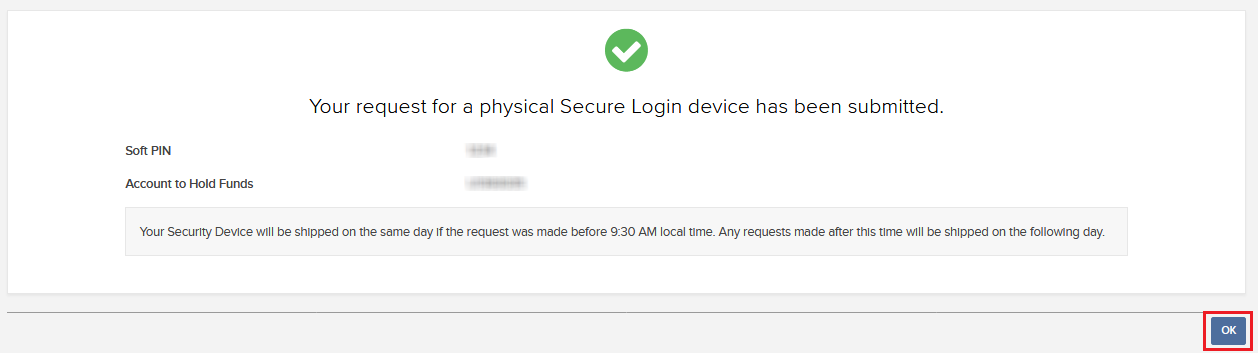

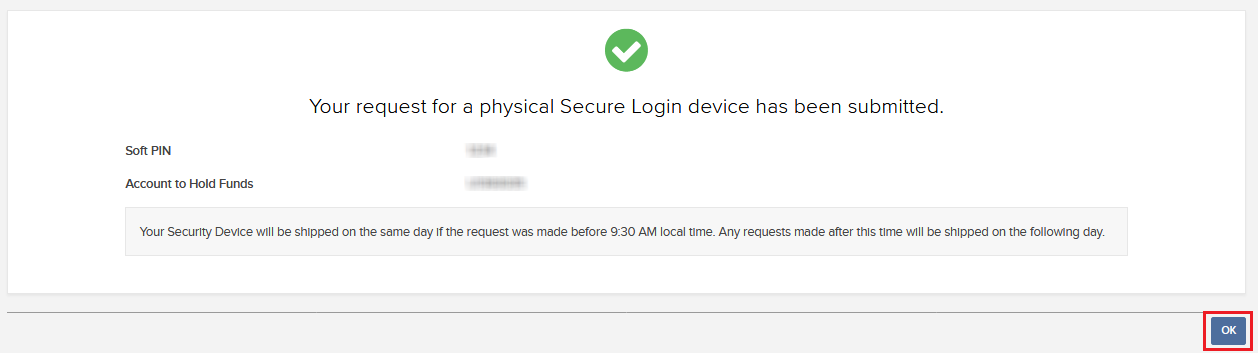

5. Вы увидите подтверждение с примерной датой доставки3. Для завершения нажмите OK.

1. Руководство по выбору PIN-кода доступно в "Базе знаний" IBKR.

2. Ключ безопасности и доставка бесплатны. Однако при заказе нового устройства на Вашем счете будет заморожена небольшая сумма (20 USD). В случае потери, повреждения или кражи устройства, а также если оно не возвращено IBKR при закрытии счета, эта сумма будет использована в качестве компенсации его стоимости. В остальных случаях сумма станет доступна после того, как Вы вернете устройство IBKR. Подробнее можно узнать в "Базе знаний" IBKR.

3. В целях безопасности замещающее устройство активируется автоматически по истечении 3-х недель с даты отправки. IBKR сообщит Вам о приближении срока и выполнении активации.

Ссылки

- Статья KB1131: общая информация о "Системе безопасного входа"

- Статья KB2636: информация и инструкции по устройствам безопасности

- Статья KB2481: инструкции о совместном использовании устройства безопасного входа двумя и более пользователями

- Статья KB2545: как снова подключить "Систему безопасного входа"

- Статья KB975: как вернуть устройство безопасности в IBKR

- Статья KB2260: как активировать аутентификацию по IB Key в IBKR Mobile

- Статья KB2895: двухфакторная система на нескольких устройствах (M2FS)

- Статья KB1861: информация о сборах и издержках, связанных с устройствами безопасности

- Статья KB69: информация о сроке действия временного кода доступа

Welcome to Interactive Brokers

Now that your account is funded and approved you can start trading. The information below will help you getting

started as a new customer of Interactive Brokers.

- Your Money

- Configure your account to trade

- How to trade

- Trade all over the World

- Five points to enrich your IB experience

1. Your Money

Deposits & Withdrawals General Info. All transactions are administered through your secure Account Management

Deposits

First, you create a deposit notification through your Account Management > Funding > Fund Transfers > Transaction Type: “Deposit” How to create a deposit notification. The second step is to instruct your Bank to do the wire transfer with the bank details provided in your Deposit Notification.

Withdrawals

Create a withdrawal instruction via your secure Account Management > Funding > Fund Transfers > Transaction Type: "Withdrawals" How to create a withdrawal instruction

If you instruct a withdrawal over the Withdrawal limits, it will be considered an exceptional withdrawal and we will therefore need to match bank account holder and IB account. If destination bank account has been used for a deposit, withdrawal will be processed; otherwise, you must contact customer service and provide the documents needed.

Troubleshooting

Deposits: My bank sent the money but I do not see it credited into my IB account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) A Deposit Notification is missing. You have to create it via your Account Management and send a ticket to Customer Service

c) Amending details are missing. Your name or IB account number is missing in the transfer details. You have to contact your bank and ask for the full amending details.

d) ACH initiated by IB is limited to 100k USD in a 7 business period. If you opened a Portfolio Margin account where the initial requirement is 110k, a wire deposit might be the better deposit option to reduce wait time for your first trade. If selecting ACH a wait time of almost 2 weeks or a temporary downgrade to RegT can be possible solutions.

Withdrawals: I have requested a withdrawal but I do not see the money credited to my bank account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) Rejected. Over the max it can be withdrawn. Please check your account cash balance. Note that for regulatory requirements, when the funds are deposited, there is a 3 day holding period before they can be withdrawn.

c) Your bank returned the funds. Probably because receiving bank account and remitting bank account names do not match.

2. Configure your account to trade

Difference between Cash and Margin accounts: If you have chosen the FastTrack application, by default your account type is a cash account with US stock permission. If you would like to get leverage and trade on margin, here how to upgrade to a RegT Margin account

Trading Permissions

In order to be able to trade a particular asset class in a particular country, you need to get the trading permission for it via your Account Management. Please note that trading permissions are free. You might however be asked to sign risk

disclosures required by local regulatory authorities. How to Request Trading Permissions

Market Data

If you want to have market data in real-time for a particular product/exchange, you need to subscribe to a market data package charged by the exchange. How to subscribe to Market data

The Market data assistant will help you choose the right package. Please watch this Video explaining how it works.

Customers have the option to receive delayed market data for free by clicking the Free Delayed Data button from a non-subscribed ticker row.

Advisor Accounts

Have a look at the user guide getting started as advisors. Here you see how to create additional users to your advisor account and grant them access and much more.

3. How to trade

The Trader's University is the place to go when you want to learn how to use our Platforms. Here you will find our webinars, live and recorded in 10 languages and tours and documentation about our various Trading Platforms.

Trader Workstation (TWS)

Traders who require more sophisticated trading tools can use our market maker-designed Trader Workstation (TWS), which optimizes your trading speed and efficiency with an easy-to-use spreadsheet interface, support for more than 60 order types, task-specific trading tools for all trading styles, and real-time account balance and activity monitoring. Try the two models

TWS Mosaic: for intuitive usability, easy trading access, order management, watchlist, charts all in one window or

TWS Classic: the Advanced Order Management for traders who need more advanced tools and algos.

General Description and Information / Quick start guide / Usersguide

Interactive Tours: TWS Basics / TWS configuration / TWS Mosaic

How to place a trade: Video Classic TWS / Video Mosaic

Trading tools: General Description and Information / Users guide

Requirements: How to install Java for Windows / How to install Java for MAC / Port 4000 and 4001 needs to be open

Login TWS / Download TWS

WebTrader

Traders who prefer a clean and simple interface can use our HTML-based WebTrader, which makes it easy to view market data, submit orders, and monitor your account and executions. Use the latest WebTrader from every browser

Quick Start Guide / WebTrader User's Guide

Introduction: Video WebTrader

How to place a Trade: Video WebTrader

Login WebTrader

MobileTrader

Our mobile solutions allow you to trade your IB account on the go. The mobileTWS for iOS and the mobileTWS for BlackBerry are custom-designed for these popular models, while the generic MobileTrader supports most other Smart phones.

General Description and Information

Order Types Order Types available and Description / Videos / Tour / Users guide

Paper Trading General Description and Information / How to get a Paper Trading Account

Once your paper account is created, you can share the market data of your real account with your paper trading account: Account Management > Manage Account > Settings > Paper trading

4. Trade all over the World

IB accounts are multi-currency accounts. Your account can hold different currencies at the same time, this allows you to trade multiple products around the world from a single account.

Base Currency

Your base currency determines the currency of translation for your statements and the currency used for determining margin requirements. Base currency is determined when you open an account. Customers may change their base currency at any time through Account Management.

We do not automatically convert currencies into your Base currency

Currency conversions must be done manually by the customer. In this video you can learn how to do a currency conversion.

In order to open a position denominated in a currency that you do not have in your account, you have two possibilities:

A) Currency conversion.

B) IB Margin Loan. (Not available for Cash Accounts)

Please see this course explaining the mechanics of a foreign transaction.

5. Five points to enrich your IB experience

1. Contract Search

Here you will find all our products, symbols and specifications.

2. IB Knowledge Base

The Knowledge Base is a repository of glossary terms, how-to articles, troubleshooting tips and guidelines designed to assist IB customers with the management of their IB accounts. Just enter in the search button what you are looking for and you will get the answer.

3. Account Management

As our trading platforms give you access to the markets, the Account Management grants you access to your IB account. Use Account Management to manage account-related tasks such as depositing or withdrawing funds, viewing your statements, modifying market data and news subscriptions, changing your trading permissions, and verifying or changing your personal information.

Log In Account Management / AM Quick Start Guide / AM Users Guide

4. Secure Login System

To provide you with the highest level of online security, Interactive Brokers has implemented a Secure Login System (SLS) through which access to your account is subject to two-factor authentication. Two-factor authentication serves to confirm your identity at the point of login using two security factors: 1) Something you know (your username and password combination); and 2) Something you have (an IB issued security device which generates a random, single-use security code). As both knowledge of your username/password and physical possession of the security device are required to login to your account, participation in the Secure Login System virtually eliminates the possibility of anyone other than you accessing your account.

How to Activate your Security Device / How to Obtain a Security Code Card / How to return Security device

In case you forgot your password or lost your security code card, please call us for immediate assistance.

5. Statements and Reports

Easy to view and customize, our statements and reports cover all aspects of your Interactive Brokers account. How to view an Activity Statement

Information Relating to Customer Protection of Assets

The below information applies to trading of non-US index options, OTC CFDs and non-US index futures (when combined with non-US index options)

Interactive Brokers (U.K.) Limited

Customer Assets

Interactive Brokers (U.K.) Limited (“IBUK)’’ is authorised and regulated by the Financial Conduct Authority (“FCA“), register no. 208159. IBUK is a wholly owned subsidiary of Interactive Brokers Group (IBG LLC). IBUK provides client money and client asset services in accordance with FCA Client Assets regulations “CASS”.

Client money is protected as follows:

Client money rules apply to all regulated firms that receive money from a client, or hold money for a client in the course of carrying out MiFID business and/or designated investment business.

Client money is entirely segregated from IBUK’s own money. In the event of a failure of an authorised firm, clients’ monies held in the segregated accounts will be returned to the clients rather than being treated as a recoverable asset by general creditors. If there was a shortfall, the client may be eligible to claim for compensation from the Financial Services Compensation Scheme (“FSCS”).

Client money is ring-fenced in separate bank accounts which are held in trust on behalf of the clients. These accounts are distributed across a number of banks with investment grade ratings to avoid a concentration risk with any single institution. When IBUK makes the selection and appointment of a bank to hold client money, it takes into account the expertise and market reputation of the bank, its financial standing and any legal requirements or market practices related to the holding of client money that could adversely affect clients' rights.

IBUK will allow client money to be held in a client transaction account by an exchange, a clearing house or an intermediate broker but only if the money is transferred to them for the purpose of a transaction or to meet a client’s obligation to provide collateral for a transaction.

Each day, IBUK performs a detailed reconciliation of client money held in client money bank accounts and client transaction accounts and its liabilities to its clients to ensure that client monies are properly segregated and sufficient to meet all liabilities in accordance with the FCA’s CASS rules. All monies credited to such bank accounts are held by the firm as trustee (or if relevant, as agent).

FCA regulations also require IBUK to maintain a CASS Resolution Pack to ensure that in the unlikely event of the firm's liquidation, the Insolvency Practitioner is able to retrieve information with a view to returning client money and assets to the firm's clients on a timely basis.

Financial Services Compensation scheme

Interactive Brokers (U.K.) Limited (“IBUK”) is authorised and regulated by the Financial Conduct Authority (“FCA”) as an investment firm and a participant in the Financial Services Compensation scheme (“FSCS”). Certain eligible clients qualify for

compensation under the FCA Compensation rules.

The main points relating to eligibility are:

- FSCS pays compensation only to eligible claimants when an authorised firm is in default and will carry out an investigation to establish whether or not this is the case.

- FSCS pays compensation only for financial loss and the limits for U.K. Investment firms are covered below.

- The FSCS was set up mainly to assist private individuals, although smaller businesses are also covered.

- Larger businesses are generally excluded.

Investments

FSCS provides protection if an authorised investment firm is unable to pay claims against it e.g. when an authorised investment firm goes out of business and cannot return assets to its clients. Assets classified as investments for authorised investment firms under the FSCS include stocks and shares, futures, options, cfds, other regulated instruments and money deposited by clients.

Compensation Limits

The actual level of compensation you receive will depend on the basis of your claim. The FSCS only pays compensation for financial loss. Compensation limits are per person per authorised firm. Compensation levels are subject to change and for current details please refer to the FSCS website at http://www.fscs.org.uk / .

The below information applies to customers who were or are continuing to trade all products (except metals and OTC CFDs) through IB LLC.

Interactive Brokers LLC (“IBLLC”)

Customer Assets

Customer money is segregated in special bank or custody accounts, which are designated for the exclusive benefit of customers of IBLLC. This protection (the SEC term is “reserve” and the CFTC term is “segregation”) is a core principle of securities and commodities brokerage. By properly segregating the customer's assets, if no money or stock is borrowed and no futures positions are held by the customer, then the customer's assets are available to be returned to the customer in the event of a default by or bankruptcy of the broker.

Securities accounts with no borrowing of cash or securities

Securities customer money is protected as follows:

- A portion is deposited at 14 large U.S. banks in special reserve accounts for the exclusive benefit of IBLLC's customers. These deposits are distributed across a number of banks with investment-grade ratings so that we can avoid a concentration risk with any single institution. No single bank holds more than 5% of total customer funds held by IBLLC.

- A portion may be invested in U.S. Treasury securities, including direct investments in short-term Treasury bills and reverse repurchase agreements, where the collateral received is in the form of U.S. Treasury securities. These transactions are conducted with third parties and guaranteed through a central counterparty clearing house (Fixed Income Clearing Corp., or “FICC”). The collateral remains in the possession of IBLLC and held at a custody bank in a segregated Special Custody Account for the exclusive benefit of customers. U.S. Treasury securities may also be pledged to a clearing house to support customer margin requirements on securities options positions.

- Customer cash is maintained on a net basis in the reserve accounts, which reflects the net credit balances of customers in excess of customer debit balances. To the extent any one customer maintains a margin loan with IBLLC, that loan will be fully secured by stock valued at up to 200% of the loan.

- Current SEC regulations require broker-dealers to perform a detailed reconciliation of customer money and securities (known as the “reserve computation”) at least weekly to ensure that customer monies are properly segregated from the broker-dealer's own funds.

Customer-owned, fully-paid securities are protected in accounts at depositories and custodians that are specifically identified for the exclusive benefit of customers. IBLLC reconciles positions in securities owned by customers daily to ensure that these securities have been received at the depositories and custodians

Commodities accounts

Commodities customer money is protected as follows:

- A portion is pledged to futures clearing houses to support customer margin requirements on futures and options on futures positions or held in custody accounts identified as segregated for the benefit of IB's customers.

- A portion is held at commodities clearing banks/brokers in accounts identified as segregated for the benefit of IBLLC customers to support customer margin requirements.

- Cash in commodities accounts is protected in accordance with US commodities regulations. CFTC rules prohibit an FCM from commingling customer funds with its own money, securities or property. Customer funds must be separately accounted for and segregated as belonging to commodity or option customers. The titles of accounts in which customer funds are deposited must clearly indicate this and show that the funds are segregated as required by the Commodity Exchange Act (“CEA”) and CFTC Rules. Customer funds may not be obligated to anyone except to purchase, margin, guarantee, secure, transfer, adjust or settle trades, contracts or commodity option transactions of commodity or option customers. These requirements also extend to U.S. customers trading on foreign exchanges.

Securities accounts with margin loans

For customers who borrow money from IBLLC to purchase securities, IBLLC is permitted by securities regulations to pledge or borrow stock valued at up to 140% of the value of the loan. Typically, IBLLC lends out a small portion of the total stock it is permitted to lend out.

- As an example, at June 30, 2011, IBLLC lent $800 million value of customers' stock out of the $13.0 billion made available to it by margin customers.

- When IBLLC lends customers' stock, it must put additional money into the special reserve accounts for the exclusive benefit of customers. In the example above, the full value of $800 million of customer stock that was lent was segregated in the special reserve accounts.

Account Protection

Customer securities accounts at IBLLC are protected by the Securities Investor Protection Corporation (“SIPC”) for a maximum coverage of $500,000 (with a cash sublimit of $250,000) and under IBLLC's excess SIPC policy with certain underwriters at Lloyd's of London for up to an additional $30 million (with a cash sublimit of $900,000) subject to an aggregate limit of $150 million. Futures, and options on futures are not covered. As with all securities firms, this coverage provides protection against failure of a broker-dealer, not against loss of market value of securities.

For the purpose of determining a customer account, accounts with like names and titles (e.g. John and Jane Smith and Jane and John Smith) are combined, but accounts with different titles are not (e.g. Individual/John Smith and IRA/John Smith).

SIPC is a non-profit, membership corporation funded by broker-dealers that are members of SIPC. For more information about SIPC and answers to frequently asked questions (such as how SIPC works, what is protected, how to file a claim, etc.), please refer to the following websites:

http://www.finra.org/InvestorInformation/InvestorProtection/SIPCProtecti...

or contact SIPC at:

Securities Investor Protection Corporation

805 15th Street, N.W. - Suite 800

Washington, D.C. 20005-2215

Telephone: (202) 371-8300

Facsimile: (202) 371-6728

How to send documents to IBKR using your smartphone

Interactive Brokers allows you to send us a copy of a document even if you do not currently have access to a scanner. You can take a picture of the requested document with your smartphone.

Below you will find the instructions on how to take a picture and send it per email to Interactive Brokers with the following smartphone operating systems:

If you already know how to take and send pictures per email using your smartphone, please click HERE - Where to send the email to and what to include in the subject.

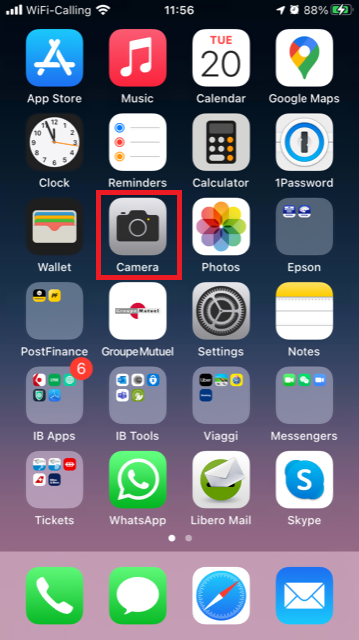

iOS

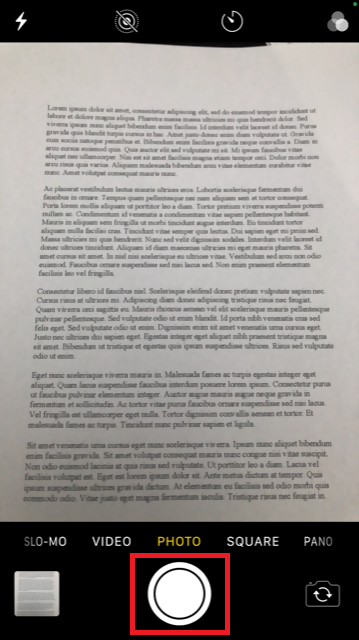

1. Swipe up from the bottom of your smartphone screen and tap the camera icon.

If you do not have the Camera icon, you can tap the Camera app icon from the home screen of your iPhone.

Normally your phone should now activate the rear camera. If it activates the front one, tap the camera switch button.

2. Place your iPhone above the document and frame the desired portion or page of the document.

3. Make sure to have uniform, sufficient lighting and not to cast any shadow on the document due to your position. Hold the smartphone firmly with your hand/s and avoid shaking. Tap on the shutter button to take the photo.

4. Tap the thumbnail image in the lower left-hand corner to access the picture you have just taken.

5. Make sure that the picture is clear and the document is well legible. You can enlarge the picture and see it in detail by swiping apart two fingers on the picture itself.

If the picture does not present a good quality or lighting, please repeat the previous steps in order to take a sharper one.

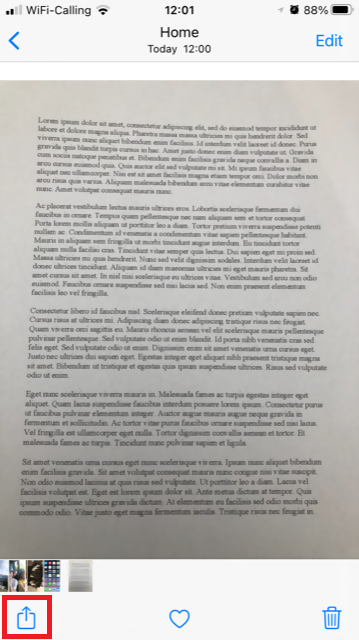

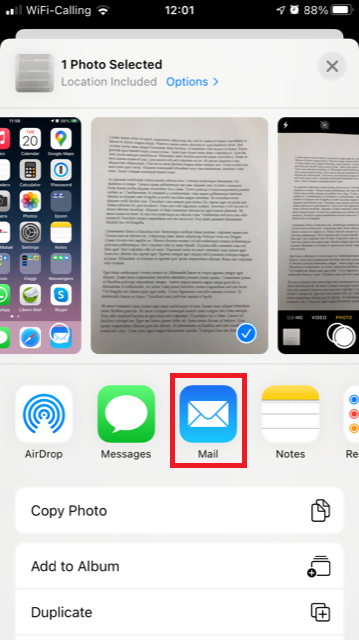

6. Tap the share icon in the lower left-hand corner of the screen.

7. Tap the Mail icon.

Note: to send emails your phone has to be configured for that. Please contact your email provider if you are not familiar with this procedure.

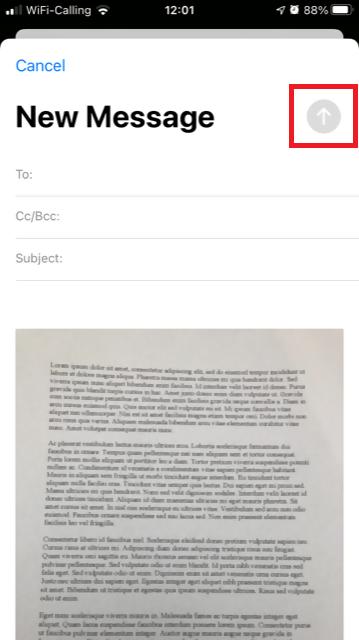

8. Please see HERE how to populate the To: and Subject: fields of your email. Once the email is ready, tap the up arrow icon on the top right to send it.

Android

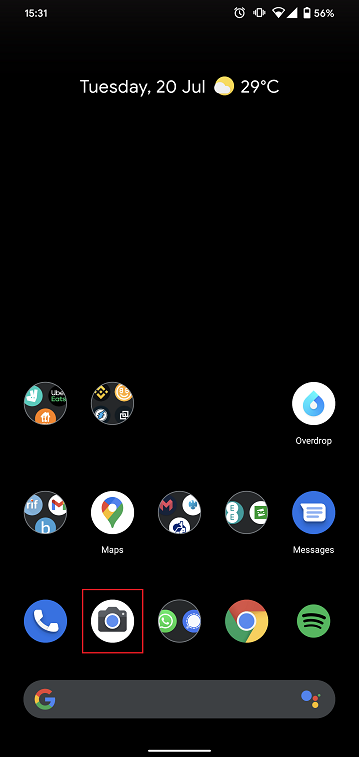

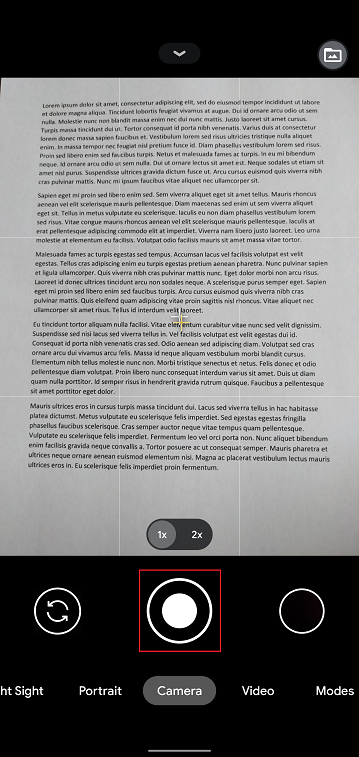

1. Open your applications list and start the Camera app. Alternatively start it from your Home screen. Depending on your phone model, maker or setup, the app might be called differently.

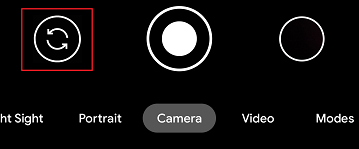

Normally your phone should now activate the rear camera. If it activates the front one, tap the camera switch button.

2. Place your Android above the document and frame the desired portion or page of the document.

3. Make sure to have uniform, sufficient lighting and not to cast any shadow on the document due to your position. Hold the smartphone firmly with your hand/s and avoid shaking. Tap on the shutter button to take the photo.

4. Make sure that the picture is clear and the document is well legible. You can enlarge the picture and see it in detail by swiping apart two fingers on the picture itself.

If the picture does not present a good quality or lighting, please repeat the previous steps in order to take a sharper one.

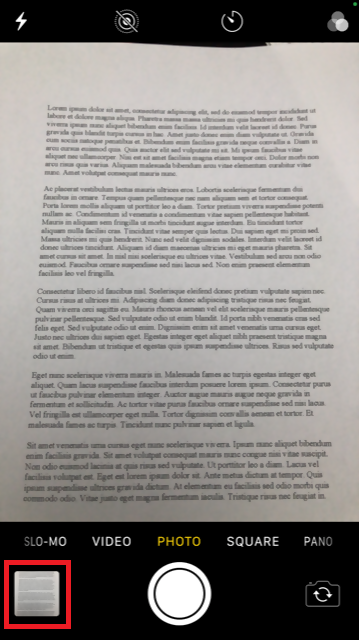

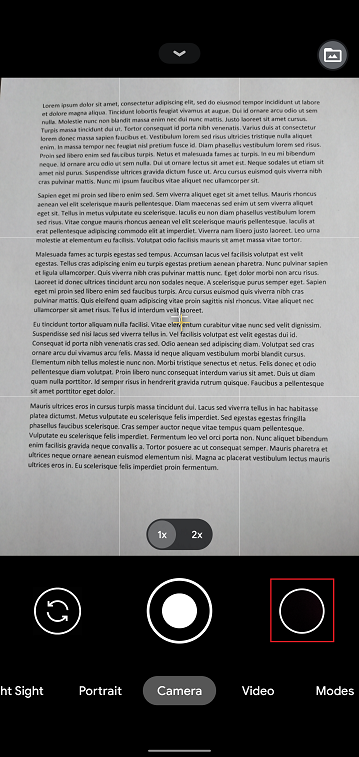

5. Tap the empty circle icon in the lower right-hand corner of the screen.

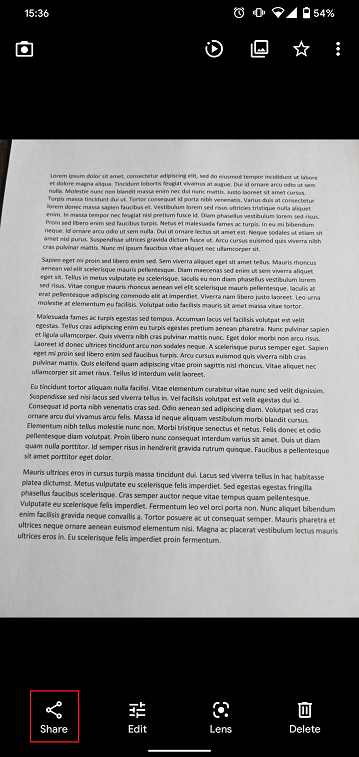

6. Tap the share icon in the lower left-hand corner of the screen.

7. In the sharing menu that will be displayed now tap the icon of the email client set up on your phone. In the example picture below, it is called Gmail but the name may vary according to your specific setup.

.png)

Note: to send emails your phone has to be configured for that. Please contact your email provider if you are not familiar with this procedure.

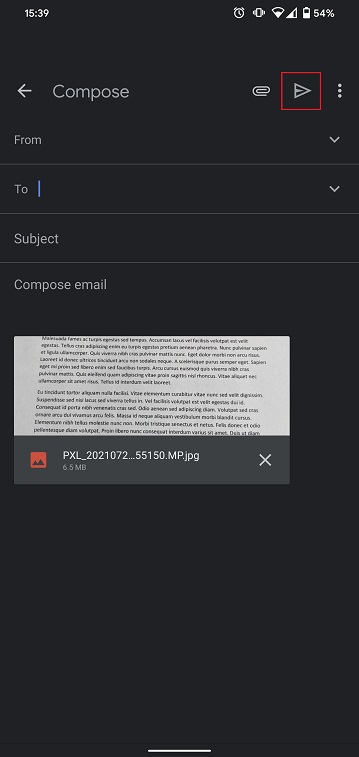

8. Please see HERE how to populate the To and Subject fields of your email. Once the email is ready, tap the airplane icon on the top right to send it.

WHERE TO SEND THE EMAIL AND WHAT TO INCLUDE IN THE SUBJECT

The email has to be created observing the below instructions:

1. In the field To: type:

- newaccounts@interactivebrokers.com if you are a resident of a non-European country

- newaccounts.uk@interactivebrokers.co.uk if you are a European resident

2. The Subject: field must contain all of the below:

- Your account number (it usually has the format Uxxxxxxx, where x are numbers) or your username

- The purpose of sending the document. Please use the below convention:

- PoRes for a proof of residential address

- PID for a proof of identity

How to request a Digital Security Card+ (DSC+) replacement

The below steps are required in order to:

- Replace a Digital Security Card+ which has been lost, stolen or has become inoperable

- Request a Digital Security Card+ alongside your current security device (if you are a new or existing Client with equity above $1,000,000, or equivalent)

1. Notify IBKR Client Services- Contact IBKR Client Services to obtain a temporary account access. This service can only be provided via telephone and requires the identity of the account holder to be verified, as detailed in the IBKR Knowledge Base.

2. Obtain an Online Security Code Card - Activate an Online Security Code Card, which offers enhanced protection and full Client Portal functionality for an extended period of 21 days. Please consult the IBKR Knowledge Base should you need guidance for this specific step.

3. Request the DSC+ replacement - Once you have completed the Online Security Code Card activation, please remain in the Secure Login System section of the Client Portal and order your replacement DSC.

Request a DSC+

1. Click on the button Request Physical Device.

.png)

.png)

3. Enter a four-digit Soft PIN1 for your DSC+. Please make sure to remember the PIN you are typing since it will be necessary to activate and to operate your device. When applicable and desired, you may change the account on which the 20 USD deposit will be kept on hold2. Complete this step by clicking on Continue..png)

4. The system will show you a summary of your selection. Please make sure the information displayed is correct. Should you need to perform changes, click on the white Back button under the information field (not your browser back button), otherwise submit the request by clicking on Continue.

5. You will receive a final confirmation containing the estimated shipment date3. Click on Ok to finalize the procedure.

1. For PIN guidelines, please consult the IBKR Knowledge Base.

2. The Security token and the shipment are both free of charge. Nevertheless, when you order your device, we will freeze a small amount of your funds (20 USD). If your device is lost, intentionally damaged, stolen or if you close your account without returning it to IBKR, we will use that amount as a compensation for the loss of the hardware. In any other case, the hold will be released once your device has been returned to IBKR. More details on the IBKR Knowledge Base.

3. For security reasons, the replacement device is set to auto-activate within three weeks from the shipment date. IBKR will notify you when the auto-activation is approaching and when it is imminent.

IBKR Knowledge Base References

- See KB1131 for an overview of the Secure Login System

- See KB2636 for information and procedures related to Security Devices

- See KB2481 for instructions about sharing the Security Login Device between two or more users

- See KB2545 for instructions on how to opt back in to the Secure Login System

- See KB975 for instructions on how to return your security device to IBKR

- See KB2260 for instructions on activating the IB Key authentication via IBKR Mobile

- See KB2895 for information about Multiple 2Factor System (M2FS)

- See KB1861 for information about charges or expenses associated with the security devices

- See KB69 for information about Temporary passcode validity

Security Device Replacement Charge

Account holders logging into their account via IBKR's Secure Login System are issued a security device, which provides an additional layer of protection to that afforded by the user name and password, and which is intended to prevent online hackers and other unauthorized individuals from accessing their account. While IBKR does not charge any fee for the use of the device, certain versions require that the account holder return the device upon account closing or incur a replacement fee. Existing account holders are also subject to this replacement fee in the event their device is lost, stolen or damaged (note that there is no fee to replace a device returned as a result of battery failure).

In addition, while IBKR does not assess a replacement fee unless a determination has been made that the device has been lost, stolen, damaged or not returned, a reserve equal to the fee will placed upon the account upon issuance of the device to secure its return. This reserve will have no effect upon the equity of the account available for trading, but will act as limit to full withdrawals or transfers until such time the device is returned (i.e., cannot withdraw the reserve balance).

Outlined below are the replacement fee associated with each device.

| SECURITY DEVICE | REPLACEMENT FEE |

| Security Code Card1 | $0.001 |

| Digital Security Card + | $20.00 |

For instructions regarding the return of security devices, please see KB975

1 The Security Code Card is not required to be returned upon account closing and may be destroyed and discarded once remaining funds have been returned and the account has been fully closed. Access to Client Portal after closure for purposes of viewing and retrieving activity statements and tax documents is maintained using solely the existing user name and password combination. This type of two-factor security is no longer being issued.

Securities Account Protection for Interactive Brokers India Customers

Customer accounts domiciled under Interactive Brokers India Pvt. Limited,(IBI) are awarded different account protection services than our IB-LLC and IB-UK clients. There are two major exchanges, the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE), each one has established their own guidelines for investor grievances against exchange members and/or sub –brokers.

National Stock Exchange of India (NSE)

The NSE has established an Investor Protection Fund with the objective of compensating investors in the event of defaulters' assets not being sufficient to meet the admitted claims of investors, promoting investor education, awareness and research. The Investor Protection Fund is administered by way of registered Trust created for the purpose. The Investor Protection Fund Trust is managed by Trustees comprising of Public representative, investor association representative, Board Members and Senior officials of the Exchange.

The Investor Protection Fund Trust, based on the recommendations of the Defaulters' Committee, compensates the investors to the extent of funds found insufficient in Defaulters' account to meet the admitted value of claim, subject to a maximum limit of Rs. 11 lakhs (1.1 million USD) per investor per defaulter/expelled member.

Bombay Stock Exchange (BSE)

Currently trading is not offered on the BSE by Interactive Brokers.

Tips for selecting your security questions and answers

The security questions represent just one component of the security framework which IB has put into place to protect your account. We offer the following simple tips for selecting your security questions and answers in order to make the most effective use of this security measure:

1. Choose questions having answers that you can remember in the future and answer consistently.

2. Use one-word answers whenever possible.

3. Be careful with spaces. If you use "San Diego" as an answer to one of your security questions, the system will reject "SanDiego."

4. Avoid using quirky or nonsensical answers as they'll likely to be difficult to remember later.

5. Select a question which cannot be easily guessed or researched, has many possible answers and where the probability of guessing the correct answer is low.

6. Select a question for which the answer is unlikely to be known by others such as a family member, close friend, relative, ex-spouse, or significant other.

7. Choose a question having an answer which is stable and not likely to change over time.